The 365/360 commercial loan calculator is a crucial tool for understanding the nuances of commercial lending. This calculator accounts for the subtle yet significant difference between using a 365-day year and a 360-day year in interest calculations, a distinction that can impact the overall cost of a loan considerably. Understanding this difference is paramount for both borrowers and lenders, ensuring transparency and accurate financial planning. This guide delves into the mechanics of this calculator, exploring its functionality, influencing factors, and practical applications for various commercial loan scenarios.

We’ll break down the complexities of 365-day versus 360-day calculations, demonstrating how these variations affect interest accrual and total loan costs. We’ll then explore the inputs and outputs of a typical 365/360 commercial loan calculator, guiding you through a step-by-step process to effectively utilize this tool. Finally, we’ll examine how factors like interest rate, loan term, and repayment schedules influence the final cost, offering illustrative scenarios to solidify your understanding.

Understanding 365/360-Day Loan Calculations

Understanding the nuances of 365-day versus 360-day loan calculations is crucial for borrowers and lenders alike. The choice of method directly impacts the total interest paid over the loan’s term, potentially leading to significant differences, especially for larger loans or longer repayment periods. This section clarifies the distinctions between these two common calculation methods.

365-Day vs. 360-Day Loan Calculations: A Comparison

The fundamental difference lies in the number of days used to calculate the daily interest rate. A 365-day calculation uses the actual number of days in a year (365, or 366 in a leap year), while a 360-day calculation uses a standardized 360-day year. This seemingly small difference can have a substantial effect on the total interest accrued over the loan’s lifetime. The 360-day method, historically preferred for its simplicity, results in a slightly higher daily interest rate, leading to increased total interest payments compared to the 365-day method.

Impact on Interest Accrual

The impact on interest accrual stems directly from the difference in the daily interest rate. In a 360-day calculation, the daily interest rate is calculated by dividing the annual interest rate by 360. In a 365-day calculation, the annual interest rate is divided by 365 (or 366 in a leap year). This seemingly minor adjustment leads to a higher daily interest rate in the 360-day method, which compounds over the loan term to produce a larger total interest amount.

Illustrative Examples

Let’s consider a loan of $10,000 with an annual interest rate of 5% over a one-year term.

Using the 360-day method:

Daily interest rate = 5% / 360 = 0.01389%

Total interest = $10,000 * 0.05 = $500

Using the 365-day method:

Daily interest rate = 5% / 365 = 0.0137%

Total interest = $10,000 * 0.05 = $500

While the annual interest remains the same, the difference will become apparent over longer loan terms. For example, a 5-year loan with the same parameters will see a more significant difference in total interest paid.

Comparison Table: 365-Day vs. 360-Day Loan Calculations

| Feature | 365-Day Calculation | 360-Day Calculation | Impact |

|---|---|---|---|

| Days in a year | 365 (or 366 in a leap year) | 360 | Affects daily interest rate |

| Daily Interest Rate | Annual Interest Rate / 365 (or 366) | Annual Interest Rate / 360 | 360-day method yields a higher daily rate |

| Total Interest Paid | Generally lower | Generally higher | Difference increases with loan term and amount |

| Accuracy | More accurate reflection of actual time | Simpler calculation, less accurate | Preference depends on lender and borrower needs |

Exploring the Functionality of a Commercial Loan Calculator

A 365/360 commercial loan calculator simplifies the complex process of determining loan payments and related figures. Understanding its functionality is crucial for borrowers and lenders alike to make informed financial decisions. This section will delve into the inputs, calculations, and usage of such a calculator.

