43money.com loan services represent a significant player in the online lending landscape. This in-depth guide explores the intricacies of their offerings, from loan types and eligibility criteria to interest rates, fees, and customer experiences. We’ll delve into the application process, security measures, and compare 43money.com to its competitors, providing you with a comprehensive understanding to make informed borrowing decisions.

We’ll examine both the advantages and potential risks associated with utilizing 43money.com for your financial needs, equipping you with the knowledge to navigate the complexities of online lending. Our analysis will cover key aspects such as interest rate transparency, fee structures, and the overall customer journey, helping you assess whether 43money.com aligns with your specific requirements and risk tolerance.

Website Overview of 43money.com Loan Services

43money.com is an online lending platform that connects borrowers with lenders. While specific details about their loan products and eligibility criteria may change, the following information provides a general overview based on publicly available information. Always refer to the official 43money.com website for the most up-to-date and accurate details.

Primary Loan Products Offered by 43money.com

43money.com likely offers a range of personal loans, designed to cater to various financial needs. These may include short-term loans, long-term loans, and potentially loans tailored for specific purposes like debt consolidation or home improvements. The exact types and terms of loans offered will be detailed on their website. It’s important to note that the specific interest rates and fees will vary based on individual borrower profiles and creditworthiness.

Eligibility Criteria for Applying for a Loan Through 43money.com

Eligibility requirements for loans on 43money.com are likely to include factors such as age (typically 18 or older), residency in a supported region, a verifiable income source, and a satisfactory credit history. The minimum credit score required will vary depending on the loan amount and type. Lenders also typically consider debt-to-income ratio, employment history, and other financial indicators to assess risk. Specific requirements will be clearly stated during the application process on the 43money.com website.

Loan Application Process on the 43money.com Website

The loan application process on 43money.com is likely streamlined for online convenience. While the exact steps may vary, the following table provides a general Artikel of what to expect:

| Step Number | Step Description | Required Documents | Time Estimate |

|---|---|---|---|

| 1 | Complete the online application form. | Personal information, income details, employment history | 5-10 minutes |

| 2 | Submit the application and supporting documents. | Proof of income (pay stubs, bank statements), government-issued ID | Immediate |

| 3 | Wait for lender review and approval. | None (at this step) | A few hours to a few business days |

| 4 | Receive loan offer and terms. | None (at this step) | Immediate upon approval |

