247 Ez Loan reviews offer a crucial lens through which to examine this lending platform. This analysis delves into the experiences of numerous borrowers, exploring both the positive and negative aspects of 247 Ez Loan’s services. We’ll dissect customer feedback, scrutinize loan terms, and assess the application process, customer support, and overall company transparency to provide a comprehensive overview.

From interest rates and repayment options to the efficiency of the application process and the responsiveness of customer service, we aim to equip potential borrowers with the knowledge needed to make informed decisions. This in-depth look at 247 Ez Loan aims to answer key questions and address common concerns, providing a balanced perspective on the platform’s strengths and weaknesses.

Understanding Customer Experiences with “247 Ez Loan”

Online reviews offer valuable insights into the customer experience with 247 Ez Loan, revealing both positive and negative aspects of their services. Analyzing these reviews allows for a comprehensive understanding of customer satisfaction and areas for potential improvement.

Common Themes in Online Reviews

Analysis of online reviews reveals recurring themes related to 247 Ez Loan’s services. These themes frequently center around the speed of the application process, the clarity of loan terms, and the responsiveness of customer service representatives. Some reviews highlight the ease of accessing funds, while others focus on concerns about high interest rates and potential hidden fees. The overall sentiment expressed varies considerably, reflecting a diverse range of customer experiences.

Frequently Praised Aspects of 247 Ez Loan, 247 ez loan reviews

Many positive reviews praise the speed and efficiency of 247 Ez Loan’s application process. Customers frequently mention the convenience of online application and the relatively quick disbursement of funds once approved. The availability of 24/7 customer support is also a frequently cited positive aspect, offering assistance when needed. Some reviewers also highlight the straightforwardness of the loan terms, although this is not a universally shared experience.

Common Customer Complaints Regarding 247 Ez Loan

Negative reviews frequently cite high interest rates and unexpected fees as major concerns. Customers often express frustration with the lack of transparency regarding these costs, suggesting that the advertised rates do not fully reflect the total cost of borrowing. Complaints regarding the customer service experience are also common, with some reviewers reporting difficulty reaching representatives or receiving unhelpful responses to their inquiries. Concerns about aggressive collection practices are also present in some reviews.

Comparison of Positive and Negative Customer Experiences

Positive experiences are largely characterized by the speed and convenience of the loan process and the accessibility of customer support. Customers who had positive experiences often needed a quick loan and valued the rapid disbursement of funds. Conversely, negative experiences often stem from a lack of transparency regarding fees and interest rates, leading to unexpected costs and financial strain. Differences in customer service responsiveness also significantly influence the overall experience, with efficient and helpful service contributing to positive reviews, while poor service exacerbates negative experiences.

Summary of Customer Feedback

| Service Aspect | Positive Feedback | Negative Feedback | Overall Assessment |

|---|---|---|---|

| Application Process | Fast, easy online application; quick disbursement of funds. | Confusing application process; lengthy wait times for approval. | Mixed; speed is a plus, but clarity needs improvement. |

| Customer Service | Responsive and helpful representatives; 24/7 availability. | Difficult to reach representatives; unhelpful or unresponsive service. | Mixed; accessibility is good, but consistency in helpfulness needs improvement. |

| Loan Terms | Clear and straightforward terms (some reviewers). | High interest rates; hidden fees; lack of transparency regarding total cost. | Negative; needs significant improvement in clarity and fairness. |

| Collection Practices | N/A (Limited feedback on this aspect in reviews) | Aggressive collection tactics reported by some customers. | Negative; requires investigation and potential policy adjustments. |

Analyzing Loan Terms and Conditions

Understanding the terms and conditions of any loan, especially a short-term loan like those offered by 247 Ez Loan, is crucial for borrowers to avoid unexpected financial burdens. This section delves into the specifics of 247 Ez Loan’s interest rates, fees, repayment options, and compares them to similar lenders. We will also examine sample loan agreements to highlight key clauses and potential risks.

Interest Rates and Fees

247 Ez Loan’s interest rates and fees vary depending on several factors, including the loan amount, the borrower’s creditworthiness, and the loan term. While specific rates are not publicly advertised consistently across all platforms, anecdotal evidence and online reviews suggest that interest rates can be significantly higher than those offered by traditional banks or credit unions. Additional fees, such as origination fees, late payment fees, and potentially early repayment penalties, can further increase the overall cost of borrowing. It’s essential to carefully review the loan agreement for a complete breakdown of all applicable charges before accepting the loan.

