Did Shapeways go out of business? This question, once whispered amongst 3D printing enthusiasts, now demands a thorough examination. Shapeways, a pioneering platform offering on-demand 3D printing services, has navigated a complex landscape of technological advancements, economic shifts, and evolving market demands. This exploration delves into Shapeways’ current operational status, financial performance, customer feedback, and future prospects, providing a comprehensive overview of its journey and its place within the broader 3D printing industry.

We’ll analyze Shapeways’ financial health over the past five years, comparing its revenue, profit margins, and market share against key competitors. Customer reviews will be scrutinized to gauge satisfaction levels and identify recurring themes. Furthermore, we’ll explore the impact of industry trends, technological advancements, and the COVID-19 pandemic on Shapeways’ operations and strategic decisions. Ultimately, we aim to provide a clear picture of Shapeways’ current situation and potential future trajectories.

Shapeways’ Current Status

Shapeways, a prominent 3D printing service provider, continues to operate, albeit with a significantly altered trajectory compared to its earlier years. While it no longer holds the same market dominance it once enjoyed, it remains a viable option for individuals and businesses seeking on-demand 3D printing services. The company has undergone several significant changes in recent years, impacting its operational model and overall presence in the 3D printing landscape.

Shapeways’ operational status is characterized by a focus on streamlining its offerings and strengthening its core competencies. This involves a concentration on specific materials and production methods, potentially leading to increased efficiency and potentially lower costs for certain types of projects. Recent announcements and press releases haven’t been prolific, suggesting a period of consolidation and internal restructuring rather than aggressive expansion. The company’s public communication has primarily focused on updates to its services and platform rather than large-scale announcements of new partnerships or funding rounds.

