Newity SBA loans offer small businesses a pathway to funding, but navigating the application process and understanding the various loan types can be challenging. This comprehensive guide breaks down everything you need to know about Newity SBA loans, from eligibility requirements and application steps to managing your loan effectively after approval. We’ll explore different loan amounts, interest rates, and potential risks, empowering you to make informed decisions about securing the right financing for your business growth.

We’ll delve into real-world examples of successful businesses that leveraged Newity SBA loans for expansion, equipment purchases, and working capital. By understanding the intricacies of the application process, potential pitfalls, and post-loan management strategies, you can significantly increase your chances of securing funding and using it wisely to achieve your business objectives. This guide aims to equip you with the knowledge and confidence to confidently pursue a Newity SBA loan.

Understanding Newity SBA Loans

Newity is a financial technology company that partners with lenders to provide Small Business Administration (SBA) loans. Understanding the nuances of these loans, their eligibility criteria, and the application process is crucial for small business owners seeking funding. This section clarifies the key aspects of obtaining an SBA loan through Newity.

Newity SBA Loan Eligibility Criteria

Eligibility for a Newity SBA loan hinges on meeting the requirements set by both Newity and the SBA. These generally include demonstrating a viable business plan, possessing a strong credit history, and showing sufficient cash flow to manage loan repayments. Specific requirements can vary based on the loan type and the individual lender involved. For instance, the lender might assess your business’s revenue, profit margins, and length of operation. A detailed review of your financial statements and credit report will be conducted to assess your risk profile. Meeting these criteria significantly increases the chances of loan approval.

Types of SBA Loans Offered Through Newity

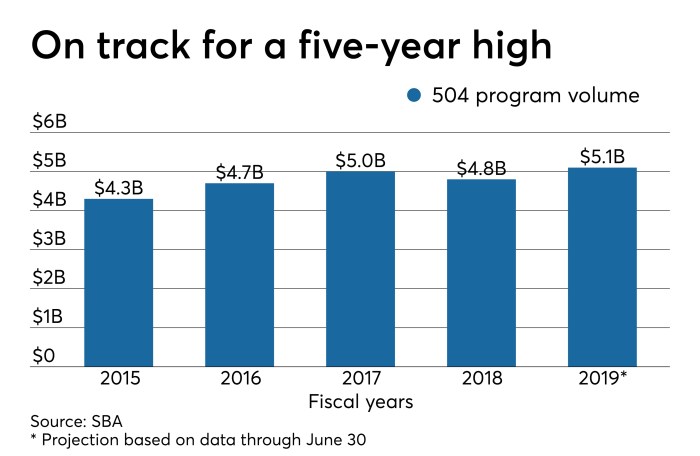

Newity doesn’t directly offer SBA loans; instead, it acts as a platform connecting businesses with lenders who offer various SBA loan programs. The most common types of SBA loans facilitated through Newity likely include 7(a) loans, which are used for a wide array of purposes, including equipment purchases, working capital, and real estate acquisition; and 504 loans, designed primarily for the purchase of major fixed assets such as land and buildings. The specific loan options available through Newity will depend on the participating lenders and the applicant’s circumstances. It’s important to consult with a Newity representative to determine which loan type best suits your business needs.

Applying for a Newity SBA Loan: A Step-by-Step Guide

The application process typically begins with completing an online application through the Newity platform. This application will request detailed information about your business, including its financial history, business plan, and the intended use of the loan funds. Following the initial application, Newity will connect you with a suitable lender. The lender will then conduct a more thorough review of your application, potentially requesting additional documentation. This stage may involve credit checks, business valuations, and interviews. Once the lender approves your application, the loan documents will be finalized and the funds disbursed. This process can take several weeks or even months, depending on the complexity of the application and the lender’s processing time.

Examples of Successful Businesses Using Newity SBA Loans

While Newity doesn’t publicly list specific success stories, it’s reasonable to assume that many small businesses across various sectors have benefited from SBA loans facilitated through their platform. For instance, a restaurant might have used a 7(a) loan to expand its seating capacity or purchase new equipment. Similarly, a manufacturing company might have leveraged a 504 loan to acquire a new facility or upgrade its machinery. The impact of these loans is evident in the sustained growth and job creation within these businesses. Successful applicants typically demonstrate a strong business plan, a clear understanding of their financial needs, and the ability to effectively manage their loan repayments.

