Can you get Medicaid if you own a business? This question is more nuanced than it initially appears. Navigating the complexities of Medicaid eligibility while also running a business requires understanding intricate rules regarding income, assets, and business structure. This guide will clarify how your business ownership impacts your chances of qualifying for Medicaid, offering insights into income calculations, asset evaluations, and state-specific variations.

The eligibility criteria for Medicaid are primarily based on income and asset limits. However, the presence of a business significantly complicates these calculations. The type of business structure—sole proprietorship, LLC, or corporation—directly influences how your income and assets are assessed. We’ll delve into the specific methods used to determine your net income, factoring in business expenses and deductions, and explain how different states handle these calculations, revealing potential discrepancies in eligibility across various jurisdictions.

Eligibility Requirements for Medicaid and Business Ownership

Medicaid eligibility is complex and varies significantly by state. While the core principles remain consistent, the specifics of income and asset limits, as well as how business ownership is factored into the equation, differ considerably. This section will explore the general guidelines and highlight the key areas where business ownership influences Medicaid eligibility.

Medicaid Eligibility Criteria: Income and Asset Limits

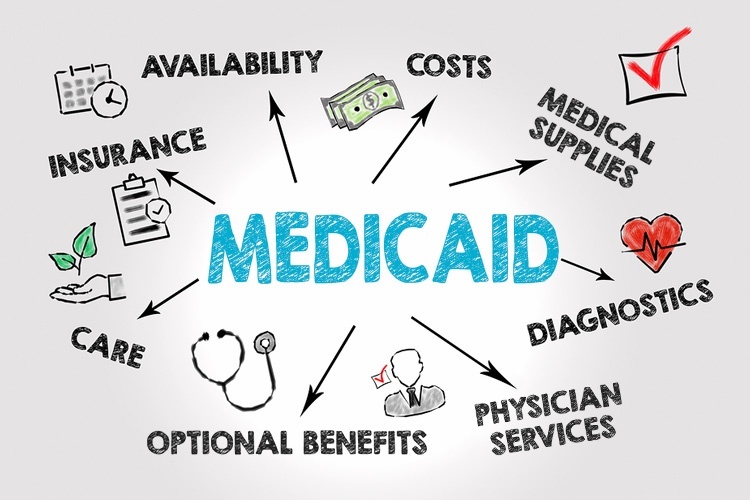

Medicaid programs primarily consider an applicant’s income and assets to determine eligibility. Income limits are generally set at or below the federal poverty level, although this varies based on family size and the state’s specific Medicaid plan. Asset limits also vary by state but typically restrict the value of an applicant’s countable resources, such as cash, savings accounts, and certain investments. These limits are designed to ensure that Medicaid resources are directed toward those with the greatest financial need. Exemptions for certain assets, such as the applicant’s primary residence and a vehicle, often exist.

Business Ownership’s Impact on Asset Calculations, Can you get medicaid if you own a business

Business ownership significantly impacts the asset calculation for Medicaid eligibility. The value of the business itself is generally considered a countable asset. This valuation can be complex, depending on the type of business and the methods used for appraisal. For instance, a sole proprietorship’s assets might be assessed based on the value of its equipment, inventory, and accounts receivable. An LLC or corporation’s assets will involve a more comprehensive valuation, potentially including intangible assets like goodwill. The complexity increases further if the business holds significant real estate or other high-value assets.

Impact of Different Business Structures on Medicaid Eligibility

The structure of the business – sole proprietorship, LLC, or corporation – influences how the business is considered for Medicaid eligibility. A sole proprietorship’s assets are often directly tied to the owner’s personal assets, making it more challenging to separate business assets from personal ones during the eligibility determination. LLCs and corporations offer a degree of separation, but this doesn’t always fully insulate the owner’s personal assets from consideration. State Medicaid agencies will examine the business’s financial records to determine the extent of the owner’s equity and its impact on overall asset limits.

Examples of Business Income Consideration and Calculation

Business income is generally considered as part of the overall income assessment for Medicaid eligibility. This income is typically calculated based on the business’s net profit, after accounting for business expenses. For example, a sole proprietor’s income might be determined by subtracting business expenses (such as cost of goods sold, rent, and utilities) from gross revenue. For an LLC or corporation, the calculation would involve reviewing the business’s tax returns and financial statements to determine net income. The specific methods for calculating business income can vary depending on the state and the complexity of the business’s financial records. For example, a seasonal business might have income fluctuations that require a different averaging method than a business with stable year-round income.

