Can I withdraw money from my business account? This is a fundamental question for any business owner, and the answer isn’t always straightforward. Understanding the intricacies of accessing your business funds involves navigating various account types, withdrawal methods, legal considerations, and security protocols. This guide unravels the complexities, offering a comprehensive overview of everything you need to know about withdrawing money from your business account, ensuring you’re equipped to manage your finances effectively and securely.

From the simple act of withdrawing cash from an ATM to the more complex procedures involved with larger transfers or specific account types, the process of accessing your business funds can vary significantly. Factors like your business structure (sole proprietorship, LLC, corporation), your banking institution, and even your transaction history can influence your withdrawal options and limitations. We’ll explore these factors in detail, clarifying potential restrictions and highlighting best practices for secure and compliant withdrawals.

Account Access and Withdrawal Limits

Withdrawing funds from your business account is a crucial aspect of managing your finances. Understanding the process, available methods, and associated limits is essential for efficient cash flow management. This section details the typical procedures and variations you might encounter.

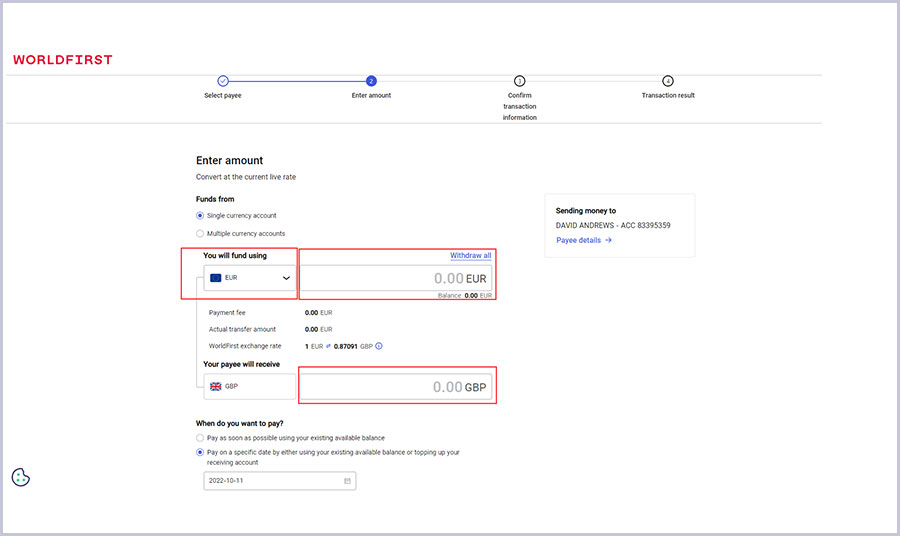

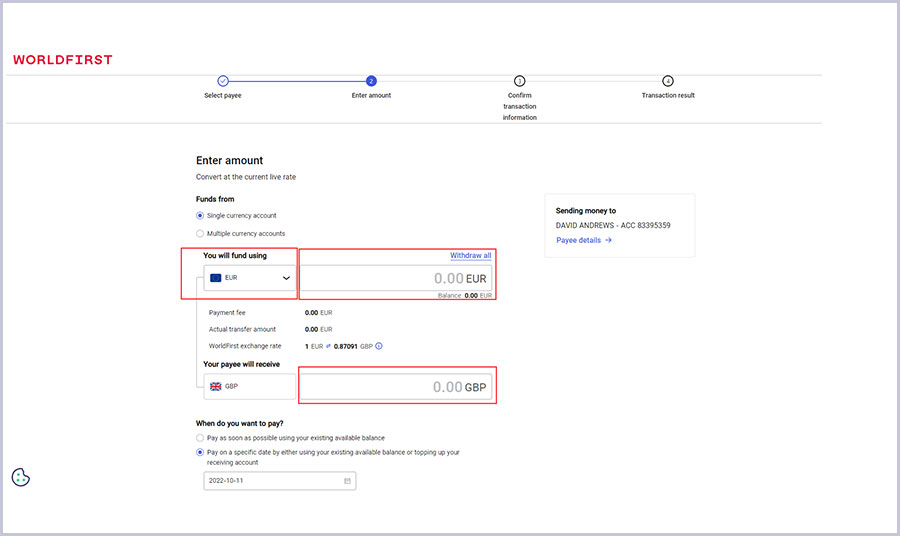

Accessing your business account and withdrawing funds typically involves using your account credentials (username and password) to log in to your online banking portal or visiting a physical branch. The specific process may vary slightly depending on your bank and the chosen withdrawal method.

