Loans like Oportun offer a lifeline to individuals often overlooked by traditional banks. This guide delves into the specifics of Oportun loans, examining their eligibility criteria, interest rates, repayment options, and potential risks and benefits. We’ll compare them to traditional loans and explore viable alternatives, providing a clear picture of whether an Oportun loan is the right financial choice for you.

Understanding the nuances of Oportun loans is crucial for making informed financial decisions. This in-depth analysis covers everything from the application process and customer experiences to the broader impact of Oportun’s model on the financial landscape. We aim to equip you with the knowledge necessary to navigate this often complex area of personal finance.

Defining “Loans Like Oportun”

Oportun provides a unique type of lending service catering to a specific underserved market segment. Unlike traditional banks, Oportun focuses on building credit and financial health for individuals often overlooked by mainstream financial institutions. Understanding their model helps clarify what constitutes a “loan like Oportun.”

Oportun loans are installment loans designed for borrowers with limited or no credit history. Key features typically include smaller loan amounts compared to traditional bank loans, shorter repayment terms, and a strong emphasis on financial education and responsible lending practices. The interest rates are generally higher than those offered by banks to individuals with established credit, but lower than those found with payday lenders or other high-cost short-term loans. Oportun often utilizes alternative data points beyond traditional credit scores to assess creditworthiness, considering factors like bank account history and payment behavior.

Oportun’s Target Demographic

Oportun primarily targets underserved communities and individuals with limited access to traditional banking services. This demographic often includes those with low credit scores, thin credit files, or a history of missed payments that might disqualify them from obtaining loans from traditional banks. These individuals frequently require smaller loan amounts for everyday expenses, such as car repairs, medical bills, or home improvements. Oportun aims to provide a responsible and accessible alternative to high-cost, predatory lending options prevalent in these communities.

Comparison with Traditional Bank Loans

Oportun loans differ significantly from traditional bank loans in several key aspects. Traditional bank loans typically require a strong credit history, higher credit scores, and larger loan amounts. The approval process is usually more rigorous, involving extensive documentation and a thorough credit check. Interest rates on bank loans are generally lower for individuals with good credit. In contrast, Oportun loans have a more flexible approval process, focusing on alternative data and offering smaller loan amounts with a higher interest rate reflecting the higher risk associated with lending to borrowers with limited credit history. While bank loans might be suitable for larger purchases or investments, Oportun loans serve as a crucial tool for managing smaller, immediate financial needs. The difference lies primarily in the risk assessment and the target borrower profile. Banks primarily lend to lower-risk borrowers, while Oportun focuses on building credit and financial health for those typically excluded from traditional banking systems.

Exploring Loan Eligibility Criteria

Securing a loan, particularly from a lender like Oportun, hinges on meeting specific eligibility criteria. Understanding these requirements is crucial for prospective borrowers to assess their chances of approval and to prepare the necessary documentation. Failure to meet these criteria can lead to loan application rejection. This section details the key eligibility requirements for Oportun loans, the role of credit score, and the documentation needed for a successful application.

Oportun’s loan eligibility criteria prioritize responsible lending practices, aiming to match borrowers with loan products suitable for their financial circumstances. The process considers a combination of factors to determine creditworthiness and repayment capacity. While specific criteria can vary slightly depending on the type of loan and the borrower’s location, several core elements consistently appear.

Credit Score Impact on Loan Approval

A borrower’s credit score significantly influences their chances of loan approval and the interest rate offered. While Oportun is known for working with borrowers who may have limited credit history or less-than-perfect credit scores, a higher credit score generally results in more favorable loan terms. A higher score demonstrates a history of responsible financial management, reducing the perceived risk for the lender. Conversely, a lower credit score might lead to a higher interest rate or even a loan application denial. Oportun assesses creditworthiness using a combination of traditional credit scoring methods and alternative data sources, which can be beneficial for those with limited credit history. This alternative data may include employment history and bank account information. This holistic approach allows Oportun to consider a wider range of applicants.

Required Documentation for Loan Application

Applicants are typically required to provide several documents to support their loan application. This documentation serves to verify the information provided and assess the borrower’s financial stability. Generally, this includes proof of identity (such as a driver’s license or state-issued ID), proof of income (pay stubs, tax returns, or bank statements), and proof of address (utility bills or bank statements). The specific documents required may vary depending on the loan amount and the applicant’s individual circumstances. Providing complete and accurate documentation promptly increases the efficiency of the application process and enhances the chances of approval. Incomplete applications may result in delays or rejection. Applicants should carefully review the lender’s requirements before submitting their application to ensure they have all the necessary documentation ready.

