Understanding Fig Loans

Fig Loans presents a unique approach to personal lending, focusing on a streamlined application process and potentially competitive interest rates. This makes it a compelling option for borrowers seeking a transparent and efficient lending experience, particularly those who may be underserved by traditional financial institutions. Let’s delve into the specifics of what Fig Loans offers.

Core Features and Services

Fig Loans primarily offers personal loans, designed to cater to a range of financial needs. These loans are typically unsecured, meaning they don’t require collateral. The platform emphasizes a quick and easy online application process, often providing instant loan decisions. While specific features may vary, Fig Loans generally focuses on providing a user-friendly experience with clear terms and conditions. This transparency aims to empower borrowers to make informed decisions.

Target Audience

Fig Loans targets individuals who need access to relatively small personal loans for various purposes. This could include debt consolidation, home improvements, medical expenses, or unexpected emergencies. The platform may particularly appeal to those who have been turned down by traditional lenders due to less-than-perfect credit scores, or who simply prefer a faster, more convenient application process than that offered by banks. The emphasis on digital accessibility broadens its reach to a wider demographic.

Loan Application Process

The Fig Loans application process is designed for simplicity. Borrowers typically begin by providing basic personal and financial information online. This includes details such as income, employment history, and credit score. The platform then uses this information to assess the applicant’s creditworthiness and determine loan eligibility and terms. Once approved, funds are often disbursed quickly, usually within a few business days. The entire process is intended to be completed online, minimizing paperwork and in-person interactions.

Interest Rate Comparison

Fig Loans’ interest rates are competitive, though the exact rates will vary depending on individual creditworthiness and loan terms. While it’s impossible to provide a precise comparison without specific data points at a given time, it’s reasonable to state that Fig Loans generally aims to be competitive within the personal loan market. For comparison, industry averages for personal loans fluctuate, but often range from 6% to 36% APR, depending on credit score and other factors. It’s crucial for potential borrowers to compare offers from multiple lenders to secure the most favorable terms. Checking the current rates directly on the Fig Loans website is advised.

Identifying Alternative Lending Platforms

Finding the right financing solution can feel like navigating a maze. Fig Loans offers a specific set of services, but understanding alternative options is crucial for securing the best terms and maximizing your financial flexibility. Exploring diverse lending platforms allows you to compare interest rates, fees, and eligibility criteria, ultimately leading to a more informed decision. This section dives into several platforms similar to Fig Loans, highlighting their strengths and weaknesses to help you choose wisely.

Comparison of Alternative Lending Platforms, Sites like fig loans

The following table compares several lending platforms to Fig Loans, considering loan types, interest rates, and key features. Remember that interest rates and eligibility criteria are subject to change and are based on current market conditions and individual applicant profiles. Always check the lender’s website for the most up-to-date information.

| Platform Name | Loan Types | Interest Rate Range (Approximate) | Key Features |

|---|---|---|---|

| Upstart | Personal Loans | 6.49% – 35.99% APR | Uses AI to assess creditworthiness; fast funding; flexible repayment options. |

| LendingClub | Personal Loans, Business Loans | 7.04% – 35.99% APR | Large network of lenders; various loan amounts; peer-to-peer lending model. |

| OnDeck | Business Loans, Lines of Credit | Varies greatly depending on creditworthiness and loan amount. | Specialized in small business financing; fast approval process; options for businesses with less-than-perfect credit. |

| Kabbage | Business Loans, Lines of Credit | Varies greatly depending on creditworthiness and loan amount. | Focuses on providing funding for online businesses; uses alternative data for credit assessment; quick application process. |

| SoFi | Personal Loans, Student Loan Refinancing, Mortgages | Varies greatly depending on loan type and applicant profile. | Offers a wide range of financial products; known for its strong customer service; potential for lower rates for members. |

Eligibility Criteria Comparison

Direct comparison of eligibility criteria across all platforms is difficult without specific applicant profiles. However, generally speaking, Fig Loans, like many other platforms, considers credit score, income, debt-to-income ratio, and loan purpose. Platforms like Upstart may place less emphasis on traditional credit scores and more on alternative data, while others like OnDeck specialize in serving businesses that may not qualify for traditional bank loans. Each platform has its own nuanced approach to assessing risk.

Situational Advantages of Alternative Platforms

Choosing the right platform depends heavily on your individual circumstances.

