Arvest Bank auto loan rates are a crucial factor for anyone considering financing a vehicle. Understanding these rates, the factors influencing them, and the application process is key to securing the best possible deal. This guide delves into the intricacies of Arvest Bank’s auto loan offerings, comparing them to competitors and outlining strategies to optimize your borrowing experience. We’ll explore everything from interest rate calculations and repayment options to special promotions and customer feedback, equipping you with the knowledge to make informed decisions.

From comparing Arvest’s rates against industry giants to examining the impact of your credit score and debt-to-income ratio, we’ll uncover how to navigate the loan application process successfully. We’ll also explore the various repayment options available and highlight any current special offers that could save you money. Finally, we’ll analyze real customer reviews to provide a balanced perspective on the overall Arvest Bank auto loan experience.

Arvest Bank Auto Loan Rate Comparison

Arvest Bank offers auto loans, but their rates are subject to change based on several factors. This comparison analyzes Arvest’s rates against three major competitors to illustrate the range of options available to borrowers. We’ll examine how credit score and loan terms influence the final interest rate offered. Note that the rates presented are hypothetical examples based on current market trends and should not be considered a guaranteed offer.

Understanding the variations in auto loan rates across different financial institutions is crucial for securing the best possible financing for your vehicle purchase. Several key factors influence these variations, impacting the total cost of borrowing over the loan’s life.

Factors Influencing Auto Loan Rate Variation

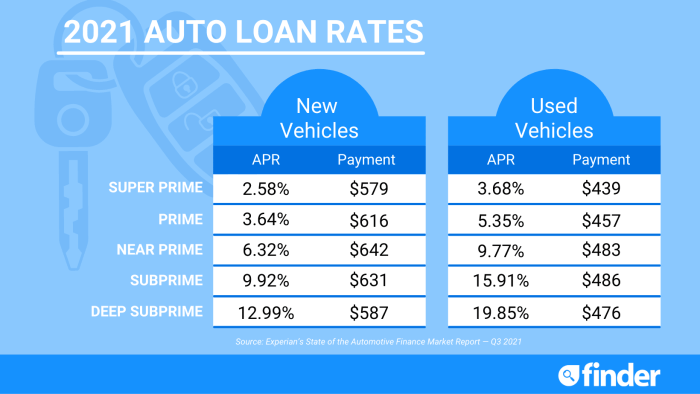

Several factors contribute to the differences in auto loan rates offered by various banks. These include the prevailing interest rate environment (the Federal Reserve’s target rate influences overall borrowing costs), the borrower’s creditworthiness (a higher credit score generally leads to lower rates), the type of vehicle being financed (new cars often command lower rates than used cars), the loan term (longer terms often mean higher rates), and the lender’s own risk assessment and profit margins. Competition also plays a significant role; banks adjust their rates to remain competitive in the market.

Hypothetical Auto Loan Rate Comparison

The following table provides a hypothetical comparison of auto loan rates from Arvest Bank and three major competitors. These rates are illustrative and based on a $25,000 loan amount for a new vehicle. Actual rates may vary depending on individual circumstances.

| Bank Name | Interest Rate (Hypothetical) | Loan Term (Years) | APR (Hypothetical) |

|---|---|---|---|

| Arvest Bank | 6.5% | 60 | 6.75% |

| Bank of America | 6.0% | 60 | 6.25% |

| Chase | 7.0% | 72 | 7.25% |

| Wells Fargo | 6.8% | 48 | 7.0% |

Impact of Credit Score on Interest Rates

A borrower’s credit score significantly impacts the interest rate they receive on an auto loan. Lenders use credit scores to assess the risk of lending. A higher credit score (generally above 700) indicates a lower risk of default, leading to more favorable interest rates. Conversely, a lower credit score (below 600) suggests a higher risk, resulting in higher interest rates or even loan denials. Each bank uses its own scoring models and risk assessment criteria, but the general trend holds true across all four banks: a higher credit score usually translates to a lower interest rate. For example, a borrower with a credit score of 750 might qualify for a 5.5% interest rate at Arvest Bank, while a borrower with a 600 credit score might receive a rate closer to 8%. Similarly, Bank of America, Chase, and Wells Fargo would likely follow a similar pattern, offering better rates to borrowers with higher credit scores.

