How to sell a landscaping business successfully requires a strategic approach encompassing valuation, marketing, financial preparation, legal considerations, and a smooth transition. This guide navigates you through each crucial step, from determining your business’s fair market value to negotiating a favorable sale agreement and ensuring a seamless handover to the new owner. We’ll explore effective marketing strategies, the importance of meticulous financial documentation, and the legal intricacies involved in transferring ownership. Ultimately, this comprehensive guide empowers you to maximize your return and minimize potential pitfalls in selling your landscaping business.

From understanding different valuation methods – asset-based, income-based, and market-based – to crafting compelling marketing materials and navigating the complexities of legal contracts, we provide a clear roadmap. We’ll delve into essential financial documents, negotiation strategies, and the critical aspects of transitioning your business to a new owner, including client relationships and employee management. Preparing for the tax implications is also addressed, ensuring you’re well-informed throughout the entire process.

Valuing Your Landscaping Business

Selling your landscaping business requires a clear understanding of its worth. Accurately determining the fair market value is crucial for attracting potential buyers and ensuring a successful transaction. This involves analyzing various financial and operational aspects, using different valuation methods, and potentially seeking professional assistance.

Methods for Determining Fair Market Value

Several methods exist for determining the fair market value of a landscaping business. These methods consider different aspects of the business, including revenue generation, asset ownership, and outstanding liabilities. A comprehensive approach typically involves a combination of these methods to arrive at a robust valuation.

Asset-Based Valuation

This method focuses on the net asset value of the business. It involves calculating the total value of all tangible assets (equipment, vehicles, inventory) and intangible assets (customer lists, brand reputation) and subtracting liabilities (loans, debts). For example, a business with $50,000 in equipment, $10,000 in inventory, and $20,000 in liabilities would have a net asset value of $40,000. This method is particularly relevant for businesses with significant physical assets. However, it may undervalue businesses with strong recurring revenue streams or valuable intangible assets.

Income-Based Valuation

This approach focuses on the future earnings potential of the business. Common methods include discounted cash flow (DCF) analysis and capitalization of earnings. DCF analysis projects future cash flows and discounts them back to their present value using a discount rate that reflects the risk associated with the business. Capitalization of earnings uses a multiple of the business’s average annual earnings to estimate its value. For instance, a business with an average annual profit of $30,000 and a capitalization rate of 5 would be valued at $600,000 ($30,000 / 0.05). This method is best suited for established businesses with a stable history of profitability.

Market-Based Valuation

This method compares the subject business to similar businesses that have recently been sold. It involves identifying comparable transactions and adjusting their sale prices based on differences in size, location, and other relevant factors. Finding truly comparable businesses can be challenging, and the availability of reliable market data may be limited. For example, if a similar landscaping business in the same area recently sold for $500,000, and the subject business is slightly smaller, a valuation might be adjusted downwards accordingly.

Spreadsheet Template for Financial Data Organization

A well-organized spreadsheet is crucial for valuation. The following template can help:

| Category | Item | Value |

|---|---|---|

| Tangible Assets | Equipment (List each item) | |

| Vehicles (List each item) | ||

| Inventory | ||

| Intangible Assets | Customer List Value | |

| Brand Reputation (Estimate) | ||

| Liabilities | Loans | |

| Other Debts | ||

| Revenue | Annual Revenue (Last 3 years) | |

| Expenses | Cost of Goods Sold | |

| Operating Expenses | ||

| Profit | Net Profit (Last 3 years) |

This template allows for detailed recording of assets, liabilities, and financial performance, crucial for accurate valuation.

Importance of Professional Valuation Services

While a business owner can perform a preliminary valuation, seeking professional valuation services is highly recommended, especially for complex businesses or when a high degree of accuracy is needed. Professional valuers possess the expertise and experience to apply appropriate valuation methods, consider all relevant factors, and produce a credible valuation report that can be used in negotiations with potential buyers. Engaging a professional is particularly important when dealing with significant assets, complex financial structures, or potential legal disputes. A professional valuation report provides an objective assessment of the business’s worth, adding credibility and weight to the selling process.