For example: An entrepreneur needing rapid funding for a short-term business expense might find OnDeck’s quick approval process more advantageous than Fig Loans’ potentially longer application period. Someone with a less-than-perfect credit score might find Upstart’s AI-driven assessment system more favorable, as it considers factors beyond traditional credit scores. If you’re looking for a broader range of financial products beyond personal loans, SoFi’s diversified offerings might be a better fit. Finally, LendingClub’s peer-to-peer lending model could potentially offer competitive rates depending on market conditions. Ultimately, the “best” platform is the one that best aligns with your specific financial needs and profile.

Analyzing Loan Terms and Conditions: Sites Like Fig Loans

Understanding the fine print is crucial when securing a loan, especially from alternative lending platforms like Fig Loans. Ignoring the details can lead to unexpected fees and financial strain. This section will dissect the typical terms and conditions, empowering you to make informed decisions and avoid potential pitfalls.

Loan Fees and Charges

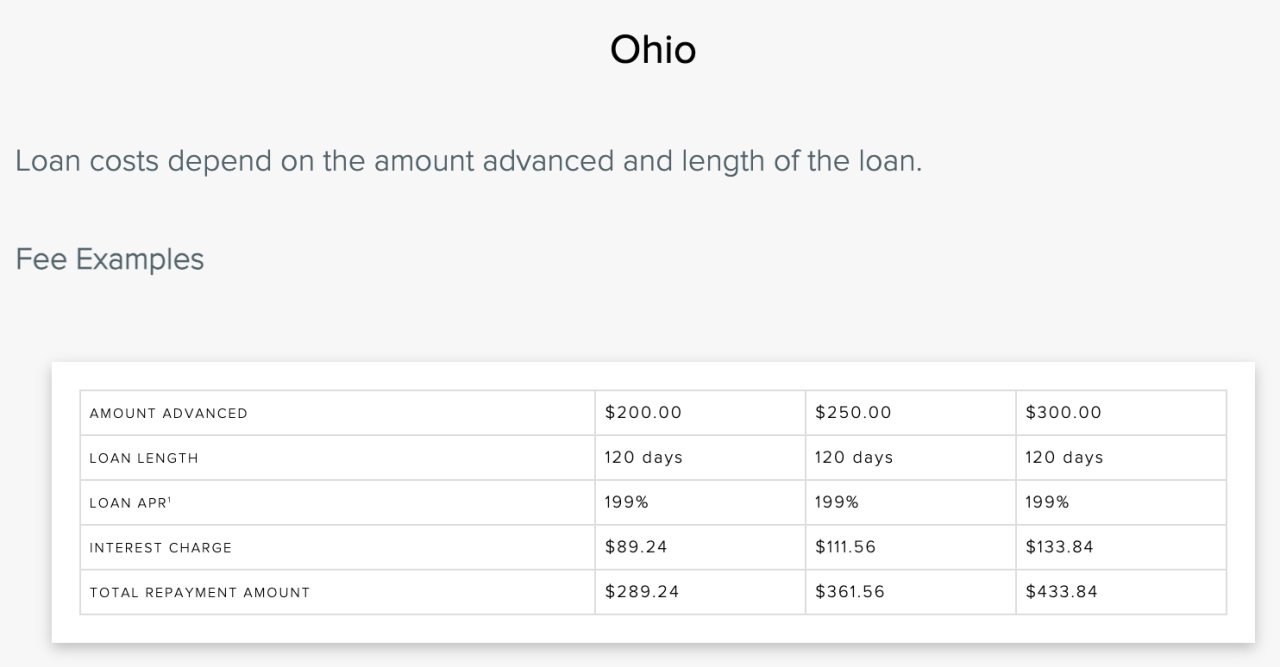

Alternative lending platforms often employ a variety of fees to generate revenue. These can include origination fees (a percentage of the loan amount charged upfront), late payment fees (penalties for missed or delayed payments), prepayment penalties (fees for paying off the loan early), and potentially others like application fees or administrative charges. The specific fees and their amounts vary considerably across platforms. For example, one platform might charge a 3% origination fee, while another might charge a flat fee of $100. Always compare the total cost of the loan, including all fees, before committing. It’s also wise to carefully review the fee schedule to understand exactly when and how these fees are applied. Transparency in this area is key.

