FinishHub loan offers a compelling financial solution, but understanding its intricacies is key. This guide delves into FinishHub’s loan products, eligibility, application processes, interest rates, repayment options, and customer experiences. We’ll compare FinishHub to competitors, explore potential risks and benefits, and offer alternatives to help you make an informed decision.

From the detailed breakdown of interest calculations and fee structures to a comprehensive analysis of repayment schedules and customer reviews, we aim to equip you with the knowledge needed to navigate the FinishHub loan landscape effectively. We’ll also examine the application process, necessary documentation, and customer service aspects to paint a complete picture.

FinishHub Loan Overview

FinishHub offers a range of financial products designed to help individuals and businesses achieve their financial goals. These loans are characterized by their streamlined application process and focus on providing accessible funding solutions. This overview details the various loan types, eligibility requirements, and application procedures. A comparison with a competitor is also provided to highlight FinishHub’s competitive advantages.

FinishHub Loan Products

FinishHub provides several loan options tailored to different needs and financial situations. These products cater to both personal and business financing requirements, offering varying loan amounts, interest rates, and repayment terms. The specific products available may vary depending on the applicant’s location and creditworthiness. Examples include personal loans for debt consolidation or home improvements, and business loans for expansion or working capital.

FinishHub Loan Eligibility Criteria

Eligibility for a FinishHub loan depends on several factors, including credit score, income, and employment history. Generally, applicants must meet minimum age and residency requirements. A strong credit history significantly improves the chances of loan approval and may result in more favorable interest rates. Applicants should also be prepared to provide documentation verifying their income and employment status. The specific eligibility criteria may vary depending on the type of loan applied for.

FinishHub Loan Application Process

The FinishHub loan application process is typically straightforward and can be completed online. Applicants need to provide personal information, financial details, and supporting documentation. The application is then reviewed, and a decision is usually communicated within a short timeframe. Once approved, the funds are usually disbursed quickly. The exact process and timeframe may vary depending on the loan amount and the applicant’s circumstances.

Comparison of FinishHub and Competitor Loan Products

The following table compares FinishHub loan products with those of a hypothetical competitor, “LoanCo,” to illustrate potential differences in interest rates and repayment terms. Note that these are examples and actual rates and terms may vary based on individual circumstances and market conditions.

| Feature | FinishHub Personal Loan | FinishHub Business Loan | LoanCo Personal Loan | LoanCo Business Loan |

|---|---|---|---|---|

| Interest Rate (APR) | 7-15% | 8-18% | 9-17% | 10-20% |

| Loan Amount | $1,000 – $50,000 | $5,000 – $250,000 | $500 – $40,000 | $10,000 – $150,000 |

| Repayment Term | 12-60 months | 12-84 months | 12-48 months | 24-72 months |

| Fees | Variable, disclosed upfront | Variable, disclosed upfront | Variable, disclosed upfront | Variable, disclosed upfront |

Interest Rates and Fees

Understanding the cost of borrowing is crucial when considering a FinishHub loan. This section details FinishHub’s interest rate calculation methods, associated fees, and a comparison to industry averages, providing a clear picture of the overall loan cost.

FinishHub employs a transparent interest rate calculation method based on several factors, including the loan amount, loan term, and the borrower’s creditworthiness. The interest rate is determined at the time of loan application and is fixed for the duration of the loan term. This means that your monthly payments will remain consistent throughout the repayment period, providing predictability and financial stability. The specific calculation methodology is proprietary to FinishHub, but the final rate is clearly presented to the borrower before loan acceptance. This allows for informed decision-making and avoids any unexpected increases during the loan’s lifespan.

Interest Rate Calculation

FinishHub’s interest rate calculation considers a complex algorithm factoring in the applicant’s credit score, debt-to-income ratio, and the loan’s purpose and term. While the precise formula isn’t publicly disclosed, the final interest rate is clearly communicated to the applicant before loan approval. This approach promotes transparency and ensures borrowers are fully aware of the cost before committing to the loan. The rate is fixed, preventing any unexpected changes during the repayment period. This fixed-rate structure provides financial certainty for borrowers.

