How to void a check in Business Central? This seemingly simple question unlocks a world of complexities within the financial management system. Mastering this process is crucial for maintaining accurate financial records, preventing errors, and adhering to best practices. This guide delves into the intricacies of voiding checks in Business Central, covering everything from prerequisites and step-by-step instructions to security considerations and integration with other systems. We’ll explore various scenarios, potential pitfalls, and best practices to ensure smooth and compliant check voiding procedures.

From understanding the different statuses of checks and required authorizations to navigating potential error messages and troubleshooting solutions, we provide a comprehensive overview. We also discuss the importance of maintaining a detailed audit trail, the implications of voiding checks after they’ve been processed, and the integration with other accounting systems. This guide is your ultimate resource for confidently managing check voiding within Business Central.

Understanding Check Voiding in Business Central

Voiding a check in Business Central is a crucial process for correcting errors or preventing fraudulent activity. Understanding the procedure and potential pitfalls ensures smooth financial management. This section details the process, prerequisites, and troubleshooting steps involved in voiding checks within the Business Central system.

Check Voiding Prerequisites in Business Central

Before attempting to void a check, several conditions must be met. The check must be in a status that allows voiding; typically, it cannot have been already deposited or cashed. Furthermore, appropriate user permissions and authorizations are necessary to execute the voiding process. Insufficient authorization will result in an error message preventing the action. The specific permissions required depend on your Business Central setup and user roles, but generally, access to the relevant check registers and the authority to modify payment transactions are essential.

Step-by-Step Guide to Voiding a Check in Business Central

The process of voiding a check in Business Central involves navigating to the relevant payment journal, locating the specific check, and then initiating the voiding action. The exact steps might vary slightly based on your Business Central version, but the general procedure remains consistent.

- Locate the Payment Journal: Navigate to the “Payments” area within Business Central. You will find the relevant payment journal where the check was originally registered. This is usually accessible through the “General Ledger” or “Cash Management” modules.

- Identify the Check: Locate the specific check you need to void within the payment journal. You can filter the journal entries using various criteria such as check number, date, or vendor.

- Select the Check: Select the check you wish to void. The interface will provide options to process the selected entries.

- Void the Check: Initiate the voiding process. This typically involves selecting a “Void Check” function or a similar action within the context menu or a dedicated button.

- Confirmation: Business Central may prompt for confirmation before voiding the check. Review the details and confirm the action.

Potential Error Messages and Solutions During Check Voiding

Several error messages can occur during the check voiding process. These messages usually indicate a problem with the check’s status, insufficient permissions, or inconsistencies in the underlying data.

| Error Message | Possible Cause | Solution |

|---|---|---|

| “Check already deposited” | The check has already been presented for payment. | The check cannot be voided. Contact your bank to stop payment. |

| “Insufficient permissions” | The user lacks the necessary authorization to void checks. | Contact your Business Central administrator to request the appropriate permissions. |

| “Data inconsistency detected” | There is a discrepancy in the data related to the check. | Review the check details for any errors. Contact your Business Central administrator if the issue persists. |

Different Scenarios for Voiding Checks: How To Void A Check In Business Central

Voiding a check in Business Central, while seemingly straightforward, involves several nuanced scenarios depending on the check’s status and the payment process. Understanding these scenarios is crucial for maintaining accurate financial records and avoiding potential complications. Incorrectly voiding a check can lead to discrepancies and reconciliation issues.

Voiding Cashed or Deposited Checks

Attempting to void a check after it has been cashed or deposited by the payee is generally not possible within Business Central. The check is already processed and cleared through the banking system. Instead of voiding, the process involves reversing the original transaction, potentially requiring journal entries to correct the accounting records. This typically involves contacting your bank to initiate a stop payment, and then recording the reversal in your accounting software. Failure to properly handle a cashed or deposited check can lead to significant accounting discrepancies and potential financial losses. The process is more complex and requires careful attention to detail to ensure accuracy.

