Cross country mortgage home equity loans offer a unique financing solution for individuals relocating across the country. This type of loan leverages the equity in your current home to fund the purchase of a new property in your desired location, streamlining the often-complex financial aspects of a long-distance move. Understanding the mechanics, eligibility requirements, and potential financial implications is crucial for making an informed decision.

This guide will explore the intricacies of cross country mortgage home equity loans, covering everything from application processes and loan terms to potential tax implications and risk mitigation strategies. We’ll delve into the various lender options available, providing a comparative analysis to help you choose the best fit for your individual circumstances. We’ll also examine real-world scenarios and provide actionable advice to navigate the challenges and maximize the opportunities associated with this type of financing.

Understanding Cross Country Mortgage Home Equity Loans

Relocating across the country often necessitates significant financial planning. A home equity loan can provide a crucial source of funds to cover moving expenses, down payments on a new home, or bridge the gap between selling your current property and purchasing a new one. This type of loan uses the equity built up in your existing home as collateral, offering a potentially substantial sum for your cross-country move.

Home equity loans for cross-country moves function similarly to other home equity loans, but the purpose is specifically tied to relocation costs. The borrower receives a lump sum of money, based on their home’s appraised value and the amount of equity they possess. This lump sum is then used to finance various aspects of the move, such as transportation, temporary housing, closing costs on a new property, and other relocation-related expenses. Repayment is typically structured as a fixed-rate loan with monthly installments over a set term, often 10-15 years.

Home Equity Loan Fees and Closing Costs

Several fees and closing costs are associated with securing a home equity loan. These can vary depending on the lender, the loan amount, and the borrower’s creditworthiness. Common fees include appraisal fees (to determine your home’s value), origination fees (a percentage of the loan amount), title insurance (protecting the lender’s interest in your property), and recording fees (for registering the loan with the relevant authorities). Expect to pay closing costs that could range from 2% to 5% of the loan amount, though this can be significantly higher or lower in specific situations. It is crucial to obtain a detailed loan estimate from your lender to fully understand all associated costs before proceeding.

Beneficial Scenarios for Home Equity Loans in Relocation

A home equity loan can be particularly beneficial in several scenarios. For example, a family selling a home in a high-cost area and purchasing a home in a lower-cost area might use the equity from their existing home to cover the down payment on their new, less expensive property, while simultaneously managing the closing costs involved in both buying and selling. Similarly, individuals who need to cover temporary living expenses during a cross-country move, such as rent or hotel stays while searching for a new home, can leverage a home equity loan to bridge the financial gap. Another example involves using the loan to cover renovation costs on a newly purchased property in the new location.

Comparison with Other Relocation Financing Options

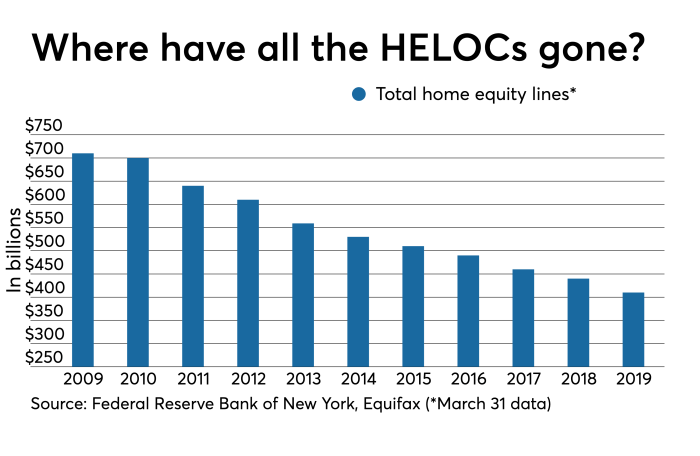

Home equity loans offer a distinct advantage compared to other relocation financing options. Unlike personal loans, which often carry higher interest rates, home equity loans typically have lower interest rates due to the lower risk associated with the secured nature of the loan. While a home equity line of credit (HELOC) offers flexibility in drawing funds as needed, a home equity loan provides a fixed amount with predictable monthly payments, which can be advantageous for budgeting during a significant life transition like a cross-country move. Furthermore, compared to selling your current home entirely to fund the move, a home equity loan allows you to retain ownership of your current property, providing a safety net and potentially a future investment opportunity.

