Do you need a license for a cleaning business? The answer, unfortunately, isn’t a simple yes or no. Navigating the legal landscape of starting a cleaning business requires understanding a complex web of local, state, and sometimes even federal regulations. From securing the right permits and licenses to ensuring adequate insurance coverage and tax compliance, the path to successfully launching your cleaning venture involves more than just a mop and bucket. This guide breaks down the essential steps to ensure you’re operating legally and ethically.

The specific requirements vary dramatically depending on factors such as your location, the type of cleaning services offered (residential, commercial, specialized), and the size of your operation. Ignoring these legal necessities can lead to significant penalties, including hefty fines and even business closure. This comprehensive overview will guide you through the process, helping you determine the exact licenses and permits you need to start and run your cleaning business successfully.

Licensing Requirements by Location

Operating a cleaning business often requires navigating a complex web of licensing and permit regulations. These requirements vary significantly depending on your location, the type of cleaning services offered, and the scale of your operation. Understanding these regulations is crucial for legal compliance and avoiding potential penalties.

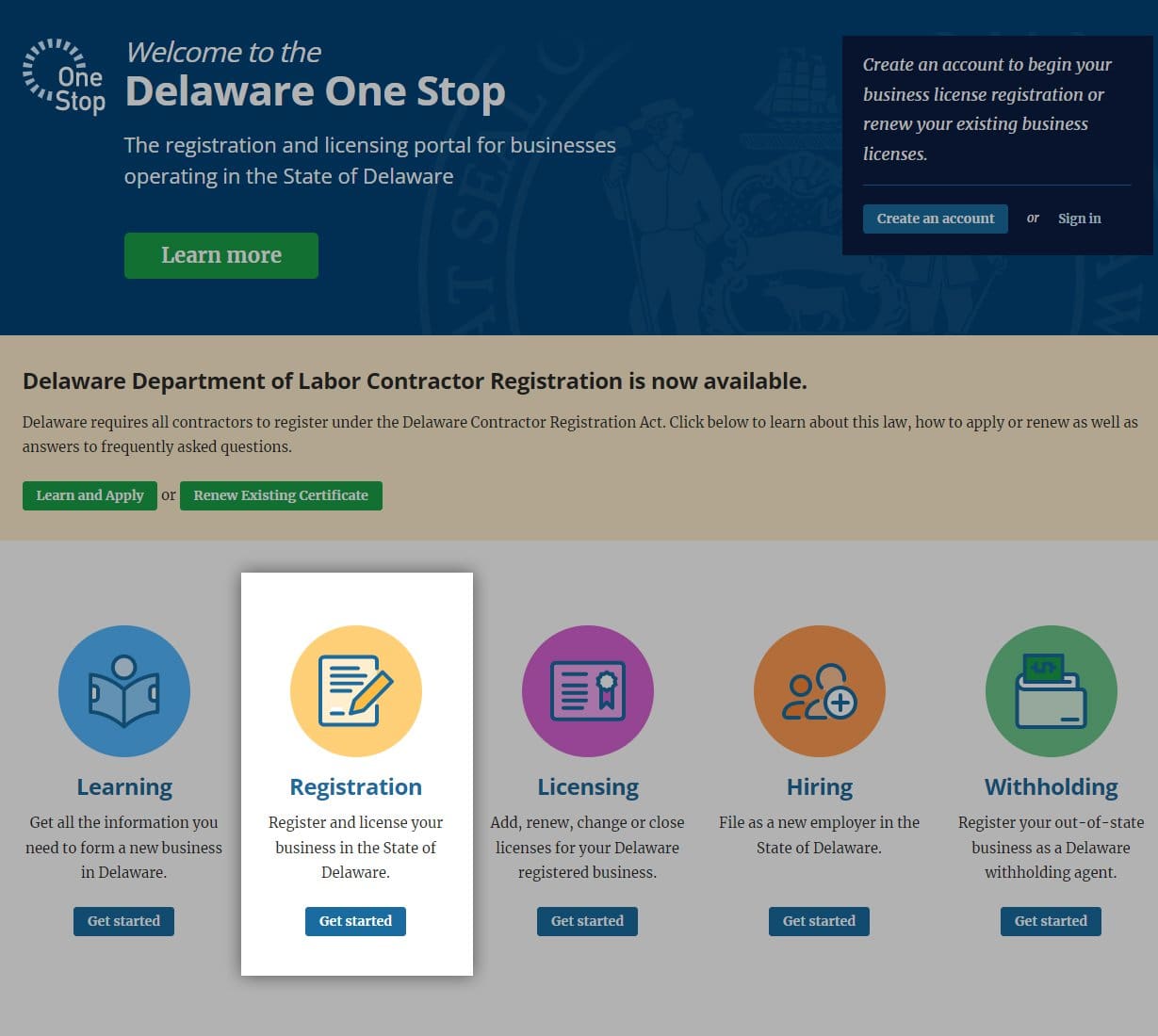

Licensing requirements for cleaning businesses differ substantially across jurisdictions. While some areas may require a general business license, others impose more specific regulations depending on the nature of the cleaning services provided. This necessitates careful research tailored to your specific location.

Licensing Requirements by Jurisdiction

The following table provides a simplified overview. Note that this is not exhaustive and should not be considered legal advice. Always consult official government sources for the most up-to-date and accurate information. Specific requirements can change frequently.

| Location | License Type | Application Process | Cost |

|---|---|---|---|

| California, USA | Business License, potentially specialized permits (e.g., for hazardous waste handling) | Online application through the Secretary of State’s office, potentially additional applications with local municipalities. | Varies by jurisdiction; expect fees for the business license and potentially additional fees for specialized permits. |

| Ontario, Canada | Business License, potentially a contractor’s license if undertaking larger commercial projects. | Application through the relevant municipal government. May require proof of insurance and bonding. | Varies by municipality. |

| London, England | Business registration with Companies House, potentially additional licenses depending on waste disposal methods and the type of cleaning. | Online registration with Companies House, potentially additional applications with local councils. | Registration fees with Companies House, plus any potential fees for additional licenses. |

| New South Wales, Australia | Australian Business Number (ABN), relevant state-based licenses depending on the services offered and location. | Application through the Australian Business Register, potentially additional applications with state government agencies. | ABN registration is free; other licenses will have associated fees. |

