Payday loans Greenville MS represent a complex financial landscape for residents. This guide delves into the realities of short-term borrowing in Greenville, Mississippi, examining the various lenders, interest rates, and associated fees. We’ll explore the legal framework surrounding these loans, highlighting both the potential benefits and significant risks involved. Understanding the alternatives to payday loans, including budgeting strategies and community resources, is crucial for making informed financial decisions.

We’ll analyze the impact of payday lending on the Greenville community, considering its social and economic consequences. By examining real consumer experiences, both positive and negative, we aim to provide a balanced and comprehensive overview of the payday loan industry in Greenville, MS, empowering readers to navigate this financial terrain responsibly.

Overview of Payday Lending in Greenville, MS

Payday lending in Greenville, Mississippi, operates within the framework of Mississippi state law, which regulates short-term, high-cost loans. The industry’s presence reflects the financial needs of a portion of the population, offering quick access to cash but also carrying significant risks due to high interest rates and potential for debt cycles. Understanding the specifics of payday loans in Greenville requires examining the types of loans available, the costs involved, and the potential consequences for borrowers.

Types of Payday Loan Products Offered in Greenville, MS

Payday lenders in Greenville typically offer short-term loans secured against the borrower’s next paycheck. These loans are usually for relatively small amounts, designed to bridge a gap until the borrower’s next payday. While the specific terms vary between lenders, common features include a short repayment period (typically two to four weeks), a requirement for a post-dated check or authorization for electronic funds withdrawal, and high interest rates and fees. Some lenders may also offer installment loans, which allow for repayment over a longer period, but these typically come with even higher overall costs. It’s crucial for borrowers to carefully review the terms of any loan before signing an agreement.

Interest Rates and Fees Charged by Payday Lenders in Greenville, MS

Interest rates and fees on payday loans in Greenville can vary significantly depending on the lender and the specific loan terms. Mississippi state law sets a limit on the amount of fees that can be charged, but these fees can still represent a substantial percentage of the loan amount. Annual Percentage Rates (APRs) on payday loans often exceed several hundred percent. These high costs can quickly lead to a debt trap if borrowers are unable to repay the loan on time. Comparing offers from multiple lenders is essential to find the most favorable terms, but it’s important to remember that even the lowest cost options carry significant financial risks.

Comparison of Payday Loan Lenders in Greenville, MS

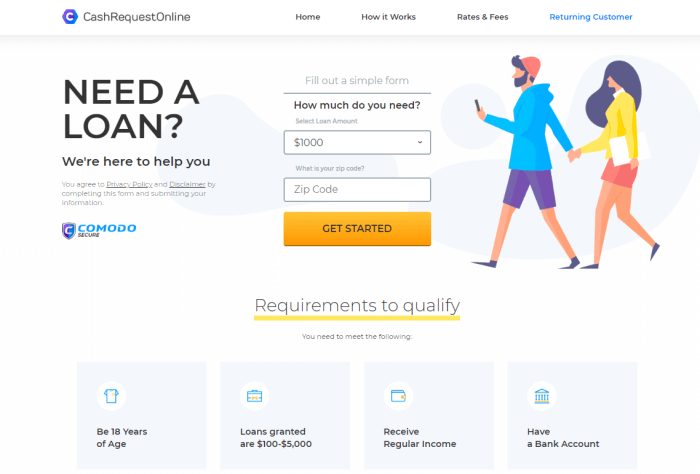

The following table provides a hypothetical comparison of interest rates and fees charged by different payday lenders in Greenville, MS. It is crucial to understand that this is illustrative and does not reflect actual lender offerings. Always verify current rates and fees directly with individual lenders before making any borrowing decisions. This data is for illustrative purposes only and should not be considered financial advice. Always consult with a financial professional before making any financial decisions.

| Lender | Loan Type | APR | Fees |

|---|---|---|---|

| Example Lender A | Payday Loan | 390% | $25 |

| Example Lender B | Payday Loan | 450% | $30 |

| Example Lender C | Installment Loan | 250% | $50 + 10% of loan amount |

Regulations and Legal Aspects

Payday lending in Greenville, Mississippi, operates within a framework of state and federal regulations designed to protect consumers while allowing lenders to operate. However, the balance between these goals is often debated, and borrowers need to be aware of both the protections and the potential pitfalls associated with these short-term loans.

Mississippi’s regulatory environment for payday loans is complex and has evolved over time. Understanding these regulations is crucial for both lenders and borrowers to avoid legal complications and financial hardship. The state’s laws aim to control interest rates, loan amounts, and repayment terms, but loopholes and variations in interpretation can exist.

