How to open an escrow account for business use? Securing transactions and protecting funds is paramount for any business. This comprehensive guide navigates you through the process of establishing a secure escrow account, from choosing the right provider to managing your funds effectively. We’ll explore the various types of escrow accounts, the legal considerations, and best practices for maintaining security and compliance. Understanding escrow accounts can significantly reduce risk and streamline your business dealings.

This guide will equip you with the knowledge and steps needed to confidently open and manage a business escrow account, allowing you to focus on growing your business while minimizing financial risks. We’ll cover everything from selecting a reputable provider and navigating the account opening process to understanding the associated fees and adhering to regulatory compliance. By the end, you’ll have a clear understanding of how to leverage escrow accounts for secure and efficient business transactions.

Understanding Escrow Accounts for Businesses

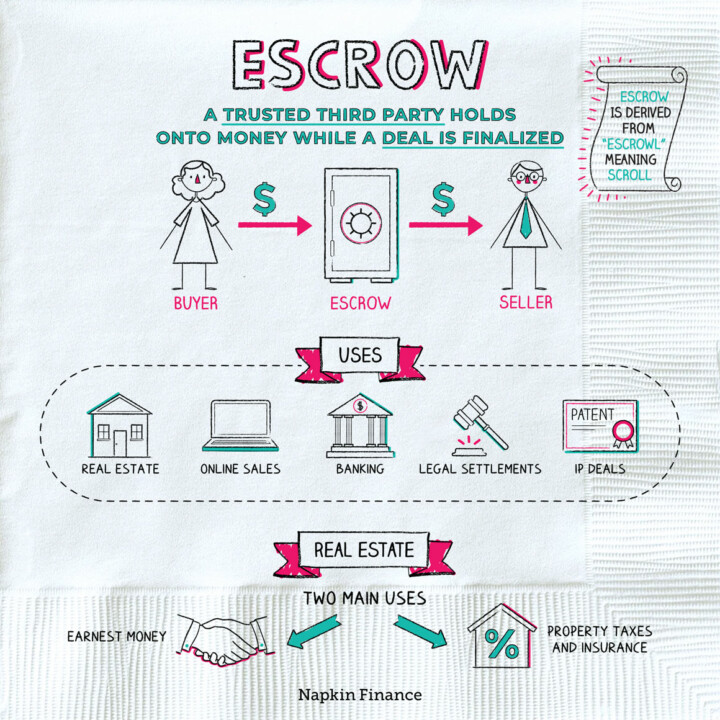

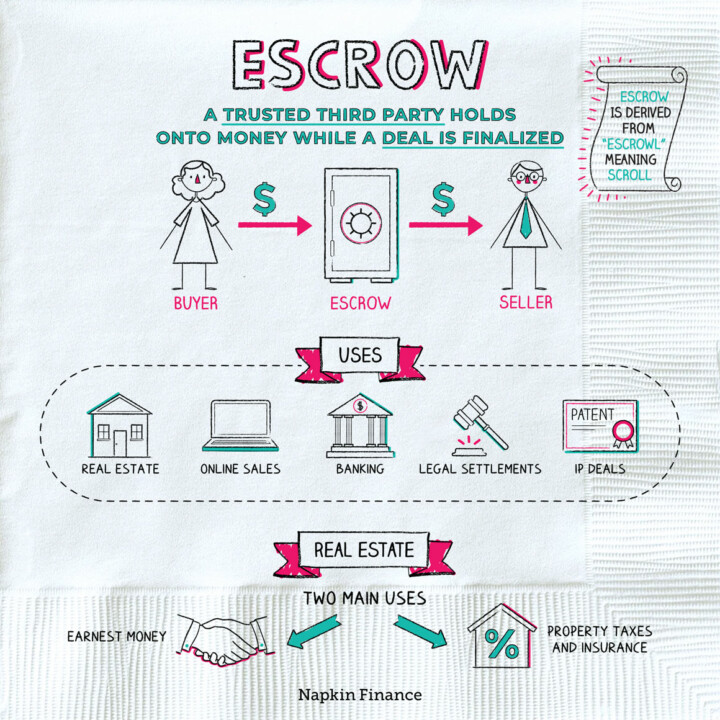

Escrow accounts serve a crucial role in mitigating risk and ensuring secure transactions for businesses. They act as a neutral third-party holding account, safeguarding funds until specific conditions of a contract are met. This protects both buyers and sellers, fostering trust and transparency in various business dealings.

