365 360 loan calculator excel unveils the intricacies of loan calculations, exploring the nuances of 365-day and 360-day methods. This guide delves into the practical application of Excel functions like PMT, IPMT, and PPMT, demonstrating how to construct a robust and user-friendly loan amortization schedule. We’ll cover building a calculator in Excel, incorporating advanced features like variable payment frequencies and visual representations of amortization, and ultimately empowering you to make informed borrowing decisions.

Understanding the differences between these calculation methods is crucial for accurately assessing loan costs. We’ll cover how to build an Excel spreadsheet capable of handling both methods, allowing for direct comparison of results and highlighting the potential financial impact of each. This detailed walkthrough, complete with step-by-step instructions and illustrative examples, ensures a clear understanding of the process, from initial setup to advanced feature implementation.

Understanding 365/360 Loan Calculation Methods

Loan calculations often employ different day-count conventions, significantly impacting the final interest amount and total repayment. Two prevalent methods are the 365-day and 360-day methods. Understanding their differences is crucial for borrowers and lenders alike. This section details the nuances of each method, highlighting their impact and typical applications.

365-Day vs. 360-Day Loan Calculations

The core difference lies in the number of days used to calculate the annual interest rate. The 365-day method uses the actual number of days in a year, accounting for leap years. Conversely, the 360-day method simplifies calculations by assuming a year always has 360 days (30 days per month). This seemingly minor difference can lead to notable variations in interest accrued, especially over longer loan terms.

Impact on Interest Accrual and Repayment

Using a 365-day method results in slightly lower daily interest compared to the 360-day method because the annual interest is divided over a larger number of days. This means that for the same loan amount and interest rate, the total interest paid over the loan term will be lower with the 365-day method. The 360-day method, conversely, results in higher daily interest and, therefore, a higher total interest payment. The difference becomes more pronounced with larger loan amounts and longer repayment periods. For example, a $100,000 loan at 5% annual interest over 10 years will show a noticeable difference in total interest paid depending on the method used.

Typical Use Cases for Each Method

The choice between the 365-day and 360-day methods often depends on industry conventions and legal requirements. The 365-day method is frequently preferred for its accuracy, reflecting the actual number of days in a year. It’s commonly used in government bonds and certain corporate lending scenarios where precise interest calculations are paramount. The 360-day method, with its simplified calculation, is often favored in mortgage lending and other consumer loans, primarily due to its ease of computation and historical usage. Its simplicity makes it easier to manually calculate interest and provides faster processing.

Comparison of 365-Day and 360-Day Loan Calculations

| Calculation Method | Interest Calculation Formula | Typical Use Cases | Advantages | Disadvantages |

|---|---|---|---|---|

| 365-Day Method | (Principal x Interest Rate x Number of Days) / 365 | Government bonds, corporate loans, situations requiring precise interest calculation | Accurate reflection of actual days in a year, leading to more precise interest calculations. | More complex calculations, potentially requiring specialized software or tools. |

| 360-Day Method | (Principal x Interest Rate x Number of Days) / 360 | Mortgages, consumer loans, situations prioritizing simplified calculations | Simplified calculations, easier manual computation, faster processing. | Slightly less accurate interest calculation, potentially leading to higher total interest paid compared to the 365-day method. |

Excel Functions for Loan Calculations

Mastering Excel’s financial functions is crucial for accurate and efficient loan analysis. This section details the key functions for calculating loan payments, interest, and principal, demonstrating their application within a loan amortization schedule and showcasing a comparative analysis using both 365-day and 360-day calculation methods.

PMT Function: Calculating Loan Payments

The PMT function calculates the periodic payment for a loan based on constant payments and a constant interest rate. Its syntax is: PMT(rate, nper, pv, [fv], [type]), where: ‘rate’ is the periodic interest rate, ‘nper’ is the total number of payment periods, ‘pv’ is the present value (loan amount), ‘fv’ is the future value (optional, defaults to 0), and ‘type’ specifies when payments are due (0 for end of period, 1 for beginning, defaults to 0). For example, to calculate the monthly payment on a $10,000 loan at 6% annual interest over 3 years, the formula would be: =PMT(0.06/12, 3*12, 10000). This will return the monthly payment amount.