Business Structure, Income, and Asset Calculation Methods’ Impact on Medicaid Eligibility

| Business Structure | Income Calculation Method | Asset Calculation Method | Impact on Medicaid Eligibility |

|---|---|---|---|

| Sole Proprietorship | Net profit (revenue minus expenses) from tax returns or financial statements. | Business assets are generally considered personal assets; valuation can be complex. | Potentially significant impact, depending on the value of assets and income. |

| LLC | Net profit (revenue minus expenses) from tax returns or financial statements. | Business assets are often considered separately but can still impact eligibility. | Impact depends on the business’s value and the applicant’s personal assets. |

| Corporation | Net income (after taxes) from tax returns or financial statements; dividends may be considered personal income. | Business assets are generally considered separately but can still impact eligibility. | Similar to LLCs, the impact depends on the business’s value and the applicant’s personal assets. |

Income and Asset Tests for Business Owners Applying for Medicaid

Medicaid eligibility for business owners hinges on a rigorous assessment of both income and assets. Unlike employees with straightforward W-2 income, self-employed individuals must navigate a more complex process to demonstrate their financial status accurately. This involves a detailed examination of business income, deductions, and asset holdings, all within the context of state-specific Medicaid guidelines. Failure to accurately report this information can lead to denial of benefits or subsequent disqualification.

Determining Net Income for Business Owners

Calculating net income for a self-employed Medicaid applicant requires a thorough review of business financial records. The process generally starts with gross income, which represents the total revenue generated by the business before any expenses are deducted. From this gross income, allowable business expenses are subtracted to arrive at the net income figure. This net income is then used to determine Medicaid eligibility, often compared to the Federal Poverty Level (FPL) adjusted for the applicant’s state and family size. It is crucial to maintain meticulous financial records, including bank statements, profit and loss statements, and tax returns, to support the income calculation.

Treatment of Business Expenses

The types of business expenses considered when calculating net income for Medicaid eligibility vary depending on state regulations. However, common allowable deductions typically include costs of goods sold (COGS), rent, utilities, salaries paid to employees, insurance premiums, and marketing expenses. Conversely, personal expenses are generally not deductible. Determining which expenses are legitimate business deductions requires a thorough understanding of accounting principles and relevant tax laws. For instance, a portion of home office expenses might be deductible if used exclusively for business purposes, while personal vehicle expenses require careful allocation between business and personal use. Incorrectly classifying expenses can significantly affect the calculated net income and impact Medicaid eligibility.

Common Misconceptions Regarding Business Assets

A common misconception is that owning a business automatically disqualifies an individual from Medicaid. This is inaccurate. While business assets are considered in the Medicaid asset test, the evaluation focuses on the *equity* in those assets, not the total value. For example, a business owner with a significant amount of business debt might have minimal equity in their business, potentially still qualifying for Medicaid. Another misconception involves the confusion between personal and business assets. Medicaid asset limits apply primarily to personal assets, such as savings accounts, stocks, and real estate not directly related to the business. Careful distinction between personal and business assets is crucial for accurate assessment of eligibility.

Income and Asset Reporting Requirements: Business Owners vs. Employees

Employees typically provide straightforward documentation like W-2 forms to demonstrate their income. Business owners, however, require a more comprehensive approach. They must submit detailed financial records, including profit and loss statements, tax returns (Schedules C, F, etc.), and bank statements to verify their income and business expenses. Regarding assets, employees may simply report their savings and investments. Business owners must report both personal assets and the equity in their business. This often involves providing documentation such as business valuations, loan agreements, and property deeds. The increased complexity stems from the need to distinguish between personal and business finances, a task that requires careful accounting and organization.

Documenting Business Income and Assets for a Medicaid Application

Preparing the necessary documentation for a Medicaid application as a business owner involves several key steps. First, gather all relevant financial records for the past year, including tax returns, bank statements, profit and loss statements, and invoices. Second, meticulously separate personal and business finances to accurately assess the applicant’s equity in the business and their personal assets. Third, prepare a detailed summary of income and expenses, clearly identifying all deductions and justifying their inclusion. Fourth, compile all supporting documentation and organize it logically for easy review by the Medicaid agency. Finally, carefully review the application and supporting documentation for completeness and accuracy before submission. Any discrepancies or omissions can delay the application process or lead to denial.

Medicaid Programs and Business Ownership

Medicaid eligibility, even for basic needs, presents a complex landscape for business owners. The federal government sets broad guidelines, but individual states hold significant power in determining specific eligibility criteria. This results in considerable variation across the country regarding how business ownership impacts an applicant’s chances of receiving Medicaid benefits. Understanding these state-level differences is crucial for business owners seeking assistance.

