How to remove my name from a business partnership? It’s a question many entrepreneurs face, often fraught with legal, financial, and emotional complexities. Leaving a partnership isn’t as simple as walking away; it requires careful planning, negotiation, and adherence to legal procedures. This guide navigates the intricacies of withdrawing from a business partnership, ensuring a smooth and legally sound exit.

Successfully disentangling yourself from a business partnership demands a thorough understanding of your partnership agreement, the relevant legal requirements, and the potential financial and tax consequences. We’ll cover each of these critical areas, providing practical advice and actionable steps to help you navigate this challenging process with confidence. From negotiating your departure to protecting your interests and managing post-withdrawal considerations, we’ll equip you with the knowledge needed to make an informed decision.

Understanding Your Partnership Agreement

Leaving a business partnership requires a thorough understanding of your partnership agreement. This document legally Artikels the terms and conditions governing the relationship between partners, including procedures for withdrawal or dissolution. Ignoring its stipulations can lead to significant legal and financial complications. Careful review and understanding are crucial before taking any action.

Your partnership agreement, regardless of its length or complexity, likely contains clauses specifically addressing the dissolution of the partnership or the withdrawal of a partner. These clauses dictate the process, the financial implications, and the rights and responsibilities of all parties involved. Failing to understand these clauses can result in disputes and costly legal battles.

