Securing a 644 credit score auto loan might seem daunting, but understanding your options and navigating the process effectively can lead to successful financing. This guide explores the intricacies of obtaining an auto loan with a 644 credit score, covering everything from understanding your creditworthiness to exploring alternative financing solutions. We’ll delve into interest rates, loan terms, and crucial factors influencing your approval chances, empowering you to make informed decisions and secure the best possible deal.

We’ll examine the types of auto loans available, compare lenders specializing in fair credit, and guide you through the pre-approval process. Understanding your debt-to-income ratio, the importance of a down payment, and negotiating favorable loan terms are all key components we will cover. Additionally, we’ll address strategies for managing your auto loan payments effectively and explore alternative financing options if traditional loans prove challenging.

Understanding a 644 Credit Score

A 644 credit score falls within the “fair” range, presenting a mixed bag of opportunities and challenges when applying for an auto loan. While it’s not considered excellent, it’s also not so poor as to automatically disqualify you. Securing financing will depend heavily on other factors, including your income, debt-to-income ratio, and the type of vehicle you’re purchasing.

Implications of a 644 Credit Score for Auto Loan Eligibility

A 644 credit score will likely result in higher interest rates compared to those with higher scores. Lenders perceive a greater risk associated with borrowers in this credit range, leading them to charge more to compensate for the perceived increased likelihood of default. This translates to higher monthly payments and a more expensive overall loan. You may also find that your loan options are more limited, with fewer lenders willing to offer you a loan or less favorable loan terms. However, it’s not impossible to secure financing; you’ll just need to shop around and potentially strengthen your application with other factors.