Voiding Checks in Batch Payments

Voiding checks within a batch payment requires a more systematic approach. Business Central usually doesn’t allow individual check voiding within an already processed batch. The entire batch might need to be reversed or adjustments made via journal entries. The specific steps depend on the payment batch’s status and the system’s configuration. Consider the potential impact on other payments in the batch before attempting any corrections. Detailed records of all adjustments are crucial for auditing purposes. For instance, if a batch of 10 checks contains one erroneous check, reversing the entire batch and re-processing the remaining nine checks may be necessary, although more efficient methods might exist depending on the system.

Voiding a Check versus Stopping a Check, How to void a check in business central

Voiding a check removes it from the system, essentially treating it as if it never existed. Stopping a check, on the other hand, prevents the check from being cashed. The check still exists in the system, but it’s flagged as stopped. The key difference lies in the finality of the action. Voiding is irreversible, while stopping allows for potential future processing, such as reissuing the check or releasing the stop payment. Choosing the correct action depends on the circumstances. If the check is lost or stolen, stopping it is preferable. If the check was issued incorrectly, voiding might be appropriate, but only if it hasn’t been presented for payment.

Situations Where Voiding Might Not Be Appropriate

Voiding a check should be avoided if the check has already been presented for payment or deposited. In such cases, reversing the transaction through appropriate journal entries and possibly a stop payment from the bank is the preferred method. Similarly, if the check is part of a complex financial transaction, voiding it might create cascading issues that are difficult to resolve. Careful consideration of the potential consequences is vital before voiding any check. In cases of doubt, consulting with an accounting professional is highly recommended to prevent errors and ensure compliance with financial regulations.

Business Central’s Audit Trail and Check Voiding

Business Central meticulously tracks all financial transactions, including the voiding of checks. This comprehensive audit trail is crucial for maintaining financial integrity, ensuring regulatory compliance, and facilitating efficient internal controls. Understanding how this audit trail functions and how to access its information is vital for both financial managers and auditors.

Business Central’s audit trail for check voiding provides a detailed record of each voiding action, including the user who performed the action, the date and time of the void, and the reason for the void (if recorded). This detailed information is essential for reconstructing events, identifying potential errors or fraudulent activities, and meeting regulatory requirements. The system’s robust logging capabilities minimize the risk of disputes and ensure transparency in financial operations.

Accessing and Interpreting the Check Voiding Audit Trail

Accessing the audit trail in Business Central depends on the specific version and configuration. Generally, it involves navigating to the appropriate administration or audit log sections within the application. The precise steps may vary, but often include searching for specific entries based on date ranges, user IDs, or transaction types. Once accessed, the audit trail displays a list of entries, each representing a specific action. Each entry contains a timestamp, the user who initiated the action, and a description of the action taken. In the context of check voiding, the description will clearly indicate the check number voided and the related transaction details. Analyzing these entries allows for a comprehensive understanding of the circumstances surrounding each check voiding event.

Check Voiding Audit Trail Key Fields

The following table illustrates key fields commonly found within Business Central’s audit trail related to check voiding. Note that the exact fields and data types may vary slightly depending on your Business Central version and customizations.

| Field Name | Data Type | Description | Example |

|---|---|---|---|

| Transaction ID | Integer | Unique identifier for the voiding transaction. | 12345 |

| Check Number | String | The number of the voided check. | 000123 |

| Void Date | Date | Date the check was voided. | 2024-10-27 |

| Void Time | Time | Time the check was voided. | 14:30:00 |

| Voided By (User ID) | String | Identifier of the user who voided the check. | jdoe |

| Reason for Void | String (Text) | Optional field for recording the reason for voiding. | Duplicate Payment |

| Original Transaction Amount | Decimal | The amount of the original check. | 1000.00 |

Security and Access Control for Check Voiding

Protecting the integrity of financial transactions and preventing fraud are paramount when dealing with check voiding in Business Central. Robust security measures are crucial to ensure only authorized personnel can initiate this sensitive process. This section details the security considerations, permission configurations, and best practices for establishing a secure check voiding process.

User Permission Configuration for Check Voiding

Business Central offers granular control over user access through role-based permissions. To restrict access to the check voiding functionality, specific permissions must be assigned or removed from user roles. This involves navigating the user management section within Business Central and modifying the permissions assigned to each role. For example, a standard employee role might lack the permission to void checks, while an accounts payable manager role would have this permission enabled. Carefully reviewing and assigning permissions based on job responsibilities is crucial for maintaining data security. Denying access to this functionality for users who don’t require it minimizes the risk of unauthorized check voiding.