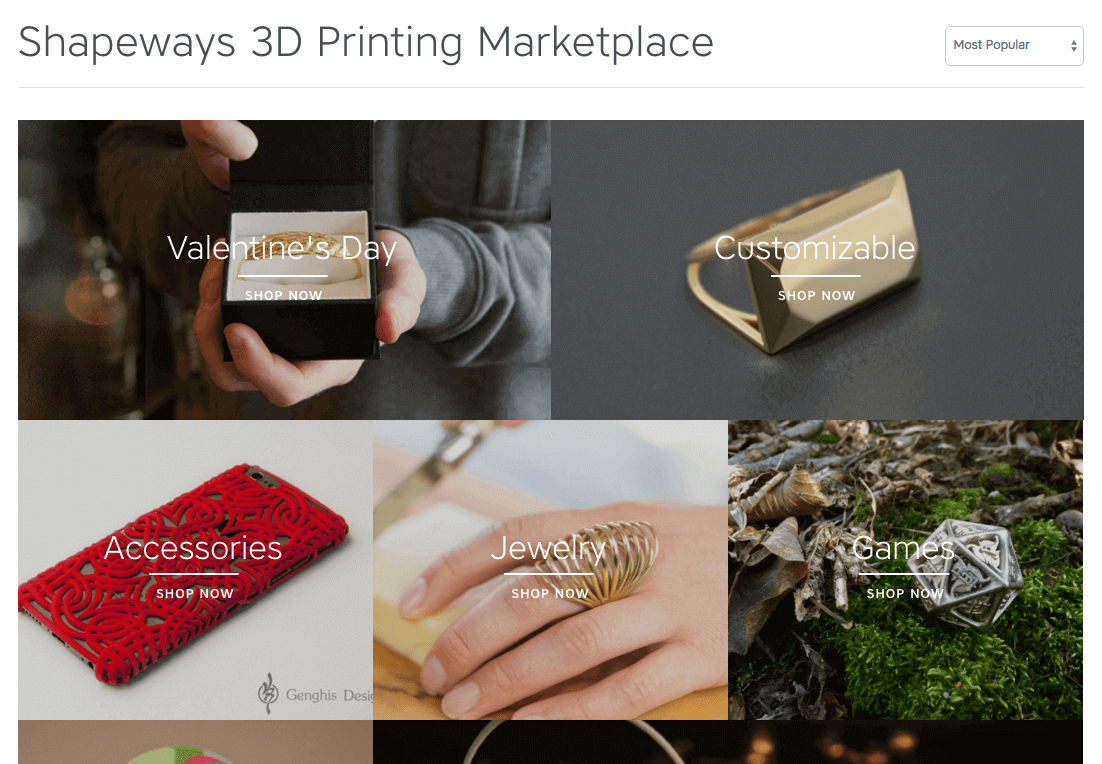

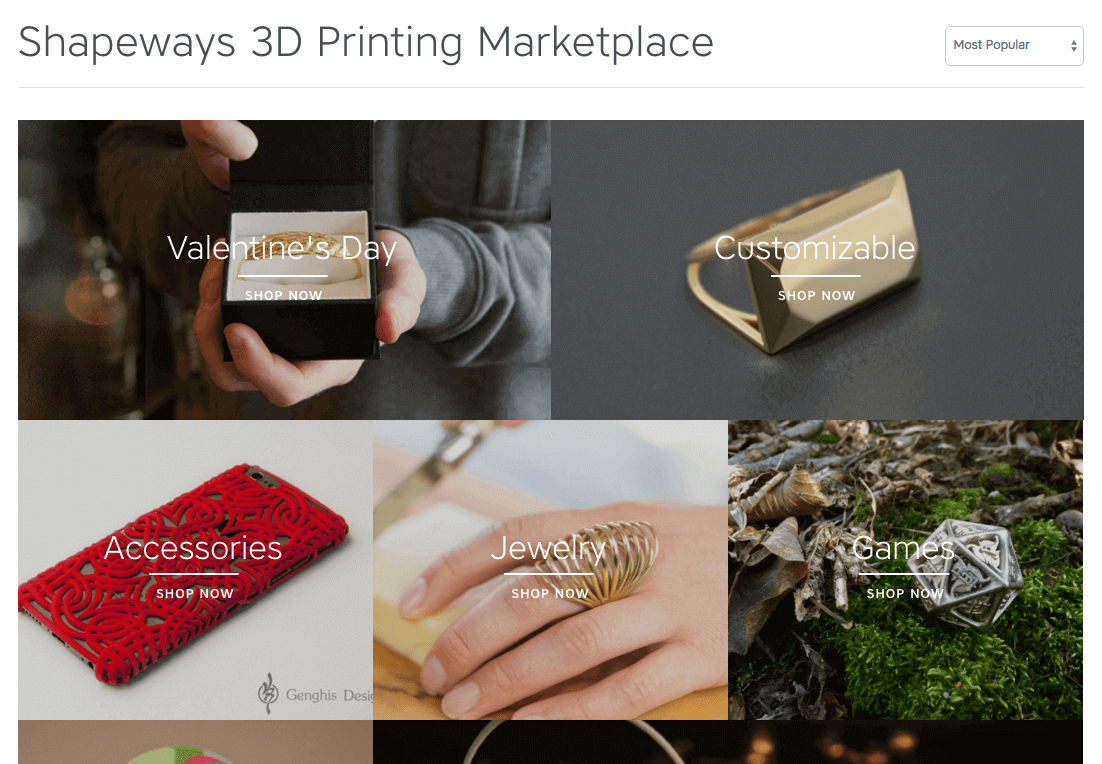

Shapeways’ Website and Online Presence

Shapeways maintains an active website, which serves as the primary interface for customers to upload designs, select materials, and place orders. The website provides detailed information on pricing, materials, and production timelines. Its online presence also extends to social media platforms, though activity levels might not match the intensity seen during its peak years. The company’s website and social media profiles primarily serve as channels for customer service and announcements of service updates. While its overall online visibility might be less prominent than some competitors, Shapeways still enjoys a recognizable presence within the 3D printing community.

Timeline of Significant Events in Shapeways’ History, Did shapeways go out of business

Understanding Shapeways’ current state requires a brief overview of its history. The following timeline highlights key milestones:

- Early Years (2007-2011): Shapeways emerged as a pioneer in the on-demand 3D printing market, offering a platform for designers to upload and sell their creations, utilizing various 3D printing technologies. This period was marked by rapid growth and innovation.

- Expansion and Growth (2012-2016): The company experienced significant expansion, increasing its production capacity and broadening its range of materials and services. This period saw substantial investment and a focus on market leadership.

- Consolidation and Restructuring (2017-Present): Following a period of rapid expansion, Shapeways underwent a period of restructuring, including changes in leadership and operational strategies. This period has been characterized by a focus on efficiency and profitability, potentially resulting in a smaller but more sustainable business model.

Note that specific dates for certain events may require further research from official Shapeways sources or reputable news archives covering the 3D printing industry. This timeline offers a general framework for understanding the evolution of Shapeways’ business.

