Can you create an LLC without a business? The answer, surprisingly, is yes. Forming a limited liability company (LLC) before launching a business offers significant advantages, from robust asset protection to streamlined future funding opportunities. This exploration delves into the legal intricacies, practical benefits, and step-by-step processes involved in establishing an LLC even before your business officially begins operations. We’ll examine the potential tax implications, compliance requirements for inactive LLCs, and various scenarios where proactive LLC formation proves strategically beneficial.

Understanding the nuances of creating an LLC without an immediate business is crucial for entrepreneurs seeking to mitigate risk and optimize their business structure. This guide provides clarity on the legal landscape, empowering you to make informed decisions about your business’s future.

Legality of Forming an LLC Without a Business

Forming a limited liability company (LLC) without immediately engaging in business activity is perfectly legal in most jurisdictions. However, it’s crucial to understand the legal and tax implications associated with maintaining an inactive LLC. While the act of formation itself is lawful, the ongoing obligations and potential consequences warrant careful consideration.

Legal Implications of an Inactive LLC

Registering an LLC without an immediate business purpose doesn’t automatically render it illegal. However, failure to comply with ongoing state requirements, such as annual report filings and franchise tax payments, can lead to penalties, fines, and even the potential dissolution of the LLC. These requirements vary by state, and non-compliance can result in significant legal repercussions. Maintaining an LLC requires proactive management, regardless of its activity level. For example, neglecting to file an annual report could result in administrative penalties, potentially leading to the LLC’s administrative dissolution. The state’s Secretary of State’s office typically Artikels these requirements and penalties.

Tax Consequences of an Inactive LLC

Even if your LLC isn’t generating income, it may still have tax obligations. Most states require annual franchise taxes or fees for maintaining an LLC, regardless of its profitability. These fees are often based on factors such as the LLC’s authorized capital or the number of members. Furthermore, while an inactive LLC won’t typically owe income tax, it might still be subject to estimated tax payments if it holds assets that generate passive income, such as interest from a bank account. Failure to file appropriate tax returns, even for an inactive LLC, can result in penalties and interest charges. The specific tax implications depend on the state and the LLC’s financial situation. Consulting with a tax professional is highly recommended.

Situations Where Forming an Inactive LLC Might Be Beneficial, Can you create an llc without a business

There are legitimate reasons to form an LLC even before starting active business operations. One common scenario involves asset protection. Establishing an LLC can shield personal assets from potential business liabilities, even if the business hasn’t yet commenced operations. This is particularly relevant for individuals anticipating future business ventures or those involved in high-risk activities. Another situation involves intellectual property protection. An LLC can be used as a vehicle to hold and manage intellectual property rights before commercializing them. Finally, some individuals form an LLC as a precursor to a larger business plan, allowing them time to develop the business strategy and secure funding before launching. This provides a structured legal entity ready to operate once the business is fully prepared.

State-Specific Requirements for Inactive LLCs

State laws governing LLCs vary considerably. While the formation process is generally similar across states, the ongoing requirements for inactive LLCs differ significantly. For instance, some states may require annual reports and franchise taxes even if the LLC isn’t generating income, while others might have less stringent requirements. Some states might have a lower threshold for administrative dissolution for inactive LLCs than others. It is crucial to research the specific requirements of the state where you intend to register your LLC. The Secretary of State’s office in each state provides detailed information on LLC formation and maintenance requirements. This research should be conducted before forming the LLC to ensure compliance with all applicable regulations.

Practical Reasons for Creating an LLC Before Starting a Business

Forming a limited liability company (LLC) before launching your business offers several strategic advantages that extend beyond the legal protections afforded after operations commence. Proactive LLC formation can significantly enhance your business’s financial stability, attract investors, and simplify future expansion. This proactive approach provides a strong foundation for long-term success.

Asset Protection Before Commencing Operations

Even before your business generates revenue or acquires significant assets, an LLC provides a crucial layer of personal asset protection. Your personal assets, such as your home, savings, and vehicles, are shielded from business liabilities. This protection extends to potential lawsuits, even if those lawsuits arise from pre-operational activities like contract negotiations or marketing campaigns. For instance, if a pre-launch marketing campaign inadvertently infringes on a trademark, the LLC, not your personal assets, would be at risk. This proactive shield minimizes personal financial risk during the vulnerable startup phase.