Associated Fees

FinishHub charges a transparent set of fees associated with its loan products. These fees are clearly Artikeld in the loan agreement and are designed to cover administrative and processing costs. There are no hidden fees or unexpected charges. These fees typically include an origination fee, a percentage of the total loan amount, and potentially a late payment fee if payments are not made on time. The specific amounts of these fees are disclosed upfront, ensuring borrowers are fully informed.

Interest Rate Comparison

While precise industry averages fluctuate based on market conditions and loan types, FinishHub’s interest rates are generally competitive with other lenders offering similar short-term personal loans. For example, a comparable loan from a major online lender might offer a rate within a 1-2 percentage point range of FinishHub’s rates for similar loan amounts and terms. However, it is crucial to always compare the total cost of the loan (including fees) rather than focusing solely on the interest rate. FinishHub strives to provide a balance between competitive rates and responsible lending practices.

Impact of Loan Amount and Term on Total Interest Paid

The following table illustrates how different loan amounts and terms affect the total interest paid over the life of the loan. These figures are illustrative examples based on a hypothetical average interest rate and do not represent a specific offer. Actual rates will vary based on individual borrower circumstances.

| Loan Amount | Loan Term (Months) | Average Interest Rate (Hypothetical) | Total Interest Paid (Approximate) |

|---|---|---|---|

| $1,000 | 6 | 10% | $50 |

| $2,000 | 12 | 12% | $240 |

| $5,000 | 24 | 15% | $1,500 |

| $10,000 | 36 | 18% | $4,320 |

Repayment Options and Schedules

FinishHub offers flexible repayment options designed to suit various financial situations. Understanding your repayment schedule and adhering to it is crucial for maintaining a healthy credit history and avoiding potential penalties. This section details the available repayment methods, Artikels a typical repayment schedule, and explains the consequences of missed or late payments.

FinishHub loans typically utilize a fixed-payment amortization schedule. This means your monthly payment remains consistent throughout the loan term, simplifying budgeting and financial planning. The payment amount covers both principal (the original loan amount) and interest. Each payment gradually reduces the principal balance until the loan is fully repaid.

Available Repayment Options

FinishHub provides borrowers with several convenient methods for making their loan payments. These options aim to maximize flexibility and accommodate individual preferences. They typically include online payments through the FinishHub portal, automated bank transfers, and payments via mail. Specific details on each option, including any associated fees, are available on the FinishHub website or by contacting their customer support.

Typical Repayment Schedule

The repayment schedule for a FinishHub loan is determined by the loan amount, interest rate, and loan term. The term is the length of time you have to repay the loan, typically ranging from several months to several years. Shorter loan terms generally result in higher monthly payments but lower overall interest costs, while longer terms result in lower monthly payments but higher overall interest costs. A detailed amortization schedule, outlining each payment’s allocation to principal and interest, is provided to borrowers upon loan approval.

Consequences of Late or Missed Payments

Late or missed payments can significantly impact your credit score and incur additional fees. FinishHub may charge late payment fees, and repeated late payments can negatively affect your creditworthiness, making it more difficult to obtain loans or credit in the future. In severe cases, persistent delinquency may lead to loan default, resulting in further penalties and potential legal action. It is therefore crucial to contact FinishHub immediately if you anticipate difficulty making a payment to explore possible solutions, such as a temporary payment plan modification.

Sample Repayment Schedule

The following table illustrates a sample repayment schedule for a hypothetical FinishHub loan of $5,000 with a 10% annual interest rate and a 24-month term. This is a simplified example and actual repayment schedules may vary. It’s crucial to refer to your personalized loan agreement for accurate details.

| Month | Payment Amount | Principal Paid | Interest Paid |

|---|---|---|---|

| 1 | $232.67 | $187.50 | $45.17 |

| 2 | $232.67 | $189.17 | $43.50 |

| 3 | $232.67 | $190.85 | $41.82 |

| … | … | … | … |

| 24 | $232.67 | $225.00 | $7.67 |

Customer Reviews and Experiences

Understanding customer feedback is crucial for assessing the overall effectiveness and impact of FinishHub loans. Analyzing both positive and negative experiences provides a balanced perspective, highlighting areas of strength and areas needing improvement. This section presents anonymized examples of customer reviews to illustrate the range of experiences.