Variations in Licensing Based on Cleaning Service Type

The type of cleaning services offered significantly impacts licensing requirements. Residential cleaning typically requires less stringent licensing compared to commercial cleaning, which may involve handling hazardous materials or working in regulated environments. Specialized cleaning services, such as medical or industrial cleaning, often necessitate additional licenses, certifications, and training. For example, a business specializing in mold remediation would need certifications in mold assessment and abatement, while a company cleaning biohazardous waste would need specialized training and permits.

Penalties for Operating Without Necessary Licenses

Operating a cleaning business without the required licenses can result in severe penalties. These can include hefty fines, business closure orders, legal action from regulatory bodies, and difficulties obtaining insurance. The specific penalties vary by jurisdiction but can significantly impact a business’s financial stability and reputation. In some cases, criminal charges might be filed for serious violations, especially if health and safety regulations are disregarded. For instance, a cleaning business operating without the proper waste disposal permits might face significant fines and legal repercussions for improper handling of hazardous materials.

Types of Cleaning Business Licenses

Navigating the licensing landscape for a cleaning business can be complex, varying significantly depending on location, the services offered, and the scale of operations. Understanding the different types of licenses and permits required is crucial for legal compliance and avoiding potential penalties. This section clarifies the various licenses you might need to operate your cleaning business legally and efficiently.

The licensing requirements for a cleaning business extend beyond a simple business registration. Depending on the specific services offered and the location, you might need a combination of licenses and permits. These can range from general business licenses, necessary for any business operation, to specialized permits for handling hazardous materials or performing specific cleaning tasks, such as mold remediation. Failure to obtain the necessary licenses can result in fines and legal repercussions.

Business Licenses

A general business license is the foundational permit for operating any business, including a cleaning service. This license grants you the legal right to operate your business within your jurisdiction. The application process, fees, and specific requirements vary widely by location (city, county, and state). It typically involves registering your business name, providing contact information, and potentially paying an annual fee. The business license allows you to legally operate your cleaning business, invoice clients, and conduct banking activities related to the business.

- Covers the general operation of the cleaning business.

- Allows legal business operation within a specific jurisdiction.

- Enables invoicing clients and managing business finances.