Typical Clauses Regarding Dissolution or Withdrawal

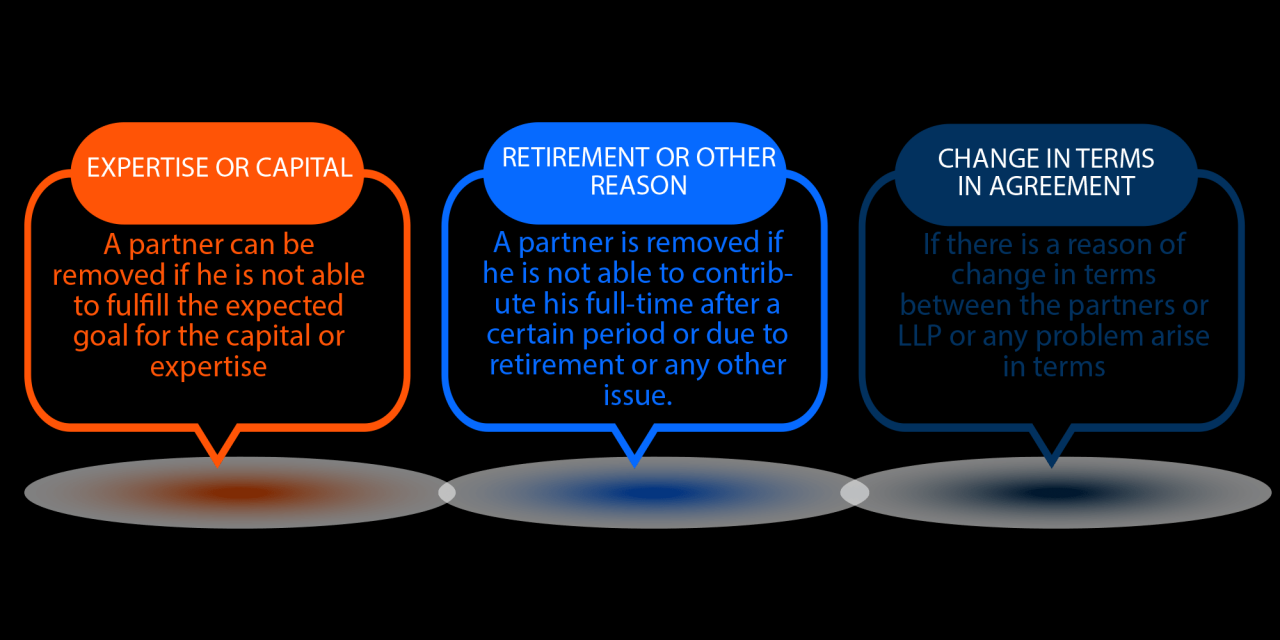

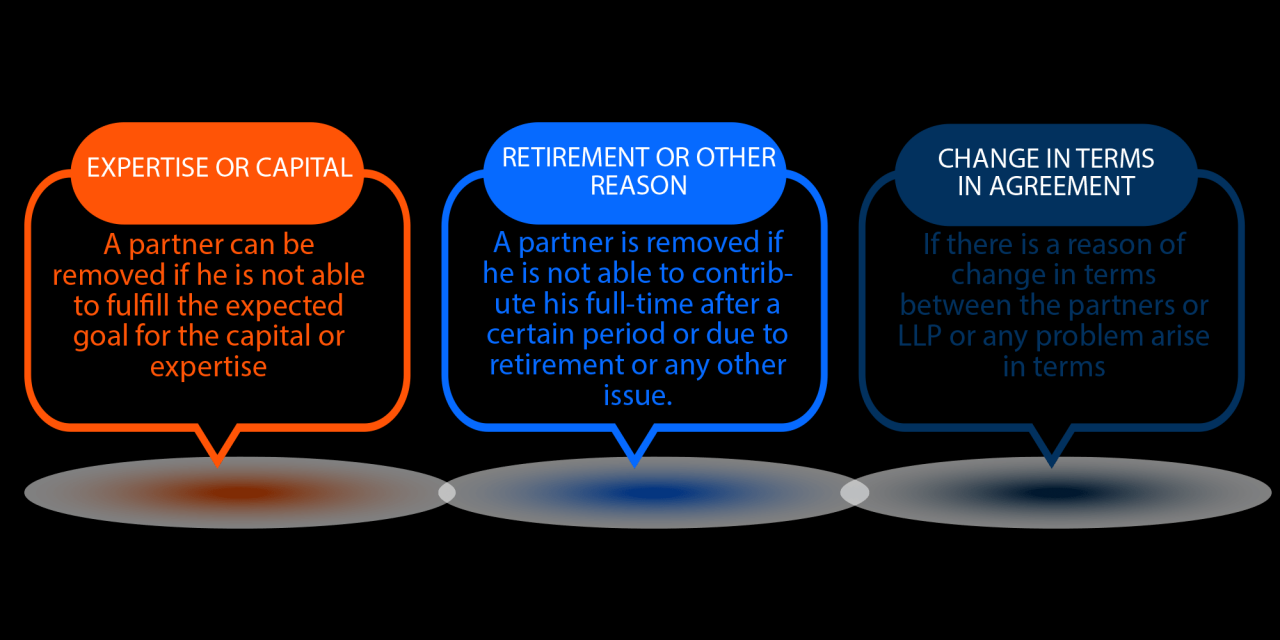

Partnership agreements commonly include clauses covering several key aspects of partner withdrawal. These provisions are designed to protect the interests of all partners involved and to ensure a smooth transition. Understanding these clauses is essential for a successful exit.

- Withdrawal Notice Period: This clause specifies the amount of time a partner must give to the other partners before formally withdrawing. For example, it might state that a partner must provide 90 days’ written notice.

- Valuation of Partnership Interests: This clause Artikels the method used to determine the value of a withdrawing partner’s share in the business. Common methods include fair market value, book value, or a predetermined formula. Disputes often arise over valuation, so clarity is crucial.

- Payment Terms: This section details how the withdrawing partner will be compensated for their share of the business. It may specify a payment schedule, the use of installments, or the potential for a lump-sum payment.

- Non-Compete Agreements: This clause often restricts the withdrawing partner from engaging in similar business activities within a specific geographic area or time frame. This protects the remaining partners’ interests and prevents unfair competition.

- Confidentiality Agreements: This ensures that confidential business information remains protected after the withdrawal. Breaching confidentiality can have severe legal consequences.

- Dispute Resolution: This clause Artikels the process for resolving any disagreements that may arise during the withdrawal process. It might specify mediation, arbitration, or litigation as the preferred method.

Reviewing Your Partnership Agreement

The process of reviewing your partnership agreement involves carefully examining each clause, paying particular attention to sections related to dissolution, withdrawal, and buy-out provisions. Seek professional legal advice if needed. A systematic approach ensures nothing is overlooked.

- Obtain a Copy: Secure a current, complete copy of the partnership agreement.

- Identify Relevant Clauses: Locate sections explicitly addressing partner withdrawal, dissolution, or buyout procedures. Look for s such as “withdrawal,” “resignation,” “termination,” “dissolution,” or “buyout.”

- Analyze the Terms: Carefully read and understand the specific terms and conditions Artikeld in these clauses. Pay attention to timelines, valuation methods, payment terms, and dispute resolution processes.

- Seek Legal Counsel: Consult with a legal professional experienced in partnership law to interpret the agreement’s legal implications and advise on your options.