Escrow accounts differ significantly from traditional business bank accounts in their purpose and functionality. While a traditional account facilitates everyday business transactions, an escrow account is specifically designed for holding funds conditionally, thereby reducing the risk of fraud or disputes.

Types of Business Escrow Accounts

Several types of escrow accounts cater to diverse business needs. The specific type chosen depends heavily on the nature of the transaction and the level of complexity involved. Choosing the right type is crucial for optimizing security and efficiency.

- Real Estate Escrow Accounts: These are commonly used in real estate transactions, holding the buyer’s down payment and other funds until the closing process is complete and all conditions of the sale are satisfied.

- Merger and Acquisition Escrow Accounts: These accounts are utilized in larger business transactions, such as mergers and acquisitions, holding funds related to the purchase price until all due diligence and regulatory approvals are finalized.

- Construction Escrow Accounts: These are frequently used in construction projects, holding payments to contractors until milestones are met and work is verified.

- Online Marketplace Escrow Accounts: Many online marketplaces use escrow accounts to protect buyers and sellers from fraud. Funds are held until the buyer receives and confirms the satisfactory condition of the goods or services.

Comparison of Escrow and Traditional Business Accounts

A table helps to clearly illustrate the key differences between escrow and traditional business accounts:

| Feature | Escrow Account | Traditional Business Account |

|---|---|---|

| Purpose | Conditional holding of funds | General business transactions |

| Access | Restricted access until conditions are met | Unrestricted access |

| Risk | Lower risk of fraud and disputes | Higher risk of fraud and disputes |

| Fees | Typically involves escrow fees | Typically involves standard banking fees |

| Transparency | High transparency due to third-party involvement | Transparency depends on the account type and bank policies |

Business Scenarios Benefiting from Escrow Accounts

Several business scenarios demonstrate the advantages of using escrow accounts. Their application enhances security and builds trust in transactions where significant financial risks are involved.

- Large-scale equipment purchases: An escrow account can safeguard the buyer’s payment until the equipment is delivered and inspected, ensuring it meets specifications.

- Franchise agreements: Escrow can hold franchise fees until the franchisor fulfills all contractual obligations.

- International transactions: Escrow accounts mitigate risks associated with cross-border payments and currency exchange fluctuations.

- Online sales of high-value goods: Protecting both the buyer and seller from potential fraud, especially in situations with significant monetary value.

Choosing an Escrow Provider

Selecting the right escrow provider is crucial for the smooth and secure operation of your business’s escrow transactions. A poorly chosen provider can lead to delays, disputes, and even financial losses. Careful consideration of several key factors will ensure you choose a provider that meets your specific needs and minimizes risk.

Key Factors in Escrow Provider Selection

Several critical factors must be weighed when choosing an escrow provider. These factors encompass the provider’s financial stability, security protocols, service features, fees, and legal compliance. A thorough evaluation across these dimensions is essential for mitigating potential risks and ensuring a positive escrow experience.

Escrow Service Provider Comparison

The following table compares three hypothetical escrow service providers, highlighting their key features and fees. Remember that these are examples, and actual provider offerings and pricing may vary. Always verify the current information directly with the provider.

| Provider | Annual Fee | Transaction Fee | Key Features |

|---|---|---|---|

| EscrowCo | $100 | 1% of transaction value | High security, dispute resolution services, international transactions |

| SecureEscrow | $50 | 1.5% of transaction value, minimum $25 | User-friendly interface, fast processing, 24/7 customer support |

| EasyEscrow | Free | 2% of transaction value, minimum $50 | Basic escrow services, limited customer support |

Provider Reputation and Security Measures

Thoroughly researching the reputation and security measures of potential providers is paramount. Check online reviews and testimonials from other businesses to gauge their experiences. Look for providers with robust security protocols, including encryption, fraud detection systems, and regular security audits. Consider providers who are compliant with relevant industry standards and regulations, such as PCI DSS for payment card processing. A strong reputation and commitment to security will help protect your business and your clients’ funds.

Legal and Regulatory Considerations

Choosing an escrow provider involves legal and regulatory considerations. Ensure the provider is licensed and operates legally in your jurisdiction. Understand the provider’s terms of service, including dispute resolution processes and liability limitations. Compliance with relevant laws and regulations, such as those related to money laundering and anti-terrorism financing, is critical. Consulting with legal counsel may be beneficial to ensure compliance and protect your business interests.

Opening an Escrow Account

Opening a business escrow account involves several crucial steps to ensure secure and compliant handling of funds. This process safeguards both buyers and sellers in transactions, providing a neutral third-party holding account. Understanding these steps is vital for maintaining financial integrity and minimizing risk.