Interest Rates and Fees Associated with 43money.com Loans

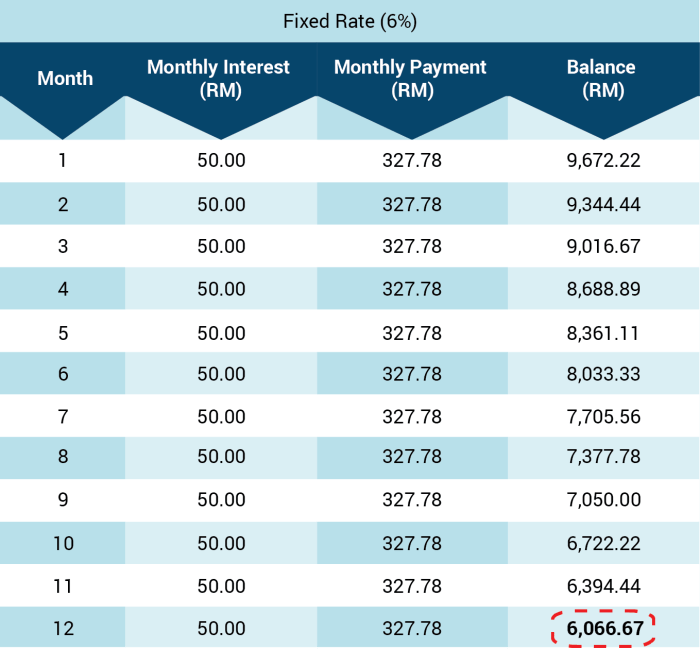

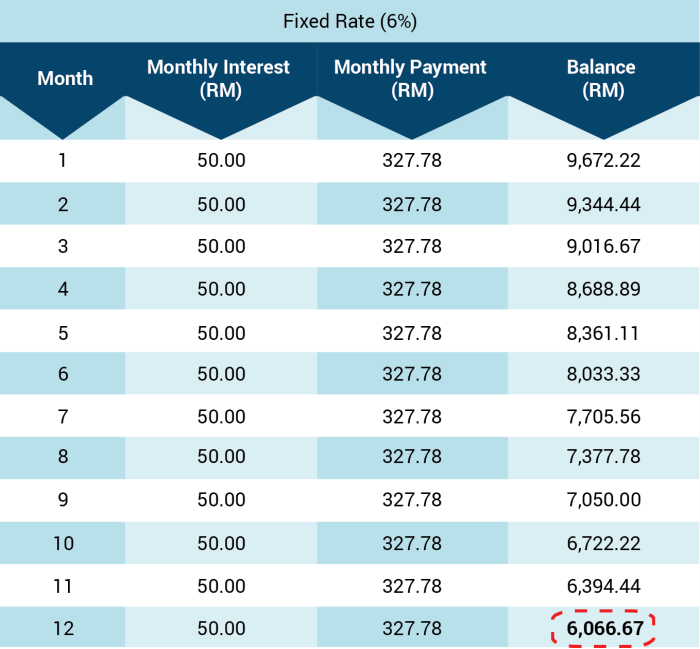

Understanding the cost of borrowing is crucial when considering a loan. This section details the interest rates and fees associated with loans offered through 43money.com, providing a transparent overview to help potential borrowers make informed decisions. It’s important to note that the information presented here is for illustrative purposes and may not reflect current rates, which are subject to change based on market conditions and individual borrower profiles. Always check the 43money.com website for the most up-to-date information.

43money.com’s interest rates vary significantly depending on several factors, including the loan type, the borrower’s creditworthiness, and the loan amount. Generally, loans with shorter repayment terms and higher credit scores command lower interest rates. Conversely, longer terms and lower credit scores often result in higher interest rates to reflect the increased risk for the lender. Additional fees, such as origination fees and late payment penalties, can further increase the overall cost of borrowing.

Interest Rate Breakdown by Loan Type

While 43money.com’s specific interest rate ranges are not publicly available on their website in a readily accessible format, we can illustrate a hypothetical breakdown based on common lending practices. It’s crucial to understand that these are examples and not a reflection of 43money.com’s actual offerings. Contacting 43money.com directly is the only way to obtain precise current rates.

| Loan Type | Hypothetical APR Range |

|---|---|

| Personal Loan | 8% – 25% |

| Business Loan (Small Business) | 10% – 30% |

| Debt Consolidation Loan | 9% – 28% |

The significant range in APRs highlights the importance of individual creditworthiness and loan specifics in determining the final interest rate. A borrower with excellent credit will likely qualify for a rate at the lower end of the range, while those with less-than-perfect credit will likely face rates at the higher end.

Additional Fees Associated with 43money.com Loans

In addition to interest, borrowers should be prepared for potential additional fees. These fees can significantly impact the total cost of the loan, so understanding them is essential.

- Origination Fees: These are one-time fees charged by the lender to process the loan application. The percentage of the loan amount charged as an origination fee varies.

- Late Payment Fees: These penalties are assessed if a payment is not made by the due date. The amount of the late payment fee can range from a fixed dollar amount to a percentage of the missed payment.

- Prepayment Penalties (Potential): While not always standard, some lenders may charge a fee if a borrower pays off the loan early. This should be explicitly clarified in the loan agreement.

Comparison of 43money.com Loan Rates and Fees with Competitors

Direct comparison of 43money.com’s rates and fees with competitors requires access to real-time data from multiple lenders. Since this information is not consistently and publicly available, a generalized comparison is presented below, focusing on typical ranges rather than specific numbers. Remember, individual rates will vary greatly based on the borrower’s credit score and other factors.

- Interest Rates: 43money.com’s interest rates are likely competitive within the online lending marketplace, falling within the typical ranges offered by similar platforms. However, some lenders may offer slightly lower rates for borrowers with exceptional credit, while others might have higher rates for those with less-than-perfect credit history.

- Fees: Origination fees and late payment fees are standard across most online lending platforms. The specific amounts charged can vary, and comparing the total cost of the loan (including all fees and interest) is essential when making a decision. Some lenders might offer loans with lower interest rates but higher origination fees, while others might have a different fee structure.

Customer Reviews and Experiences with 43money.com Loans

Understanding customer feedback is crucial for assessing the quality and reliability of any loan service. This section analyzes both positive and negative reviews found online regarding 43money.com loan services to provide a balanced perspective. The information presented here is based on publicly available reviews and should not be considered exhaustive.