Mississippi State Regulations on Payday Loans

Mississippi law dictates specific limits on payday loan amounts, interest rates, and loan terms. These regulations aim to prevent predatory lending practices and protect consumers from excessive debt burdens. However, the specifics of these regulations can be intricate and may change, so consulting up-to-date resources from the Mississippi Department of Banking and Consumer Finance is recommended. Enforcement of these regulations varies, and borrowers should be aware that not all lenders adhere to the letter of the law. Understanding the legal maximums for interest and fees is crucial to comparing loan offers and avoiding exploitative terms.

Risks and Consequences of Payday Loans

Borrowing through payday loans carries inherent risks. The high-interest rates and short repayment periods can create a cycle of debt, making it difficult for borrowers to repay the loan on time. Late fees and rollover charges can quickly escalate the total amount owed, leading to significant financial strain. In Greenville, MS, as in other areas, the consequences of defaulting on a payday loan can include damage to credit scores, collection agency involvement, and potential legal action. The financial burden can also negatively impact other aspects of life, such as housing, transportation, and healthcare. For individuals with limited financial resources, a payday loan can easily become a long-term problem rather than a short-term solution.

Legal Protections for Borrowers in Greenville, MS

While payday loans present risks, Mississippi law provides some legal protections for borrowers. These protections may include limits on the total amount of fees and interest that can be charged, restrictions on loan rollovers, and procedures for disputing inaccurate or unfair charges. Borrowers should be aware of their rights and actively seek to understand the terms of any loan agreement before signing. If a lender engages in illegal or unethical practices, borrowers have legal recourse to challenge the loan terms and potentially recover damages. The Mississippi Attorney General’s office provides resources and information for consumers facing problems with payday lenders.

Steps to Take When Struggling to Repay a Payday Loan

If you are struggling to repay a payday loan, taking proactive steps is crucial to mitigate the negative consequences.

- Contact the Lender Immediately: Explain your situation and explore options for repayment plans or extensions.

- Seek Credit Counseling: A credit counselor can provide guidance on managing debt and negotiating with lenders.

- Explore Alternative Financial Resources: Consider options such as borrowing from family or friends, seeking assistance from local charities, or utilizing community resources.

- Review Your Budget: Identify areas where you can reduce spending to free up funds for loan repayment.

- Document All Communication: Keep records of all interactions with the lender, including emails, letters, and phone calls.

Alternatives to Payday Loans

Securing short-term financial assistance doesn’t always necessitate resorting to payday loans, which often carry exorbitant interest rates and fees. Several viable alternatives exist in Greenville, MS, offering more manageable and sustainable financial solutions. These alternatives provide borrowers with better terms and conditions, fostering improved financial health in the long run.

Exploring these options can significantly impact your financial well-being, potentially saving you substantial amounts of money and preventing a cycle of debt. Understanding the differences between payday loans and these alternatives is crucial for making informed decisions.

Credit Unions

Credit unions are member-owned financial cooperatives offering a range of financial products, including small loans with significantly lower interest rates than payday loans. Unlike banks, credit unions prioritize member needs and often offer more flexible loan terms and personalized service. Eligibility requirements may be less stringent than those for bank loans, making them accessible to individuals with less-than-perfect credit histories. Credit unions often offer financial literacy programs and counseling services, helping members improve their financial management skills. In Greenville, MS, several credit unions cater to diverse community needs, providing a responsible alternative to high-cost payday loans.

Banks

While banks may seem less accessible than payday lenders for those with poor credit, they do offer various loan products, including personal loans, lines of credit, and overdraft protection. While interest rates might still be higher than those offered to individuals with excellent credit, they are generally much lower than payday loan interest rates. Bank loans typically involve a more thorough application process and credit check, but this rigorous approach offers a degree of protection against over-indebtedness. Some banks also offer financial education resources to help customers manage their finances effectively. It’s important to compare offers from multiple banks in Greenville, MS, to find the most suitable loan product.

Community Assistance Programs

Numerous non-profit organizations and government programs in Greenville, MS, provide financial assistance to individuals facing temporary financial hardship. These programs often offer grants, emergency loans, or budgeting counseling, helping individuals navigate financial challenges without resorting to high-interest payday loans. Eligibility criteria vary depending on the specific program, but they typically target low-income individuals and families. These programs can be invaluable resources for those struggling to make ends meet, offering a path towards financial stability without the burden of crippling debt. Local churches, community centers, and social service agencies can provide information on available assistance programs.

