Can I withdraw cash from my business account? This seemingly simple question opens a door to a world of possibilities and potential pitfalls. Understanding the nuances of accessing cash from your business account—whether it’s a checking, savings, or money market account—is crucial for efficient financial management. From daily withdrawal limits and associated fees to the various methods available, navigating this process requires clarity and awareness of the regulations involved. This guide will equip you with the knowledge to confidently manage your business finances.

We’ll explore the different types of business accounts and their associated withdrawal options, detailing the procedures for accessing cash via ATM, bank branch, or check. We’ll also delve into legal and regulatory restrictions, covering reporting requirements for substantial withdrawals and the implications of exceeding limits. Beyond traditional methods, we’ll examine alternative ways to access funds, including electronic transfers and mobile banking, highlighting their convenience and speed. Finally, we’ll address troubleshooting common issues and discuss essential security measures to protect your business account.

Types of Business Accounts and Cash Withdrawal Options

Choosing the right business account depends heavily on your withdrawal needs. Different account types offer varying levels of access to your funds, with associated fees and limitations. Understanding these nuances is crucial for efficient cash management.

Business Checking Accounts and Cash Withdrawal Methods

Business checking accounts are designed for frequent transactions, making them ideal for daily operational expenses. Cash withdrawals are typically facilitated through ATMs, in-person visits to the bank branch, or via debit cards. Many banks offer mobile check deposit capabilities, effectively eliminating the need for physical branch visits for many transactions. However, it’s important to note that some banks may impose limits on the number of free withdrawals per month.

Business Savings Accounts and Cash Withdrawal Options

Business savings accounts prioritize accumulating funds rather than frequent access. While withdrawals are possible, they might be subject to more stringent limitations compared to checking accounts. Withdrawal methods usually include ATMs (with potential limitations), bank branches, and potentially online transfers. Frequent withdrawals from a savings account might incur fees or penalties depending on the bank’s policy.

Business Money Market Accounts and Their Withdrawal Features

Business money market accounts combine features of both checking and savings accounts. They offer higher interest rates than checking accounts but usually allow a limited number of withdrawals per month. Withdrawal methods are similar to savings accounts, typically including ATMs, bank branches, and online transfers. Exceeding the stipulated withdrawal limit can lead to penalties or fees.

Fees Associated with Cash Withdrawals

Fees associated with cash withdrawals vary significantly depending on the bank, account type, and the withdrawal method. Common fees include ATM fees (especially when using out-of-network ATMs), monthly maintenance fees, and per-transaction fees for exceeding withdrawal limits. Some banks might waive fees for certain account types or under specific conditions, such as maintaining a minimum balance. It’s always advisable to carefully review your bank’s fee schedule.

Daily/Weekly Withdrawal Limits for Business Accounts

Daily and weekly withdrawal limits vary widely depending on the bank and account type. Checking accounts usually have higher limits than savings or money market accounts, reflecting their intended purpose for frequent transactions. Limits can range from a few hundred dollars to several thousand dollars per day or week. Exceeding these limits might trigger additional fees or require prior notification to the bank. Some banks may offer increased limits upon request, particularly for established businesses with a strong transaction history.

| Account Type | Withdrawal Method | Fees | Limits |

|---|---|---|---|

| Business Checking | ATM, Branch, Debit Card, Online Transfer | ATM fees (out-of-network), monthly maintenance fees, potential per-transaction fees | Varies widely, generally high |

| Business Savings | ATM (limited), Branch, Online Transfer | ATM fees (out-of-network), monthly maintenance fees, potential withdrawal penalties | Generally lower than checking accounts |

| Business Money Market | ATM (limited), Branch, Online Transfer | ATM fees (out-of-network), monthly maintenance fees, potential withdrawal penalties | Limited number of withdrawals per month |

Accessing Cash from a Business Account

Withdrawing cash from your business account requires understanding the available methods and their associated procedures and limitations. Choosing the right method depends on factors such as the amount of cash needed, the urgency, and the security preferences of your business. This section details the common methods for accessing cash, highlighting their respective steps and considerations.