Professional Licenses and Certifications

Depending on the services offered, specific professional licenses or certifications may be required. For instance, if your cleaning business involves specialized services like asbestos abatement or mold remediation, you’ll likely need to obtain relevant certifications and licenses demonstrating competency and adherence to safety regulations. These licenses often involve rigorous training, examinations, and ongoing professional development requirements. Failure to hold the necessary licenses could lead to significant legal and financial consequences.

- Covers specialized cleaning services requiring expertise (e.g., asbestos abatement, mold remediation).

- Demonstrates competency and adherence to industry safety standards.

- May involve training, examinations, and continuing education requirements.

Permits for Handling Specific Materials

Cleaning businesses often handle various materials, some of which may require specific permits for safe and legal handling and disposal. This is especially true for hazardous waste, such as medical waste or chemical cleaning agents. These permits often involve detailed procedures for storage, transportation, and disposal, ensuring compliance with environmental regulations. Non-compliance can result in severe fines and environmental damage.

- Covers the handling, storage, transportation, and disposal of hazardous materials.

- Ensures compliance with environmental regulations and safety standards.

- Often involves detailed procedures and documentation requirements.

Obtaining the Appropriate Licenses: A Flowchart

The process of obtaining the necessary licenses depends on the scope of your cleaning business. The following flowchart illustrates a simplified process:

[Imagine a flowchart here. The flowchart would start with a box labeled “Start,” then branch to “What type of cleaning services will you offer?” with branches leading to different boxes representing general cleaning, specialized cleaning (with sub-branches for specific types like mold remediation or asbestos abatement), and hazardous waste handling. Each of these boxes would then lead to a box representing the necessary licenses (business license, professional license/certification, hazardous waste permits, etc.). Finally, all paths converge to a final box labeled “Obtain all necessary licenses and permits.”]

Insurance and Bonding Requirements

Operating a cleaning business requires careful consideration of insurance and bonding to protect both your business and your clients. These safeguards are crucial for mitigating financial risks associated with accidents, injuries, or property damage. Understanding the different types of coverage and their implications is essential for legal compliance and business sustainability.

General liability insurance is a fundamental requirement for most cleaning businesses. This policy protects you against financial losses resulting from third-party claims of bodily injury or property damage caused by your business operations. For instance, if a client trips and falls due to a wet floor in their home that your cleaning crew failed to properly dry, general liability insurance would cover the resulting medical expenses and potential legal fees. Workers’ compensation insurance, on the other hand, is designed to protect your employees. It covers medical expenses and lost wages for employees injured on the job. This is a legal requirement in many jurisdictions for businesses with employees. Failure to carry this insurance can result in significant penalties. Commercial auto insurance is also vital if your business uses vehicles for transportation of equipment or personnel. This protects against accidents involving company vehicles.

General Liability Insurance Coverage

General liability insurance offers broad coverage for various incidents that may occur during your cleaning operations. This includes bodily injury liability, which covers medical expenses and legal costs associated with injuries sustained by third parties on your worksite. Property damage liability covers the cost of repairing or replacing property damaged by your employees or operations. For example, if a cleaning solution accidentally damages a client’s expensive rug, general liability insurance would help cover the replacement cost. It also often includes advertising injury coverage, protecting against claims of libel or slander related to your business advertising. The policy limits, usually expressed as a per-occurrence and aggregate limit, determine the maximum amount the insurer will pay out for covered claims.

Workers’ Compensation Insurance Coverage

Workers’ compensation insurance is specifically designed to protect your employees from work-related injuries or illnesses. This coverage typically includes medical expenses for treatment of injuries sustained on the job, as well as wage replacement benefits during the recovery period. It also covers rehabilitation costs and death benefits in cases of fatal work-related accidents. The specific benefits and requirements vary by state and are usually mandated by law. For example, a cleaner injured while lifting heavy equipment would be covered under workers’ compensation, irrespective of fault.

Surety Bonds

Surety bonds are not insurance, but rather a financial guarantee that protects clients from potential financial losses caused by your business’s failure to fulfill its contractual obligations or comply with regulations. A surety bond involves three parties: the principal (your cleaning business), the obligee (your client), and the surety (the bonding company). If your business fails to perform its contractual duties, the client can make a claim against the bond. The surety company will then pay the client, and your business is obligated to reimburse the surety. The amount of the bond is determined by the potential risk associated with your business operations and the value of the contracts you undertake. This helps build trust with clients and assures them of your commitment to professional conduct and financial responsibility. For example, a cleaning business that fails to complete a contracted cleaning job as agreed upon could face a claim against their surety bond.

