Do you need a license to be a business broker? This question is crucial for anyone considering a career in this lucrative field. Navigating the complex world of business brokerage requires understanding the licensing requirements, which vary significantly by state. This guide delves into the specifics of licensing, exploring the different types of licenses, potential exemptions, and the serious consequences of operating without the necessary credentials. We’ll also examine ethical considerations and provide resources to help you find accurate and up-to-date information.

The path to becoming a successful business broker involves more than just a keen business sense; it demands a thorough understanding of the legal landscape. This includes knowing whether or not a license is required in your jurisdiction and, if so, the precise steps to obtain one. Failure to comply with licensing regulations can lead to significant penalties, making this a critical aspect of the profession.

Licensing Requirements by State

The licensing requirements for business brokers vary significantly across the United States. While some states require specific business broker licenses, others may allow individuals to operate under real estate licenses or with no license at all. This variation stems from differing state regulations and the evolving nature of the business brokerage profession. Understanding these nuances is crucial for anyone considering entering this field.

State-Specific Business Broker Licensing Requirements

The following table provides a comparison of licensing needs for business brokers in five states. Note that this information is for general guidance only and should not be considered legal advice. Always consult with the relevant state licensing authority for the most up-to-date and accurate information.

| State | Required License Type | Licensing Body | Application Process Overview |

|---|---|---|---|

| California | Real Estate Broker License (often required) | California Department of Real Estate (DRE) | Requires education, examination, and background check. Specific requirements for business brokerage may vary. |

| Texas | Real Estate License (often sufficient) or Business Broker License (in some cases) | Texas Real Estate Commission (TREC) | Similar to California, involving education, examination, and background check. Specific requirements for business brokerage may vary. |

| New York | Real Estate Broker License (often required) | New York Department of State | Requires extensive education, examination, and background check. Specific requirements for business brokerage may vary. |

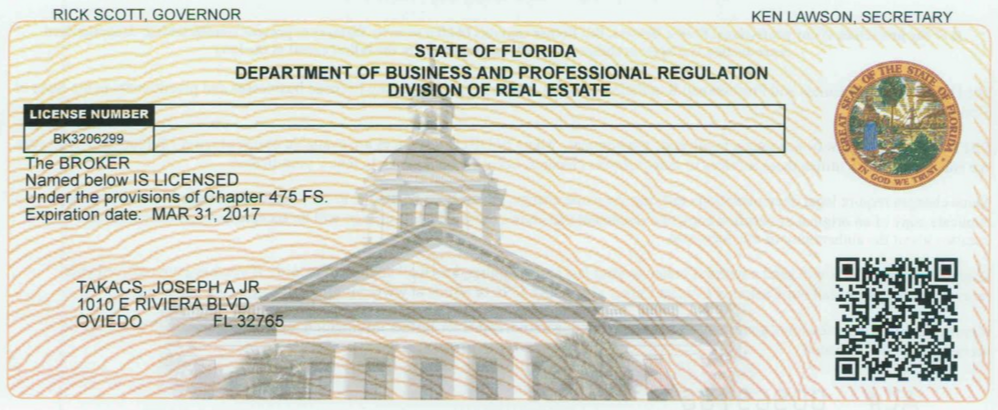

| Florida | Real Estate Broker License (often sufficient) | Florida Real Estate Commission (FREC) | Requires education, examination, and background check. Specific requirements for business brokerage may vary. |

| Illinois | Real Estate Broker License (often sufficient) or Business Broker License (in some cases) | Illinois Department of Financial and Professional Regulation (IDFPR) | Similar to other states, requiring education, examination, and background check. Specific requirements for business brokerage may vary. |

Real Estate Broker License Requirements: California and New York

Obtaining a real estate broker’s license, often a prerequisite or sufficient qualification for business brokerage in many states, involves distinct processes depending on the state. In California, the application process through the DRE typically includes completing a real estate education program, passing a state exam, and undergoing a background check. In New York, the requirements are generally more stringent, often demanding more extensive coursework and a higher passing score on the state examination. Both states require applicants to demonstrate good moral character and financial responsibility. The specific course requirements and exam content differ between the two states, reflecting their unique regulatory frameworks.