Interpreting Legal Jargon

Legal language in partnership agreements can be complex and confusing. Understanding key terms is vital for making informed decisions. Seeking professional legal interpretation is always recommended.

Many partnership agreements use specific legal terms. For instance, a clause might refer to a “winding-up” of the partnership, which refers to the process of settling the partnership’s affairs after dissolution. Similarly, terms like “good faith,” “fair market value,” and “reasonable efforts” can be subject to interpretation, highlighting the need for clear communication and, if necessary, legal intervention. Understanding these terms is crucial to avoid future disputes. For example, “fair market value” might require a professional appraisal, while “reasonable efforts” might need to be defined by case law or expert testimony. Ambiguous terms should always be clarified with legal counsel.

Legal Requirements for Withdrawal

Withdrawing from a business partnership is a significant legal action with potentially far-reaching consequences. The specific legal requirements vary considerably depending on your jurisdiction and the terms Artikeld in your partnership agreement. Understanding these requirements is crucial to ensure a smooth and legally sound exit from the partnership. Failure to adhere to the proper procedures can lead to protracted legal battles and financial liabilities.

The legal steps involved in formally withdrawing from a business partnership are governed by both state/provincial and federal laws, as well as the terms of the partnership agreement itself. These laws often dictate the process for providing notice, the valuation of a withdrawing partner’s share, and the distribution of assets. Ignoring these legal mandates can expose the withdrawing partner to significant financial and legal risks.

Notification Process and Required Documentation

Formal notification is paramount. The method and content of this notification must comply with the partnership agreement and any relevant legislation. Typically, written notification is required, often via certified mail or courier service, to provide verifiable proof of delivery. This letter should clearly state the intention to withdraw, the effective date of withdrawal, and any relevant claims or requests for compensation. Depending on your jurisdiction and partnership agreement, additional documentation may be required, such as a detailed accounting of the withdrawing partner’s share of assets and liabilities. Timelines for notification are usually specified within the partnership agreement or dictated by statute. Failure to provide timely and proper notification can severely impact the withdrawing partner’s rights and entitlements.

Potential Legal Ramifications of Improper Withdrawal

Improper withdrawal from a business partnership can have serious consequences. These can include: breach of contract lawsuits, liability for partnership debts incurred after the purported withdrawal date, loss of any agreed-upon compensation upon withdrawal, and potential legal fees and costs associated with resolving disputes. For example, a partner who fails to provide the legally required notice might find themselves still liable for partnership debts even after attempting to withdraw, potentially facing significant financial losses. In cases where the partnership agreement is ambiguous or silent on withdrawal procedures, court intervention might be necessary, leading to additional legal costs and delays. Therefore, adherence to legal requirements during the withdrawal process is critical to mitigate potential risks.

Sample Withdrawal Notification Letter

[Your Name/Address]

[Date]

[Partnership Name/Address]Subject: Formal Notice of Withdrawal from Partnership

Dear [Partner Names],

This letter serves as formal notification of my withdrawal from [Partnership Name], effective [Date]. This withdrawal is in accordance with [Section of Partnership Agreement/Relevant Statute].

I request a full accounting of my share of the partnership assets and liabilities as of [Date]. I further request that the process for the valuation and distribution of my share be initiated promptly, as Artikeld in [Section of Partnership Agreement/Relevant Statute].

Please confirm receipt of this notice and provide a timeline for the settlement of my share.

Sincerely,

[Your Signature]

[Your Typed Name]

This sample letter provides a basic framework; it should be adapted to reflect the specific details of your partnership agreement and relevant legal requirements. It is highly recommended to seek legal counsel before sending this notification to ensure it complies with all applicable laws and protects your interests.

Financial Implications of Withdrawal: How To Remove My Name From A Business Partnership

Leaving a business partnership has significant financial consequences. Understanding these implications beforehand is crucial to ensuring a fair and smooth transition. This section details the methods for determining the value of your share, the process of asset division and debt allocation, and examples of potential financial settlements.

Determining Fair Market Value

Accurately assessing the fair market value of your share in the partnership is paramount. Several methods exist, each with its strengths and weaknesses. The chosen method often depends on the partnership agreement and the nature of the business. Common approaches include asset-based valuation, income-based valuation, and market-based valuation.