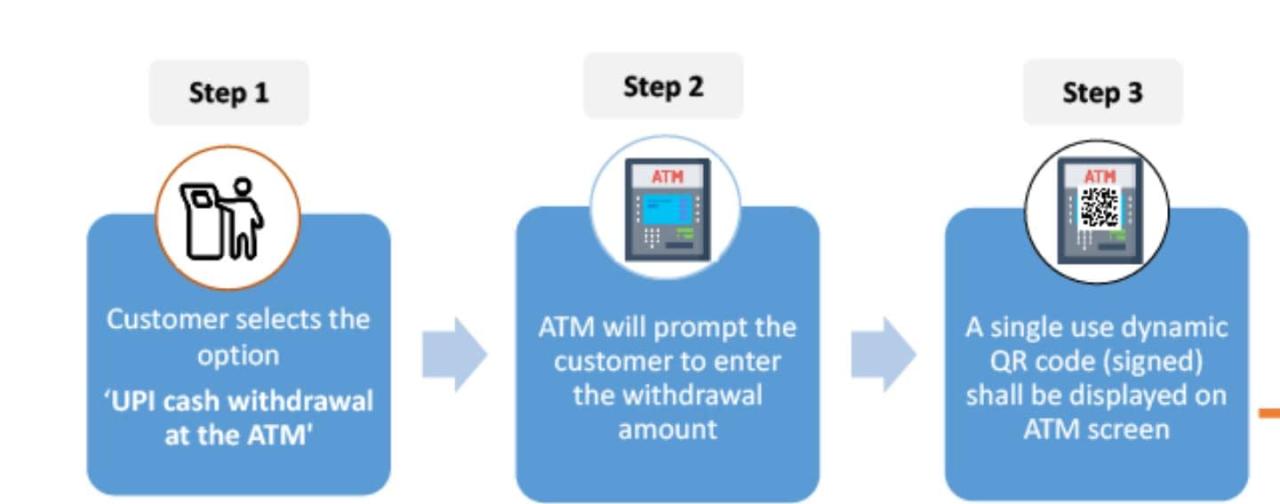

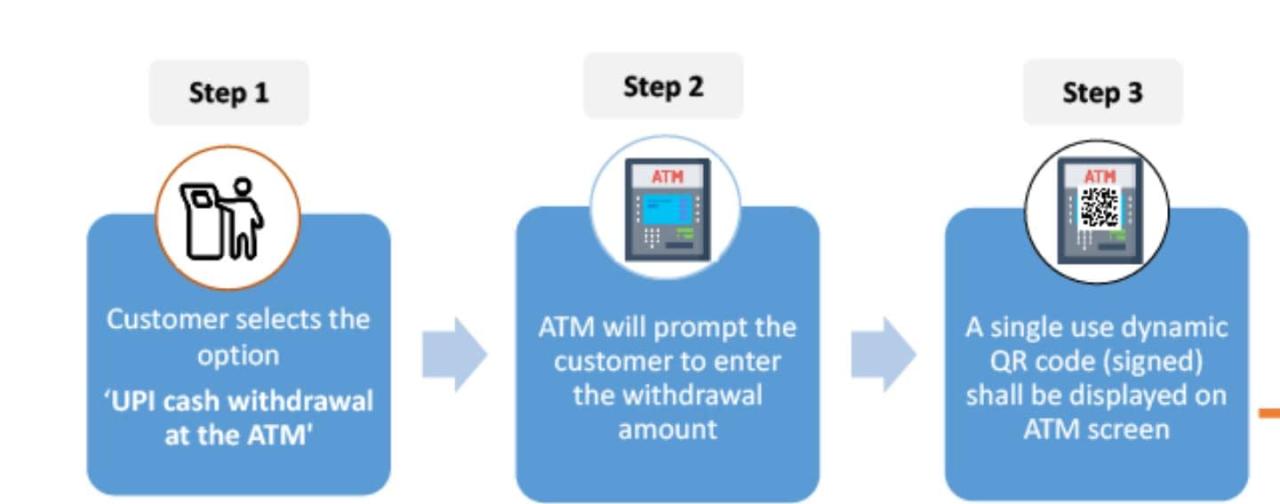

ATM Cash Withdrawal Using a Business Debit Card

Withdrawing cash from an ATM using your business debit card is a convenient and widely accessible method. The process is generally straightforward, but it’s crucial to understand potential limitations and security protocols.

- Insert your business debit card into the ATM and follow the on-screen prompts.

- Select your preferred language and enter your PIN.

- Choose the “Withdrawal” option and specify the amount you wish to withdraw. Remember to stay within your daily withdrawal limit, which is usually set by your bank.