Applying for a Business Broker License in Illinois

While a real estate license often suffices in Illinois, some brokers may choose to pursue a specific business broker license. The application process through the IDFPR typically involves submitting an application form, providing proof of education and experience in business brokerage, undergoing a background check, and paying applicable fees. Required documentation might include transcripts, proof of identity, and financial statements. The specific fees and requirements are subject to change and can be found on the IDFPR website. The application process generally involves a thorough review of the applicant’s qualifications and background to ensure they meet the state’s standards for competency and ethical conduct.

Types of Business Broker Licenses

While the core function of a business broker involves facilitating the sale or acquisition of businesses, the specific licensing requirements and designations can vary significantly depending on the location and the nature of the transactions. This complexity arises from the interplay between business brokerage and other regulated professions, such as real estate. Understanding these nuances is crucial for both aspiring and established business brokers.

The licensing landscape for business brokers isn’t uniformly standardized across all jurisdictions. Some states may require a specific business brokerage license, while others might allow real estate brokers to handle business sales under certain conditions, or rely on general business licenses. Furthermore, brokers may choose to pursue additional certifications or designations to enhance their expertise and credibility within the industry.

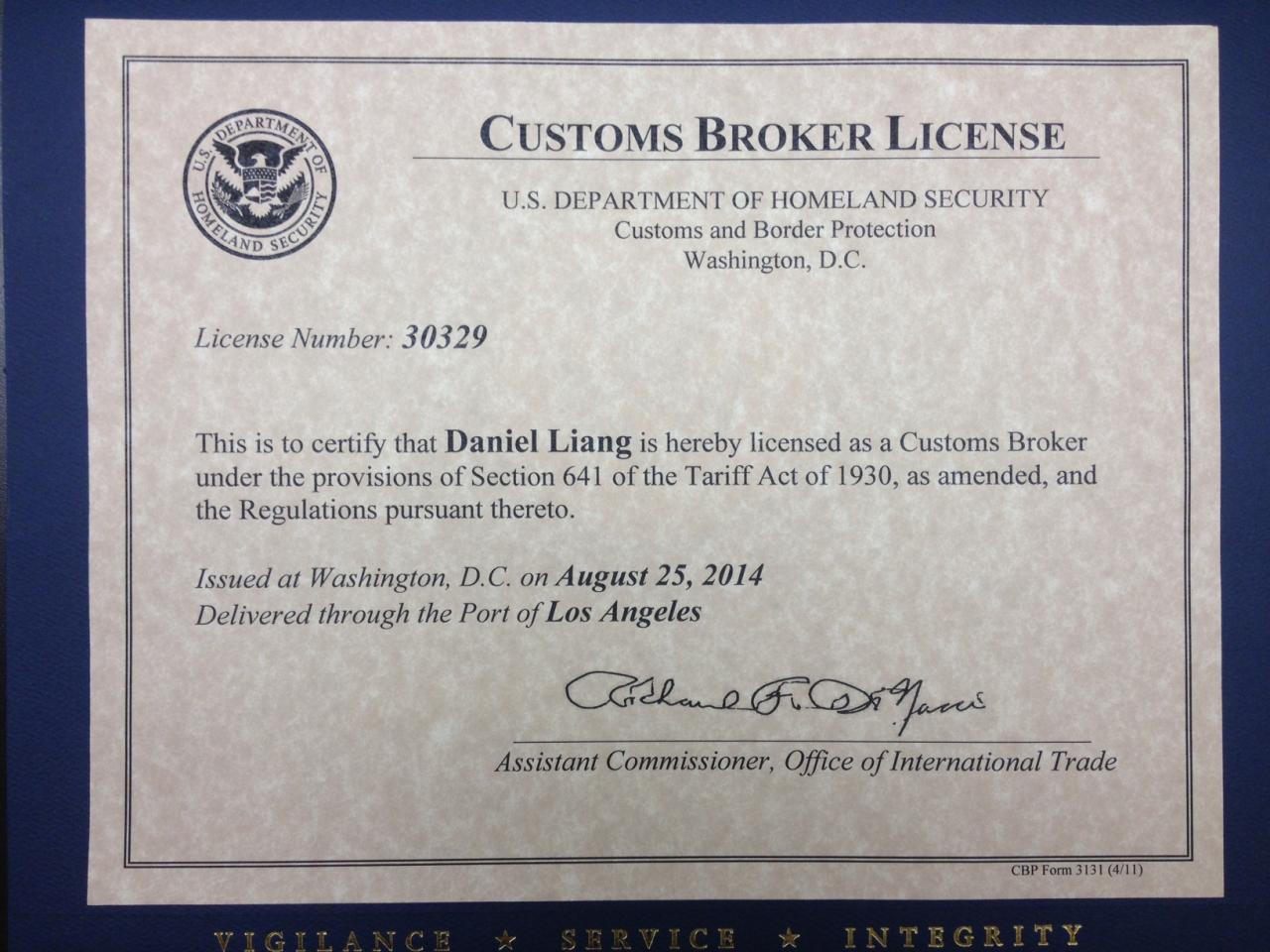

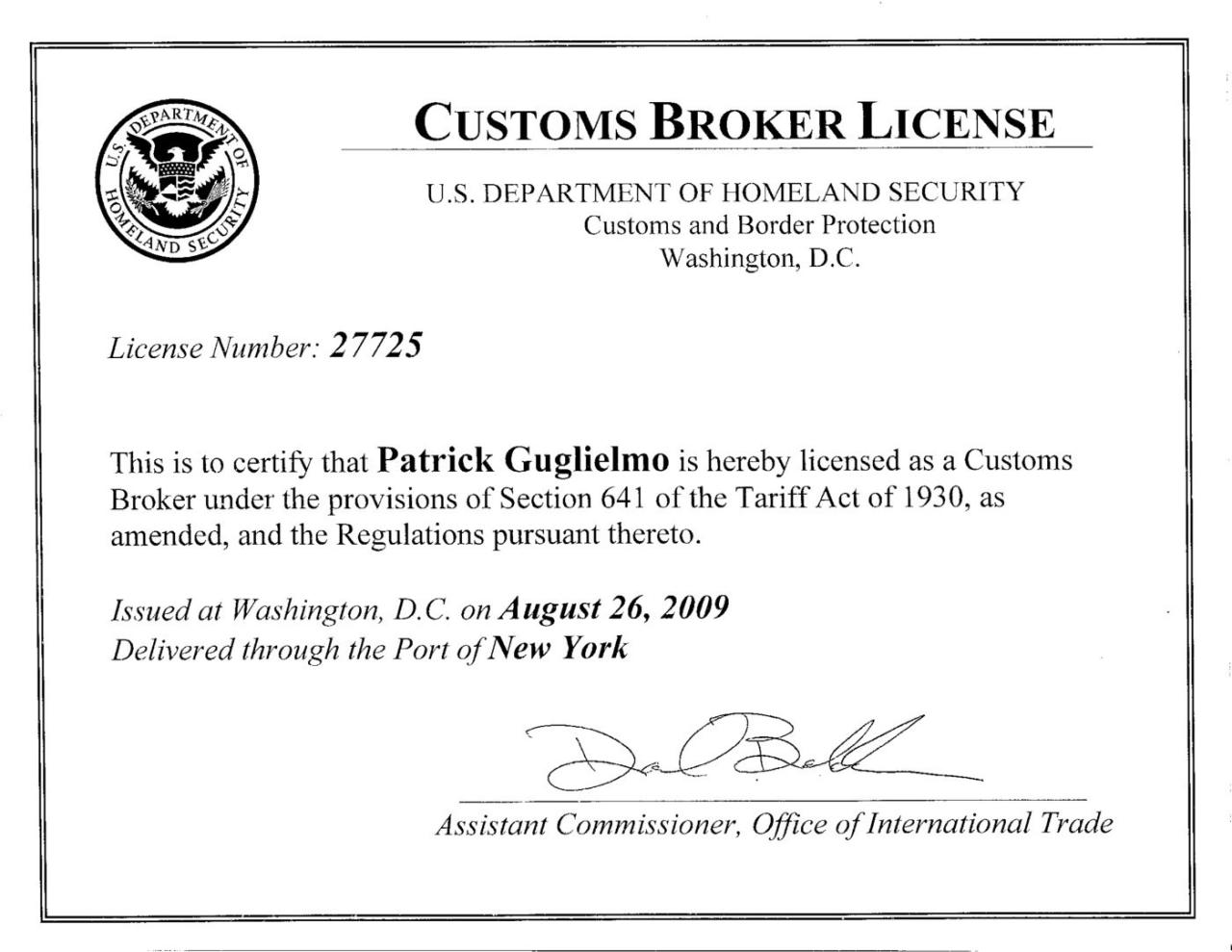