Arvest Bank Auto Loan Rate Factors

Securing a favorable auto loan interest rate from Arvest Bank depends on several key factors. Understanding these factors empowers borrowers to improve their chances of obtaining the best possible terms. The process isn’t arbitrary; Arvest, like other lenders, uses a systematic approach to assess risk and determine appropriate interest rates.

Arvest Bank’s auto loan interest rates are influenced by a variety of borrower-specific and loan-specific characteristics. These factors interact to determine the final rate offered. A strong understanding of these elements allows borrowers to strategically improve their loan application and potentially reduce their overall borrowing costs.

Factors Influencing Arvest Bank Auto Loan Rates

Arvest Bank, like most financial institutions, considers several key factors when determining auto loan interest rates. These factors are carefully weighted to assess the risk associated with lending to a particular borrower. A higher perceived risk typically results in a higher interest rate.

- Credit Score: Your credit score is arguably the most significant factor. A higher credit score (generally above 700) indicates a lower risk to the lender, leading to more favorable interest rates. Conversely, a lower credit score reflects higher risk and often results in higher interest rates or even loan denial.

- Loan Amount: Larger loan amounts generally carry a slightly higher interest rate due to increased risk for the lender. Smaller loan amounts are often associated with lower rates.

- Loan Term: Longer loan terms (e.g., 72 or 84 months) typically result in higher interest rates compared to shorter terms (e.g., 36 or 48 months). This is because the lender faces a greater risk over a longer period.

- Vehicle Type: The type of vehicle being financed can influence the interest rate. Newer vehicles often command lower rates due to their higher resale value, acting as collateral for the loan. Older vehicles, especially those with higher mileage, may attract higher rates.

- Debt-to-Income Ratio (DTI): Arvest will assess your DTI ratio, which compares your monthly debt payments to your gross monthly income. A lower DTI ratio indicates a greater capacity to repay the loan, leading to potentially lower interest rates. A high DTI suggests a higher risk and may result in a higher rate or loan rejection.

Improving Chances of Securing a Lower Interest Rate

Borrowers can proactively improve their chances of securing a lower auto loan interest rate by focusing on several key areas. These actions demonstrate financial responsibility and reduce the perceived risk to the lender.

- Improve Credit Score: Paying bills on time, keeping credit utilization low, and avoiding new credit applications are crucial for improving your credit score. A higher credit score significantly impacts the interest rate you’ll receive.

- Reduce Debt: Lowering your debt-to-income ratio makes you a less risky borrower. Paying down existing debts can positively influence your loan application.

- Shop Around for Rates: Comparing rates from multiple lenders, including Arvest Bank and its competitors, is essential to find the most favorable terms. This competitive approach can lead to significant savings.

- Choose a Shorter Loan Term: While monthly payments are higher with shorter loan terms, the total interest paid over the life of the loan is significantly lower. This is a cost-effective strategy in the long run.

- Make a Larger Down Payment: A larger down payment reduces the loan amount, potentially leading to a lower interest rate.

Examples of How Loan Terms Affect Total Cost

The choice of loan term significantly impacts the total cost of borrowing. Let’s illustrate this with examples. Assume a $20,000 auto loan at a 5% annual interest rate.

| Loan Term (Months) | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|

| 36 | $588 | $1,175 |

| 48 | $452 | $1,600 |

| 60 | $376 | $2,100 |

| 72 | $320 | $2,675 |

As the table shows, a longer loan term results in lower monthly payments, but significantly increases the total interest paid over the life of the loan. Borrowers should carefully weigh the benefits of lower monthly payments against the increased total cost.