Establishing a Separate Legal Entity for Future Ventures

Creating an LLC early on establishes a distinct legal entity ready for future business expansion. This allows for easier diversification into new product lines or services without the legal complexities of restructuring later. It simplifies the process of securing additional funding or attracting investors as the business grows, presenting a clear and established corporate structure from the outset. Imagine a scenario where you initially plan to sell handmade crafts online but later decide to open a physical store. Having an LLC already in place streamlines this expansion, reducing legal and administrative hurdles.

Facilitating Funding and Loan Acquisition

Many lenders and investors prefer to work with established legal entities. An LLC, even without operational history, demonstrates a higher level of commitment and professionalism, making it easier to secure loans or attract investments. The formal structure of an LLC provides a clear framework for financial projections and risk assessment, increasing the likelihood of securing funding for initial setup costs, inventory, or marketing efforts. This proactive approach can significantly impact the speed and ease of accessing necessary capital to launch your business effectively.

Cost and Benefit Comparison: Forming an LLC Before vs. After Starting a Business

| Factor | Forming LLC Before Starting Business | Forming LLC After Starting Business |

|---|---|---|

| Initial Costs | Filing fees, legal consultation (potentially higher upfront cost) | Filing fees, legal consultation (potentially higher cost due to existing liabilities) |

| Asset Protection | Immediate and comprehensive protection from the outset. | Protection only after formation, leaving prior actions vulnerable. |

| Funding Acquisition | Easier access to loans and investment due to established structure. | More difficult to secure funding, requiring more convincing evidence of viability. |

| Administrative Burden | Slightly higher initial administrative burden, but smoother long-term management. | Potentially higher administrative burden due to restructuring existing operations. |

Steps Involved in Forming an LLC Without a Current Business

Forming a Limited Liability Company (LLC) before launching a specific business offers several strategic advantages, including asset protection and enhanced credibility. This process, while straightforward, requires careful attention to detail to ensure compliance with state regulations. The steps Artikeld below provide a comprehensive guide to navigating this process.

