Eastman Credit Union auto loan rates are a key consideration for anyone in the market for a new or used vehicle. Understanding these rates, and how they compare to competitors, is crucial for securing the best possible financing. This guide delves into the specifics of Eastman Credit Union’s auto loan offerings, exploring factors that influence interest rates, potential fees, and customer experiences. We’ll also compare their rates to those of other financial institutions to help you make an informed decision.

From the types of loans available and the application process, to the impact of credit score and loan term on interest rates, we’ll cover all the essential aspects. We’ll examine potential fees, customer reviews, and eligibility criteria to provide a comprehensive overview of the Eastman Credit Union auto loan experience. This detailed analysis will empower you to navigate the process confidently and secure the financing that best suits your needs.

Eastman Credit Union Auto Loan Overview

Eastman Credit Union offers a range of auto loan options designed to meet the diverse financial needs of its members. These loans provide competitive interest rates and flexible terms, making it easier for individuals to purchase new or used vehicles. The application process is straightforward and designed for convenience.

Types of Auto Loans Offered

Eastman Credit Union likely offers various auto loan types, including loans for new and used vehicles, and potentially specialized options like loans for recreational vehicles (RVs) or motorcycles. Specific offerings should be confirmed directly with Eastman Credit Union. The terms and conditions, including interest rates and repayment periods, will vary depending on the type of loan and the borrower’s creditworthiness.

Auto Loan Application Process

The application process typically begins with an online pre-qualification or a visit to a local branch. Applicants will need to provide personal information, employment details, and information about the vehicle they intend to purchase. Eastman Credit Union will then review the application and assess the applicant’s creditworthiness. Once approved, the loan funds will be disbursed, often directly to the dealership or to the seller.

Required Documentation

To apply for an auto loan, applicants will generally need to provide documentation such as a valid driver’s license or state-issued ID, proof of income (pay stubs, tax returns, or W-2 forms), and proof of residence (utility bills or bank statements). They will also need to provide information about the vehicle being purchased, such as the Vehicle Identification Number (VIN) and the purchase price. Additional documentation may be required depending on the individual circumstances.

Loan Terms and Interest Rates

The following table provides example loan terms and associated interest rates. These are illustrative examples only and actual rates and terms offered by Eastman Credit Union may vary depending on factors such as credit score, loan amount, and prevailing market conditions. It’s crucial to contact Eastman Credit Union directly for current rates and terms.

| Loan Term (Months) | Interest Rate (%) | APR (%) | Monthly Payment (Example) |

|---|---|---|---|

| 36 | 4.5 | 4.75 | $300 |

| 48 | 5.0 | 5.25 | $250 |

| 60 | 5.5 | 5.75 | $200 |

| 72 | 6.0 | 6.25 | $175 |

Factors Influencing Interest Rates

Securing an auto loan involves understanding the factors that determine your interest rate. Several key elements influence the final rate offered by Eastman Credit Union, impacting your monthly payments and overall loan cost. These factors are interconnected, and a strong performance in one area may offset a weakness in another.

