USPS allotment loans offer a unique financial tool for postal service employees, providing access to credit directly through their employer. Understanding the intricacies of these loans—their eligibility requirements, application processes, and various options—is crucial for making informed financial decisions. This guide delves into the specifics of USPS allotment loans, comparing them to alternative financing solutions and outlining effective management strategies to ensure responsible borrowing and repayment.

We’ll explore the advantages and disadvantages, examining potential pitfalls and highlighting best practices for budgeting and repayment planning. By comparing interest rates, loan terms, and fees across different options, you can determine the best fit for your individual financial situation. We’ll also look at alternative financing options and illustrative scenarios to provide a comprehensive overview.

Understanding USPS Allotment Loans

USPS allotment loans offer a convenient way for postal service employees to borrow money directly through payroll deductions. These loans are typically characterized by their ease of application and relatively straightforward terms, making them an attractive option for those seeking a manageable borrowing solution. This section will delve into the specifics of these loans, providing a comprehensive overview of eligibility, application procedures, and loan types.

USPS Allotment Loan Mechanics

USPS allotment loans operate on a simple principle: employees authorize a portion of their paycheck to be deducted automatically to repay the loan. The loan amount is typically disbursed directly into the employee’s bank account. Eligibility is generally determined by factors such as employment status (active, full-time or part-time employee), length of service, and creditworthiness, although specific requirements may vary. The application process usually involves completing a loan application form, providing necessary documentation, and obtaining approval from the USPS finance department. Once approved, funds are disbursed, and regular deductions commence according to the agreed-upon repayment schedule.

Types of USPS Allotment Loans

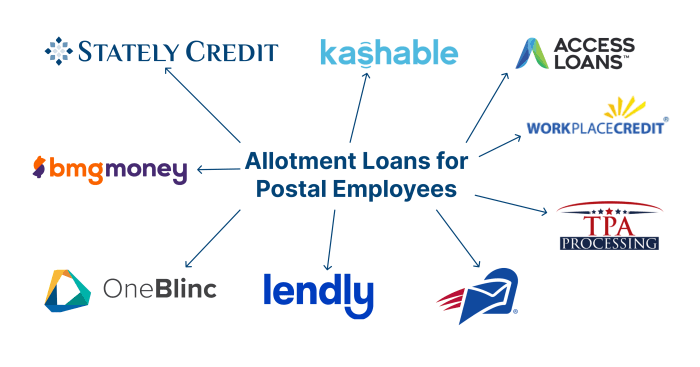

While the precise types of allotment loans offered by the USPS may vary over time and potentially by location, common options frequently include short-term loans for immediate financial needs and longer-term loans for larger purchases or debt consolidation. Specific loan amounts and interest rates will be determined based on individual circumstances and the current financial policies of the USPS. Some programs might also offer different interest rates based on the employee’s credit score or length of service. It is crucial to check directly with the USPS finance department for the most up-to-date information on available loan products.

Comparison with Other Employee Loans

USPS allotment loans differ from other employee loans primarily in their direct integration with payroll. This streamlined process often results in simpler application procedures and potentially lower administrative fees compared to external loans. However, interest rates on USPS allotment loans might not always be the most competitive compared to those offered by banks or credit unions. The key advantage lies in the convenience and guaranteed repayment mechanism through payroll deduction, reducing the risk of missed payments and potential penalties. External loans often offer higher loan amounts and more flexible repayment terms, but might involve more complex application processes and higher administrative fees.

USPS Allotment Loan Comparison Table

| Loan Type | Interest Rate (Example) | Loan Term (Example) | Fees (Example) |

|---|---|---|---|

| Short-Term Loan | 5% APR | 6 months | $10 application fee |

| Long-Term Loan | 7% APR | 24 months | $25 application fee |

| Alternative Loan (if available) | Variable, based on credit score | 12-36 months | $0 application fee |

Note: The interest rates, loan terms, and fees provided in this table are examples only and should not be considered definitive. Actual rates and fees will vary depending on the specific loan program, creditworthiness of the applicant, and prevailing USPS financial policies. Always consult the official USPS guidelines for the most accurate and up-to-date information.

Benefits and Drawbacks of USPS Allotment Loans

USPS allotment loans offer a unique financing option for postal employees, leveraging their guaranteed income stream for borrowing. Understanding both the advantages and disadvantages is crucial for making an informed financial decision. This section will analyze the benefits and drawbacks of these loans, comparing them to other personal loan options available to the general public.