Withdrawal Methods

Several methods exist for withdrawing money from a business account, each with its own advantages and limitations. The most common options include online transfers, ATM withdrawals, and checks. Online transfers allow for immediate transfers to other accounts, while ATM withdrawals offer convenient access to cash. Checks provide a paper trail and can be used for various payments, but processing times can be slower.

Withdrawal Limits

Withdrawal limits vary significantly across banking institutions and depend on factors such as account type, account history, and the chosen withdrawal method. Smaller banks and credit unions may have lower daily or weekly withdrawal limits compared to larger national banks. For example, a small local bank might impose a daily limit of $5,000 for ATM withdrawals, whereas a major national bank might allow $10,000 or more. Online transfers often have higher limits than ATM withdrawals, and some banks may have no limit for online transfers between accounts they own. Furthermore, businesses with a strong credit history and substantial account balances may be granted higher withdrawal limits upon request.

Withdrawal Fees

Fees associated with withdrawing money from a business account can also vary considerably depending on the method used and the financial institution. While some banks offer free withdrawals via online transfers between their own accounts, others may charge fees for ATM withdrawals, especially if using out-of-network ATMs. Check withdrawals may also incur fees, particularly if a large number of checks are processed. The following table provides a sample comparison, though it is crucial to check with your specific bank for the most accurate and up-to-date information.

| Method | Fee Amount | Minimum Withdrawal | Maximum Withdrawal |

|---|---|---|---|

| Online Transfer (Same Bank) | $0 | $1 | Variable (Often High) |

| ATM Withdrawal (In-Network) | $0 | $20 | $1000 |

| ATM Withdrawal (Out-of-Network) | $3 – $5 | $20 | $1000 |

| Check Withdrawal | $0.50 – $1.00 per check | $1 | Variable (Often High) |

Business Account Types and Withdrawal Restrictions

Understanding the nuances of business account types is crucial for smooth financial operations. Different legal structures for businesses—sole proprietorships, LLCs, and corporations—impact how you access and withdraw funds from your business account. These differences stem from legal distinctions in ownership and liability. Ignoring these distinctions can lead to complications and potential penalties.

Business account withdrawal procedures vary depending on the legal structure of your business. Sole proprietorships, often simpler in structure, may have less stringent withdrawal requirements than corporations, which face more complex regulatory oversight. Understanding these differences ensures compliance and prevents unforeseen issues.

Sole Proprietorship Withdrawal Procedures

Sole proprietorships typically enjoy simpler withdrawal processes. Funds are generally accessible as needed, often with minimal documentation required. However, it’s crucial to maintain accurate records of all withdrawals for tax purposes. Improper record-keeping can lead to audits and potential penalties. While there aren’t specific restrictions beyond standard account terms and conditions, maintaining detailed financial records is paramount. This ensures accurate tax reporting and simplifies financial management.

LLC Withdrawal Procedures

Limited Liability Companies (LLCs) offer a blend of simplicity and protection. Withdrawal procedures are generally straightforward, but it’s advisable to consult the LLC’s operating agreement for any specific guidelines. The operating agreement might Artikel procedures for member distributions or restrictions on withdrawals. Failing to adhere to these stipulations could lead to internal disputes among members. Maintaining meticulous records, as with sole proprietorships, remains vital for tax compliance and financial transparency.

