MCU personal loan rates are a crucial factor for anyone considering borrowing money. Understanding these rates, along with the eligibility criteria and application process, is key to securing a loan that fits your financial needs. This guide delves into the specifics of MCU’s personal loan offerings, providing a comprehensive overview to help you make informed decisions.

We’ll explore the various factors that influence interest rates, compare MCU’s rates to competitors, and Artikel the steps involved in applying for and securing a loan. We’ll also cover repayment options, fees, and special offers to give you a complete picture of the MCU personal loan experience. This information will empower you to navigate the loan process with confidence and secure the best possible terms.

Understanding MCU Personal Loan Rates

Securing a personal loan involves careful consideration of interest rates, as these significantly impact the overall cost of borrowing. Understanding the factors that influence these rates, as well as comparing them to other financial institutions, is crucial for making an informed decision. This section will delve into the specifics of MCU personal loan rates, providing clarity on what influences them and how they compare to market averages.

Factors Influencing MCU Personal Loan Interest Rates

Several key factors determine the interest rate MCU applies to personal loans. These include the applicant’s credit score, the loan amount requested, the loan term length, and the type of collateral offered (if any). A higher credit score generally results in a lower interest rate, reflecting lower perceived risk for the lender. Larger loan amounts might also command slightly higher rates due to increased risk exposure. Similarly, longer loan terms typically lead to higher interest rates due to the extended repayment period. Finally, secured loans (backed by collateral) usually carry lower rates than unsecured loans. The prevailing economic conditions and MCU’s internal lending policies also play a role.

Typical Range of MCU Personal Loan Interest Rates

MCU’s personal loan interest rates vary depending on the factors mentioned above. However, a general range can be provided for illustrative purposes. For example, borrowers with excellent credit might qualify for rates as low as 6% APR, while those with less-than-perfect credit might face rates closer to 18% APR or higher. These figures are estimates and should not be considered a guarantee. It’s crucial to contact MCU directly for a personalized rate quote based on individual circumstances.

Comparison of MCU Personal Loan Rates to Other Institutions

Direct comparison of MCU’s rates with those of other major financial institutions requires accessing current rate information from each lender. This information fluctuates frequently. However, a general observation is that MCU’s rates are competitive within the market, particularly for borrowers with strong credit histories. It’s recommended that potential borrowers compare offers from several lenders, including banks, credit unions, and online lenders, to find the most favorable terms.

Examples of Loan Amounts and Corresponding Interest Rates

To illustrate, consider these hypothetical examples (these are for illustrative purposes only and are not reflective of current MCU rates): A $5,000 loan with excellent credit might carry an APR of 7%, while a $15,000 loan with fair credit might have an APR of 12%. A $25,000 loan to a borrower with poor credit could have an APR of 18% or higher. Remember, these are hypothetical examples, and your actual rate will depend on your individual creditworthiness and other factors.

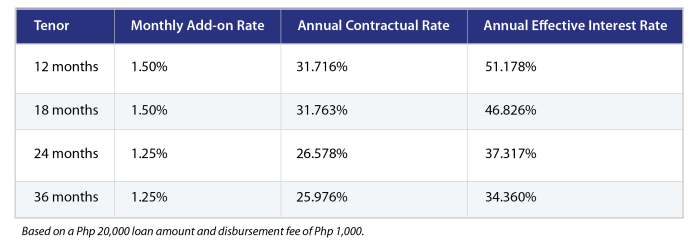

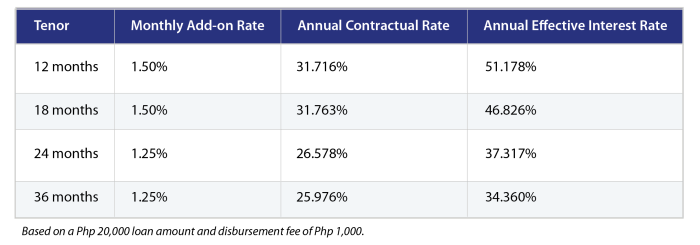

MCU Personal Loan Products: APR, Loan Term, and Fees

The following table provides a sample of potential APRs, loan terms, and fees for various MCU personal loan products. These are examples and may not represent the complete range of options or current pricing. Contact MCU directly for the most up-to-date information.

