EECU loan calculator simplifies the often-daunting process of securing a loan. Understanding loan terms, interest rates, and repayment schedules can be confusing, but with the right tool, making informed financial decisions becomes significantly easier. This guide delves into the features and functionalities of the EECU loan calculator, empowering you to navigate the loan application process with confidence.

We’ll cover various EECU loan options, providing a step-by-step guide on how to use the calculator, interpreting the results, and adjusting parameters to see their impact on your repayments. We’ll also explore how the EECU calculator compares to other loan calculators available, highlighting its unique features and advantages. By the end, you’ll be well-equipped to leverage this tool for budgeting, comparing loan offers, and ensuring financial affordability.

Understanding EECU Loan Calculators

EECU loan calculators are valuable tools designed to help members estimate their potential loan payments and understand the overall cost of borrowing before applying for a loan. These calculators provide a quick and easy way to explore different loan scenarios and make informed financial decisions. They eliminate the guesswork involved in calculating monthly payments and total interest paid, allowing borrowers to compare various loan options effectively.

EECU Loan Calculator Functionality and Inputs

EECU offers a range of loan products, and many have accompanying online calculators. These calculators typically handle inputs such as loan amount, interest rate, and loan term (length). The loan amount represents the principal sum borrowed. The interest rate is the annual percentage rate (APR) charged on the loan, reflecting the cost of borrowing. The loan term is the duration of the loan, typically expressed in months or years. By adjusting these input parameters, users can observe how changes affect their estimated monthly payments and total interest paid over the life of the loan. Additional inputs may include any associated fees, such as origination fees, which can impact the overall cost.

Types of EECU Loans with Calculators, Eecu loan calculator

EECU likely provides calculators for several loan types, including auto loans, personal loans, and possibly home equity loans. Each loan type will have its own specific calculator tailored to the features and terms of that particular product. For instance, an auto loan calculator would incorporate factors like the vehicle’s purchase price, down payment, and trade-in value, in addition to the standard loan amount, interest rate, and term. A personal loan calculator would focus on the loan amount, interest rate, and term, while a home equity loan calculator would incorporate the home’s value, existing mortgage balance, and loan-to-value ratio (LTV). The availability and specific features of each calculator should be confirmed directly on the EECU website.

Example Input Parameters

To illustrate, consider a hypothetical scenario using a personal loan calculator. Suppose a member wants to borrow $10,000 with an interest rate of 7% over a 36-month term. Entering these values into the calculator would generate an estimated monthly payment and the total interest paid over the loan’s duration. By changing the loan term to 48 months, the member could see how this impacts the monthly payment and overall cost. Similarly, altering the interest rate allows for a comparison of different borrowing costs. This iterative process empowers the borrower to choose the most suitable loan option based on their financial capabilities and preferences.

Comparison of EECU Loan Options

The following table offers a simplified comparison of hypothetical interest rates and terms for different EECU loan types. Note that these are examples only and actual rates and terms are subject to change based on creditworthiness and EECU’s current offerings. Always check the EECU website for the most up-to-date information.

| Loan Type | Interest Rate (APR) | Loan Term (Months) | Estimated Monthly Payment (Example $10,000 loan) |

