How is business? This seemingly simple question unlocks a world of complexity, encompassing everything from a casual check-in with a friend to a deep dive into macroeconomic analysis. Understanding the multifaceted nature of “how is business” requires examining financial performance, operational efficiency, market positioning, and employee morale – all crucial elements of a thriving enterprise. This guide explores these aspects and more, providing a framework for assessing business health and charting a course for future success.

We’ll delve into key performance indicators (KPIs), explore the impact of external factors like inflation and competition, and examine the role of technology in shaping modern business operations. We’ll also cover strategies for improving efficiency, visualizing performance data effectively, and adapting to changing market dynamics. Whether you’re a seasoned entrepreneur or just starting out, this comprehensive guide offers valuable insights into the intricate world of business health and growth.

Defining “How is Business?”

The seemingly simple phrase “How is business?” belies a multifaceted query, encompassing a broad spectrum of aspects related to a company’s performance and overall health. Its meaning and interpretation vary significantly depending on the context, ranging from casual conversation to formal business analysis. Understanding the nuances of this question is crucial for effective communication and strategic decision-making.

The phrase’s ambiguity allows it to function as a broad inquiry into a company’s well-being. It can be used informally among colleagues to gauge the general atmosphere, or formally in board meetings to assess overall financial health. Economists might use similar phrasing to analyze the performance of an entire industry or sector, assessing factors like growth rates, profitability, and market share.

Contexts of Use for “How is Business?”

The interpretation of “How is business?” is heavily influenced by the context in which it is used. In informal settings, such as a casual conversation between acquaintances involved in similar industries, it serves as a general icebreaker, allowing for an exchange of anecdotal observations about market trends or personal experiences. However, in formal business settings, like investor meetings or quarterly reports, the question demands a more precise and data-driven response, focusing on key performance indicators (KPIs) and strategic objectives. Economic analysis might use the concept to assess the health of an entire industry, examining factors like employment levels, investment, and overall economic contribution.

Aspects of Business Encompassed by “How is Business?”

The question “How is business?” can encompass a wide range of aspects. Financial performance, a critical component, includes metrics such as revenue, profitability (net income, operating margin), and cash flow. Operational efficiency examines how effectively resources are used to achieve business objectives, considering factors like productivity, inventory management, and supply chain performance. Market position assesses the company’s standing within its industry, including market share, brand recognition, and competitive advantage. Finally, employee morale plays a significant role, as a motivated and engaged workforce contributes directly to overall productivity and success. A low employee morale can negatively impact all other aspects of the business. For example, a company with strong financial performance but low employee morale might be vulnerable to high turnover and reduced long-term sustainability.

Assessing Business Health: How Is Business

Understanding the health of a business is crucial for informed decision-making. A comprehensive assessment goes beyond simply looking at profit margins; it requires a holistic view encompassing various financial and operational aspects. Regularly evaluating these key indicators allows businesses to identify potential problems early, implement corrective actions, and ultimately improve their chances of long-term success.

Methods for Evaluating Business Health

Several methods can be employed to gauge the overall health of a business. These methods provide different perspectives, and using a combination offers a more complete picture than relying on a single metric. The choice of methods will depend on the specific industry, business size, and the goals of the assessment.

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Financial Ratio Analysis | Examining key financial ratios like profitability ratios (gross profit margin, net profit margin), liquidity ratios (current ratio, quick ratio), and solvency ratios (debt-to-equity ratio). | Provides a quantitative assessment of financial performance and risk; allows for comparison to industry benchmarks. | Can be misleading if used in isolation; requires understanding of the context and industry specifics; historical data may not accurately reflect current performance. |

| Cash Flow Analysis | Tracking the movement of cash into and out of the business over a specific period. | Highlights the business’s ability to meet its short-term obligations; identifies potential cash flow problems early. | Can be complex to analyze, especially for businesses with multiple revenue streams; doesn’t always reflect profitability. |

| Customer Satisfaction Surveys | Gathering feedback from customers through surveys, reviews, or focus groups. | Provides valuable insights into customer perception and loyalty; identifies areas for improvement in products or services. | Can be subjective; may not accurately reflect the overall customer base; requires careful design and analysis. |

| Market Analysis | Assessing the competitive landscape, market trends, and customer demographics. | Identifies opportunities and threats; helps inform strategic decision-making. | Can be time-consuming and expensive; requires expertise in market research. |

Hypothetical Scenario: Struggling Business

Imagine “Coffee Corner,” a local cafe experiencing declining sales and profitability. Applying the above methods reveals the following:

* Financial Ratio Analysis: Shows a low net profit margin, high debt-to-equity ratio, and declining current ratio, indicating poor profitability, high financial risk, and potential liquidity problems.

