Can I start a business while in Chapter 13? This question weighs heavily on many individuals navigating the complexities of bankruptcy. Starting a business during Chapter 13 bankruptcy presents a unique set of legal, financial, and ethical considerations. Understanding the rules and regulations, as well as the potential impact on your repayment plan, is crucial for success. This guide explores the intricacies of launching a business while under Chapter 13 protection, offering a practical roadmap for navigating this challenging situation.

Balancing the desire for financial independence with the obligations of a bankruptcy plan requires careful planning and transparency. This involves understanding the disclosure requirements to your bankruptcy trustee, the potential impact on your repayment plan, and the importance of seeking court approval where necessary. We’ll delve into practical strategies for financial management, conflict resolution, and maintaining ethical business practices throughout the process.

Legality of Starting a Business During Chapter 13 Bankruptcy

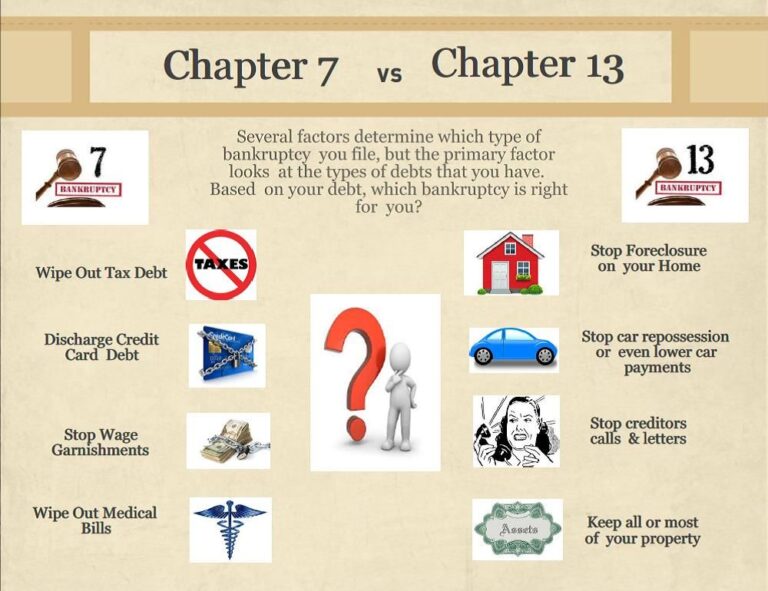

Filing for Chapter 13 bankruptcy doesn’t automatically prohibit you from starting a business. However, it significantly impacts your ability to do so and requires careful consideration of legal implications. The bankruptcy court’s primary concern is ensuring that your Chapter 13 plan, which Artikels how you’ll repay your debts, is feasible and that creditors receive their fair share. Starting a business can affect this plan, potentially requiring modifications or even jeopardizing its success.

The legal implications stem from the need to disclose all income and assets to the bankruptcy trustee. This includes any income generated from a new business. The trustee will assess whether the business income should be included in your plan’s repayment schedule, contributing to the funds available to creditors. Failure to disclose business income or assets is a serious breach of bankruptcy law, potentially leading to sanctions or even dismissal of your Chapter 13 case.

Requirements and Restrictions Imposed by Bankruptcy Law on Business Ventures, Can i start a business while in chapter 13

Bankruptcy law doesn’t explicitly forbid starting a business during Chapter 13, but it imposes significant requirements. The most critical is the need for complete transparency and honesty with the bankruptcy court and trustee. Any new business venture must be fully disclosed, including its nature, projected income, and expenses. The trustee will review this information to determine if it impacts the feasibility of your repayment plan. Furthermore, the business must operate within the confines of your Chapter 13 plan, meaning you cannot use business income to fund lavish spending or avoid your debt obligations. You must continue to make payments as Artikeld in your plan, even if the business is not yet profitable. Failure to comply with these requirements can result in serious legal consequences.