Comparison of Newity SBA Loans to Other SBA Loan Providers

| Feature | Newity | Other SBA Lenders (e.g., Banks, Credit Unions) | Online Lenders |

|---|---|---|---|

| Application Process | Online platform, potentially faster initial screening | Typically involves in-person meetings and more paperwork | Often entirely online, potentially faster but potentially less personalized |

| Loan Types Offered | Varies based on lender network | Wide range of SBA loan programs | May offer a more limited selection of SBA loan products |

| Interest Rates | Competitive, varies by lender and applicant profile | Competitive, varies by lender and applicant profile | Potentially higher interest rates due to higher risk assessment |

| Fees | Varies by lender | Varies by lender | Potentially higher fees |

Loan Amounts and Interest Rates

Securing funding for your small business can be a complex process, and understanding the financial aspects of SBA loans, specifically those offered through Newity, is crucial for making informed decisions. This section details the typical loan amounts, interest rate factors, comparative analysis with competitors, a sample repayment schedule, and potential associated fees.

Typical Loan Amounts

Newity SBA loans, like other SBA 7(a) loans, offer a wide range of funding options depending on the borrower’s needs and creditworthiness. While there’s no fixed maximum, loan amounts typically range from a few thousand dollars for smaller businesses with modest expansion plans to several million dollars for larger projects or acquisitions. The specific amount approved depends on factors such as the business’s revenue, credit history, collateral, and the purpose of the loan. For instance, a bakery seeking to expand its production capacity might receive a loan in the range of $50,000 to $250,000, while a tech startup developing a new software platform might secure a loan significantly larger, potentially exceeding $1 million, depending on its projected revenue and market potential.

Factors Influencing Interest Rates

Several factors influence the interest rate a borrower receives on a Newity SBA loan. These include the borrower’s credit score, the length of the loan term, the amount borrowed, the type of collateral offered, and the overall economic climate. A higher credit score generally results in a lower interest rate, reflecting a lower perceived risk to the lender. Longer loan terms usually come with higher interest rates, as the lender bears the risk for a longer period. Similarly, larger loan amounts might carry slightly higher rates due to increased risk. The type and value of collateral also influence the rate; more valuable and readily marketable collateral can secure a lower interest rate. Finally, prevailing interest rates in the broader economy impact SBA loan rates, reflecting the overall cost of borrowing.

Comparison with Competitors

Comparing Newity’s interest rates to competitors requires considering several factors. Direct comparison is challenging because interest rates are not publicly advertised and vary based on individual borrower circumstances. However, it’s generally accepted that SBA loans, including those through Newity, tend to offer lower interest rates than conventional business loans from banks or online lenders. This is because the SBA guarantees a portion of the loan, mitigating the lender’s risk and allowing for more favorable terms for borrowers. The actual difference in rates can vary significantly depending on the specific loan terms and the borrower’s profile. For example, a borrower with excellent credit might find a negligible difference between Newity and a major bank, while a borrower with a less-than-perfect credit history might see a more substantial advantage with an SBA loan.

Hypothetical Repayment Schedule

Let’s consider a hypothetical scenario: A small business owner secures a $100,000 Newity SBA loan at a 7% interest rate over a 10-year term. This would translate to monthly payments of approximately $1,160. The exact amount will vary slightly based on the specific amortization schedule used. The repayment schedule would involve consistent monthly payments over the 10-year period, with each payment consisting of both principal and interest. Early in the loan term, a larger portion of the payment goes toward interest, while later payments progressively allocate more towards principal repayment. This type of structured repayment plan allows for predictable budgeting and financial planning for the business owner.

Potential Fees Associated with a Newity SBA Loan

Several fees can be associated with obtaining a Newity SBA loan. These may include an origination fee, which is a percentage of the loan amount charged by the lender to cover administrative costs. There might also be appraisal fees, if an appraisal of the collateral is required. Other potential fees could include closing costs, which cover various expenses associated with finalizing the loan agreement, and potentially prepayment penalties if the loan is repaid early. It’s crucial for borrowers to thoroughly review all fees and associated costs before accepting a loan offer to understand the total cost of borrowing.

The Application Process

Securing a Newity SBA loan involves a multi-step application process that requires careful preparation and clear communication. Understanding the requirements and timeline will significantly increase your chances of approval. This section details the key aspects of the application process to guide you through it successfully.

Required Documents for Newity SBA Loan Application

A complete application requires a comprehensive set of documents to demonstrate your business’s financial health and viability. These documents are crucial for Newity to assess your creditworthiness and the loan’s risk. Missing or incomplete documentation can significantly delay the process.