Loan Interest Rates and Fees

Understanding the cost of borrowing is crucial when considering any loan, and Oportun loans are no exception. This section details Oportun’s interest rates and fees, comparing them to other lenders and providing a clear picture of the total cost of borrowing. We’ll also explore how these costs vary depending on the loan amount.

Oportun’s interest rates are generally higher than those offered by traditional banks or credit unions. This is because Oportun specializes in serving borrowers with limited credit history, who may be considered higher-risk by conventional lenders. However, Oportun aims to provide responsible lending practices and transparent pricing, offering an alternative for individuals who might otherwise be excluded from the traditional lending market.

Oportun Loan Interest Rates Compared to Other Lenders

A direct comparison of Oportun’s interest rates with other lenders requires specifying the loan type and the borrower’s credit profile. However, we can make some general observations. For example, a payday loan might carry an annual percentage rate (APR) of 400% or more, whereas a personal loan from a credit union could range from 6% to 18%, depending on creditworthiness. Oportun’s APRs typically fall somewhere between these extremes, reflecting the balance between serving underserved borrowers and maintaining responsible lending practices. Specific rates are determined based on individual credit assessments, loan amount, and repayment terms. It’s essential to check Oportun’s website for the most up-to-date information.

Fees Associated with Oportun Loans

Oportun may charge various fees associated with its loans. These fees can include origination fees (a one-time fee charged at the beginning of the loan), late payment fees (for missed or late payments), and potentially other administrative fees. The exact fees and their amounts will be clearly disclosed in the loan agreement before you accept the loan. It’s crucial to carefully review all fees to understand the total cost of borrowing. Failure to make timely payments can result in significant additional costs.

Comparison of Interest Rates and Fees Across Different Loan Amounts

The following table illustrates a hypothetical example of how interest rates and fees might vary across different loan amounts. Remember that these are examples and actual rates and fees will depend on individual circumstances and may change over time. Always check Oportun’s website or contact them directly for the most current information.

| Loan Amount | APR (Example) | Origination Fee (Example) | Total Cost (Example) |

|---|---|---|---|

| $500 | 36% | $50 | $650 (Approximate) |

| $1000 | 30% | $75 | $1200 (Approximate) |

| $1500 | 28% | $100 | $1750 (Approximate) |

| $2000 | 25% | $125 | $2300 (Approximate) |

Loan Repayment Options and Schedules

Oportun offers various repayment schedules designed to fit borrowers’ individual financial situations. Understanding these options and the consequences of missed payments is crucial for responsible borrowing and avoiding financial hardship. The repayment process itself is straightforward, although adherence to the schedule is paramount.

Oportun typically structures its loans with fixed monthly payments over a predetermined term. The length of the loan term, and therefore the monthly payment amount, varies depending on the loan amount and the borrower’s creditworthiness. For example, a smaller loan might have a repayment period of six months, resulting in higher monthly payments, while a larger loan might be repaid over 12, 18, or even 24 months, leading to lower monthly payments. The specific terms are clearly Artikeld in the loan agreement before the borrower accepts the loan.

Loan Repayment Schedules: Examples

Let’s illustrate with hypothetical examples. Assume a borrower receives a $500 loan. One repayment schedule might involve six monthly payments of approximately $88.33. Alternatively, a $1000 loan might be structured with twelve monthly payments of around $87.50, or 18 monthly payments of approximately $60.00. These are illustrative examples; actual amounts will vary based on the specific loan terms and applicable fees.

Consequences of Late or Missed Payments

Late or missed payments can significantly impact a borrower’s credit score and overall financial standing. Oportun, like other lenders, will likely charge late fees, which can add substantially to the total cost of the loan. Repeated late payments can lead to the loan being sent to collections, further damaging credit and potentially resulting in legal action. Furthermore, consistent late payments can make it more difficult to obtain future loans, as lenders will view the borrower as a higher risk.

Loan Payment Process

Oportun provides several convenient methods for making loan payments. Borrowers can typically make payments online through the Oportun website or mobile app, offering a quick and secure way to manage their repayments. Other options often include paying in person at designated locations or through mail. The loan agreement will clearly detail the accepted payment methods and provide instructions on how to make payments. It’s crucial to keep records of all payments made to avoid disputes and ensure timely repayment.