Marketing and Advertising Your Landscaping Business for Sale

Selling a landscaping business requires a strategic marketing approach to attract the right buyers. A well-executed plan will highlight the business’s strengths and reach potential investors or companies seeking expansion. This involves crafting compelling marketing materials and utilizing appropriate advertising channels to maximize exposure and generate interest.

Marketing Plan Strategies

A comprehensive marketing plan should target specific buyer segments. This plan should detail the channels used, the marketing materials employed, and a timeline for implementation. For instance, a landscaping business with a strong residential clientele might target smaller, local landscaping companies seeking expansion, while a larger commercial landscaping business could attract larger investment firms or national landscaping companies. The plan should also Artikel a budget for each marketing activity and methods for tracking results to ensure efficient resource allocation. Consider including a phased approach, starting with targeted online listings and progressing to broader advertising as interest grows.

Examples of Compelling Marketing Materials

A professionally designed brochure is crucial. It should showcase the business’s history, services offered, financial performance (including revenue growth and profitability), client testimonials, and a strong value proposition for potential buyers. A visually appealing brochure with high-quality photographs of completed projects can significantly enhance its impact. Online listings on business-for-sale platforms should include similar information, presented concisely and accurately. Key performance indicators (KPIs) such as average revenue per client, customer retention rate, and operating margins should be prominently displayed. For example, a brochure might feature a before-and-after photo of a large-scale landscaping project, highlighting the transformation and the business’s expertise. An online listing would incorporate this visual along with quantifiable data demonstrating the profitability and growth potential of the business.

Advertising Channel Analysis

Online marketplaces specializing in business sales (such as BizBuySell or FE International) offer broad reach to a large pool of potential buyers. However, they often involve listing fees and competition from other businesses. Industry publications (trade magazines or online forums focused on landscaping) offer a more targeted approach, reaching buyers actively seeking businesses within the sector. Networking within industry events and conferences allows for direct interaction with potential buyers and can lead to more personalized negotiations. Each channel has unique advantages and disadvantages that need to be carefully weighed against the specific characteristics of the business being sold and the target buyer profile.

Potential Buyer Identification

Potential buyers for a landscaping business can be categorized into several groups: existing landscaping companies looking to expand their market share or service area; private equity firms or angel investors seeking profitable businesses; and individual entrepreneurs with experience in the landscaping industry. Identifying these potential buyers requires research and understanding their specific needs and investment criteria. For example, a local landscaping company might be interested in acquiring a smaller business to gain access to new clients and expand their geographic reach, while a larger investment firm might be looking for a well-established business with a strong track record of profitability and growth. This targeted approach increases the chances of a successful sale.

Preparing Financial Documents: How To Sell A Landscaping Business

Preparing comprehensive and accurate financial documents is crucial for a successful landscaping business sale. Potential buyers will scrutinize these records to assess the business’s profitability, stability, and overall value. A well-organized and clearly presented financial package significantly increases your chances of securing a favorable sale price.

Potential buyers rely heavily on financial data to make informed decisions. Clean and accurate statements demonstrate transparency and build trust, encouraging buyers to proceed with confidence. Inaccurate or incomplete information can raise red flags and deter potential investors. The presentation of this information is as important as the information itself; clear and concise presentation showcases professionalism and attention to detail.

Compiling Comprehensive Financial Records

This involves gathering three key types of financial statements: profit & loss statements, balance sheets, and tax returns. Profit and loss (P&L) statements detail the business’s revenue and expenses over a specific period, showing its profitability. Balance sheets provide a snapshot of the business’s assets, liabilities, and equity at a particular point in time. Tax returns, filed with the relevant tax authorities, provide a verified record of the business’s financial performance and tax obligations. All three should be readily available and cover at least the past three years, preferably five. Consistency in accounting methods throughout this period is also vital.

Importance of Clean and Accurate Financial Statements

Buyers use financial statements to assess several key aspects of your business. They examine profitability trends to understand the business’s growth potential. They analyze the balance sheet to determine the business’s financial health and its ability to meet its obligations. Tax returns provide independent verification of the financial information, building confidence and credibility. Any discrepancies or inconsistencies will raise concerns and potentially lead to a lower valuation or failed sale. Therefore, ensuring the accuracy and completeness of these documents is paramount.