Typical Inputs Required

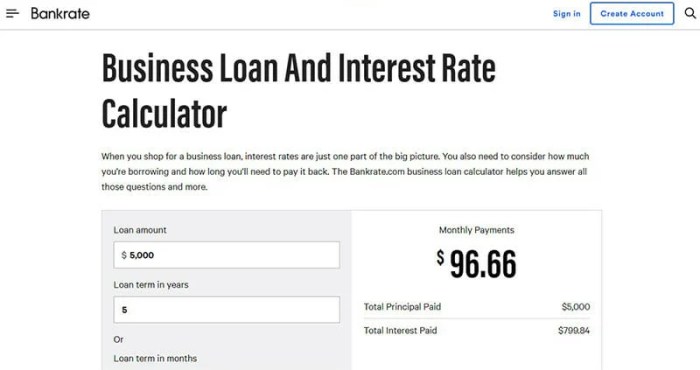

A typical 365/360 commercial loan calculator requires several key inputs to accurately compute loan payments and other relevant financial metrics. These inputs typically include the loan amount (principal), the annual interest rate, the loan term (typically expressed in years or months), and the day-count convention (365 or 360 days). Accurate input of these values is paramount for obtaining reliable results. Additional inputs might include origination fees, prepayment penalties, or other loan-specific charges, depending on the complexity of the loan agreement. For example, a loan of $100,000 with a 6% annual interest rate, a 5-year term, and a 360-day count convention would require all these values as input.

Determining the Monthly Payment Amount

The calculator uses a formula derived from standard loan amortization principles to determine the monthly payment. This formula considers the time value of money, incorporating both the principal and interest components of the loan. The 365/360 day-count convention impacts the calculation by determining the precise number of days used in calculating interest accrual. The core formula employed is typically a variation of:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

where:

* M = Monthly payment

* P = Principal loan amount

* i = Monthly interest rate (Annual interest rate / 12)

* n = Total number of payments (Loan term in years * 12)

The 360-day year convention simplifies calculations but might slightly underestimate the actual interest paid compared to a 365-day year convention, depending on the specific loan structure and payment schedule.

Step-by-Step Procedure for Using a Commercial Loan Calculator

Using a commercial loan calculator involves a straightforward process. First, gather all the necessary information: loan amount, annual interest rate, loan term (in years or months), and the day-count convention (365 or 360). Second, input these values into the designated fields of the calculator. Third, the calculator will automatically compute the monthly payment, total interest paid, and possibly other relevant data such as an amortization schedule showing the breakdown of principal and interest payments over the loan term. Finally, review the results carefully to ensure they align with your expectations and the terms of your loan agreement. For example, if the inputs are $500,000, 4%, 10 years, and 360 days, the calculator would output the monthly payment, total interest paid over 10 years, and a detailed amortization schedule.

User Interface Flowchart

A user interface flowchart for a 365/360 commercial loan calculator would typically begin with a start node, followed by input fields for loan amount, interest rate, loan term (years or months), and day-count convention (365/360). A decision point would then check if all fields are correctly populated. If yes, the calculation is performed using the appropriate formula. The results (monthly payment, total interest, amortization schedule) would then be displayed. If any fields are missing or invalid, an error message would be displayed, prompting the user to correct the input. Finally, an end node concludes the process. The flowchart would visually represent the sequential steps, ensuring a clear and user-friendly experience.

Factors Influencing Commercial Loan Costs: 365/360 Commercial Loan Calculator

Understanding the total cost of a commercial loan is crucial for businesses seeking financing. Several interconnected factors significantly impact the final expense, influencing both the initial outlay and the long-term repayment burden. This section will dissect these key elements, highlighting their individual and collective effects.

Interest Rate’s Impact on Loan Costs

The interest rate is the most significant factor determining the overall cost of a commercial loan. It represents the percentage of the principal loan amount a borrower pays as a fee for using the lender’s money. A higher interest rate directly translates to a higher total interest paid over the loan’s lifespan. Conversely, a lower interest rate results in lower overall costs. The interest rate is influenced by various market factors, including the prevailing economic climate, the lender’s risk assessment of the borrower, and the prevailing prime rate.

Loan Term and Total Interest Paid

The loan term, or the length of time a borrower has to repay the loan, significantly interacts with the interest rate to determine the total interest paid. Longer loan terms generally result in higher total interest payments, even with lower interest rates, because the borrower pays interest over a longer period. Shorter loan terms, while resulting in higher monthly payments, lead to lower overall interest costs.

Comparison of Loan Costs Under Varying Interest Rates and Terms

The following illustrates the impact of different interest rates and loan terms on the total cost of a $100,000 commercial loan:

- Scenario 1: 5% interest rate, 5-year term. Total interest paid: Approximately $12,800. Total repayment: $112,800

- Scenario 2: 7% interest rate, 5-year term. Total interest paid: Approximately $18,600. Total repayment: $118,600

- Scenario 3: 5% interest rate, 10-year term. Total interest paid: Approximately $26,600. Total repayment: $126,600

- Scenario 4: 7% interest rate, 10-year term. Total interest paid: Approximately $38,600. Total repayment: $138,600

Note: These calculations are simplified and do not include any potential fees or charges. Actual costs may vary depending on the specific loan terms and conditions.

