Specta Loan offers a fast and convenient way to access short-term funds. This guide delves into the intricacies of Specta loans, exploring eligibility requirements, interest rates, repayment options, and security measures. We’ll equip you with the knowledge to determine if a Specta loan is the right financial solution for your needs and navigate the application process with confidence. Understanding the terms and conditions is crucial before committing to any loan, and this comprehensive overview aims to provide that clarity.

Specta Loan

Specta loans are a type of short-term personal loan designed to provide quick access to funds for unexpected expenses or immediate needs. They are often characterized by their online application process and relatively fast disbursement times. This makes them a convenient option for borrowers who require funds quickly.

Specta Loan Core Features

Specta loans typically offer a streamlined online application process, requiring minimal documentation. Loan amounts are generally smaller than traditional bank loans, and repayment terms are often shorter, usually ranging from a few weeks to several months. Interest rates are generally higher than those of longer-term loans, reflecting the higher risk associated with short-term borrowing. However, the convenience and speed of the process can outweigh the higher cost for some borrowers. Transparency in fees and interest rates is a key feature, allowing borrowers to make informed decisions.

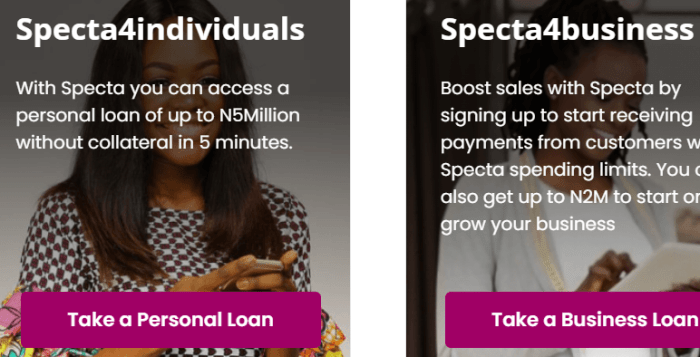

Typical Specta Loan Amounts

The typical loan amount offered by Specta varies depending on the borrower’s creditworthiness and financial history. While exact figures are not publicly available on their website, anecdotal evidence and online reviews suggest loan amounts generally range from a few hundred dollars to a few thousand dollars. The specific amount a borrower can access will be determined during the application process, taking into account individual circumstances.

Applying for a Specta Loan: A Step-by-Step Guide

Applying for a Specta loan is generally a straightforward process. First, borrowers will need to visit the Specta website and complete an online application form. This typically involves providing personal information, employment details, and financial information. Next, Specta will review the application and may request additional documentation to verify the provided information. Following a successful review, the loan amount will be approved, and funds will be disbursed to the borrower’s designated account. Finally, the borrower will receive a loan agreement outlining the repayment terms and conditions. The entire process, from application to disbursement, can often be completed within a short timeframe, typically within a few business days.

Situations Where a Specta Loan Might Be Beneficial

Specta loans can be a useful financial tool in various situations. For example, they can provide immediate funds for unexpected car repairs, urgent medical expenses, or covering unexpected household bills. They can also be beneficial for bridging short-term financial gaps between paychecks or for covering small business expenses when immediate cash flow is needed. However, it’s crucial to use Specta loans responsibly and only borrow what can be comfortably repaid within the agreed-upon timeframe.

Specta Loans Compared to Other Financial Products

| Feature | Specta Loan | Payday Loan | Credit Card Cash Advance | Personal Loan (Bank) |

|---|---|---|---|---|

| Loan Amount | Several hundred to several thousand dollars | Usually smaller, often under $1000 | Varies depending on credit limit | Higher amounts, often several thousand to tens of thousands of dollars |

| Repayment Term | Weeks to months | Typically due on next payday | Repayment plan determined by credit card agreement | Months to years |

| Interest Rate | Higher than traditional loans | Very high | High, often higher than regular purchases | Lower than Specta loans and payday loans |

| Application Process | Online, relatively quick | Often online, quick | Usually immediate, via ATM or online banking | More extensive application and approval process |

Specta Loan Eligibility and Requirements

Securing a Specta loan hinges on meeting specific eligibility criteria and providing the necessary documentation. Understanding these requirements is crucial for a smooth and successful application process. Failure to meet these criteria may result in loan application rejection. This section details the eligibility requirements, documentation needed, credit score implications, and a comparison with other lenders.

