Do I need an LLC for my online business? This fundamental question plagues many entrepreneurs venturing into the digital world. The decision hinges on a careful consideration of liability protection, tax implications, and the overall impact on your business’s growth and credibility. Understanding the nuances of different business structures—sole proprietorship, partnership, and LLC—is crucial for making an informed choice that aligns with your specific circumstances and long-term goals. This guide delves into the essential aspects to help you determine the best legal structure for your online venture.

We’ll explore the shield an LLC provides against personal liability, comparing it to the risks associated with sole proprietorships and partnerships. We’ll also analyze the tax implications of each structure, highlighting potential tax deductions and the administrative burden involved. Furthermore, we’ll examine how choosing an LLC can influence your business’s professional image, its ability to attract investors, and its overall ease of operation. By the end, you’ll have a clearer understanding of whether forming an LLC is the right move for your online business.

Liability Protection

Choosing the right legal structure for your online business is crucial, and a key consideration is the level of liability protection it offers. The structure you select significantly impacts your personal assets’ vulnerability to business-related debts and lawsuits. Understanding the differences between sole proprietorships, partnerships, and LLCs is essential for making an informed decision.

Liability Protection in Different Business Structures

A sole proprietorship offers minimal liability protection. Your personal assets are directly exposed to business debts and legal actions against your business. Similarly, in a general partnership, partners typically share unlimited personal liability for business obligations. This means creditors can pursue personal assets to satisfy business debts, and partners can be held personally responsible for the actions or negligence of other partners. In contrast, a Limited Liability Company (LLC) provides a crucial layer of protection, shielding your personal assets from business liabilities. This separation is a key advantage, limiting the risk to your personal wealth.

Scenarios Where an LLC Protects Personal Assets

An LLC’s liability protection is particularly valuable in several scenarios. Imagine a situation where your online business is sued for product liability. If structured as an LLC, the lawsuit would target the business’s assets, not your personal savings, house, or car. Similarly, if your online business incurs significant debt and is unable to repay it, creditors can only pursue the LLC’s assets, protecting your personal finances. This protection extends to various scenarios, including copyright infringement claims, contract breaches, and even personal injury lawsuits related to your business operations.

Situations Where Personal Assets Might Be at Risk Without an LLC

Without the protection of an LLC, the consequences can be severe. Consider a scenario where a customer suffers injury due to a faulty product sold through your online store. If you operate as a sole proprietor, you could be personally liable for significant damages, potentially jeopardizing your personal savings, home, and other assets. Similarly, if your online business fails and incurs substantial debt, creditors could seize your personal possessions to recover their losses. This risk extends to situations involving employee lawsuits, intellectual property disputes, and various other legal challenges.

Comparison of Liability Protection

| Business Structure | Liability Protection | Setup Complexity | Cost |

|---|---|---|---|

| Sole Proprietorship | No separate legal entity; personal liability for business debts and lawsuits. | Low | Low |

| Partnership | Generally, partners share unlimited personal liability. Limited partnerships offer some protection to limited partners. | Moderate | Moderate |

| LLC | Personal assets are generally protected from business debts and lawsuits. Exceptions may exist depending on specific circumstances and state laws. | Moderate to High (depending on state requirements) | Moderate to High (depending on state fees and ongoing compliance costs) |

Taxes and an LLC for Online Businesses

Choosing the right legal structure for your online business significantly impacts your tax obligations. Understanding the differences between operating as a sole proprietor versus a Limited Liability Company (LLC) is crucial for minimizing your tax burden and ensuring compliance. This section will detail the tax implications of each structure, highlighting key differences in tax forms and available deductions.

Tax Implications of Sole Proprietorship vs. LLC

As a sole proprietor, your business income and expenses are reported on your personal income tax return (Form 1040, Schedule C). This means your business profits are taxed at your individual income tax rate, which can vary significantly depending on your income bracket. In contrast, an LLC offers more flexibility. While the IRS treats most single-member LLCs (LLCs with one owner) as disregarded entities—meaning the profits and losses pass through to the owner’s personal income tax return—multi-member LLCs or those electing to be taxed as corporations face different tax structures. A single-member LLC’s tax treatment mirrors that of a sole proprietorship, while a multi-member LLC can choose to be taxed as a partnership (using Form 1065) or as an S corporation (using Form 1120-S), offering potential tax advantages depending on the specific circumstances. The choice of taxation for an LLC can significantly affect the owner’s tax liability and should be carefully considered with the help of a tax professional.

