How are restricted stock units taxed? That’s a question many employees who receive this form of compensation have. RSUs, or restricted stock units, are a type of stock compensation that can be a great perk for employees, but it’s important to understand the tax implications. It’s not just about how much money you’re making; it’s also about how much you’ll owe to the IRS.

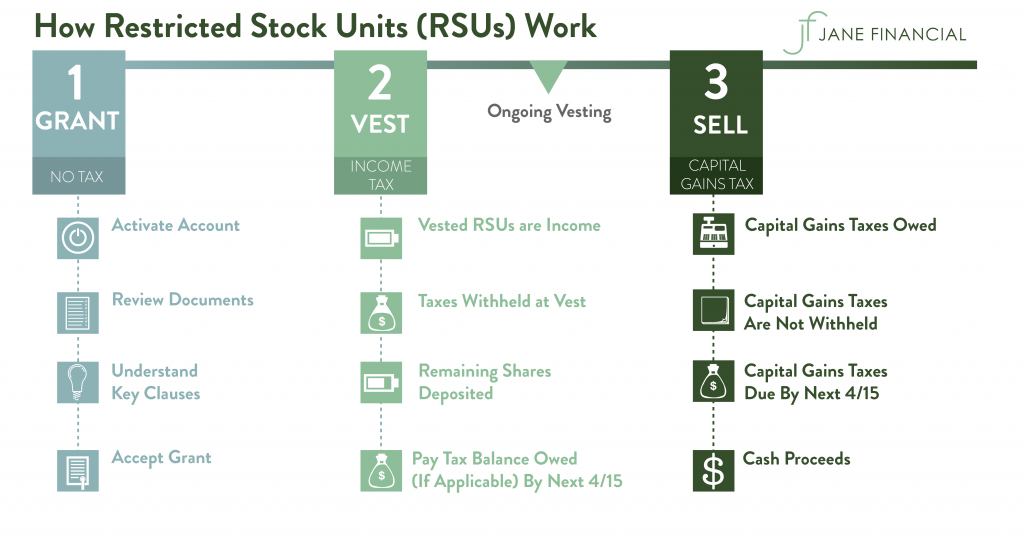

Essentially, when your RSUs vest, you’re taxed on the value of the stock at that moment. This means you’ll have to pay taxes on the value of the stock even if you don’t sell it right away. And when you eventually sell the stock, you’ll have to pay capital gains taxes on any profits you make. But don’t worry, we’ll break it all down for you in this guide.

What are Restricted Stock Units (RSUs)?: How Are Restricted Stock Units Taxed

Restricted stock units (RSUs) are a form of employee stock compensation that gives employees the right to receive shares of company stock in the future, subject to certain conditions. RSUs are different from other forms of stock compensation, such as stock options, because they do not give employees the right to purchase shares at a discounted price. Instead, RSUs represent a direct grant of company stock, which will be awarded to the employee upon the vesting of the units.

RSU Granting and Vesting

RSUs are typically granted to employees as part of their compensation packages. The number of RSUs granted and the vesting schedule are determined by the company. The vesting schedule specifies the conditions under which the RSUs will be awarded to the employee. Typically, RSUs vest over a period of time, such as four years, with a certain percentage of the units vesting each year. For example, an employee might receive 1,000 RSUs that vest over four years, with 250 units vesting each year. The vesting schedule may be subject to certain conditions, such as continued employment with the company or the achievement of specific performance goals.

Examples of Companies that Use RSUs

Many companies use RSUs as part of their employee compensation packages. Some well-known examples include:

- Apple

- Microsoft

- Amazon

These companies use RSUs to attract and retain top talent, as well as to align the interests of employees with those of the company’s shareholders.

Taxation of RSUs

When your RSUs vest, you’ll be taxed on the value of the shares you receive. The way this is taxed depends on whether the shares are considered ordinary income or capital gains.

Tax Treatment of RSUs

The tax treatment of RSUs depends on whether they are considered ordinary income or capital gains.