Advantages of USPS Allotment Loans

USPS allotment loans often present attractive features for postal workers. A key advantage is the streamlined application process, often simpler and faster than securing a loan from a traditional bank or credit union. The loan’s repayment is directly deducted from the employee’s paycheck, ensuring consistent and automatic payments, minimizing the risk of missed payments and potential late fees. This automated repayment system provides peace of mind, particularly for individuals who may struggle with budgeting or consistent repayment schedules. Furthermore, interest rates may be competitive, especially when compared to high-interest options like payday loans. The loan’s availability solely to USPS employees often translates to a degree of trust and understanding from the lender, which can simplify the borrowing process.

Disadvantages of USPS Allotment Loans

While USPS allotment loans offer convenience, certain drawbacks exist. Loan amounts may be capped, limiting the borrowing capacity for larger financial needs such as home renovations or significant medical expenses. The repayment schedule, while convenient in its automation, may lack flexibility, potentially creating difficulties during periods of financial hardship or unexpected income changes. Moreover, interest rates, while potentially competitive, might not always be the lowest available on the market. Finally, eligibility is restricted solely to USPS employees, excluding individuals who may require similar financial assistance but don’t work for the postal service.

Comparison with Other Personal Loan Options

USPS allotment loans offer a convenient alternative to other personal loan options. Compared to traditional bank loans, the application process is typically less rigorous and faster. However, bank loans often offer higher loan amounts and potentially lower interest rates. Payday loans, known for their extremely high interest rates and short repayment terms, present a significantly riskier alternative. Credit union loans offer a middle ground, often with lower interest rates than banks and more flexible terms than USPS allotment loans, but potentially requiring a higher credit score for approval. Ultimately, the best option depends on the individual’s specific financial circumstances, creditworthiness, and the amount of money needed.

Pros and Cons of USPS Allotment Loans

The following list summarizes the key advantages and disadvantages to consider before applying for a USPS allotment loan:

- Pros: Convenient application and repayment process; Automatic deductions minimize missed payments; Potentially competitive interest rates; Simplified approval process due to employer-based security.

- Cons: Limited loan amounts; Inflexible repayment schedule; Interest rates may not always be the lowest available; Eligibility restricted to USPS employees only.

Managing USPS Allotment Loans

Effective management of a USPS allotment loan is crucial for maintaining financial stability and avoiding potential negative consequences. Understanding repayment strategies, budgeting techniques, and the implications of default are key to responsible loan management. This section details practical steps to ensure successful loan repayment and address potential issues proactively.

Repayment Planning Strategies for USPS Allotment Loans

Creating a comprehensive repayment plan is essential for successful loan management. This involves assessing your income, expenses, and loan terms to develop a realistic repayment schedule. Consider using online budgeting tools or spreadsheets to track your income and expenses meticulously. Prioritize loan payments alongside essential living expenses, ensuring consistent and timely repayments. A key strategy is to automate payments whenever possible, preventing missed payments due to oversight. This can often be set up directly through your USPS payroll system. Building a financial buffer, even a small emergency fund, can provide a safety net in case of unexpected expenses that might otherwise jeopardize loan repayments.

Budgeting Techniques for Managing Loan Repayments

Effective budgeting is paramount to successful loan repayment. The 50/30/20 budgeting rule is a helpful starting point. This method allocates 50% of your after-tax income to needs (housing, food, transportation, loan payments), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. However, this needs adjustment based on individual circumstances and loan repayment amounts. For example, if your loan payment constitutes a significant portion of your income, you may need to reduce your allocation to wants to ensure timely repayments. Detailed expense tracking, using budgeting apps or spreadsheets, allows you to identify areas where you can cut back and reallocate funds towards your loan payments. Regularly reviewing and adjusting your budget based on your financial situation ensures your plan remains effective.

Consequences of Defaulting on a USPS Allotment Loan

Defaulting on a USPS allotment loan can have serious consequences, significantly impacting your financial well-being and credit score. This includes potential wage garnishment, where a portion of your paycheck is directly deducted to repay the debt. Your credit score will suffer, making it harder to secure loans, credit cards, or even rent an apartment in the future. Furthermore, your employment with the USPS could be jeopardized, potentially leading to disciplinary action or termination. In severe cases, the debt may be sent to collections, resulting in additional fees and further damage to your credit. Therefore, proactive communication with the USPS is crucial if you anticipate difficulty making payments.