State-Specific Medicaid Eligibility Rules and Business Ownership

The impact of business ownership on Medicaid eligibility varies widely across states. Some states adopt a more lenient approach, considering factors beyond simple business income or assets, while others maintain stricter guidelines, potentially disqualifying individuals based solely on business ownership, regardless of profitability or financial hardship. This inconsistency underscores the importance of researching your specific state’s Medicaid program.

Examples of States with Lenient and Strict Rules

Several states demonstrate more flexible approaches to Medicaid eligibility for business owners. For example, some states may focus primarily on the applicant’s *total* income, considering business income alongside other sources, and may allow for deductions related to business expenses. This approach recognizes that business income isn’t always indicative of disposable income or overall financial stability. In contrast, other states may employ stricter rules, automatically disqualifying individuals who own a business, regardless of their actual income or financial need. These states may prioritize a stricter interpretation of asset limits, potentially counting business assets more heavily than other states. The specific criteria for evaluating business income and assets differ significantly.

State-Specific Programs and Waivers Affecting Eligibility

Many states utilize Medicaid waivers to offer more flexible eligibility criteria tailored to specific populations or needs. These waivers can significantly impact business owners seeking Medicaid. For example, a state might have a waiver program allowing for consideration of factors beyond simple income or assets, such as the applicant’s health status or care needs. Other waivers might temporarily modify asset limits or income thresholds, providing more opportunities for eligibility for business owners experiencing financial hardship due to unforeseen circumstances, like a temporary business downturn. These state-specific programs and waivers create exceptions to the standard Medicaid rules, creating a more nuanced eligibility landscape.

Comparison of Medicaid Rules Across Three States

The following table illustrates the key differences in Medicaid rules regarding business ownership across three states: California, Texas, and New York. Note that these are simplified examples and should not be considered exhaustive. Always consult the official state Medicaid agency for the most up-to-date and accurate information.

| State | Income Consideration | Asset Consideration | Business Ownership Impact |

|---|---|---|---|

| California | Considers total income from all sources, including business income, after allowable deductions. | Considers all assets, including business assets, but may have higher thresholds than other states. | Business ownership does not automatically disqualify, but income and asset limits must be met. |

| Texas | May place stricter limits on business income, potentially reducing eligibility for those with higher business profits. | May have lower asset limits, potentially disqualifying individuals with substantial business assets. | Business ownership can significantly impact eligibility; stricter guidelines compared to some states. |

| New York | Similar to California, considers total income, but specific deductions and calculations may differ. | Asset limits may vary depending on the specific Medicaid program and applicant’s circumstances. | Business ownership is considered, but the impact depends heavily on individual circumstances and available waivers. |

Impact of Business Expenses and Deductions on Medicaid Eligibility

Determining Medicaid eligibility for business owners involves a careful assessment of income, and this calculation is significantly influenced by allowable business deductions and expenses. Understanding these deductions is crucial for accurately determining eligibility and avoiding potential delays or denials. Failing to account for legitimate business expenses can lead to an overestimation of income, resulting in ineligibility even when a business owner might otherwise qualify.

Business expenses directly reduce the net income used in Medicaid eligibility calculations. Medicaid programs generally allow for the deduction of ordinary and necessary business expenses, meaning those that are common and helpful in running the business. This differs from personal expenses, which are not deductible. The key is to clearly separate business and personal finances to demonstrate accurately how much income is truly available for personal use after business expenses.

Deductible Business Expenses

The types of business expenses considered deductible vary by state and program, but generally include costs associated with running the business, such as supplies, rent, utilities, marketing, professional fees (accountants, lawyers), and employee wages. It’s important to note that the specific documentation required to substantiate these expenses will also vary. For instance, receipts, invoices, and bank statements are generally necessary to support claims of deductible business expenses. Failure to maintain meticulous records can severely hinder the eligibility process.

Examples of Business Expenses Impacting Medicaid Eligibility

Consider a self-employed plumber with substantial business expenses. Their gross income might appear high, potentially exceeding Medicaid income limits. However, after deducting legitimate business expenses like materials, truck maintenance, and advertising, their net income available for personal use could fall well below the eligibility threshold. Conversely, a small business owner who doesn’t accurately track and deduct expenses might appear to have a higher disposable income than they actually do, leading to an incorrect denial of Medicaid benefits. A similar scenario could apply to a freelance writer who has significant expenses for software, marketing, and professional development.

