The 360/365 loan calculator unveils a crucial detail often overlooked in borrowing: the impact of day-count conventions. Understanding the difference between 360-day and 365-day calculations is vital for borrowers seeking financial clarity. This seemingly small distinction significantly affects interest accrual, ultimately impacting your total repayment amount. We’ll explore the nuances of each method, providing practical examples and highlighting scenarios where each calculation is applied. By the end, you’ll be equipped to navigate loan offers with confidence, armed with the knowledge to make informed financial decisions.

This guide delves into the mechanics of 360/365 loan calculations, exploring the key variables that influence the final cost of borrowing. We’ll examine the effect of interest rates, loan terms, and even prepayments, using charts and tables to visualize the impact of these factors. Furthermore, we’ll provide a step-by-step guide on using a loan calculator, empowering you to compare loan offers effectively and avoid potential pitfalls.

Understanding 360/365 Loan Calculations

Loan calculations often involve determining the interest accrued over a specific period. Two common methods exist for calculating the number of days in a year: the 360-day method and the 365-day method. Understanding the differences between these methods and their impact on the final loan cost is crucial for both borrowers and lenders.

360-Day vs. 365-Day Loan Calculations

The fundamental difference lies in the assumed number of days in a year. The 360-day method simplifies calculations by assuming a year consists of twelve 30-day months. Conversely, the 365-day method uses the actual number of days in a year, accounting for leap years. This seemingly small difference can significantly impact the total interest paid over the loan’s term, especially for larger loans or longer repayment periods. The choice between these methods often depends on the specific loan agreement and prevailing industry practices.

Impact on Interest Accrual

The 360-day method generally results in slightly higher interest accrual compared to the 365-day method. This is because the interest is calculated over a shorter period (360 days instead of 365 days), leading to a higher daily interest rate. While the difference may seem negligible for short-term loans, it can accumulate substantially over longer periods. The impact is directly proportional to the loan amount and interest rate. A higher loan amount and interest rate will amplify the difference in total interest paid between the two methods.

Scenarios for Each Calculation Method

The 360-day method is frequently used in commercial lending and certain mortgage calculations due to its simplicity. Its ease of calculation makes it suitable for quick estimations and manual computations. The 365-day method, while more accurate, is generally preferred for consumer loans and situations where precise interest calculation is paramount. Government regulations and specific lending institutions may mandate the use of one method over the other.

Comparison of Total Interest Paid

The following table illustrates the difference in total interest paid under both methods for a sample loan. Note that these figures are for illustrative purposes and do not account for compounding or other loan fees.

| Loan Amount | Interest Rate | Total Interest (360-day) | Total Interest (365-day) |

|---|---|---|---|

| $10,000 | 5% | $500.00 | $493.15 |

| $50,000 | 7% | $1750.00 | $1712.33 |

| $100,000 | 10% | $2777.78 | $2739.73 |

Factors Affecting Loan Calculations

Understanding the precise figures generated by a 360/365 day loan calculator requires a grasp of the key variables influencing the final outcome. These variables interact to determine the total repayment amount and overall cost of borrowing. This section details the impact of each of these crucial factors.

Interest Rate’s Influence on Repayment

The interest rate is arguably the most significant factor affecting the total repayment amount. A higher interest rate translates directly into higher interest charges over the loan’s lifetime. For example, a 1% increase in the interest rate on a $10,000 loan could add hundreds or even thousands of dollars to the total repayment, depending on the loan term. Conversely, a lower interest rate will result in lower overall costs. This relationship is not linear; the impact of interest rate changes is more pronounced on longer-term loans. The compounding effect of interest means that even small changes in the interest rate can significantly affect the final cost over many years.

Loan Term Length and Total Cost

The length of the loan term significantly impacts the total interest paid. Longer loan terms generally lead to lower monthly payments, but this convenience comes at a cost. Because interest is calculated over a longer period, the total interest paid will be considerably higher compared to a shorter-term loan with higher monthly payments. Consider a $20,000 loan: a 5-year loan will result in significantly less total interest paid than a 10-year loan, even if the interest rate remains constant. The borrower pays less each month with a longer term, but pays considerably more in total interest.