- Confirm the transaction. The ATM will dispense the cash and print a receipt detailing the transaction.

- Retrieve your card and receipt. Review the receipt to ensure the amount withdrawn is correct.

Limitations include daily withdrawal limits imposed by the bank, potential ATM fees, and the risk of card skimming or theft if the ATM is not secure. Always be vigilant about your surroundings when using an ATM and report any suspicious activity immediately.

Over-the-Counter Cash Withdrawal at a Bank Branch

Withdrawing cash over the counter at your bank branch offers a secure and potentially higher withdrawal limit compared to ATMs. However, it requires visiting a physical branch during their operating hours.

- Visit your bank branch during business hours with appropriate identification, such as your driver’s license and your business account information.

- Approach a teller and inform them of your intention to withdraw cash from your business account.

- Provide the necessary information, such as your account number and the desired withdrawal amount. You may be asked for additional verification, such as your business registration number.

- The teller will process your request and dispense the cash. They will usually count the cash in front of you.

- Verify the amount received and sign any necessary documents. You may also receive a receipt for the transaction.

Security is generally higher at bank branches due to the presence of security personnel and surveillance systems. However, potential limitations include branch operating hours and the need for personal visits. Large withdrawals might require prior notification to the bank.

Cash Withdrawal Using a Business Check

Cashing a business check is another method, suitable for larger withdrawals, though it might be less convenient than using an ATM or visiting a branch.

- Ensure you have sufficient funds in your business account to cover the check amount.

- Fill out the business check correctly, including the date, payee’s name (your business name), the amount in both numerals and words, and your signature.

- Present the check at your bank branch or a designated cashing location, along with your identification.

- The bank teller or cashier will verify the check and your identification before dispensing the cash.

- Count the cash received and ensure the amount is correct before leaving.

Limitations include the potential for check fraud, the need for proper checkbook management, and the possibility of delays in clearing the check if it’s presented at a location other than your bank. Lost or stolen checks can also pose significant financial risks. Always maintain secure storage of your checkbook and report any lost or stolen checks immediately.

Business Account Regulations and Restrictions on Cash Withdrawals

Navigating the complexities of business finances often involves understanding the regulations surrounding cash withdrawals from business accounts. These regulations are in place to prevent illicit activities like money laundering and to ensure transparency in financial transactions. Failure to comply can result in penalties and legal repercussions. This section Artikels key aspects of these regulations and their implications.

Various legal and regulatory bodies, including federal and state agencies, influence the rules governing cash withdrawals from business accounts. These regulations vary depending on the country, state, and even the specific financial institution. Understanding these regulations is crucial for maintaining compliance and avoiding potential issues.

Legal and Regulatory Restrictions on Cash Withdrawals, Can i withdraw cash from my business account

Several legal and regulatory frameworks impact cash withdrawals from business accounts. These restrictions aim to prevent financial crimes and ensure the integrity of the financial system. Understanding these restrictions is paramount for responsible business operation.

- Anti-Money Laundering (AML) Regulations: These regulations require financial institutions to monitor and report suspicious transactions, including large cash withdrawals. The threshold for what constitutes a “large” withdrawal varies by jurisdiction but often involves amounts exceeding $10,000 USD. Failure to report suspicious activity can lead to severe penalties.

- Know Your Customer (KYC) Regulations: Financial institutions are obligated to verify the identity of their business clients to prevent fraud and money laundering. This often involves providing documentation such as articles of incorporation, tax IDs, and identification for all business owners.

- Bank-Specific Policies: Individual banks may impose their own withdrawal limits based on account type, history, and risk assessment. These limits can vary widely and are often communicated in account agreements or upon request.

- Tax Regulations: Cash withdrawals may have tax implications depending on the nature of the business and the purpose of the withdrawal. Proper record-keeping is essential to comply with tax laws.

Implications of Exceeding Withdrawal Limits

Exceeding established withdrawal limits, whether self-imposed by the bank or mandated by law, can have significant consequences for businesses. These consequences can range from administrative inconveniences to severe legal penalties.

- Account Suspension or Closure: Banks may temporarily suspend or permanently close accounts that repeatedly violate withdrawal limits or engage in suspicious activity.

- Fines and Penalties: Depending on the jurisdiction and the severity of the violation, businesses could face substantial fines for exceeding withdrawal limits, particularly if it is linked to illegal activities.