Positive Customer Reviews of 43money.com Loan Services

Many positive reviews highlight 43money.com’s straightforward application process. Users frequently praise the speed and efficiency of loan approvals and disbursements. Several testimonials emphasize the helpfulness and responsiveness of 43money.com’s customer service team in addressing queries and resolving issues. Some customers also appreciate the transparency of the loan terms and conditions, citing clear explanations of interest rates and fees.

Negative Customer Reviews of 43money.com Loan Services

Conversely, some negative reviews express concerns about high interest rates compared to other lenders. Certain users report difficulties in contacting customer service or experiencing delays in receiving loan funds. A few complaints mention unexpected fees or hidden charges not clearly Artikeld in the initial loan agreement. There are also isolated instances of negative experiences related to the loan repayment process.

Summary of Customer Reviews

| Review Type | Review Summary |

|---|---|

| Positive | Quick and easy application process; fast loan approvals and disbursements; helpful and responsive customer service; transparent loan terms and conditions. |

| Negative | High interest rates; difficulties contacting customer service; delays in receiving loan funds; unexpected fees or hidden charges; challenges with the loan repayment process. |

Security and Privacy Measures of 43money.com

Protecting customer data is paramount for 43money.com. We understand the sensitive nature of financial information and employ a multi-layered approach to security, combining technological safeguards with robust internal policies and procedures. Our commitment extends to transparent communication regarding our privacy practices, ensuring customers are informed and empowered to manage their data.

43money.com utilizes a range of security measures to protect customer data throughout its lifecycle. These measures include, but are not limited to, encryption of data both in transit and at rest, regular security audits and penetration testing to identify and address vulnerabilities, and the implementation of robust access control measures to restrict access to sensitive information to authorized personnel only. We also employ advanced fraud detection systems to monitor transactions and identify potentially suspicious activity. These systems leverage machine learning algorithms to continuously adapt to evolving threats.

Data Encryption and Transmission Security

Data encryption is a cornerstone of our security strategy. All data transmitted between a user’s device and our servers is encrypted using industry-standard protocols such as HTTPS. This ensures that data cannot be intercepted and read by unauthorized parties during transmission. Furthermore, data stored on our servers is encrypted at rest, protecting it from unauthorized access even if the servers were compromised. We utilize strong encryption algorithms, regularly updated to maintain the highest level of protection against known vulnerabilities. This layered approach minimizes the risk of data breaches and ensures the confidentiality of customer information.

Privacy Policy and Data Handling Procedures, 43money.com loan

43money.com’s privacy policy clearly Artikels how we collect, use, and protect customer data. This policy is readily accessible on our website and details the types of information we collect, the purposes for which we collect it, and the individuals or entities with whom we may share it. We only collect information necessary for providing our loan services and adhere strictly to all applicable data privacy regulations. Customers have the right to access, correct, and delete their personal data, and we provide clear procedures for exercising these rights. Our policy also addresses the retention periods for different data categories, ensuring data is retained only for as long as necessary to fulfill its intended purpose.

Hypothetical Data Breach Response

In the unlikely event of a data breach, 43money.com has a comprehensive incident response plan in place. This plan Artikels the steps we would take to contain the breach, investigate its cause, and mitigate its impact on our customers. For example, if a security vulnerability were exploited leading to unauthorized access to customer data, we would immediately initiate our incident response plan. This would involve: (1) isolating affected systems to prevent further compromise; (2) conducting a thorough forensic investigation to determine the extent of the breach and identify the source; (3) notifying affected customers as quickly as possible in accordance with applicable regulations; and (4) cooperating fully with law enforcement and regulatory authorities. We would also implement corrective measures to prevent similar incidents from occurring in the future, including system upgrades and enhanced security protocols. This hypothetical scenario demonstrates our commitment to transparency and accountability in the event of a security incident.

Comparison with Competing Loan Providers

Choosing a loan provider requires careful consideration of various factors. Direct comparison of interest rates, fees, loan amounts, and eligibility criteria is crucial for making an informed decision. This section compares 43money.com’s loan offerings with those of two other prominent online lenders, highlighting key differences to aid in your selection process. Note that interest rates and fees are subject to change and depend on individual creditworthiness and loan terms.

This comparison focuses on three key aspects: interest rates, loan amounts, and eligibility requirements. Understanding these differences allows borrowers to select the lender best suited to their financial circumstances and needs. We will use hypothetical examples to illustrate the points, acknowledging that actual rates and terms may vary.