Positive Customer Experiences

Many FinishHub loan recipients have reported positive experiences. These positive reviews frequently cite the speed and ease of the application process as key benefits. For example, one customer, referred to as “Customer A,” shared that they received their funds within 24 hours of approval, exceeding their expectations. Another customer, “Customer B,” praised the clear and concise communication throughout the loan process, stating that they always felt informed and supported. These positive experiences highlight FinishHub’s commitment to efficient service and transparent communication.

Negative Customer Experiences

While many experiences are positive, some customers have reported challenges. “Customer C,” for instance, expressed dissatisfaction with the interest rate, finding it higher than anticipated. Another customer, “Customer D,” encountered difficulties navigating the online portal, leading to delays in accessing loan information. These negative experiences underscore the need for FinishHub to continuously improve its interest rate competitiveness and the user-friendliness of its online platform.

Comparison of Positive and Negative Experiences

Comparing the positive and negative experiences reveals a pattern. Positive reviews frequently focus on the speed and efficiency of the loan process and the clarity of communication. Conversely, negative reviews often center on concerns about interest rates and the usability of the online platform. This suggests that while FinishHub excels in providing a quick and transparent application process, there is room for improvement in offering more competitive interest rates and a more intuitive online user experience.

Common Themes in Customer Reviews

The following points summarize common themes identified across customer reviews:

- Rapid Loan Processing: Many customers praised the speed at which they received their loan funds.

- Clear Communication: Positive feedback frequently mentioned the clear and consistent communication from FinishHub.

- High Interest Rates: Some customers expressed concern about the interest rates charged.

- Online Portal Usability: A few reviews highlighted difficulties navigating the online loan portal.

- Overall Satisfaction: Despite some negative feedback, a significant portion of customers expressed overall satisfaction with their FinishHub loan experience.

Loan Application Process and Documentation

Applying for a FinishHub loan is a straightforward process designed for efficiency and transparency. The application, from submission to approval, is managed through a secure online portal, minimizing paperwork and maximizing convenience. The entire process is designed to be completed within a reasonable timeframe, allowing for quick access to needed funds.

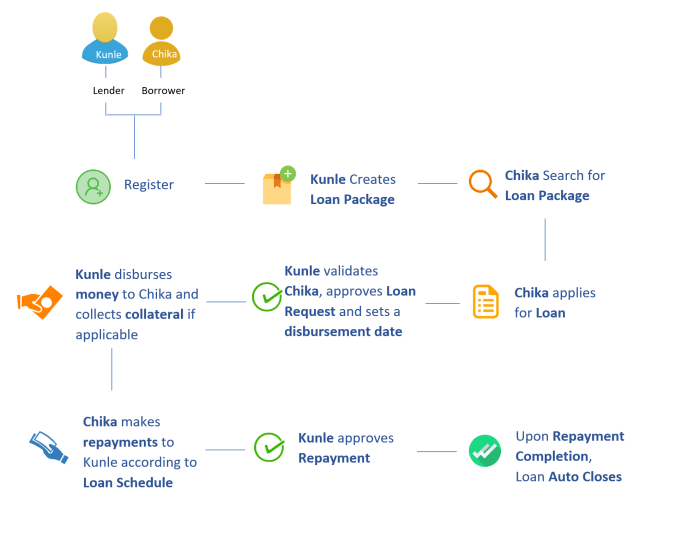

Steps Involved in Applying for a FinishHub Loan

The FinishHub loan application process involves several key steps. These steps are designed to ensure a thorough assessment of the applicant’s financial situation and eligibility for a loan. Each stage contributes to a fair and responsible lending practice.

- Online Application Submission: Applicants begin by completing the online application form, providing accurate and complete information regarding their personal details, income, and employment history.

- Document Upload: Supporting documentation, as Artikeld below, is then uploaded securely through the portal. This step is crucial for verifying the information provided in the application.

- Application Review: FinishHub’s automated system and loan officers review the submitted application and supporting documents. This review assesses the applicant’s creditworthiness and eligibility based on pre-defined criteria.