Asset-based valuation involves determining the net asset value of the partnership by appraising all assets and subtracting liabilities. This method is straightforward but may undervalue intangible assets like brand reputation or customer relationships. Income-based valuation focuses on the partnership’s projected future earnings. Methods like discounted cash flow analysis are used to estimate the present value of these future earnings. This approach is more complex but can better reflect the ongoing value of the business. Market-based valuation compares the partnership to similar businesses that have recently been sold. This method relies on the availability of comparable transactions and may not be suitable for unique businesses. Ultimately, a professional valuation may be necessary to ensure fairness and avoid disputes.

Asset Division and Debt Allocation, How to remove my name from a business partnership

Upon withdrawal, the partnership’s assets and liabilities must be divided fairly among the remaining partners and the withdrawing partner. The partnership agreement should Artikel the process for this division. If the agreement is silent or ambiguous, legal recourse may be necessary. The division often involves a combination of cash payments, asset transfers, and adjustments to debt obligations. For example, the withdrawing partner might receive a portion of the partnership’s cash reserves, certain tangible assets, or a combination of both. The allocation of debts depends on the partnership agreement and the nature of the debts. Some debts might be allocated proportionally based on ownership percentages, while others might be assigned based on individual liability.

Examples of Financial Settlements

Several scenarios illustrate potential financial settlements. Consider a partnership with three partners, each owning one-third. If one partner withdraws, several options exist.

A complete buyout: The remaining partners could purchase the withdrawing partner’s share for a predetermined price, potentially financed through loans or internal reserves. This price would reflect the fair market value of the one-third share, determined using one of the methods described above.

A partial buyout with asset transfer: The withdrawing partner might receive a specific asset (e.g., a piece of equipment) along with a cash payment to equalize the value of their share.

Phased buyout: The remaining partners could agree to a payment schedule, paying the withdrawing partner in installments over a set period. This option provides liquidity to the withdrawing partner while managing the financial burden on the remaining partners.

Comparison of Financial Settlement Scenarios

| Scenario | Advantages | Disadvantages |

|---|---|---|

| Complete Buyout | Clean break, immediate liquidity for withdrawing partner | Requires significant upfront capital for remaining partners, potential for disagreement on valuation |

| Partial Buyout with Asset Transfer | Reduces the financial burden on remaining partners, allows for targeted asset distribution | May not be feasible if the partnership’s assets are indivisible or difficult to value individually |

| Phased Buyout | Manages financial burden on remaining partners, provides liquidity to withdrawing partner over time | Requires ongoing communication and agreement between parties, potential for disputes over payment schedule |

Tax Consequences of Withdrawal

Withdrawing from a business partnership has significant tax implications, often involving capital gains taxes and adjustments to your individual tax liability. Understanding these implications beforehand is crucial for effective financial planning and minimizing your tax burden. The specific tax consequences will depend on several factors, including the structure of the partnership, the terms of your withdrawal agreement, and the fair market value of your partnership interest at the time of withdrawal.

Capital Gains Tax on Partnership Interest

Upon withdrawing from a partnership, you’ll likely realize a capital gain or loss. This is calculated by comparing the amount you receive upon withdrawal (including cash, assets, and your share of the partnership’s liabilities) to your adjusted basis in the partnership. Your adjusted basis reflects your initial investment plus any additional contributions and minus any distributions you’ve already received. If the amount received exceeds your adjusted basis, you’ll recognize a capital gain, taxed at your applicable capital gains tax rate. Conversely, if the amount received is less than your adjusted basis, you’ll recognize a capital loss, which may be deductible against other capital gains or ordinary income, subject to limitations.

Minimizing Tax Liabilities During Withdrawal

Strategic planning can significantly reduce your tax liability. One approach is to carefully time your withdrawal to coincide with periods of lower income, potentially lowering your overall tax bracket. Another strategy involves negotiating the form of your distribution. Receiving assets with a higher basis than their fair market value can reduce your taxable gain. For instance, receiving depreciable assets might allow for future tax deductions through depreciation. Consulting with a tax professional is vital to explore these options and determine the most tax-efficient strategy for your specific situation.

Hypothetical Scenario: Partnership Dissolution and Tax Calculation

Let’s consider a hypothetical scenario: Sarah is a partner in “ABC Partnership,” with an adjusted basis of $50,000 in her partnership interest. Upon dissolution, she receives $100,000 in cash and assets. Her capital gain is $50,000 ($100,000 – $50,000). Assuming a long-term capital gains tax rate of 15%, Sarah’s capital gains tax liability would be $7,500 ($50,000 * 0.15). However, this is a simplified example; the actual tax liability may be influenced by other factors such as state taxes and any applicable deductions. This calculation ignores potential self-employment taxes and other potential tax ramifications.