Comparison of a 644 Credit Score to Other Credit Score Ranges

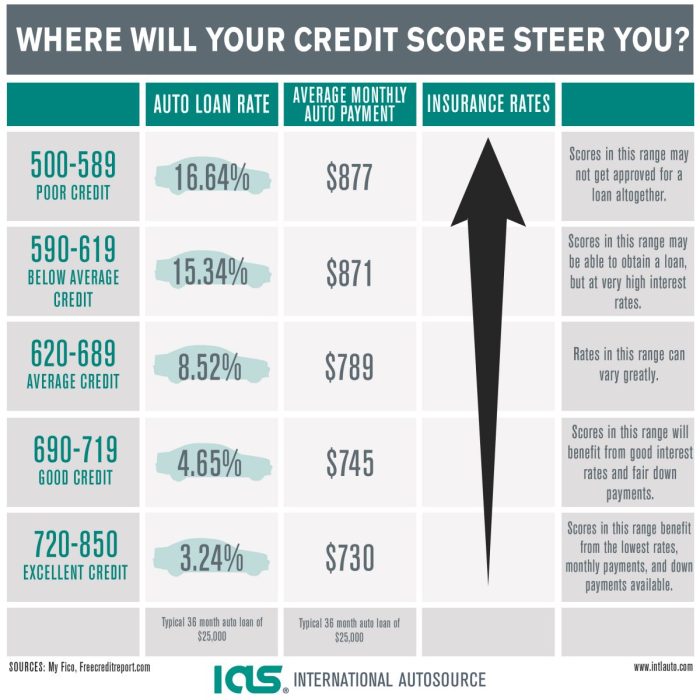

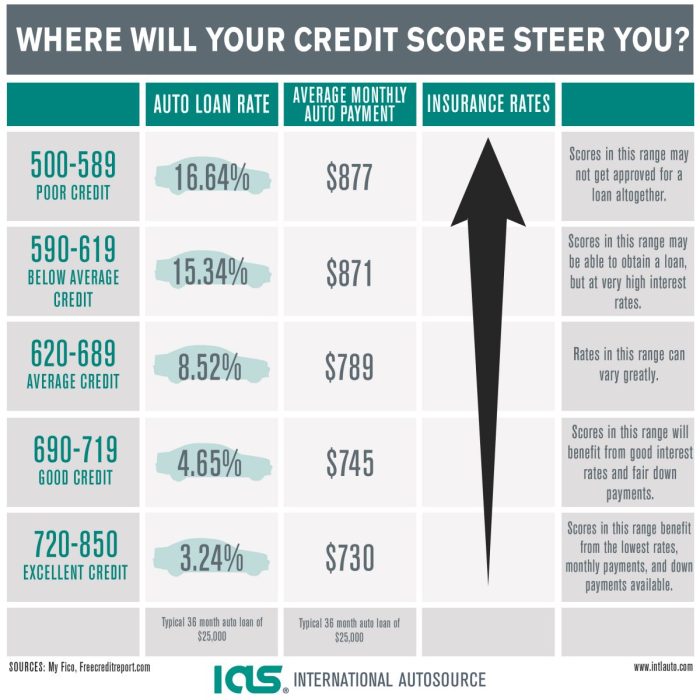

Credit scores are typically categorized into ranges, with each range carrying different implications for loan approval and interest rates. A 644 score falls within the “fair” range, sitting between “poor” (300-579) and “good” (680-719). A “good” credit score will generally qualify for the best interest rates and loan terms. Scores in the “excellent” range (720 and above) typically enjoy the most favorable loan offers. Conversely, scores in the “poor” range may face loan denials or extremely high interest rates.

Factors Contributing to a 644 Credit Score

Several factors influence a credit score. These include payment history (missed or late payments significantly impact scores), amounts owed (high credit utilization – using a large portion of your available credit – negatively affects scores), length of credit history (longer history generally translates to a better score), credit mix (having a variety of credit accounts, such as credit cards and loans, can be beneficial), and new credit (applying for many new credit accounts in a short period can lower your score). A 644 score suggests a history that may include some late payments, high credit utilization, or a relatively short credit history.

Strategies for Improving a 644 Credit Score

Improving your credit score takes time and consistent effort. Key strategies include paying all bills on time, consistently, reducing credit utilization (keeping balances low on credit cards), avoiding opening multiple new credit accounts simultaneously, and monitoring your credit report regularly for errors. Addressing any negative items on your report, such as late payments, can also help. Consider paying down high-interest debts first to reduce your overall debt burden. Finally, maintaining a longer credit history simply by responsible credit use over time will also contribute to score improvement.

Interest Rates for Various Credit Scores for Auto Loans

The following table provides a general comparison of interest rates for auto loans based on credit scores. Keep in mind that these are estimates, and actual rates can vary depending on several factors, including the lender, loan term, and the type of vehicle.

| Credit Score Range | Interest Rate (Approximate) | Monthly Payment (Example: $20,000 loan, 60 months) | Total Interest Paid (Example: $20,000 loan, 60 months) |

|---|---|---|---|

| 640-660 (Fair) | 8-12% | $400-$450 | $3,000-$6,000 |

| 680-719 (Good) | 6-8% | $375-$400 | $2,000-$3,000 |

| 720+ (Excellent) | 4-6% | $350-$375 | $1,000-$2,000 |

| Below 640 (Poor/Subprime) | 12% + | $450+ | $6,000+ |

Auto Loan Options with a 644 Credit Score

Securing an auto loan with a 644 credit score, considered fair credit, presents a range of options, though potentially with less favorable terms than those available to borrowers with higher credit scores. Understanding the landscape of lenders and loan types is crucial for navigating this process successfully. This section will Artikel the available choices, compare interest rates and terms, and guide you through the pre-approval process.

Types of Auto Loans Available

A 644 credit score typically qualifies you for several auto loan types. These may include loans from traditional banks and credit unions, online lenders, and buy-here-pay-here dealerships. However, access to the most competitive rates and terms might be limited compared to borrowers with excellent credit. Expect a higher interest rate and potentially shorter loan terms to compensate for the perceived higher risk associated with a fair credit score. The availability of specific loan types will vary based on individual lender policies and the borrower’s financial situation.

Interest Rates and Loan Terms Comparison

Interest rates for borrowers with a 644 credit score will generally be higher than those offered to individuals with higher credit scores. The exact rate will depend on several factors including the lender, the type of vehicle being financed, the loan term, and the borrower’s overall financial profile. For example, a 5-year loan might have an interest rate between 8% and 15%, while a shorter 3-year loan could range from 10% to 18%. Credit unions often offer more competitive rates than banks, but membership requirements might apply. Online lenders provide convenience but may have less flexibility and higher rates than traditional lenders. It’s crucial to compare offers from multiple lenders before making a decision.