|---|---|---|---|

| Personal Loan | 7% | 36 | $304 |

| Auto Loan | 5% | 60 | $189 |

| Home Equity Loan | 6% | 120 | $103 |

Using an EECU Loan Calculator

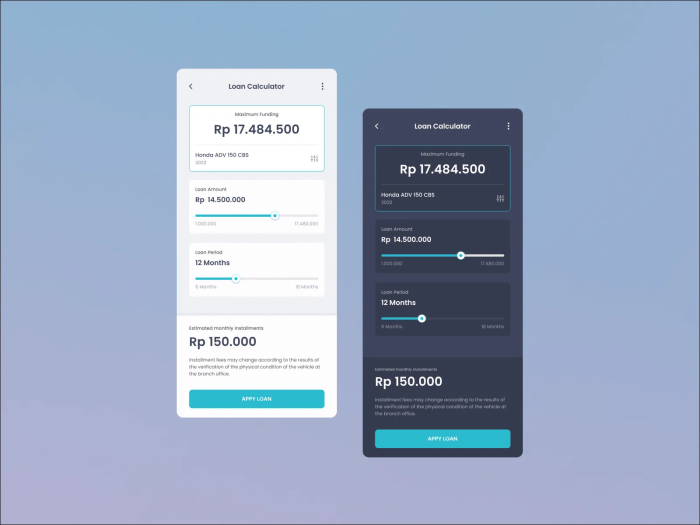

EECU loan calculators are user-friendly tools designed to provide quick estimates of loan payments and total costs. Understanding how to effectively utilize these calculators can significantly aid in the loan application process, allowing for informed financial decisions. This guide will walk you through a step-by-step process, using hypothetical examples and descriptive screenshots to illustrate each stage.

The process of using an EECU loan calculator typically involves inputting specific loan details and then interpreting the generated results. These results provide crucial information to help borrowers understand the financial implications of their loan choices.

Inputting Loan Details

The first step involves entering the necessary information into the calculator fields. A typical EECU loan calculator interface might display fields for loan amount, interest rate, loan term (in months or years), and potentially additional fees or charges.

Imagine a screenshot: The calculator displays a form with clearly labeled input fields such as “Loan Amount,” where a user would enter the desired loan amount (e.g., $10,000); “Interest Rate,” where the annual interest rate (e.g., 6%) would be entered; “Loan Term,” where the loan duration in months (e.g., 36 months) or years would be selected; and finally, an optional field for “Additional Fees,” where any upfront or recurring fees could be added (e.g., $100 origination fee).

Interpreting the Results

Once all the necessary information is entered, the calculator will process the data and display the results. This typically includes the monthly payment amount, the total interest paid over the loan term, and possibly an amortization schedule.

Consider this screenshot representation: The results section shows a clear breakdown of the calculated figures. For example, “Monthly Payment: $300,” clearly displays the recurring monthly payment. Below this, “Total Interest Paid: $1,800” indicates the cumulative interest cost over the loan’s lifespan. Finally, a table titled “Amortization Schedule” is shown, listing month-by-month breakdowns of principal and interest payments. This table would illustrate how the loan balance decreases over time.

Adjusting Input Parameters

One of the most valuable aspects of using a loan calculator is the ability to adjust input parameters and observe their effect on the loan repayment schedule. By changing the loan amount, interest rate, or loan term, borrowers can explore various scenarios and determine the most suitable loan option.

Let’s illustrate with an example shown in a hypothetical screenshot: Initially, with a $10,000 loan, a 6% interest rate, and a 36-month term, the monthly payment is $300. Now, if we increase the loan term to 48 months, keeping other parameters unchanged, a new calculation shows a lower monthly payment (e.g., $230). Conversely, if the interest rate is increased to 7%, while keeping the loan amount and term constant, the monthly payment increases (e.g., to $310). This allows borrowers to see the direct impact of changes to their loan parameters.

Understanding Amortization Schedules

The amortization schedule is a crucial part of the calculator’s output. It provides a detailed breakdown of each payment, showing the proportion allocated to principal repayment and interest.

An example from a hypothetical screenshot: The amortization schedule is presented as a table with columns for “Month,” “Beginning Balance,” “Payment,” “Interest,” “Principal,” and “Ending Balance.” Each row represents a month, showing how the payment is divided between interest and principal reduction, and the remaining loan balance after each payment. This allows for a clear visualization of how the loan is paid off over time.

Factors Affecting EECU Loan Calculations

EECU loan calculators utilize several key variables to determine your monthly payments, total interest paid, and overall loan cost. Understanding these factors allows borrowers to make informed decisions and potentially save money. Accurate input is crucial for reliable results. Minor discrepancies in input data can significantly affect the final calculations.

The accuracy of an EECU loan calculator’s output is directly dependent on the accuracy of the inputted data. Therefore, double-checking all information before submitting the calculation is essential.

Interest Rate Impact on Total Loan Cost

The interest rate is arguably the most significant factor influencing the total cost of an EECU loan. A higher interest rate results in substantially higher total interest paid over the loan’s life. Conversely, a lower interest rate leads to significant savings. For example, a 1% increase in the interest rate on a $10,000 loan over 5 years could add hundreds of dollars to the total repayment amount. This impact is magnified over longer loan terms. The interest rate is determined by several market factors and the borrower’s creditworthiness.