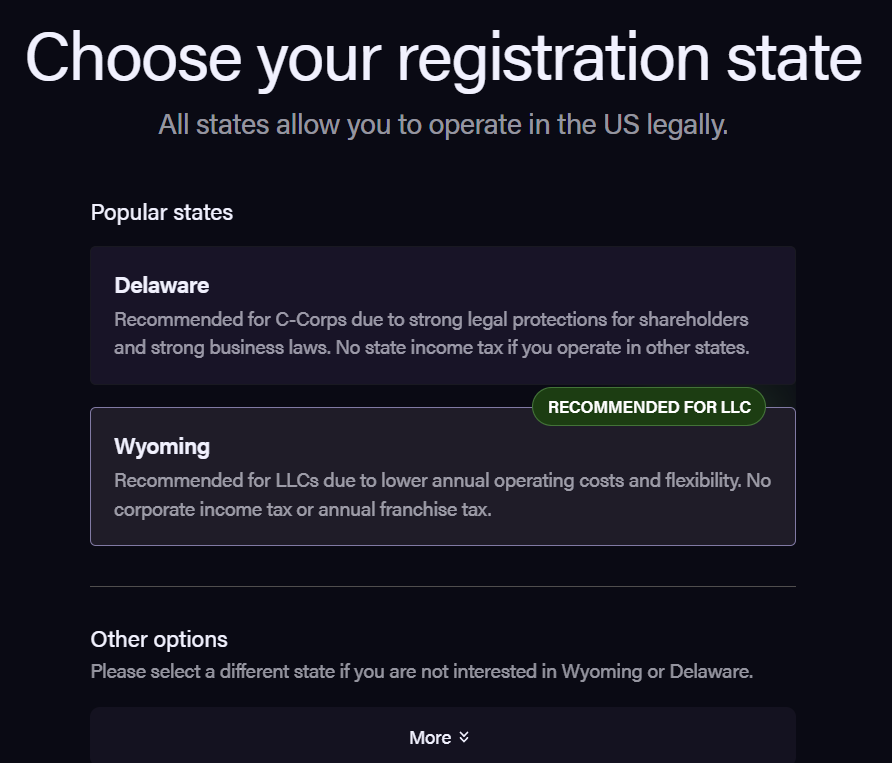

Choosing a State and LLC Name

The state in which you register your LLC will significantly impact its operational requirements and tax obligations. Factors to consider include the state’s business-friendliness, annual fees, and the complexity of its LLC formation process. Many entrepreneurs choose to form their LLC in the state where they reside, simplifying administrative tasks. Once you’ve chosen a state, you’ll need to select a unique name for your LLC that complies with that state’s naming conventions. This typically involves including the words “Limited Liability Company” or the abbreviation “LLC” in the name. For example, if you choose Delaware as your state, and want to name your LLC “Example Business,” the full name would be “Example Business LLC.” It is advisable to check for name availability through the relevant state’s business registration website before proceeding.

Appointing a Registered Agent

Every LLC needs a registered agent, a designated individual or business entity that receives official legal and government correspondence on behalf of the LLC. This person or entity must have a physical street address within the state where the LLC is formed. The registered agent is responsible for receiving service of process (legal documents) and other important notices. While you can act as your own registered agent, many entrepreneurs opt for a professional registered agent service for convenience and to ensure compliance with strict availability requirements. These services handle all correspondence and ensure timely processing of legal documents. Choosing a professional registered agent often involves an annual fee.

Filing the Articles of Organization

The Articles of Organization are the formal document submitted to the state to establish the LLC. This document typically includes the LLC’s name, registered agent information, the principal business address, the effective date of the LLC, and the names and addresses of the LLC’s members (owners). The specific requirements for the Articles of Organization vary by state. The document must be accurately completed and filed with the designated state agency, often the Secretary of State’s office. A filing fee is typically associated with this process, the amount of which varies depending on the state. After filing, the state typically issues a Certificate of Organization or a similar document confirming the LLC’s legal existence.

Necessary Documentation for LLC Formation

The essential documentation for LLC formation primarily includes the Articles of Organization. However, depending on the state and the complexity of your LLC structure, you might need additional documents. These can include a copy of your registered agent’s consent to act as such, an operating agreement (which Artikels the internal management and ownership structure of the LLC), and proof of payment of the filing fees. Keeping accurate records of all filed documents is crucial for future reference and potential audits.

LLC Formation Checklist

Before beginning the LLC formation process, creating a comprehensive checklist is beneficial to ensure a smooth and efficient process. This checklist should include:

- Choosing a state for LLC registration.

- Selecting a unique LLC name.

- Appointing a registered agent.

- Preparing and filing the Articles of Organization.

- Paying the state filing fees.

- Obtaining the Certificate of Organization.

- Creating an operating agreement (if required by the state or desired).

- Opening a business bank account.

Following these steps will help to ensure your LLC is properly formed and compliant with state regulations. Remember that state requirements can vary, so always consult your state’s official resources for the most up-to-date information.

Maintaining an Inactive LLC

Maintaining an inactive LLC, while seemingly straightforward, requires ongoing attention to avoid legal and financial pitfalls. Simply not conducting business doesn’t absolve you of your LLC’s legal obligations. Failure to comply can result in penalties, fines, and even the involuntary dissolution of your entity. Understanding these requirements is crucial for responsible LLC management, even during periods of inactivity.

Ongoing compliance for an inactive LLC primarily centers around state-mandated annual reports and associated fees. These requirements vary significantly by state, with some demanding only a minimal filing fee while others require detailed reports on the LLC’s financial status, even if no activity occurred. Failure to file these reports on time usually incurs late fees, and repeated non-compliance can lead to the suspension or revocation of your LLC’s good standing. This means your LLC will be unable to conduct business legally until the outstanding issues are resolved, a process which can be costly and time-consuming.

Annual Reports and Fees for Inactive LLCs

Annual reports, even for inactive LLCs, are a fundamental aspect of maintaining compliance. These reports generally require basic information such as the LLC’s registered agent, principal place of business, and the names and addresses of its members. Some states may require additional information, including financial statements, even if the LLC has generated no revenue during the reporting period. The fees associated with filing these reports vary significantly across states, ranging from a few dollars to several hundred, and late fees often double or even triple the original cost. It’s essential to consult your state’s specific requirements to ensure timely and accurate filing. Failing to file these reports can result in penalties, including fines, suspension of your LLC’s status, and even potential legal action.