Alternatives to Oportun Loans

Oportun offers installment loans targeted at individuals with limited credit history. However, several alternative lending options cater to similar financial needs, each with its own set of advantages and disadvantages. Understanding these alternatives allows borrowers to make informed decisions based on their specific circumstances. This section compares three common alternatives to Oportun loans, highlighting key differences in terms of eligibility, interest rates, and repayment flexibility.

Comparison of Alternative Loan Options

Choosing the right loan depends heavily on individual financial situations and creditworthiness. The following comparison Artikels three common alternatives to Oportun loans: secured loans, credit union loans, and online personal loans from reputable lenders. Each option presents a different balance between accessibility and cost.

- Secured Loans: These loans require collateral, such as a car or savings account, to secure the loan. This collateral reduces the lender’s risk, often leading to lower interest rates and more favorable terms, even for borrowers with less-than-perfect credit.

- Advantages: Lower interest rates compared to unsecured options, higher approval chances for those with poor credit, potentially larger loan amounts.

- Disadvantages: Risk of losing collateral if unable to repay the loan, potentially lower loan amounts than desired due to collateral value limitations, requires owning valuable assets.

- Credit Union Loans: Credit unions are member-owned financial cooperatives often offering more favorable loan terms than traditional banks. They frequently prioritize community support and may offer programs specifically designed to assist members with limited credit history.

- Advantages: Potentially lower interest rates than other options, personalized service, community-focused lending programs, may offer financial literacy resources.

- Disadvantages: Membership requirements may exist, loan amounts and availability might be limited compared to larger institutions, may require a longer application process.

- Online Personal Loans from Reputable Lenders: Numerous online lenders offer personal loans, some specializing in borrowers with less-than-perfect credit. These loans are typically unsecured, meaning no collateral is required, but interest rates can be higher to compensate for the increased risk. It’s crucial to compare offers from multiple lenders and thoroughly research the lender’s reputation before borrowing.

- Advantages: Convenient online application process, quick funding, wider availability compared to credit unions or local banks.

- Disadvantages: Higher interest rates compared to secured loans or credit union loans, potential for predatory lending practices if not careful in selecting a lender, thorough research is required to avoid high fees and unfavorable terms.

Potential Risks and Benefits

Oportun loans, while offering a valuable service to those with limited access to traditional credit, come with inherent risks and benefits that borrowers should carefully consider before applying. Understanding these aspects is crucial for making an informed financial decision. This section details the potential pitfalls and advantages associated with utilizing Oportun’s loan products.

Potential Risks of Oportun Loans

High interest rates are a significant risk associated with Oportun loans. While they cater to a clientele often excluded from traditional lending, the interest rates are generally higher than those offered by banks or credit unions. This can lead to a substantial increase in the total amount repaid compared to the initial loan amount, potentially exacerbating financial difficulties if not managed carefully. Another risk is the potential for debt cycling. If borrowers struggle to repay the loan on time, they might find themselves needing to take out another loan to cover the missed payments, creating a cycle of debt that’s hard to break. Furthermore, late or missed payments can negatively impact credit scores, making it harder to secure loans or credit in the future. Finally, the fees associated with Oportun loans, while often transparent, can add to the overall cost and should be carefully factored into the borrowing decision. Borrowers should thoroughly understand the terms and conditions before committing to a loan.

Potential Benefits of Oportun Loans

Despite the risks, Oportun loans offer several benefits, primarily their accessibility to individuals with limited credit history or low credit scores. This accessibility opens doors for borrowers who might otherwise be excluded from traditional financial institutions. The loan application process is often simpler and faster compared to traditional banks, providing quicker access to needed funds. Oportun also offers financial education resources and tools, which can empower borrowers to manage their finances more effectively and avoid future debt problems. Moreover, responsible repayment of an Oportun loan can contribute to building credit history, potentially improving future borrowing opportunities. Finally, Oportun loans can provide a much-needed financial safety net for unexpected expenses or emergencies, helping borrowers navigate difficult financial situations.