Potential Lenders Specializing in Fair Credit

Several lenders specialize in providing auto loans to borrowers with fair credit. These include some credit unions that focus on community members, online lenders who utilize alternative credit scoring methods, and buy-here-pay-here dealerships. Buy-here-pay-here dealerships often have higher interest rates but may be more lenient with credit requirements. Online lenders frequently offer pre-qualification tools that allow you to check your eligibility without impacting your credit score. Banks may also offer loans, but their approval criteria tend to be stricter for borrowers with fair credit scores. Careful research is essential to find the best fit for your financial situation.

Pre-Approval Process for Auto Loans

The pre-approval process involves submitting an application to a lender, providing necessary financial information (income, employment history, debts), and allowing the lender to perform a credit check. Pre-approval doesn’t guarantee loan approval, but it provides an estimated interest rate and loan amount you can expect. This helps you shop for a vehicle within your budget and strengthens your negotiating position with dealerships. Many lenders offer online pre-approval applications, streamlining the process. Gathering all necessary documents beforehand significantly speeds up the application process.

Securing an Auto Loan with a 644 Credit Score: A Flowchart

The following flowchart illustrates the steps involved in securing an auto loan with a 644 credit score:

[Imagine a flowchart here. The flowchart would begin with “Check Credit Score,” branching to “644 Score – Proceed” and “Score Below 644 – Improve Credit.” The “644 Score – Proceed” branch would lead to “Research Lenders,” then to “Compare Loan Offers,” followed by “Pre-Approval Application,” then “Loan Approval/Denial.” If approved, the flow continues to “Vehicle Purchase” and “Loan Finalization.” If denied, it loops back to “Research Lenders” to explore alternative options. The “Score Below 644 – Improve Credit” branch would lead to actions like “Pay Down Debt,” “Dispute Errors,” and “Build Credit History,” ultimately looping back to “Check Credit Score.”]

Factors Influencing Loan Approval

Securing an auto loan with a 644 credit score presents challenges, but approval isn’t impossible. Several key factors significantly influence a lender’s decision, impacting both the likelihood of approval and the terms offered. Understanding these factors empowers you to improve your chances of securing a favorable loan.

Debt-to-Income Ratio’s Role in Auto Loan Approval

Your debt-to-income ratio (DTI) is a crucial factor lenders consider. DTI represents the percentage of your gross monthly income allocated to debt payments. A higher DTI indicates a greater financial burden, making lenders more hesitant to approve loans, especially for those with a 644 credit score. Lenders typically prefer a DTI below 43%, but the acceptable threshold can vary depending on the lender and the specific loan terms. For example, if your gross monthly income is $4,000 and your total monthly debt payments are $1,500, your DTI is 37.5% (1500/4000 * 100). A lower DTI demonstrates your ability to manage existing debts and handle additional loan payments, increasing your chances of approval.

Documentation Required for Auto Loan Applications

Lenders require various documents to verify your financial information and assess your creditworthiness. Common documentation includes:

- Proof of Income: Pay stubs, W-2 forms, tax returns, or bank statements demonstrating consistent income.

- Proof of Residence: Utility bills, rental agreements, or mortgage statements showing your current address.

- Driver’s License or State-Issued ID: For identification and verification purposes.

- Vehicle Information: Details about the vehicle you intend to purchase, including the year, make, model, and VIN (Vehicle Identification Number).

- Credit Report Authorization: Permission for the lender to access your credit report from a credit bureau.

Providing complete and accurate documentation promptly streamlines the application process and improves your chances of approval.

Impact of Down Payment Size on Loan Approval and Interest Rates

A larger down payment significantly impacts both loan approval and interest rates. A substantial down payment reduces the loan amount needed, lessening the lender’s risk. This is particularly beneficial with a 644 credit score, as it compensates for the less-than-ideal credit history. A larger down payment might even secure a lower interest rate, leading to lower overall loan costs. For instance, a 20% down payment on a $20,000 vehicle reduces the loan amount to $16,000, making the loan less risky for the lender and potentially leading to better terms.

Strategies for Negotiating Favorable Loan Terms, 644 credit score auto loan

Negotiating favorable loan terms with a 644 credit score requires preparation and strategic approaches. Consider these strategies:

- Shop Around: Compare offers from multiple lenders to find the best rates and terms. Credit unions often offer more competitive rates than banks for borrowers with less-than-perfect credit.

- Improve Your Credit Score: Even small improvements in your credit score can significantly impact the interest rate you qualify for. Focus on paying down debt and maintaining good payment history.