Key Eligibility Criteria for Specta Loans

Specta Loan eligibility is determined by a combination of factors assessing the applicant’s financial stability and creditworthiness. These typically include minimum age requirements (often 18 or 21 years old), a verifiable income source demonstrating consistent earning capacity, and a satisfactory credit history, though the specific requirements may vary depending on the loan product and the applicant’s location. Applicants should also possess a valid government-issued identification and a permanent address. Additional criteria might include employment history and debt-to-income ratio.

Required Documentation for Specta Loan Applications

Applicants are typically required to submit various documents to support their loan application. This usually includes a valid government-issued photo ID (such as a driver’s license or passport), proof of income (pay stubs, tax returns, or bank statements), proof of address (utility bills or bank statements), and possibly additional documents depending on the loan amount and type. Providing complete and accurate documentation expedites the application process and increases the chances of approval.

Credit Score Implications of Specta Loan Applications

Applying for and obtaining a Specta loan will likely impact your credit score. The impact depends on several factors, including your existing credit score, the loan amount, your repayment history, and the lender’s reporting practices. A hard credit inquiry, conducted during the application process, can temporarily lower your score, though this effect is usually minimal. Consistent on-time payments on the Specta loan, however, can positively influence your credit score over time, potentially leading to improved creditworthiness and access to better financial products in the future. Conversely, late or missed payments can significantly damage your credit score.

Comparison of Specta Loan Eligibility with Other Lenders

Specta Loan’s eligibility requirements should be compared to those of other lenders to determine the best option for individual circumstances. Some lenders may have stricter requirements regarding credit scores or income levels, while others may offer more flexible terms. Factors such as interest rates, loan amounts, and repayment periods should also be considered when comparing different lenders. A thorough comparison allows borrowers to make informed decisions and secure the most suitable loan. For example, some lenders may prioritize length of employment over credit score, while others may place a stronger emphasis on credit history.

Specta Loan Application Process Flowchart

The following describes a simplified flowchart illustrating the Specta loan application process. This is a generalized representation, and the actual process may vary slightly.

[Imagine a flowchart here. The flowchart would begin with “Application Submission,” branching to “Eligibility Check” (yes/no). A “yes” branch would lead to “Document Verification,” then “Loan Approval/Rejection.” A “no” branch would lead to “Application Rejection.” The “Loan Approval” branch would then lead to “Loan Disbursement.”] The flowchart visually depicts the sequential steps involved, highlighting key decision points and outcomes. The process begins with the submission of the application, followed by an eligibility check, document verification, and finally, loan approval or rejection. Successful applicants then proceed to loan disbursement.

Specta Loan Interest Rates and Fees

Understanding the interest rates and associated fees is crucial before applying for any loan, including a Specta loan. This section details the cost of borrowing with Specta, providing examples and comparisons to help you make an informed decision. Transparency in pricing is key to responsible borrowing.

Specta Loan Interest Rates

Specta loan interest rates are variable and depend on several factors, including the applicant’s creditworthiness, the loan amount, and the repayment term. Generally, Specta offers competitive rates compared to other lenders in the market. However, it’s essential to check the current rates on the Specta website or through a loan application as they are subject to change. For example, a loan of $5,000 might attract an annual interest rate ranging from 10% to 20%, depending on the aforementioned factors. This translates to a significant difference in the total repayment amount. The exact interest rate will be clearly displayed during the application process before you commit to the loan.