Risk and Benefit Comparison

| Feature | Risk | Benefit |

|---|---|---|

| Interest Rates | High interest rates can lead to significant additional costs and potential debt burden. | Access to credit for those excluded from traditional lending. |

| Fees | Various fees can increase the overall cost of the loan. | Faster and simpler application process than traditional banks. |

| Repayment | Missed payments can negatively impact credit scores and lead to debt cycling. | Potential for credit score improvement with responsible repayment. |

| Accessibility | Loans may not be suitable for everyone due to high interest rates and fees. | Financial education resources provided to help manage finances. |

The Customer Experience with Oportun

Oportun aims to provide a positive and accessible lending experience for its customers, focusing on transparency and ease of use throughout the loan process. The company’s success hinges on customer satisfaction, and understanding their experience is crucial to evaluating Oportun’s overall effectiveness.

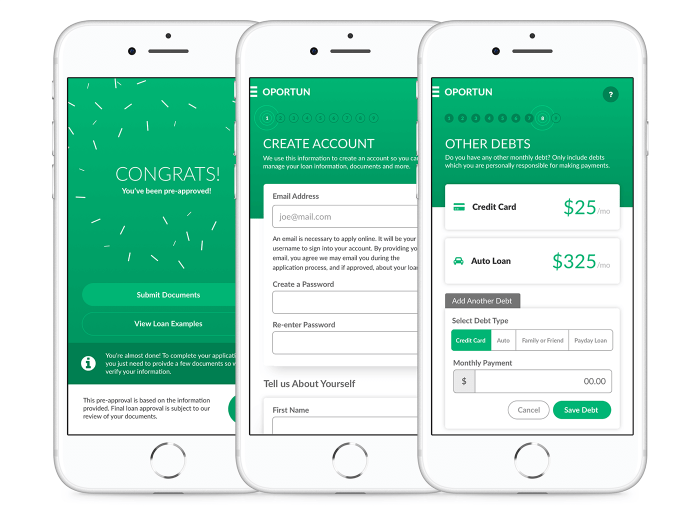

The application process for an Oportun loan is designed to be straightforward and can be completed online or in person at a physical Oportun location. Applicants typically need to provide personal identification, proof of income, and banking information. The application itself involves answering a series of questions about the applicant’s financial situation and intended use of the loan. Oportun utilizes a proprietary scoring system that considers factors beyond traditional credit scores, allowing them to assess creditworthiness for individuals who may be underserved by traditional lenders. The application process is often praised for its speed and efficiency, with many customers reporting approvals within minutes or hours.

Customer Testimonials Regarding Oportun

Many customer testimonials highlight the positive aspects of their experience with Oportun. These positive comments often focus on the ease and speed of the application process, the helpfulness of Oportun’s staff, and the overall accessibility of the loans. Some customers have described the application process as simple and intuitive, even for those unfamiliar with online loan applications. There are testimonials expressing gratitude for the loan’s approval, particularly for those who have been turned down by other lenders. Positive feedback also often mentions the clear communication and transparency throughout the loan process, minimizing confusion and unexpected fees. However, some negative feedback exists, which often focuses on high interest rates and the difficulty of managing repayments. These testimonials provide valuable insights into both the positive and negative aspects of the customer experience.

Oportun’s Customer Service

Oportun provides customer service through various channels, including phone, email, and online chat. Customers generally report that the customer service representatives are responsive and helpful, addressing concerns and providing clear explanations of loan terms and conditions. The company’s commitment to multilingual support is frequently praised, making it accessible to a wider range of customers. Oportun’s website also provides a comprehensive FAQ section and resources designed to educate customers about loan management and financial literacy. While generally positive, some customers have reported difficulties reaching customer service representatives during peak hours or experiencing longer-than-expected wait times. Oportun’s overall customer service aims to provide support and guidance throughout the loan process, fostering a positive relationship with its borrowers.

Oportun’s Role in the Financial Landscape

Oportun occupies a unique niche in the financial services industry, focusing on serving underserved communities often overlooked by traditional banks and credit unions. Its mission extends beyond simply providing loans; it aims to build a more inclusive and equitable financial system by offering accessible and responsible financial products. This approach has significant implications for both its customers and the broader financial landscape.

Oportun’s impact stems from its commitment to responsible lending practices and its innovative use of technology to assess creditworthiness. By leveraging alternative data sources and sophisticated algorithms, Oportun is able to extend credit to individuals who may be deemed “subprime” by traditional lenders, thereby expanding access to vital financial services. This expansion of access directly combats financial exclusion and empowers individuals to build better financial futures.

