Payday loans Redding CA represent a short-term borrowing solution for residents facing financial emergencies. However, these loans often come with high interest rates and fees, making them a potentially risky option. This guide explores the availability, legal aspects, alternatives, and consumer experiences associated with payday loans in Redding, California, aiming to provide a comprehensive understanding of this financial product and its implications.

We’ll delve into the specifics of payday loan providers in Redding, including their terms and conditions. We’ll also examine the legal framework governing these loans in California and discuss the potential consequences of default. Crucially, we’ll highlight viable alternatives to payday loans, empowering you to make informed financial decisions. Finally, we’ll share real-life experiences and offer valuable financial literacy resources available to Redding residents.

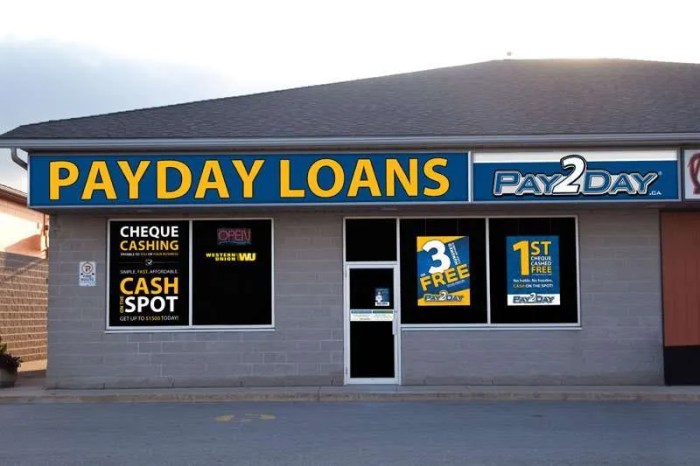

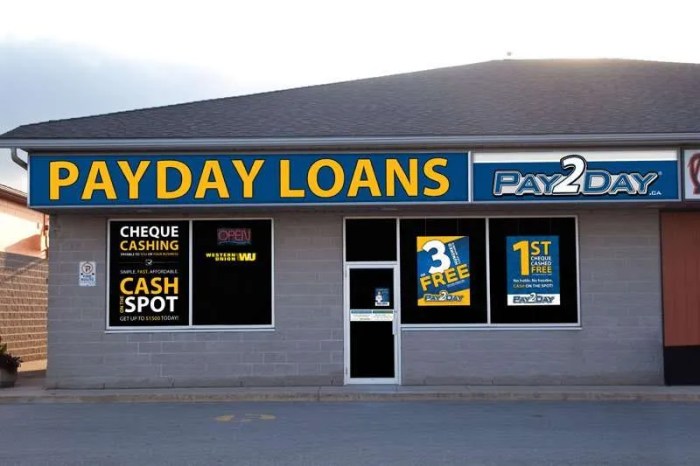

Understanding Payday Loan Availability in Redding, CA: Payday Loans Redding Ca

Securing a payday loan in Redding, California, requires understanding the local landscape of lenders, their offered loan terms, and associated costs. This information is crucial for making informed financial decisions and avoiding potential pitfalls associated with high-interest borrowing. This section details the availability of payday loans in Redding, providing insights into typical loan amounts, interest rates, and fees charged by various lenders. Remember, always carefully review loan agreements before signing.

Payday Loan Providers in Redding, CA

Finding comprehensive, publicly available contact information for all payday lenders operating in Redding, CA, is challenging. Many lenders operate primarily online, and their physical locations may not be consistently listed in public directories. The following table represents a sample of potential providers, and this list is not exhaustive. It is crucial to independently verify the accuracy of this information and conduct thorough research before engaging with any lender. Always exercise caution when dealing with financial institutions and prioritize your financial security.

| Provider Name | Address | Phone Number | Website |

|---|---|---|---|

| (Provider Name 1 – Example) | (Address – Example: 123 Main St, Redding, CA 96001) | (Phone Number – Example: 555-1212) | (Website URL – Example: www.examplepaydayloan.com) |

| (Provider Name 2 – Example) | (Address – Example: 456 Elm Ave, Redding, CA 96002) | (Phone Number – Example: 555-3434) | (Website URL – Example: www.anotherpaydayloan.com) |

| (Provider Name 3 – Example) | (Address – Example: 789 Pine Ln, Redding, CA 96003) | (Phone Number – Example: 555-5656) | (Website URL – Example: www.yetanotherpaydayloan.com) |

Typical Loan Amounts and Interest Rates

Payday loans in Redding, CA, typically range from $100 to $500, although the exact amount offered may vary depending on the lender and the borrower’s creditworthiness and income. These loans are designed to be short-term, typically repaid on the borrower’s next payday. The interest rates and fees associated with payday loans are significantly higher than those of traditional loans.