Corporation Withdrawal Procedures

Corporations, due to their more complex legal structure, have more formalized withdrawal procedures. Withdrawals are typically treated as shareholder dividends or officer salaries, requiring adherence to corporate bylaws and tax regulations. Incorrectly classifying withdrawals can result in significant tax penalties. Corporations often have more stringent internal controls and documentation requirements for withdrawals, ensuring transparency and accountability. Failure to comply with these regulations can result in fines and legal repercussions.

Withdrawal Restrictions and Penalties Across Account Types

All business account types face potential penalties for violating account terms or exceeding withdrawal limits. These penalties can range from fees and account suspensions to legal action in severe cases. Common violations include insufficient funds, exceeding overdraft limits, and failing to comply with reporting requirements. The specific penalties vary depending on the financial institution and the nature of the violation. For example, exceeding overdraft limits consistently might lead to higher fees or even account closure. Similarly, failing to comply with reporting requirements for tax purposes could result in substantial fines and legal repercussions.

Flowchart: Corporation Withdrawal Process

The following describes a simplified flowchart illustrating the withdrawal process for a corporation. Note that this is a generalized example and may vary based on specific corporate bylaws and financial institution policies.

[Descriptive Flowchart Text]

Start -> Initiate Withdrawal Request (Internal Form) -> Approval by Designated Officer(s) -> Verification of Funds Availability -> Processing by Accounting Department -> Funds Transferred -> Record Updated (Accounting System & Bank Records) -> End. This process involves multiple checks and balances to ensure compliance and accurate financial record-keeping. Each step is crucial in maintaining the integrity of the corporate financial system.

Legal and Regulatory Considerations

Withdrawing funds from your business account is subject to various legal and regulatory frameworks designed to prevent financial crime and ensure transparency. Understanding these regulations is crucial for maintaining compliance and avoiding potential legal issues. Failure to comply can result in significant penalties, including fines and even criminal charges.

Maintaining accurate records of all transactions is paramount. These records serve as evidence of your business’s financial activities and are essential for tax purposes, audits, and potential legal disputes. Accurate record-keeping demonstrates responsible financial management and aids in the detection of any discrepancies or fraudulent activity.

Record Keeping Requirements

Accurate record-keeping involves meticulously documenting all transactions, including deposits, withdrawals, and transfers. This typically includes the date, amount, description of the transaction, and the recipient or payer. Depending on your jurisdiction and business type, specific record-keeping requirements may apply, such as maintaining detailed ledgers, using accounting software, or adhering to specific industry standards. Failure to maintain adequate records can lead to penalties from tax authorities and difficulties in resolving financial disputes. For example, a small business owner failing to accurately record a large withdrawal might face challenges during a tax audit if the source of the funds is unclear.

Discrepancies in Account Balance

If a discrepancy arises in your business account balance, prompt action is necessary. Begin by carefully reviewing your bank statements and transaction records, comparing them to your internal accounting records. If the discrepancy persists, contact your bank immediately to report the issue. Provide them with all relevant information, including the dates and amounts of the transactions in question. The bank will investigate the discrepancy and provide you with a resolution. Documentation of all communication with the bank, including dates, times, and names of individuals contacted, is crucial in case further action is required.

Potential Legal Issues Related to Unauthorized Withdrawals

Unauthorized withdrawals from a business account constitute a serious offense with significant legal implications. These actions may constitute theft, fraud, or embezzlement, depending on the circumstances. Potential legal issues include civil lawsuits to recover stolen funds and criminal prosecution, leading to fines and imprisonment. For instance, an employee who fraudulently withdraws funds from the business account can face criminal charges and be held liable for repaying the stolen amount plus potential damages. Establishing clear procedures for access and authorization of withdrawals is crucial in preventing unauthorized access and mitigating the risk of such legal issues.

Security and Fraud Prevention

Protecting your business finances requires a multi-layered approach to security. Banks employ various methods to safeguard business accounts from unauthorized access and fraudulent withdrawals, while individuals also bear responsibility for maintaining robust security practices. Understanding these measures and potential threats is crucial for mitigating risk.