| Loan Amount | APR | Loan Term (Years) | Fees |

|---|---|---|---|

| $5,000 | 7-10% | 3-5 | $50 – $100 origination fee (example) |

| $10,000 | 8-12% | 3-5 | $75 – $150 origination fee (example) |

| $15,000 | 9-14% | 3-7 | $100 – $200 origination fee (example) |

| $20,000 | 10-16% | 5-7 | $150 – $250 origination fee (example) |

MCU Loan Eligibility Criteria

Securing an MCU personal loan hinges on meeting specific eligibility requirements. These criteria are designed to assess the applicant’s creditworthiness and ability to repay the loan. The application process involves a thorough review of several key factors, ensuring responsible lending practices.

MCU’s loan eligibility assessment is a multi-faceted process, going beyond simply checking credit scores. While a strong credit history is beneficial, other factors, such as income stability and employment history, also play significant roles in determining loan approval. Understanding these criteria can significantly improve your chances of a successful application.

Credit Score Requirements

A favorable credit score is a crucial element in the MCU personal loan application process. While MCU doesn’t publicly state a minimum credit score requirement, a higher score generally increases the likelihood of approval and can also influence the interest rate offered. A higher credit score demonstrates a history of responsible financial management, reducing the perceived risk for the lender. Applicants with lower credit scores may still be considered, but they might face higher interest rates or stricter loan terms. Improving your credit score before applying can significantly enhance your chances of securing a favorable loan offer.

Income Verification Process

MCU requires verification of income to ensure applicants possess the financial capacity to repay the loan. This typically involves providing documentation such as pay stubs, tax returns, or bank statements. The purpose of this verification is to assess the applicant’s consistent income stream and its stability over time. The income verification process is a standard procedure for responsible lending, mitigating the risk of loan defaults. Self-employed individuals may need to provide additional documentation, such as business tax returns or profit and loss statements, to substantiate their income.

Other Factors Considered During Loan Application Review

Beyond credit score and income, MCU considers several other factors when evaluating loan applications. These include the applicant’s employment history, length of residence, existing debt obligations, and the purpose of the loan. A stable employment history, demonstrating consistent income over a period of time, strengthens the application. Similarly, a long-term residence history suggests stability and reduces the lender’s risk. Existing debt obligations are reviewed to assess the applicant’s overall financial burden. Finally, the intended use of the loan is considered; while not always a deciding factor, it can provide context for the lender.

Required Documents for MCU Personal Loan Applications

The following documents are typically required when applying for an MCU personal loan. Having these documents readily available can streamline the application process and expedite the approval timeline. It is recommended to contact MCU directly to confirm the most current list of required documents.

- Government-issued photo identification (e.g., driver’s license, passport)

- Proof of income (e.g., pay stubs, tax returns, bank statements)

- Proof of address (e.g., utility bill, bank statement)

- Employment verification (e.g., letter from employer)

Loan Application and Approval Process: Mcu Personal Loan Rates

Securing an MCU personal loan involves a straightforward process, but understanding the steps and potential timelines is crucial for a smooth experience. This section details the application process, typical processing times, and potential delays, equipping you with the knowledge to navigate it effectively.

Applying for an MCU personal loan is designed to be convenient and efficient. Applicants can choose from several methods, each offering a unique level of interaction and speed. The entire process, from application to approval, is carefully managed to ensure transparency and a timely response.

MCU Personal Loan Application Methods

MCU offers multiple avenues for submitting a personal loan application. Applicants can choose the method that best suits their preferences and technological comfort. Each method requires similar information, ensuring consistency across the application process.

- Online Application: This method offers the quickest and most convenient way to apply. Applicants can complete the application form online, upload necessary documents, and track the progress of their application through a dedicated online portal. This typically involves creating an account on the MCU website and completing the required fields.