The following bullet points illustrate a comparison of interest rates and fees from three hypothetical lenders. These are examples and actual rates may vary considerably. It is crucial to obtain current information directly from each lender before making a borrowing decision.

- Lender A: Annual Percentage Rate (APR) of 400%, origination fee of $20 per $100 borrowed.

- Lender B: APR of 350%, origination fee of $15 per $100 borrowed.

- Lender C: APR of 450%, no origination fee, but higher interest charges accrued daily.

Note: These are illustrative examples only. Actual APRs and fees will vary significantly depending on the lender and the specifics of the loan agreement. Always compare multiple offers before borrowing.

Legal Aspects of Payday Lending in Redding, CA

Payday lending in Redding, CA, is governed by California state laws, which are designed to protect consumers from predatory lending practices. Understanding these regulations is crucial for both borrowers and lenders to ensure compliance and avoid potential legal ramifications. These laws significantly impact the terms, conditions, and consequences associated with payday loans in the city.

California’s stringent regulations on payday loans aim to curb high-interest rates and abusive lending practices. These regulations apply equally across the state, including Redding, and dictate maximum loan amounts, fees, and the overall repayment process. Non-compliance can result in severe penalties for lenders, while borrowers need to be aware of their rights and responsibilities to avoid financial hardship.

California’s Payday Loan Regulations

California’s Financial Code strictly regulates payday loans. Key aspects include limitations on the amount a lender can charge in fees, restrictions on the number of outstanding loans a borrower can have simultaneously, and mandated disclosures about loan terms and potential consequences of default. These regulations aim to prevent borrowers from falling into a cycle of debt by limiting the total amount they can borrow and the fees they can accrue. The California Department of Financial Protection and Innovation (DFPI) enforces these regulations and investigates complaints against lenders who violate them. For instance, the maximum loan amount is capped, and lenders cannot charge fees exceeding a specific percentage of the loan principal. Violation of these regulations can lead to significant fines and other legal repercussions for lenders.

Consequences of Defaulting on a Payday Loan in Redding, CA

Defaulting on a payday loan in Redding, CA, can have serious financial consequences. These consequences are largely the same across California and include damage to credit scores, potential legal action from the lender, and difficulty obtaining future loans. Lenders may pursue collection actions, which could involve wage garnishment or legal judgments. Furthermore, repeated defaults can severely impact a borrower’s creditworthiness, making it challenging to secure credit cards, mortgages, or other loans in the future. The negative impact on credit scores can last for several years, making it difficult to obtain favorable interest rates or even qualify for loans. While the specific consequences depend on the lender and the loan agreement, the potential for significant financial harm is substantial.

Process of Obtaining and Repaying a Payday Loan in Redding, CA

The following flowchart illustrates the typical process, highlighting key legal considerations at each stage.

[Diagram Description: The flowchart would begin with “Apply for Payday Loan.” This would branch to “Loan Application Approved” and “Loan Application Denied.” “Loan Application Approved” would lead to “Loan Agreement Signed (Review terms carefully, including APR, fees, and repayment schedule).” This then branches to “Loan Disbursed” and “Loan Agreement Not Signed.” “Loan Disbursed” leads to “Repayment Schedule Followed” and “Repayment Schedule Not Followed.” “Repayment Schedule Followed” leads to “Loan Paid in Full.” “Repayment Schedule Not Followed” leads to “Default – Potential legal action, credit damage, and debt collection.” “Loan Application Denied” leads to “Explore alternative financial options.” “Loan Agreement Not Signed” leads back to “Apply for Payday Loan” or “Explore alternative financial options”. Each step would have a brief note indicating relevant legal considerations, such as the disclosure requirements for the loan agreement and the consequences of default. ]

Alternatives to Payday Loans in Redding, CA

Securing short-term funds can be challenging, and while payday loans might seem like a quick solution, they often come with high fees and interest rates that can trap borrowers in a cycle of debt. Fortunately, several alternatives exist for residents of Redding, CA seeking financial assistance. Exploring these options can lead to more manageable and sustainable solutions.