IPMT and PPMT Functions: Distributing Interest and Principal

The IPMT function calculates the interest payment for a given period, while PPMT calculates the principal payment for that same period. Both use the same arguments as PMT: IPMT(rate, per, nper, pv, [fv], [type]) and PPMT(rate, per, nper, pv, [fv], [type]). ‘per’ represents the period for which you want to calculate the interest or principal. For instance, to find the interest payment for the first month of the loan example above, use: =IPMT(0.06/12, 1, 3*12, 10000). Similarly, =PPMT(0.06/12, 1, 3*12, 10000) will provide the principal payment for the first month. These functions are vital for building a detailed amortization schedule.

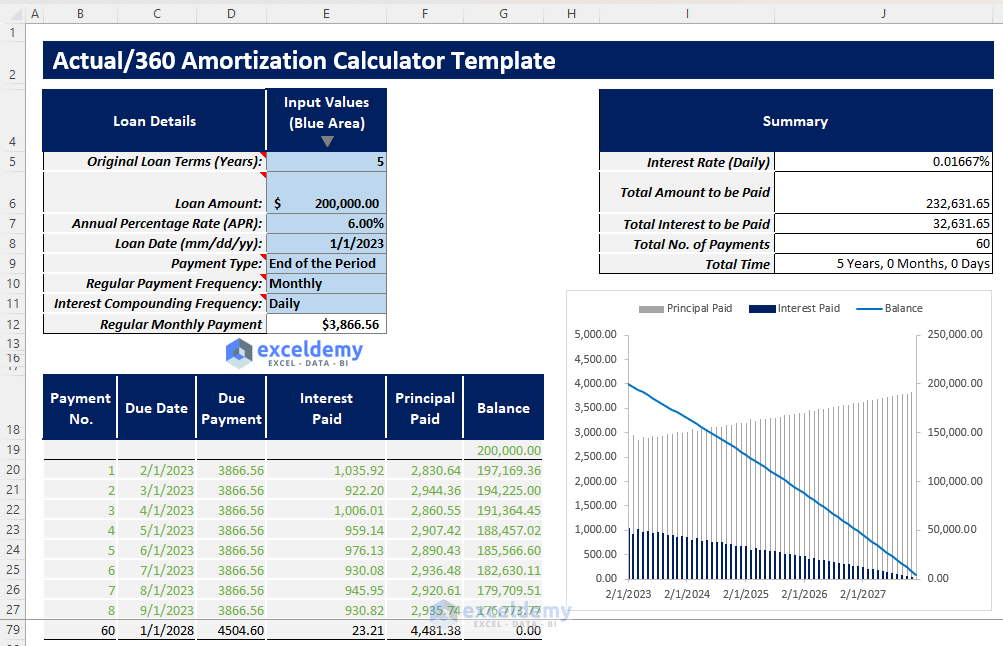

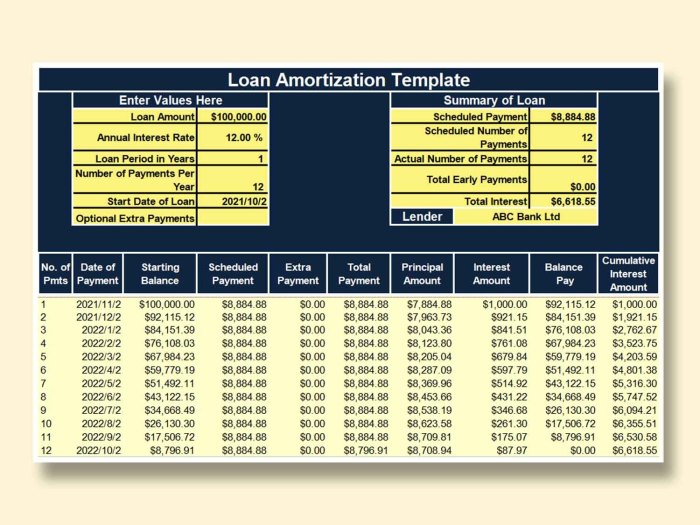

Constructing a Loan Amortization Schedule

An amortization schedule systematically breaks down each loan payment into its interest and principal components, showing the remaining loan balance over time. To build one in Excel, you’ll need columns for: Payment Number, Payment Amount, Interest Paid, Principal Paid, and Loan Balance. The first row contains the initial loan amount in the “Loan Balance” column. The “Payment Amount” column uses the PMT function. Subsequent rows calculate interest paid using IPMT, principal paid using PPMT, and the remaining balance by subtracting the principal paid from the previous balance. This process is repeated for each payment period. The schedule provides a clear picture of how the loan is repaid over its lifetime.