* Cash Flow Analysis: Reveals inconsistent cash inflows, with significant outflows exceeding inflows in recent months, pointing to a cash crunch.

* Customer Satisfaction Surveys: Indicate declining customer satisfaction due to inconsistent coffee quality and slow service.

* Market Analysis: Shows increased competition from larger chains and changing consumer preferences towards healthier beverage options.

This comprehensive assessment allows Coffee Corner to identify the root causes of its struggles – poor operational efficiency, declining customer satisfaction, and intense competition. This information can then be used to develop a turnaround strategy, perhaps focusing on improving operational processes, enhancing customer service, and diversifying its menu offerings.

Analyzing Business Performance Indicators

Understanding and interpreting key performance indicators (KPIs) is crucial for effective business management. KPIs provide quantifiable measures of a company’s progress toward its strategic goals, allowing for data-driven decision-making and strategic adjustments. By tracking and analyzing these metrics, businesses can identify areas of strength and weakness, optimize operations, and ultimately enhance profitability and growth.

Analyzing various KPIs provides a comprehensive view of business health, revealing trends and patterns that might not be apparent through qualitative assessments alone. The selection of appropriate KPIs depends heavily on the specific industry, business model, and strategic objectives.

Key Performance Indicators and Their Significance

Several key performance indicators are commonly used to assess business performance across various functional areas. Their significance lies in their ability to provide actionable insights into operational efficiency, profitability, and market positioning.

- Revenue Growth: This measures the percentage increase or decrease in revenue over a specific period. High revenue growth indicates strong market demand and effective sales strategies. Conversely, declining revenue may signal the need for adjustments to pricing, product offerings, or marketing efforts. For example, a company experiencing consistent 15% year-over-year revenue growth is demonstrating robust market performance.

- Customer Acquisition Cost (CAC): This represents the total cost of acquiring a new customer. A high CAC can indicate inefficient marketing or sales processes. Companies strive to lower CAC while maintaining a healthy customer acquisition rate. A successful marketing campaign might reduce CAC by 20%, indicating improved efficiency.

- Customer Churn Rate: This metric quantifies the percentage of customers who stop using a company’s products or services within a given period. High churn rates suggest issues with customer satisfaction, product quality, or competitive pressures. A low churn rate, say below 5%, suggests high customer loyalty and retention.

- Net Promoter Score (NPS): This measures customer loyalty and satisfaction by asking customers how likely they are to recommend a company’s products or services to others. A high NPS score indicates strong brand advocacy and customer satisfaction. An NPS above 70 is generally considered excellent.

- Return on Investment (ROI): This crucial metric measures the profitability of an investment relative to its cost. High ROI indicates successful investment decisions, while low ROI may suggest the need for reevaluation of resource allocation. A project with a 25% ROI is significantly more attractive than one with a 5% ROI.

KPI Measurement Approaches

Different approaches exist for measuring KPIs, each with its own strengths and weaknesses. The choice of approach depends on factors such as data availability, resources, and the specific KPI being measured.

- Quantitative Measurement: This involves using numerical data to measure KPIs. This approach is objective and provides precise results, but may not capture the full complexity of the business environment. For example, measuring revenue growth as a percentage change provides a clear, quantitative measure.

- Qualitative Measurement: This approach uses descriptive data, such as customer feedback or market research, to assess KPIs. It offers valuable context and insights, but may be subjective and difficult to quantify. Customer satisfaction surveys, for instance, provide qualitative data on customer experiences.

- Benchmarking: This involves comparing a company’s KPIs to those of its competitors or industry averages. Benchmarking helps identify areas for improvement and provides a competitive context for performance evaluation. Comparing a company’s customer churn rate to the industry average reveals its relative performance in customer retention.

Exploring External Factors Affecting Business

Understanding a business’s internal operations is crucial, but equally important is recognizing the significant influence of external factors. These external forces, often beyond a company’s direct control, can profoundly impact profitability, growth, and even survival. This section examines key external elements and their effects on business performance.