Credit Score Impact on Auto Loan Rates

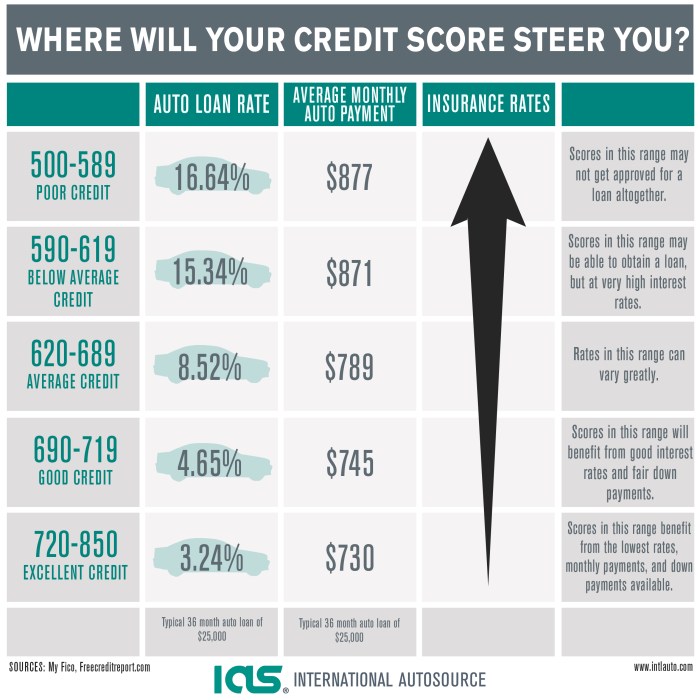

Your credit score is a significant determinant of your auto loan interest rate. A higher credit score signifies lower risk to the lender, resulting in a more favorable interest rate. Eastman Credit Union, like most financial institutions, uses credit scoring models to assess risk. A score above 750 typically qualifies for the best rates, while scores below 600 may result in significantly higher rates or loan denial. Improving your credit score before applying can lead to substantial savings over the life of the loan. For example, a borrower with a 780 credit score might receive a rate 2-3 percentage points lower than a borrower with a 650 score, translating to hundreds or even thousands of dollars in interest savings over a 60-month loan.

Loan Amount’s Influence on Interest Rates

The amount you borrow also plays a role in determining your interest rate. Larger loan amounts generally carry a slightly higher risk for lenders. While not always a significant difference, a larger loan might result in a marginally higher interest rate compared to a smaller loan amount, all other factors being equal. This is because lenders may perceive a higher risk of default with larger loan balances. For instance, a $20,000 loan might attract a slightly lower rate than a $30,000 loan with the same credit score and loan term.

Loan Term Length and Interest Rates

The length of your loan term significantly affects your interest rate. Longer loan terms (e.g., 72 months or more) typically come with higher interest rates than shorter terms (e.g., 36 or 48 months). This is because you are borrowing money for a longer period, increasing the lender’s risk exposure. While a longer term results in lower monthly payments, the total interest paid over the life of the loan will be considerably higher. Choosing a shorter term can lead to significant interest savings, though it will require larger monthly payments.

New versus Used Car Loan Interest Rates

Eastman Credit Union typically offers different interest rates for new and used car loans. New car loans often have slightly lower interest rates than used car loans. This is because new cars tend to depreciate less quickly, providing a lower risk to the lender. However, the specific rate offered depends on various factors, including the vehicle’s value, your credit score, and the loan amount. The difference in rates between new and used car loans may not be substantial, but it can still amount to a noticeable difference in the total interest paid over the loan term.

Comparison with Competitors

Choosing the right auto loan requires careful consideration of interest rates and terms. Eastman Credit Union offers competitive rates, but it’s crucial to compare them against other financial institutions to ensure you’re getting the best deal. This section analyzes Eastman Credit Union’s auto loan rates against those of three key competitors.

Eastman Credit Union’s rates are typically competitive, especially for members with strong credit scores and long-standing relationships with the institution. However, rates fluctuate based on market conditions and the borrower’s creditworthiness. Competitors may offer slightly lower rates in specific situations, such as promotional periods or for borrowers with exceptional credit. It’s important to obtain personalized quotes from multiple lenders before making a decision.

Auto Loan Rate Comparison

The following table compares Eastman Credit Union’s auto loan rates with those of three competing financial institutions: First National Bank, Community Savings Bank, and Auto Loan Direct (an online lender). Note that these rates are examples and are subject to change. Actual rates will depend on various factors, including credit score, loan amount, and loan term.

| Institution | Loan Type | Interest Rate (Example) | Loan Term (Example) |

|---|---|---|---|

| Eastman Credit Union | New Car Loan | 4.99% APR | 60 months |

| First National Bank | New Car Loan | 5.25% APR | 72 months |

| Community Savings Bank | Used Car Loan | 6.50% APR | 48 months |

| Auto Loan Direct | Used Car Loan | 7.00% APR | 60 months |

| Eastman Credit Union | Used Car Loan | 5.75% APR | 48 months |

| First National Bank | Used Car Loan | 6.75% APR | 60 months |

Potential Fees and Charges

Eastman Credit Union, like most financial institutions, may assess various fees associated with auto loans. Understanding these potential costs is crucial for accurately budgeting and comparing loan offers. Failing to account for these fees can lead to unexpected expenses and impact your overall loan repayment.