Loan Calculation Comparison: 365-Day vs. 360-Day Methods

The choice between 365-day and 360-day methods significantly impacts the calculated interest, especially for longer loan terms. The difference stems from the number of days used to calculate the daily interest rate. A spreadsheet comparing both methods would include two separate amortization schedules, one for each method. The key difference lies in the ‘rate’ argument within the PMT, IPMT, and PPMT functions. For the 365-day method, the annual interest rate is divided by 365 to get the daily rate, which is then multiplied by the number of days in each payment period. For the 360-day method, the annual rate is divided by 360. This slight difference in daily rate accumulates over time, leading to variations in total interest paid and the final payment amount.

| Payment Number | Payment Amount (365-Day) | Payment Amount (360-Day) | Interest Paid (365-Day) | Interest Paid (360-Day) | Principal Paid (365-Day) | Principal Paid (360-Day) | Loan Balance (365-Day) | Loan Balance (360-Day) |

|---|---|---|---|---|---|---|---|---|

| 1 | =PMT(0.06/365*30,36,10000) | =PMT(0.06/360*30,36,10000) | =IPMT(0.06/365*30,1,36,10000) | =IPMT(0.06/360*30,1,36,10000) | =PPMT(0.06/365*30,1,36,10000) | =PPMT(0.06/360*30,1,36,10000) | =10000 – PPMT(0.06/365*30,1,36,10000) | =10000 – PPMT(0.06/360*30,1,36,10000) |

| … | … | … | … | … | … | … | … | … |

Building a 365/360 Loan Calculator in Excel

This section details the step-by-step process of constructing a user-friendly 365/360 loan calculator within Microsoft Excel. We will cover designing the input fields, implementing the core calculations, and incorporating error handling for a robust and reliable tool.

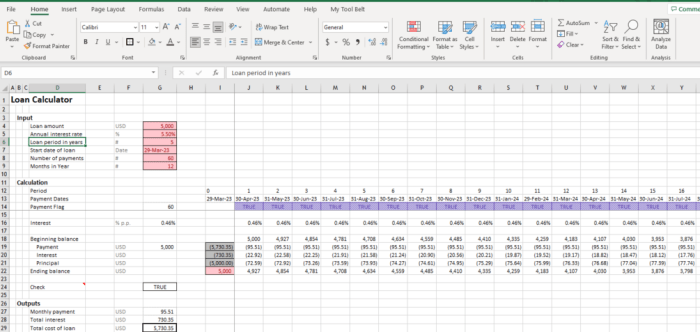

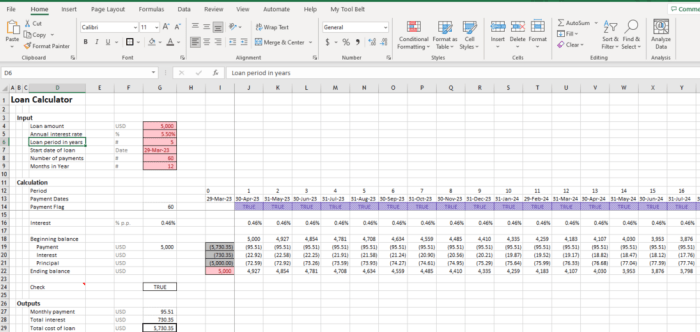

Spreadsheet Setup and Input Fields

Begin by creating a new Excel worksheet. Designate specific cells for user input. For instance, cell A1 could be labeled “Loan Amount,” cell A2 “Interest Rate (Annual),” cell A3 “Loan Term (Years),” and cell A4 “Calculation Method (365/360).” Next to each label (in column B), leave a cell for the user to enter their data. A screenshot of this setup would show a simple table with these labels and empty input cells clearly marked. The “Calculation Method” cell (B4) could use a dropdown menu for easy selection between “365” and “360,” created using Excel’s data validation feature. This screenshot would highlight the dropdown menu’s functionality.

