Can IG business accounts see who views their profile? The short answer is: not directly. Instagram’s built-in analytics for business accounts offer valuable insights into profile activity, but they don’t reveal a list of individual viewers. Understanding what data is available, and what isn’t, is crucial for effective strategy. This exploration delves into the limitations of Instagram’s native analytics, the possibilities offered by third-party tools, and alternative methods for gauging audience interest.

While you can’t see a precise list of every eye that lands on your business profile, Instagram provides valuable metrics such as website clicks, call button taps, and overall profile visits. These indirect indicators offer a glimpse into audience engagement and help you understand the effectiveness of your content and profile optimization. This article will dissect these metrics, discuss the ethical implications of using third-party apps that claim to offer more detailed viewing data, and present alternative strategies for assessing audience interest in your brand.

Instagram Business Account Insights

Instagram provides valuable analytics for business accounts, allowing businesses to track their performance and understand audience engagement. However, the depth of these insights varies, and some data points remain unavailable, particularly concerning direct profile views. While Instagram doesn’t offer a precise count of who views your business profile, it does provide other metrics that offer valuable insights into profile activity and audience engagement.

Instagram Business Account Profile View Limitations

Instagram’s built-in analytics don’t directly reveal the identities of users who view your business profile. This limitation is a deliberate design choice, prioritizing user privacy. Unlike some other platforms, Instagram doesn’t offer a feature that explicitly lists profile visitors. Instead, the platform focuses on providing aggregate data and metrics that help businesses understand broader audience engagement trends. This approach balances the need for business insights with the protection of individual user privacy.

Available Profile Activity Metrics for Business Accounts

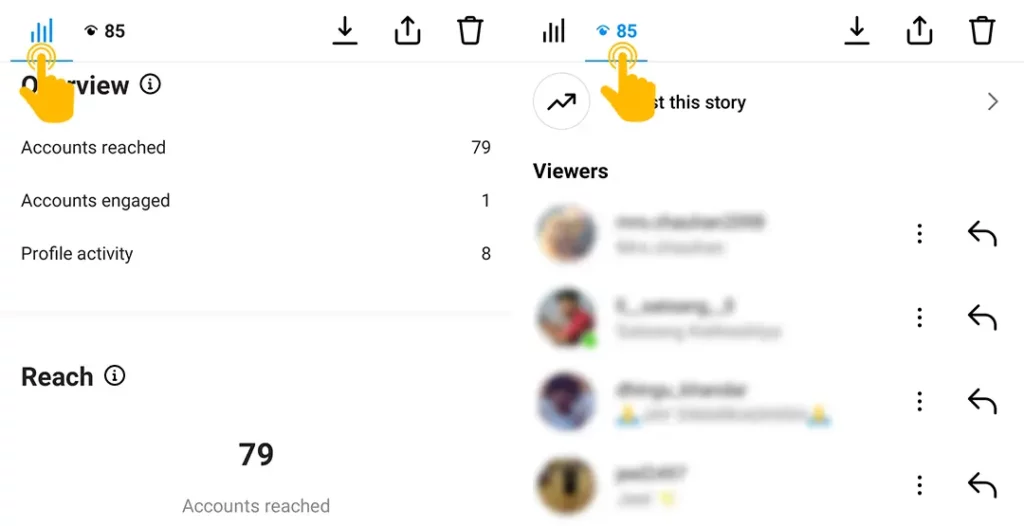

While you can’t see who viewed your profile, Instagram Business accounts *can* access several metrics that provide a valuable understanding of profile activity. This data allows businesses to assess the effectiveness of their profile and content in attracting and engaging their target audience.

For example, businesses can track:

- Website Clicks: This metric shows how many users clicked on the website link in your bio. This directly measures the effectiveness of your profile in driving traffic to your website.

- Call Button Clicks: If you’ve included a call button in your profile, this metric shows how many users clicked to call your business. This is particularly useful for local businesses.

- Reach: This indicates the total number of unique accounts that saw your posts, stories, or profile in a given period. This metric provides a general overview of your profile’s visibility.

- Impressions: This shows the total number of times your posts, stories, or profile were displayed. This is a measure of potential exposure.

- Profile Visits: Although you don’t see *who* visited, you *can* see the total number of visits to your profile over a given period.