Comparison of Financial Products

The following table compares the features, costs, and eligibility requirements of payday loans and the alternative financial products discussed above:

| Product Type | Interest Rate | Fees | Eligibility Requirements |

|---|---|---|---|

| Payday Loan | Often exceeds 400% APR | High origination fees, potential rollover fees | Generally requires proof of income and a bank account |

| Credit Union Loan | Significantly lower than payday loans, often 18-24% APR | Lower fees than payday loans | Membership in the credit union, proof of income, credit check (often less stringent than banks) |

| Bank Loan | Varies widely depending on credit score, typically lower than payday loans | Fees vary depending on the loan type | Good to excellent credit score, proof of income, employment history |

| Community Assistance Programs | Grants are typically interest-free; loans may have low or no interest | Fees are generally minimal or non-existent | Income restrictions, residency requirements, and demonstration of need |

Financial Literacy and Budgeting Resources

Improving financial literacy and developing strong budgeting skills are crucial for residents of Greenville, MS, to avoid relying on high-cost payday loans. Access to reliable resources and understanding budgeting principles can empower individuals to manage their finances effectively and achieve long-term financial stability. This section highlights available resources and provides a practical guide to budgeting.

Financial literacy programs and budgeting assistance are available through various community organizations and government agencies in Greenville, MS. These resources offer workshops, online courses, and one-on-one counseling to help individuals build their financial knowledge and manage their money more effectively. Effective budgeting is a proactive strategy that significantly reduces the need for short-term, high-interest loans.

Local Resources for Financial Literacy in Greenville, MS

Several organizations in Greenville, MS, provide valuable resources to enhance financial literacy. These resources often include workshops, seminars, and individual consultations focused on budgeting, debt management, and credit building. Contacting local credit unions, banks, non-profit organizations, and government agencies is a good starting point to identify available programs. For example, the local library may offer free workshops on budgeting and financial management. Similarly, some churches or community centers might provide financial literacy classes. Checking local community calendars and websites is recommended to find relevant events and programs.

Budgeting as a Preventative Measure Against Payday Loans

Creating and adhering to a realistic budget is a powerful tool for preventing the need for payday loans. A well-structured budget ensures that income covers expenses, eliminating the reliance on short-term, high-interest loans to bridge unexpected financial gaps. By tracking income and expenses, individuals can identify areas where they can reduce spending or increase savings, ultimately gaining better control over their finances. This proactive approach promotes financial stability and prevents the debt cycle often associated with payday loans.

Steps to Create a Personal Budget

Developing a personal budget involves a structured approach to track income and expenses. Following these steps can help individuals gain control of their finances and avoid the need for payday loans.

- Calculate your net income: Determine your total monthly income after taxes and deductions. This is the amount you have available to spend and save.

- Track your expenses: For at least one month, meticulously record all your expenses, categorizing them (e.g., housing, transportation, food, entertainment). Use a budgeting app, spreadsheet, or notebook to maintain accurate records.

- Categorize and analyze your spending: Once you have a complete picture of your expenses, analyze your spending habits. Identify areas where you can potentially cut back.

- Create a budget plan: Allocate your net income to different expense categories, ensuring your expenses do not exceed your income. Prioritize essential expenses (housing, food, transportation) and allocate funds for savings and debt repayment.

- Regularly review and adjust your budget: Your budget should not be a static document. Review it regularly (monthly or quarterly) to assess your progress, adjust allocations as needed, and make changes based on your changing circumstances.

Impact on the Greenville, MS Community

Payday lending in Greenville, Mississippi, presents a complex issue with both potential benefits and significant drawbacks for the community. While offering short-term financial relief to some residents, the high interest rates and potential for debt traps raise serious concerns about its long-term effects on the economic well-being and social fabric of the city. Understanding the multifaceted impact of payday lending is crucial for developing effective strategies to mitigate negative consequences and promote financial health within the Greenville community.

The pervasiveness of payday lending in Greenville, MS, disproportionately affects specific demographics and creates a ripple effect across the social and economic landscape. Analyzing this impact requires examining both the immediate and long-term consequences, as well as considering the underlying factors that contribute to the reliance on these high-cost loans.

Demographics Utilizing Payday Loans

Individuals in Greenville, MS, who are most likely to utilize payday loans often share common characteristics. These include low-income earners struggling to meet immediate expenses, individuals facing unexpected financial emergencies (medical bills, car repairs), and those with limited access to traditional banking services or credit. Data from the Consumer Financial Protection Bureau (CFPB) and similar sources could provide a more detailed breakdown of the demographic profile of payday loan borrowers in Greenville, but such data is often not publicly available at a granular, city-specific level. However, national trends strongly suggest that the most vulnerable populations – those with unstable employment, limited financial literacy, and already existing debt – are most susceptible.