Hierarchical Structure of Factors Influencing Commercial Loan Costs

The relative importance of factors influencing commercial loan costs can be represented hierarchically.

- Interest Rate: This is the most dominant factor, directly impacting the overall cost. A small change in the interest rate can significantly alter the total interest paid.

- Loan Term: The length of the loan significantly affects the total interest paid, interacting directly with the interest rate.

- Loan Amount: The principal amount borrowed directly influences the absolute amount of interest paid, although the relative impact (percentage-wise) might be less than interest rate or term.

- Fees and Charges: Origination fees, closing costs, prepayment penalties, and other fees add to the overall cost, though they usually represent a smaller percentage compared to interest.

- Creditworthiness of the Borrower: This indirectly influences the interest rate offered by the lender. A borrower with a strong credit history will likely secure a lower interest rate, reducing the overall cost.

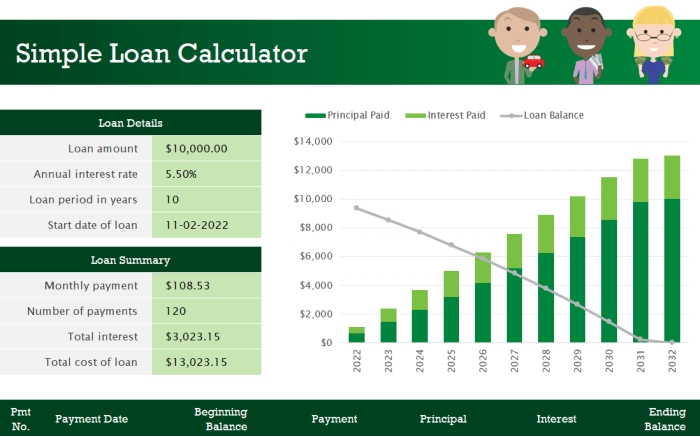

Amortization Schedules and Loan Repayment

Understanding how a commercial loan is repaid is crucial for effective financial planning. An amortization schedule provides a detailed breakdown of each loan payment, clearly showing the allocation between principal and interest over the loan’s lifespan. This allows borrowers to track their progress, anticipate future payments, and make informed decisions about their financial obligations.

An amortization schedule is a table that Artikels the repayment of a loan over time. Each payment is broken down into two components: principal (the original loan amount) and interest (the cost of borrowing the money). Initially, a larger portion of each payment goes towards interest, with the principal repayment increasing gradually over the loan term. The schedule’s importance lies in its transparency and predictability, allowing for better budgeting and financial management.

Creating a Simple Amortization Schedule

Creating a basic amortization schedule involves calculating the periodic payment amount using a formula and then iteratively applying it to determine the principal and interest components of each payment. While complex spreadsheets and software can automate this process, a simplified manual calculation demonstrates the underlying principles. The most common formula for calculating the periodic payment (PMT) is:

PMT = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* P = Principal loan amount

* i = Periodic interest rate (annual interest rate divided by the number of payments per year)

* n = Total number of payments

Let’s consider a $100,000 commercial loan with a 5% annual interest rate and a 10-year term (120 monthly payments).

Amortization Schedule Example

The following table illustrates a simplified portion of the amortization schedule for the example loan. Note that due to rounding, the final payment may slightly vary.

| Payment Number | Payment Amount | Principal | Interest |

|---|---|---|---|

| 1 | $1,059.72 | $400.72 | $659.00 |

| 2 | $1,059.72 | $404.75 | $654.97 |

| 3 | $1,059.72 | $408.80 | $650.92 |

| … | … | … | … |

| 120 | $1,059.72 | $1,059.72 | $0.00 |

Implications of Prepaying a Commercial Loan, 365/360 commercial loan calculator

Prepaying a commercial loan can significantly impact the amortization schedule. When a borrower makes additional payments or a lump-sum payment, the principal balance reduces, leading to lower interest payments in subsequent periods. This accelerates the loan repayment process, potentially reducing the overall interest paid. However, the terms of the loan agreement should be reviewed as some loans may include prepayment penalties. These penalties are typically a percentage of the prepaid amount and can offset some of the savings achieved through prepayment. The exact impact of prepayment on the remaining schedule will depend on the loan’s terms and the amount prepaid.