Business vs. Personal Account Profile Visibility

The following table summarizes the key differences in profile visibility features between Instagram business and personal accounts.

| Feature | Business Account Visibility | Personal Account Visibility | Notes |

|---|---|---|---|

| Profile Views (Individual Users) | Not available | Not available | Instagram does not provide this data for privacy reasons. |

| Total Profile Visits | Available in Insights | Not available | Shows the total number of profile visits, not individual users. |

| Website Clicks | Available in Insights | Not available | Tracks clicks from the website link in bio. |

| Call Button Clicks | Available in Insights | Not available | Tracks clicks on the call button in bio. |

| Reach and Impressions | Available in Insights | Limited data available | Business accounts have more detailed reach and impression data. |

Third-Party Tools and Apps

While Instagram’s built-in analytics offer a basic understanding of account performance, third-party tools promise a deeper dive into user engagement, including potentially revealing who has viewed your profile. These tools often claim to provide more granular data than Instagram officially offers, appealing to businesses seeking a competitive edge in understanding their audience. However, it’s crucial to approach these tools with caution, considering both their benefits and inherent risks.

Third-party apps leverage Instagram’s API (Application Programming Interface) or employ less transparent methods to gather data, often offering features like detailed profile visitor lists, advanced demographic breakdowns, and competitor analysis. Some tools may even provide insights into user behavior beyond simple views, such as engagement patterns and content interaction specifics. The promise of such detailed information is alluring, but it comes with significant caveats.

Potential Drawbacks and Risks of Third-Party Tools

Using third-party apps for Instagram analytics carries several potential drawbacks. Firstly, the accuracy of the data provided can be questionable. Many tools rely on estimations and algorithms, which may not always reflect reality. Secondly, the reliance on third-party tools introduces a vulnerability point. A security breach within the app could expose your Instagram account credentials or business data. Thirdly, Instagram’s terms of service often prohibit the use of unauthorized tools to access data, leading to potential account suspension or permanent ban. Finally, the cost of these services can be significant, especially for businesses with limited budgets. A thorough cost-benefit analysis is essential before committing to a paid subscription.

Privacy Implications for Businesses and Followers

The use of third-party tools to gather detailed profile view data raises significant privacy concerns. For businesses, the risk of data breaches and unauthorized access to sensitive information is substantial. This includes not only account credentials but also potentially confidential business strategies and marketing plans. For followers, the lack of transparency about data collection practices can be unsettling. The collection and analysis of viewing habits without explicit consent raises ethical questions and could lead to negative perceptions of the brand. Furthermore, the aggregation and potential misuse of user data for targeted advertising or other purposes without informed consent could violate data protection regulations like GDPR.

Ethical Considerations of Accessing Detailed Profile View Data

Consider this scenario: A fashion boutique uses a third-party app to identify users who frequently view their profile but haven’t made a purchase. The boutique then uses this data to target these users with highly personalized, aggressive marketing campaigns, including direct messages emphasizing limited-time offers or highlighting specific items they’ve viewed. While seemingly effective, this approach raises serious ethical concerns. The lack of explicit consent from users to be tracked and targeted in this manner could be considered intrusive and manipulative. This scenario highlights the ethical dilemma of leveraging detailed profile view data without transparent consent and the potential for exploiting user behavior for commercial gain. The balance between business needs and user privacy remains a critical challenge in the utilization of such tools.

Understanding Instagram’s Algorithm and Reach

Instagram’s algorithm is a complex system that determines which posts users see in their feeds. Understanding its intricacies is crucial for businesses aiming to maximize their profile visibility and reach a wider audience. While Instagram doesn’t publicly reveal the exact workings of its algorithm, consistent patterns and influencing factors have emerged through observation and analysis. This section explores these factors and offers strategies for improving profile visibility organically.

Factors influencing the visibility of a business profile are multifaceted and interconnected. The algorithm prioritizes content that it deems engaging and relevant to individual users. This relevance is determined by a variety of signals, including user interaction history, account relationships, and the content itself. For example, a user who frequently interacts with fitness-related content is more likely to see similar content from accounts they follow, even if the post’s reach is not inherently high. Conversely, a post with low engagement signals, such as few likes, comments, and shares, will likely have a lower reach. This creates a self-reinforcing cycle where high-performing content attracts more visibility, while low-performing content is less likely to be shown to a broader audience.