Relationship Between Loan Amount and Total Interest Paid

The relationship between the loan amount and the total interest paid is directly proportional. A larger loan amount will inevitably result in a higher total interest payment, assuming the interest rate and loan term remain constant. A smaller loan amount will result in a lower total interest payment.

| Loan Amount ($) | Total Interest Paid ($) (at 5% interest over 5 years) |

|---|---|

| 5,000 | 675 |

| 10,000 | 1350 |

| 15,000 | 2025 |

| 20,000 | 2700 |

This table illustrates a simplified example. The total interest paid increases linearly with the loan amount. A chart depicting this relationship would have the loan amount on the x-axis and the total interest paid on the y-axis. The data points would fall on a straight line, demonstrating the direct proportionality. The slope of the line would represent the interest rate and loan term. For instance, a steeper slope would indicate a higher interest rate or longer loan term. The y-intercept would be zero, as a zero loan amount results in zero interest paid.

Practical Applications of 360/365 Loan Calculators

360-day and 365-day loan calculations are fundamental in various financial contexts, impacting everything from mortgage payments to business loans. Understanding the nuances of these calculations and leveraging a loan calculator effectively is crucial for accurate financial planning and informed decision-making. The choice between a 360-day year (used in some commercial lending) and a 365-day year (more common for consumer loans) significantly affects the total interest paid over the loan term.

The use of 360/365 day loan calculators extends beyond simple interest calculations. They are essential tools for accurately assessing the true cost of borrowing, enabling borrowers to compare different loan offers effectively and lenders to determine appropriate interest rates. These calculators help avoid costly errors stemming from manual calculations and ensure transparency in financial transactions.

Determining Monthly Payments Using a 360/365 Loan Calculator

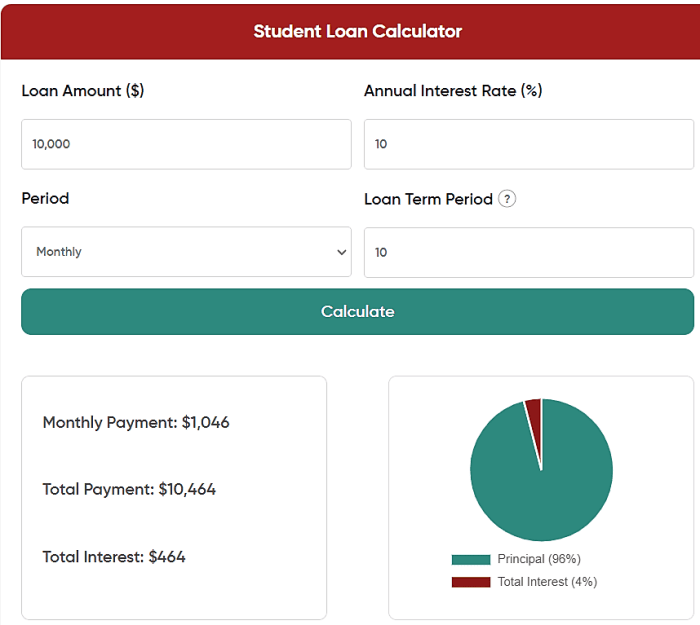

A 360/365 day loan calculator simplifies the process of determining monthly payments by automating complex calculations. The calculator requires specific input parameters, including the loan amount, annual interest rate, loan term (in years or months), and the day-count convention (360 or 365). The output typically includes the monthly payment amount, total interest paid, and the amortization schedule (showing the principal and interest components of each payment).