- Negotiate the Interest Rate: Don’t be afraid to negotiate the interest rate. Highlight your positive financial aspects, such as a stable job and low DTI, to strengthen your case.

- Consider a Co-signer: If possible, having a co-signer with excellent credit can improve your chances of approval and secure a better interest rate.

Common Reasons for Auto Loan Application Rejection

Several factors can lead to auto loan application rejection, even with a 644 credit score. Common reasons include:

- Insufficient Income: Lenders need to be confident you can afford the monthly payments.

- High Debt-to-Income Ratio: A high DTI indicates a greater financial risk for the lender.

- Negative Credit History: Late payments, bankruptcies, or collections can negatively impact your approval chances.

- Incomplete or Inaccurate Application: Providing incomplete or inaccurate information can lead to rejection.

- Lack of Down Payment: A minimal or no down payment can increase the lender’s perceived risk.

Managing Auto Loan Payments

Securing an auto loan, especially with a credit score of 644, requires diligent financial management to ensure timely payments and avoid potential negative consequences. Successfully navigating your auto loan hinges on creating a realistic budget, understanding payment schedules, and proactively addressing any challenges that may arise. This section will Artikel effective strategies for managing your auto loan payments, including budgeting techniques, strategies for avoiding late payments, and the implications of refinancing.

Effective budgeting is crucial for successful auto loan management. Failing to account for the monthly payment can lead to missed payments, late fees, and damage to your credit score. Careful planning ensures consistent payments and avoids financial strain.

Budgeting and Managing Auto Loan Payments

Creating a comprehensive monthly budget is the cornerstone of effective auto loan management. This involves meticulously tracking all income and expenses to determine how much you can comfortably allocate towards your loan payment. Start by listing all sources of monthly income, including salary, bonuses, and any other regular earnings. Then, list all your monthly expenses, categorizing them into necessities (rent/mortgage, utilities, groceries) and discretionary spending (entertainment, dining out). Subtract your total expenses from your total income to determine your disposable income. Allocate a portion of this disposable income to your auto loan payment, ensuring that you have sufficient funds remaining for other essential expenses and a reasonable amount for savings.

Avoiding Late Payments and Their Consequences

Late payments can significantly impact your credit score and incur substantial fees. To prevent this, set up automatic payments directly from your bank account. This ensures that your payment is made on time each month, eliminating the risk of forgetting. Alternatively, consider setting reminders on your phone or calendar. Many banks and lending institutions also offer email or text message payment reminders. If you anticipate difficulty making a payment, contact your lender immediately. Many lenders are willing to work with borrowers who communicate their financial challenges proactively. They may offer options such as payment extensions or hardship programs. Ignoring the problem only exacerbates the situation. Late payment fees can quickly accumulate, adding significant extra costs to your loan. Furthermore, consistent late payments will severely damage your credit score, making it more difficult and expensive to secure loans in the future.

Refinancing an Auto Loan

Refinancing your auto loan involves obtaining a new loan to pay off your existing loan. This can be beneficial if you qualify for a lower interest rate, potentially saving you money on interest payments over the life of the loan. Several factors influence whether refinancing is a worthwhile option. These include your current credit score, prevailing interest rates, and the remaining term of your loan. A higher credit score typically qualifies you for lower interest rates. If interest rates have fallen since you took out your original loan, refinancing could significantly reduce your monthly payments. However, refinancing involves fees and administrative costs, so it’s essential to carefully weigh the potential savings against these expenses.

Resources for Financial Literacy and Credit Counseling

Numerous resources are available to assist with financial planning and credit management. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services. These services can provide guidance on budgeting, debt management, and improving your credit score. Many non-profit organizations and government agencies also offer financial literacy programs and workshops. These programs often cover topics such as budgeting, saving, and investing. Online resources, such as websites and apps dedicated to personal finance, provide valuable information and tools to manage your finances effectively.