Implementing the Loan Calculation Formulas

In separate cells, implement the formulas for calculating monthly payments and total interest paid. The formulas will depend on the chosen calculation method (365 or 360). For example, a cell could be designated to display the monthly payment using the PMT function, incorporating the loan amount, interest rate (adjusted for the chosen day-count convention), and loan term. Another cell could display the total interest paid by subtracting the loan amount from the total amount repaid. A screenshot would show the formulas entered in the designated cells, clearly referencing the input cells and illustrating the use of the PMT function and other relevant calculations based on the chosen day count convention. For clarity, the formula for the 365-day calculation method will be displayed separately from the 360-day calculation method. For example, the formula for monthly payment using the 365-day method could be displayed separately from the formula using the 360-day method.

Error Handling and Data Validation

To enhance user experience and prevent errors, implement data validation. This could include restricting input to numerical values for loan amount, interest rate, and loan term. For the interest rate, you could also set a maximum value to avoid unrealistic inputs. Error messages should appear if the user enters non-numerical data or values outside the allowed range. A screenshot illustrating the data validation setup with associated error messages would be useful. Additionally, error handling should be incorporated to address potential division by zero errors (e.g., if the loan term is zero) and display appropriate messages in such scenarios. The screenshot would show examples of these error messages.

Output and Formatting

Finally, format the output cells to clearly display the calculated values (monthly payment, total interest, etc.). Use appropriate formatting (currency for monetary values, percentage for interest rates) to enhance readability. A screenshot showing the final calculator with sample input and formatted output would complete the guide. The screenshot would highlight the clear labeling of the output values and their formatted display. For example, the monthly payment could be displayed with a currency symbol, and the total interest could be displayed with a percentage symbol.

Advanced Features for the Excel Loan Calculator

This section details the implementation of advanced features to enhance the functionality and user experience of our 365/360 loan calculator. These additions move beyond basic loan calculations to provide a more comprehensive and insightful financial tool. We’ll cover adjustable payment frequencies, visual amortization schedules, total interest calculations, and remaining balance determination.

Payment Frequency Adjustment, 365 360 loan calculator excel

The ability to adjust payment frequency is crucial for realistic loan modeling. Users should be able to select from various payment options, including monthly, bi-weekly, and weekly payments. This requires modifying the loan calculation formulas to accommodate different payment periods per year. For instance, a monthly payment frequency uses 12 payment periods per year, while bi-weekly uses 26, and weekly uses 52. The interest rate needs to be adjusted proportionally to reflect the change in payment frequency. The formula for the monthly payment, for example, would need to be adjusted to accommodate different numbers of payments per year. The following formula calculates the payment amount considering the number of payments per year:

PMT = (PV * r) / (1 – (1 + r)^-n)

where:

* PMT = payment amount

* PV = present value (loan amount)

* r = periodic interest rate (annual interest rate / number of payments per year)

* n = total number of payments (loan term in years * number of payments per year)

Implementing this involves creating a dropdown menu or input field where users can select their desired payment frequency, and the calculator automatically adjusts the calculations accordingly using the adjusted formula.

Amortization Schedule Graph

A visual representation of the amortization schedule significantly improves understanding. The graph should clearly display the breakdown of principal and interest payments over the loan’s lifespan. A column chart is ideal, with the x-axis representing the payment period (e.g., month 1, month 2, etc.) and the y-axis representing the monetary value. Two distinct columns for each period should be included: one for the principal payment and one for the interest payment. A line graph could also be overlaid to show the remaining loan balance after each payment, providing a clear visual representation of the debt reduction over time. The graph should be dynamically updated whenever the user changes any input parameters (loan amount, interest rate, loan term, payment frequency). A clear legend should differentiate the principal, interest, and remaining balance components. Adding data labels to the bars would further enhance readability, providing the exact amount of principal and interest for each payment.