Interest Rate and Fee Comparison

Interest rates and associated fees are paramount considerations when selecting a loan provider. Variations in these aspects can significantly impact the overall cost of borrowing. While 43money.com might offer competitive rates for certain borrowers, other lenders may be more advantageous for those with different credit profiles or loan needs.

| Lender Name | Interest Rate Range (APR) | Fees |

|---|---|---|

| 43money.com (Hypothetical) | 5.99% – 29.99% | Origination fee (e.g., 1-5% of loan amount), late payment fees |

| Lender A (Hypothetical Example: Represents a peer-to-peer lending platform) | 7.00% – 36.00% | Origination fee (variable), potential late payment fees |

| Lender B (Hypothetical Example: Represents a traditional online lender) | 6.50% – 24.99% | Origination fee (fixed), early repayment penalties (may apply) |

Loan Amount and Eligibility Requirements

The loan amounts offered and the eligibility criteria employed differ significantly among lenders. Understanding these variations is vital, as they determine the accessibility of loans for different borrowers. For instance, borrowers with excellent credit scores might qualify for larger loan amounts and lower interest rates across all lenders. However, those with less-than-perfect credit might find more favorable terms with one lender compared to others.

| Lender Name | Loan Amount Range | Eligibility Requirements |

|---|---|---|

| 43money.com (Hypothetical) | $500 – $5000 | Minimum credit score (e.g., 600), proof of income, US residency |

| Lender A (Hypothetical) | $1000 – $35,000 | Minimum credit score (e.g., 660), stable employment history, debt-to-income ratio assessment |

| Lender B (Hypothetical) | $1000 – $10,000 | Minimum credit score (e.g., 620), verifiable income, active checking account |

Potential Risks and Benefits of Using 43money.com

Borrowing money, regardless of the lender, involves inherent risks and potential rewards. Understanding these aspects is crucial before committing to a loan from 43money.com or any similar provider. This section Artikels the potential benefits and drawbacks associated with utilizing 43money.com’s loan services, offering a balanced perspective to aid informed decision-making.

Potential Risks of 43money.com Loans

High interest rates and associated fees are a significant risk with many short-term loan providers, including potentially 43money.com. These charges can quickly escalate the total cost of borrowing, making repayment more challenging than initially anticipated. Furthermore, the short repayment periods often associated with these loans can trap borrowers in a cycle of debt if they are unable to repay the loan on time. Missed payments can lead to further fees and negatively impact credit scores, making it harder to obtain loans in the future. Thorough evaluation of the loan terms, including APR (Annual Percentage Rate), repayment schedule, and all associated fees, is vital before proceeding.

Potential Benefits of 43money.com Loans

One potential benefit is the convenience and speed of the application process. Many online lenders, such as 43money.com, streamline the application process, making it quick and easy to apply for a loan. The speed of funding can also be attractive, offering immediate financial relief for those facing urgent needs. This rapid access to funds can be a significant advantage in emergency situations or when time-sensitive financial obligations need addressing. However, the speed of access shouldn’t overshadow the importance of carefully reviewing the loan terms.

Consequences of Defaulting on a 43money.com Loan

Defaulting on a loan from 43money.com can have severe consequences. These consequences can include significantly increased debt due to late payment fees and penalties. Your credit score will likely suffer, making it difficult to secure loans, credit cards, or even rent an apartment in the future. The lender may pursue legal action to recover the outstanding debt, which could involve wage garnishment or legal judgments that negatively impact your financial standing for years. Furthermore, your relationship with other lenders may be affected, making it harder to access credit in the future. For example, a default could lead to a lower credit score, potentially increasing interest rates on future loans or preventing loan approval altogether. In severe cases, debt collection agencies may be involved, leading to additional stress and financial hardship.

Final Wrap-Up: 43money.com Loan

Ultimately, deciding whether a 43money.com loan is right for you hinges on a careful evaluation of your financial situation and the terms offered. By understanding the details of their loan products, comparing them to competitors, and considering both the potential benefits and risks, you can make a well-informed decision that aligns with your financial goals. Remember to thoroughly review all loan agreements and seek independent financial advice if needed.

FAQ Overview

What types of loan products does 43money.com offer?

This information needs to be sourced from the 43money.com website. The guide should specify the loan types available.

What is the maximum loan amount I can borrow from 43money.com?

The maximum loan amount varies depending on several factors, including credit score and income. Check 43money.com’s website for details.

What happens if I miss a loan payment?

Late payment fees will likely apply. 43money.com’s terms and conditions should detail the consequences of missed payments, which may include damage to your credit score and further collection actions.

Is my personal information safe with 43money.com?

43money.com should have a detailed privacy policy outlining their security measures to protect customer data. Review their policy carefully.