Eligibility and Qualification Criteria

Securing a home equity loan, especially across state lines, involves a rigorous assessment of your financial standing. Lenders meticulously examine various factors to determine your creditworthiness and ability to repay the loan. Understanding these criteria is crucial for a successful application. This section details the key aspects lenders consider, the necessary documentation, and the influence of credit scores and debt-to-income ratios on loan approval.

Key Factors Considered by Lenders

Lenders evaluate multiple factors to gauge the risk associated with extending a home equity loan. These factors go beyond just your credit score and encompass a holistic view of your financial health and the value of your property. A comprehensive assessment is critical, as it protects both the borrower and the lender. This ensures responsible lending practices and minimizes the likelihood of defaults.

Required Documentation for Loan Application

The application process for a cross-country home equity loan necessitates providing comprehensive documentation to verify your financial information and property ownership. Incomplete or inaccurate documentation can significantly delay the approval process or even lead to rejection. Therefore, gathering all the necessary documents beforehand is highly recommended.

- Proof of Income: Pay stubs, W-2 forms, tax returns, or bank statements demonstrating consistent income.

- Credit Report: A copy of your credit report, showing your credit history and score.

- Home Appraisal: A professional appraisal of your home’s current market value.

- Proof of Homeownership: Mortgage statement, deed, or other documentation proving ownership of the property.

- Bank Statements: Recent bank statements showing your account activity and available funds.

- Employment Verification: A letter from your employer confirming your employment status and income.

Credit Score Requirements and Impact on Loan Approval

Your credit score plays a pivotal role in determining your eligibility for a home equity loan and the interest rate you’ll receive. A higher credit score typically translates to better loan terms, including lower interest rates and potentially higher loan amounts. Lenders use credit scores as an indicator of your creditworthiness and repayment ability. Generally, a higher credit score indicates a lower risk to the lender. For instance, a borrower with a credit score above 700 might qualify for a lower interest rate compared to a borrower with a score below 650.

Debt-to-Income Ratio and Loan Eligibility

The debt-to-income ratio (DTI), calculated by dividing your total monthly debt payments by your gross monthly income, is a critical factor in loan approval. A lower DTI indicates a greater capacity to manage additional debt. Lenders prefer borrowers with a low DTI, typically below 43%, as it suggests a reduced risk of default. A high DTI might necessitate a larger down payment or lead to loan rejection. For example, a borrower with a high DTI might be required to make a larger down payment to reduce the loan amount and, consequently, their DTI.

Loan Amount and Repayment Terms

Securing a home equity loan through Cross Country Mortgage involves understanding the loan amount you can borrow and the repayment terms available. These factors are crucial for determining your monthly payments and overall financial commitment. Careful consideration of these details is essential for responsible borrowing.

Maximum Loan Amount

Several factors determine the maximum loan amount available to a borrower. Lenders assess the applicant’s creditworthiness, debt-to-income ratio, and the appraised value of the home. The loan-to-value (LTV) ratio, representing the loan amount as a percentage of the home’s value, plays a significant role. A higher credit score generally allows for a higher LTV ratio and thus a larger loan amount. Existing mortgages and other debts reduce the amount available for a home equity loan. For example, a homeowner with excellent credit and a home appraised at $500,000 might qualify for a higher loan amount than someone with a lower credit score and a similar home value. Furthermore, the lender’s internal policies and prevailing market conditions also influence the maximum loan amount offered.