Illustrative Examples of Total Loan Costs

To illustrate the total cost, let’s consider a few scenarios. Remember, these are examples only, and your actual cost will vary based on your individual circumstances and the prevailing interest rate.

| Loan Amount | Repayment Period (Months) | Annual Interest Rate (Example) | Total Repayment (Estimate) |

|---|---|---|---|

| $2,000 | 12 | 15% | $2,300 |

| $5,000 | 24 | 18% | $6,800 |

| $10,000 | 36 | 20% | $15,000 |

Note: The total repayment amounts shown are estimates and do not include any potential fees. The actual amount will be determined by Specta’s loan calculation based on the specific interest rate applied to your loan.

Additional Fees and Charges, Specta loan

While Specta aims for transparency, it’s vital to be aware of any potential additional fees. These might include origination fees (a percentage of the loan amount charged upfront), late payment fees, or early repayment charges. It is crucial to carefully review the loan agreement to understand all associated costs before signing. These fees can significantly impact the overall cost of the loan. Always inquire about all potential fees during the application process.

Comparison of Specta’s Interest Rates with Competitors

Specta’s interest rates are competitive, but it’s beneficial to compare them with other lenders. The actual rates vary considerably depending on the lender, loan amount, and the borrower’s credit profile. A direct comparison requires checking the current rates offered by different lenders.

| Lender | Annual Interest Rate Range (Example) | Loan Amount Range (Example) | Other Notable Features |

|---|---|---|---|

| Specta | 10% – 20% | $1,000 – $10,000 | Fast application process |

| Competitor A | 12% – 22% | $2,000 – $15,000 | Longer repayment terms available |

| Competitor B | 8% – 18% | $500 – $7,500 | Lower fees |

Note: The interest rate ranges and other features provided are for illustrative purposes only and may not reflect the current offerings of the lenders mentioned. Always check the lenders’ websites for the most up-to-date information.

Impact of Different Repayment Schedules on Total Cost

Choosing a shorter repayment period will generally result in a lower total interest paid, despite higher monthly payments. Conversely, a longer repayment period lowers monthly payments but increases the total interest paid over the loan’s lifetime. For instance, a $5,000 loan repaid over 12 months will have significantly lower total interest than the same loan repaid over 36 months, even if the interest rate remains the same. Carefully consider your budget and financial goals when selecting a repayment schedule. A longer repayment period can be attractive for affordability, but it is important to weigh this against the higher total interest cost.

Specta Loan Repayment Options and Processes

Understanding your repayment options and the process for managing your Specta loan is crucial for maintaining a healthy financial standing. This section details the available repayment methods, provides a step-by-step guide for account management, and clarifies the implications of late or missed payments. Properly managing your loan ensures you avoid penalties and maintain a positive credit history.

Specta offers several convenient repayment options designed to suit various lifestyles and preferences. Borrowers can choose from a range of methods to make their loan repayments, ensuring flexibility and ease of access.

Available Repayment Options

Specta typically provides multiple ways to repay your loan. These may include online payments through the Specta website or mobile app, bank transfers, or potentially through authorized third-party payment processors. The specific options available may vary depending on your location and the terms of your loan agreement. Always check your loan agreement for the most up-to-date and accurate information regarding your repayment options.

Making Loan Repayments

Repaying your Specta loan is generally straightforward. Online payments through the Specta website or mobile application usually involve logging in to your account, selecting the “Make a Payment” option, and entering the amount you wish to pay. Bank transfers typically require you to use the provided account details in your loan agreement, specifying your loan account number as a reference. Third-party payment processors, if available, may involve following their specific instructions, often requiring a loan reference number.

Managing Your Specta Loan Account

Managing your Specta loan account efficiently involves several key steps. First, regularly log in to your online account to review your loan balance, payment history, and upcoming due dates. This proactive approach allows you to stay informed about your repayment schedule and avoid any potential missed payments. Second, ensure your contact information is up-to-date within your account to receive timely notifications and updates regarding your loan. Third, promptly address any discrepancies or questions you may have by contacting Specta’s customer service department.