Tax Forms for Sole Proprietorships and LLCs

Sole proprietors report their business income and expenses using Schedule C of Form 1040. This form details all business revenue and allowable deductions, ultimately determining the net profit or loss that is added to the owner’s personal income. For single-member LLCs taxed as disregarded entities, the process is identical. Multi-member LLCs taxed as partnerships file Form 1065, reporting the partnership’s income and allocating it to each partner. Partners then report their share of the income or loss on their individual tax returns (Form 1040, Schedule K-1). LLCs electing to be taxed as S corporations use Form 1120-S, reporting the corporation’s income and distributing profits to shareholders, who then report their share on their personal tax returns (Form 1040, Schedule K-1).

Tax Deductions Available to LLC Owners

LLC owners, regardless of the tax classification, have access to many deductions available to sole proprietors, such as deductions for business expenses like office supplies, advertising, and travel. However, some deductions might be more easily claimed or strategically utilized by LLCs. For example, an LLC might be able to deduct expenses related to establishing and maintaining the LLC itself, such as legal fees for formation and annual maintenance fees, which are generally not deductible for sole proprietors. Furthermore, the ability to structure the business as an S-Corp or a partnership may open up additional tax advantages, such as qualified business income (QBI) deductions, which are not directly available to sole proprietors in the same way. The specific deductions available will depend on the LLC’s structure and activities.

Filing Taxes for an Online Business Structured as an LLC

Proper tax filing is crucial for LLCs. The steps involved can vary depending on the chosen tax structure. Here’s a general Artikel:

- Gather financial records: Compile all income statements, expense receipts, bank statements, and other relevant financial documents throughout the tax year.

- Choose a tax accounting method: Select either the cash or accrual method for accounting, depending on your business needs and size. This will determine when income is recognized and expenses are deducted.

- Determine your LLC’s tax classification: Single-member LLCs are typically disregarded entities, while multi-member LLCs can elect to be taxed as partnerships or S corporations.

- Prepare the appropriate tax forms: This will depend on your LLC’s tax classification (Form 1040, Schedule C; Form 1065; or Form 1120-S).

- File your tax return: File your tax return by the tax deadline (typically April 15th).

- Pay any taxes owed: Pay any taxes owed along with your tax return.

Credibility and Professionalism

Establishing a credible and professional online presence is crucial for success, and the legal structure of your business plays a significant role. While operating as a sole proprietorship is simple to set up, it can limit your perceived professionalism and impact customer trust. Forming an LLC, on the other hand, often projects a more established and trustworthy image, leading to increased credibility with customers and potential partners.

The perceived professional image associated with an LLC significantly differs from that of a sole proprietorship. An LLC presents a more formal and structured business entity, suggesting a higher level of commitment and professionalism. This perception is often crucial in building trust and confidence, particularly in competitive online markets.

Enhanced Customer Trust and Confidence

The use of an LLC can significantly enhance customer trust and confidence. Customers are more likely to engage with businesses that appear established and legitimate. The formal structure of an LLC conveys a sense of stability and professionalism that a sole proprietorship may lack. For example, a customer might be more hesitant to share sensitive information or make a significant purchase from a business operating solely under an individual’s name, compared to one with the clearly defined structure and liability protection offered by an LLC. The LLC designation acts as a visual cue of legitimacy, subtly reassuring customers of the business’s seriousness and reliability.

Attracting Investors and Partners

An LLC structure can be a significant advantage when seeking investors or partners. Investors and potential partners are often more inclined to invest in or collaborate with businesses that present a well-defined legal structure. The liability protection offered by an LLC reduces their risk, making the investment or partnership more appealing. Furthermore, the formal structure of an LLC demonstrates a higher level of business acumen and professionalism, signaling a greater likelihood of success. This is particularly relevant when presenting a business plan or seeking funding, as investors often prioritize businesses with a solid foundation and clear legal standing.