- In-Person Application: For those preferring a more personal approach, applying in person at an MCU branch allows for direct interaction with a loan officer. This method enables applicants to clarify any questions and receive immediate feedback on their application status. This option may require scheduling an appointment beforehand.

- Phone Application: Some MCU branches may allow for applications over the phone, although this may require more follow-up to provide necessary documentation.

MCU Personal Loan Application Processing Time

The typical processing time for an MCU personal loan application is between 3 to 7 business days. However, this timeframe can vary depending on several factors, including the completeness of the application, the verification of information, and the applicant’s credit history. Faster processing is usually seen for applications with complete and accurate information. For instance, an application submitted online with all required documentation attached can often be processed within 3 business days. Conversely, an application with missing information or requiring further verification may take longer.

MCU Personal Loan Application Flowchart

The following describes a simplified flowchart illustrating the loan application and approval process:

[Imagine a flowchart here. The flowchart would begin with “Application Submission” (online, in-person, or phone). This would branch to “Application Review and Verification,” which would then lead to either “Loan Approved” or “Loan Denied”. The “Loan Approved” branch would proceed to “Loan Disbursement,” while the “Loan Denied” branch would lead to “Notification of Denial and Reason”. A feedback loop could be included from “Loan Denied” back to “Application Submission” to allow for re-application after addressing the reasons for denial.]

Potential Delays in the Loan Approval Process and Mitigation Strategies

Several factors can cause delays in the loan approval process. Understanding these potential issues and proactive measures to mitigate them can significantly improve the efficiency of the process.

- Incomplete Application: Missing information or incomplete documentation can significantly delay the process. Mitigation: Carefully review all required documents before submitting the application. Ensure all fields are completed accurately and completely.

- Credit Report Discrepancies: Inconsistencies or errors in the applicant’s credit report can lead to delays in verification. Mitigation: Review your credit report for any inaccuracies and dispute them with the credit bureaus if necessary, before applying for the loan.

- Income Verification Issues: Difficulty verifying income information can prolong the process. Mitigation: Provide clear and concise documentation of your income, such as recent pay stubs, tax returns, or bank statements.

- High Debt-to-Income Ratio: A high debt-to-income ratio may negatively impact loan approval. Mitigation: Reduce existing debt or explore alternative financing options if your debt-to-income ratio is too high.

Repayment Options and Fees

Understanding the repayment options and associated fees for your MCU personal loan is crucial for effective financial planning. Choosing the right repayment schedule can significantly impact your overall loan cost. This section details the available options and helps you understand the financial implications of each.

MCU offers flexible repayment options designed to accommodate various financial situations. Borrowers can typically choose between monthly and bi-weekly payment schedules. Monthly payments are the most common and offer a predictable, once-a-month payment. Bi-weekly payments, while requiring more frequent payments, can potentially lead to faster loan payoff and reduced interest charges over the life of the loan. The specific options available will depend on the loan amount and term.

Associated Fees

MCU personal loans may involve several fees. These fees are important to consider when budgeting for your loan and comparing the overall cost. Common fees include origination fees, which are typically a percentage of the loan amount and are charged upfront. Late payment fees are assessed for missed or late payments and can significantly increase the total cost of borrowing. It’s crucial to review your loan agreement thoroughly to understand all applicable fees. Failure to do so could lead to unexpected expenses.

Comparison of Repayment Schedules and Costs

The total cost of a loan is significantly influenced by the chosen repayment schedule and the associated interest rate. A shorter repayment period, while requiring larger payments, will generally result in lower overall interest paid. Conversely, a longer repayment period allows for smaller monthly payments but will lead to higher total interest payments.