Factors Influencing Profile Visibility

Several key factors significantly impact how many people see a business profile. These include the quality and type of content posted, the frequency of posting, the engagement rate of previous posts, the use of relevant hashtags, and the overall health and activity of the business account. A consistent posting schedule helps maintain user engagement and keeps the account top-of-mind for followers. High-quality images and videos are visually appealing and more likely to stop users scrolling, increasing the chance of engagement. Similarly, engaging captions that encourage interaction (e.g., questions, calls to action) boost engagement rates, signaling to the algorithm that the content is valuable. Finally, using relevant and popular hashtags increases the discoverability of posts to users searching for content related to the business’s niche.

Impact of Content Strategies on Profile Visibility

Different content strategies demonstrably affect profile visibility. For instance, posting high-quality images consistently leads to higher engagement rates than posting low-quality or infrequent content. Engaging captions that prompt interaction (e.g., asking questions, running polls, using emojis) significantly increase the visibility of posts. A consistent posting schedule keeps the account active and visible to followers, preventing the algorithm from prioritizing other accounts. Conversely, sporadic posting can lead to decreased visibility as the algorithm perceives the account as less active and relevant. A study by Statistica showed that brands posting daily saw a significant increase in follower engagement compared to those posting less frequently. This highlights the importance of consistency in maintaining visibility.

Best Practices for Increasing Profile Visibility

Improving profile visibility without relying on specific viewer data requires a focus on creating high-quality, engaging content and optimizing the account for discoverability.

- Prioritize High-Quality Content: Invest in professional-quality photos and videos that are visually appealing and relevant to your target audience.

- Develop an Engaging Content Strategy: Create content that encourages interaction, such as asking questions, running polls, and using calls to action.

- Maintain a Consistent Posting Schedule: Post regularly to keep your account active and top-of-mind for followers.

- Utilize Relevant Hashtags: Research and use relevant hashtags to increase the discoverability of your posts.

- Engage with Your Audience: Respond to comments and messages promptly to build relationships with your followers.

- Collaborate with Other Accounts: Partner with relevant accounts to reach a wider audience.

- Run Contests and Giveaways: Encourage interaction and attract new followers.

Improved Content Quality and Higher Profile Views

Improved content quality indirectly leads to higher profile views through a chain reaction. High-quality content attracts more engagement (likes, comments, shares, saves). This increased engagement signals to Instagram’s algorithm that the content is valuable and relevant, resulting in a wider reach and ultimately, more profile views. For example, a visually stunning product image with a compelling caption is more likely to attract attention and engagement than a blurry, poorly-lit image with a generic caption. The increased engagement from the high-quality post will then lead to more people seeing the business profile and its other content. This creates a positive feedback loop where high-quality content leads to increased visibility, which further reinforces the account’s performance.

Interpreting Engagement Metrics: Can Ig Business Accounts See Who Views

Understanding engagement metrics—likes, comments, and shares—provides valuable insights beyond the raw numbers. While Instagram doesn’t directly reveal who views your profile, a significant increase in engagement often correlates with a rise in profile visits. This is because engaging content attracts attention, prompting users to explore your profile further to learn more about your brand or the content creator.

Engagement metrics indirectly reflect profile viewership because they indicate the level of interest and interaction your content generates. High engagement suggests your content resonates with your audience, making them more likely to visit your profile to see more. Conversely, low engagement might indicate that your content isn’t capturing attention, resulting in fewer profile views.

Engagement Spikes and Profile Viewership

A sudden surge in likes, comments, or shares on a particular post often signals a corresponding increase in profile views. For example, if a business posts a compelling video showcasing a new product and receives a substantial number of likes and comments within a short period, it’s highly probable that many users clicked through from the post to view the business’s profile. This is because the initial engagement indicates that the content successfully piqued users’ interest, leading them to seek more information. Another example could be a time-sensitive promotion. A limited-time offer post that generates high engagement is likely to see a related surge in profile views as users rush to learn more about the offer. This connection isn’t always perfectly linear, but the correlation is frequently observed.

Actionable Steps Based on Engagement Data

Understanding the relationship between engagement and profile views allows businesses to proactively improve their profile visibility. Analyzing engagement data helps pinpoint what resonates with the audience and allows for more targeted content creation.