- Verification Process: FinishHub may contact applicants to verify information or request additional documentation if necessary. This ensures the accuracy of the data provided.

- Loan Approval or Denial: Applicants are notified of the loan decision via email and/or through the online portal. If approved, the loan terms and conditions are presented.

- Loan Disbursement: Upon acceptance of the loan terms, the funds are disbursed according to the agreed-upon schedule, typically electronically transferred to the applicant’s designated bank account.

Necessary Documentation for a Loan Application, Finishhub loan

Providing accurate and complete documentation is essential for a smooth and efficient loan application process. The required documents help FinishHub assess the applicant’s creditworthiness and ensure responsible lending. Failure to provide the necessary documents may delay or prevent loan approval.

- Government-Issued Identification: A valid passport, driver’s license, or national identification card is required to verify the applicant’s identity.

- Proof of Income: Pay stubs, bank statements, tax returns, or other verifiable proof of income is needed to demonstrate the applicant’s ability to repay the loan.

- Proof of Address: Utility bills, bank statements, or other official documents showing the applicant’s current residential address are required.

- Employment Verification: A letter from the applicant’s employer confirming employment status, income, and length of employment may be requested.

- Bank Statements: Recent bank statements showing account activity are often required to assess the applicant’s financial stability.

Loan Application Verification Process

FinishHub employs a robust verification process to ensure the accuracy of the information provided in loan applications and to mitigate risk. This process involves both automated checks and manual review by loan officers.

The verification process may include:

- Automated Credit Check: FinishHub uses automated systems to check the applicant’s credit history and score, providing an objective assessment of creditworthiness.

- Manual Document Review: Loan officers manually review submitted documents to verify authenticity and consistency with the information provided in the application.

- Income Verification: FinishHub may contact the applicant’s employer or financial institutions to verify income information.

- Identity Verification: FinishHub may use third-party services to verify the applicant’s identity, ensuring the applicant is who they claim to be.

- Address Verification: FinishHub may use various methods to verify the applicant’s residential address.

Loan Application Process Flowchart

A visual representation of the loan application process would show a flow starting with the online application, progressing through document upload, review, verification, approval/denial, and finally loan disbursement. Each step would be represented by a box, with arrows indicating the progression from one stage to the next. The flowchart would clearly illustrate the sequential nature of the process and the decision points involved. For example, a “No” decision at the verification stage would loop back to request additional information, while a “Yes” decision would proceed to the loan approval stage. The final box would represent the successful loan disbursement.

Potential Risks and Benefits

Taking out a loan, regardless of the lender, involves inherent risks and potential benefits. Understanding these aspects is crucial for making an informed decision about whether a FinishHub loan is right for your specific financial situation. This section will Artikel the potential advantages and disadvantages to help you assess the suitability of a FinishHub loan for your needs.

Borrowing money always carries a degree of risk. The primary risk is the potential inability to repay the loan, leading to negative consequences such as damage to credit score, debt collection actions, and potential legal repercussions. Conversely, a loan can offer significant benefits, such as funding for crucial expenses, business opportunities, or debt consolidation, leading to improved financial stability. The decision to borrow should be based on a careful weighing of these factors.

Potential Risks of a FinishHub Loan

Several risks are associated with taking out a FinishHub loan. These risks, while common to many loan products, need careful consideration. Failing to understand and mitigate these risks could have serious financial consequences.

- High Interest Rates: FinishHub loans, like many short-term loans, may come with higher interest rates compared to traditional bank loans. This can significantly increase the total cost of borrowing if the loan isn’t repaid promptly.

- Strict Repayment Terms: Missing even a single payment can trigger penalties and fees, potentially escalating the debt quickly. The repayment schedule should be carefully reviewed to ensure it aligns with the borrower’s financial capabilities.

- Impact on Credit Score: Late or missed payments can negatively affect your credit score, making it harder to obtain credit in the future. Maintaining a good payment history is crucial for long-term financial health.

- Debt Trap Potential: If not managed carefully, the high interest rates and fees can lead to a cycle of debt, making it difficult to repay the loan. Borrowers should ensure they have a clear plan for repayment before taking out a loan.