Essential Financial Documents Checklist, How to sell a landscaping business

A comprehensive sale package should include the following documents:

- Profit & Loss Statements (at least 3-5 years)

- Balance Sheets (at least 3-5 years)

- Tax Returns (at least 3-5 years)

- Cash Flow Statements (at least 3-5 years)

- Bank Statements (at least 12 months)

- Accounts Receivable and Payable Aging Reports (current)

- Inventory List (if applicable)

- List of Equipment and Assets with valuations

- Contracts and Agreements with Clients and Suppliers

This checklist ensures all necessary financial information is provided to the potential buyer, facilitating a smooth and efficient due diligence process.

Presenting Financial Information Clearly and Concisely

Using charts and graphs can significantly enhance the clarity and understanding of your financial data. Visual representations highlight key trends and figures, making it easier for buyers to grasp the business’s financial performance at a glance. For example, a line graph showing revenue growth over time or a bar chart comparing expenses across different categories can effectively convey important information. Tables can also effectively organize complex data.

Example Financial Data Presentation

| Year | Revenue | Net Profit | Profit Margin |

|---|---|---|---|

| 2020 | $150,000 | $30,000 | 20% |

| 2021 | $175,000 | $35,000 | 20% |

| 2022 | $200,000 | $40,000 | 20% |

This table presents a simplified view of revenue, net profit, and profit margin over three years. More detailed data can be included, and additional tables or graphs can be used to showcase other financial aspects of the business. Remember to maintain consistency in units and formatting throughout the presentation.

Legal and Contractual Aspects

Selling a landscaping business involves navigating a complex legal landscape. Understanding the key legal considerations and engaging legal professionals are crucial for a smooth and successful transaction, minimizing potential risks and ensuring a fair deal for all parties involved. Ignoring these aspects can lead to costly disputes and delays.

Key Legal Considerations in Selling a Business

The sale of a landscaping business necessitates careful consideration of various legal aspects. These include existing contracts with clients, suppliers, and employees; potential liabilities related to past operations; and compliance with relevant environmental regulations and labor laws. Failure to address these thoroughly can significantly impact the transaction’s value and create future problems for the buyer. For instance, outstanding debts or pending lawsuits can drastically reduce the business’s worth. Similarly, undisclosed environmental liabilities can lead to substantial costs for the new owner. Understanding and mitigating these risks is paramount.

Importance of Consulting with Legal Professionals

Engaging experienced legal counsel is not merely advisable; it’s essential. Legal professionals provide expert guidance throughout the sales process, ensuring compliance with all applicable laws and regulations. They review and negotiate contracts, protecting the seller’s interests and minimizing potential liabilities. Their expertise in contract law, business law, and environmental law is crucial in identifying and addressing potential legal pitfalls. Without legal representation, the seller risks making costly mistakes that could jeopardize the entire transaction. The cost of legal counsel is a small price to pay compared to the potential consequences of neglecting this critical step.

Steps Involved in Negotiating a Sales Agreement

Negotiating a sales agreement involves several key steps. Initially, a letter of intent (LOI) Artikels the basic terms of the sale, including the purchase price and key conditions. This non-binding agreement serves as a starting point for more detailed negotiations. Following the LOI, the parties work together with their legal representatives to draft a comprehensive purchase agreement, which details all aspects of the transaction, including payment terms, asset transfer, liabilities, and warranties. This agreement undergoes thorough review and negotiation before finalizing the sale. The process often involves several rounds of revisions and discussions to ensure both parties’ satisfaction and legal protection.

Common Clauses Found in Business Sale Contracts

Business sale contracts typically include various standard clauses, such as representations and warranties (statements made by the seller about the business’s condition and performance), covenants (promises made by the buyer or seller), indemnification clauses (protecting against potential liabilities), and dispute resolution mechanisms (specifying how disagreements will be handled). A specific example of a common clause is a non-compete agreement, preventing the seller from starting a competing business within a defined geographic area and time period. Another is an escrow agreement, which holds funds until specific conditions are met. These clauses are designed to protect both the buyer and the seller and to ensure a smooth and fair transaction. Careful consideration of each clause is vital to avoid future disputes.