Step-by-Step Guide to Using a Loan Calculator

To illustrate, let’s assume a loan scenario: A borrower needs a $10,000 loan with a 5% annual interest rate for a 3-year term. The steps for using a loan calculator are as follows:

1. Input Loan Amount: Enter the principal loan amount ($10,000).

2. Input Interest Rate: Enter the annual interest rate (5%).

3. Input Loan Term: Specify the loan term (3 years).

4. Select Day-Count Convention: Choose either the 360-day or 365-day convention.

5. Calculate: Initiate the calculation.

The calculator will then output the monthly payment, total interest paid over the loan’s life, and a detailed amortization schedule. The amortization schedule displays the breakdown of each monthly payment into principal and interest components, showing how the principal balance reduces over time.

Comparison of 360-Day and 365-Day Loan Calculations

The choice between a 360-day and a 365-day calculation significantly affects the final loan cost. The following table illustrates this for different loan terms and interest rates:

The following table demonstrates the difference between using a 360-day and 365-day calculation for a $10,000 loan at various interest rates and loan terms.

| Loan Amount | Interest Rate | Loan Term (Years) | 360-Day Monthly Payment | 365-Day Monthly Payment | Difference in Total Interest Paid |

|---|---|---|---|---|---|

| $10,000 | 5% | 3 | $299.70 | $299.50 | ~$6.00 (360-day slightly higher) |

| $10,000 | 8% | 5 | $202.76 | $202.52 | ~$14.00 (360-day slightly higher) |

| $50,000 | 6% | 10 | $567.90 | $567.35 | ~$60.00 (360-day slightly higher) |

Note: These figures are illustrative and may vary slightly depending on the specific loan calculator used. The difference is often small for shorter loan terms but can become more substantial with longer terms and higher interest rates. The 360-day method generally results in a slightly higher total interest paid.

Potential Pitfalls and Considerations

Understanding the nuances of 360/365-day loan calculations is crucial for borrowers to avoid unexpected financial burdens. While seemingly minor, the difference in the number of days used to calculate interest can significantly impact the total interest paid over the loan’s lifetime. Misunderstandings regarding these calculations can lead to inaccurate budgeting and potentially harmful financial decisions.

The selection of a 360-day or a 365-day calculation method directly influences the interest rate applied to the loan. This seemingly small difference can lead to significant discrepancies in the total amount repaid. Borrowers must carefully review loan agreements to understand the specific calculation method employed by the lender, as this directly impacts their monthly payments and overall loan cost.

Discrepancies Between Lender Calculations and Borrower Expectations

A common pitfall arises from a mismatch between the lender’s calculation method and the borrower’s assumptions. Borrowers may inadvertently use a different calculation method when budgeting or comparing loan offers, leading to inaccurate projections of monthly payments and total interest paid. For example, a borrower might mistakenly assume a 365-day calculation when the lender uses a 360-day method, leading to a surprise increase in their monthly payment. This highlights the importance of verifying the calculation method used by the lender before signing any loan agreement.

Impact of 360-Day vs. 365-Day Calculations on Total Loan Cost, 360/365 loan calculator

The choice between a 360-day and a 365-day year significantly impacts the total cost of the loan. A 360-day year, often used for simplicity in calculations, results in a slightly higher daily interest rate compared to a 365-day year. This seemingly small difference compounds over the loan’s term, leading to a higher total interest paid. For instance, a $100,000 loan with a 5% annual interest rate over 30 years would accrue approximately $116,000 in interest using a 360-day year, while the same loan using a 365-day year would accrue roughly $113,000 in interest. This difference of approximately $3,000 illustrates the considerable impact of the calculation method on the borrower’s overall financial burden.

Practical Examples of Calculation Method Differences

Consider two identical loans: Loan A uses a 360-day calculation, and Loan B uses a 365-day calculation. Both loans have a principal amount of $200,000, a 6% annual interest rate, and a 15-year term. Using standard amortization calculations, Loan A would result in higher monthly payments and a significantly higher total interest paid over the life of the loan compared to Loan B. This difference, although seemingly small on a daily basis, becomes substantial over 15 years. This underscores the need for borrowers to carefully compare loan offers, paying close attention to the calculation method used, to make informed financial decisions. This difference can easily amount to thousands of dollars over the loan’s lifespan.