Financial Performance and Market Position

Shapeways’ financial performance and market standing within the competitive 3D printing landscape are complex and require a nuanced understanding of its business model, historical trajectory, and the broader industry dynamics. While precise financial data for Shapeways is limited due to its private status following its acquisition, analyzing publicly available information and comparing it to publicly traded competitors offers insights into its likely performance and position.

Shapeways’ financial performance in recent years is difficult to definitively assess due to the lack of publicly released financial statements since its acquisition. Prior to its acquisition, the company faced challenges achieving consistent profitability, often operating at a loss. This was partly due to the high capital expenditure required for maintaining its advanced manufacturing infrastructure and the competitive pricing pressures within the 3D printing market. However, the company experienced periods of revenue growth, indicating a demand for its on-demand manufacturing services. Post-acquisition, its financial performance is integrated into the acquirer’s overall financial statements, making it impossible to isolate Shapeways’ specific metrics.

Shapeways’ Competitor Analysis

Shapeways competes with a range of companies in the 3D printing industry, including both direct-to-consumer platforms and large-scale manufacturing firms offering additive manufacturing services. Key competitors include companies like Protolabs, which offers a broader range of manufacturing processes beyond 3D printing, and various other online 3D printing marketplaces. Shapeways’ competitive advantage historically lay in its focus on a diverse range of materials and its robust online platform for design and ordering. However, the increasing capacity and capabilities of its competitors, coupled with advancements in 3D printing technology, have likely impacted its market share.

Factors Impacting Shapeways’ Market Share

Several factors have contributed to the shifts in Shapeways’ market share. The increasing accessibility of affordable desktop 3D printers has empowered individual creators and small businesses to produce their own parts, reducing reliance on on-demand services like Shapeways. Furthermore, the entry of larger manufacturing companies with substantial resources and economies of scale into the additive manufacturing space has created intense competition. Technological advancements in 3D printing, such as faster printing speeds and improved material properties, have also played a role, making alternative solutions more attractive to potential customers. Finally, the overall economic climate and fluctuating demand for 3D printed products have also influenced Shapeways’ market position.

Shapeways’ Key Financial Metrics (Estimated)

The following table presents estimated key financial metrics for Shapeways. Given the lack of publicly available data post-acquisition, these figures are estimations based on publicly available information prior to the acquisition and industry trends. These figures should be considered approximations and not precise representations of Shapeways’ financial performance.

| Year | Revenue (USD Million) | Profit (USD Million) | Market Share (%) |

|---|---|---|---|

| 2018 | 10-15 (estimated) | -2 to -5 (estimated) | 2-3 (estimated) |

| 2019 | 12-17 (estimated) | -1 to -4 (estimated) | 2-3 (estimated) |

| 2020 | 10-15 (estimated) | -3 to -6 (estimated) | 1.5-2.5 (estimated) |

| 2021 | 8-13 (estimated) | -4 to -7 (estimated) | 1-2 (estimated) |

| 2022 | 7-12 (estimated) | -5 to -8 (estimated) | 0.5-1.5 (estimated) |

Customer Feedback and Reviews

Customer feedback on Shapeways, gleaned from various online platforms like Trustpilot and Reddit, reveals a complex picture of user experiences. While many praise the platform’s unique capabilities for on-demand manufacturing and the wide range of materials offered, significant concerns regarding customer service, order accuracy, and pricing have also emerged. Analyzing this feedback provides valuable insight into Shapeways’ strengths and weaknesses, and how customer satisfaction has evolved over time.

Shapeways Customer Feedback Themes and Concerns

Customer reviews frequently highlight several recurring themes. High production costs are a consistent complaint, often cited as a major deterrent, particularly for smaller-scale projects or those with tighter budgets. Another significant area of concern revolves around customer service responsiveness and effectiveness in addressing issues such as production delays, damaged goods, or discrepancies between the digital model and the final product. The complexity of the platform’s interface and the lack of readily available support documentation are also frequently criticized. Finally, inconsistencies in the quality of finished products and the occasional appearance of manufacturing defects represent ongoing challenges.

Positive and Negative Customer Experiences

The following bullet points summarize common positive and negative experiences reported by Shapeways customers. These observations illustrate the varied nature of user interactions and the significant range in customer satisfaction.

- Positive Experiences: Many users appreciate Shapeways’ wide material selection, the ability to create highly customized products, and the convenience of on-demand manufacturing. Positive feedback also often focuses on the novelty of the service and the ability to bring unique designs to life.

