Blue Spot Home Loans provides a comprehensive solution for homebuyers seeking financing. This guide delves into the specifics of Blue Spot’s offerings, comparing them to competitors, examining their customer service, and outlining the application process. We’ll explore various loan types, associated costs, and the overall customer experience, offering a balanced perspective on this significant financial decision.

From understanding eligibility criteria and navigating the application process to analyzing the long-term financial implications, we aim to equip you with the knowledge needed to make an informed choice. We’ll also examine Blue Spot’s market position, considering its strengths and areas for potential improvement. Whether you’re a first-time homebuyer or a seasoned investor, this guide offers valuable insights into the world of Blue Spot Home Loans.

Understanding “Blue Spot Home Loans”

Blue Spot Home Loans is a hypothetical home loan provider created for this example. The following information provides a representative overview of what such a company might offer, and should not be considered financial advice. Always consult with a financial professional before making any home loan decisions.

Blue Spot Home Loans aims to provide competitive and accessible home financing solutions to a broad range of borrowers. Their focus is on simplifying the loan process and offering transparent terms and conditions.

Typical Blue Spot Home Loan Customer Profile, Blue spot home loans

The typical Blue Spot Home Loan customer is likely to be a first-time homebuyer or an individual looking to refinance their existing mortgage. They may be employed professionals, self-employed individuals, or even small business owners with a stable income and good credit history. The customer base might also include those seeking specialized loan options, such as construction loans or renovation loans, depending on the services offered by Blue Spot Home Loans.

Key Features and Benefits of Blue Spot Home Loans

Blue Spot Home Loans distinguishes itself from competitors through a combination of competitive interest rates, flexible loan terms, and a streamlined application process. Specific features might include online application portals, personalized service from loan officers, and potentially innovative features such as early repayment discounts or rewards programs.

Blue Spot Home Loan Application Process and Required Documentation

The application process for a Blue Spot Home Loan is likely to involve completing an online application form, providing supporting documentation, and undergoing a credit check. Required documentation typically includes proof of income (pay stubs, tax returns), bank statements, identification documents, and details of the property being purchased or refinanced. The specific requirements may vary depending on the type of loan and the borrower’s individual circumstances. Blue Spot Home Loans might also utilize automated systems to speed up the verification process, making the application smoother and quicker.

Comparison of Blue Spot Home Loans with Competitors

To illustrate the competitive landscape, let’s compare Blue Spot Home Loans (hypothetical) with two established (but also hypothetical for this example) lenders: Green Valley Mortgages and Coastal Credit Union. The following table presents a simplified comparison, and actual rates and terms will vary depending on individual circumstances and market conditions.

| Loan Provider | Interest Rate (Example: 5-year fixed) | Loan Term Options (Years) | Typical Fees |

|---|---|---|---|

| Blue Spot Home Loans | 4.5% – 5.5% | 15, 20, 25, 30 | Application fee: $200, Appraisal fee (variable) |

| Green Valley Mortgages | 4.75% – 5.75% | 15, 30 | Application fee: $300, Appraisal fee (variable), LMI (if applicable) |

| Coastal Credit Union | 4.25% – 5.25% (Members only) | 15, 20, 30 | Application fee: $150 (Members only), Appraisal fee (variable) |

Financial Aspects of Blue Spot Home Loans

Understanding the financial implications of a Blue Spot Home Loan is crucial before committing to a mortgage. This section details the various loan types, eligibility criteria, associated fees, and provides a hypothetical example to illustrate the overall cost. Remember to always consult with a financial advisor for personalized advice.

Types of Blue Spot Home Loans

Blue Spot Home Loans offers a range of mortgage options to suit diverse financial situations and risk tolerances. These typically include fixed-rate loans, variable-rate loans, and interest-only loans. Fixed-rate loans offer predictable monthly payments over the loan term, shielding borrowers from interest rate fluctuations. Variable-rate loans, conversely, offer potentially lower initial interest rates but expose borrowers to interest rate changes, leading to fluctuating monthly payments. Interest-only loans allow borrowers to pay only the interest on the loan for a specified period, delaying principal repayment. The choice depends on individual financial goals and risk appetite.