Total Interest Paid Calculation

Calculating the total interest paid over the loan’s lifetime provides a valuable summary metric. This is easily achieved by summing the interest paid in each period throughout the amortization schedule. The total interest can be displayed separately, providing a clear indication of the total cost of borrowing. This is a crucial figure for borrowers to understand the overall expense of the loan. For example, a $100,000 loan might have a total interest paid of $30,000 over 15 years, a figure easily calculated and displayed by the advanced calculator.

Remaining Balance Calculation

A feature to calculate the remaining loan balance after a specified number of payments offers significant practical value. This requires calculating the present value of the remaining payments using the standard loan amortization formula. Users should be able to input the number of payments made, and the calculator should display the outstanding balance. This functionality is particularly useful for refinancing or understanding the debt reduction progress. For instance, after making 60 payments on a 360-month loan, the calculator could show the remaining balance, helping users understand their financial position.

Comparing Different Loan Scenarios

Understanding the impact of interest rates and loan terms on the total cost of a loan is crucial for making informed borrowing decisions. This section demonstrates how to use the 365/360 loan calculator to compare different loan scenarios and choose the most financially advantageous option. By inputting varying parameters into the calculator, you can quickly assess the implications of different borrowing choices.

The 365/360 loan calculator allows for a direct comparison of total loan costs under various conditions. This involves altering input variables such as interest rate and loan term to observe the resulting changes in monthly payments and total interest paid. This comparative analysis empowers borrowers to make more strategic financial decisions.

Impact of Varying Interest Rates and Loan Terms

The total cost of a loan is significantly influenced by both the interest rate and the loan term. A higher interest rate leads to a greater total interest paid over the life of the loan, even if the monthly payment seems manageable. Conversely, a longer loan term reduces the monthly payment but increases the overall interest paid due to the extended repayment period. The calculator facilitates a clear visualization of this trade-off.

For example, consider a $10,000 loan. Using the calculator, we can compare two scenarios: a 5% interest rate over 36 months and a 7% interest rate over 60 months. The first scenario, with a lower interest rate and shorter term, will result in a higher monthly payment but significantly lower total interest paid compared to the second scenario. The longer loan term, while offering lower monthly payments, will result in considerably more interest paid over the life of the loan. The calculator allows for quick and precise calculation of these differences.

Using the Calculator for Informed Borrowing Decisions

The calculator’s primary function is to provide a clear and concise comparison of different loan options. By inputting various interest rates and loan terms, borrowers can quickly identify the most cost-effective option. This allows for a more informed decision-making process, minimizing the risk of overspending on interest payments.

The calculator helps to avoid impulsive decisions by providing a quantifiable comparison of loan scenarios. For instance, if a borrower is considering a loan with a lower monthly payment but a longer term, the calculator can clearly show the increased total interest paid. This information empowers the borrower to weigh the benefits of a lower monthly payment against the long-term cost of increased interest.

Comparison of Loan Scenarios

| Interest Rate | Loan Term (Months) | Total Interest Paid | Monthly Payment |

|---|---|---|---|

| 5% | 36 | $1,180.76 | $305.77 |

| 7% | 36 | $1,655.87 | $326.08 |

| 5% | 60 | $2,002.87 | $195.78 |

| 7% | 60 | $2,902.87 | $225.07 |

*(Note: These figures are illustrative examples and may vary based on the specific 365/360 calculation method used in the Excel calculator.)*

Closing Summary: 365 360 Loan Calculator Excel

Mastering the 365 360 loan calculator in Excel provides a powerful tool for financial planning and informed borrowing decisions. By understanding the underlying calculations and leveraging Excel’s functionalities, you gain control over your financial projections. This guide equips you not only with the technical skills to build a comprehensive loan calculator but also with the financial literacy to interpret the results effectively, leading to smarter borrowing choices and improved financial management.

Essential Questionnaire

Can this calculator handle different loan types (e.g., mortgages, auto loans)?

While the core principles apply, specific adjustments might be needed for different loan types. For example, mortgage calculations often involve additional factors like property taxes and insurance.

What happens if I enter incorrect data into the calculator?

A well-designed calculator should include error handling to prevent crashes and provide clear feedback to the user, indicating which input is invalid.

Where can I find more advanced Excel tutorials for financial modeling?

Numerous online resources, including YouTube channels and educational websites, offer comprehensive tutorials on advanced Excel functions and financial modeling techniques.