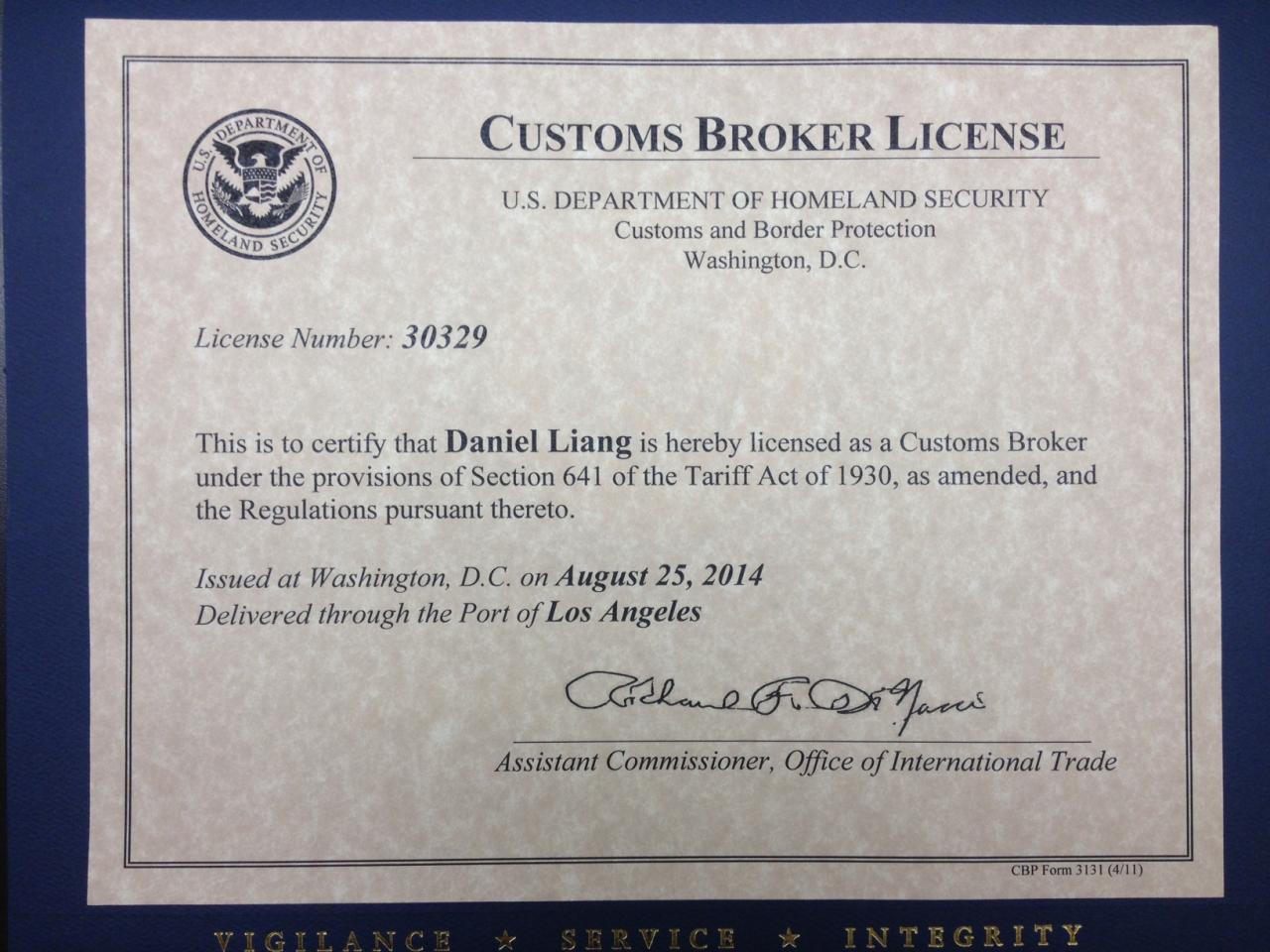

Real Estate Broker Licenses and Business Brokerage

Many business brokers also hold real estate licenses. This is particularly common when the business being sold includes significant real estate holdings, such as a retail store with owned property or a restaurant with leased premises. A real estate license grants the authority to facilitate real estate transactions, which is often a key component of a business sale. However, a real estate license alone doesn’t automatically qualify someone to act as a business broker. The scope of practice differs; a real estate license focuses solely on the real estate aspect of the transaction, while a business brokerage license encompasses the valuation and sale of the entire business entity, including its assets, liabilities, and goodwill, regardless of whether real estate is involved. For instance, a real estate broker might handle the transfer of ownership of the building, while the business broker manages the sale of the business operations, customer lists, and brand.

Additional Licenses and Certifications for Business Brokers

In certain situations, a business broker might need additional licenses beyond the basic business brokerage or real estate license. This frequently depends on the specific industry or type of business being brokered. For example, a broker specializing in the sale of liquor licenses would need to be compliant with all relevant alcohol beverage control regulations and possess any necessary permits. Similarly, brokers dealing with businesses in regulated industries, such as healthcare or finance, may need to comply with industry-specific licensing or registration requirements. These additional licenses demonstrate specialized knowledge and ensure compliance with applicable laws and regulations, adding a layer of credibility and trustworthiness to the broker’s services. Failure to obtain necessary licenses can result in significant legal penalties.