Roles and Responsibilities for Check Voiding Authorization

Clearly defined roles and responsibilities are essential for a secure check voiding process. Typically, the responsibility for authorizing check voids rests with individuals in accounting or finance departments who possess a high level of authority and oversight. These individuals should have a thorough understanding of accounting procedures and internal controls. A segregation of duties is also important; the person voiding the check should not be the same person who originally processed or approved it. This separation helps prevent fraud and ensures accountability. For instance, an accounts payable clerk might process payments, but a supervisor or manager would have the sole authority to void checks. A clear authorization workflow, perhaps involving multiple approvals for larger or more significant checks, further strengthens security.

Security Policy Best Practices for Check Voiding Procedures

A comprehensive security policy should Artikel the procedures for check voiding, including authorization levels, documentation requirements, and audit trail review. This policy should be readily accessible to all relevant personnel and regularly reviewed and updated. The policy should mandate proper documentation for each voided check, including the reason for voiding, the authorization signature, and a record of the date and time of the void. Regular audits of the check voiding process should be conducted to identify any anomalies or potential security breaches. Moreover, the policy should stipulate that all voided checks be physically marked as voided and stored securely to prevent reuse. Implementing strong password policies for user accounts and regularly updating Business Central software are additional best practices. Consideration should also be given to implementing multi-factor authentication for increased security.

Best Practices and Prevention of Check Voiding Issues

Effective check management minimizes the need for voiding checks and reduces the risk of fraudulent activities. Implementing robust procedures and adhering to best practices significantly improves financial control and operational efficiency. This section Artikels strategies for preventing check voiding issues and mitigating potential problems.

Best Practices for Check Management

Minimizing the need to void checks begins with proactive management. This involves establishing clear procedures for check creation, authorization, and distribution. Implementing a robust system for tracking checks from issuance to clearing ensures accountability and minimizes the chances of errors. Regular reconciliation of bank statements with internal records helps identify discrepancies early, preventing potential voiding situations. Furthermore, establishing clear roles and responsibilities for check handling and authorization helps prevent unauthorized check issuance and reduces the risk of fraud. A well-defined approval process, including multiple levels of authorization for high-value checks, adds another layer of security.

Preventing Fraudulent Check Voiding Attempts

Fraudulent check voiding attempts often involve collusion or exploiting weaknesses in internal controls. Implementing strong security measures, such as limiting access to check-writing software and restricting the number of individuals authorized to void checks, is crucial. Regular audits of check-writing activities, including review of voiding logs, help detect anomalies and potential fraudulent activities. Employee background checks and regular training on fraud prevention are also essential. Implementing a system of dual control, where two individuals must authorize any check voiding request, significantly reduces the risk of unauthorized voiding. Finally, utilizing check security features like watermarks and microprinting makes it harder to counterfeit checks and thus reduces the incentive for fraudulent voiding.

Common Check Voiding Mistakes and Their Prevention

Several common mistakes lead to unnecessary check voiding. These mistakes can be prevented through careful attention to detail and the implementation of effective internal controls.

- Incorrect Payee Information: Double-checking payee information before printing the check is crucial. Implementing a system for verifying payee details against company records before check issuance minimizes errors.

- Incorrect Amount: Carefully reviewing the amount written in both numerals and words prevents errors. Using software with built-in checks for numerical and alphabetical consistency further reduces mistakes.

- Unauthorized Check Issuance: Establishing a clear approval workflow for all checks and implementing access controls to the check-writing system prevents unauthorized issuance. Regular reviews of check issuance logs can detect anomalies.

- Missing or Incomplete Documentation: Ensuring that all supporting documentation is attached to the check before issuance and that the documentation is properly filed helps prevent confusion and unnecessary voiding.

- Delayed Check Processing: Promptly processing checks minimizes the risk of issues arising from delays. Establishing clear timelines for check processing and reconciliation helps maintain efficiency.

Check Voiding Request Workflow

The following flowchart illustrates the process for handling check voiding requests. This process ensures proper authorization and documentation of all voiding actions.