- Legal Action: In cases of suspected money laundering or other financial crimes, exceeding withdrawal limits could trigger investigations and potential legal action from regulatory bodies.

- Reputational Damage: Negative publicity associated with violations of financial regulations can damage a business’s reputation and make it difficult to secure future financing.

Reporting Requirements for Large Cash Withdrawals

Many jurisdictions require businesses to report large cash withdrawals to the relevant authorities. These reporting requirements are designed to deter financial crimes and maintain transparency in the financial system. Failure to comply can result in significant penalties.

- Currency Transaction Reports (CTRs): In the United States, for example, CTRs are required for cash transactions exceeding $10,000. These reports provide information about the transaction, the parties involved, and the purpose of the transaction.

- Suspicious Activity Reports (SARs): SARs are filed when a financial institution suspects that a transaction may be related to money laundering, terrorist financing, or other illegal activities. The reporting threshold for SARs is generally lower than that for CTRs and is based on suspicion rather than a specific monetary amount.

- Penalties for Non-Compliance: Failure to file required reports can result in significant fines, criminal charges, and reputational damage for both the business and the individuals involved.

Alternative Methods for Accessing Funds

Accessing funds from your business account doesn’t always require a trip to the ATM. Several convenient and efficient electronic methods exist, offering flexibility and control over your finances. These alternatives often provide faster processing times and enhanced security compared to traditional cash withdrawals.

Electronic Funds Transfers Between Accounts

Transferring funds electronically from your business account to your personal account is a straightforward process, typically available through online banking platforms. Most banks offer this functionality, allowing you to specify the amount and initiate the transfer with a few clicks. The transfer speed varies depending on the bank and the chosen transfer method, but generally occurs within one to three business days. For instance, a same-day transfer might be available with certain banks for a small fee, while standard transfers are usually free but take longer. Security measures, such as two-factor authentication, are commonly implemented to protect against unauthorized access. Before initiating a transfer, carefully review the details, including the recipient’s account number and the transfer amount, to prevent errors.

Online Bill Pay for Business Expenses

Online bill pay offers a streamlined approach to managing business expenses. This feature, typically integrated into online banking platforms, allows you to schedule payments to vendors, suppliers, and other business creditors directly from your business account. This eliminates the need for writing checks or manually processing payments. Many online bill pay systems allow you to set up recurring payments for regular expenses, such as rent or utilities, simplifying your accounting and reducing the risk of missed payments. The system typically provides confirmation of payment and keeps a detailed record of all transactions, which can be useful for tax purposes. For example, a business owner could schedule monthly rent payments to their landlord directly through their online banking platform.

Mobile Banking Apps for Business Transactions

Mobile banking apps provide convenient access to your business account from virtually anywhere. These apps offer many of the same features as online banking, including the ability to check balances, transfer funds, and pay bills. Many apps also provide additional features such as mobile check deposit, allowing you to deposit checks without visiting a physical branch. The convenience of mobile banking is particularly beneficial for business owners who are frequently on the go. For example, a freelancer could use their mobile banking app to deposit a client’s check immediately after receiving it, ensuring quick access to funds. Security features such as biometric authentication (fingerprint or facial recognition) add an extra layer of protection.

Comparison of Alternative Methods

The speed and convenience of these alternative methods vary. Electronic funds transfers between accounts generally offer relatively fast processing, with same-day options often available. Online bill pay is convenient for scheduling and managing recurring payments, while mobile banking provides on-the-go access and additional features like mobile check deposit. While all three methods generally offer enhanced security compared to cash withdrawals, the specific security features implemented may differ between banks and platforms. The choice of method often depends on individual needs and preferences, as well as the specific features offered by the bank or financial institution.

Troubleshooting Common Withdrawal Issues: Can I Withdraw Cash From My Business Account

Withdrawing cash from your business account should be a straightforward process, but occasionally issues arise. Understanding how to resolve these problems quickly and efficiently is crucial for maintaining smooth business operations. This section details common withdrawal problems, their solutions, and steps to take when encountering difficulties.

Lost or Stolen Cards

Losing or having your business debit card stolen can disrupt cash flow. Immediate action is necessary to minimize potential financial losses. First, contact your bank immediately to report the loss or theft. This will prevent unauthorized transactions. Next, request a replacement card and inquire about any potential liability for fraudulent charges. Your bank should provide instructions on how to cancel the old card and secure your account. They may also offer temporary access to funds through alternative methods until your replacement card arrives. Remember to review your account statements regularly for any suspicious activity, even after receiving a new card.