Examples of Permissible and Prohibited Businesses During Chapter 13

Permissible businesses typically involve modest ventures that generate income to supplement existing resources and help repay debts. Examples might include a home-based craft business, freelance writing or design services, or a small-scale online retail operation. The key is that these activities are relatively low-risk, manageable within the constraints of the Chapter 13 plan, and fully disclosed to the court.

Prohibited businesses usually involve high-risk ventures or those that could be seen as attempts to hide assets or income from creditors. These might include starting a high-capital investment business, engaging in speculative trading, or establishing a business known for high financial risk and volatility. Essentially, any business that could significantly alter the financial picture presented in the Chapter 13 plan without court approval would be problematic.

Implications of Starting a Sole Proprietorship Versus a Corporation Under Chapter 13

The choice between a sole proprietorship and a corporation during Chapter 13 bankruptcy has significant legal ramifications. A sole proprietorship blends the business and personal finances, making it easier for the trustee to access all business income and assets. This simplification can be advantageous if the business is straightforward and has limited assets. Conversely, a corporation offers a degree of legal separation between personal and business assets. However, establishing and maintaining a corporation adds complexity, requiring more disclosure and potentially greater scrutiny from the bankruptcy trustee. The increased complexity may not be worthwhile for small-scale businesses, but it might be preferable for larger or more complex ventures, offering a layer of protection for personal assets should the business fail. The decision depends on the specific circumstances and should be made in consultation with legal counsel.

Disclosure Requirements to the Bankruptcy Trustee

Filing for Chapter 13 bankruptcy necessitates complete transparency with your bankruptcy trustee. This includes any income or assets acquired during the bankruptcy proceedings, especially those stemming from a newly started business. Failure to disclose such information can have serious consequences, potentially leading to the dismissal of your bankruptcy case or even legal repercussions.

Necessity of Disclosing Business Income and Assets

All income and assets generated by a new business venture undertaken while in Chapter 13 bankruptcy must be disclosed to the bankruptcy trustee. This is a crucial aspect of the bankruptcy process, ensuring the equitable distribution of assets to creditors. The trustee uses this information to assess your ability to make payments under your Chapter 13 plan and to determine if any additional funds are available for distribution. Withholding information prevents the trustee from accurately evaluating your financial situation and could be construed as fraudulent concealment. This disclosure obligation applies to all forms of income, including salary, profits, and any other financial gains derived from the business. Assets acquired through the business, such as equipment or inventory, also fall under this reporting requirement.

Best Practices for Maintaining Transparent Financial Records

Maintaining meticulous and accurate financial records for your new business is paramount. This not only aids in fulfilling your disclosure obligations but also assists in managing your business effectively. Best practices include using accounting software to track income and expenses, keeping detailed records of all transactions, and regularly reconciling bank statements. Consider consulting with a qualified accountant to ensure compliance with accounting standards and to help establish a robust record-keeping system. This proactive approach minimizes the risk of errors and demonstrates your commitment to transparency. Remember to separate business and personal finances meticulously to avoid confusion and simplify the reporting process.

Consequences of Failing to Disclose Business Activities or Income

Failure to disclose business activities or income to the bankruptcy trustee can lead to severe consequences. The trustee may initiate an investigation, potentially resulting in the dismissal of your Chapter 13 bankruptcy case. This would leave you vulnerable to creditor actions and could severely damage your credit rating. Furthermore, non-disclosure could be considered a criminal offense, leading to significant fines or even imprisonment. In some instances, the trustee may seek to seize assets from the undisclosed business to satisfy outstanding debts. Such actions can have devastating financial and legal repercussions, underscoring the importance of full and honest disclosure.