Legal and Regulatory Compliance: Do You Need A License For A Cleaning Business

Operating a cleaning business requires strict adherence to a complex web of legal and regulatory requirements designed to protect public health, safety, and the environment. Failure to comply can result in significant fines, legal action, and damage to your business reputation. Understanding and meeting these obligations is crucial for long-term success.

Navigating the legal landscape involves understanding and complying with local, state, and federal regulations. These regulations often overlap and vary significantly depending on the type of cleaning services offered and the location of the business. For example, a company specializing in medical facility cleaning will face different regulations than a residential cleaning service. Proactive compliance not only mitigates risk but also demonstrates professionalism and builds trust with clients.

Occupational Safety and Health Administration (OSHA) Regulations

OSHA sets national standards for workplace safety and health. Cleaning businesses must comply with relevant OSHA standards to protect their employees from hazards like exposure to chemicals, ergonomic injuries, and slips, trips, and falls. This includes providing proper training, personal protective equipment (PPE), and maintaining a safe work environment. Specific OSHA standards relevant to cleaning businesses include those related to hazardous waste disposal, bloodborne pathogens (for medical cleaning), and respiratory protection when working with cleaning chemicals. Failure to comply with OSHA regulations can lead to significant fines and legal penalties. For example, a cleaning business that fails to provide proper PPE to employees handling harsh chemicals could face substantial fines and potential legal action from injured workers.

Environmental Protection Agency (EPA) Regulations, Do you need a license for a cleaning business

The EPA regulates the handling, storage, and disposal of hazardous waste, including many cleaning chemicals. Cleaning businesses must comply with EPA regulations concerning the proper disposal of hazardous waste, as well as the safe handling and storage of these materials to prevent environmental contamination. This includes understanding and adhering to labeling requirements, proper containerization, and the use of approved disposal methods. Violation of EPA regulations can lead to significant fines, cleanup costs, and potential criminal charges. For instance, improperly disposing of cleaning solvents could result in soil or water contamination, leading to costly remediation efforts and legal repercussions.

State and Local Regulations

Beyond federal regulations, cleaning businesses must also comply with state and local laws. These can vary significantly and may include specific licensing requirements, health codes, and environmental regulations. For example, some localities may have stricter regulations concerning the use of specific cleaning chemicals or the disposal of certain types of waste. Regularly checking with the relevant state and local agencies is crucial to ensure ongoing compliance.

Key Legal Considerations and Compliance Procedures

| Legal Consideration | Compliance Procedure |

|---|---|

| OSHA Standards (e.g., Hazard Communication, Bloodborne Pathogens) | Employee training, PPE provision, safety data sheet (SDS) access, incident reporting. |

| EPA Regulations (e.g., hazardous waste disposal) | Proper labeling, storage, and disposal of hazardous materials; adherence to waste manifest procedures. |

| State and Local Licensing Requirements | Obtain necessary licenses and permits; comply with local health and safety codes. |

| Insurance Requirements (e.g., general liability, workers’ compensation) | Secure appropriate insurance coverage to protect against potential liabilities. |

| Contract Law | Use clear and legally sound contracts with clients, outlining services, payment terms, and liability. |

Tax Obligations and Business Structure

Choosing the right business structure for your cleaning business significantly impacts both your licensing requirements and your tax obligations. Understanding these implications is crucial for minimizing your tax burden and ensuring legal compliance. The structure you select determines how you file taxes, your personal liability, and even the types of licenses you might need.

The choice of business structure—sole proprietorship, partnership, LLC, S-corp, or C-corp—directly affects how your business is taxed. A sole proprietorship, for example, blends the business and personal finances, meaning the owner reports business income and expenses on their personal income tax return (Form 1040, Schedule C). Conversely, an LLC offers more liability protection, separating personal assets from business debts, and provides flexibility in tax choices, allowing it to be taxed as a sole proprietorship, partnership, or corporation. Corporations (S-corps and C-corps) are treated as separate legal entities, resulting in more complex tax filings and potentially higher tax rates, but also offering greater liability protection.