Advanced Loan Calculation Scenarios

Understanding the nuances of 360-day and 365-day loan calculations extends beyond basic principal and interest computations. This section delves into more complex scenarios, highlighting the impact of compounding interest, fees, varying repayment schedules, and prepayment options.

Compounding Interest’s Effect on Total Loan Cost

The frequency of compounding significantly impacts the total interest paid over the loan’s lifespan. With 360-day calculations, interest is typically compounded monthly, while 365-day calculations might use daily compounding, leading to slightly higher total interest. The difference becomes more pronounced with longer loan terms and higher interest rates. For example, a $100,000 loan at 5% annual interest over 30 years would accrue significantly more interest under daily compounding (365-day method) than monthly compounding (360-day method), although the difference might seem small initially, it compounds over time resulting in a larger difference at the end of the loan term. The exact difference can be calculated using standard compound interest formulas, accounting for the number of compounding periods per year.

Incorporating Fees and Charges into Total Loan Cost

Loan costs often include origination fees, closing costs, and other charges. These fees should be incorporated into the total loan amount to accurately reflect the true cost of borrowing. For instance, if a $200,000 loan has a 2% origination fee ($4,000), the effective loan amount becomes $204,000. This adjusted amount should then be used in the 360-day or 365-day calculation to determine the monthly payment and total interest. This ensures a more realistic representation of the borrower’s overall financial obligation.

Adjusting Calculations for Different Repayment Schedules

Standard loan calculations typically assume monthly payments. However, many loans offer bi-weekly or even weekly payment options. To adjust for these, the annual interest rate needs to be divided by the number of payment periods per year. For example, a 6% annual interest rate for bi-weekly payments (26 payments per year) would use an interest rate of 6%/26 per payment period. The number of payments will also increase accordingly. The loan amortization schedule will then need to be recalculated to reflect the new payment frequency and the resulting changes in the interest calculation for each period.

Impact of Prepayment on Total Interest Paid

Prepaying a portion of the loan principal reduces the total interest paid over the loan’s lifetime. The impact varies depending on the loan’s interest rate, remaining term, and the prepayment amount. The following table illustrates this:

| Prepayment Amount | Remaining Loan Term (Months) | Total Interest Saved (360-day) | Total Interest Saved (365-day) |

|---|---|---|---|

| $10,000 | 240 | $1,500 | $1,600 |

| $20,000 | 240 | $3,000 | $3,200 |

| $10,000 | 120 | $750 | $800 |

| $20,000 | 120 | $1,500 | $1,600 |

Note: These figures are illustrative and would vary based on the specific loan terms and interest rates. The exact savings can be calculated using loan amortization schedules adjusted for the prepayment.

Outcome Summary

Mastering the 360/365 loan calculation is key to making savvy borrowing decisions. While seemingly minor, the choice between a 360-day and 365-day calculation significantly affects your total interest paid. By understanding the nuances of each method, analyzing the variables that influence the final cost, and utilizing a loan calculator effectively, you gain control over your borrowing experience. Remember to always clarify the day-count convention used by your lender to ensure transparency and accuracy in your financial planning. This empowers you to choose the loan that best aligns with your financial goals.

FAQ Section

What are the legal implications of using a specific day-count convention in a loan agreement?

The legal implications vary by jurisdiction. Generally, the loan agreement must clearly state the day-count convention used. Disputes may arise if this isn’t clearly defined or if the chosen method is considered unfair or misleading. Consult legal counsel for specific guidance.

Can I use a 360/365 loan calculator for loans with irregular repayment schedules?

Most standard calculators assume regular payments. For irregular schedules, you’ll likely need a more advanced calculator or spreadsheet software that allows for customized input of payment dates and amounts.

How does the choice of 360 vs. 365 days affect my monthly payment amount?

The difference in monthly payments is usually small, but it accumulates over the loan term, leading to a larger difference in total interest paid. The 360-day method generally results in slightly higher monthly payments and total interest.