Sample Disclosure Form for Reporting Business Income and Expenses

Accurate and timely reporting is crucial. A structured form simplifies this process. Below is a sample form illustrating the necessary information.

| Date | Description | Income | Expenses |

|---|---|---|---|

| 2024-03-15 | Sales Revenue | $1,500 | $500 |

| 2024-03-22 | Service Fees | $800 | $200 |

| 2024-03-29 | Sales Revenue | $1,200 | $400 |

Impact on the Chapter 13 Repayment Plan: Can I Start A Business While In Chapter 13

Starting a business while under Chapter 13 bankruptcy can significantly impact your repayment plan, presenting both opportunities and challenges. The success of your plan hinges on your ability to consistently meet your payment obligations, and a new business venture introduces both additional income potential and added financial complexities. Careful planning and transparent communication with your bankruptcy trustee are crucial for navigating this situation effectively.

The primary concern is whether the business will generate sufficient income to supplement, or potentially even replace, your existing income sources to meet your Chapter 13 plan obligations. Conversely, if the business incurs losses, it could negatively impact your ability to make timely payments, potentially leading to complications with your bankruptcy case. The financial volatility inherent in starting a business needs to be carefully considered within the context of your legal obligations.

Business Income Incorporation into the Repayment Plan

Incorporating a new business’s income into your existing Chapter 13 repayment plan requires a formal amendment to the plan. This process involves providing detailed financial information about the business to the bankruptcy trustee, including projected income and expenses. The trustee will review this information to assess its impact on your ability to meet your repayment obligations. This review process usually involves submitting detailed financial projections, such as profit and loss statements, cash flow projections, and business plans. The trustee may request additional documentation or clarification to ensure the accuracy and completeness of the submitted information. The amendment to the plan will then reflect the increased income, potentially leading to higher monthly payments or a shorter repayment period, depending on the projected income and the terms of the original plan. Failure to accurately reflect the business income could lead to sanctions from the bankruptcy court.

Adjusting the Repayment Plan Based on Business Performance

Fluctuations in business income are common, particularly during the initial stages. If your business performs better than projected, generating significantly higher income, you may be able to request a modification to your repayment plan to increase payments and potentially shorten the repayment period. This could benefit you by allowing you to complete your bankruptcy proceedings sooner. Conversely, if your business income falls short of projections or experiences losses, you will need to immediately inform your bankruptcy trustee. This might necessitate another amendment to the repayment plan, potentially requiring a reduction in payments or an extension of the repayment period. Failure to disclose such changes could have severe consequences. For example, a scenario where a debtor’s new bakery initially surpasses projections but later faces unexpected competition, resulting in lower-than-expected income, would require an amended plan to reflect this change and avoid default. The trustee will work with you to determine a feasible and legally sound adjustment to the plan.

Financial Management and Planning for the New Business

Starting a business while navigating Chapter 13 bankruptcy requires meticulous financial planning and management. Success hinges on a clear understanding of bankruptcy regulations, careful budgeting, and a robust strategy for separating personal and business finances. This section Artikels key considerations and strategies for achieving financial stability and compliance.

Sample Business Plan for Individuals Under Chapter 13 Bankruptcy

A business plan for an individual under Chapter 13 should differ from a standard plan by explicitly addressing the bankruptcy proceedings. It needs to demonstrate how the business will contribute positively to the Chapter 13 repayment plan, not hinder it. This plan should include a realistic financial projection showing how the business will generate income to contribute to debt repayment. For example, a plan for a freelance graphic designer might project income based on a realistic number of clients and hourly rate, factoring in expenses like software subscriptions and marketing costs. The plan should also detail how the business will manage its finances to ensure transparency and compliance with bankruptcy regulations. A crucial element is a dedicated section detailing how the business’s income will be used, with a clear allocation to debt repayment and other expenses. This demonstrates commitment to the bankruptcy plan and reduces the trustee’s concerns.

Key Financial Considerations for a New Business Operating During Bankruptcy

Several financial factors demand careful consideration when starting a business under Chapter 13. These include realistic revenue projections, thorough expense budgeting, and securing appropriate funding while adhering to bankruptcy restrictions. Ignoring these could lead to further financial complications.