Repayment Term Options and Their Impact on Monthly Payments

Cross Country Mortgage typically offers various repayment term options, ranging from a few years to potentially 15 or 30 years. The repayment term significantly impacts the monthly payment amount. A shorter term results in higher monthly payments but lower overall interest paid. Conversely, a longer term reduces monthly payments but increases the total interest paid over the loan’s life. For instance, a $50,000 home equity loan with a 5% interest rate would have a significantly higher monthly payment over a 5-year term compared to a 15-year term. Borrowers should carefully weigh the benefits of lower monthly payments against the increased overall cost of borrowing associated with longer terms.

Sample Amortization Schedule

The following table illustrates a sample amortization schedule for a $50,000 home equity loan at 5% interest over 10 years. Note that this is a simplified example and actual loan terms may vary.

| Loan Payment Number | Beginning Balance | Payment Amount | Ending Balance |

|---|---|---|---|

| 1 | $50,000.00 | $530.80 | $49,469.20 |

| 2 | $49,469.20 | $530.80 | $48,938.40 |

| 3 | $48,938.40 | $530.80 | $48,407.61 |

| … | … | … | … |

| 120 | $530.80 | $530.80 | $0.00 |

Consequences of Defaulting on a Home Equity Loan

Defaulting on a home equity loan can have severe financial consequences. Late payments can damage credit scores, impacting future borrowing opportunities. Lenders may pursue legal action to recover the outstanding debt, potentially leading to foreclosure proceedings. Foreclosure could result in the loss of the home. It’s crucial to maintain consistent payments and contact the lender immediately if facing financial difficulties to explore potential solutions, such as loan modification or forbearance. The severity of the consequences depends on the terms of the loan agreement and the lender’s policies.

Tax Implications and Financial Considerations: Cross Country Mortgage Home Equity Loan

Utilizing a home equity loan to finance a cross-country move presents several financial considerations, including potential tax implications and inherent risks. Understanding these aspects is crucial for making an informed decision and ensuring the move doesn’t negatively impact your long-term financial health. Careful planning and awareness of potential pitfalls are essential.

Home equity loans, while offering access to significant funds, are subject to specific tax rules. Interest paid on home equity loans is generally tax-deductible, but only up to the amount of debt used to buy, build, or substantially improve your home. If you’re using the loan for relocation expenses, only the portion directly tied to home improvements (such as renovations to prepare the new property for sale or occupancy) might be deductible. Consult with a tax professional to determine the deductibility of your specific situation. Using the loan for non-home improvement related moving expenses, such as travel costs or temporary housing, may not offer tax benefits.

Potential Financial Risks Associated with Home Equity Loans

Borrowing against your home’s equity introduces inherent risks that require careful consideration. Failure to understand these risks can lead to significant financial hardship.

- Risk of Default: If you fail to make your loan payments, the lender could foreclose on your home, leading to its sale and potential loss of equity.

- Increased Debt Burden: Adding a home equity loan increases your overall debt load, potentially impacting your credit score and limiting your access to future credit.

- Fluctuating Home Values: If your home’s value decreases, your equity may shrink, making it harder to repay the loan or potentially resulting in negative equity (owing more than your home is worth).

- High Interest Rates: Interest rates on home equity loans can be variable, meaning they can increase over time, leading to higher monthly payments and a larger total loan cost.

- Hidden Fees and Costs: Be aware of closing costs, appraisal fees, and other associated fees that can add to the overall cost of the loan.

Strategies for Managing the Financial Burden of a Cross-Country Move

Effective financial planning is vital to mitigate the risks associated with using a home equity loan for relocation.

- Create a Detailed Budget: Before taking out the loan, create a comprehensive budget that includes all moving expenses, anticipated costs in your new location, and loan repayments. This helps determine the necessary loan amount and ensures you can comfortably manage the payments.

- Explore Alternative Financing Options: Consider comparing home equity loans with other financing methods, such as personal loans or credit cards, to identify the most cost-effective option. Factors such as interest rates, repayment terms, and fees should be carefully evaluated.

- Prioritize Debt Reduction: If possible, pay down existing debts before taking out a home equity loan to reduce your overall debt burden and improve your financial flexibility.

- Build an Emergency Fund: Having an emergency fund can provide a financial cushion in case of unexpected expenses or job loss, protecting against defaulting on the loan.