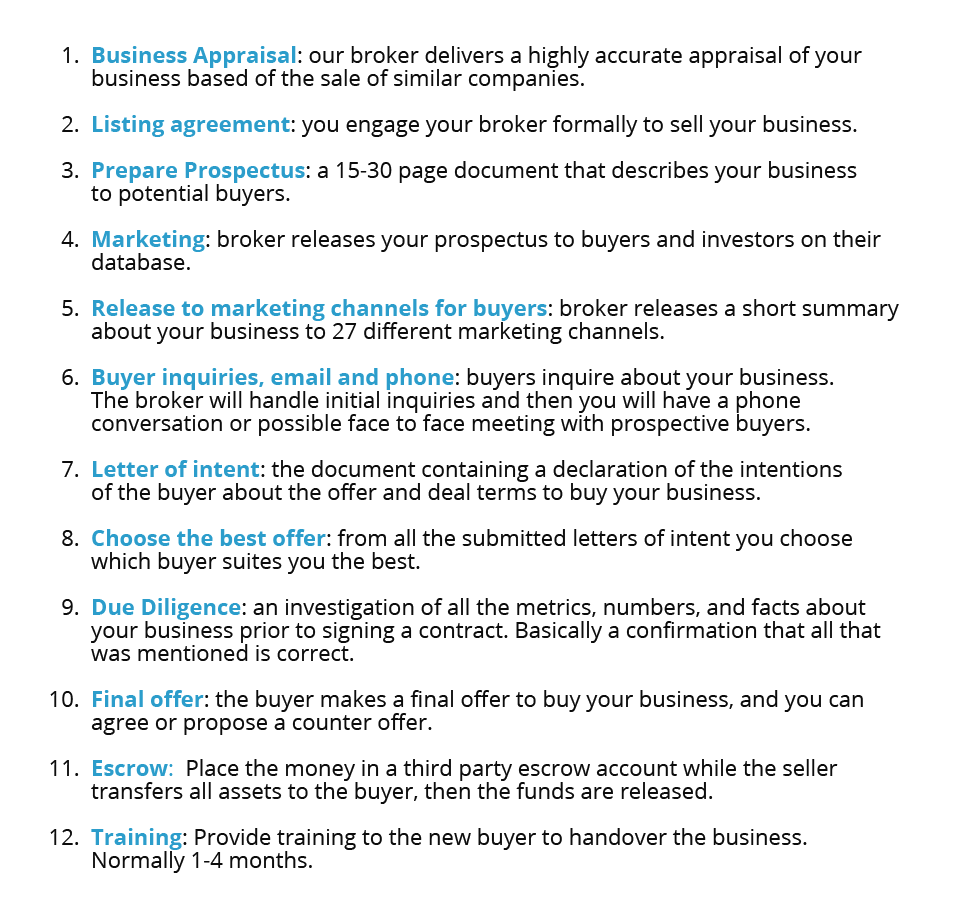

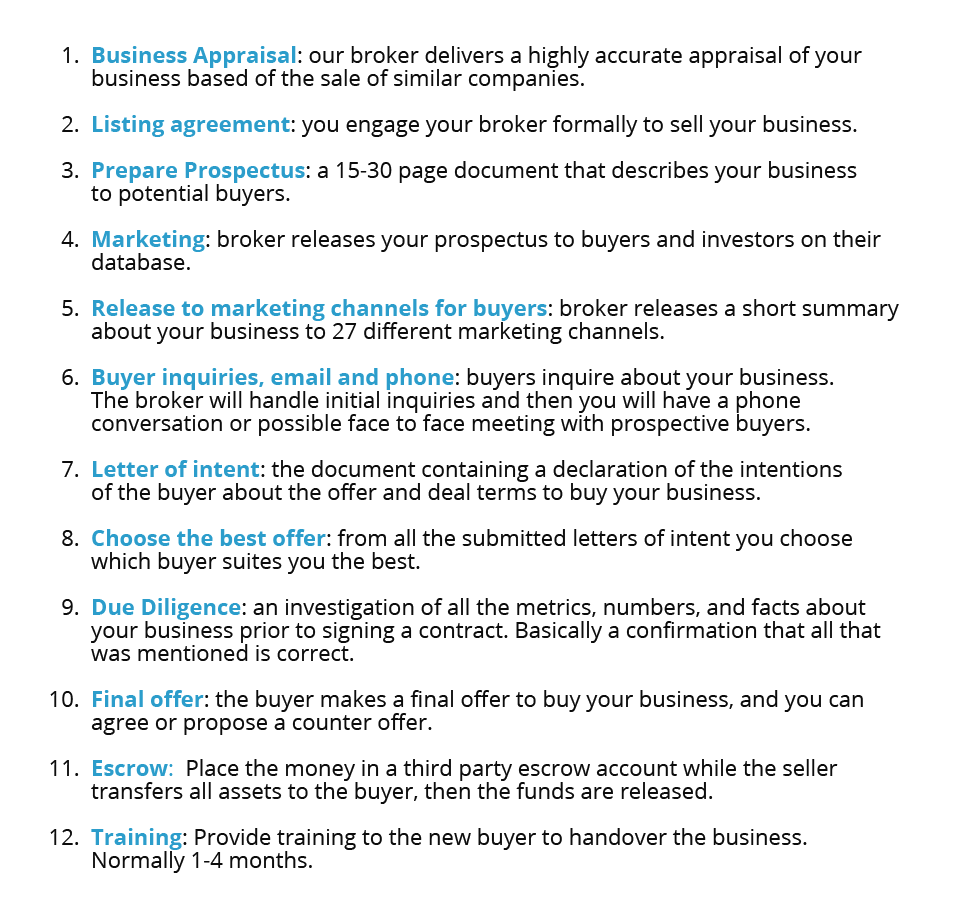

The Sales Process and Negotiation

Selling a landscaping business requires a strategic and well-executed sales process. A smooth transition ensures both a fair price for the seller and a successful acquisition for the buyer. This process involves several key stages, from initial marketing to final contract signing, each demanding careful planning and execution.

Stages of the Sales Process

The sales process unfolds in a series of distinct stages. Each stage builds upon the previous one, contributing to a successful sale. A clear understanding of these stages is crucial for maximizing the chances of a positive outcome.

- Initial Contact and Qualification: This stage involves generating leads through marketing efforts and then qualifying potential buyers to determine their seriousness and financial capacity. This often involves preliminary conversations to gauge interest and assess the buyer’s understanding of the business.

- Business Presentation and Due Diligence: Once qualified buyers are identified, a detailed presentation of the business is crucial. This includes providing comprehensive financial records, operational details, client lists, and future projections. The buyer will typically conduct due diligence, verifying the information provided and assessing the business’s overall health and potential.

- Negotiation and Offer: After due diligence, the buyer will usually make an offer. This stage involves careful negotiation to reach a mutually acceptable price and terms. This may include discussions on payment schedules, asset transfers, and non-compete agreements.

