$255 payday loans online same day California: Need cash fast? This guide explores the landscape of quick online payday loans in California, examining their legality, application process, risks, and viable alternatives. We’ll delve into the details of eligibility requirements, interest rates, and the crucial steps to finding reputable lenders. Understanding the potential pitfalls and comparing these loans to other short-term borrowing options is key to making informed financial decisions.

We’ll cover everything from the legal framework surrounding these loans in California to the potential consequences of default. We’ll also provide a step-by-step guide to the application process, highlighting crucial aspects like required documentation and verification. Finally, we’ll explore safer alternatives to payday loans, ensuring you have a complete picture before making a decision.

Understanding $255 Payday Loans in California

$255 payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. While offering quick access to funds, they are subject to strict regulations in California and carry significant financial risks if not managed carefully. Understanding the legal framework, terms, and potential costs is crucial before considering this type of loan.

Legal Framework Governing $255 Payday Loans in California

California’s Department of Financial Protection and Innovation (DFPI) regulates payday loans. The California Finance Lenders Law (CFLL) dictates maximum loan amounts, fees, and interest rates. Crucially, the CFLL limits the total amount a borrower can owe to 15% of their monthly gross income, and places restrictions on the number of outstanding loans allowed. These regulations aim to protect consumers from predatory lending practices. The DFPI actively monitors lenders to ensure compliance and investigates complaints. Borrowers should be aware that lenders who violate these laws face significant penalties.

Terms and Conditions of $255 Payday Loans

$255 payday loans typically require repayment within a short period, usually two to four weeks. The loan agreement will clearly Artikel the repayment schedule, including the due date and the total amount due. Borrowers must provide personal information, including bank account details, for direct deposit and automatic repayment. Failure to repay on time can lead to significant fees and potentially damage credit scores. Late fees and additional interest charges are common. Some lenders may offer loan extensions, but these usually come with additional fees. Borrowers should carefully read and understand all terms and conditions before signing any loan agreement.

Fees and Interest Rates

While the principal loan amount is $255, the total cost of borrowing can be significantly higher due to fees and interest. Lenders commonly charge fees that can range from $15 to $45, depending on the lender and the loan amount. These fees are often expressed as a percentage of the loan amount, and represent the cost of borrowing the money. The annual percentage rate (APR) on $255 payday loans can be very high, sometimes exceeding 400%. This high APR reflects the short repayment period and the associated risks for lenders. It’s crucial to compare the total cost of borrowing from different lenders before making a decision. For example, a $255 loan with a $45 fee would result in a total repayment of $300 within a short timeframe.

Comparison of $255 Payday Loans with Other Short-Term Loan Options in California

Choosing the right short-term loan requires careful consideration of various factors. Payday loans are just one option among several alternatives. Below is a comparison:

| Loan Type | Loan Amount | Interest Rate (APR) | Repayment Period |

|---|---|---|---|

| Payday Loan | $255 | Often exceeds 400% | 2-4 weeks |

| Small Credit Union Loan | Varies, often up to $1000 | Significantly lower than payday loans | Several months |

| Personal Installment Loan (Online) | Varies, often up to several thousand | Lower than payday loans, but varies | Several months to years |

| Credit Builder Loan | Smaller amounts | Often low or moderate | Several months |

Eligibility Criteria and Application Process

Securing a $255 payday loan in California requires meeting specific eligibility criteria and navigating a straightforward online application process. Understanding these requirements and the steps involved is crucial for a smooth and successful loan application. This section details the necessary qualifications, the application procedure, and the documentation needed.

Eligibility Requirements for $255 Payday Loans in California, 5 payday loans online same day california

To qualify for a $255 payday loan in California, applicants must generally meet several key requirements. These typically include being a legal resident of California, possessing a valid government-issued ID, and having a verifiable income source. The minimum age is usually 18 years old. Lenders will also assess creditworthiness, although payday loans often cater to borrowers with less-than-perfect credit. Finally, active bank accounts are necessary for direct deposit of funds and loan repayment. Specific requirements may vary slightly between lenders.

Online Application Process for $255 Payday Loans

The online application process for a $255 payday loan is generally quick and convenient. It typically involves these steps: First, locate a reputable online lender. Next, complete the online application form, providing accurate personal and financial information. Then, submit the application for review. The lender will assess the application based on the eligibility criteria. Following approval, the loan amount will be deposited into the applicant’s designated bank account, usually within one business day. Finally, repayment is typically due on the borrower’s next payday.