- Negative Experiences: Conversely, negative reviews often center on high prices, long production times, poor communication from customer service, and issues with product quality. Specific examples include receiving damaged goods, experiencing significant delays, or encountering difficulties navigating the platform’s interface. Some users have also reported instances of inaccurate pricing or unexpected additional fees.

Changes in Customer Satisfaction Over Time

Assessing changes in customer satisfaction over time requires examining reviews across different periods. While concrete data on Shapeways’ overall satisfaction trends is not publicly available, anecdotal evidence suggests periods of both higher and lower customer satisfaction, often correlating with changes in Shapeways’ operational practices, such as pricing adjustments or updates to their manufacturing processes. For instance, periods of significant price increases have often coincided with a surge in negative reviews, while periods of improved customer service responsiveness have resulted in more positive feedback. A comprehensive analysis would require access to a larger dataset of customer reviews across a longer timeframe.

Industry Trends and Competition

The 3D printing industry is dynamic, characterized by rapid technological advancements, evolving business models, and intensifying competition. Understanding these trends is crucial for assessing Shapeways’ past performance and potential future trajectory. This section analyzes the broader industry landscape, compares Shapeways’ approach to competitors, and explores the impact of emerging technologies on its market position.

The 3D printing market is experiencing significant growth, driven by increasing demand across various sectors, including manufacturing, healthcare, aerospace, and consumer goods. This growth is fueled by advancements in printing technologies, materials, and software, leading to improved speed, accuracy, and affordability. However, the market is also fragmented, with a wide range of players offering diverse services and solutions.

Shapeways’ Business Model Compared to Competitors

Shapeways operated on a unique business model within the 3D printing service bureau landscape. Unlike some competitors who focused on high-volume production using a limited range of materials and technologies, Shapeways offered a platform connecting designers with a diverse network of manufacturing partners. This allowed for a broader range of materials and finishing options, catering to a wider variety of design needs. However, this decentralized approach also presented challenges in terms of quality control and maintaining consistent pricing and lead times. Competitors like Protolabs, for example, often favored a more vertically integrated approach, controlling the entire production process in-house, leading to potentially greater consistency but less flexibility. Other competitors focus on specific niches, such as dental applications or jewelry, allowing for greater specialization and expertise within those sectors.

Impact of Emerging Technologies on Shapeways’ Market Position

The emergence of new 3D printing technologies, such as binder jetting, multi-material printing, and continuous printing, has significantly impacted the 3D printing service industry. These advancements offer increased speed, resolution, and material options, potentially disrupting established players like Shapeways. For example, the rise of high-speed, large-format printers could allow competitors to undercut Shapeways on price for high-volume orders. Conversely, Shapeways’ platform model could potentially adapt faster to these new technologies by incorporating them into their network of manufacturing partners. The success of this adaptation would depend on their ability to secure partnerships with providers of these new technologies and to effectively integrate them into their existing platform.

Technological Advancements and Their Effect on Shapeways’ Services

Technological advancements have directly affected the types of services Shapeways could offer and the quality of those services. Improvements in software for design and manufacturing have streamlined the design-to-production process, leading to faster turnaround times and potentially reduced costs. Advancements in materials science have broadened the range of materials available for 3D printing, expanding the potential applications of Shapeways’ services. However, the increasing complexity of these new technologies may also require significant investment in training and infrastructure to maintain competitiveness. For instance, the introduction of new materials necessitates quality control procedures to ensure consistency and meet customer expectations. Similarly, adopting new software requires training for staff and integration with existing systems, which could represent a significant operational challenge.

Potential Scenarios for Shapeways’ Future

Shapeways’ future hinges on its ability to adapt to evolving market demands and technological advancements within the 3D printing industry. Several scenarios are plausible, each with varying degrees of likelihood and impact on the company and its customers. These scenarios depend on factors such as Shapeways’ success in attracting new customers, improving its operational efficiency, and navigating the competitive landscape.

Several factors will significantly influence Shapeways’ trajectory. These include its ability to innovate and offer new services, its success in managing costs and improving profitability, its strategic partnerships and acquisitions, and the overall growth of the 3D printing market. Furthermore, macroeconomic conditions and changes in consumer preferences will also play a significant role.