Macroeconomic factors exert a powerful influence on businesses of all sizes. Fluctuations in these factors can create both opportunities and challenges.

Macroeconomic Factor Impacts on Business Performance

Inflation, interest rates, and economic growth are three primary macroeconomic indicators that significantly affect business performance. High inflation erodes purchasing power, potentially leading to decreased consumer demand and higher input costs for businesses. Rising interest rates increase borrowing costs, making expansion and investment more expensive. Conversely, periods of strong economic growth typically boost consumer spending and business investment, creating a favorable environment for expansion. For example, during periods of high inflation, businesses might experience squeezed profit margins due to rising input costs if they are unable to pass these costs on to consumers through price increases. Similarly, a rise in interest rates could deter a small business from taking out a loan to expand its operations. Conversely, a period of robust economic growth could see a surge in demand for a particular product, allowing businesses to increase production and profits.

Competitive Landscape and Industry Trends

The competitive landscape and prevailing industry trends are equally crucial. A highly competitive market may necessitate aggressive pricing strategies, increased marketing efforts, and continuous innovation to maintain market share. Emerging industry trends, such as technological advancements or shifts in consumer preferences, can present both opportunities and threats. Businesses that fail to adapt to these changes risk becoming obsolete. For instance, the rise of e-commerce significantly disrupted the traditional retail industry, forcing many brick-and-mortar stores to adapt their business models or face closure. The emergence of sustainable and ethically sourced products in various industries is another example of a trend forcing businesses to adapt their practices or risk losing market share to competitors who embrace these values.

Hypothetical Scenario: External Factor Impact on a Coffee Shop

Imagine a small, independent coffee shop. Suppose inflation unexpectedly spikes, increasing the cost of coffee beans, milk, and other supplies. Simultaneously, interest rates rise, making it more expensive to renew the shop’s lease or invest in new equipment. Furthermore, a large national coffee chain opens a location nearby, intensifying competition. These combined external factors – inflation, rising interest rates, and increased competition – could significantly reduce the coffee shop’s profitability. The shop might need to raise prices, potentially losing price-sensitive customers, or cut costs, which could impact quality or service. Without effective adaptation, the shop could struggle to remain viable.

Internal Business Operations and Efficiency

Efficient internal operations are the backbone of a successful business. Streamlined processes, optimized workflows, and effective resource allocation directly impact profitability, productivity, and overall competitive advantage. Understanding and improving these internal functions is crucial for sustainable growth.

Efficient internal business processes are characterized by their speed, accuracy, and cost-effectiveness. They minimize wasted time and resources, ensuring that tasks are completed smoothly and effectively. This leads to improved employee morale, increased customer satisfaction, and ultimately, higher profits. The impact of efficient operations extends beyond immediate productivity gains; it contributes to a stronger company culture, better risk management, and enhanced adaptability to changing market conditions.

Examples of Efficient Internal Business Processes

Several processes can significantly boost a company’s efficiency. These include inventory management systems that minimize stockouts and overstocking, automated invoicing and payment processing systems that reduce administrative overhead, and streamlined communication channels that ensure quick and clear information flow. Effective project management methodologies, such as Agile or Scrum, can also significantly improve efficiency by optimizing resource allocation and promoting collaboration.

Contribution of Efficient Processes to Business Success

Efficient internal processes directly contribute to improved financial performance. Reduced operational costs, increased output, and faster turnaround times all translate into higher profit margins. Furthermore, efficient processes enhance customer satisfaction through faster delivery times, improved service quality, and reduced errors. This leads to increased customer loyalty and positive word-of-mouth marketing, further boosting business success. Internally, efficient processes improve employee morale and productivity by reducing frustration and workload, fostering a more positive and productive work environment.

Strategies for Improving Operational Efficiency

Improving operational efficiency requires a multifaceted approach. This includes identifying bottlenecks in current processes through process mapping and analysis. Technology plays a crucial role; implementing automation tools, such as CRM systems or ERP software, can significantly streamline workflows and reduce manual effort. Employee training and development are also essential; empowering employees with the necessary skills and knowledge to perform their tasks efficiently is vital. Regular process reviews and adjustments, based on performance data and feedback, are necessary to maintain efficiency and adapt to changing business needs. For example, a company might implement a lean manufacturing methodology to eliminate waste in its production process, leading to significant cost savings and increased output.