Banks utilize a range of security measures to protect business accounts. These typically include robust authentication processes, such as multi-factor authentication (requiring verification from multiple sources, like a password and a one-time code sent to a mobile device), encryption of sensitive data both in transit and at rest, and sophisticated fraud detection systems that monitor transactions for unusual patterns. Regular security updates to their systems and employee training on security protocols are also essential components of their security posture. Furthermore, many banks offer additional security features such as transaction alerts, which notify account holders of any activity on their account in real-time.

Examples of Fraudulent Activities

Fraudulent activities targeting business account withdrawals can take many forms. Common examples include phishing scams, where criminals impersonate legitimate entities (like the bank) to obtain login credentials; malware infections that secretly steal account information; check fraud, involving forged or altered checks; and unauthorized online transfers. A particularly insidious method is business email compromise (BEC), where hackers infiltrate a company’s email system and manipulate communications to redirect funds to fraudulent accounts. For example, a BEC attack might involve a hacker posing as a supplier requesting a change of bank details for an invoice payment. The resulting transfer would go to the hacker’s account, leaving the business unaware until the discrepancy is discovered.

Identifying and Reporting Suspicious Activity

Identifying suspicious activity requires vigilance and awareness. Regularly reviewing account statements for unauthorized transactions is crucial. Any discrepancies, unusual activity patterns (e.g., unusually large withdrawals, frequent small transactions to unfamiliar accounts), or communications requesting changes to account details should be treated with extreme caution. If suspicious activity is detected, it’s vital to immediately contact the bank’s fraud department. Detailed records of suspicious transactions and communications should be documented and provided to the bank to aid in the investigation.

Best Practices for Securing a Business Account

Implementing robust security practices significantly reduces the risk of fraudulent withdrawals.

- Utilize strong, unique passwords for all online banking accounts and regularly update them.

- Enable multi-factor authentication whenever available.

- Install and maintain up-to-date antivirus and anti-malware software on all devices used to access the business account.

- Regularly review account statements and transactions for any unauthorized activity.

- Be cautious of unsolicited emails or phone calls requesting account information.

- Educate employees about phishing scams and other online security threats.

- Implement strong internal controls over financial transactions, including segregation of duties.

- Consider using virtual private networks (VPNs) when accessing online banking from public Wi-Fi networks.

- Report any suspicious activity to the bank immediately.

Troubleshooting Common Withdrawal Issues

Withdrawal requests from business accounts, while generally straightforward, can sometimes encounter delays or rejections. Understanding the common causes and troubleshooting steps can significantly expedite the process and minimize frustration. This section Artikels the typical reasons for withdrawal failures and provides a clear path to resolving them.

Reasons for Withdrawal Declines

Several factors can lead to a declined withdrawal request. Insufficient funds in the account are the most frequent cause. This might be due to pending transactions, insufficient clearing time for deposited funds, or simply an inaccurate assessment of available balance. Other reasons include exceeding daily or monthly withdrawal limits, violations of account terms and conditions (such as engaging in suspicious activity), discrepancies in account information (like mismatched addresses), or technical glitches within the banking system. Finally, holds placed on the account due to regulatory compliance or fraud prevention measures can also temporarily prevent withdrawals.

Steps to Take After a Rejected Withdrawal

If your withdrawal is rejected, the first step is to carefully review the reason provided by the bank or financial institution. This information is usually included in the rejection notification. Check your account balance and transaction history to confirm the availability of funds and identify any pending transactions that might be impacting your available balance. Verify that all your account information is accurate and up-to-date, including contact details and addresses. If you suspect a technical issue, try resubmitting your withdrawal request after a short period. If the problem persists, gather all relevant information, including the rejection notification and transaction details, before contacting customer support.

Contacting Customer Support for Withdrawal Problems, Can i withdraw money from my business account

Contacting customer support is crucial for resolving persistent withdrawal issues. Most financial institutions offer multiple channels for support, such as phone, email, and online chat. When contacting support, have your account number, the date and amount of the rejected withdrawal, and a brief description of the issue readily available. Clearly explain the situation and provide any supporting documentation as requested. Be prepared to answer security questions to verify your identity. Keep a record of your communication with customer support, including dates, times, and the names of the representatives you speak with. This documentation can be helpful if the issue is not resolved promptly.