Contacting USPS for Loan-Related Inquiries

Contacting the USPS regarding your allotment loan should be a straightforward process. Begin by gathering all relevant information, including your loan number, account details, and the nature of your inquiry. The USPS website typically provides contact information for their finance department or loan services. Look for a dedicated phone number or email address for loan inquiries. If online contact information is unavailable, consider contacting your local USPS branch or your supervisor for guidance on the appropriate contact method. Maintain a record of all communication with the USPS, including dates, times, and the outcome of each interaction. Should you need to escalate an issue, this documentation will be valuable.

Illustrative Scenarios

Understanding the practical application of USPS allotment loans requires examining specific scenarios. This section will illustrate situations where an allotment loan proves beneficial and others where alternative financing options might be more advantageous. We will analyze the financial implications of each scenario, highlighting the impact of different repayment plans on overall debt.

USPS Employee Benefits from Allotment Loan, Usps allotment loans

Imagine a USPS mail carrier, Sarah, who needs $5,000 for an unexpected car repair. Her credit score isn’t ideal, making securing a traditional loan difficult and potentially expensive. However, she’s eligible for a USPS allotment loan. She chooses a 12-month repayment plan with a relatively low interest rate compared to other high-interest credit options. This allows her to pay off the loan quickly and avoid accumulating significant interest charges. The fixed monthly deduction from her paycheck ensures consistent repayment, reducing the risk of missed payments and potential damage to her credit. This scenario demonstrates how a USPS allotment loan can provide a convenient and affordable solution for unexpected expenses when other credit options are less accessible or more costly. The predictability of the payment schedule also aids in budgeting and financial planning.

Alternative Financing Option More Beneficial

Consider another USPS employee, Mark, who requires a $20,000 loan for a home renovation. While he could use an allotment loan, the repayment period might be quite lengthy, potentially stretching over several years. Given the significant loan amount, the total interest paid over this extended period could be substantial. In this case, a personal loan from a reputable bank or credit union offering a lower interest rate and potentially a longer repayment term might be more financially advantageous. A personal loan allows for more flexibility in repayment terms and potentially lower overall interest costs, particularly for larger loan amounts. This could lead to significant savings compared to the total cost of a longer-term allotment loan. A comparison of interest rates and total repayment amounts would be crucial in making this decision. For instance, if the bank loan offers a 5% interest rate over 5 years versus the allotment loan’s 8% over 7 years, the long-term cost savings of the bank loan could be considerable.

Financial Implications Comparison

Let’s compare the financial implications of Sarah and Mark’s scenarios. For Sarah, assume a $5,000 allotment loan at 6% interest over 12 months. Her monthly payment would be approximately $430, resulting in a total repayment of around $5,160. Had she used a high-interest credit card with a 20% APR, her total repayment could be significantly higher, potentially exceeding $6,000 due to accumulating interest and fees.

For Mark, let’s assume a $20,000 allotment loan at 8% interest over 60 months (5 years). His monthly payment would be approximately $390, resulting in a total repayment exceeding $23,400. If he secured a personal loan at 5% interest over 60 months, his monthly payment would be approximately $370, with a total repayment around $22,200. This shows a potential saving of over $1,200 by choosing the personal loan, highlighting the importance of comparing financing options before committing to a loan. The difference becomes even more pronounced with larger loan amounts and longer repayment periods.

Outcome Summary

Securing financial stability requires careful planning and understanding of available resources. USPS allotment loans present a viable option for postal service employees, but careful consideration of their benefits and drawbacks is essential. By weighing the pros and cons, comparing interest rates and terms against alternatives, and developing a robust repayment plan, you can leverage these loans responsibly to achieve your financial goals. Remember to thoroughly research all available options and seek professional financial advice when necessary.

Query Resolution: Usps Allotment Loans

What happens if I miss a payment on my USPS allotment loan?

Missing payments can result in late fees, damage to your credit score, and potential wage garnishment. Contact the USPS loan provider immediately to discuss options.

Can I refinance my USPS allotment loan?

Refinancing options may be available depending on the loan provider and your financial circumstances. Check with your loan provider to explore possibilities.

Are there any prepayment penalties for USPS allotment loans?

This depends on the specific terms of your loan agreement. Review your loan documents carefully for details on prepayment penalties.

How long does it take to get approved for a USPS allotment loan?

Processing times vary but typically range from a few days to a few weeks. The exact timeframe depends on the completeness of your application and the loan provider’s processing speed.