Arvest Bank Auto Loan Application Process

Securing an auto loan from Arvest Bank involves a straightforward process designed for efficiency and transparency. Understanding the steps involved, the pre-approval process, and typical processing times will help you navigate your application effectively. This section details the application process to help you prepare and understand what to expect.

Applying for an Arvest Bank auto loan typically involves several key steps. Careful preparation beforehand will streamline the process.

Application Steps

The application process is designed to be user-friendly, but thorough preparation is key to a smooth experience. The following steps Artikel the typical procedure:

- Gather Required Documentation: Before starting the application, collect all necessary documents. This typically includes proof of income (pay stubs, tax returns), proof of residence (utility bill, lease agreement), and information about the vehicle you intend to purchase (VIN, make, model, year).

- Complete the Application: You can typically begin the application online through Arvest Bank’s website or in person at a local branch. The online application usually requires you to provide personal information, employment details, and vehicle information.

- Submit the Application: Once the application is completed, submit it electronically or in person. Arvest Bank will then review your application and supporting documentation.

- Credit Check and Approval: Arvest Bank will perform a credit check as part of the approval process. Your credit score, debt-to-income ratio, and other financial factors will influence the interest rate and loan terms offered.

- Loan Offer and Negotiation: If approved, you’ll receive a loan offer outlining the terms, interest rate, and monthly payments. You may have the opportunity to negotiate certain aspects of the loan agreement.

- Loan Closing and Funding: Once you accept the loan offer, the final paperwork will be processed. The funds will then be disbursed, typically to the dealership if you’re financing a new or used vehicle purchase.

Pre-Approval Process and Benefits

Pre-approval involves completing a preliminary application to determine your eligibility for a loan *before* you begin shopping for a vehicle. This process provides several advantages:

- Knowing Your Budget: Pre-approval gives you a clear understanding of how much you can borrow, helping you focus your car search on vehicles within your financial reach.

- Strengthening Your Negotiating Position: Dealerships often view pre-approved buyers more favorably, as it demonstrates your seriousness and financial readiness. This can give you a stronger negotiating position when it comes to price and terms.

- Faster Closing: Because much of the financial vetting is completed beforehand, the final loan closing process can be significantly faster once you’ve chosen a vehicle.

Typical Processing Time

The time it takes to process an Arvest Bank auto loan application varies depending on several factors, including the completeness of your application, your credit history, and the overall volume of applications being processed. While specific timelines are not publicly guaranteed, you can expect the process to take anywhere from a few days to a couple of weeks. For example, a complete application with excellent credit might be processed within a week, while a more complex application might take longer.

Arvest Bank Auto Loan Repayment Options

Understanding your repayment options is crucial for managing your Arvest Bank auto loan effectively. Choosing a method that aligns with your financial habits and preferences can simplify the process and help you avoid late payment fees. Arvest offers several convenient ways to make your payments.

Arvest Bank provides borrowers with a variety of convenient methods to repay their auto loans. These options are designed to accommodate different lifestyles and technological preferences. Selecting the most suitable method ensures timely payments and helps maintain a positive credit history.

Available Repayment Methods

Arvest Bank offers several convenient ways to make your auto loan payments. These options provide flexibility to fit various schedules and preferences.

- Online Payments: Borrowers can access their accounts online through the Arvest Bank website or mobile app to make payments securely and efficiently. This method often allows for scheduling payments in advance.

- Automatic Payments: This automated option allows for automatic deductions from a linked bank account or credit card on the due date. This ensures timely payments and eliminates the need for manual tracking.

- In-Person Payments: Payments can be made in person at any Arvest Bank branch location. This option provides a personal touch for those who prefer face-to-face interactions.

- Mail Payments: Arvest Bank accepts payments sent via mail. However, it’s crucial to allow sufficient processing time and include the correct account information to avoid delays.

Consequences of Late Payments

Failing to make your Arvest auto loan payments on time can result in several negative consequences. Understanding these potential repercussions is essential for responsible loan management.