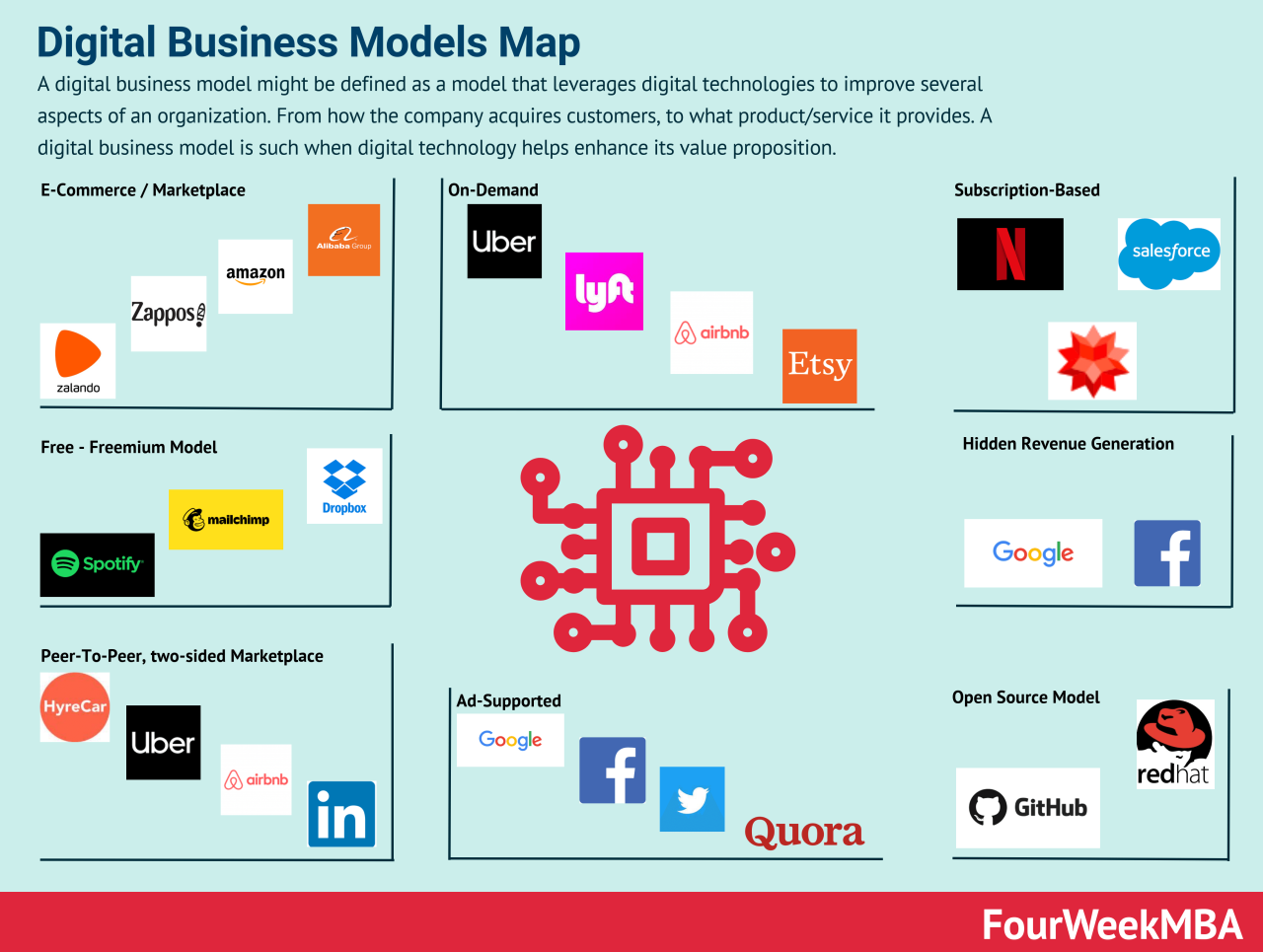

The Role of Technology in Business

Technology is fundamentally reshaping the business landscape, impacting every aspect from operations and marketing to customer service and product development. Its pervasive influence necessitates a thorough understanding of both its advantages and inherent challenges for businesses of all sizes. Failure to adapt to technological advancements can lead to obsolescence and loss of competitive edge in today’s rapidly evolving market.