Accurate Record-Keeping for Business Expenses

Maintaining meticulous records is paramount. Every business expense should be documented with receipts, invoices, or other verifiable proof. This documentation should clearly show the date, amount, and purpose of each expense. Organized financial records are crucial not only for Medicaid eligibility but also for tax purposes. Failure to maintain proper records can lead to delays in processing the application and may result in a denial of benefits. Consider using accounting software or consulting with a tax professional to ensure accurate record-keeping.

Common Business Deductions and Their Impact

The impact of business deductions on Medicaid eligibility is significant. Here are some common examples:

- Cost of Goods Sold (COGS): For businesses that sell products, this deduction significantly reduces income. A higher COGS directly lowers net income, potentially increasing the chances of Medicaid eligibility.

- Rent and Utilities: These are significant expenses for many businesses, especially those with physical locations. Substantial deductions for rent and utilities can reduce net income, potentially leading to Medicaid eligibility.

- Employee Wages: Businesses with employees can deduct payroll expenses. This can substantially lower net income, making Medicaid eligibility more likely.

- Vehicle Expenses: For businesses that require vehicles for transportation, mileage or lease payments are often deductible. These deductions can lower the applicant’s net income.

- Marketing and Advertising: Expenses related to promoting the business can be deducted. This can influence the net income calculation, potentially leading to Medicaid eligibility.

Resources and Assistance for Business Owners Applying for Medicaid: Can You Get Medicaid If You Own A Business

Navigating the Medicaid application process as a business owner can be complex, requiring careful consideration of income, assets, and business expenses. Fortunately, several resources and organizations offer support and guidance to simplify this process. Understanding these resources is crucial for a successful application.

Available Resources for Information on Medicaid Eligibility

Numerous resources provide information about Medicaid eligibility criteria for business owners. State Medicaid agencies maintain websites with detailed eligibility guidelines, application forms, and frequently asked questions (FAQs). These websites often include contact information for assistance with specific questions. Additionally, the Centers for Medicare & Medicaid Services (CMS) website offers national-level information and resources, providing a broader overview of the Medicaid program. Finally, many non-profit organizations dedicated to healthcare access provide educational materials and support services, offering valuable information and assistance in understanding the complexities of Medicaid eligibility for self-employed individuals. These resources can help clarify confusing aspects of the application process and ensure applicants have the information they need to complete the application accurately.

Organizations Providing Assistance with Medicaid Applications

Several organizations offer assistance with Medicaid applications. Legal aid societies often provide free or low-cost legal assistance to individuals navigating the complexities of the Medicaid application process, including business owners. These organizations can help applicants understand their rights, gather necessary documentation, and complete the application accurately. Similarly, some non-profit organizations specializing in healthcare access offer application assistance, providing guidance and support throughout the process. These organizations may also offer assistance with appealing denials and navigating the appeals process. Furthermore, many community health centers provide assistance with Medicaid applications and enrollment, connecting individuals with the resources they need to access healthcare. The services provided vary by location and organization.

The Medicaid Application Process for Business Owners

The Medicaid application process for business owners generally involves completing a detailed application form, providing supporting documentation, and undergoing an eligibility determination. Applicants must accurately report their income, assets, and business expenses. The application process may require providing financial statements, tax returns, and bank statements. State Medicaid agencies will review the application and supporting documentation to determine eligibility based on the applicant’s income and assets, taking into account business-related expenses and deductions. This process can take several weeks or months to complete, depending on the complexity of the application and the workload of the state agency.

Necessary Documentation for Medicaid Application

The specific documentation required for a Medicaid application varies by state, but generally includes proof of identity, proof of residency, social security numbers for all household members, income documentation (tax returns, pay stubs, bank statements, business financial statements), and asset documentation (bank statements, investment accounts, property ownership records). Business owners will need to provide detailed financial information about their business, including profit and loss statements, balance sheets, and tax returns. This documentation helps determine the applicant’s income and assets, considering business-related income, expenses, and deductions. Failure to provide complete and accurate documentation can delay the application process or lead to denial.

Step-by-Step Guide to Navigating the Medicaid Application Process

- Gather Necessary Documentation: Compile all required documentation, including proof of identity, residency, income, assets, and business financial records.

- Complete the Application Form: Carefully and accurately complete the Medicaid application form, providing detailed information about your income, assets, and business expenses.

- Submit the Application: Submit the completed application and all supporting documentation to the appropriate state Medicaid agency.

- Follow Up: After submitting the application, follow up with the state Medicaid agency to check on the status of your application.

- Appeal if Necessary: If your application is denied, understand your right to appeal the decision and follow the appeals process Artikeld by the state Medicaid agency.