Consequences of Late or Missed Payments

Late or missed payments on your Specta loan can have several serious consequences. These may include late payment fees, increased interest charges, negative impacts on your credit score, and potential legal action from Specta. Consistent late payments can significantly damage your creditworthiness, making it harder to obtain loans or credit in the future. Therefore, prompt repayment is crucial to maintain a positive credit history and avoid financial penalties.

Advantages and Disadvantages of Repayment Methods

Choosing the right repayment method depends on individual preferences and circumstances. Here’s a comparison of common methods:

- Online Payments (Website/App):

- Advantages: Convenient, accessible 24/7, automated payment options available, instant confirmation.

- Disadvantages: Requires internet access, potential for technical glitches.

- Bank Transfer:

- Advantages: Widely available, familiar process for many.

- Disadvantages: May take longer to process, requires manual input of details, no instant confirmation.

- Third-Party Payment Processors (if available):

- Advantages: May offer additional convenience or features.

- Disadvantages: May involve additional fees, dependent on third-party service availability and reliability.

Specta Loan Customer Support and Resources

Specta Loan prioritizes providing its customers with efficient and accessible support channels to address any questions or concerns related to their loan applications, repayments, or account management. A multi-faceted approach ensures customers can easily reach out and receive timely assistance.

Specta offers various avenues for customers to connect with its support team. This ensures accessibility for individuals who prefer different communication methods. Response times vary depending on the chosen method and the complexity of the issue.

Available Customer Support Channels

Specta Loan provides several ways to contact customer support, catering to diverse customer preferences. These channels aim to provide prompt and effective assistance. Customers can choose the method that best suits their needs and comfort level.

- Phone Support: A dedicated phone line allows customers to speak directly with a support representative. This is ideal for complex issues requiring immediate attention.

- Email Support: Customers can send detailed inquiries and supporting documents via email, receiving a response within a specified timeframe. This method is suitable for non-urgent issues.

- Live Chat: A live chat feature on the Specta Loan website provides instant communication with a support agent. This is particularly useful for quick questions or troubleshooting minor issues.

- FAQ Section: A comprehensive FAQ section on the Specta website addresses common questions, offering immediate self-service solutions.

Typical Customer Support Response Times

Response times for customer support inquiries vary depending on the chosen method and the current volume of requests. While phone support aims for immediate assistance, email responses typically take between 24 and 48 hours. Live chat generally provides instant responses.

Common Customer Support Issues and Resolutions

Several common issues arise regarding Specta Loans. Understanding these issues and their resolutions can provide valuable insights for both customers and the support team.

- Loan Application Status: Customers frequently inquire about the status of their loan application. Support representatives provide updates based on the application’s progress and address any delays.

- Repayment Schedule Clarification: Customers may need clarification on their repayment schedule, including due dates and payment amounts. Support agents provide detailed explanations and ensure the customer understands their obligations.

- Technical Issues with the Website or App: Technical difficulties can hinder access to account information or the application process. Support addresses these issues by providing troubleshooting steps or escalating the problem to the technical team.

- Payment Issues: Problems with payments, such as declined transactions or late payments, are common. Support guides customers through resolving these issues and explains any associated fees or penalties.

Frequently Asked Questions (FAQs) Regarding Specta Loans

A comprehensive FAQ section is crucial for addressing common customer queries and reducing the workload on the support team. This self-service resource empowers customers to find answers quickly and efficiently.

- What are the eligibility requirements for a Specta Loan?

- What interest rates and fees apply to Specta Loans?

- What repayment options are available?

- How can I apply for a Specta Loan?

- What happens if I miss a payment?

- How can I contact Specta Loan customer support?

- What security measures are in place to protect my personal information?

Hypothetical Scenario Demonstrating Effective Customer Support Interaction

Imagine Sarah, a Specta Loan customer, experiences difficulty accessing her online account. She contacts Specta support via live chat. A support agent, Alex, promptly responds, guiding Sarah through troubleshooting steps, such as password resets and browser compatibility checks. When these steps fail, Alex escalates the issue to the technical team, providing Sarah with a ticket number and estimated resolution time. Alex keeps Sarah updated throughout the process, ensuring she feels heard and supported. The issue is resolved within a few hours, and Sarah receives a follow-up email confirming the resolution and apologizing for the inconvenience.