Certified Business Intermediaries (CBI) and Other Designations

Professional organizations within the business brokerage industry offer various certifications and designations, such as the Certified Business Intermediary (CBI) designation. These certifications are voluntary but signal a commitment to professional development and adherence to ethical standards. While not legally required in most jurisdictions, these designations can significantly enhance a broker’s credibility and attract more clients. These certifications often involve completing rigorous training programs, passing examinations, and demonstrating a commitment to ongoing professional development. They signify a higher level of expertise and professionalism within the field.

Exemptions and Exceptions to Licensing

Navigating the world of business brokerage licensing can be complex, as not all individuals or transactions require a license. Understanding the nuances of exemptions and exceptions is crucial for anyone involved in facilitating business sales. This section clarifies the differences and provides examples of situations where a license may not be needed.

The terms “exemption” and “exception” are often used interchangeably, but in the context of business brokerage licensing, they represent distinct legal concepts. An *exemption* describes a specific category of individuals or transactions that are explicitly excluded from the licensing requirements by law. An *exception*, on the other hand, might refer to a situation where a licensing board grants permission for a particular transaction to proceed without a license due to unique circumstances. These exceptions are typically granted on a case-by-case basis and are not codified in the same way as exemptions.

Transactions Exempt from Licensing Requirements

Several types of business transactions commonly fall under exemption clauses within state business brokerage licensing laws. These exemptions are designed to avoid unnecessary regulatory burden on activities that pose minimal risk to the public. The specific exemptions vary by state, so it’s essential to consult the relevant state regulations.

The following are common examples of exempt transactions:

- Sales by Owners: Individuals selling their own businesses, without acting as agents for others, are typically exempt. This exemption recognizes that business owners are selling their own assets and not acting as intermediaries for profit.

- Sales by Employees: Similarly, employees selling their employer’s business, acting solely as an employee and not as an independent broker, are often exempt from licensing requirements. The key distinction lies in the capacity in which the individual acts—as an employee or as a licensed professional.

- Sales by Attorneys and Real Estate Agents: In some states, attorneys and real estate agents may be exempt from business brokerage licensing if the business sale is incidental to their primary professional practice. This exemption is often limited to situations where the business sale is a minor component of their overall services.

- Sales of Assets Only: The sale of individual assets of a business (such as equipment or inventory) without the sale of the entire business entity may fall under an exemption in some jurisdictions. The sale of the business as a going concern, however, would likely require a license.