Potential Benefits of a FinishHub Loan

Despite the risks, FinishHub loans offer several potential benefits that may outweigh the drawbacks for certain borrowers. The benefits depend largely on individual circumstances and responsible borrowing practices.

- Quick Access to Funds: FinishHub loans are often known for their fast approval and disbursement processes, providing immediate financial relief in emergencies or urgent situations. For example, a borrower needing immediate funds for an unexpected car repair could benefit from this speed.

- Flexible Repayment Options: While repayment terms can be strict, some lenders may offer flexible options, such as different repayment schedules, to accommodate individual needs. It is crucial to inquire about these options during the application process.

- Improved Financial Stability: For borrowers facing unexpected expenses or needing to consolidate high-interest debt, a FinishHub loan might help improve their overall financial situation by providing a manageable repayment plan and lower overall interest costs compared to existing debts.

- Building Credit (with responsible use): While late payments can harm credit, consistently making on-time payments on a FinishHub loan can demonstrate creditworthiness and contribute positively to a credit score over time, particularly for individuals with limited credit history.

Comparison of Risks and Benefits

The suitability of a FinishHub loan depends heavily on the individual borrower’s financial situation and risk tolerance. Borrowers with a strong repayment plan and a good understanding of the associated risks are more likely to benefit from the convenience and speed of these loans. Conversely, those with poor credit history or limited financial resources should carefully consider the potential negative consequences before applying.

For example, a borrower with a stable income and a history of responsible credit management might find a FinishHub loan a convenient solution for a short-term financial need. However, a borrower struggling with existing debt or facing unpredictable income might find the high interest rates and strict repayment terms overwhelming.

Advantages and Disadvantages of a FinishHub Loan

To summarize, the following points highlight the key advantages and disadvantages of considering a FinishHub loan.

- Advantages: Quick access to funds, potential for flexible repayment options, possibility of improved financial stability (when used responsibly), and potential credit-building opportunity.

- Disadvantages: High interest rates, strict repayment terms, potential negative impact on credit score if payments are missed, and risk of falling into a debt trap if not managed carefully.

Alternatives to FinishHub Loans

Exploring alternatives to FinishHub loans is crucial for borrowers to secure the best financing option based on their individual financial situations and needs. Different lenders offer varying terms, interest rates, and fees, impacting the overall cost and repayment schedule. Understanding these differences allows for informed decision-making and potentially significant savings.

Several alternative loan providers exist, each catering to specific borrower profiles and loan purposes. Direct comparison helps determine which option aligns best with your circumstances. Key factors to consider include interest rates, fees, repayment terms, and the lender’s reputation and customer service.

Comparison of Loan Providers

The following table compares FinishHub loans with several alternatives. Note that interest rates and fees are subject to change and depend on individual creditworthiness and loan terms. This data represents a snapshot in time and should not be considered financial advice.

| Loan Provider | Interest Rate (APR) | Fees | Repayment Terms |

|---|---|---|---|

| FinishHub | Variable, depending on credit score and loan amount. Assume a range of 10-25% for illustrative purposes. | Origination fee, potential late payment fees. Specifics vary by loan. | Typically 3-60 months, depending on loan amount and borrower profile. |

| Online Banks (e.g., LendingClub, Upstart) | Variable, generally lower than payday lenders but higher than traditional bank loans. Assume a range of 6-20% for illustrative purposes. | Origination fees may apply. Some platforms have higher fees for borrowers with lower credit scores. | Flexible repayment terms, often ranging from 3 to 72 months. |

| Credit Unions | Generally lower than online lenders and banks, often offering competitive rates and lower fees. Assume a range of 6-18% for illustrative purposes. | Lower fees compared to other options, possibly including membership fees. | Flexible repayment options available, tailored to individual circumstances. |

| Personal Loans from Banks | Variable, typically lower than online lenders for borrowers with good credit. Assume a range of 7-15% for illustrative purposes. | Origination fees may apply. | Typically longer repayment terms, ranging from 12 to 84 months. |

Situations Where Alternatives Are Preferable

Choosing an alternative to a FinishHub loan often depends on specific circumstances. For example, borrowers with good credit might find more favorable terms from banks or credit unions. Those seeking longer repayment periods might prefer personal loans from traditional banks.