Reporting Fraudulent Activity

Fraudulent activity on your business account requires prompt reporting to protect your finances. If you suspect unauthorized withdrawals or transactions, contact your bank immediately through their designated fraud hotline or online reporting system. Provide them with all relevant details, including the dates and amounts of suspicious transactions. Your bank will initiate an investigation to determine the source of the fraudulent activity and take appropriate steps to secure your account. They may temporarily freeze your account during the investigation to prevent further losses. Keep detailed records of all communication with your bank regarding the fraudulent activity.

Steps to Take When Encountering a Withdrawal Problem

A flowchart can help streamline the process of addressing withdrawal issues.

[Imagine a flowchart here. The flowchart would begin with a “Problem Encountered?” box. A “Yes” branch would lead to a series of boxes: “Is it a card issue? (Lost/Stolen/Damaged)”, “Is it a transaction error?”, “Is it suspected fraud?”. Each of these would have branches leading to specific actions like “Contact bank immediately,” “Report to fraud department,” “Check account balance and transaction history,” “Request a new card,” “Dispute the transaction,” and finally, “Problem Resolved?”. A “No” branch from the initial box would lead to a “Withdrawal Successful” box.]

Contacting Customer Support

Contacting customer support is a crucial step in resolving withdrawal problems. Most banks offer multiple channels for customer support, including phone, email, and online chat. Before contacting support, gather all necessary information, such as your account number, the date and time of the attempted withdrawal, and a description of the problem. When you contact customer support, be clear and concise in explaining the issue. Note down the name of the representative you spoke with, the date and time of the call, and any agreed-upon actions. If the problem is not resolved immediately, request a follow-up and keep detailed records of all communication.

Security Measures for Business Account Withdrawals

Protecting your business account from unauthorized access and fraudulent withdrawals is paramount. A breach can have severe financial and reputational consequences, potentially crippling your operations. Implementing robust security measures is not merely a best practice; it’s a necessity for the survival and success of your business. This section Artikels essential steps to safeguard your business account and its funds.

Strong passwords and regular account monitoring are fundamental security pillars. Weak passwords, easily guessed or cracked, leave your account vulnerable. Regularly reviewing your account statements allows you to quickly identify any suspicious activity, such as unauthorized transactions or unusual spending patterns. Early detection is crucial in mitigating potential losses.

Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security by requiring two forms of verification before granting access. This typically involves a password and a second factor, such as a one-time code sent to your mobile phone or email address. Even if a hacker obtains your password, they will still be unable to access your account without the second verification code. This significantly reduces the risk of unauthorized withdrawals, offering a much higher level of protection than password-only authentication. Implementing 2FA is a simple yet highly effective way to bolster your account security. For example, if someone attempts to log in from an unfamiliar device, the 2FA code would prevent access, even if they had your password.

Security Tips for Business Account Holders

Implementing a multi-faceted security approach is crucial. The following points highlight essential security practices for safeguarding your business account:

- Use strong, unique passwords: Avoid easily guessable passwords. Use a combination of uppercase and lowercase letters, numbers, and symbols. Consider using a password manager to generate and securely store complex passwords for all your online accounts.

- Enable two-factor authentication (2FA): This adds an extra layer of security, making it significantly harder for unauthorized individuals to access your account, even if they have your password.

- Regularly monitor account activity: Review your account statements frequently for any suspicious transactions. Set up alerts to notify you of unusual activity, such as large withdrawals or transactions from unfamiliar locations.

- Keep your software updated: Ensure your computer and mobile devices have the latest security patches and antivirus software installed. Outdated software can contain vulnerabilities that hackers can exploit.

- Be cautious of phishing scams: Never click on links or open attachments from unknown senders. Legitimate financial institutions will never ask for your password or other sensitive information via email or text message.

- Use secure Wi-Fi networks: Avoid accessing your business account on public Wi-Fi networks, as these can be vulnerable to eavesdropping.

- Limit access to your account: Restrict access to your business account to authorized personnel only. Implement strong internal controls to prevent unauthorized access.

- Report suspicious activity immediately: If you suspect unauthorized access or fraudulent activity, contact your bank immediately to report the incident and take necessary steps to secure your account.