Specta Loan Security and Privacy

Protecting your financial information is paramount at Specta Loan. We understand the sensitive nature of the data you entrust to us and have implemented robust security measures to safeguard your privacy. Our commitment extends beyond compliance with industry regulations; we strive to exceed expectations in protecting your personal and financial details throughout your loan journey.

Specta Loan employs a multi-layered approach to security, encompassing technological safeguards, rigorous internal policies, and ongoing monitoring to mitigate risks and maintain the confidentiality, integrity, and availability of your data.

Data Encryption and Protection

Specta Loan utilizes advanced encryption technologies, such as TLS/SSL, to protect data transmitted between your device and our servers. All sensitive data, including personal information and financial details, is encrypted both in transit and at rest. This ensures that even if unauthorized access were to occur, the data would remain unreadable without the appropriate decryption keys. Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities in our systems. We also employ firewalls and intrusion detection systems to monitor network traffic and prevent unauthorized access.

Privacy Policy and Data Handling

Our comprehensive privacy policy Artikels how we collect, use, disclose, and protect your personal information. This policy is readily available on our website and details the specific types of data we collect, the purposes for which we use it, and the individuals or entities with whom we may share it. We only collect information necessary for processing your loan application and managing your account. We are transparent about our data collection practices and obtain your consent where required by law. Your data is stored securely and access is strictly controlled and limited to authorized personnel.

Data Breach Procedures

In the unlikely event of a data breach, Specta Loan has established a comprehensive incident response plan. This plan Artikels the steps we will take to contain the breach, investigate its cause, notify affected individuals, and mitigate any potential harm. Our response team includes cybersecurity experts and legal counsel who will work diligently to address the situation and minimize any negative consequences. We are committed to complying with all applicable data breach notification laws and regulations. We will also collaborate with law enforcement authorities as needed.

Comparison with Other Financial Institutions

Specta Loan’s security measures are comparable to, and in many aspects exceed, those implemented by other reputable financial institutions. We adhere to industry best practices and continuously invest in upgrading our security infrastructure and protocols. Our commitment to data protection is reflected in our rigorous security audits, ongoing training for our employees, and proactive measures to prevent and detect security threats. We regularly review and update our security policies to stay ahead of evolving threats in the digital landscape.

Data Security Process Illustration

Imagine a multi-layered security fortress. The outer walls represent our network security measures, such as firewalls and intrusion detection systems. The inner walls depict data encryption technologies protecting data both in transit and at rest. At the heart of the fortress lies the data itself, protected by access control measures and rigorous internal policies. Regular security audits and penetration testing act as vigilant guards, constantly monitoring and reinforcing the fortress’s defenses. In case of a breach (a breach in the walls), a well-defined incident response plan acts as a rapid response team, immediately containing the situation and minimizing any damage.

Last Point: Specta Loan

Securing a loan should be a well-informed decision. This guide has provided a thorough exploration of Specta Loan, covering everything from application procedures to repayment options and security protocols. By carefully considering your financial situation and comparing Specta Loan to other alternatives, you can make a confident choice that aligns with your financial goals. Remember to always review the fine print and contact Specta’s customer support if you have any questions.

Answers to Common Questions

What happens if I miss a Specta Loan payment?

Missing payments can result in late fees and negatively impact your credit score. Contact Specta immediately to discuss payment arrangements.

Can I prepay my Specta Loan?

Check your loan agreement for prepayment terms and any associated fees. Specta may or may not allow prepayment.

What types of identification are required for a Specta Loan application?

Typically, you’ll need a government-issued ID and proof of address. Specific requirements may vary; check Specta’s website for the most up-to-date information.

How long does it take to get approved for a Specta Loan?

Approval times vary, but Specta aims for quick processing. The exact timeframe depends on factors like your creditworthiness and the completeness of your application.