Repayment Terms and Options

Repayment terms for 247 Ez Loan products are typically short-term, often ranging from a few weeks to a few months. Repayment is usually structured as a lump-sum payment at the end of the loan term, although some lenders may offer installment payment plans. The frequency of payments and the specific due dates will be clearly Artikeld in the loan agreement. Borrowers should carefully assess their ability to repay the loan in full by the due date to avoid incurring additional late payment fees and potential damage to their credit score.

Comparison with Similar Lending Institutions

Compared to traditional banks and credit unions, 247 Ez Loan and similar payday lenders typically charge significantly higher interest rates and fees. Banks and credit unions often offer longer repayment terms and more flexible repayment options. However, obtaining a loan from a traditional institution may require a more extensive credit check and a more rigorous application process. Payday lenders, like 247 Ez Loan, often prioritize speed and accessibility, making them attractive to borrowers with immediate financial needs but at a substantially higher cost.

Examples of Loan Agreements and Key Clauses

A typical 247 Ez Loan agreement would include clauses detailing the loan amount, the annual percentage rate (APR), the repayment schedule, late payment fees, and any other applicable charges. Crucially, the agreement should clearly state the total amount repayable, including all fees and interest. Borrowers should pay close attention to clauses related to rollovers (extending the loan term), which can significantly increase the overall cost of borrowing. Additionally, clauses concerning collection practices in the event of default should be carefully reviewed. For example, a clause might state that failure to repay the loan on time could result in the lender reporting the delinquency to credit bureaus, negatively impacting the borrower’s credit score.

Visual Representation of Borrowing Costs

A bar chart comparing the total cost of borrowing a $500 loan over a 30-day period from 247 Ez Loan, a traditional bank, and a credit union would illustrate the significant differences in cost. The bar representing 247 Ez Loan would be considerably taller than the others, reflecting the higher interest rates and fees. For example, the 247 Ez Loan bar might show a total repayment of $600, while the bank and credit union bars might show $525 and $515 respectively. This visual representation would clearly demonstrate the substantial cost difference associated with choosing a short-term, high-interest lender compared to more traditional financial institutions.

Examining the Application and Approval Process: 247 Ez Loan Reviews

Applying for a loan with 247 Ez Loan involves a series of steps designed to assess the applicant’s creditworthiness and financial capacity. Understanding this process is crucial for a smooth and efficient loan application experience. This section details the steps, required documentation, processing times, and potential challenges involved.

The application process for 247 Ez Loan aims to collect sufficient information to determine the applicant’s eligibility for a loan. This involves verifying income, employment history, and creditworthiness, all of which are essential for responsible lending practices. The lender uses this information to assess the risk associated with providing a loan and to determine the appropriate loan terms.

Required Documentation and Information

Applicants should anticipate providing various documents and pieces of information to support their loan application. This information helps 247 Ez Loan verify the details provided and assess the risk involved in lending. Incomplete applications will likely result in delays or rejection.

Generally, applicants will need to provide proof of identity (such as a driver’s license or passport), proof of income (pay stubs, bank statements, or tax returns), and details about their current employment. Additional documentation may be requested depending on the specific loan amount and the applicant’s financial profile. For example, applicants with less robust credit histories might need to provide more extensive documentation to demonstrate their ability to repay the loan.

Loan Application Processing Times

The time it takes to process a loan application varies depending on several factors, including the completeness of the application, the applicant’s credit history, and the lender’s current workload. While 247 Ez Loan may advertise quick processing times, it’s essential to understand that these are estimates and can fluctuate.

Applicants should expect the process to take anywhere from a few hours to a few business days. Factors that can contribute to longer processing times include incomplete applications, discrepancies in the information provided, or a need for further verification of the applicant’s financial situation. Clear and accurate documentation will help expedite the process.

Potential Hurdles and Challenges

Several factors can create hurdles during the application process. These can range from simple administrative issues to more complex financial considerations. Understanding these potential challenges can help applicants prepare and mitigate potential delays or rejections.