Resources for Obtaining Professional Tax Advice

Obtaining professional tax advice is highly recommended. Several resources can assist you in finding qualified tax professionals:

The American Institute of CPAs (AICPA): The AICPA website offers a search tool to locate certified public accountants (CPAs) in your area. They can provide specialized advice on partnership taxation and withdrawal strategies.

The National Association of Enrolled Agents (NAEA): Enrolled agents (EAs) are federally authorized tax practitioners who can represent taxpayers before the IRS. The NAEA website provides a directory of EAs.

Your State’s Board of Accountancy: Each state has a board of accountancy that regulates CPAs within that state. Their website usually offers a search function to find licensed CPAs.

Negotiating Your Departure

Negotiating your exit from a business partnership requires careful planning and a strategic approach. A well-executed negotiation can minimize potential conflict and ensure a fair and equitable settlement for all parties involved. The key is to approach the process professionally, focusing on mutual respect and a shared goal of a smooth transition.

Negotiating a smooth withdrawal involves several key steps and considerations. Effective communication, clear objectives, and a willingness to compromise are crucial for achieving a successful outcome.

Strategies for Amicable Withdrawal

A successful negotiation hinges on proactive communication and a collaborative spirit. Begin by clearly outlining your intentions to withdraw to your partners, providing ample notice as stipulated in your partnership agreement. This allows for a structured discussion, minimizing surprises and fostering a more cooperative atmosphere. Openly discussing your reasons for leaving, without assigning blame, can help establish a foundation of mutual understanding. Presenting a well-reasoned proposal, including your desired terms for withdrawal, demonstrates professionalism and preparedness. This approach increases the likelihood of a mutually acceptable agreement. Consider seeking professional legal and financial advice to ensure your interests are adequately protected throughout the process.

Potential Points of Contention and Resolution Methods

Several points of contention frequently arise during partnership dissolution negotiations. One common issue is the valuation of your share in the partnership. Disagreements can stem from differing opinions on the methods used for valuation, such as asset-based or income-based approaches. To mitigate this, it’s advisable to engage an independent valuation expert to provide an objective assessment. Another potential point of contention is the payment structure for your share. Negotiating a payment plan that accommodates both your needs and the partnership’s financial capacity is vital. This might involve a combination of immediate payment and deferred payments over a defined period, secured by appropriate collateral. Finally, disputes over the division of assets and liabilities can also complicate the process. A clear and detailed inventory of all partnership assets and liabilities, along with a pre-agreed allocation strategy, can help prevent future disputes.

Structured Negotiation Plan

A structured approach to negotiations significantly increases the chances of a successful outcome. Define clear objectives before commencing negotiations. These might include a specific buyout price, a payment schedule, and a clear timeline for completing the withdrawal process. Develop a range of potential compromises to address potential disagreements. For instance, if a dispute arises over valuation, you might consider compromising on the valuation method or accepting a slightly lower price in exchange for a faster payment schedule. Consider involving a neutral mediator to facilitate discussions and help resolve impasses. Document all agreements reached in writing, ensuring all parties sign and acknowledge the terms. This legally binding document protects all parties involved.

Maintaining a Professional Relationship

Maintaining a professional relationship throughout the negotiation process is paramount, even if disagreements arise. Remember that preserving professional relationships can be beneficial in the future, especially in the business community. Respectful communication, active listening, and a willingness to compromise contribute to a smoother and more amicable outcome. Avoid making personal attacks or engaging in emotional outbursts. Instead, focus on presenting your case logically and rationally, supported by relevant documentation and expert opinions. Maintaining a professional demeanor, even in the face of disagreements, fosters a climate of trust and cooperation, leading to a more successful negotiation.

Protecting Your Interests

Withdrawing from a business partnership can expose you to significant financial and legal risks. Careful planning and proactive measures are crucial to safeguarding your personal assets and minimizing potential disputes. This section Artikels potential risks, protective steps, and legal safeguards to ensure a smoother transition.

Protecting your personal assets during a partnership dissolution requires a multi-faceted approach. Failing to adequately protect your interests can lead to unforeseen financial burdens and protracted legal battles. This section details the critical steps to minimize such risks.