Sample Monthly Budget Incorporating an Auto Loan Payment

A well-structured budget is key to managing an auto loan effectively. Here’s a sample monthly budget incorporating an auto loan payment:

- Income: $4,000 (Net monthly salary)

- Expenses:

- Rent: $1,200

- Utilities: $200

- Groceries: $400

- Transportation (excluding loan): $150

- Auto Loan Payment: $400

- Credit Card Payment: $100

- Savings: $250

- Other Expenses: $300

- Total Expenses: $3,000

- Net Savings: $1,000

This example demonstrates how incorporating an auto loan payment into a comprehensive budget can still allow for savings and other expenses. Remember to adjust this budget to reflect your individual income and expenses. Consistent monitoring and adjustments are crucial for maintaining a balanced budget and ensuring timely loan payments.

Alternative Financing Options: 644 Credit Score Auto Loan

Securing an auto loan with a 644 credit score can be challenging, often resulting in higher interest rates or loan denials from traditional lenders. Fortunately, several alternative financing options exist for individuals facing this situation. These alternatives offer varying degrees of risk and reward, and understanding their nuances is crucial for making an informed decision. Careful consideration of your financial situation and long-term goals is essential before choosing a path.

Buy Here, Pay Here Dealerships

Buy Here, Pay Here (BHPH) dealerships offer in-house financing, meaning they act as both the seller and the lender. This can be advantageous for individuals with poor credit because they often don’t require a credit check or have more lenient approval standards. However, BHPH dealerships typically charge significantly higher interest rates and fees than traditional lenders. The terms are often less favorable, and the vehicles themselves might be older or have higher mileage. Reputable BHPH dealerships exist, but thorough research and careful contract review are paramount. The application process usually involves providing basic personal information and proof of income, with a focus on the ability to make timely payments.

Credit Unions

Credit unions are member-owned financial institutions that often offer more flexible lending options compared to banks. While they still assess credit scores, they may be more willing to work with borrowers who have a 644 score, potentially offering more competitive interest rates or loan terms than traditional banks or other alternative lenders. Credit unions often prioritize building relationships with members, which can translate to better customer service and more personalized support. The application process generally involves completing a loan application, providing documentation (proof of income, residence, etc.), and potentially undergoing a credit check.

Co-signing a Loan

Having a co-signer with good credit can significantly improve your chances of securing a loan and potentially obtaining a lower interest rate. A co-signer agrees to share responsibility for the loan payments, effectively guaranteeing the loan. This reduces the lender’s risk, making approval more likely. However, it also means the co-signer’s credit will be impacted if payments are missed. Choosing a co-signer should be approached cautiously, as it involves a significant financial commitment for the co-signer. The application process typically involves the co-signer completing a separate application and providing their credit information.

Personal Loans

Personal loans from banks, credit unions, or online lenders can be used to purchase a vehicle. While the interest rates might be higher than traditional auto loans, they offer more flexibility in terms of repayment and vehicle choice. Personal loans aren’t specifically tied to the purchase of a car, providing more freedom in selecting the vehicle. However, securing a personal loan with a 644 credit score might still prove challenging, potentially leading to higher interest rates. The application process varies depending on the lender, but typically includes a credit check, income verification, and debt-to-income ratio assessment.

Secured Loans

A secured loan requires collateral, such as savings or another asset, to guarantee the loan. This reduces the lender’s risk and can make approval more likely, even with a lower credit score. However, if you default on the loan, you risk losing the collateral. The interest rates are generally lower than unsecured loans, but the risk of losing your collateral needs careful consideration. The application process involves providing information about the collateral and undergoing a credit check and income verification.

Conclusive Thoughts

Obtaining an auto loan with a 644 credit score is achievable with careful planning and informed decision-making. By understanding your credit profile, exploring various lenders, and diligently managing your finances, you can increase your chances of securing favorable loan terms. Remember to compare offers, consider your budget carefully, and don’t hesitate to seek professional financial advice if needed. Armed with the right knowledge and strategies, you can navigate the auto loan process successfully and drive away in your desired vehicle.

FAQ Compilation

What is considered a fair credit score?

Generally, a credit score between 600 and 699 is considered fair. A 644 credit score falls within this range.

Can I get pre-approved for an auto loan with a 644 credit score?

Yes, many lenders offer pre-approval for auto loans, even with a fair credit score. Pre-approval gives you an idea of your interest rate and loan amount before applying formally.

How long does it take to get an auto loan approved?

The approval process varies by lender, but it can typically take anywhere from a few days to a few weeks.

What happens if my auto loan application is rejected?

If rejected, review your credit report for errors and consider improving your credit score before reapplying. You might also explore alternative financing options.