Marketing Materials Comparison

Consider two fictional online businesses selling handcrafted jewelry: “Artisan Gems” (sole proprietorship) and “Gemstone Creations LLC” (LLC). “Artisan Gems” marketing materials might feature images of the owner crafting jewelry, emphasizing a personal touch but potentially lacking the formal business identity. Their website might simply be a personal blog with online ordering capabilities. In contrast, “Gemstone Creations LLC” would likely showcase professional photography, a more sophisticated website design, and clear branding elements that reflect the LLC structure. Their marketing might highlight their legal structure, emphasizing liability protection and business stability as a way to build customer confidence and attract potential wholesale partners. The visual difference, even without explicit mention of the legal structure, would subtly communicate a higher level of professionalism and trustworthiness associated with the LLC. This difference in perceived professionalism can directly impact customer acquisition and overall business success.

Raising Capital and Funding

Securing funding is a critical step for any online business, and the legal structure you choose significantly impacts your ability to attract investors and lenders. An LLC, or Limited Liability Company, offers several advantages in this area, but also presents some considerations. Understanding these nuances is crucial for maximizing your chances of securing the capital needed for growth.

The structure of an LLC can significantly influence investor and lender perception. Investors often favor LLCs over sole proprietorships or partnerships because of the inherent liability protection they offer. This protection reduces the risk for investors, making the investment appear less risky and thus more appealing. Furthermore, the formal structure of an LLC demonstrates a level of professionalism and commitment that can be persuasive to potential funders.

LLCs and Venture Capital Attraction

Advantages of using an LLC to attract venture capital include the limited liability protection, which safeguards investors’ personal assets, and the established corporate structure, which signifies a well-organized and professional business. This structure also facilitates easier transfer of ownership should the need arise. However, securing venture capital through an LLC might be more challenging than for corporations, especially if seeking significant funding. Venture capitalists often prefer corporations due to their established governance structures and potential for larger scale investment and returns. The more complex regulatory requirements for LLCs, compared to simpler structures, can be a factor in this preference. Finally, the valuation of an LLC can be more complex than that of a corporation, leading to potentially more challenging negotiations.

Loan Acquisition for LLCs versus Sole Proprietorships

Banks and other lenders generally view LLCs more favorably than sole proprietorships when considering loan applications. The limited liability protection afforded to LLC owners reduces the lender’s risk. This translates to a potentially higher likelihood of loan approval and potentially more favorable terms, such as lower interest rates. A sole proprietor, on the other hand, faces greater personal liability, making them a riskier proposition for lenders. Lenders will scrutinize the personal credit history of the sole proprietor much more closely, and a single default could jeopardize the entire business. In contrast, an LLC’s assets and liabilities are generally separate from the personal assets of its owners. This separation significantly mitigates the lender’s risk, making it easier to secure financing.

Creating a Business Plan Highlighting LLC Benefits

A well-structured business plan is essential for attracting investment, regardless of the business structure. However, highlighting the benefits of the LLC structure within the plan can significantly improve its appeal. The plan should clearly articulate the limited liability protection afforded to investors, emphasizing how this reduces their risk. It should also detail the LLC’s operational structure, showcasing its professionalism and preparedness. Financial projections should demonstrate the business’s potential for growth and profitability, reinforcing the investment’s potential return. For example, a section detailing the management team’s expertise and experience, coupled with a strong financial model showcasing realistic revenue projections and a clear exit strategy, would significantly enhance the appeal of the business plan to potential investors. This structured approach, combined with the clear benefits of an LLC, presents a compelling case for investment.

Administrative and Legal Requirements

Forming and maintaining a Limited Liability Company (LLC) involves navigating a series of legal and administrative hurdles. While the benefits of LLC structure are significant, understanding the ongoing compliance obligations and associated costs is crucial for responsible business ownership. Failure to meet these requirements can lead to penalties, fines, and even the dissolution of the LLC.

The administrative burden of an LLC varies by state, but generally includes initial formation steps, ongoing compliance filings, and the maintenance of accurate records. These requirements are designed to ensure transparency and accountability, protecting both the LLC and its members. The complexity increases with the size and activities of the business, making it essential for entrepreneurs to understand these obligations before committing to an LLC structure.