Several viable alternatives to payday loans offer residents of Redding, CA, a pathway to short-term financial relief without the exorbitant costs associated with payday lending. These options provide more responsible and sustainable approaches to managing unexpected expenses.

Alternative Financial Solutions in Redding, CA, Payday loans redding ca

The following list Artikels three alternative financial solutions readily available to Redding residents facing short-term financial needs:

- Credit Unions: Many credit unions offer small loans with lower interest rates and more flexible repayment terms than payday lenders. They often prioritize member well-being and offer financial education resources.

- Community Banks: Similar to credit unions, some community banks provide small-dollar loans or lines of credit with more favorable terms than payday loans. These institutions often have a strong local presence and understand the financial needs of their community.

- Borrowing from Family or Friends: This option, while informal, can be a helpful solution for small, short-term loans. Clear agreements on repayment terms and timelines are crucial to avoid straining relationships.

Comparison of Payday Loans and Alternative Solutions

The table below compares the advantages and disadvantages of payday loans versus the alternative financial solutions discussed above:

| Payday Loans | Alternative Solutions (Credit Unions, Community Banks, Family/Friends) |

|---|---|

| Advantages: Quick access to cash; minimal paperwork. | Advantages: Lower interest rates; more flexible repayment terms; potential for financial education and support; stronger relationships maintained. |

| Disadvantages: Extremely high interest rates; short repayment periods leading to debt traps; potential for damage to credit score; fees can significantly increase the cost of the loan. | Disadvantages: May require a credit check; application process may take longer; may require collateral (in some cases); borrowing from family/friends can strain relationships if not managed carefully. |

Hypothetical Scenario: Avoiding a Payday Loan

Sarah, a resident of Redding, CA, experienced an unexpected car repair bill of $500. Instead of resorting to a payday loan, she first contacted her local credit union. After a brief application process, she secured a small loan with a significantly lower interest rate and a manageable repayment plan over several months. By choosing this alternative, Sarah avoided the high fees and potential debt cycle associated with a payday loan, maintaining her financial stability.

Consumer Experiences with Payday Loans in Redding, CA

Understanding the experiences of Redding, CA residents with payday loans provides crucial insight into the impact of these short-term loans on the community’s financial well-being. Anecdotal evidence suggests a wide range of outcomes, from temporary relief to prolonged financial hardship. Analyzing these experiences helps illuminate the factors contributing to both successful and unsuccessful loan utilization.

Payday loans in Redding, CA, as elsewhere, are a double-edged sword. While they can offer immediate financial assistance for unexpected expenses, their high interest rates and short repayment periods can quickly lead to a cycle of debt. The following examples illustrate both positive and negative experiences reported by residents.

Positive and Negative Experiences with Payday Loans

“I needed to fix my car’s transmission unexpectedly. The repair cost was more than I had saved, and I couldn’t wait for my next paycheck. A payday loan allowed me to cover the repair, and I paid it back on time without issue. It was a stressful situation, but the loan prevented a much larger problem.”

“I took out a payday loan to cover unexpected medical bills. However, the high interest rates made it incredibly difficult to repay the loan on time. I ended up rolling it over several times, accumulating substantial fees and interest. It quickly spiraled out of control, causing significant financial stress and impacting my credit score.”

These contrasting experiences highlight the inherent risks and potential benefits associated with payday loans. The outcome often hinges on factors beyond the borrower’s control, such as the unexpected nature of the expense, the borrower’s ability to manage their finances, and access to alternative financial resources.

Impact of Payday Loans on Financial Well-being

Payday loans can have a significant and often detrimental impact on the financial well-being of individuals in Redding, CA. The high interest rates and short repayment periods can trap borrowers in a cycle of debt, leading to increased financial stress, damaged credit scores, and difficulty meeting essential expenses. For individuals already struggling financially, a payday loan can exacerbate existing problems and make it harder to achieve financial stability. Conversely, for those with strong financial discipline and a clear repayment plan, a payday loan can offer a temporary solution to an immediate financial emergency, provided it’s repaid promptly.