Required Documentation and Verification Procedures

Lenders will require certain documentation to verify the information provided in the application. This typically includes a government-issued photo ID (such as a driver’s license or state ID card), proof of income (such as pay stubs or bank statements), and proof of residence (such as a utility bill or bank statement). Verification procedures may involve checking credit reports, confirming employment details, and verifying bank account information. Providing accurate and complete documentation expedites the application process.

Flowchart Illustrating the Application Process

Imagine a flowchart starting with a box labeled “Begin Application.” An arrow points to a diamond-shaped decision box: “Meet Eligibility Requirements?”. A “Yes” arrow leads to a rectangle labeled “Complete Online Application Form.” A “No” arrow leads to an end box labeled “Application Denied.” From the “Complete Online Application Form” rectangle, an arrow leads to a rectangle labeled “Submit Application for Review.” This leads to another diamond: “Application Approved?”. A “Yes” arrow leads to a rectangle: “Funds Deposited.” A “No” arrow leads to a rectangle: “Application Denied.” From “Funds Deposited”, an arrow points to an end box labeled “Loan Granted.” The entire process is a clear visual representation of the steps involved in applying for a $255 payday loan online.

Risks and Potential Consequences of $255 Payday Loans: 5 Payday Loans Online Same Day California

Payday loans, while offering quick access to cash, carry significant financial risks. The seemingly small loan amount can quickly escalate into a debt trap due to high interest rates and fees, potentially leading to severe financial consequences if not managed carefully. Understanding these risks is crucial before considering this borrowing option.

High Interest Rates and Fees

$255 payday loans in California are notorious for their extremely high interest rates, often expressed as an Annual Percentage Rate (APR), which can reach several hundred percent. These rates far exceed those of traditional loans like personal loans or credit cards. In addition to the high interest, borrowers often face substantial fees, such as origination fees, late payment fees, and rollover fees. These fees can quickly add up, making the total cost of the loan significantly higher than the initial borrowed amount. For example, a $255 loan with a 400% APR and a $50 fee could easily cost several hundred dollars more by the repayment date. This makes it critical to understand the complete cost before accepting the loan.

Consequences of Defaulting on a $255 Payday Loan

Failure to repay a $255 payday loan on time can trigger a cascade of negative consequences. Lenders may repeatedly attempt to collect the debt, resulting in numerous phone calls, letters, and even potential legal action. Your credit score will likely suffer significantly, making it harder to obtain loans, rent an apartment, or even secure a job in the future. Furthermore, some lenders may resort to aggressive collection tactics, leading to stress and anxiety. In severe cases, defaulting on a payday loan can lead to wage garnishment or bank account levies.

Long-Term Financial Implications: Payday Loans vs. Alternatives

The long-term financial implications of relying on $255 payday loans are often detrimental. The high cost of borrowing can create a cycle of debt, making it difficult to meet essential expenses and hindering financial progress. Alternative borrowing options, such as personal loans from banks or credit unions, offer lower interest rates and more manageable repayment terms. While these alternatives may involve a more rigorous application process, they are generally a more responsible and sustainable way to manage short-term financial needs. Choosing a payday loan over a personal loan could mean paying several times the initial loan amount in interest and fees over the loan’s lifespan.

Suitable and Unsuitable Situations for $255 Payday Loans

A $255 payday loan might be a suitable solution in rare, emergency situations where a small amount of money is urgently needed to cover an unavoidable expense, such as a sudden medical bill or car repair, and all other options have been exhausted. However, it is unwise to use a payday loan for non-essential expenses, such as entertainment or shopping. Furthermore, if you are already struggling with debt or have a poor credit history, taking out a payday loan is likely to exacerbate your financial problems. It’s crucial to explore all other options, such as borrowing from friends or family, negotiating payment plans with creditors, or seeking financial counseling before resorting to a payday loan.

Finding Reputable Lenders

Securing a $255 payday loan in California requires careful consideration of the lender’s legitimacy. Navigating the online lending landscape can be challenging, with numerous lenders vying for your business. Understanding how to identify trustworthy lenders is crucial to avoid predatory practices and ensure a safe borrowing experience. This section provides guidance on identifying reputable lenders and avoiding scams.