To illustrate this, consider two scenarios for a $10,000 personal loan with a 7% annual interest rate:

| Repayment Plan | Loan Term (Months) | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|---|

| Monthly Payments | 36 | $304 | $1,147 |

| Bi-weekly Payments | 36 (equivalent to 72 bi-weekly payments) | $152 | $1,000 (approximately, as bi-weekly payment calculations are slightly more complex) |

Note: These figures are approximate and do not include any potential fees. Actual figures will vary based on the specific loan terms and MCU’s current interest rates. Always consult with MCU directly for precise calculations.

Impact of Interest Rates on Total Repayment

The interest rate plays a crucial role in determining the total repayment amount. A higher interest rate will result in significantly higher total interest paid over the life of the loan, even with the same repayment schedule.

For example, a $10,000 loan with a 7% interest rate over 36 months will have a substantially lower total repayment amount than the same loan with a 10% interest rate. The difference in total interest paid can be hundreds, even thousands of dollars depending on the loan term.

A lower interest rate translates directly to lower overall borrowing costs. Shop around and compare rates before committing to a loan.

Special Offers and Promotions

MCU regularly offers special promotions on its personal loans to attract new customers and reward existing ones. These offers can significantly impact the overall cost of borrowing, making them a worthwhile consideration for potential borrowers. Understanding the terms and conditions associated with these promotions is crucial to making an informed decision.

MCU’s special offers are typically time-sensitive, meaning they have a defined start and end date. The terms and conditions will Artikel the specific interest rates, fees, and eligibility requirements. These may differ from the standard loan terms, offering advantages such as reduced interest rates, waived fees, or increased loan amounts. Carefully comparing these special offers against the standard loan terms allows borrowers to maximize their savings and choose the most suitable option for their financial needs.

Details of Current Special Offers

Currently, MCU is running a promotion offering a 0.5% reduction on the standard personal loan interest rate for applicants who complete their application online. This offer is valid for new personal loans with a loan amount of $10,000 or more and a loan term of 36 months. The reduced rate applies for the entire loan term. Eligible applicants must also have a credit score above 700. Standard application fees still apply.

Comparison of Special Offers and Standard Loan Terms

Let’s compare a hypothetical example. Suppose a borrower needs a $15,000 personal loan for 36 months. The standard interest rate is 8%. Using a standard loan calculator (results will vary based on the exact calculator used), the total interest paid would be approximately $2,780, resulting in total repayment of $17,780. With the 0.5% reduction under the current promotion, the interest rate becomes 7.5%. The total interest paid would then be approximately $2,625, resulting in a total repayment of $17,625. This represents a savings of $155 in interest.

Examples of Past MCU Personal Loan Promotions

In the past, MCU has offered various promotions, including:

- A limited-time offer of a 1% interest rate reduction for existing MCU members.

- A promotion waiving the application fee for loans exceeding $20,000.

- A cashback reward program offering a percentage of the loan amount back to borrowers who paid off their loan early.

These past promotions highlight the variety of incentives MCU offers, demonstrating their commitment to providing competitive loan options to their members.

Frequently Asked Questions Regarding Special Offers

To clarify common queries about special offers, the following information is provided:

- How long do special offers last? The duration of each special offer varies and is clearly stated in the terms and conditions. It’s essential to check the offer’s validity period before applying.

- Who is eligible for special offers? Eligibility criteria for special offers vary depending on the specific promotion. Factors such as credit score, existing membership status, and loan amount often determine eligibility.

- What are the steps to take advantage of a special offer? Typically, to avail a special offer, you must apply during the promotion period and meet all the specified eligibility criteria. Sometimes, a special promotional code might be required during the application process.

- What happens if I don’t meet the eligibility criteria? If you don’t meet the eligibility criteria, you may still be able to apply for a personal loan under MCU’s standard terms and conditions.

- Can I combine special offers? Unless explicitly stated otherwise, combining multiple special offers is usually not permitted.

Customer Reviews and Experiences

Understanding customer sentiment is crucial for evaluating the effectiveness of MCU’s personal loan services. Analyzing customer reviews and testimonials provides valuable insights into their overall experience, highlighting both positive and negative aspects of the loan process. This section examines customer feedback, focusing on common themes, satisfaction levels, and MCU’s response to complaints.