[Imagine a flowchart here. The flowchart would begin with a “Check Voiding Request Submitted” box, leading to a “Request Review and Verification” box. This would branch to either “Request Approved” or “Request Denied”. “Request Approved” would lead to “Check Voided and Logged” and then “Notification to Relevant Parties”. “Request Denied” would lead to “Notification to Requestor with Explanation”. Each box would have clear descriptions of the actions taken at each stage.]

Integration with Other Systems

Business Central’s check voiding functionality doesn’t exist in isolation; it’s designed to interact seamlessly with other systems within a business’s technological ecosystem. Effective integration ensures data consistency, minimizes errors, and streamlines reconciliation processes. Understanding these integrations is crucial for maintaining accurate financial records and preventing discrepancies.

The impact of voiding a check extends beyond Business Central, affecting related transactions in other accounting and banking systems. For instance, voiding a check in Business Central must also be reflected in the general ledger, potentially requiring adjustments to accounts payable or receivable. Similarly, the void must be communicated to the bank to prevent potential payment processing issues.

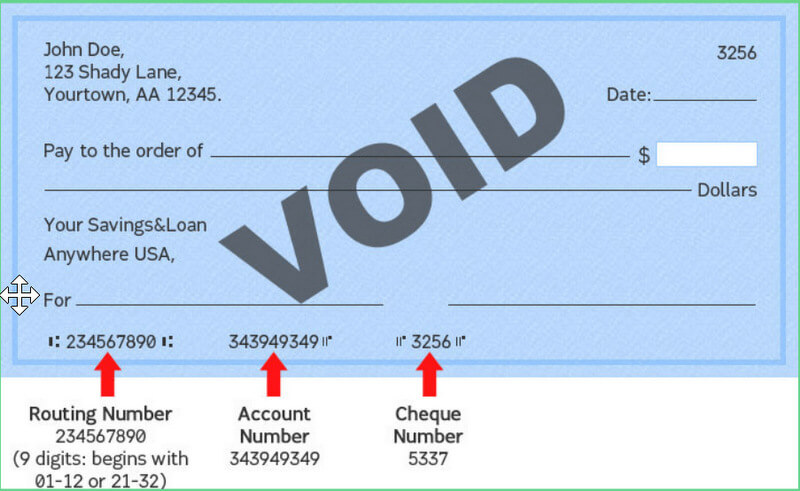

Reconciling Voided Checks with Bank Statements

Reconciling voided checks requires careful attention to detail. The voided check information, including the check number and amount, must be accurately reflected in both Business Central and the bank statement. Discrepancies can arise if the void isn’t properly recorded in Business Central or if the bank hasn’t processed the void correctly. A common reconciliation method involves comparing the check register in Business Central with the bank statement, identifying any voided checks listed in the register but not marked as voided on the statement. This process usually involves manually reviewing the bank statement and making any necessary adjustments in Business Central. Any unexplained discrepancies should be investigated to identify the source of the error, whether it’s a timing issue, a data entry error, or a problem with the bank’s processing.

Data Transfer Between Systems

Data related to voided checks is typically transferred between systems using various methods, including direct database integration, file-based transfers (like CSV or XML files), or through application programming interfaces (APIs). For example, Business Central might directly update the general ledger in another accounting system upon voiding a check. Alternatively, a nightly batch process could transfer a file containing a list of voided checks to the bank’s reconciliation system. The specific method depends on the systems used and the level of integration implemented. A robust integration strategy ensures data integrity and consistency across all systems. For instance, a company using Business Central and a third-party payroll system might integrate the voiding process so that if a payroll check is voided in Business Central, the payroll system is automatically updated to reflect the change, preventing duplicate payments or discrepancies in payroll reports.

Illustrative Examples of Check Voiding Processes

Understanding the practical application of check voiding in Business Central is crucial for maintaining accurate financial records. The following scenarios illustrate the process and its impact on the system. Each example details the steps involved in voiding the check and the subsequent adjustments made to the general ledger.

Accidental Duplicate Check Issuance

This scenario involves the unintentional creation and issuance of two checks for the same payment. Let’s assume a payment of $1,000 was mistakenly issued twice to vendor “ABC Company” with check numbers 1234 and 1235. To rectify this, the second check (1235) needs to be voided.