Pitfalls of Neglecting Inactive LLC Maintenance

Neglecting the maintenance of an inactive LLC can lead to several severe consequences. The most immediate is the accumulation of late fees and penalties for non-compliance with annual reporting requirements. More seriously, states can revoke or suspend an LLC’s status, making it impossible to conduct business legally. This can impact creditworthiness and create difficulties in securing loans or business licenses in the future. Furthermore, neglecting an inactive LLC could expose personal assets to liability if a lawsuit arises, even if the LLC itself is inactive. The LLC’s legal protection shield may be weakened or even completely removed due to non-compliance. In extreme cases, the state may administratively dissolve the LLC, requiring a complex and costly reinstatement process.

Dissolving an Inactive LLC

Dissolving an inactive LLC, also known as formal dissolution or winding up, is a formal process to officially terminate the LLC’s existence. The process usually involves filing specific paperwork with the state, often including a certificate of dissolution or a statement of intent to dissolve. This process officially closes the LLC’s books, distributing any remaining assets and discharging any outstanding liabilities. While not mandatory for an inactive LLC, formal dissolution is a recommended practice if the LLC is unlikely to resume operations. It provides a clean break, shielding personal assets from potential future liabilities associated with the now-defunct LLC. The specific requirements for dissolution vary by state, so checking with the relevant Secretary of State office is crucial.

Best Practices for Managing an Inactive LLC

Maintaining a system for tracking deadlines for annual reports and fees is crucial. Setting reminders using digital calendars or employing a dedicated service to handle these tasks minimizes the risk of missed deadlines. Regularly reviewing the state’s requirements for LLCs ensures compliance with any changes in regulations. This includes staying updated on fee changes, changes to filing procedures, and any new requirements that may impact an inactive LLC. Keeping accurate records of all LLC-related documents, including filings, financial statements, and correspondence with the state, is crucial for efficient management and defense against potential legal issues. Finally, consulting with a legal professional specializing in business law can provide valuable guidance and ensure compliance with all relevant regulations. This is particularly beneficial if the LLC has complex financial matters or anticipates potential legal challenges.

Illustrative Scenarios: Can You Create An Llc Without A Business

Forming an LLC before actively engaging in business operations offers several strategic advantages. These scenarios illustrate how establishing an LLC proactively can provide significant legal and financial protection, even before revenue generation begins. The key is understanding how the LLC’s structure acts as a shield, separating personal assets from business liabilities.

Asset Protection Before Commencing Business

Imagine Sarah, a recent graduate with a promising app idea. Before investing significant time and resources into development, she forms an LLC. This proactive step protects her personal savings and assets from potential liabilities that might arise during the app’s development or later launch. If the app development incurs unforeseen legal challenges or financial setbacks, her personal assets remain separate and shielded from creditors. The LLC acts as a legal entity, absorbing potential losses without jeopardizing Sarah’s personal wealth. This allows her to pursue her entrepreneurial goals with reduced financial risk.

Facilitating Future Business Partnerships

John, a seasoned entrepreneur, is developing a revolutionary sustainable energy technology. He establishes an LLC even before securing funding or bringing on partners. This provides a clear legal framework for future collaborations. When John seeks investors or partners, the LLC structure simplifies the process of allocating ownership shares and defining responsibilities. The LLC’s established legal identity facilitates negotiations and agreements, making the process more efficient and transparent. It also offers a clear pathway for managing potential conflicts or disagreements among future partners.

Securing Funding for a Business Idea in the Planning Stages

Maria has a compelling business plan for a unique line of organic cosmetics. While still in the planning stages, she forms an LLC to enhance her credibility when seeking funding. Investors are more likely to support a business structured as an LLC, perceiving it as a more serious and professional venture. The LLC provides a formal business entity that allows for clearer financial projections, investor agreements, and overall accountability. This structure demonstrates to potential investors a commitment to long-term sustainability and responsible business practices.

Holding Real Estate Assets

David, a real estate investor, purchases a commercial property. Instead of holding the property personally, he forms an LLC to own it. This isolates the property’s liabilities from his personal assets. If unforeseen legal issues or financial difficulties arise related to the property, David’s personal finances remain protected. This strategy also simplifies tax planning and offers greater flexibility for managing the property’s ownership and future transactions. The LLC structure provides a clear and legally distinct entity for managing the real estate investment, minimizing personal risk.