Business Structure and Licensing

The specific business licenses required can vary depending on your chosen structure. For instance, a sole proprietor might only need a general business license and potentially a professional license if required by the state or locality. An LLC, while generally needing similar licenses, might face slightly more stringent requirements due to its separate legal entity status. Larger corporations often face a more extensive licensing process. It’s essential to check with your local and state authorities to determine the precise licensing needs for your chosen structure.

Tax Forms and Filing Requirements

The tax forms and filing requirements differ significantly based on the business structure.

- Sole Proprietorship: Files Schedule C (Profit or Loss from Business) with Form 1040, the individual income tax return. Estimated taxes (Form 1040-ES) are usually required quarterly.

- Partnership: Files Form 1065 (U.S. Return of Partnership Income), with each partner reporting their share of income or loss on their individual Form 1040.

- LLC (Taxed as Sole Proprietorship/Partnership): Follows the same filing procedures as a sole proprietorship or partnership, depending on its designated tax structure.

- LLC (Taxed as an S-Corp): Files Form 1120-S (U.S. Income Tax Return for an S Corporation).

- C-Corporation: Files Form 1120 (U.S. Corporation Income Tax Return).

Beyond these federal forms, most cleaning businesses will also need to comply with state and local tax regulations, including sales tax, unemployment tax, and potentially others depending on location. Accurate record-keeping is paramount for successful tax compliance, regardless of business structure.

Resources for Understanding Tax Obligations

Understanding your tax obligations requires consulting several resources.

- Internal Revenue Service (IRS): The IRS website (irs.gov) offers comprehensive information on federal tax laws and forms. It provides guidance for various business structures and offers resources for small businesses.

- State Tax Agencies: Each state has its own tax agency with specific requirements. These agencies provide information on state income tax, sales tax, and other state-level taxes. Examples include the California Franchise Tax Board (ftb.ca.gov) and the New York State Department of Taxation and Finance (tax.ny.gov).

- Local Tax Authorities: Counties and municipalities often levy their own taxes. Contact your local government offices for information on local business licenses and taxes.

- Tax Professionals: Consulting a tax accountant or other qualified tax professional can provide personalized guidance tailored to your specific business structure and location. They can assist with tax planning, filing, and ensuring compliance.

Impact of Business Size and Scope

The size and scope of a cleaning business significantly influence its licensing and regulatory requirements. A solo entrepreneur operating a small residential cleaning service will face a different regulatory landscape than a large commercial cleaning franchise with multiple locations and specialized services. Understanding these differences is crucial for ensuring legal compliance and avoiding potential penalties.

The scale of operations directly impacts the complexity of licensing procedures. Larger businesses often require more extensive permits, licenses, and insurance coverage compared to smaller, independent operators. This is due to increased liability, employee management, and the potential for more significant environmental impact. The specific requirements also vary considerably depending on the type of cleaning services offered and the location of operations.

Licensing Process Differences Between Small and Large Cleaning Businesses

Small cleaning businesses, often sole proprietorships or partnerships, typically navigate a simpler licensing process. This usually involves obtaining a general business license from the local municipality or county, registering the business name (if applicable), and securing necessary insurance coverage. The process often involves completing an application, paying a fee, and potentially undergoing a simple background check. Conversely, larger commercial cleaning companies face a more intricate process. They often need to obtain licenses at both the state and local levels, comply with more stringent environmental regulations (especially if handling hazardous materials), and secure comprehensive liability and workers’ compensation insurance. They may also need to register with relevant industry associations and obtain specialized permits for specific services or locations. For example, a large company servicing multiple high-rise buildings may require additional permits and safety certifications. The application process is more extensive and often involves legal and accounting professionals to ensure full compliance.

Specialized Cleaning Services and Additional Licensing

Specialized cleaning services frequently require additional licenses or certifications beyond those needed for general cleaning. Medical cleaning, for example, often mandates adherence to strict health and safety standards, potentially necessitating certifications in infection control, bloodborne pathogen training, and the proper handling of medical waste. Similarly, industrial cleaning, particularly in sectors like manufacturing or chemical processing, may necessitate specialized training and licensing to handle hazardous materials, operate specific equipment, and adhere to stringent environmental regulations. These specialized licenses often involve rigorous training programs, examinations, and ongoing compliance requirements. For instance, a company specializing in asbestos abatement would require specific licenses and certifications, given the hazardous nature of the material. Failure to obtain the proper licenses can lead to significant fines and legal repercussions.