Finding a reputable lender involves a multi-faceted approach, combining due diligence with a healthy dose of skepticism. It’s not simply about finding the lowest interest rate; it’s about finding a lender who operates ethically and transparently. This involves examining several key aspects of the lender’s operations, including their licensing, customer reviews, and fee structures.

Identifying Legitimate Online Lenders

Legitimate online lenders in California are licensed and comply with state regulations. They operate with transparency, clearly outlining loan terms, fees, and repayment schedules. They will never pressure you into accepting a loan you don’t understand or can’t afford. Conversely, fraudulent lenders often operate anonymously, lack proper licensing, and employ high-pressure tactics to secure your loan application. They may promise unrealistic terms or use misleading advertising to attract borrowers. Be wary of lenders who contact you unsolicited or who are unwilling to provide clear and detailed information about their services. A legitimate lender will have a physical address and readily available contact information.

Warning Signs of Fraudulent or Predatory Lending Practices

Several red flags indicate potentially fraudulent or predatory lending practices. These include excessively high interest rates or fees far exceeding California’s legal limits, vague or unclear loan terms, pressure to apply quickly without allowing time for careful consideration, demands for upfront fees before loan approval (a hallmark of a scam), lack of a physical address or contact information, and overwhelmingly negative customer reviews across multiple platforms. Additionally, be wary of lenders who fail to clearly explain the loan repayment process or who make unrealistic promises about loan approval.

Factors to Consider When Choosing a Lender

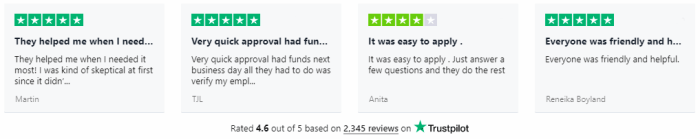

Choosing a lender involves evaluating several key factors. First, verify the lender’s California lending license through the Department of Financial Protection and Innovation (DFPI). Thoroughly examine customer reviews on independent review sites like the Better Business Bureau (BBB) to gauge the lender’s reputation. Pay close attention to reviews detailing the lender’s responsiveness, transparency, and overall customer service. Transparency in fees is paramount; ensure the lender clearly Artikels all fees associated with the loan, avoiding hidden charges or unexpected costs. Compare interest rates and fees across multiple lenders to secure the best possible terms. Finally, consider the lender’s customer service channels and their accessibility; easily accessible communication channels are essential for addressing any questions or concerns during the loan process.

Questions to Ask Potential Lenders Before Applying

Before applying for a $255 payday loan, it is advisable to ask potential lenders several key questions. Inquire about their California lending license number and verify it with the DFPI. Ask for a detailed breakdown of all fees and interest rates, ensuring there are no hidden costs. Clarify the loan repayment process, including the repayment schedule and options for early repayment. Inquire about the lender’s complaint resolution process and how they handle customer disputes. Ask about the lender’s data security practices to ensure your personal information is protected. Finally, request examples of their loan agreements and thoroughly review them before proceeding with the application.

Alternatives to $255 Payday Loans

Securing a $255 payday loan might seem like a quick solution to a financial emergency, but the high interest rates and fees can quickly exacerbate the problem. Fortunately, Californians have access to several alternative borrowing options that offer more manageable repayment terms and lower overall costs. Exploring these alternatives is crucial for making informed financial decisions and avoiding the debt trap often associated with payday loans.

Credit Unions

Credit unions are member-owned financial cooperatives that often offer more favorable loan terms than traditional banks or payday lenders. They typically have lower interest rates and more flexible repayment options. Membership requirements vary depending on the credit union, but many have open or community-based memberships. Credit unions frequently offer small personal loans suitable for covering unexpected expenses. Applying for a loan typically involves completing an application, providing proof of income and identity, and undergoing a credit check (though credit unions often consider factors beyond credit scores). The advantages include lower interest rates and potentially more lenient approval criteria than banks. However, the application process might take longer than obtaining a payday loan.