Oportun’s Mission and Impact on the Financial Services Industry

Oportun’s stated mission is to provide affordable financial services to underserved communities, empowering them to achieve financial health and build a better future. This mission is reflected in its product offerings, which include installment loans, deposit accounts, and other financial tools designed to help customers manage their finances effectively. The company’s success in reaching and serving this segment of the population has demonstrably impacted the financial services industry by highlighting the significant unmet demand for responsible and accessible financial products among low-to-moderate-income individuals. This has spurred some larger financial institutions to re-evaluate their lending practices and consider more inclusive approaches.

Oportun’s Approach to Responsible Lending

Oportun differentiates itself through its commitment to responsible lending. This commitment goes beyond complying with regulatory requirements and incorporates several key elements. Firstly, Oportun emphasizes transparent pricing and clear loan terms, ensuring customers fully understand the costs associated with their loans. Secondly, the company employs rigorous underwriting processes to assess creditworthiness accurately and responsibly, mitigating the risk of borrowers taking on debt they cannot manage. Thirdly, Oportun provides financial education and resources to its customers, empowering them to make informed financial decisions and improve their overall financial well-being. This multifaceted approach helps to prevent predatory lending practices and fosters a more sustainable and equitable financial ecosystem.

Comparison of Oportun’s Business Model to Other Financial Institutions, Loans like oportun

Unlike traditional banks that often rely heavily on credit scores and FICO ratings, Oportun leverages alternative data points, such as transaction history and bill payment records, to assess creditworthiness. This allows them to reach a wider customer base, including those with limited or no credit history. Compared to payday lenders, Oportun offers longer repayment terms and lower interest rates, reducing the risk of borrowers falling into a cycle of debt. While some credit unions also target underserved communities, Oportun’s technological approach to credit assessment and its broader suite of financial products distinguish it from many credit union models. The company’s business model combines the social mission of serving underserved populations with the efficiency and scalability of a technology-driven approach, setting it apart in the financial landscape.

Illustrative Scenarios: Loans Like Oportun

Understanding the potential outcomes of taking out an Oportun loan requires examining both positive and negative scenarios. These examples illustrate the range of experiences borrowers might have, highlighting the importance of careful consideration before applying.

Successful Oportun Loan Scenario

Maria, a single mother of two, needed $2,000 to repair her car, essential for commuting to her job and transporting her children. She had previously struggled with accessing traditional credit but qualified for an Oportun loan with a 36-month repayment term and an APR of 36%. Maria meticulously budgeted her expenses, ensuring she could comfortably make her monthly payments of approximately $70. She successfully repaid the loan on time, avoiding late fees and improving her credit score in the process. The repaired car ensured her continued employment and stability for her family. This positive outcome demonstrates how responsible borrowing and financial planning can lead to successful loan repayment.

Challenging Oportun Loan Scenario

David, facing an unexpected medical bill of $1,500, took out an Oportun loan with a 12-month repayment term and a high APR of 40%. He underestimated the monthly payment amount, which proved significantly higher than he anticipated. Unforeseen job loss further exacerbated his financial difficulties. He missed several payments, incurring late fees and negatively impacting his credit score. The debt snowball effect compounded his financial stress, leading to a difficult cycle of missed payments and escalating debt. This scenario highlights the potential risks associated with taking on high-interest loans without a robust financial plan and a buffer for unexpected events.

Last Recap

Navigating the world of personal loans can be challenging, especially for those with less-than-perfect credit. Oportun loans represent one avenue, but careful consideration of eligibility, interest rates, and repayment terms is paramount. By understanding the alternatives and potential risks, you can make a well-informed decision that aligns with your individual financial situation and long-term goals. Remember, responsible borrowing is key to financial health.

FAQ

What happens if I miss an Oportun loan payment?

Missing payments will likely result in late fees and can negatively impact your credit score. Contact Oportun immediately if you anticipate difficulty making a payment to explore possible solutions.

Can I prepay my Oportun loan?

Check your loan agreement for details on prepayment options and any associated fees. Many lenders allow prepayment, potentially saving you on interest.

How does Oportun’s credit scoring differ from traditional lenders?

Oportun often considers factors beyond traditional credit scores, such as income and banking history, to assess creditworthiness. This can make them a more accessible option for some borrowers.

Does Oportun offer different loan types beyond personal loans?

Oportun primarily focuses on personal loans. It’s best to check their website for the most up-to-date information on available loan products.