MCU’s online presence, including its website and social media platforms, reveals a mix of customer experiences. While many express satisfaction with the loan approval process, interest rates, and customer service, others highlight challenges faced during the application or repayment phases. Analyzing this feedback allows for a comprehensive understanding of MCU’s strengths and areas for improvement.

Examples of Customer Reviews and Testimonials

Several online platforms host MCU customer reviews. Positive reviews often praise the speed and efficiency of the loan application process, competitive interest rates, and the helpfulness of MCU’s customer service representatives. For example, one review states, “The entire process was surprisingly smooth. I got approved quickly, and the representative was very patient in answering my questions.” Conversely, negative reviews frequently cite issues with communication, lengthy processing times, and difficulties navigating the repayment system. One such review mentions, “I had trouble getting in touch with someone to address a billing issue, and the automated system was unhelpful.”

Common Themes and Sentiments in Customer Feedback

Analyzing numerous reviews reveals several recurring themes. Positive feedback frequently centers on the ease of application, competitive interest rates, and responsive customer support. Negative feedback often highlights communication breakdowns, delays in processing applications, and challenges with the online portal or repayment processes. The overall sentiment appears to be moderately positive, with a significant portion of customers expressing satisfaction with the loan terms and service, but a noticeable number reporting negative experiences.

Overall Customer Satisfaction with MCU’s Personal Loan Services

Based on available online reviews and feedback, MCU’s overall customer satisfaction with personal loan services appears to be above average but not universally positive. While many customers praise the speed and efficiency of the process and the competitive interest rates, a considerable number report negative experiences related to communication, processing times, and repayment issues. This suggests that while MCU excels in some areas, there’s room for improvement in others to enhance customer satisfaction.

MCU’s Response to Customer Complaints and Concerns

Information regarding MCU’s specific methods for addressing customer complaints is limited in publicly available sources. However, based on the available reviews, it appears that MCU attempts to resolve issues raised by customers, although the effectiveness and timeliness of their response vary. Further research into MCU’s internal complaint resolution procedures would be necessary for a more complete assessment of their customer service practices.

Case Studies: Positive and Negative Customer Experiences, Mcu personal loan rates

To illustrate the range of customer experiences, consider these hypothetical case studies (note: these are illustrative examples and do not represent specific, verifiable MCU customers):

Positive Case Study: Sarah needed a quick loan for unexpected home repairs. She applied online through MCU’s website and received approval within 24 hours. The interest rate was competitive, and she found the customer service representatives helpful and responsive to her questions. She successfully repaid the loan on time and was satisfied with the overall experience.

Negative Case Study: Mark applied for a personal loan to consolidate debt. His application took significantly longer than expected, and he experienced difficulties communicating with MCU representatives to track its progress. Once approved, he encountered issues with the online repayment system, leading to late payment fees. His overall experience was negative, impacting his perception of MCU’s services.

Closing Notes

Securing a personal loan can be a significant financial decision. By understanding MCU personal loan rates, eligibility requirements, and the application process, you can make an informed choice that aligns with your financial goals. Remember to carefully review all terms and conditions before signing any loan agreement. With careful planning and a thorough understanding of the process, you can successfully navigate the world of personal loans and achieve your financial objectives.

Clarifying Questions

What is the minimum credit score required for an MCU personal loan?

MCU’s minimum credit score requirement varies depending on the loan amount and other factors. It’s best to check directly with MCU for the most up-to-date information.

Can I pre-qualify for an MCU personal loan without affecting my credit score?

Yes, MCU likely offers a pre-qualification process that performs a soft credit check, which doesn’t impact your credit score.

What happens if I miss a loan payment?

Missing a payment will likely result in late fees and potentially negatively impact your credit score. Contact MCU immediately if you anticipate difficulties making a payment.

How long does it take to receive the loan funds after approval?

The time it takes to receive funds after approval varies, but MCU will likely provide an estimated timeframe during the application process.