Illustrative Scenarios and Comparative Analysis

Understanding the impact of different loan terms on the total cost is crucial for informed decision-making. Analyzing specific scenarios allows for a clearer comparison of various loan options and their financial implications. This section presents two illustrative examples to highlight the effects of loan amount and interest rate on the total interest paid over the loan’s lifetime.

Scenario 1: Small Bakery Securing a Commercial Loan

Let’s consider a small bakery needing a $50,000 commercial loan at a 7% annual interest rate over a 5-year term. Using a 365/360 day-count convention, the calculator would determine the monthly payment amount. This payment includes both principal and interest. The total interest paid over the five years would be calculated by subtracting the initial loan amount from the total amount repaid. A detailed amortization schedule would show the breakdown of principal and interest payments for each month. For this scenario, let’s assume the monthly payment is approximately $960, and the total interest paid over the five-year period is approximately $17,600.

Scenario 2: Expansion Loan for a Growing Business

Now, consider a different scenario. Suppose the same bakery, experiencing significant growth, requires a $100,000 loan at a slightly lower interest rate of 6% over the same 5-year term. Again, utilizing the 365/360 day-count convention, the calculator would compute a higher monthly payment, reflecting the larger loan amount. However, the lower interest rate would mitigate the overall cost. Let’s assume the monthly payment in this case is approximately $1,900, and the total interest paid over the five years is approximately $26,000.

Comparative Analysis of Interest Paid

Comparing the two scenarios, we see that while the larger loan in Scenario 2 resulted in a higher total interest paid ($26,000) compared to Scenario 1 ($17,600), the difference is less than double despite the loan amount being doubled. This is due to the lower interest rate in Scenario 2. A visual representation, such as a bar chart, could clearly show the difference in total interest paid between the two scenarios. The bar chart would visually represent the magnitude of the total interest paid for each scenario, allowing for an immediate comparison of the financial implications.

Impact of Different Repayment Schedules

The repayment schedule significantly impacts the overall cost of the loan. A shorter repayment period, while requiring higher monthly payments, generally results in less total interest paid due to less time accruing interest. Conversely, a longer repayment period leads to lower monthly payments but higher overall interest costs. For example, if the bakery in Scenario 1 chose a 3-year loan term instead of 5 years, the monthly payment would be substantially higher, but the total interest paid would be considerably lower. Conversely, extending the loan term to 7 years would reduce monthly payments but significantly increase the total interest paid. This highlights the importance of carefully considering the trade-off between manageable monthly payments and minimizing the overall cost of borrowing.

Last Recap

Mastering the 365/360 commercial loan calculator empowers you to navigate the complexities of commercial lending with confidence. By understanding the underlying calculations and the impact of various factors, you can make informed decisions, negotiate favorable loan terms, and effectively manage your financial obligations. Remember that while this calculator provides a valuable tool for estimation, always consult with financial professionals for personalized advice tailored to your specific circumstances. The information presented here serves as a foundational understanding, equipping you with the knowledge to approach commercial lending with greater clarity and control.

Key Questions Answered

What is the difference between a 360-day and 365-day year in loan calculations?

The difference lies in the number of days used to calculate daily interest. A 360-day year simplifies calculations but results in slightly higher interest payments over the loan’s lifetime compared to a 365-day year.

Can I use this calculator for personal loans?

While the underlying principles apply, this calculator is primarily designed for commercial loans, which often involve different interest calculation methods and terms than personal loans.

How does prepayment affect my loan’s total cost?

Prepaying a loan can significantly reduce the total interest paid, as you’re eliminating future interest accrual. However, some loans have prepayment penalties, so check your loan agreement.

Where can I find a free 365/360 commercial loan calculator?

Many financial websites and online calculators offer free 365/360 commercial loan calculators. Search online for “365/360 commercial loan calculator” to find several options.