Typical Resolution Time for Withdrawal Issues

The resolution time for withdrawal problems varies depending on the complexity of the issue and the responsiveness of the financial institution’s customer support. Simple issues, such as insufficient funds or minor account discrepancies, are usually resolved within a few business days. More complex problems, involving regulatory reviews or investigations into potential fraud, may take longer, potentially several weeks. For example, a withdrawal rejection due to a suspected fraudulent transaction might require a thorough investigation by the bank’s fraud department, potentially delaying resolution. Proactive communication with customer support and providing necessary documentation promptly can generally help expedite the resolution process.

Impact of Account Balance and Transaction History: Can I Withdraw Money From My Business Account

Your ability to withdraw funds from your business account is directly influenced by both your current account balance and your past transaction history. Insufficient funds are the most obvious barrier, but a less apparent factor is the assessment of your account’s activity by the financial institution. This assessment helps mitigate risk and ensure compliance with regulations.

A sufficient account balance is the fundamental requirement for any withdrawal. Simply put, you cannot withdraw more money than you have available. However, even with a sufficient balance, certain withdrawal requests might be flagged for review based on your transaction history. This review process aims to identify potentially suspicious activity and prevent fraudulent transactions.

Account Balance and Withdrawal Limits

The most straightforward impact of your account balance is the limitation it places on withdrawal amounts. You cannot withdraw more money than is currently held in your account. Attempting to do so will result in a declined transaction. Furthermore, some banks or financial institutions may impose daily or monthly withdrawal limits, irrespective of your account balance. These limits vary based on account type and individual bank policies. For instance, a small business account might have a daily limit of $10,000, while a larger corporate account might have a higher limit. Exceeding these limits will lead to transaction rejection until the next withdrawal period.

Transaction History and Withdrawal Approvals

Your business’s transaction history plays a crucial role in the approval process for withdrawals, especially for larger sums or unusually frequent withdrawals. Banks analyze transaction patterns to identify anomalies. Consistent, predictable transactions generally lead to smoother withdrawals. Conversely, irregular activity, such as sudden large deposits followed by equally large withdrawals, may trigger a review. This review process can temporarily delay or even prevent withdrawals until the bank verifies the legitimacy of the transactions. This is a key measure in fraud prevention.

Scenarios Illustrating Transaction History Impact

Let’s consider two hypothetical scenarios:

Scenario 1: “SteadyStream Solutions,” a well-established consulting firm, has a consistent history of regular client payments and predictable operational expenses. Their transactions show a stable pattern over several years. When they request a large withdrawal for a planned office relocation, the bank processes it smoothly because the transaction aligns with their established pattern of financial activity.

Scenario 2: “QuickBucks Enterprises,” a newly established online retailer, experiences a sudden surge in sales and deposits. They then attempt to withdraw a significant portion of these funds shortly after. This abrupt change in transaction pattern might raise red flags for the bank’s fraud detection system. The bank might require additional verification before approving the withdrawal to ensure the funds’ origin and intended use are legitimate. This could involve providing documentation supporting the recent increase in sales and the purpose of the withdrawal.

Hypothetical Scenario: Transaction History and Withdrawal Approval

Imagine “GreenThumb Gardening,” a landscaping business, consistently deposits small amounts from various clients over several months. Their average monthly deposit is $5,000, and their withdrawals are similarly modest. They then receive a large payment of $50,000 from a new, large-scale contract. If they immediately attempt to withdraw a significant portion of this amount, their transaction history might trigger a review by the bank due to the atypical size of the deposit and the subsequent withdrawal request. The bank may request documentation to verify the source of the $50,000 payment and the intended use of the funds before approving the withdrawal. This scenario highlights how even a legitimate large transaction can be flagged if it significantly deviates from the established pattern of the business’s financial activity.