- Business Plan: A detailed business plan outlining your business’s goals, market analysis, management team, and financial projections. This should clearly articulate your need for the loan and how you intend to use the funds.

- Personal Financial Statements: This includes personal tax returns (typically the last two years), bank statements, and credit reports for all business owners and significant stakeholders. These documents help Newity assess the personal financial strength of the applicants.

- Business Financial Statements: This encompasses profit and loss statements, balance sheets, and cash flow statements for the past two to three years. These documents provide a clear picture of your business’s financial performance.

- Legal Documents: This includes articles of incorporation, partnership agreements, or sole proprietorship documentation, depending on your business structure. These documents legally establish your business entity.

- Collateral Information: If the loan requires collateral, you’ll need to provide documentation related to the assets being offered as security. This might include appraisals, titles, or deeds.

Steps in Completing the Newity SBA Loan Application

The application process typically involves several distinct steps, each requiring careful attention to detail. A well-organized approach can significantly streamline the process.

- Pre-qualification: Begin by contacting Newity to discuss your loan needs and determine your eligibility. This initial step helps you understand the requirements and gather the necessary documentation.

- Application Submission: Once you’ve gathered all required documents, submit your complete application through the Newity platform or designated channels. Ensure all information is accurate and consistent across all documents.

- Underwriting Review: Newity’s underwriting team will thoroughly review your application and supporting documentation. This stage involves assessing your creditworthiness, financial history, and business viability.

- Loan Approval/Denial: After the underwriting review, Newity will notify you of their decision. If approved, the loan terms will be finalized. If denied, you may be provided with reasons for the denial and potentially advised on how to improve your application in the future.

- Loan Closing: For approved loans, this involves finalizing the loan agreement and receiving the loan funds. This typically involves signing legal documents and completing any required formalities.

Timeline for Newity SBA Loan Application Process

The timeline for a Newity SBA loan application can vary depending on the complexity of the application and the responsiveness of the applicant. However, a reasonable estimate is 4 to 8 weeks, with some applications taking longer. Factors such as incomplete documentation or requests for additional information can extend this timeline. Proactive communication and prompt responses to requests from Newity can significantly shorten the process.

Effective Communication with Newity During the Application Process

Maintaining clear and consistent communication with Newity throughout the application process is crucial. Promptly responding to requests for information and proactively addressing any questions or concerns can significantly accelerate the process and improve your chances of approval. Establish a clear point of contact within your organization and ensure that all communication is documented.

Common Mistakes to Avoid During the Application Process

Several common mistakes can hinder the application process and potentially lead to delays or denial. Avoiding these pitfalls will improve your chances of a successful outcome.

- Incomplete Application: Submitting an incomplete application with missing documents is a major cause of delays. Ensure you gather all required documents before submitting your application.

- Inaccurate Information: Providing inaccurate or inconsistent information can lead to application rejection. Double-check all information for accuracy and consistency across all documents.

- Lack of Communication: Failing to respond promptly to Newity’s requests for information or clarification can significantly delay the process. Maintain consistent and timely communication.

- Unrealistic Financial Projections: Presenting overly optimistic or unrealistic financial projections can raise red flags. Ensure your projections are grounded in realistic market conditions and your business’s capabilities.

- Poorly Prepared Business Plan: A poorly written or incomplete business plan can undermine your application. Develop a comprehensive and well-structured business plan that clearly Artikels your business goals, strategies, and financial projections.

Using Newity SBA Loans for Business Growth

Newity SBA loans offer small businesses a powerful tool for achieving significant growth. By providing access to capital that might otherwise be unavailable, these loans enable businesses to pursue expansion strategies, invest in essential equipment, and manage working capital effectively. The strategic use of these funds can lead to increased revenue, improved efficiency, and enhanced long-term sustainability.

Expansion Strategies Using Newity SBA Loans

Newity SBA loans can fuel various expansion strategies, from opening new locations to expanding into new markets. The flexible nature of these loans allows businesses to tailor their use to specific growth objectives. For example, a bakery could use an SBA loan to open a second location in a high-traffic area, increasing its customer base and production capacity. A software company might leverage the loan to expand its development team and launch a new product line, targeting a wider market segment. The key is aligning the loan’s purpose with a well-defined expansion plan.

Equipment Purchases with Newity SBA Loans

Investing in new equipment is crucial for many businesses to improve efficiency, productivity, and product quality. Newity SBA loans provide the financial resources to acquire this equipment, leading to significant long-term benefits. A manufacturing company might use an SBA loan to purchase a state-of-the-art machine that automates a production process, reducing labor costs and increasing output. A landscaping company could invest in new, more efficient mowers and other equipment, allowing them to take on more jobs and expand their service area. The return on investment from such equipment purchases often far outweighs the cost of the loan.