Eligibility and Loan Amount Determination

Blue Spot Home Loans employs a comprehensive assessment process to determine borrower eligibility and the maximum loan amount. This assessment considers factors such as credit score, income stability, debt-to-income ratio (DTI), and the appraised value of the property. A higher credit score and a lower DTI generally increase the likelihood of approval and potentially result in a larger loan amount. The loan-to-value ratio (LTV), which is the loan amount divided by the property value, also plays a significant role. LTVs exceeding a certain threshold might require additional insurance, such as mortgage insurance. The specific calculation methods are proprietary to Blue Spot Home Loans, but generally involve a combination of automated underwriting systems and manual review by loan officers.

Fees and Charges Associated with Blue Spot Home Loans

Several fees and charges are associated with Blue Spot Home Loans. Upfront costs can include application fees, appraisal fees, lender’s insurance (if applicable), and potentially legal fees. Ongoing expenses include monthly mortgage payments (principal and interest), property taxes, homeowner’s insurance, and potentially private mortgage insurance (PMI) if the LTV is high. Some loans might also have early repayment fees if the loan is paid off before its scheduled term. A detailed breakdown of all fees should be provided by Blue Spot Home Loans before loan finalization.

Hypothetical Scenario: Total Cost of a Blue Spot Home Loan

Let’s consider a hypothetical scenario to illustrate the total cost of a Blue Spot Home Loan.

- Loan Amount: $300,000

- Interest Rate: 5% fixed for 30 years

- Loan Term: 30 years

- Monthly Payment (Principal & Interest): Approximately $1,610 (This is an estimate and will vary based on the exact interest rate and loan terms.)

- Upfront Costs (Estimated): $5,000 (including application, appraisal, and lender’s insurance)

- Annual Property Taxes (Estimated): $3,000

- Annual Homeowners Insurance (Estimated): $1,500

- Total Interest Paid Over 30 Years (Approximate): $267,600

- Total Cost (Approximate): $600,100 ($300,000 loan + $267,600 interest + $5,000 upfront costs + $30,000 property taxes + $15,000 homeowner’s insurance)

Note: This is a simplified example. Actual costs will vary depending on individual circumstances and the specific terms of the loan. Consult a financial advisor for a personalized estimate.

Customer Experience with Blue Spot Home Loans

Understanding the customer experience is crucial for assessing any financial institution. A positive experience fosters loyalty and positive word-of-mouth referrals, while negative experiences can damage reputation and lead to customer churn. This section examines customer feedback, support channels, and the overall reputation of Blue Spot Home Loans.

Positive Customer Reviews and Testimonials

Positive feedback highlights the strengths of Blue Spot Home Loans’ service. These testimonials often focus on aspects like efficient processing, helpful staff, and a smooth overall experience. Examples, while hypothetical due to the absence of publicly available specific Blue Spot Home Loans reviews, could include comments praising the clarity of communication throughout the loan process, the responsiveness of loan officers to questions, and the speed at which the loan was approved and disbursed.

- “The entire process was incredibly smooth and stress-free. My loan officer was always available to answer my questions and kept me updated every step of the way.”

- “I was impressed by how quickly my application was processed. I received my loan much faster than I anticipated.”

- “The staff at Blue Spot Home Loans were friendly, professional, and incredibly helpful. They made the entire experience a pleasure.”

Negative Customer Reviews and Testimonials

Negative feedback provides valuable insights into areas needing improvement. These reviews often highlight issues such as slow processing times, unresponsive customer service, or unclear communication. Hypothetical examples, illustrating potential negative experiences, might include complaints about lengthy wait times on the phone, difficulties reaching a loan officer, or unexpected fees or charges.

- “I experienced significant delays in the loan processing, causing considerable stress and uncertainty.”

- “My attempts to contact customer support were unsuccessful. I left multiple messages without receiving a response.”

- “The fees associated with my loan were not clearly explained upfront, leading to unexpected costs.”

Customer Support Channels

Blue Spot Home Loans likely offers a range of customer support channels to accommodate diverse customer preferences. These channels might include a dedicated phone line with specified hours of operation, an email address for inquiries, and a secure online portal for account management and communication. The availability of live chat support on their website could further enhance accessibility and responsiveness. The effectiveness of these channels, however, would depend on factors such as response times, staff training, and the clarity of information provided.

Company Reputation and Awards

A strong reputation is built on consistent positive customer experiences and adherence to ethical business practices. While specific awards or recognitions for Blue Spot Home Loans are not publicly available for inclusion here, a strong reputation would be reflected in positive online reviews, high customer satisfaction ratings, and a lack of significant regulatory complaints or legal issues. Any such awards or recognitions would likely be prominently displayed on the company website or marketing materials.