- Seek Professional Financial Advice: Consult with a financial advisor to discuss your financial situation, assess your risk tolerance, and develop a personalized financial plan that addresses your specific needs.

Comparison of Long-Term Financial Implications

The long-term financial implications of using a home equity loan versus other financing options depend on several factors, including interest rates, loan terms, and individual financial circumstances. For example, a personal loan may offer a lower interest rate but a shorter repayment period, while a home equity loan might offer a longer repayment period but a higher interest rate. Credit cards often carry the highest interest rates and should be considered only as a last resort for short-term, high-interest debt. A detailed comparison, factoring in all associated costs and repayment schedules, is essential before making a decision. Using a financial calculator or seeking professional advice can significantly aid in this process. For instance, a $50,000 home equity loan at 6% interest over 15 years would cost significantly more in total interest than a $50,000 personal loan at 4% interest over 5 years.

Finding and Choosing a Lender

Securing a home equity loan for relocation requires careful consideration of various lenders and their offerings. Understanding the differences between lender types and their respective services is crucial for obtaining the best possible loan terms. This section will guide you through the process of finding and choosing a suitable lender, focusing on interest rates, fees, and customer service.

Comparison of Lender Types

Choosing the right lender is a critical step in the home equity loan process. Different lenders—banks, credit unions, and online lenders—offer varying services and terms. The following table provides a general comparison; however, specific rates and fees will vary depending on individual circumstances and market conditions. Always compare multiple offers before making a decision.

| Lender Type | Interest Rates | Fees | Customer Service |

|---|---|---|---|

| Banks | Generally competitive, can vary based on credit score and loan amount. Often offer a range of loan products. | May include origination fees, appraisal fees, and potentially higher closing costs. | Typically offer a wide range of channels for customer service, including branches, phone, and online support. Service levels can vary significantly between banks. |

| Credit Unions | Often offer lower interest rates than banks, particularly for members with strong credit histories. | May have lower fees compared to banks, although this can vary depending on the specific credit union. | Generally known for personalized service and a strong focus on member relationships. Access to services may be limited depending on branch locations. |

| Online Lenders | Can be competitive, sometimes offering lower rates due to lower overhead costs. Rates may vary based on credit score and loan amount. | May have lower or more transparent fees compared to traditional lenders. | Primarily offer online support; personal interaction may be limited. Technology proficiency is required for successful loan application and management. |

Shopping for the Best Interest Rates and Loan Terms

Securing the best interest rate and loan terms involves diligent comparison shopping. Begin by checking your credit score and improving it if necessary, as a higher credit score typically qualifies you for better rates. Then, obtain pre-approvals from multiple lenders to compare their offers side-by-side. Pay close attention to the Annual Percentage Rate (APR), which includes interest and other fees, providing a more accurate representation of the loan’s total cost. Consider the loan term length; longer terms generally result in lower monthly payments but higher total interest paid. Finally, compare the loan’s closing costs, including origination fees, appraisal fees, and title insurance.

Reviewing Loan Documents Carefully

Before signing any loan documents, thoroughly review every detail. Understand all terms and conditions, including interest rates, fees, repayment schedule, and prepayment penalties. If anything is unclear, seek clarification from the lender before proceeding. Don’t hesitate to consult with a financial advisor or attorney to ensure you fully understand the implications of the loan agreement. Failing to carefully review the documents could lead to unexpected costs and financial difficulties.

Responsible Borrowing Practices for Relocation

Using a home equity loan for relocation requires responsible borrowing practices. Carefully budget your expenses, ensuring the loan amount is sufficient to cover relocation costs without overextending your finances. Prioritize essential expenses, such as moving costs, down payment on a new home, and temporary housing, before considering less critical items. Develop a realistic repayment plan, factoring in your current income and expenses. Consider setting aside an emergency fund to handle unforeseen circumstances during the relocation process. Remember, maintaining a healthy credit score is crucial throughout the process.