Working Capital Management with Newity SBA Loans

Maintaining sufficient working capital is essential for smooth business operations. Newity SBA loans can provide the necessary buffer to cover expenses during periods of low revenue or unexpected costs. A retail business might use an SBA loan to manage inventory during peak seasons, ensuring they have enough stock to meet customer demand. A construction company could use the loan to cover payroll and material costs on a large project, preventing cash flow issues. Proper working capital management minimizes financial risks and ensures consistent business operations.

Case Study: The Impact of a Newity SBA Loan on a Small Business

Sarah’s handcrafted jewelry business experienced rapid growth but lacked the capital to meet increasing demand. A Newity SBA loan enabled her to purchase new equipment, significantly increasing her production capacity. The loan also allowed her to hire additional staff, improving customer service and overall efficiency. Within a year, Sarah’s revenue doubled, showcasing the transformative potential of strategic loan utilization. Her improved production capabilities also allowed her to expand her product line and explore new market opportunities.

Strategies for Maximizing Return on Investment from a Newity SBA Loan

To maximize the benefits of a Newity SBA loan, businesses should:

- Develop a detailed business plan outlining how the loan will be used and the expected return on investment.

- Carefully research and compare different loan options to secure the most favorable terms.

- Implement robust financial management practices to track expenses and monitor progress toward goals.

- Invest in employee training and development to enhance productivity and efficiency.

- Regularly review and adjust the business plan as needed to adapt to changing market conditions.

Potential Risks and Considerations

Securing an SBA loan through Newity, while offering significant opportunities for business growth, also presents potential risks that entrepreneurs must carefully consider. Understanding these risks and implementing proactive mitigation strategies is crucial for successful loan management and long-term business viability. Failing to adequately assess these risks can lead to financial strain and even business failure.

Potential Risks Associated with Newity SBA Loans

Several risks are inherent in taking out any loan, and Newity SBA loans are no exception. These include the potential for increased debt burden, impacting cash flow and potentially hindering future growth opportunities if not managed effectively. Another significant risk is the possibility of defaulting on the loan, which can have severe consequences, including damage to credit score, legal action, and even business closure. Furthermore, the interest rates, while often favorable compared to conventional loans, still represent a significant ongoing expense that needs to be factored into the business’s financial projections. Finally, the extensive application process and stringent requirements can be time-consuming and resource-intensive, potentially delaying crucial business initiatives.

Strategies for Mitigating Risks Associated with Newity SBA Loans

Effective risk mitigation begins with meticulous financial planning. This includes creating a robust business plan that realistically assesses revenue projections, expenses, and potential challenges. Thorough due diligence on the loan terms, including interest rates, repayment schedules, and any associated fees, is essential. Maintaining accurate financial records and consistently monitoring cash flow are crucial for identifying potential problems early. Building a strong relationship with your Newity loan officer facilitates open communication and can help navigate unforeseen difficulties. Finally, exploring options for securing additional funding or establishing emergency reserves can provide a financial buffer against unexpected setbacks.

Importance of a Comprehensive Business Plan

A comprehensive business plan serves as the bedrock of any successful loan application and subsequent business operation. It provides a detailed roadmap outlining the business’s goals, strategies, and financial projections. A well-structured business plan demonstrates to lenders, including Newity, a clear understanding of the market, the business model, and the financial feasibility of the project. It also Artikels risk mitigation strategies, demonstrating a proactive approach to potential challenges. Lenders use this plan to assess the borrower’s ability to repay the loan and minimize their risk. A poorly developed business plan can significantly weaken a loan application and reduce the chances of approval.

Long-Term Financial Implications of Different Repayment Options

Newity SBA loans offer various repayment options, each with its own long-term financial implications. For example, a shorter repayment term leads to higher monthly payments but reduces the total interest paid over the loan’s life. Conversely, a longer repayment term results in lower monthly payments but increases the overall interest paid. Choosing the optimal repayment option requires careful consideration of the business’s cash flow projections and its ability to manage monthly payments without compromising operational needs. A thorough financial analysis, considering both short-term and long-term financial implications, is crucial in making an informed decision. For instance, a business experiencing rapid growth might opt for a shorter term to minimize long-term interest costs, while a business with slower, steadier growth might prefer a longer term to ease monthly financial burdens.