Repayment Options and Schedules

Repayment schedules and options offered by alternative lending platforms are equally diverse. Some platforms offer fixed-term loans with equal monthly payments, similar to traditional bank loans. Others may provide more flexible options, such as shorter-term loans with higher payments or longer-term loans with lower payments. Some may even allow for bi-weekly or accelerated payments to reduce the overall interest paid. For instance, a 36-month loan might have a fixed monthly payment of $500, while a 12-month loan might require a higher monthly payment of $1500. The choice of repayment schedule directly impacts your monthly budget and the total interest paid over the life of the loan. Consider your financial situation and choose a repayment schedule that aligns with your capabilities.

Transparency and Clarity of Terms and Conditions

The level of transparency and clarity in loan terms and conditions varies significantly across different alternative lending platforms. Some platforms present their terms in a straightforward, easy-to-understand manner, while others might use complex legal jargon that is difficult for the average borrower to decipher. Look for platforms that provide clear explanations of all fees, interest rates, repayment terms, and other relevant details in plain language. A platform with a high level of transparency builds trust and reduces the risk of misunderstandings or disputes. Compare the clarity of the terms and conditions across multiple platforms before making a decision. A well-structured and easily navigable website with readily available information on fees and repayment options is a strong indicator of transparency.

Exploring Customer Experiences

Understanding the customer experience is crucial when choosing a lending platform. Positive reviews can indicate a reliable and efficient service, while negative feedback can highlight potential pitfalls. By analyzing customer experiences across various platforms, you can make a more informed decision about which lender best suits your needs.

Sites like fig loans – Analyzing customer reviews provides invaluable insights into the strengths and weaknesses of different lending platforms. This analysis allows for a more objective comparison, moving beyond marketing materials and focusing on the real-world experiences of borrowers.

Summary of Customer Reviews for Similar Platforms

Customer reviews for platforms similar to Fig Loans reveal a mixed bag of experiences. While some borrowers report positive experiences, others highlight significant challenges. A comprehensive understanding of both sides is vital for making an informed decision.

- Platform A: Positive reviews frequently cite fast processing times and helpful customer service. Negative reviews mention high interest rates and inflexible repayment options. A common complaint involves difficulty contacting customer support during peak hours.

- Platform B: Positive feedback centers on transparent fee structures and a user-friendly online platform. Negative comments focus on lengthy application processes and a perceived lack of personalized support. Several users reported technical glitches impacting their application submissions.

- Platform C: This platform receives praise for its competitive interest rates and flexible repayment schedules. However, negative reviews criticize the platform’s limited accessibility, citing difficulties in navigating the website and a lack of phone support. Some users reported experiencing delays in loan disbursement.

Common Themes in Customer Experiences

Several common themes emerge from the analysis of customer reviews across these platforms. These recurring patterns highlight key areas of concern for borrowers and provide valuable insights for potential applicants.

- Interest Rates and Fees: A significant portion of negative reviews centers on perceived high interest rates and hidden fees. Transparency regarding fees is a recurring concern among borrowers.

- Customer Service Responsiveness: The responsiveness and helpfulness of customer service teams are frequently mentioned, both positively and negatively. Long wait times and difficulty contacting support are common complaints.

- Application Process Efficiency: The ease and speed of the application process significantly impact customer satisfaction. Lengthy processes and technical glitches frequently lead to negative reviews.

- Repayment Flexibility: The availability of flexible repayment options is a crucial factor for many borrowers. Rigid repayment schedules are often cited as a source of frustration.

Hypothetical Customer Scenario and Platform Recommendation

Consider a self-employed freelance writer needing a $5,000 loan for business expenses. They require a relatively quick turnaround time and value clear communication and flexible repayment options. Based on the reviewed platforms, Platform C, despite its accessibility challenges, might be the most suitable option. Its competitive interest rates and flexible repayment schedules outweigh the minor inconvenience of a less user-friendly website, given the borrower’s priority on cost and repayment flexibility. However, they should carefully review the website and ensure they can navigate it effectively before proceeding with the application.

Assessing Security and Trustworthiness

Choosing a lending platform requires careful consideration of its security measures and overall trustworthiness. Your financial data is highly sensitive, and you need assurance that the platform prioritizes its protection. Equally crucial is understanding the platform’s commitment to responsible lending practices to avoid predatory lending or unfair terms. This section will analyze the security protocols and ethical considerations of various platforms, helping you make an informed decision.