- Transactions Below a Certain Value: Some states have thresholds for transaction values below which a license is not required. For instance, a state might exempt transactions under $50,000, but this threshold varies significantly between states.

It is crucial to note that even if a transaction seems to fall under an exemption, it’s always advisable to seek legal counsel to ensure compliance with all applicable state regulations. Misinterpreting exemption clauses can lead to significant legal and financial repercussions.

Consequences of Operating Without a License

Operating as a business broker without the required license carries significant legal and financial risks. These consequences can severely impact your business and personal assets, potentially leading to substantial financial penalties and legal repercussions. Understanding these potential outcomes is crucial for anyone considering entering the business brokerage field.

The severity of the consequences varies by state, but generally involves a range of penalties designed to deter unlicensed activity and protect consumers. These penalties aim to compensate for any damages caused by the unlicensed broker’s actions and to prevent future instances of illegal operation. Ignoring licensing requirements exposes brokers to significant liabilities.

Potential Legal and Financial Repercussions

Operating a business brokerage without a license can lead to a variety of legal and financial problems. These problems range from relatively minor administrative penalties to significant legal battles and substantial financial losses. The penalties are designed not only to punish illegal activity but also to deter others from engaging in similar practices. For example, a broker operating without a license might face lawsuits from clients who experienced financial losses due to the broker’s negligence or misconduct. This is because the lack of a license can affect the broker’s credibility and ability to demonstrate competency.

Hypothetical Scenario Illustrating Consequences

Imagine Sarah, an aspiring business broker, decides to start her business without obtaining the necessary license in her state. She successfully brokers the sale of a small bakery for $150,000, earning a commission of $15,000. However, shortly after the sale, the buyer discovers undisclosed liabilities associated with the bakery, leading to significant financial losses. The buyer sues both the seller and Sarah, the unlicensed broker. Because Sarah operated without a license, she lacks the legal protections and insurance typically afforded to licensed brokers. She is found liable for a portion of the buyer’s losses, potentially facing a substantial financial judgment far exceeding her initial commission. Furthermore, she could face administrative fines and legal fees, severely impacting her personal finances and reputation. This scenario highlights the substantial risks involved in operating without the necessary licenses.

Potential Penalties for Unlicensed Operation

The penalties for operating as a business broker without a license vary widely depending on the state and the specifics of the violation. However, several common penalties frequently occur.

- Fines: States typically impose significant monetary fines for operating without a license. These fines can range from several hundred dollars to tens of thousands of dollars, depending on the severity of the violation and the state’s regulations.

- Legal Action: Unlicensed brokers may face lawsuits from clients who have suffered losses due to their actions. These lawsuits can result in significant financial judgments against the broker, potentially including compensation for damages, legal fees, and court costs.

- Injunctions: Courts may issue injunctions, legally prohibiting the unlicensed broker from continuing to operate. This effectively shuts down their business and prevents them from engaging in future brokerage activities.

- Criminal Charges: In some cases, operating without a license can lead to criminal charges, particularly if fraud or other illegal activities are involved. These charges can result in jail time, substantial fines, and a criminal record.

- Loss of Revenue and Reputation: Beyond legal penalties, operating without a license can result in the loss of future revenue and damage to the broker’s reputation, making it difficult to regain credibility and operate legitimately in the future.

Resources for Finding Licensing Information: Do You Need A License To Be A Business Broker

Securing accurate and up-to-date information on business broker licensing is crucial for prospective brokers. Navigating the often complex landscape of state regulations requires a strategic approach, utilizing reliable resources and understanding how to interpret official documentation. This section details key resources and strategies for effectively researching licensing requirements.

Finding the correct information requires diligence. Relying solely on unofficial sources can lead to inaccuracies and potentially costly mistakes. Always prioritize official government websites and recognized professional organizations for the most current and legally sound information.