Required Documentation and Information

Gathering the necessary documentation before initiating the application process streamlines the account opening procedure. Incomplete applications often lead to delays. Having all the required information readily available saves time and ensures a smooth transition.

- Business Legal Structure: Provide documentation verifying your business’s legal structure (e.g., LLC operating agreement, corporation articles of incorporation, sole proprietorship documentation).

- Business Registration: Submit proof of business registration with the relevant state or federal authorities (e.g., EIN, business license).

- Identification: Provide government-issued photo identification for all authorized signatories on the account.

- Bank Information: Supply details of your existing business bank account for funding and disbursement purposes.

- References: Some escrow providers may request business or banking references.

Step-by-Step Account Opening Process

The process of opening a business escrow account varies slightly depending on the provider, but generally follows a consistent pattern. Following these steps will help ensure a successful application.

- Choose an Escrow Provider: Select a reputable escrow provider based on your needs and research (as discussed in the previous section).

- Complete the Application: Carefully fill out the application form provided by your chosen provider, ensuring accuracy in all fields.

- Submit Documentation: Upload or mail the required documentation as specified by the provider. Maintain copies for your records.

- Account Review: The provider will review your application and documentation. This process may take several business days.

- Account Activation: Once approved, your escrow account will be activated, and you will receive account access details.

- Initial Funding (Optional): Depending on your transaction needs, you may need to fund the account initially.

Pre-Application Checklist

Preparing beforehand minimizes delays and ensures a smoother application process. This checklist helps organize your efforts.

- Research and select an escrow provider.

- Gather all required business documentation.

- Confirm the identity of all authorized signatories.

- Understand the provider’s fees and terms of service.

During Application Checklist

Maintaining accuracy and organization during the application process is crucial.

- Double-check all information on the application form for accuracy.

- Ensure all required documentation is submitted.

- Keep copies of all submitted documents for your records.

- Maintain open communication with the escrow provider.

Post-Application Checklist

Following account activation, these steps help ensure secure and effective account management.

- Review the account agreement thoroughly.

- Understand the procedures for deposits and withdrawals.

- Establish secure access protocols for authorized users.

- Maintain accurate records of all transactions.

Managing and Using Your Escrow Account

Effective management of your business escrow account is crucial for maintaining financial security and ensuring smooth transactions. This involves understanding the procedures for depositing and withdrawing funds, implementing robust tracking systems, and establishing strong security measures to prevent unauthorized access. Following best practices will minimize risk and build trust with clients and partners.

Depositing and Withdrawing Funds

Depositing funds into your escrow account typically involves transferring money electronically from your business account. Many escrow providers offer online portals for easy transfers. Withdrawal procedures are generally more stringent, often requiring mutual agreement from all parties involved in the transaction, as Artikeld in the escrow agreement. Supporting documentation, such as invoices or completed project milestones, is usually required to justify the release of funds. The specific methods and requirements will vary depending on your chosen escrow provider and the terms of your escrow agreement. Always retain copies of all transaction records for auditing purposes.

Transaction Tracking and Record Keeping

Maintaining accurate and detailed records of all escrow account transactions is paramount. This involves meticulously documenting each deposit and withdrawal, including the date, amount, transaction ID, and a brief description of the transaction’s purpose. Consider using accounting software specifically designed for escrow management to streamline this process. This software can often automate aspects of record-keeping, generate reports, and help maintain compliance with relevant regulations. Regular reconciliation of your escrow account statements with your internal records is also essential to identify any discrepancies promptly.

Securing the Escrow Account

Protecting your escrow account from unauthorized access requires a multi-layered approach. This begins with choosing a reputable escrow provider with robust security measures in place, including encryption and multi-factor authentication. It’s also vital to select strong, unique passwords and avoid sharing your account login credentials with anyone. Regularly review your account activity for any suspicious transactions. Furthermore, consider implementing internal controls, such as requiring multiple authorizations for withdrawals, to enhance security. Finally, stay informed about emerging security threats and best practices to proactively mitigate potential risks.

Sample Escrow Agreement

A well-defined escrow agreement is the cornerstone of a secure and transparent escrow process. It should clearly Artikel the roles and responsibilities of all parties involved, including the buyer, seller, and escrow agent. The agreement must specify the conditions under which funds will be released, the procedures for dispute resolution, and the fees associated with the escrow service. It should also address issues such as confidentiality and data security. A sample clause might read:

“The Escrow Agent shall release funds to the Seller upon receipt of written confirmation from the Buyer that the goods/services have been delivered and accepted in accordance with the terms of the underlying agreement.”