Social and Economic Consequences of Widespread Payday Loan Usage

Widespread use of payday loans in Greenville can lead to a cycle of debt that is difficult to escape. High interest rates and short repayment periods mean that borrowers often find themselves rolling over loans, accumulating substantial fees, and facing financial hardship. This can lead to decreased credit scores, difficulty securing housing or employment, and increased stress and anxiety. The cumulative effect on the community can manifest in reduced economic activity, increased poverty rates, and strain on social services. For instance, individuals struggling to repay loans may delay essential medical care or forgo necessary household repairs, exacerbating existing problems.

Visual Representation of Payday Loan Impact

Imagine a graph with income levels on the x-axis and debt levels on the y-axis. The graph would show a cluster of points concentrated in the lower-income bracket with significantly high debt levels. These points would represent individuals trapped in a cycle of payday loans, repeatedly borrowing to repay previous loans, resulting in escalating debt. A smaller cluster of points would be visible in the higher income bracket with relatively low debt, representing individuals who use payday loans less frequently or for emergency situations. A line could be drawn to illustrate the escalating debt cycle, showing how even small initial loans can quickly snowball into unmanageable debt for low-income borrowers. The visual would clearly demonstrate the disproportionate impact of payday lending on lower-income residents and their tendency to fall into persistent debt cycles.

Consumer Experiences and Reviews

Understanding consumer experiences with payday lenders in Greenville, MS, is crucial for assessing the overall impact of this financial service on the community. This section summarizes publicly available information regarding consumer feedback, focusing on both positive and negative aspects of using payday loans in the area. The methodology involved reviewing online reviews from various sources, including but not limited to, independent review websites and social media platforms. Due to privacy concerns, specific platforms are not named.

Categorization of Consumer Feedback

The collected feedback was categorized to highlight recurring themes and trends. This analysis reveals prevalent positive and negative experiences reported by Greenville, MS residents. Positive reviews generally focused on the convenience and speed of accessing funds, while negative reviews consistently highlighted concerns regarding high interest rates and the potential for debt traps.

Positive Consumer Experiences, Payday loans greenville ms

Positive experiences often centered around the immediate accessibility of cash. Many borrowers described situations where a payday loan provided a necessary financial bridge during unexpected emergencies.

“I needed money quickly for a car repair, and the payday loan helped me avoid a much bigger problem. The process was easy and fast.”

The ease and speed of the application process were also frequently praised.

“The application was simple, and I got the money deposited into my account within hours. It was a lifesaver.”

Negative Consumer Experiences

Negative feedback overwhelmingly focused on the high cost of borrowing. The high interest rates and associated fees frequently led to borrowers struggling to repay the loan on time, resulting in a cycle of debt.

“The interest rates are incredibly high, and I ended up paying back much more than I borrowed. I wouldn’t recommend it unless it’s a true emergency.”

Many consumers reported feeling trapped in a cycle of debt due to the difficulty of repaying the loan within the short timeframe. This often resulted in taking out additional loans to cover previous debts, exacerbating the financial burden.

“I took out one loan, then needed another to pay it back, and it just kept snowballing. It’s a vicious cycle.”

Difficulty in understanding the terms and conditions of the loan was another common complaint. The complex nature of the loan agreements often led to borrowers feeling misled or taken advantage of.

“The paperwork was confusing, and I didn’t fully understand the fees until after I signed the loan agreement.”

Last Point: Payday Loans Greenville Ms

Navigating the world of payday loans requires careful consideration. While they can offer immediate financial relief, the high costs and potential for debt cycles necessitate a thorough understanding of the risks involved. This guide has aimed to provide a clear picture of the payday loan landscape in Greenville, MS, empowering residents to make informed choices and explore safer alternatives. Remember to prioritize financial literacy and responsible budgeting to avoid the need for high-interest loans in the future. By understanding the options available and planning effectively, you can build a stronger financial foundation.

FAQ Corner

What happens if I can’t repay my payday loan in Greenville, MS?

Failure to repay can lead to additional fees, collection efforts, and potential damage to your credit score. Contact your lender immediately to discuss options like repayment plans or extensions.

Are there any non-profit organizations in Greenville offering financial assistance?

Yes, many non-profit organizations offer budgeting assistance and financial counseling. Check with local churches, community centers, and social service agencies for resources.

What is the average APR for payday loans in Greenville, MS?

APR varies significantly between lenders. It’s crucial to compare rates before committing to a loan. Expect rates to be considerably higher than traditional loans.

How can I improve my credit score to avoid needing payday loans in the future?

Focus on paying bills on time, reducing credit utilization, and maintaining a positive credit history. Consider using credit-building tools and monitoring your credit report regularly.