Loan Term’s Influence on Total Loan Cost

The length of the loan term (e.g., 36 months, 60 months, or longer) also significantly impacts the total loan cost. Shorter loan terms typically result in higher monthly payments but lower overall interest paid because the principal is repaid more quickly. Longer loan terms lead to lower monthly payments but significantly higher total interest paid due to the extended repayment period. For instance, a $20,000 loan at a fixed 5% interest rate will have much lower total interest paid if repaid over 36 months compared to 72 months.

Loan Amount’s Effect on Total Loan Cost

The principal loan amount is a straightforward factor; a larger loan amount naturally results in higher monthly payments and a higher total cost. This is a direct proportionality: doubling the loan amount will roughly double the total cost, all other factors remaining equal. Borrowers should carefully consider their financial capacity before requesting a loan. A realistic assessment of affordability is critical to avoid financial strain.

Other Factors Affecting Loan Calculations

Several other factors, while less impactful than the interest rate, loan term, and loan amount, can still influence the final calculation. These include:

- Loan Fees: Origination fees, processing fees, or other associated charges add to the overall cost of the loan. These fees are typically added to the principal loan amount.

- Payment Frequency: While less common, some loans allow for more frequent payments (e.g., bi-weekly instead of monthly). This can slightly reduce the total interest paid.

- Prepayment Penalties: Some loans may include penalties for early repayment. Understanding these penalties is crucial for planning loan repayment.

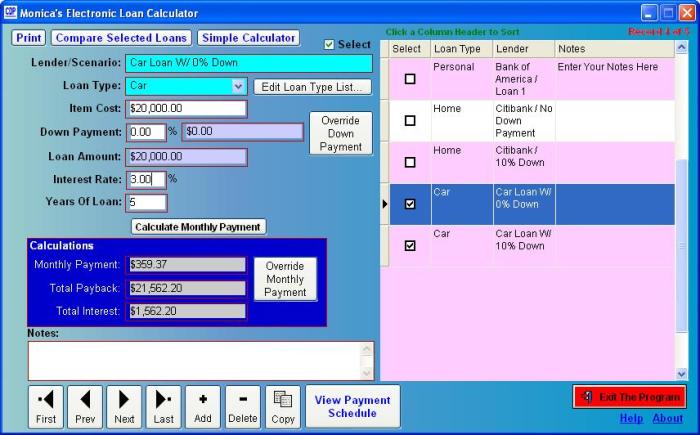

Comparing EECU Loan Calculators to Other Loan Calculators

EECU’s loan calculator, while useful for estimating loan payments and exploring different loan options within their institution, functions within a specific set of parameters and features that differ from those offered by other financial institutions. Comparing it to other calculators highlights both its strengths and limitations. This comparison allows borrowers to make informed decisions about where to seek financing and what tools best suit their needs.

Several key features distinguish EECU’s loan calculator from those provided by national banks, online lenders, and credit unions. These differences stem from variations in loan product offerings, interest rate structures, and the overall borrowing experience each institution aims to provide. Understanding these nuances is crucial for borrowers seeking the most accurate and relevant loan estimates.

EECU Loan Calculator Features and Comparisons

EECU’s loan calculator likely focuses on the types of loans they offer, providing specific details relevant to their interest rates and fees. This targeted approach contrasts with more generalized calculators offered by some larger institutions that may cater to a broader range of loan products, potentially offering less precise estimates for EECU’s specific loan terms. A unique feature might be the inclusion of EECU’s specific membership requirements or the integration with their online banking platform for a seamless application process. However, EECU’s calculator might lack the advanced features found in some other calculators, such as the ability to compare loans across multiple lenders or incorporate factors like property taxes or insurance costs into mortgage calculations. The limitation of focusing solely on EECU products restricts the borrower’s comparative shopping options.