Technology’s transformative impact on business operations is multifaceted and profound. It streamlines processes, improves efficiency, and opens up new avenues for growth and innovation. However, successful integration requires careful planning, investment, and a skilled workforce capable of leveraging these tools effectively.

Technological Transformation of Business Operations

The integration of technology is altering how businesses operate across various departments. This includes increased automation, improved data analysis capabilities, and enhanced communication and collaboration tools. For example, the shift towards cloud computing allows businesses to access and share data remotely, fostering greater flexibility and scalability. Similarly, the implementation of CRM (Customer Relationship Management) systems improves customer service and allows for personalized marketing campaigns. The use of AI and machine learning is automating tasks, improving decision-making processes, and creating new opportunities for innovation.

Benefits of Technological Adoption in Business

Technological adoption offers numerous benefits, contributing significantly to increased profitability and sustained competitiveness. These advantages span various areas of business function.

- Increased Efficiency and Productivity: Automation of repetitive tasks frees up human resources for more strategic initiatives, leading to significant gains in productivity. For example, automated inventory management systems reduce errors and optimize stock levels.

- Improved Decision-Making: Data analytics tools provide businesses with real-time insights into performance, allowing for data-driven decision-making and improved strategic planning. This can lead to more effective resource allocation and enhanced profitability.

- Enhanced Customer Experience: Technologies such as CRM systems and personalized marketing tools enable businesses to deliver superior customer service and create more engaging customer experiences, fostering loyalty and repeat business. Examples include chatbots providing instant support and targeted email campaigns based on customer preferences.

- Cost Reduction: Automation and streamlined processes often result in significant cost savings through reduced labor costs, improved efficiency, and minimized errors. Cloud computing, for instance, can reduce IT infrastructure costs.

- New Revenue Streams: Technology can open up new avenues for revenue generation, such as through the development of new products and services, expansion into new markets, and the creation of innovative business models. Examples include subscription-based services and the use of e-commerce platforms.

Challenges of Technological Adoption in Business

While the benefits of technology are substantial, businesses face several challenges during the adoption process. Overcoming these obstacles is crucial for successful implementation.

- High Initial Investment Costs: Implementing new technologies often requires significant upfront investment in hardware, software, training, and infrastructure. This can be a major barrier for smaller businesses with limited resources.

- Integration Complexity: Integrating new technologies with existing systems can be complex and time-consuming, requiring specialized expertise and potentially causing disruptions to operations during the transition.

- Security Risks: Increased reliance on technology exposes businesses to a wider range of cybersecurity threats, necessitating robust security measures and ongoing monitoring to protect sensitive data.

- Skills Gap: The successful adoption and utilization of new technologies require a skilled workforce capable of operating and maintaining the systems. A shortage of qualified personnel can hinder the process.

- Resistance to Change: Employees may resist adopting new technologies due to concerns about job security, lack of training, or difficulty adapting to new processes. Effective change management strategies are essential to overcome this resistance.

Visualizing Business Performance

Data visualization is crucial for understanding and communicating the health of a business. By transforming raw data into easily digestible visual formats, key trends and patterns become readily apparent, facilitating better decision-making and improved stakeholder communication. Effective visualization allows for a quick grasp of complex information, highlighting areas of success and areas needing improvement.

Effective data visualization transforms complex business metrics into easily understandable charts and graphs. This allows for quicker identification of trends, patterns, and outliers, enabling data-driven decision-making. Choosing the right visualization type depends on the data and the message being conveyed. For example, line charts effectively showcase trends over time, while bar charts compare different categories. Pie charts illustrate proportions, and scatter plots reveal correlations between variables. The key is to select a visualization method that accurately and clearly represents the data, avoiding misleading or overly complex representations.

Chart and Graph Selection for Business Metrics, How is business

The selection of appropriate charts and graphs is paramount for effective communication. Line graphs are ideal for displaying trends over time, such as revenue growth or website traffic. Bar charts are excellent for comparing different categories, such as sales performance across different product lines or marketing campaign effectiveness. Pie charts effectively illustrate proportions, for instance, the market share of a company or the distribution of customer demographics. Scatter plots are useful for identifying correlations between two variables, such as advertising spend and sales revenue. Heatmaps can be used to visualize large datasets, highlighting areas of high and low performance. The choice should always align with the data and the message being communicated. For instance, showing year-over-year revenue growth is best done with a line graph, while comparing sales figures across different regions is better suited to a bar chart.