Late payments can lead to late fees, negatively impacting your credit score, and potentially leading to loan default. Arvest Bank will typically notify borrowers of late payments and may offer assistance to avoid further penalties. However, consistent late payments can damage your credit rating and make it more difficult to secure loans in the future. In severe cases, late payments can lead to repossession of the vehicle.

Sample Monthly Payment Calculation

Calculating your monthly payment helps you budget effectively and understand the overall cost of your auto loan. This example demonstrates a common calculation method.

Let’s assume a loan amount of $20,000, an annual interest rate of 6% (0.06), and a loan term of 60 months (5 years). We’ll use the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount ($20,000)

- i = Monthly Interest Rate (Annual Interest Rate / 12 = 0.06 / 12 = 0.005)

- n = Number of Months (60)

Substituting the values into the formula:

M = 20000 [ 0.005(1 + 0.005)^60 ] / [ (1 + 0.005)^60 – 1]

Calculating this equation step-by-step:

- (1 + 0.005)^60 ≈ 1.34885

- 0.005 * 1.34885 ≈ 0.006744

- 20000 * 0.006744 ≈ 134.88

- 1.34885 – 1 = 0.34885

- 134.88 / 0.34885 ≈ 386.66

Therefore, the approximate monthly payment for this loan would be $386.66. Note that this is a simplified calculation, and actual payments may vary slightly depending on the lender’s specific methods.

Arvest Bank Auto Loan Special Offers and Promotions

Arvest Bank occasionally offers special promotions on its auto loans to attract new customers and reward existing ones. These promotions can significantly impact the overall cost of borrowing, making them a worthwhile consideration for potential borrowers. The specific offers vary over time, so it’s crucial to check the Arvest Bank website or contact a loan officer for the most up-to-date information. The following table summarizes hypothetical examples of the types of promotions Arvest might offer; these are illustrative and not a guarantee of current offerings.

Current Special Offers

The availability of special offers changes frequently. Therefore, the following table presents examples of the *kinds* of promotions Arvest might run, rather than a definitive list of currently active promotions. Always verify current offers directly with Arvest Bank.

| Offer Name | Description | Eligibility Criteria | Expiration Date |

|---|---|---|---|

| Reduced APR for New Vehicles | Reduced Annual Percentage Rate (APR) on new vehicle purchases. For example, a 1% reduction from the standard APR. | New vehicle purchase, good credit score (e.g., 700 or above), Arvest checking account. | October 31, 2024 (Hypothetical) |

| $500 Cash Back on Used Car Loans | $500 cash back at closing on a used car loan. | Used vehicle purchase, minimum loan amount of $15,000, credit score above 650. | December 31, 2024 (Hypothetical) |

| Loyalty Reward: 0.5% APR Reduction | 0.5% reduction in APR for existing Arvest customers. | Existing Arvest customer with good standing, minimum loan amount of $10,000. | November 15, 2024 (Hypothetical) |

Comparison of Promotional and Standard Rates

Promotional auto loan rates are typically lower than standard rates. The extent of the reduction depends on the specific offer and the borrower’s creditworthiness. For instance, a standard APR might be 7%, while a promotional offer could reduce it to 6% or even 5.5%. This seemingly small difference can result in substantial savings over the life of the loan. Lower APRs translate to lower monthly payments and less interest paid overall.

Hypothetical Scenario Illustrating Benefits, Arvest bank auto loan rates

Let’s consider a hypothetical scenario. Suppose a borrower needs a $20,000 auto loan for 60 months. With a standard APR of 7%, their monthly payment would be approximately $395. If they qualify for a promotional offer reducing the APR to 6%, their monthly payment would drop to approximately $380, saving them roughly $15 per month. Over the life of the loan (60 months), this translates to a total savings of approximately $900 in interest payments. The $500 cash back offer further reduces the total cost by an additional $500. This illustrates how promotional offers can result in significant financial benefits for borrowers.