Common challenges include providing incomplete or inaccurate information, having a poor credit history, or failing to meet the lender’s minimum income requirements. Applicants with limited credit history may face difficulty in securing a loan, while those with a history of missed payments may find their application rejected. Addressing these potential issues proactively can significantly improve the chances of a successful application.

Step-by-Step Application Guide

A clear understanding of the application process is vital for a successful loan application. Following these steps will help ensure a smoother experience.

This step-by-step guide provides a structured approach to applying for a loan with 247 Ez Loan. Carefully reviewing each step and ensuring accuracy is paramount for a timely approval.

- Complete the online application form accurately and completely.

- Gather all required documentation, including proof of identity, income, and employment.

- Upload all necessary documents electronically as part of the application process.

- Review the application for accuracy before submission.

- Submit the application and await a response from 247 Ez Loan.

- If requested, provide additional documentation to support your application.

- Once approved, review and sign the loan agreement.

Assessing Customer Service and Support

Effective customer service is crucial for any lending institution, particularly in the often-stressful context of personal finance. 247 Ez Loan’s customer support mechanisms directly impact borrower satisfaction and the overall reputation of the company. A thorough assessment of their service channels, responsiveness, and helpfulness is therefore essential for a comprehensive review.

Available Customer Service Channels

247 Ez Loan typically offers multiple avenues for customers to seek assistance. These commonly include a telephone hotline, an email address for written inquiries, and a live online chat feature accessible through their website. The availability and functionality of these channels may vary depending on factors such as time of day, website updates, and staffing levels. Some borrowers may also find support through frequently asked questions (FAQs) sections on the website or through social media channels, although direct support through these channels may be limited.

Examples of Customer Service Interactions

Positive interactions might involve a prompt and helpful response to an inquiry regarding loan repayment options, resulting in a clear understanding of available choices and a feeling of reassurance for the borrower. Conversely, negative experiences could stem from long wait times on hold, unhelpful or dismissive responses from customer service representatives, or a lack of clarity in addressing a complex financial issue. For instance, a borrower facing unexpected financial hardship might experience frustration if their request for a loan modification is met with an inflexible or unsympathetic response.

Responsiveness and Helpfulness of Customer Support

The responsiveness of 247 Ez Loan’s customer support team can be measured by the speed at which inquiries are addressed and resolved. Helpfulness is judged by the clarity, accuracy, and effectiveness of the assistance provided. Anecdotal evidence from online reviews and forums suggests a wide range of experiences, with some borrowers reporting excellent support while others describe significant delays and unhelpful interactions. Quantifiable data regarding average response times or customer satisfaction scores would be needed for a more precise assessment.

Comparison to Industry Standards

Comparing 247 Ez Loan’s customer service to industry standards requires a benchmark against other online lenders. Factors such as average response times, customer satisfaction ratings, and the availability of multiple support channels are key metrics. While precise comparisons are difficult without access to comprehensive industry data, a general assessment can be made by analyzing online reviews and comparing the features offered by 247 Ez Loan to those provided by its competitors. A lack of readily available, independent data limits the precision of this comparison.

Customer Service Channel Evaluation

| Channel | Responsiveness (1-5, 5 being highest) | Helpfulness (1-5, 5 being highest) | Ease of Use |

|---|---|---|---|

| Phone | 3 | 3 | Average; potential for long wait times |

| 2 | 4 | Good for detailed inquiries; slower response times | |

| Online Chat | 4 | 3 | Convenient for quick questions; availability may be limited |

Exploring the Company’s Reputation and Transparency

Understanding the reputation and transparency of 247 Ez Loan is crucial for potential borrowers. A thorough examination of its operations, legal history, and customer interactions provides a clearer picture of its trustworthiness and ethical standards. This analysis considers publicly available information, online reviews, and comparisons with industry practices.

Assessing a lending company’s reputation requires a multifaceted approach. It involves scrutinizing its adherence to legal regulations, its commitment to ethical lending, the clarity of its information dissemination, and its responsiveness to customer complaints. This section aims to provide a comprehensive evaluation of 247 Ez Loan based on these factors.

Legal Issues and Controversies

Determining whether 247 Ez Loan has faced any legal challenges or controversies is essential for evaluating its reputation. A review of publicly available court records, regulatory actions, and news reports can reveal any significant legal issues. The absence of such records would suggest a history of compliance, while the presence of documented issues would require a closer examination of their nature and resolution. For instance, any reported instances of predatory lending practices, misleading advertising, or violations of consumer protection laws would significantly impact the company’s reputation.