- Legal and Contractual Review: Once an agreement is reached, legal professionals review and finalize the sale agreement. This ensures all aspects of the transaction are legally sound and protect the interests of both parties. This stage often involves lawyers specializing in business acquisitions.

- Closing and Handover: The final stage involves completing the legal formalities, transferring ownership, and handing over the business operations. This includes transferring assets, accounts, and client relationships to the new owner. A smooth transition is vital for maintaining business continuity.

Effective Negotiation Strategies

Negotiation is a critical element of the sales process. Successful negotiation requires a balanced approach, prioritizing both the seller’s interests and the buyer’s needs. Preparation is key to achieving a favorable outcome.

Effective strategies include:

- Know your worth: Thoroughly research comparable business sales to determine a realistic asking price. Understanding your business’s strengths and weaknesses is crucial in justifying the asking price.

- Active listening: Pay close attention to the buyer’s concerns and address them directly. Understanding their perspective can help you tailor your negotiation strategy.

- Flexibility and compromise: Be prepared to negotiate on certain terms, but be firm on others. Finding a balance between meeting the buyer’s needs and protecting your interests is crucial.

- Professional demeanor: Maintain a professional and respectful attitude throughout the negotiation process. This fosters trust and encourages a positive outcome.

Common Challenges and Solutions

Several challenges can arise during the sales process. Anticipating these challenges and developing strategies to overcome them is essential for a successful sale.