- Revenue Projections: Develop conservative, yet achievable, revenue projections based on market research and realistic sales estimates. Avoid overestimating income to avoid disappointment and potential conflict with the bankruptcy court.

- Expense Budgeting: Create a detailed budget that accounts for all business expenses, including start-up costs, operating expenses, and marketing. This should also factor in any potential legal fees associated with the bankruptcy proceedings.

- Funding Sources: Explore funding options compatible with Chapter 13, such as personal savings (if permitted by the court), small business loans (if approved given the bankruptcy), or investments from family or friends. Clearly document all funding sources in the business plan.

- Compliance with Bankruptcy Regulations: Ensure all financial transactions are documented and transparent to comply with Chapter 13 regulations. Maintain separate business accounts and records to avoid commingling personal and business funds.

Strategies for Managing Cash Flow and Minimizing Financial Risk During Chapter 13

Effective cash flow management is crucial for survival during Chapter 13. This involves proactive budgeting, efficient expense control, and securing timely payment from clients. Minimizing financial risk requires careful planning and risk mitigation strategies.

- Cash Flow Projections: Create monthly cash flow projections to anticipate potential shortfalls and surpluses. This allows for proactive planning and prevents unexpected financial crises.

- Expense Control: Implement strict expense controls, prioritizing essential expenses and eliminating unnecessary costs. This might involve negotiating better deals with suppliers or exploring cheaper alternatives.

- Client Payment Terms: Establish clear and enforceable payment terms with clients to ensure timely payment. Consider offering discounts for early payments to incentivize prompt settlements.

- Risk Mitigation: Identify potential risks, such as market fluctuations or changes in client demand, and develop contingency plans to mitigate these risks. This could involve diversifying revenue streams or building an emergency fund (if allowed under the bankruptcy plan).

Methods for Separating Personal and Business Finances

Maintaining separate personal and business finances is paramount during Chapter 13. This ensures transparency and prevents the trustee from claiming business assets to satisfy personal debts.

- Separate Bank Accounts: Open a separate business bank account to keep business funds distinct from personal funds. All business transactions should be processed through this account.

- Separate Accounting Systems: Use separate accounting software or methods to track business income and expenses separately from personal finances. This ensures clear financial records for both.

- Detailed Financial Records: Maintain meticulous records of all business transactions, including invoices, receipts, and bank statements. This will be crucial during audits and interactions with the bankruptcy trustee.

- Regular Financial Reporting: Prepare regular financial reports, such as income statements and balance sheets, to monitor the business’s financial health and ensure compliance with Chapter 13 requirements.

Seeking Permission from the Bankruptcy Court

Starting a business while under Chapter 13 bankruptcy requires navigating a complex legal landscape. A key element of this process involves obtaining permission from the bankruptcy court before commencing any business operations. This ensures compliance with the bankruptcy plan and protects the interests of creditors. Failure to secure this approval can have significant repercussions.

The process of obtaining court approval typically involves filing a motion with the bankruptcy court. This motion must clearly articulate the details of the proposed business, including its nature, projected income, and how it will impact the debtor’s ability to fulfill their Chapter 13 repayment plan. The court will review the motion and supporting documentation to determine whether the business venture is consistent with the debtor’s obligations under the bankruptcy plan.

Court Approval Scenarios

Several situations necessitate seeking court approval before starting a business during Chapter 13. For instance, if the business requires significant capital investment, exceeding the debtor’s disposable income, court authorization is usually needed. Similarly, if the business involves the use of assets that are part of the bankruptcy estate, explicit permission is required. Another example is when the business activity directly impacts the debtor’s ability to make timely payments to creditors as Artikeld in their Chapter 13 plan. The court’s primary concern is ensuring that the new business does not jeopardize the repayment plan or unfairly benefit the debtor at the expense of creditors.