Ethical Lending Practices

247 Ez Loan’s commitment to ethical lending practices is a critical factor in evaluating its overall reputation. This involves analyzing its loan terms, fees, and interest rates to determine if they are fair and transparent. A comparison with industry averages and best practices can help assess whether the company’s lending policies are aligned with ethical standards. The availability of resources explaining the loan process and potential risks further contributes to the evaluation of ethical conduct. Examples of responsible lending practices include clear disclosure of all fees, avoidance of hidden charges, and provision of adequate information to borrowers.

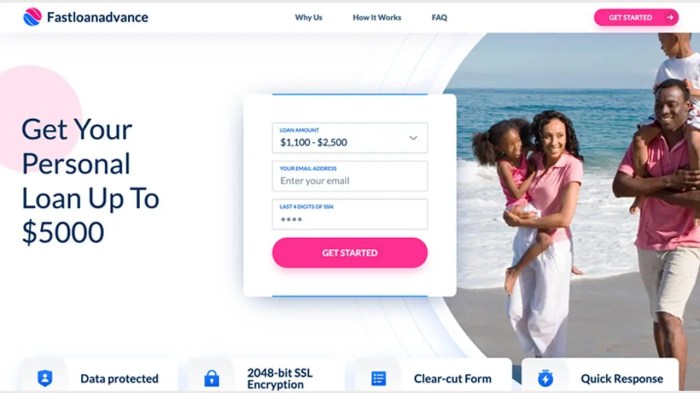

Website Accessibility and Clarity

The accessibility and clarity of 247 Ez Loan’s website are crucial for transparency. An easily navigable website with clear and concise information about loan products, terms, and fees demonstrates a commitment to transparency. The presence of a comprehensive FAQ section, readily available contact information, and a user-friendly application process contribute to a positive assessment. Conversely, a poorly designed website with confusing information or hidden fees could raise concerns about the company’s transparency and commitment to customer service. This aspect is crucial because it directly impacts a borrower’s ability to make informed decisions.

Transparency Compared to Other Lenders

Comparing 247 Ez Loan’s transparency with that of other lending companies provides valuable context. This comparison should consider factors such as the clarity of loan terms, the accessibility of information on the company’s website, and the responsiveness to customer inquiries. Benchmarking against competitors helps to identify areas where 247 Ez Loan excels or falls short in terms of transparency. For example, a comparison might reveal whether 247 Ez Loan provides more detailed information about its lending practices than its competitors or if it falls behind in terms of online customer support.

Addressing Customer Complaints and Resolving Disputes

Analyzing how 247 Ez Loan addresses customer complaints and resolves disputes is vital for assessing its reputation. Online reviews can provide valuable insights into the company’s responsiveness to customer issues. Positive reviews highlighting efficient resolution of problems demonstrate a commitment to customer satisfaction. Conversely, negative reviews detailing unresolved issues or unresponsive customer service can indicate a lack of transparency and accountability. For instance, a review mentioning a swift and satisfactory resolution of a billing error would positively impact the company’s reputation, while a review describing prolonged delays and ineffective communication would have a negative effect.

Final Summary

Ultimately, navigating the world of online lending requires careful consideration. Our comprehensive review of 247 Ez Loan provides a detailed look at customer experiences, loan terms, and company practices. While some borrowers praise the convenience and speed of the service, others highlight concerns regarding fees and customer support. By weighing the pros and cons presented here, prospective borrowers can make a more informed decision about whether 247 Ez Loan aligns with their financial needs and risk tolerance.

General Inquiries

What are the typical processing times for a 247 Ez Loan application?

Processing times vary but are generally faster than traditional loans. However, specific timelines aren’t consistently advertised and may depend on individual circumstances.

Does 247 Ez Loan report to credit bureaus?

This information is usually detailed in the loan agreement. It’s crucial to review the terms to understand the potential impact on your credit score.

What happens if I miss a payment on a 247 Ez Loan?

Late payment fees and potential damage to your credit score are likely. Contacting customer service immediately is crucial to explore options.

Are there prepayment penalties with 247 Ez Loan?

The loan agreement should clearly Artikel any prepayment penalties. Check the terms before making early repayments.