Eastman Credit Union’s auto loan fee structure is transparently Artikeld in their loan agreements. It’s advisable to carefully review this document before signing to understand all applicable charges. The total cost of an auto loan is calculated by adding the principal loan amount, interest accrued over the loan term, and all applicable fees. This total cost represents the true expense of borrowing.

Origination Fees

Origination fees are charges levied by the lender to cover the administrative costs associated with processing your loan application. These fees can vary depending on the loan amount and the specific terms of your agreement. For example, an origination fee might be a fixed dollar amount, such as $200, or a percentage of the loan amount, perhaps 1%. It’s important to inquire about any origination fees during the loan application process.

Late Payment Fees

Late payment fees are penalties imposed when a loan payment is not received by the due date. These fees can significantly impact the overall cost of your loan if payments are consistently late. The amount of the late payment fee is typically specified in the loan agreement and can range from a flat fee to a percentage of the missed payment. For instance, a late payment fee might be $25 or 2% of the missed payment amount. Consistent on-time payments are essential to avoid incurring these additional costs.

Other Potential Fees

While origination and late payment fees are common, other fees might apply depending on your specific loan agreement. These could include fees for early payoff, returned checks, or other administrative actions. It is crucial to thoroughly review the loan documents to identify all potential fees and understand the circumstances under which they may be applied.

Calculating Total Loan Cost

Calculating the total cost of an auto loan involves a straightforward process. First, determine the principal loan amount (the amount borrowed). Next, calculate the total interest paid over the loan term using the agreed-upon interest rate and repayment schedule. Finally, add all applicable fees (origination fees, late payment fees, etc.) to the principal and interest. This sum represents the total cost of the loan.

Total Loan Cost = Principal Loan Amount + Total Interest Paid + Total Fees

Loan Amortization Schedule Example

Let’s illustrate with a sample amortization schedule for a $20,000 auto loan at a 5% annual interest rate over 60 months, assuming a $200 origination fee. This is a simplified example, and actual schedules will vary.

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,200.00 | $377.42 | $84.17 | $293.25 | $19,906.75 |

| 2 | $19,906.75 | $377.42 | $82.94 | $294.48 | $19,612.27 |

| 3 | $19,612.27 | $377.42 | $81.71 | $295.71 | $19,316.56 |

| … | … | … | … | … | … |

| 60 | $377.42 | $377.42 | $1.57 | $375.85 | $0.00 |

Note: This is a simplified example and does not include any potential late payment fees. The actual amortization schedule will be provided by Eastman Credit Union upon loan approval.

Customer Experiences and Reviews

Understanding customer experiences is crucial for assessing the overall quality of Eastman Credit Union’s auto loan services. Analyzing reviews and testimonials provides valuable insights into customer satisfaction and identifies areas for potential improvement. This section summarizes customer feedback, highlighting common themes and providing specific examples of both positive and negative experiences.

Customer feedback regarding Eastman Credit Union auto loans is largely positive, though some negative experiences exist. A comprehensive analysis reveals recurring themes that inform a complete picture of the customer journey.

Summary of Customer Reviews and Testimonials

Customer reviews often highlight the ease and speed of the application process, the competitive interest rates offered, and the helpfulness and responsiveness of the loan officers. However, some customers express frustration with communication delays or perceived inflexibility in certain loan terms.

- Many praise the straightforward application process and quick approval times.

- Several reviews mention receiving lower interest rates compared to other financial institutions.

- Positive feedback frequently cites the excellent customer service provided by loan officers.

- Some negative comments focus on difficulties reaching loan officers by phone or email.

- A few customers mention experiencing delays in loan processing or disbursement.

Common Themes in Customer Feedback

The most prevalent themes in customer feedback revolve around the efficiency of the loan process, the competitiveness of the interest rates, and the quality of customer service. Positive experiences frequently emphasize the ease of application and the helpfulness of the staff. Negative experiences often center on communication issues and potential delays. This duality suggests areas where Eastman Credit Union excels and areas where improvement could enhance the overall customer experience.

Examples of Positive and Negative Customer Experiences

One positive review describes a seamless application process, with the loan officer proactively answering all questions and guiding the customer through each step. The customer received approval within days and expressed gratitude for the competitive interest rate. In contrast, a negative review details a frustrating experience with delayed communication and a lack of clarity regarding loan terms. This customer felt that their inquiries were not adequately addressed, leading to a sense of uncertainty and dissatisfaction.