This sample clause illustrates the importance of specifying clear conditions for fund release. Remember to consult with legal counsel to ensure your escrow agreement complies with all applicable laws and regulations.

Escrow Account Regulations and Compliance

Operating a business escrow account necessitates strict adherence to a complex web of regulations designed to protect clients’ funds and maintain financial transparency. Failure to comply can result in significant legal and financial repercussions, including hefty fines, legal action from clients, and damage to the business’s reputation. Understanding these regulations is crucial for maintaining a compliant and successful business.

Relevant Laws and Regulations Governing Business Escrow Accounts

The specific regulations governing business escrow accounts vary significantly depending on the jurisdiction and the nature of the business. At the federal level in the United States, regulations often fall under the purview of the Office of the Comptroller of the Currency (OCC) for nationally chartered banks and the Federal Reserve for state-member banks. State laws also play a critical role, often dictating specific licensing requirements, record-keeping practices, and permissible uses of escrow funds. For example, real estate transactions frequently involve state-specific escrow regulations that dictate how funds are handled, disbursed, and reported. Businesses engaging in international transactions may also find themselves subject to additional international regulations. It is vital to thoroughly research and understand all applicable federal, state, and potentially international regulations relevant to the specific industry and location of operation.

Implications of Non-Compliance with Escrow Account Regulations

Non-compliance with escrow account regulations carries severe consequences. These can range from administrative penalties and fines levied by regulatory bodies to civil lawsuits initiated by clients alleging mismanagement or misappropriation of funds. In severe cases, criminal charges may be filed, leading to significant financial penalties, imprisonment, and a permanent tarnish on the business’s reputation. The loss of trust among clients and potential clients can be devastating, leading to a significant decrease in business and potentially forcing the business to close. Furthermore, regulatory bodies may impose sanctions, such as suspension or revocation of licenses, effectively shutting down the business’s operations. The reputational damage alone can be costly to overcome, even if legal action is avoided.

Common Compliance Issues and Their Solutions

Several common compliance issues arise in the management of business escrow accounts. One frequent problem is inadequate record-keeping. Failure to maintain meticulous and accurate records of all transactions, including deposits, withdrawals, and the purpose of each transaction, can lead to difficulties in audits and investigations. The solution involves implementing a robust record-keeping system, using software designed for escrow account management, and regularly reviewing records for accuracy and completeness. Another common issue is commingling escrow funds with business operating funds. This is a serious breach of regulations and is strictly prohibited. To avoid this, businesses must maintain separate escrow accounts, clearly distinguishing them from their general operating accounts. Finally, unauthorized disbursements of escrow funds are a significant concern. To mitigate this risk, businesses should establish clear authorization protocols and implement multiple layers of checks and balances before releasing funds.

Reporting Requirements for Business Escrow Accounts, How to open an escrow account for business use

Businesses operating escrow accounts are subject to various reporting requirements. These requirements often include regular filings with regulatory bodies, providing detailed information about the account’s activity, balances, and transactions. The frequency and nature of these reports vary based on jurisdiction and the specific regulations governing the industry. For example, real estate escrow accounts may require monthly or quarterly reports to state regulatory agencies, detailing all transactions and the current balance. Failure to file reports accurately and on time can result in penalties. Moreover, businesses must maintain detailed records to support their reporting, ensuring that all information provided to regulatory bodies is accurate and verifiable. The specific reporting requirements should be carefully reviewed and understood to avoid potential penalties.

Security and Risk Mitigation in Escrow Accounts: How To Open An Escrow Account For Business Use

Escrow accounts, while designed to protect funds during transactions, are not immune to security threats. Understanding these risks and implementing robust mitigation strategies is crucial for businesses utilizing escrow services to safeguard their financial interests and maintain client trust. Neglecting security can lead to significant financial losses and reputational damage.

Common security threats targeting escrow accounts range from simple phishing scams to sophisticated cyberattacks. Internal vulnerabilities, such as employee negligence or malicious intent, also pose significant risks. External threats include unauthorized access attempts via hacking, malware infections, and social engineering techniques aimed at obtaining sensitive information like account credentials or transaction details. Furthermore, fraudulent activities, such as impersonating parties involved in the transaction or manipulating transaction details, are a constant concern.