Comparative Analysis of Loan Calculators

The following table compares three different loan calculators, highlighting key features and differences. Note that the specific features and functionalities of these calculators may change over time. This comparison is based on currently available information and should be verified independently.

| Calculator | Features | Strengths | Limitations |

|---|---|---|---|

| EECU Loan Calculator | Specific to EECU loan products, potential integration with online banking, clear display of monthly payments and total interest | Easy to use for EECU members, accurate for EECU loans | Limited to EECU products, may not offer advanced features found in other calculators |

| Bank of America Loan Calculator (Example) | Broad range of loan types (mortgages, auto loans, personal loans), ability to adjust loan terms and interest rates, comparison tools | Comprehensive loan comparison options, detailed breakdown of loan costs | May be less precise for specific EECU loan products, potentially more complex interface |

| NerdWallet Loan Calculator (Example) | Comparison tool across multiple lenders, allows for input of various loan parameters, detailed amortization schedules | Facilitates comparison shopping, provides comprehensive loan information | Requires user input of lender-specific data, may not always reflect real-time interest rates |

Practical Applications of EECU Loan Calculators

EECU loan calculators offer significant practical benefits for individuals navigating the complexities of borrowing. By providing quick and accurate estimations, these tools empower users to make informed decisions, ultimately leading to better financial outcomes. Understanding how to leverage these calculators effectively is key to maximizing their utility.

Budgeting with Loan Projections

An EECU loan calculator allows users to incorporate potential loan payments into their existing budget. For example, a prospective borrower considering a $20,000 auto loan over 60 months at a 5% interest rate can input these figures into the calculator. The resulting monthly payment estimate can then be compared to their current income and expenses to determine affordability. This proactive approach prevents overextension and ensures responsible borrowing. This process helps avoid the financial strain of unexpectedly high monthly payments.

Comparing Loan Offers

When faced with multiple loan offers, an EECU loan calculator becomes invaluable for comparison. Imagine a borrower receiving two offers: one with a lower interest rate but a shorter loan term, and another with a higher interest rate but a longer repayment period. By inputting the details of each offer into the calculator, the borrower can easily compare the total interest paid and the monthly payments for each option. This allows for a clear understanding of the long-term financial implications of each choice, facilitating a more informed decision based on individual financial circumstances.

Assessing Loan Affordability

Determining loan affordability is crucial before applying. An EECU loan calculator streamlines this process by calculating the estimated monthly payment based on the loan amount, interest rate, and loan term. For instance, a borrower aiming for a monthly payment no higher than $500 can use the calculator to experiment with different loan amounts and terms until they find a combination that fits within their budget. This iterative process ensures the borrower only applies for loans they can realistically afford, minimizing the risk of default. This feature directly contributes to responsible financial management.

Pre-Application Planning

Using an EECU loan calculator before applying for a loan allows borrowers to refine their application and improve their chances of approval. By understanding the likely monthly payment and total interest cost, borrowers can adjust their loan request to better align with their financial capabilities. For example, if the calculator reveals a higher-than-expected monthly payment, the borrower can reduce the loan amount or extend the loan term to make it more manageable. This proactive approach demonstrates financial responsibility to lenders, potentially increasing the likelihood of loan approval.

Final Summary

Mastering the EECU loan calculator unlocks a world of financial clarity. By understanding the factors influencing loan calculations and effectively utilizing the calculator’s features, you can confidently compare loan options, make informed borrowing decisions, and ultimately achieve your financial goals. Remember, proactive financial planning and using tools like the EECU loan calculator are key to responsible borrowing and long-term financial well-being.

Essential FAQs

Can I use the EECU loan calculator if I’m not an EECU member?

No, the EECU loan calculator is typically only accessible to existing EECU members. You may need to create an account or log in to access it.

What happens if I enter inaccurate information into the calculator?

Inaccurate input will result in inaccurate calculations. Double-check all your inputs (loan amount, interest rate, loan term) to ensure accuracy. The calculator’s output is only as good as the data you provide.

Does the EECU loan calculator consider additional fees?

The inclusion of additional fees (e.g., origination fees, closing costs) varies depending on the specific loan type. Check the calculator’s details and your loan agreement for complete cost information.

How often is the EECU loan calculator updated?

EECU typically updates its calculator periodically to reflect changes in interest rates and loan policies. Check the calculator for a last updated date.