The following steps can help leverage engagement data to boost profile views:

- Identify high-performing content: Analyze which posts generate the most likes, comments, and shares. This reveals content themes, formats, and styles that resonate most with your audience. Replicate successful elements in future posts.

- Improve content quality: Based on insights from engagement analysis, refine your content strategy. If images consistently outperform videos, focus on improving image quality and visual appeal. If a specific topic garners significant engagement, delve deeper into it.

- Engage with your audience: Respond to comments and messages promptly and thoughtfully. This shows you value your audience’s input, encouraging further engagement and profile visits.

- Use relevant hashtags: Thorough hashtag research can significantly increase your content’s reach and, consequently, profile views. Experiment with different hashtags to find the most effective combinations.

- Run contests and giveaways: These interactive activities boost engagement and drive traffic to your profile, as users participate to win prizes and explore your brand.

Reach and Profile Views

Reach and profile views are interconnected but distinct metrics. Reach measures the number of unique accounts that saw your content, while profile views represent the number of unique accounts that visited your profile. High reach doesn’t automatically translate into high profile views, but a significant reach increases the *potential* for profile views. A post with high reach exposes your brand to a wider audience, increasing the likelihood that some of those users will click through to your profile to learn more. Conversely, low reach limits the opportunity for profile views, even if your profile is engaging. Therefore, strategies that increase reach, such as targeted advertising and relevant hashtag usage, indirectly support the growth of profile views.

Alternatives to Direct Profile View Tracking

Understanding precisely who views your Instagram business profile is unfortunately limited by Instagram’s privacy features. However, several indirect methods offer valuable insights into audience engagement and interest, allowing for data-driven decisions regarding content strategy and overall business growth. These alternatives provide a more holistic view of your audience’s interaction with your brand.

Assessing audience interest requires a shift in perspective from direct profile views to a broader measurement of engagement and brand awareness. By focusing on actions indicative of interest – website clicks, social media mentions, and active participation in your content – you can build a compelling picture of your audience’s connection to your brand. This approach provides a richer understanding than simply knowing who viewed your profile.

Website Traffic Analysis

Analyzing website traffic originating from Instagram provides a strong indicator of audience interest. By using UTM parameters in your Instagram bio link or within Stories and Reels, you can track which specific posts drive traffic to your website. For instance, a post promoting a new product might generate significantly more clicks than a general brand awareness post. Comparing traffic sources helps identify which content resonates most effectively and informs future content creation. This data can be tracked through Google Analytics or similar website analytics platforms. High website traffic from Instagram suggests a strong correlation between your Instagram presence and audience conversion into potential customers.

Social Media Mentions and Brand Awareness

Monitoring mentions of your brand or relevant hashtags on Instagram and other social media platforms reveals how people are interacting with your brand organically. Positive mentions, shares, and comments indicate high audience interest and brand affinity. Conversely, negative feedback can highlight areas for improvement. Tools like Brand24 or Mention can help track these mentions, providing insights into brand sentiment and reach. For example, a spike in mentions after a particular campaign indicates its effectiveness in driving engagement and brand awareness.

Instagram Stories and Reels Engagement Metrics

Instagram Stories and Reels offer unique opportunities to gauge audience interest through direct interaction. Metrics like views, reach, replies, and shares provide real-time feedback on content performance. A high number of views and shares, for instance, suggests your content is engaging and resonates with your target audience. Analyzing the types of content that receive the most interaction allows for refining future content strategy. For example, Reels focusing on behind-the-scenes content or product demonstrations may perform better than static image posts.

Leveraging Stories and Reels for Profile Traffic, Can ig business accounts see who views

Creating compelling Stories and Reels that drive traffic to your profile requires a strategic approach. Include clear calls to action, such as “Visit our website for more information” or “Check out our bio link for exclusive offers.” Use interactive elements like polls, quizzes, and questions to encourage audience participation and boost engagement. Visually appealing content, concise messaging, and consistent posting schedules are crucial for maximizing reach and driving traffic. A well-designed Story or Reel can act as a powerful funnel, guiding viewers from passive observation to active engagement with your business profile and website. For example, a series of Reels showcasing product features and benefits can lead viewers to your website to make a purchase.