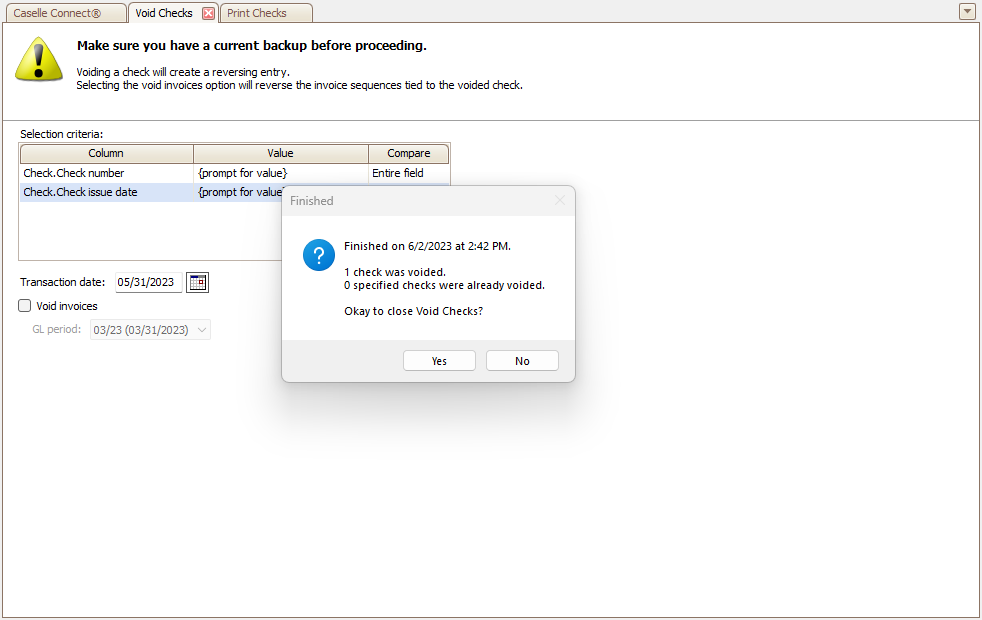

In Business Central, navigating to the relevant check register, locating check number 1235, and selecting the “Void Check” function initiates the voiding process. The system will typically prompt for confirmation before proceeding. Upon successful voiding, the check’s status is updated to “Voided,” and the transaction is marked as such.

The impact on the general ledger is a reversal of the initial payment entry for check 1235. This involves a debit to the Accounts Payable account and a credit to the bank account, effectively canceling the duplicate payment. The Accounts Payable balance is restored to its correct value. No impact is observed on the original payment (check 1234). The audit trail will clearly show the voiding transaction, including date, time, and user who performed the action.

Incorrect Payee Information on Check

Suppose a check (number 1236) for $500 was issued to “XYZ Corp” instead of the intended recipient, “XYZ Inc.” Correcting this requires voiding check 1236 and issuing a new check with the correct payee information.

The voiding process in Business Central remains the same: locate the check in the register, select “Void Check,” and confirm the action. The general ledger entry will reflect a reversal similar to the duplicate check scenario, debiting Accounts Payable and crediting the bank account. A new check will then be created for “XYZ Inc.” This new check will generate a separate, new general ledger entry debiting the bank account and crediting the Accounts Payable account. The audit trail will show both the voiding of the incorrect check and the creation of the correct one.

Payment Reversal Requested by Customer

Consider a scenario where a customer requests a reversal of a payment (check 1237 for $2,000) already issued. This necessitates voiding the check.

The voiding process follows the same steps as before. In Business Central, find check 1237, select “Void Check,” and confirm. The general ledger will show a reversal, debiting the bank account and crediting the Accounts Payable (or a relevant customer receivable account, depending on the setup). The customer’s account will be updated to reflect the reversed payment. The audit trail will record this transaction.

- Accidental Duplicate: Affects only the duplicate check; original payment remains unaffected. General ledger impact is a simple reversal of the duplicate payment.

- Incorrect Payee: Requires voiding the incorrect check and creating a new one. General ledger shows both a reversal and a new entry for the correct payment.

- Payment Reversal: Initiated by the customer; voiding affects the original payment and updates customer accounts. General ledger shows a reversal of the original payment.