Factors Contributing to Successful or Unsuccessful Payday Loan Use

The success or failure of using a payday loan often depends on a combination of factors. Careful consideration of these factors can help individuals make informed decisions and potentially mitigate the risks associated with these loans.

- Financial Planning and Budgeting: Individuals with strong budgeting skills and a clear understanding of their income and expenses are more likely to manage a payday loan successfully.

- Emergency Fund Availability: Having an emergency fund to cover unexpected expenses can eliminate the need for a payday loan altogether.

- Credit Score and Access to Alternative Financing: A good credit score opens doors to more affordable loan options, making payday loans less necessary.

- Repayment Plan and Capacity: A realistic repayment plan and the ability to repay the loan on time are crucial to avoid accumulating excessive fees and interest.

- Understanding of Loan Terms and Conditions: Thoroughly reading and understanding the loan agreement, including all fees and interest rates, is essential.

Financial Literacy Resources in Redding, CA

Redding, CA, like many communities, offers a range of resources to help residents improve their financial well-being and avoid the high-cost cycle of payday loans. These resources provide education, counseling, and practical assistance to individuals and families struggling with debt or seeking to build a stronger financial foundation. Accessing these services can be crucial in preventing reliance on short-term, high-interest loans.

Understanding personal finance is key to escaping the debt trap often associated with payday loans. Financial literacy empowers individuals to make informed decisions about budgeting, saving, and managing debt, thereby reducing the likelihood of needing to resort to expensive payday loans in times of financial hardship. A strong understanding of credit scores, interest rates, and responsible borrowing practices is essential for long-term financial health.

Local Organizations Offering Financial Counseling and Assistance

Several organizations in Redding provide valuable financial counseling and assistance. These services often include budgeting workshops, credit counseling, debt management planning, and assistance with navigating financial aid programs. Direct contact is recommended to determine the specific services offered and eligibility requirements.

While a comprehensive list is difficult to maintain due to the dynamic nature of service offerings, some potential resources to explore include local credit unions, non-profit organizations focused on financial empowerment, and community action agencies. Many of these organizations collaborate with government agencies to offer a wider array of support services. It is recommended to conduct online searches using s such as “financial counseling Redding CA,” “credit counseling Redding CA,” or “debt management Redding CA” to locate the most current and relevant options available.

Importance of Financial Literacy in Preventing Payday Loan Reliance

Financial literacy plays a crucial role in mitigating the need for payday loans. By understanding budgeting principles, individuals can better manage their income and expenses, reducing the likelihood of unexpected financial shortfalls. Knowledge of saving and investing strategies allows for the creation of an emergency fund, providing a safety net to handle unexpected costs without resorting to high-interest loans. Furthermore, understanding credit scores and responsible borrowing practices helps individuals avoid accumulating debt that might necessitate the use of payday loans. For example, a family who diligently budgets and saves might be able to cover a car repair bill from their savings, whereas a family without a budget or savings might be forced to consider a payday loan. This highlights the critical difference financial literacy makes in navigating unexpected expenses.

End of Discussion

Navigating the world of payday loans requires careful consideration. While they can offer immediate relief, the high costs and potential for debt cycles necessitate a thorough understanding of the risks involved. By exploring alternative solutions and prioritizing financial literacy, residents of Redding, CA can make informed choices that protect their financial well-being. Remember to always research lenders, compare terms, and seek professional financial advice when facing financial hardship.

Frequently Asked Questions

What happens if I can’t repay my payday loan in Redding, CA?

Failure to repay a payday loan can lead to late fees, damage to your credit score, and potential legal action from the lender. Contact the lender immediately if you anticipate difficulty repaying to explore possible solutions.

Are there any hidden fees associated with payday loans in Redding, CA?

Always carefully review the loan agreement for all fees and charges. Some lenders may include additional fees beyond the stated interest rate, so transparency is key.

How long does it take to get approved for a payday loan in Redding, CA?

Approval times vary depending on the lender and your financial situation. Some lenders offer same-day approvals, while others may take longer.

Where can I find free financial counseling in Redding, CA?

Several non-profit organizations and credit counseling agencies offer free or low-cost financial counseling services. A web search for “financial counseling Redding CA” will provide a list of options.