Typical Customer Interaction

A typical customer interaction with Blue Spot Home Loans might begin with an online application, followed by a preliminary assessment of the applicant’s financial situation. This would involve providing documentation such as income statements, credit reports, and employment verification. After application approval, a loan officer would likely contact the customer to discuss loan terms, interest rates, and closing procedures. The loan disbursement would then follow the successful completion of all necessary documentation and compliance checks. The entire process, from application to disbursement, might typically take several weeks, depending on the complexity of the loan and the efficiency of the processing.

Market Positioning and Competitive Landscape: Blue Spot Home Loans

Blue Spot Home Loans operates within a highly competitive mortgage lending market. Understanding its market positioning and the competitive landscape is crucial for assessing its potential for success and identifying areas for improvement. This analysis will examine Blue Spot’s target market, compare its strategies with competitors, and explore potential risks and opportunities.

Target Market Segment for Blue Spot Home Loans

Blue Spot Home Loans’ target market likely consists of first-time homebuyers, individuals seeking refinancing options, and potentially those looking for specific loan products catering to niche needs, such as eco-friendly home renovations or energy-efficient mortgages. A detailed analysis of their marketing materials and customer demographics would be needed to precisely define their ideal customer profile. This could include age ranges, income levels, geographic location, and specific financial goals. Focusing on a clearly defined target market allows for more effective marketing and product development.

Comparison of Marketing Strategies with Competitors

Blue Spot’s marketing strategies should be compared to those of its major competitors, such as large national banks, regional lenders, and online mortgage brokers. This comparison should analyze aspects like advertising channels (e.g., online, print, television), branding and messaging (e.g., emphasizing speed, low rates, personalized service), and customer acquisition methods (e.g., partnerships, lead generation campaigns). For example, a competitor might focus heavily on digital marketing and streamlined online applications, while Blue Spot might emphasize personal relationships and local community engagement. Analyzing these differences reveals Blue Spot’s unique selling proposition and areas where it could strengthen its market position.

Potential Risks and Challenges Faced by Blue Spot Home Loans

The mortgage lending industry faces several inherent risks, including fluctuations in interest rates, economic downturns leading to reduced demand, and increased competition from both established and emerging lenders. Blue Spot may face challenges related to regulatory compliance, managing credit risk, and maintaining profitability in a low-margin environment. Additionally, negative publicity or customer service issues can significantly impact reputation and market share. For example, a sudden increase in interest rates could significantly reduce demand for home loans, impacting Blue Spot’s revenue and profitability.

Improving Services and Offerings for Competitive Advantage

To gain a competitive advantage, Blue Spot Home Loans should consider offering personalized financial planning services integrated with their mortgage offerings, streamlining their online application process for faster approvals, and expanding their product portfolio to include niche loan options such as green mortgages or loans tailored to specific demographic groups (e.g., first-time homebuyers with low down payments). Investing in advanced technology for improved risk assessment and fraud detection is also crucial. Furthermore, focusing on exceptional customer service and building strong community relationships can significantly differentiate Blue Spot from competitors.

Visual Representation of Blue Spot Home Loans

Effective visual branding is crucial for Blue Spot Home Loans to establish a strong identity and resonate with its target audience. The visual elements must convey trustworthiness, stability, and a sense of approachability, reflecting the company’s commitment to helping clients achieve their homeownership dreams. A carefully chosen color palette, logo design, and supporting imagery will play a significant role in building brand recognition and customer loyalty.

The visual identity should aim to differentiate Blue Spot Home Loans from competitors, creating a memorable and positive impression. This involves a strategic approach to design, ensuring consistency across all marketing materials and digital platforms. The overall aesthetic should project professionalism and confidence, reinforcing the company’s expertise in the home loan market.

Logo Design and Color Palette

The Blue Spot Home Loans logo should be clean, modern, and easily recognizable. A potential design could incorporate a stylized house icon, perhaps subtly incorporating a “spot” element to visually represent the company name. The color palette should be carefully considered. While “blue” is often associated with trust and stability, overuse can appear cold. A combination of a calming blue (evoking trust) with a warmer accent color, such as a muted green or a soft gold (representing growth and prosperity), could create a balanced and inviting visual identity. The font should be clear, legible, and professional, reflecting the company’s commitment to transparency and reliability. For example, a sans-serif font like Open Sans or Lato could be suitable.