Required Documentation for Court Approval

Supporting documentation for a motion seeking court approval to start a business is crucial. This typically includes a detailed business plan outlining the business structure, market analysis, projected income statements, and expense budgets. The debtor must also provide financial statements demonstrating their current financial situation and how the new business will impact their ability to meet their obligations under the Chapter 13 plan. A sworn affidavit attesting to the accuracy of the information provided is also generally required. The court may request additional documentation depending on the specifics of the business proposal.

Consequences of Operating Without Court Authorization

Operating a business without prior court authorization during Chapter 13 bankruptcy can lead to several negative consequences. The court may view this as a violation of the bankruptcy plan, potentially resulting in sanctions. This could include the dismissal of the Chapter 13 case, conversion to Chapter 7 bankruptcy, or even contempt of court charges. Furthermore, creditors could argue that the unauthorized business income should be included in the bankruptcy estate, impacting the distribution of assets to creditors. Finally, the debtor could face personal liability for debts incurred by the unauthorized business. The risks associated with operating a business without court approval significantly outweigh the potential benefits.

Potential Conflicts of Interest

Operating a business while undergoing Chapter 13 bankruptcy presents unique challenges, primarily the potential for conflicts of interest. These conflicts can arise from the inherent tension between the debtor’s obligations to creditors under the bankruptcy plan and the pursuit of profit for the new business. Navigating these complexities requires careful planning, transparency, and a commitment to ethical business practices.

Identifying Potential Conflicts of Interest

Conflicts of interest can manifest in various ways. For example, using bankruptcy funds to finance the new business, commingling business and personal funds, or prioritizing business profits over Chapter 13 plan payments could be construed as a conflict. Another potential conflict arises when the business activities directly compete with existing creditors or interfere with the bankruptcy estate’s assets. Failing to properly account for business income and expenses in the bankruptcy proceedings also constitutes a significant conflict. The key is to maintain strict separation between personal finances, business operations, and the bankruptcy estate to avoid any perception of impropriety.

Strategies for Mitigating Conflicts of Interest

Mitigating these conflicts requires proactive measures. First, meticulous record-keeping is paramount. Maintaining separate bank accounts for personal finances, the business, and bankruptcy-related funds is crucial. Detailed financial records for the business, including income statements, balance sheets, and cash flow projections, should be meticulously maintained and readily available for review by the bankruptcy trustee. Secondly, developing a robust business plan that clearly Artikels the business’s financial projections and operational strategies is essential. This plan should demonstrate the feasibility of the business and its ability to generate sufficient income to meet both business and Chapter 13 repayment obligations. Finally, seeking professional advice from a bankruptcy attorney and a financial advisor is highly recommended to ensure compliance with all legal and ethical requirements.

Transparency and Full Disclosure

Transparency and full disclosure are not merely recommended but are legally mandated. The bankruptcy trustee must be informed of any business ventures undertaken during the Chapter 13 proceedings. Failure to disclose such activities can lead to serious consequences, including sanctions or even the dismissal of the bankruptcy case. Regular communication with the trustee, providing timely updates on the business’s financial performance and any significant developments, is crucial to maintain open communication and build trust. This proactive approach helps avoid any misunderstandings and demonstrates a commitment to transparency.

Examples of Conflicts of Interest and Proactive Solutions

Consider a scenario where a debtor uses bankruptcy funds intended for creditor payments to purchase equipment for their new business. This is a clear conflict of interest. The solution is to secure separate funding for the business venture, perhaps through loans or investments, and avoid using bankruptcy funds for business purposes. Another example: a debtor’s new business directly competes with a creditor, potentially impacting their ability to repay debts. A proactive approach would involve disclosing this competition to the trustee and developing a strategy to minimize any negative impact on the creditor’s recovery. If the business is exceptionally profitable, the debtor should consider proposing modifications to their Chapter 13 plan to increase payments to creditors, demonstrating good faith and equitable treatment of all stakeholders.