Arvest Bank Auto Loan Customer Reviews and Feedback

Arvest Bank’s auto loan services receive a mixed bag of reviews online, with customer experiences varying significantly. While many praise the bank’s generally friendly service and straightforward application process, others express concerns regarding interest rates and communication during the loan process. Analyzing these reviews helps identify areas for improvement and highlights both strengths and weaknesses of Arvest’s auto loan offerings.

Customer feedback reveals a range of experiences, from highly positive to moderately negative. The following examples illustrate the spectrum of opinions found in online reviews.

Summary of Customer Reviews

“The application process was surprisingly easy and quick. The staff was helpful and answered all my questions.”

This positive review highlights a common theme: the ease and efficiency of the Arvest Bank auto loan application process. Many customers appreciate the streamlined application and the responsiveness of the bank’s staff.

“I was initially impressed, but then the interest rate ended up being higher than I was quoted. It felt a little misleading.”

This comment exemplifies a recurring concern: discrepancies between initial quotes and final interest rates. This lack of transparency negatively impacts customer satisfaction.

“I had trouble getting a hold of someone to answer my questions about my loan payment. The communication could definitely be improved.”

Poor communication is another frequently cited issue. Customers often report difficulty reaching loan representatives to address concerns or questions about their loans.

Common Themes in Customer Feedback

Several key themes emerge from the analysis of Arvest Bank auto loan customer reviews:

* Positive experiences with application process: Many customers find the application process simple and efficient.

* Concerns about interest rate transparency: Inconsistencies between initial quotes and final interest rates are a common complaint.

* Communication challenges: Customers frequently report difficulty contacting loan representatives to resolve issues or answer questions.

* Overall satisfaction varies: While many are satisfied, a significant portion expresses dissatisfaction with aspects of the service.

Hypothetical Improvement Plan

Based on the collected feedback, a multi-pronged improvement plan could significantly enhance Arvest Bank’s auto loan services. This plan would focus on addressing the key areas of concern identified in customer reviews:

* Enhanced Rate Transparency: Implement a system that ensures initial interest rate quotes accurately reflect the final rate, minimizing discrepancies. This could involve more detailed disclosures and a clearer explanation of factors influencing the final rate. For example, Arvest could provide a detailed breakdown of all fees and charges upfront.

* Improved Communication Channels: Expand communication channels to include more readily accessible options, such as a dedicated online chat feature or improved phone support availability. Proactive communication regarding loan status updates would also enhance customer experience. This might involve automated email and SMS updates on loan application progress and payment due dates.

* Streamlined Customer Support: Invest in training programs to ensure that loan representatives are well-equipped to handle customer inquiries effectively and efficiently. This could involve creating standardized responses to common questions and providing employees with tools to quickly access necessary information.

* Proactive Feedback Collection: Implement a system for regularly collecting customer feedback through surveys and reviews. Actively analyzing this feedback and making necessary adjustments based on customer input will demonstrate a commitment to continuous improvement. This could involve using online surveys and automated feedback mechanisms after loan completion.

Last Point

Securing an auto loan can feel daunting, but understanding the nuances of Arvest Bank’s rates and processes empowers you to make confident choices. By carefully considering the factors influencing interest rates, comparing offers, and leveraging available resources, you can navigate the process efficiently and obtain a loan that fits your financial needs. Remember to always review your loan agreement thoroughly and don’t hesitate to ask questions before signing. Armed with this knowledge, you can confidently embark on your car-buying journey with Arvest Bank.

FAQ Corner: Arvest Bank Auto Loan Rates

What documents are typically required for an Arvest Bank auto loan application?

Generally, you’ll need proof of income, identification, and vehicle information (VIN, etc.). Specific requirements may vary.

Can I refinance my existing auto loan with Arvest Bank?

Yes, Arvest Bank often offers auto loan refinancing options. Check their website or contact them directly for details.

What happens if I miss an auto loan payment with Arvest Bank?

Late payments can result in late fees, damage your credit score, and potentially lead to loan default.

Does Arvest Bank offer pre-approval for auto loans?

Yes, pre-approval helps you understand your borrowing power before you start shopping for a car.