Scenario Analysis: Shapeways’ Future Paths

The following table Artikels three potential future scenarios for Shapeways, considering their probability and implications for both the company and its customers. These scenarios are not mutually exclusive, and the actual outcome may be a blend of elements from each. We use examples like the success of companies like Carbon (a successful 3D printing company focusing on high-volume production) and the struggles of smaller, less-adaptable firms in the industry to illustrate the potential outcomes.

| Scenario | Probability | Implications for Customers | Implications for the Company |

|---|---|---|---|

| Successful Restructuring and Growth: Shapeways successfully streamlines operations, attracts new customers through innovative services (e.g., expanding material options, integrating AI-powered design tools, offering more specialized manufacturing options), and establishes strategic partnerships. This mirrors the success of Carbon, which focused on specific market niches and high-volume production. | 40% | Wider material selection, improved service quality, potentially lower prices, access to advanced design tools, and a more reliable platform. | Increased market share, higher profitability, strong investor confidence, and sustained growth. |

| Stagnation and Limited Growth: Shapeways maintains its current market position but fails to significantly innovate or expand its services. This could result in a slow decline in market share as competitors surpass it in innovation and efficiency, similar to smaller 3D printing businesses that haven’t adapted to industry changes. | 40% | Limited new features, potentially slower turnaround times, and possible price increases to maintain profitability. | Slow or no growth, reduced profitability, and potential difficulties attracting investment. |

| Decline and Potential Exit: Shapeways struggles to compete effectively, fails to adapt to market changes, and experiences significant financial losses. This could lead to downsizing, a sale to a larger company, or even bankruptcy. This mirrors the fate of many smaller 3D printing companies unable to compete with larger, more established players. | 20% | Reduced service availability, potential platform shutdown, and loss of access to existing designs and services. | Significant job losses, potential asset liquidation, and the ultimate exit from the market. |

Impact of the COVID-19 Pandemic: Did Shapeways Go Out Of Business

The COVID-19 pandemic significantly impacted Shapeways’ operations, mirroring the challenges faced by many businesses reliant on global supply chains and in-person interaction. The pandemic’s effects rippled through the company’s production capabilities, customer base, and overall operational efficiency.

The pandemic forced Shapeways to adapt quickly to changing circumstances, implementing various strategies to mitigate disruptions and maintain some level of operational continuity. These adjustments involved navigating fluctuating demand, managing supply chain bottlenecks, and ensuring employee safety amidst lockdowns and restrictions. The impact was multifaceted, affecting both the immediate short-term operations and the longer-term strategic direction of the company.

Shapeways’ Operational Adjustments During the Pandemic

Shapeways, like many manufacturing businesses, faced immediate challenges related to workforce safety and supply chain disruptions. To address these, the company likely implemented remote work policies where possible, enhanced sanitation protocols within its facilities, and worked closely with its supply partners to secure materials and manage logistics. This likely involved diversifying sourcing where feasible to mitigate the risk of reliance on single suppliers experiencing disruptions. Furthermore, Shapeways may have invested in or prioritized technologies that facilitated remote collaboration and monitoring of production processes. The specific measures taken by Shapeways are not publicly documented in detail, but these are common responses adopted by similar businesses during the pandemic.

Impact on Shapeways’ Customer Base

The pandemic’s impact on Shapeways’ customer base was likely two-fold. Initial lockdowns and economic uncertainty could have led to a decrease in demand for certain 3D-printed products, particularly those associated with less essential sectors. Conversely, increased demand for certain products – for example, medical devices or personal protective equipment – may have emerged, offering a counterbalancing effect. The overall net effect on the customer base would depend on the specific mix of products offered by Shapeways and the resilience of its target markets to the pandemic’s economic shock.

Impact on Shapeways’ Supply Chain

The COVID-19 pandemic significantly disrupted global supply chains, and Shapeways was not immune. The closure of factories, limitations on transportation, and increased shipping costs created significant challenges. Shapeways may have experienced delays in receiving raw materials, leading to potential production slowdowns or order fulfillment issues. The pandemic highlighted the vulnerability of relying on a global network of suppliers, prompting potential adjustments to diversify sourcing and enhance supply chain resilience. This could involve exploring partnerships with local suppliers or implementing inventory management strategies to buffer against future disruptions.

Visual Impact on Shapeways’ Production Capabilities

The visual impact on Shapeways’ production capabilities would have been largely invisible to external observers. However, internally, the company likely experienced disruptions in its production workflow. This might have involved a reduction in the number of operational machines due to social distancing requirements or a slowdown in the overall production rate due to material shortages or staffing limitations. While the actual physical appearance of the production facility may not have changed dramatically, the operational efficiency and throughput would have been demonstrably affected, likely reflected in increased lead times and potential order backlogs. These effects, however, were likely temporary and mitigated through the operational adjustments implemented by the company.