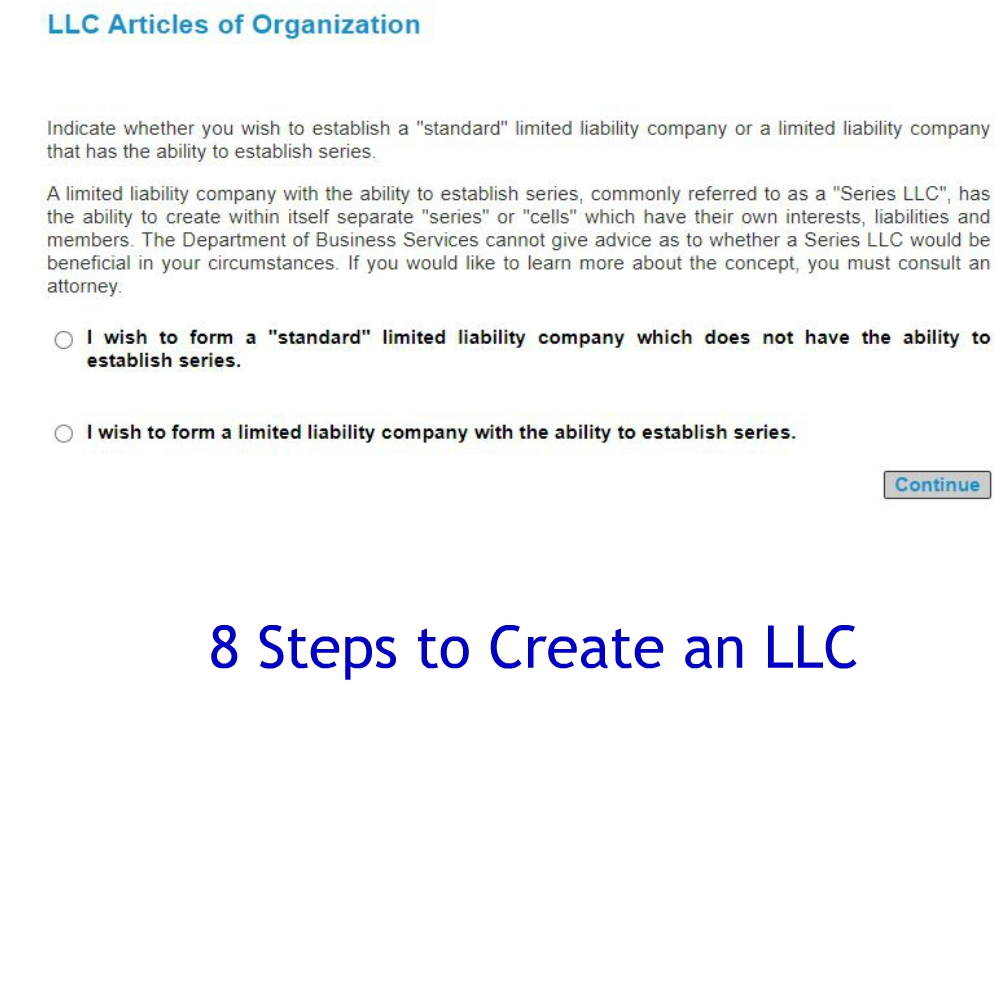

LLC Formation Steps and Associated Costs, Do i need an llc for my online business

Establishing an LLC typically involves several key steps, each with associated costs. These costs vary significantly depending on the state of incorporation and the services used (e.g., hiring a lawyer or using an online formation service). The initial steps usually include choosing a name, appointing a registered agent, filing the articles of organization, and creating an operating agreement.

For example, in Delaware, a popular state for LLC formation due to its favorable business laws, the initial filing fee for articles of organization can range from $100 to $500. Additional fees might include those charged by a registered agent service, legal counsel, and the cost of preparing the operating agreement. These initial costs can easily total several hundred dollars, and sometimes exceed a thousand, depending on the complexity of the business and the level of professional assistance sought.

Ongoing Compliance Obligations

Maintaining an LLC’s legal standing requires ongoing compliance with state regulations. These obligations are essential to avoid penalties and maintain the LLC’s good standing. Failure to comply can result in administrative sanctions, including fines and potential dissolution of the LLC. These obligations frequently involve the timely filing of annual reports and the payment of associated fees.

- Annual Reports: Most states require LLCs to file an annual report, providing updates on the business’s information and often involving a filing fee. Failure to file this report on time can result in late fees and potential penalties.

- Franchise Taxes: Some states impose franchise taxes on LLCs, based on factors like revenue or the number of employees. These taxes are distinct from income taxes and must be paid annually or as required by the state.

- Registered Agent: Maintaining a registered agent is a crucial ongoing requirement. The registered agent receives legal and official correspondence on behalf of the LLC. This service usually involves an annual fee.