Measures to Mitigate Fraud and Unauthorized Access

Implementing a multi-layered security approach is vital for mitigating risks associated with escrow accounts. This includes robust authentication protocols, such as multi-factor authentication (MFA), requiring users to provide multiple forms of verification before gaining access to their accounts. Regular security audits and penetration testing can identify and address vulnerabilities before they are exploited by malicious actors. Employee training programs focusing on cybersecurity awareness and best practices are essential to prevent internal threats. Strong password policies and regular password changes should be enforced. Furthermore, employing encryption technologies to protect data both in transit and at rest is paramount. Finally, implementing robust fraud detection systems that monitor account activity for suspicious patterns can help identify and prevent fraudulent transactions.

Best Practices for Protecting Sensitive Financial Information

Protecting sensitive financial information held within an escrow account requires a comprehensive strategy. This involves adhering to strict data privacy regulations, such as GDPR or CCPA, depending on the geographic location and jurisdiction. Regularly updating security software and implementing strong firewall protection are crucial steps. Data loss prevention (DLP) tools can monitor and prevent sensitive data from leaving the organization’s network without authorization. The principle of least privilege should be applied, granting employees only the necessary access to sensitive data based on their roles and responsibilities. Regular security awareness training for employees should emphasize the importance of data security and the consequences of security breaches. Finally, employing robust access control mechanisms and regularly reviewing and updating access permissions can prevent unauthorized access to sensitive financial information.

Visual Representation of Escrow Account Security Layers

Imagine a layered security model, much like a castle with multiple defensive walls. The outermost layer represents physical security measures, such as secure office spaces and access controls for physical servers. The next layer depicts network security, including firewalls, intrusion detection systems, and network segmentation to isolate sensitive systems. The third layer focuses on application security, incorporating secure coding practices, input validation, and regular security updates for escrow management software. The fourth layer comprises data security measures, such as encryption at rest and in transit, access controls, and data loss prevention mechanisms. The innermost layer represents user security, encompassing strong authentication protocols like MFA, robust password policies, and comprehensive employee security awareness training. Each layer provides a level of defense, working together to create a robust security system protecting the escrow account and the sensitive financial information it holds.

Escrow Account Costs and Fees

Operating a business escrow account involves various costs and fees, which can significantly impact your profitability. Understanding these fees and how they vary among providers is crucial for making informed decisions and minimizing expenses. This section details typical fees, compares fee structures across different providers, and offers strategies for cost reduction.

Typical Escrow Account Fees

Escrow account fees vary widely depending on the provider, the services offered, and the volume of transactions. Common fee categories include setup fees, monthly maintenance fees, transaction fees, and wire transfer fees. Some providers also charge for additional services like reporting or account statements. The total cost can range from a few dollars per month for simple accounts to hundreds of dollars per month for high-volume accounts with extensive services.

Comparison of Fee Structures Across Providers

Different escrow providers employ various fee structures. Some charge a flat monthly fee regardless of transaction volume, while others use a tiered system with fees increasing based on the number of transactions or the total value of funds held. Some providers may also charge per-transaction fees, which can be a significant expense for businesses with high transaction volumes. It’s vital to compare the overall cost of different providers, considering not only the stated fees but also any hidden charges or additional service costs. For example, Provider A might have a lower monthly fee but higher per-transaction charges, while Provider B might have a higher monthly fee but lower per-transaction charges. The optimal choice depends on your business’s specific transaction volume and needs.

Minimizing Escrow Account Costs

Several strategies can help businesses minimize their escrow account costs. Negotiating with providers for lower fees, especially for high-volume accounts, is a common tactic. Choosing a provider with a fee structure aligned with your transaction volume is also crucial. For instance, if you have a low transaction volume, a provider with a flat monthly fee might be more cost-effective than one with per-transaction fees. Additionally, carefully reviewing the service agreement to understand all applicable fees and charges can help avoid unexpected expenses. Finally, streamlining your processes to reduce the number of transactions can also lead to cost savings.

Breakdown of Typical Escrow Account Fees

| Fee Type | Description | Typical Range | Notes |

|---|---|---|---|

| Setup Fee | One-time fee for opening the account. | $0 – $200 | May be waived for certain account types or promotional offers. |

| Monthly Maintenance Fee | Recurring fee for maintaining the account. | $10 – $50 | Can vary based on account features and services. |

| Transaction Fee | Fee charged per transaction processed through the account. | $5 – $25 per transaction | Can be a percentage of the transaction value in some cases. |

| Wire Transfer Fee | Fee for sending or receiving funds via wire transfer. | $15 – $30 per transfer | Often higher for international transfers. |

| Reporting Fee | Fee for generating customized reports on account activity. | $10 – $50 per report | May be included in the monthly maintenance fee for some providers. |