Security and trustworthiness are paramount when dealing with financial transactions online. A robust security infrastructure is essential to protect user data from unauthorized access, breaches, and misuse. Responsible lending practices ensure that borrowers are treated fairly and are not burdened with unaffordable loan terms. Analyzing these aspects is crucial for identifying reputable and reliable lending platforms.

Data Encryption and Security Protocols

Many reputable lending platforms employ advanced encryption technologies, such as SSL/TLS, to protect data transmitted between the user’s device and the platform’s servers. This encryption scrambles sensitive information, making it unreadable to unauthorized individuals. Furthermore, strong password requirements, multi-factor authentication (MFA), and regular security audits are common practices among platforms committed to data security. For instance, a platform might use 256-bit encryption, a widely accepted standard for securing sensitive data, and require passwords that meet complexity criteria, including a minimum length, uppercase and lowercase letters, numbers, and special characters. MFA adds an extra layer of security by requiring a second verification method, such as a code sent to the user’s mobile phone, before granting access to the account. Regular security audits by independent third-party firms help identify and address potential vulnerabilities.

Responsible Lending Practices

Demonstrating a commitment to responsible lending goes beyond just offering loans. Reputable platforms often provide clear and transparent loan terms, readily available customer support, and fair collection practices. They might offer financial literacy resources or tools to help borrowers manage their debt effectively. For example, a responsible lender might clearly display the Annual Percentage Rate (APR), including all fees and charges, prominently on their website and loan documents. They might also offer various repayment options to accommodate different financial situations and avoid aggressive debt collection tactics. Transparency in fees and charges, along with readily accessible customer service channels, are indicators of responsible lending.

Reputation and Trustworthiness Analysis

Assessing a platform’s reputation and trustworthiness involves examining various sources of information. Independent reviews and ratings from websites like Trustpilot or the Better Business Bureau (BBB) can provide valuable insights into customer experiences. Checking for any legal issues or complaints filed against the platform is also crucial. A platform with a consistently high rating and minimal negative feedback often suggests a strong reputation. Conversely, a platform with numerous unresolved complaints or negative reviews might raise concerns about its trustworthiness. Examining a platform’s history, including its duration in operation and its adherence to regulatory compliance, further enhances the evaluation of its reputation and trustworthiness. Looking at independent third-party reviews and ratings, along with the platform’s regulatory compliance history, provides a comprehensive view of its overall trustworthiness.

Visualizing Key Differences

Understanding the nuances between different lending platforms is crucial for securing the best loan terms. A visual comparison allows for a quick and effective assessment of key features, enabling informed decision-making. This avoids the overwhelming task of sifting through lengthy terms and conditions across multiple platforms.

A comparative table provides the most effective visual representation. Imagine a table with three columns, each representing a different lending platform (Platform A, Platform B, and Platform C – think of these as stand-ins for Fig Loans and its competitors). The rows would represent key features and benefits.

Key Features Comparison Table

The table’s first row would list “Loan Amounts,” showing the minimum and maximum loan amounts offered by each platform. For instance, Platform A might offer loans from $1,000 to $50,000, Platform B from $500 to $25,000, and Platform C from $2,000 to $40,000. The second row would display “Interest Rates,” presenting the typical APR range for each platform, perhaps illustrating the variability based on credit score. Platform A might offer 8-18%, Platform B 10-22%, and Platform C 7-15%. Subsequent rows would compare “Repayment Terms” (e.g., 3-60 months for Platform A, 6-36 months for Platform B, and 12-48 months for Platform C), “Fees and Charges” (clearly outlining origination fees, late payment penalties, etc. for each), and “Eligibility Requirements” (summarizing credit score minimums, income requirements, and other qualifying factors for each platform). Finally, a row dedicated to “Customer Support” would assess the accessibility and responsiveness of each platform’s customer service channels.

Illustrative Data and Insights

This visual representation instantly highlights the differences. For example, a borrower needing a loan of $45,000 would immediately see that Platform C is a better fit than Platform B. Similarly, a borrower with a lower credit score might find Platform B’s higher interest rate range less appealing than Platform A’s potentially more favorable terms. The comparison of fees and charges allows borrowers to calculate the total cost of borrowing across platforms, revealing potential cost savings. The clear presentation of eligibility requirements enables borrowers to quickly determine which platforms they even qualify for. Finally, the comparison of customer support channels allows borrowers to anticipate the level of assistance they might receive should they encounter any issues. The table’s structured format enables rapid, side-by-side comparison, reducing the cognitive load associated with evaluating multiple platforms individually.