Examples of common challenges and their solutions:

| Challenge | Solution |

|---|---|

| Buyer’s low initial offer | Present a strong justification for the asking price, highlighting the business’s strengths and market value. Be prepared to negotiate, but don’t undervalue your business. |

| Lengthy due diligence process | Be organized and prepared to provide all necessary documentation promptly. Maintain open communication with the buyer throughout the process. |

| Disagreements on contract terms | Engage legal counsel to navigate complex legal issues. Be prepared to compromise on less critical aspects of the contract while protecting your key interests. |

Effective Communication Techniques

Clear and consistent communication is vital throughout the sales process. Effective communication builds trust, fosters understanding, and contributes to a smoother transaction.

Examples of effective communication techniques include:

- Prompt responses: Respond to inquiries promptly and professionally. This demonstrates respect for the buyer’s time and interest.

- Clear and concise language: Avoid jargon and technical terms that the buyer may not understand. Use clear and concise language to convey information effectively.

- Regular updates: Keep the buyer informed of the progress of the sales process. This helps maintain transparency and builds trust.

- Professional written communication: Use professional email correspondence and avoid informal language or slang. This maintains a level of professionalism and formality appropriate for a business transaction.

Transitioning the Business to the New Owner

Successfully transferring a landscaping business requires meticulous planning and execution. A smooth transition minimizes disruption to clients and employees, ensuring the continued success of the business under new ownership. This involves a well-defined process encompassing the transfer of ownership, operational handover, and ongoing support.

A comprehensive transition plan is crucial for a successful handover. This plan should detail the steps involved in transferring ownership and responsibilities, outlining clear timelines and responsibilities for both the seller and the buyer. The plan must address all aspects of the business, from client relationships and employee management to financial records and operational procedures. A well-structured transition period, typically lasting several weeks or months, allows for a gradual transfer of knowledge and responsibilities, minimizing potential disruptions and ensuring business continuity.

Transfer of Ownership and Responsibilities

The transfer of ownership is a legal process that requires careful attention to detail. This involves the execution of legal documents, such as a bill of sale or an asset purchase agreement, clearly outlining the terms of the sale, including the purchase price, assets included, and any liabilities assumed by the buyer. The seller should also ensure that all necessary licenses and permits are transferred to the new owner. Responsibilities should be transferred gradually, allowing the buyer sufficient time to familiarize themselves with the business operations and client base. This may involve shadowing the seller for a period of time, attending meetings with clients, and participating in daily operations. A comprehensive checklist detailing all responsibilities and their transfer dates ensures nothing is overlooked.

Client Relationship Management

Maintaining positive client relationships is essential for the continued success of the landscaping business. The transition plan should include a strategy for informing clients of the ownership change and introducing them to the new owner. This may involve sending personalized letters or emails to clients, scheduling meetings to discuss the transition, and ensuring a seamless continuation of services. Building trust and rapport with existing clients is paramount during this period. Maintaining accurate client records, including contact information, service history, and payment details, is crucial for a smooth transition. Open communication and transparency are key to ensuring client satisfaction and retention throughout the process. For example, a personalized email could be sent to clients announcing the transition, highlighting the new owner’s commitment to providing the same high level of service.

Employee Management During the Transition

A successful transition requires a thoughtful approach to employee management. The new owner should be introduced to the employees, and a clear communication plan should be established to address any concerns or questions they may have. The seller should work closely with the new owner to ensure a smooth transition of employee responsibilities and maintain employee morale. Maintaining open communication channels, providing training to the new owner on employee management, and ensuring the continuity of employee benefits are crucial for a smooth transition. For example, a town hall meeting could be held to introduce the new owner and answer employee questions, followed by individual meetings to discuss roles and responsibilities. Maintaining a positive work environment throughout the transition is vital to retaining experienced employees and ensuring business continuity.