The Importance of Data Visualization in Communication

Data visualization plays a critical role in communicating business performance effectively to various stakeholders, including investors, employees, and management. Visual representations simplify complex datasets, making them easier to understand and interpret, even for those without extensive analytical skills. A well-designed visualization can quickly highlight key findings, such as revenue growth, cost reductions, or market share changes, facilitating faster and more informed decision-making. Furthermore, visual representations can enhance engagement and improve the understanding and retention of information compared to presenting data solely in tabular or textual formats. This leads to more effective communication and collaboration within the organization.

Visual Representation of Hypothetical Business Growth

Imagine a hypothetical startup, “InnovateTech,” selling software solutions. Their growth over five years can be visually represented using a line graph. The X-axis would represent the years (Year 1, Year 2, Year 3, Year 4, Year 5), and the Y-axis would represent revenue in millions of dollars. The line would start at a low point in Year 1, perhaps $0.5 million, then gradually increase, showing steeper growth in Year 3 and Year 4, reaching $3 million in Year 4 and then leveling off slightly to $3.5 million in Year 5. This visual representation clearly illustrates InnovateTech’s growth trajectory, highlighting periods of rapid expansion and periods of stabilization. The graph could be further enhanced with annotations to indicate key events that influenced growth, such as a successful product launch or a new strategic partnership. A visually appealing color scheme and clear labeling would ensure easy readability and understanding.

Business Strategies and Future Outlook

Understanding a business’s strategies and future outlook is crucial for sustained success. A well-defined strategy, adaptable to market shifts, is the cornerstone of long-term viability. This section explores successful strategies, adaptation methods, and key factors contributing to enduring business prosperity.

Successful business strategies often hinge on a clear understanding of the market, the competitive landscape, and the business’s unique strengths. A well-executed strategy allows a company to leverage its resources efficiently, achieve sustainable growth, and maintain a competitive edge. This requires continuous monitoring, evaluation, and adjustment based on performance data and market intelligence.

Successful Business Strategy Examples

Several business strategies have proven effective across various industries. For instance, Amazon’s focus on customer experience and relentless innovation has propelled its dominance in e-commerce. Their strategy of prioritizing customer satisfaction, investing heavily in technology, and expanding into diverse markets has resulted in unparalleled growth. Conversely, Southwest Airlines’ low-cost carrier model, focused on operational efficiency and point-to-point routes, has consistently outperformed competitors in its niche. This demonstrates the power of focusing on a specific market segment and optimizing operations for that segment. Finally, Apple’s brand-building strategy, centered on design, innovation, and a premium customer experience, has created exceptional brand loyalty and sustained high profit margins. These examples highlight the diversity of successful strategies, each tailored to the specific business and its market.

Adapting to Changing Market Conditions

The ability to adapt to changing market conditions is paramount for long-term survival. Businesses must be agile and responsive to shifts in consumer preferences, technological advancements, and economic fluctuations. This involves implementing robust market research methodologies to identify emerging trends and potential threats. Furthermore, companies must cultivate a culture of innovation and experimentation, allowing them to quickly develop new products and services to meet evolving customer needs. For example, the rise of e-commerce forced many brick-and-mortar retailers to adapt by integrating online sales channels and enhancing their digital presence. Those who failed to adapt quickly faced significant challenges or even closure. Companies that proactively anticipate and respond to change are better positioned to navigate uncertainty and capitalize on new opportunities.

Factors Contributing to Long-Term Business Success

Long-term business success is a multifaceted achievement, dependent on several interconnected factors. A strong and adaptable business model is fundamental, providing a clear framework for operations and growth. Furthermore, a skilled and motivated workforce is essential for innovation and efficient execution of the business strategy. Effective leadership, capable of guiding the business through challenges and opportunities, is also crucial. Finally, a commitment to ethical practices and corporate social responsibility fosters trust with stakeholders and builds a positive brand image. Continuous investment in research and development fuels innovation and keeps the business competitive. These combined factors create a robust foundation for sustainable growth and long-term success.