State Government Websites

Each state maintains its own licensing board or agency responsible for regulating business brokers. These agencies are the primary source for accurate and current licensing information. Their websites typically include detailed requirements, application procedures, fees, and contact information. To find the relevant agency, a simple web search such as “[State Name] business broker license” will usually yield the correct result. For example, searching “California business broker license” will likely lead to the California Department of Real Estate website, which governs real estate brokers, a category often encompassing business brokers. Once on the state’s website, look for sections on “business licenses,” “professional licenses,” “real estate licenses,” or similar terms. Navigation typically involves clicking through menus and submenus to locate the specific licensing information. The website will often provide downloadable forms, application instructions, and frequently asked questions (FAQs) sections. Pay close attention to any specific requirements for education, experience, or examinations.

National Association of Business Brokers (NABB)

The National Association of Business Brokers (NABB) is a valuable resource for individuals interested in the business brokerage industry. While they don’t directly issue licenses, NABB offers educational resources, networking opportunities, and industry best practices. Their website may provide links to state licensing boards or general information on licensing requirements, acting as a useful starting point for your research. NABB’s website can offer a broader understanding of the industry and its standards, which can be helpful in navigating the licensing process.

Other Professional Organizations

Depending on the state and the specific focus of the business brokerage (e.g., mergers and acquisitions), other professional organizations may offer relevant resources or links to state licensing information. These organizations might include industry-specific associations or chambers of commerce. A general internet search focusing on the type of business brokerage and the relevant state will help identify potential resources.

Importance of Verifying Information Through Official Channels, Do you need a license to be a business broker

It is paramount to verify licensing information exclusively through official channels. Unofficial websites, forums, or blog posts may contain outdated, inaccurate, or misleading information. Relying on such sources could lead to incomplete applications, missed deadlines, or even operating illegally. Always cross-reference information found on unofficial websites with the official state licensing board’s website to ensure accuracy. This extra step significantly reduces the risk of errors and ensures compliance with all applicable regulations.

Ethical Considerations for Licensed Brokers

Business brokerage, while offering significant financial rewards, demands unwavering adherence to a strict ethical code. Licensed brokers act as fiduciaries, entrusted with sensitive financial and business information, and their actions directly impact the livelihoods of buyers and sellers. Maintaining ethical standards is not merely a matter of professional reputation; it’s crucial for building trust and ensuring the integrity of the marketplace.

Ethical responsibilities extend beyond legal compliance; they encompass a commitment to fairness, honesty, and transparency in all aspects of the brokerage process. This includes diligent representation of clients’ interests, meticulous due diligence, and accurate disclosure of all material information. Failure to uphold these ethical standards can result in significant legal and reputational consequences.

Transparency and Disclosure in Business Brokerage Transactions

Transparency and full disclosure are cornerstones of ethical business brokerage. Brokers must proactively disclose any potential conflicts of interest, material facts about the business being sold (including financial information, legal issues, and operational challenges), and any relevant information that could influence a buyer’s decision. This includes both positive and negative aspects of the business. Withholding information, even if seemingly insignificant, can constitute a breach of ethical conduct and lead to legal repercussions. For example, a broker who knows about pending litigation against the business but fails to disclose this information to a potential buyer is acting unethically. Similarly, failing to disclose a significant decline in sales figures, even if explained, is a breach of trust and a potential legal liability. Open and honest communication builds trust and helps ensure that both buyers and sellers make informed decisions.

Examples of Ethical Dilemmas and Their Resolution

Business brokers often face complex ethical dilemmas. One common scenario involves a broker representing both the buyer and the seller in a transaction. While permissible in some jurisdictions with full disclosure and informed consent from both parties, this presents a significant conflict of interest. The broker must prioritize the best interests of both clients equally, which can be challenging. A proper resolution would involve complete transparency regarding potential conflicts and obtaining explicit written consent from both parties, ideally with separate representation for each party to ensure impartial advice.

Another dilemma might arise if a broker receives a significantly higher commission for selling a business to a specific buyer, even if another buyer offers a better price. This situation requires the broker to prioritize the client’s best financial interests over personal gain. The ethical solution is to disclose all offers to the client and let them make the final decision, regardless of the commission implications.

A further example involves the discovery of a hidden liability within a business during the due diligence process. The broker has an ethical obligation to inform both the buyer and the seller, even if it might jeopardize the deal. The ethical course of action involves full disclosure to all parties involved, allowing them to assess the situation and decide how to proceed. This maintains the broker’s integrity and fosters trust in the marketplace.