Real-World Examples and Case Studies

Understanding the practical application of a cross-country home equity loan requires examining real-world scenarios. This section explores hypothetical examples to illustrate the process, potential challenges, and financial outcomes associated with using home equity for relocation. We’ll also analyze how unforeseen events can impact loan repayment.

Let’s consider Sarah and Mark, a couple who recently received a job offer requiring a move from Chicago to San Francisco. Their Chicago home, valued at $500,000 with a $200,000 mortgage, has built-up significant equity. They decide to utilize a home equity loan to finance the move, aiming to cover the costs of selling their Chicago property, purchasing a new home in San Francisco, and managing associated relocation expenses. They secure a $150,000 home equity loan at a fixed interest rate of 6% over 15 years. The loan application process involved providing financial documentation, including proof of income, credit history, and home appraisal. After successfully navigating the approval process, they receive the funds, allowing them to manage the sale of their Chicago home, purchase their San Francisco property, and cover moving costs. Their monthly payments are manageable within their combined income, and they are able to successfully repay the loan over the 15-year term. Their improved financial situation due to higher salaries in San Francisco makes the loan repayment less burdensome.

Hypothetical Scenario: Cross-Country Relocation Using a Home Equity Loan

This case study details Sarah and Mark’s experience, highlighting the process and financial outcomes. Their successful experience demonstrates the potential benefits of a home equity loan for cross-country moves when financial planning and responsible borrowing are prioritized.

Challenges and Successes of Using Home Equity Loans for Cross-Country Moves

Utilizing home equity for a cross-country move presents both opportunities and risks. Careful consideration of potential challenges and a strategic approach can maximize the chances of success.

- Challenges: Unexpected delays in selling the existing home, higher-than-anticipated closing costs in the new location, fluctuating interest rates impacting loan affordability, and unforeseen expenses related to the move (e.g., storage, transportation).

- Successes: Sufficient equity in the existing home to cover relocation expenses, securing a favorable interest rate on the home equity loan, a smooth and timely sale of the existing property, and managing the move efficiently within budget.

Impact of Unforeseen Circumstances on Loan Repayment, Cross country mortgage home equity loan

Unforeseen circumstances can significantly impact loan repayment. It’s crucial to have a contingency plan to mitigate potential financial difficulties.

- Job Loss: A job loss can severely impact repayment ability. Exploring options like loan modification or seeking financial assistance is crucial. For example, if Sarah were to lose her job, they might need to consider a temporary deferral or explore hardship programs offered by their lender. The potential need to sell their San Francisco home to repay the loan is a significant risk.

- Unexpected Expenses: Unexpected medical bills or home repairs can strain finances. Creating an emergency fund and having a budget in place are essential. For example, if their new home required unexpected repairs, they would need to either use savings or consider a short-term loan to cover the costs, ensuring that the home equity loan repayments remain prioritized.

Last Word

Relocating across the country is a significant undertaking, and securing the right financing can make all the difference. A cross country mortgage home equity loan can be a powerful tool, but it’s essential to carefully weigh the benefits against the potential risks. By understanding the intricacies of this loan type, comparing lender options, and proactively managing your finances, you can successfully navigate the complexities of a long-distance move and achieve your relocation goals. Remember to thoroughly review loan documents and seek professional financial advice before making a final decision.

Top FAQs

What is the typical interest rate for a cross country home equity loan?

Interest rates vary depending on factors like your credit score, loan amount, and the lender. It’s best to shop around and compare offers from multiple lenders.

Can I use a home equity loan to cover moving expenses beyond the purchase of a new home?

While primarily used for purchasing a new home, some lenders might allow a portion of the loan to cover closing costs or other relocation-related expenses. This should be clarified during the loan application process.

What happens if I lose my job after taking out a home equity loan?

Job loss can significantly impact your ability to repay the loan. It’s crucial to have an emergency fund and explore options like loan modification or forbearance with your lender if you face financial hardship.

How long does the application process typically take?

The application process can vary depending on the lender and the complexity of your situation. It can take anywhere from a few weeks to several months.