Establishing a Well-Defined Transition Period

A well-defined transition period, typically ranging from several weeks to several months, is crucial for a successful business handover. This period allows for a gradual transfer of knowledge, responsibilities, and client relationships. A detailed schedule outlining key milestones and responsibilities for both the seller and buyer should be established. Regular meetings should be held to track progress, address any issues, and ensure a smooth transition. The length of the transition period should be tailored to the size and complexity of the business. A longer transition period may be necessary for larger businesses with more complex operations and a larger client base. For instance, a small landscaping business might require a two-month transition, while a larger company with multiple crews and complex contracts might need six months or more. This allows for adequate time to onboard the new owner and ensure a seamless handover of all aspects of the business.

Examples of Successful Business Transitions

Many successful business transitions are characterized by thorough planning, open communication, and a collaborative approach between the seller and buyer. For example, a landscaping business owner in California successfully transitioned their business by creating a detailed transition plan that included a six-month handover period, regular meetings with the buyer, and a comprehensive training program for the new owner. This allowed for a smooth transfer of knowledge and responsibilities, resulting in a seamless transition and minimal disruption to clients and employees. Another example involves a landscaping company in Florida that used a phased approach, gradually transferring responsibilities over a year. This approach allowed the new owner to learn the business gradually and build relationships with clients and employees before taking full ownership. These examples demonstrate the importance of a well-structured transition plan and the benefits of a collaborative approach between the seller and buyer.

Understanding Tax Implications

Selling a landscaping business involves significant tax implications, particularly concerning capital gains taxes. Understanding these implications is crucial for maximizing your return and minimizing your tax liability. Proper planning and consultation with a tax professional are essential to navigate the complexities of this process effectively.

Capital gains taxes are levied on the profit you make from selling an asset, in this case, your landscaping business. The tax rate depends on several factors, including your taxable income and how long you owned the business. Generally, long-term capital gains (holding the business for more than one year) are taxed at a lower rate than short-term capital gains. However, the calculation is not simply the sale price minus the purchase price. Numerous factors such as accumulated depreciation, improvements, and business expenses will all impact the final taxable gain.

Capital Gains Tax Calculation

The calculation of capital gains tax on the sale of a landscaping business is complex and depends on several factors. It begins with determining the net selling price, which is the sale price less any selling expenses, such as brokerage fees or legal costs. Then, the adjusted basis of the business must be determined. This involves subtracting accumulated depreciation and other allowable deductions from the original cost basis. The difference between the net selling price and the adjusted basis represents the capital gain. This gain is then subject to capital gains tax rates, which vary depending on the taxpayer’s income bracket and the holding period of the business. For example, a business owner selling their landscaping business for $500,000 after deducting selling expenses and with an adjusted basis of $200,000 would have a capital gain of $300,000. The tax liability would then be calculated based on applicable capital gains tax rates. This process often requires professional assistance to ensure accuracy and compliance.

Tax-Saving Strategies

Several strategies can help minimize your tax liability when selling your landscaping business. These strategies often involve careful financial planning and potentially require adjustments to your business operations in the period leading up to the sale.

Careful planning is essential to mitigate the tax burden. For instance, strategically timing the sale to align with lower tax brackets or utilizing tax-loss harvesting to offset gains can prove beneficial. Additionally, understanding and maximizing deductions for business expenses and depreciation throughout the ownership period can reduce the overall taxable gain at the time of sale. It is crucial to consult with a tax professional to explore the most effective strategies given your individual circumstances.

Resources for Tax Information

Several resources can provide valuable information about tax obligations related to selling a business. The Internal Revenue Service (IRS) website offers comprehensive guidelines and publications, including publications specific to business sales and capital gains. State tax agencies also provide relevant information specific to state taxes. Furthermore, numerous reputable financial and legal websites offer guidance and educational resources on business tax matters. However, given the complexity of tax laws, it is strongly recommended to seek professional advice to ensure compliance and optimize your tax planning.

Importance of Consulting a Tax Professional

Given the complexities of tax laws and the potential for significant financial consequences, consulting with a qualified tax professional is crucial. A tax professional can help you understand your specific tax obligations, identify potential tax-saving strategies tailored to your situation, and ensure accurate completion of all necessary tax forms and filings. This professional guidance can save you considerable time, effort, and potentially substantial amounts of money in taxes. They can also help navigate any potential tax audits or disputes with tax authorities. The cost of professional advice is often far outweighed by the potential benefits of tax optimization and compliance.