Borrowers with lower credit scores might explore online lenders offering more lenient eligibility requirements, although they may face higher interest rates. Credit unions frequently offer competitive rates and personalized service, making them a strong option for those seeking a community-focused approach to borrowing. The optimal choice depends on a thorough evaluation of individual financial circumstances and loan needs.

FinishHub’s Customer Service

Accessing reliable and responsive customer service is crucial when dealing with financial products like loans. FinishHub’s customer service performance directly impacts borrower satisfaction and trust in the platform. Understanding the available channels, typical response times, and overall helpfulness is vital for potential and existing borrowers.

FinishHub offers several methods for contacting customer support. These typically include email, phone, and a frequently asked questions (FAQ) section on their website. The availability and responsiveness of each channel can vary, with email support often being the most consistent method for detailed inquiries. The phone support, while potentially offering quicker resolution for urgent matters, might experience higher call volumes, leading to longer wait times. The FAQ section provides readily available answers to common questions, potentially reducing the need to contact support directly.

Contact Methods and Availability

FinishHub’s customer service channels are designed to cater to various communication preferences. Email support provides a written record of the interaction, allowing borrowers to refer back to previous conversations. Phone support offers immediate assistance for pressing issues, but might involve longer wait times. The FAQ section on the website acts as a first point of contact, providing quick answers to frequently asked questions, potentially resolving issues without needing direct contact with a representative. The effectiveness of each channel can fluctuate based on factors such as time of day, day of the week, and overall demand.

Examples of Customer Service Interactions

Positive interactions often involve prompt responses, efficient problem-solving, and courteous communication. For example, a borrower experiencing difficulty uploading documentation might receive immediate assistance via phone, with a support agent guiding them through the process and resolving the issue quickly. Conversely, negative experiences might involve long wait times, unhelpful responses, or a lack of follow-up on inquiries. A borrower might submit an email regarding a billing discrepancy, only to receive a delayed and unsatisfactory response that doesn’t fully address their concern.

Responsiveness and Helpfulness of Support

The responsiveness and helpfulness of FinishHub’s customer support are subjective and can vary based on individual experiences. While some borrowers report positive experiences with prompt and effective assistance, others describe encountering delays and unhelpful responses. Analyzing customer reviews and online forums can provide insights into the overall performance of FinishHub’s customer support, offering a broader perspective than isolated experiences. Factors such as staffing levels, training, and the efficiency of internal processes influence the overall quality of support provided.

Tips for Effective Interaction with FinishHub Customer Service

Before contacting FinishHub’s customer service, it’s advisable to gather all relevant information, including your loan agreement number, transaction details, and a clear description of your issue. This ensures efficient and accurate resolution.

- Clearly articulate your issue: Provide concise and detailed information about your problem.

- Be patient and polite: Maintain a respectful tone throughout the interaction.

- Keep a record of your communication: Note down dates, times, and key details of your conversations.

- Utilize the FAQ section: Check for answers to common questions before contacting support.

- Follow up if necessary: If you haven’t received a response within a reasonable timeframe, follow up on your inquiry.

Last Word

Ultimately, deciding whether a FinishHub loan is right for you hinges on careful consideration of your financial situation, needs, and risk tolerance. By understanding the terms, fees, repayment options, and alternatives, you can make an informed choice. Remember to thoroughly review the loan agreement and seek independent financial advice if needed. This guide serves as a starting point for your research; further due diligence is crucial before committing to any loan.

Questions Often Asked

What credit score is required for a FinishHub loan?

FinishHub’s credit score requirements vary depending on the loan type and amount. Check their website for specific criteria or contact their customer service.

Can I prepay my FinishHub loan?

Prepayment options and associated penalties (if any) should be detailed in your loan agreement. Contact FinishHub directly to inquire about prepayment possibilities.

What happens if I miss a payment?

Late or missed payments can result in late fees, increased interest charges, and potential damage to your credit score. Your loan agreement will Artikel the specific consequences.

Does FinishHub offer loan consolidation?

Whether FinishHub offers loan consolidation services is not specified in the provided Artikel. Check their website or contact them directly to confirm.