Checklist of Factors to Consider Before Applying for a Newity SBA Loan

Before submitting a Newity SBA loan application, a comprehensive checklist should be reviewed. This checklist should include:

- A thorough review of the business’s financial health, including revenue projections, expenses, and cash flow analysis.

- A detailed understanding of the loan terms, including interest rates, fees, and repayment schedules.

- A comprehensive business plan that clearly Artikels the business’s goals, strategies, and risk mitigation plans.

- An assessment of the business’s ability to manage monthly loan payments without compromising operational needs.

- Exploration of alternative funding options and the establishment of emergency reserves.

- A clear understanding of the application process and required documentation.

Post-Loan Management: Newity Sba Loan

Securing a Newity SBA loan is a significant step towards business growth, but responsible post-loan management is crucial for long-term success. This involves meticulous record-keeping, timely payments, effective cash flow management, and maintaining a strong relationship with Newity. Failure to manage these aspects effectively can lead to financial strain and jeopardize the loan’s positive impact.

Maintaining Accurate Financial Records

Maintaining detailed and accurate financial records after receiving your Newity SBA loan is paramount. This includes meticulously tracking all income and expenses, categorizing transactions for easy analysis, and regularly reconciling bank statements. Comprehensive financial records provide a clear picture of your business’s financial health, allowing you to monitor progress, identify potential problems early, and demonstrate financial responsibility to Newity. This diligent record-keeping is vital for demonstrating compliance with loan terms and facilitating future reporting requirements. Consider using accounting software to streamline this process and ensure accuracy.

Timely Loan Repayment to Newity

Prompt and consistent loan repayment is a cornerstone of maintaining a positive relationship with Newity and avoiding potential penalties. Understand your repayment schedule clearly, noting the due dates and payment amounts. Set up automatic payments to avoid missed payments, and always ensure sufficient funds are available in your account before the due date. Communicate with Newity immediately if you anticipate any difficulties in making a payment; proactive communication is always appreciated. Late payments can negatively impact your credit score and your standing with Newity.

Effective Cash Flow Management Post-Loan

Effective cash flow management is critical after securing a Newity SBA loan. Create a detailed cash flow projection, forecasting income and expenses for the loan repayment period. This projection should incorporate the loan repayments into your overall budget, ensuring sufficient funds are allocated for these obligations. Prioritize expenses, focusing on essential business operations and loan repayments. Consider implementing strategies to improve cash flow, such as invoice factoring or negotiating favorable payment terms with suppliers. Regularly monitor your cash flow, adjusting your budget as needed to maintain financial stability.

Maintaining a Positive Lender Relationship

Maintaining open and consistent communication with Newity is crucial. Regularly provide updates on your business’s progress, highlighting key achievements and addressing any challenges proactively. Respond promptly to any inquiries from Newity and maintain transparent and honest communication regarding your financial situation. Building a strong relationship with your lender fosters trust and can be invaluable if you encounter unforeseen difficulties. A positive relationship can facilitate easier communication and potential assistance should you face financial challenges.

Addressing Financial Difficulties

If you anticipate or experience financial difficulties after receiving your Newity SBA loan, immediate action is crucial. Contact Newity as soon as possible to discuss your situation. Explain the circumstances clearly and honestly, outlining the steps you’re taking to address the issue. Explore potential solutions with Newity, such as loan modification or forbearance. Remember, proactive communication is key to navigating financial challenges and maintaining a positive relationship with your lender. Failing to communicate can lead to more severe consequences. Document all communication with Newity thoroughly.

Last Word

Securing a Newity SBA loan can be a pivotal step in your business journey. By understanding the eligibility criteria, meticulously preparing your application, and developing a robust post-loan management plan, you can significantly increase your chances of success. Remember to carefully weigh the potential risks and benefits, create a comprehensive business plan, and maintain open communication with Newity throughout the process. With diligent planning and execution, a Newity SBA loan can provide the necessary capital to fuel your business growth and achieve long-term financial stability.

FAQ

What credit score is needed for a Newity SBA loan?

While there’s no single minimum credit score, a higher score generally improves your chances of approval. Newity will consider your overall financial health.

How long does the Newity SBA loan application process take?

The application process varies, but expect it to take several weeks to months, depending on the complexity of your application and the loan type.

Can I use a Newity SBA loan for real estate purchases?

Some SBA loan programs allow for real estate purchases, but it depends on the specific program and your business needs. Consult with Newity directly.

What happens if I miss a loan payment?

Missing payments can negatively impact your credit score and potentially lead to default. Contact Newity immediately if you anticipate difficulties making a payment.