- Ordinary Income: When your RSUs vest, you are taxed on the fair market value of the shares at that time. This is treated as ordinary income, which means you’ll pay the same tax rate as your regular salary.

- Capital Gains: If you hold the shares after they vest for more than a year, you will be taxed on the difference between the price you paid for the shares and the price you sell them for. This is considered a capital gain, and the tax rate depends on how long you held the shares and your income level.

IRS Determination of Taxability, How are restricted stock units taxed

The IRS is responsible for determining the taxability of RSUs. They use a variety of factors to determine the tax treatment, including the terms of the grant agreement, the nature of the company’s business, and the timing of the vesting. The IRS has a specific set of rules that apply to RSUs, and these rules are subject to change.

For example, if you work for a publicly traded company and your RSUs vest when the stock price is $50 per share, you will be taxed on the $50 per share at that time. If you hold the shares for more than a year and sell them for $75 per share, you will pay capital gains tax on the $25 per share profit.

Taxable Event: Vesting

When RSUs vest, they become taxable. Vesting refers to the process where the employee gains ownership rights to the RSUs, allowing them to be exercised or sold. At this point, the RSUs are considered income and subject to taxation.

Think of it this way: when your RSUs vest, it’s like receiving a gift from your employer. You now have the right to sell these shares, and you’ll need to pay taxes on the value of the shares at the time of vesting. The tax rate depends on your income bracket.

Tax Implications of Vesting Schedules

Different vesting schedules impact the timing and amount of taxes you pay. A vesting schedule Artikels the timeframe over which an employee gradually acquires ownership of RSUs. For example, a common vesting schedule might be “25% after one year, 25% every six months thereafter, until fully vested after four years.” This means you’d receive 25% of your RSUs after one year, another 25% after 18 months, and so on.

The longer the vesting period, the longer you’ll have to wait to receive your shares and pay taxes. However, it also means you’ll be taxed on a smaller amount of shares each time. A shorter vesting period means you’ll receive your shares sooner, but you’ll also be taxed on a larger amount of shares at once.

It’s important to understand the tax implications of your vesting schedule. Here’s a breakdown of how different vesting schedules might affect your taxes:

- Example 1: Let’s say you receive 100 RSUs with a vesting schedule of 25% per year for four years. After the first year, you’ll vest 25 RSUs and be taxed on their value at that time. You’ll repeat this process each year until all 100 RSUs are vested.

- Example 2: Imagine you receive 100 RSUs with a vesting schedule of 50% after two years and 50% after three years. In this case, you’ll be taxed on 50 RSUs after two years and another 50 RSUs after three years.

The specific tax implications of your vesting schedule will depend on the terms of your grant and the applicable tax laws. It’s always a good idea to consult with a tax professional to understand how vesting will impact your taxes.

Last Recap

So, understanding how RSUs are taxed is crucial for anyone who receives them. From the vesting process to the exercise and sale of your shares, it’s important to be aware of the tax implications. While it may seem complicated, with a little research and planning, you can make informed decisions about your stock compensation and minimize your tax burden.

Essential FAQs

What are the different vesting schedules for RSUs?

Vesting schedules can vary, but common examples include monthly, quarterly, or annually. It all depends on the company’s policy and your employment agreement. For example, you might have a four-year vesting schedule with a one-year cliff. This means you’ll receive 25% of your RSUs after one year, and then the remaining 75% will vest over the next three years.

What happens if I leave the company before my RSUs vest?

It’s a bummer, but if you leave before your RSUs vest, you may lose them. The specific rules about forfeiture depend on your employment agreement. It’s best to check with your company’s HR department or your legal counsel to understand the details.

Can I deduct the taxes I pay on my RSUs?

Unfortunately, you can’t directly deduct the taxes you pay on your RSUs. However, you can deduct certain expenses related to your job, like travel or continuing education, if they are directly related to your work. Always consult with a tax professional for specific guidance.