Personal Loans from Banks and Online Lenders

Banks and online lenders provide personal loans with varying interest rates and repayment terms. These loans typically require a credit check and may involve a more rigorous application process than payday loans. However, the longer repayment periods and potentially lower interest rates can make them a more affordable option in the long run. For example, a personal loan of $500 from a bank might have an APR of 10%, while a payday loan for the same amount could have an APR exceeding 400%. Applying typically involves submitting an application online or in person, providing financial documentation, and potentially undergoing an interview. The advantages include larger loan amounts and longer repayment periods, but the disadvantages are the more stringent credit requirements and a longer application process.

Community Assistance Programs

Numerous non-profit organizations and government programs in California offer financial assistance to individuals facing hardship. These programs often provide grants or loans with low or no interest rates. Examples include local food banks, housing assistance programs, and unemployment benefits. Accessing these resources typically involves contacting the relevant organization or government agency and completing an application that assesses eligibility based on income and other factors. These programs offer crucial support but have limited funding and may have specific eligibility requirements. The advantages are the potential for no-interest loans or grants, but the disadvantages include a potentially lengthy application process and limited availability of funds.

Illustrative Scenario

Maria, a single mother working part-time as a cashier, faced an unexpected car repair bill of $255. Her regular income barely covered her monthly expenses, leaving her with no savings to address this emergency. After exploring other options and finding herself short of funds, she considered a $255 payday loan as a last resort to avoid having her car repossessed, impacting her ability to get to work and care for her child.

Maria’s financial situation before the loan was precarious. She lived paycheck to paycheck, with minimal disposable income. Her monthly expenses, including rent, childcare, groceries, and utilities, consistently exceeded her earnings. This left her vulnerable to unexpected financial shocks, like the car repair.

Application and Approval Process

Maria found a payday lender online that advertised same-day funding for $255 loans in California. The application process was quick and straightforward, requiring her to provide basic personal information, employment details, and bank account information. After submitting the application, she received approval within minutes. The lender did not conduct a thorough credit check, which was a factor in the speedy approval. The funds were deposited into her bank account within a few hours.

Repayment and Financial Impact

The loan agreement stipulated that Maria would repay the $255 principal plus a $45 fee (a common example of fees associated with such loans, although the exact amount varies by lender and state regulations) within two weeks. This meant a total repayment of $300. While the quick access to funds temporarily solved her immediate problem, it significantly worsened her already tight financial situation. She struggled to meet her regular expenses while also saving for the loan repayment. To make the repayment, she had to cut back on essential expenses, leading to increased stress and difficulty managing her daily life.

Timeline of Events and Financial Consequences

| Date | Event | Financial Impact |

|---|---|---|

| October 26th | Car breaks down; $255 repair bill. | Immediate financial crisis. |

| October 27th | Applies for and receives $255 payday loan. | Short-term relief, but adds debt. |

| October 28th | Car repaired. | Restores transportation, but at the cost of debt. |

| November 9th | Payday loan due ($300). | Significant strain on budget; potential for further borrowing. |

| November 10th | Maria repays the loan. | Debt eliminated, but financial reserves depleted. |

Maria’s experience highlights the potential risks associated with payday loans. While they offer quick access to funds in emergencies, the high fees and short repayment periods can create a cycle of debt, making it difficult to manage finances effectively in the long term. Her ability to repay the loan on time prevented further consequences, but many borrowers are not so fortunate.

Concluding Remarks

Securing a $255 payday loan online in California can provide immediate relief, but it’s crucial to proceed with caution. Thoroughly understanding the terms, fees, and potential risks is paramount. Weighing the pros and cons against alternative borrowing options allows for a more informed and responsible financial choice. Remember to always prioritize reputable lenders and carefully consider the long-term financial implications before committing to any loan agreement.

Questions and Answers

What happens if I can’t repay my $255 payday loan?

Failure to repay can lead to additional fees, damage to your credit score, and potential legal action from the lender. Contact your lender immediately if you anticipate difficulty repaying.

Are there any hidden fees associated with $255 payday loans?

Always review the loan agreement carefully for all fees and charges. Reputable lenders will be transparent about all costs upfront. Be wary of lenders who are unclear about their fees.

How long does it take to receive the loan funds?

The time varies depending on the lender and your application’s approval. Same-day funding is often advertised, but it’s not guaranteed.

Can I get a $255 payday loan with bad credit?

While payday lenders often don’t conduct extensive credit checks, your credit history might still influence your eligibility and the interest rate offered. A poor credit history may result in higher interest rates or loan denial.