- Maintaining Records: LLCs must maintain accurate financial records and other relevant documents, ensuring compliance with tax and other legal requirements. Poor record-keeping can lead to difficulties during audits and increase the risk of penalties.

Cost of Maintaining an LLC

The ongoing costs of maintaining an LLC can vary considerably. These costs include annual report fees, franchise taxes (where applicable), registered agent fees, and the potential costs associated with legal and accounting services. Budgeting for these ongoing expenses is crucial for long-term financial planning.

For instance, annual report fees can range from $50 to $200 or more, depending on the state. Registered agent services typically cost between $100 and $300 annually. If legal or accounting professionals are engaged, these costs can significantly add to the overall maintenance expenses. These costs, though seemingly small individually, can add up over time, forming a substantial part of the LLC’s operational budget.

Forming an LLC: A Flowchart

The process of forming an LLC can be visualized as a flowchart, guiding entrepreneurs through the necessary steps. This simplifies the process and helps ensure that no crucial steps are missed. This flowchart is a simplified representation; specific requirements may vary by state.

[Imagine a flowchart here. The flowchart would begin with “Decide to form an LLC,” branching to “Choose a state of incorporation,” then “Choose a name and register it,” followed by “Appoint a registered agent,” then “Prepare and file Articles of Organization,” then “Create an operating agreement,” and finally “Obtain an EIN (Employer Identification Number).” Each step would have a potential cost associated with it, represented visually. The flowchart would end with “LLC Formation Complete”.]

Specific Business Types and LLC Suitability: Do I Need An Llc For My Online Business

Choosing the right legal structure for your online business is crucial for managing liability, taxes, and future growth. While an LLC offers many advantages, its suitability depends heavily on the specific nature of your online business and its projected scale. Understanding these nuances is key to making an informed decision.

The benefits of an LLC, such as limited liability protection and pass-through taxation, are particularly appealing to certain online business models, while others might find alternative structures more efficient. Factors like the level of risk involved, the complexity of operations, and long-term growth plans all play a significant role in determining the optimal legal structure.

Online Business Models Where an LLC is Particularly Beneficial

High-risk online businesses, such as those involving significant financial transactions, substantial customer data handling, or potential for product liability claims, benefit significantly from the liability protection offered by an LLC. This shields personal assets from business debts or lawsuits. E-commerce businesses selling physical products, online courses with a large student base, and software-as-a-service (SaaS) companies often fall into this category. The potential for legal challenges related to product defects, intellectual property disputes, or data breaches makes the limited liability protection of an LLC a valuable asset.

Online Business Models Where an LLC Might Be Less Advantageous

For very small, low-risk online businesses, such as freelance writing or simple affiliate marketing with minimal financial transactions, the overhead and administrative burden of forming and maintaining an LLC might outweigh the benefits. The limited liability protection might be less crucial when the financial risk is low. Sole proprietorships or partnerships might be more suitable and simpler to manage in these cases. Similarly, businesses operating solely within a specific state might find that the administrative requirements associated with registering as an LLC in multiple states (if expanding) become burdensome.

LLC Suitability for Different Online Business Sizes

The suitability of an LLC scales with business size. For small online businesses, the administrative complexities might seem disproportionate to the perceived benefits. However, as the business grows, the increased liability risks and potential for attracting investors make an LLC a more attractive option. Larger online businesses often require the legal structure and credibility an LLC provides to facilitate fundraising and manage complex operational aspects. The added layer of protection for personal assets becomes increasingly valuable as the business’s assets and liabilities grow.

Online Business Types and Suitable Structures

The following table summarizes recommended business structures for different online business types, considering factors like liability, taxation, and administrative burden.

| Business Type | Recommended Structure | Reasons | Alternatives |

|---|---|---|---|

| E-commerce (High Volume) | LLC | Strong liability protection, easier fundraising. | S Corp (for tax optimization) |

| Freelance Writing/Graphic Design | Sole Proprietorship | Simple setup, minimal administrative burden. | Partnership (if collaborating with others) |

| Online Course Platform | LLC | Protection against potential lawsuits related to course content. | S Corp (for tax optimization, if substantial income) |

| Affiliate Marketing (Low Volume) | Sole Proprietorship | Low risk, simple to manage. | Limited Liability Partnership (LLP) (if collaborating) |

| Software as a Service (SaaS) | LLC | Liability protection, suitable for scaling and attracting investors. | C Corp (for larger, publicly traded companies) |