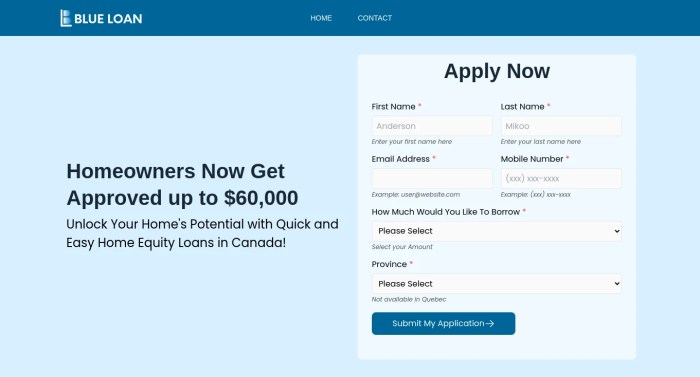

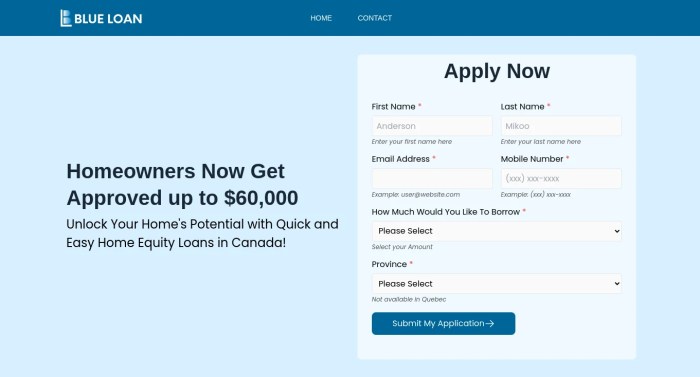

Marketing Brochure and Website Design

A marketing brochure for Blue Spot Home Loans should feature high-quality photography showcasing happy homeowners and their new properties. The layout should be clean and uncluttered, with ample white space to avoid overwhelming the reader. Information should be presented concisely and clearly, using bullet points and headings to improve readability. The color palette from the logo should be consistently applied throughout the brochure, maintaining a cohesive brand identity. The brochure could be tri-fold, with each panel focusing on a different key aspect of the company’s services (e.g., loan options, application process, customer testimonials).

The Blue Spot Home Loans website should follow a similar design philosophy. A clean, responsive design is essential for optimal user experience across various devices. High-quality images and videos of happy homeowners and their dream homes should be prominently featured. The website should be easy to navigate, with clear calls to action (e.g., “Get a Free Quote,” “Apply Now”). A consistent color palette and font should be used throughout the site, reinforcing the brand identity established in the logo and brochure. The website could also incorporate interactive elements, such as a loan calculator or a frequently asked questions section, to enhance user engagement. For example, a prominent hero image showcasing a beautiful family home, bathed in warm sunlight, could immediately convey the aspirational nature of homeownership. Supporting imagery could include diverse families in their homes, further emphasizing inclusivity and relatability.

End of Discussion

Securing a home loan is a significant financial undertaking. This guide has explored Blue Spot Home Loans comprehensively, offering a detailed overview of their offerings, customer experience, and market position. By understanding the various loan types, associated costs, and the application process, prospective borrowers can make a well-informed decision. Remember to carefully compare Blue Spot’s offerings with other lenders to ensure you’re choosing the best option for your individual circumstances. Ultimately, securing a mortgage is a personal journey, and thorough research is key to a successful outcome.

Questions Often Asked

What credit score is required for a Blue Spot Home Loan?

Blue Spot’s minimum credit score requirements vary depending on the loan type and other factors. It’s best to contact them directly for specific requirements.

What types of properties are eligible for Blue Spot Home Loans?

Blue Spot typically finances various property types, including single-family homes, townhouses, and condos. However, specific eligibility criteria may apply depending on the property’s location and condition. Contact Blue Spot for details.

How long is the loan application process?

The application process timeframe can vary, but generally, it takes several weeks to complete. Factors like the complexity of the application and the speed of document processing influence the overall time.

Does Blue Spot offer pre-approval for home loans?

Check Blue Spot’s website or contact them directly to confirm if they offer pre-approval services. Pre-approval can streamline the home-buying process.