Potential Risks Associated with Partnership Withdrawal

Withdrawal from a partnership can expose you to several risks, including unforeseen financial liabilities, disputes over asset valuation, and protracted legal battles. For example, if the partnership has outstanding debts, you may be held personally liable for these debts even after your withdrawal, depending on the partnership agreement and applicable laws. Similarly, disagreements over the valuation of your share of the partnership assets can lead to costly and time-consuming litigation. Finally, if your withdrawal isn’t properly documented and managed, you may face legal challenges from your former partners.

Steps to Protect Personal Assets During Withdrawal

Several steps can be taken to protect your personal assets. First, thoroughly review your partnership agreement to understand your rights and obligations upon withdrawal. Second, obtain independent legal and financial advice to ensure you fully understand the financial implications of your departure. Third, ensure that all financial transactions related to your withdrawal are properly documented and recorded. Fourth, consider obtaining liability insurance to protect yourself against potential claims. Fifth, if possible, negotiate a clear and comprehensive settlement agreement with your former partners that Artikels the terms of your departure and protects your interests. This agreement should specify the division of assets, the payment of any outstanding debts, and the release of each party from future liability.

Legal Safeguards to Mitigate Disputes

Implementing appropriate legal safeguards is crucial to mitigating potential disputes. A well-drafted partnership agreement, reviewed by independent legal counsel, is the cornerstone of protection. This agreement should clearly define the terms of withdrawal, including procedures for valuation of assets, distribution of proceeds, and dispute resolution mechanisms. Consider including clauses for binding arbitration or mediation to avoid lengthy and costly court battles. Additionally, ensuring that all financial transactions are documented transparently and independently verified can help prevent future disagreements. Finally, obtaining a formal release of liability from your former partners, once the withdrawal process is complete, provides further protection.

Checklist for Safeguarding Interests During Withdrawal

Before initiating the withdrawal process, it is essential to systematically address key aspects to minimize potential risks. This checklist helps you navigate the complexities involved.

- Review the partnership agreement thoroughly.

- Seek independent legal and financial advice.

- Document all financial transactions related to the withdrawal.

- Negotiate a comprehensive settlement agreement with your former partners.

- Consider obtaining liability insurance.

- Implement dispute resolution mechanisms within the agreement (e.g., arbitration).

- Obtain a formal release of liability from your former partners upon completion.

- Maintain detailed records of all communications and agreements.

Post-Withdrawal Considerations

Leaving a business partnership requires careful attention to detail beyond the initial withdrawal process. Successfully navigating this transition involves formally severing ties, meticulously documenting all financial transactions, and proactively managing your professional reputation. Failing to address these post-withdrawal considerations can lead to unforeseen legal, financial, and reputational risks.

Formally Dissolving Business Ties

After completing the legal withdrawal process, it’s crucial to formally sever all remaining connections with the business. This involves executing any necessary release agreements, returning company property, and ensuring all outstanding obligations are settled. This might include returning company equipment, canceling business credit cards, and updating your professional contact information to reflect your separation from the partnership. Failure to thoroughly sever these ties could expose you to future liability.

Maintaining Accurate Records

Maintaining precise records of all transactions related to your withdrawal is paramount. This includes copies of all agreements, financial statements, tax documents, and communication with your former partners. These documents serve as crucial evidence in case of future disputes or audits. Consider using a secure, organized system for storing these records, such as cloud-based storage with robust security features. A well-organized system will facilitate easier access and provide a clear audit trail for all financial dealings associated with your departure.

Managing Personal and Professional Reputation

Your reputation, both personally and professionally, can be significantly impacted by your departure from the business partnership. Maintain open and professional communication with your former partners and clients. Avoid making negative public statements about the business or your former partners. Proactively update your professional network about your new endeavors and focus on highlighting your achievements and future goals. Consider creating a professional online presence that showcases your skills and expertise independently of the former partnership. For example, updating your LinkedIn profile to reflect your new status and focusing on positive career developments can help manage your online reputation effectively.

Post-Withdrawal Timeline

A typical timeline for post-withdrawal activities may look like this:

| Activity | Duration |

|---|---|

| Finalizing withdrawal agreement | 2-4 weeks |

| Returning company property and assets | 1-2 weeks |

| Settling outstanding financial obligations | 4-8 weeks |

| Filing necessary tax documents | 4-6 weeks |

| Updating professional network and online presence | Ongoing |

Note: This timeline is an estimate and may vary depending on the complexity of the partnership and the specific circumstances of the withdrawal. It’s advisable to consult with legal and financial professionals for personalized guidance.