Illustration of a Satisfied Customer, Eastman credit union auto loan rates

Imagine Sarah, a young professional, excitedly reviewing the loan approval email on her phone. A wave of relief washes over her as she realizes her dream of owning a new car is finally within reach. The sleek, modern design of the approval email itself reflects the efficiency and professionalism of Eastman Credit Union’s online portal. A broad smile spreads across her face as she envisions the freedom and convenience of her new vehicle. The entire process, from the initial application to the final approval, felt smooth and straightforward. She mentally thanks the friendly and helpful loan officer who patiently answered all her questions. The feeling of accomplishment and financial security fills her with immense joy. This positive experience solidifies her loyalty to Eastman Credit Union and leaves her with a feeling of confidence and trust in their services.

Eligibility Criteria and Requirements: Eastman Credit Union Auto Loan Rates

Securing an Eastman Credit Union auto loan hinges on meeting specific eligibility criteria. These requirements are designed to assess the applicant’s creditworthiness and ability to repay the loan. Understanding these criteria is crucial for a smooth and successful application process.

Minimum Credit Score Requirements

Eastman Credit Union doesn’t publicly list a specific minimum credit score. However, like most financial institutions, they consider credit history a significant factor in loan approval. A higher credit score generally translates to better loan terms, including lower interest rates. Applicants with excellent credit (typically 750 and above) are more likely to qualify for favorable loan offers. Those with lower scores may still be considered, but they might face higher interest rates or stricter loan terms. It’s advisable to check your credit report before applying to understand your standing and improve your chances of approval.

Income Verification Process

Verifying income is a standard part of the auto loan application process at Eastman Credit Union. This process helps the credit union assess your ability to make timely payments. Applicants are typically required to provide documentation such as pay stubs, W-2 forms, tax returns, or bank statements to demonstrate their income. The specific documents required may vary depending on the applicant’s employment situation and income source. Self-employed individuals may need to provide additional documentation, such as business tax returns. The credit union will review this information to confirm the applicant’s income stability and capacity to repay the loan.

Residency Requirements

Eastman Credit Union likely has residency requirements for auto loan applicants, although the specifics are not publicly available on their website. These requirements are common among credit unions, as they often serve members within a specific geographic area. It’s essential to contact Eastman Credit Union directly to inquire about their specific residency requirements before applying. This will prevent any delays or rejection due to not meeting the location criteria. For example, some credit unions might require applicants to live within a certain radius of a branch location or within a specific state.

Pre-Qualification Process

Pre-qualifying for an auto loan with Eastman Credit Union allows applicants to get an estimate of their potential loan terms without impacting their credit score. This process usually involves providing basic information such as income, desired loan amount, and vehicle details. Eastman Credit Union will then provide a preliminary assessment of the applicant’s eligibility and potential interest rate. This pre-qualification is not a guarantee of loan approval, but it gives applicants a clearer understanding of their chances and allows them to refine their application before formally submitting it. Pre-qualification helps manage expectations and allows applicants to shop around for the best loan terms before committing to a specific lender.

Summary

Securing an auto loan can feel daunting, but understanding the intricacies of interest rates, fees, and eligibility requirements can significantly simplify the process. By carefully considering the factors Artikeld in this guide, including Eastman Credit Union’s specific offerings and a comparison with competitors, you can confidently approach your auto loan application. Remember to check your credit score, research different loan terms, and compare offers to find the best financing solution tailored to your individual circumstances. Armed with this knowledge, you’re well-equipped to navigate the world of auto loans and make a smart financial decision.

Essential FAQs

What is the minimum loan amount offered by Eastman Credit Union?

This information is not publicly available on their website and would require contacting the credit union directly.

Does Eastman Credit Union offer pre-approval for auto loans?

Yes, pre-approval allows you to know your potential loan terms before shopping for a car, streamlining the process.

What happens if I miss a payment on my Eastman Credit Union auto loan?

Late payment fees will apply, and your credit score may be negatively impacted. Contact the credit union immediately if you anticipate difficulty making a payment.

Can I refinance my existing auto loan with Eastman Credit Union?

This is possible, but eligibility will depend on several factors, including your current loan terms and credit score. Contact them to explore your options.