MidweekPay loans offer a lifeline for those facing unexpected expenses mid-week. Unlike traditional loans, they provide faster access to smaller amounts, often bridging the gap until payday. This guide delves into the benefits and drawbacks, the application process, and crucial considerations before taking out a midweekpay loan. We’ll also explore responsible borrowing practices and viable alternatives to ensure you make informed financial decisions.

Understanding the nuances of midweekpay loans is crucial. We’ll examine their typical characteristics – loan amounts, repayment terms, and eligibility requirements – and compare them to similar short-term options like payday loans and cash advances. This comparison will highlight the key differences and help you choose the most suitable option for your circumstances.

Defining “Midweek Pay Loan”

Midweek pay loans are short-term, small-dollar loans designed to bridge the gap between paychecks for individuals facing unexpected expenses or financial shortfalls before their next payday. They cater specifically to those who need access to funds mid-week, rather than waiting until the traditional payday lending cycle. The target audience includes working individuals with regular income but who may experience irregular cash flow or unexpected emergencies.

Midweek pay loans offer a faster alternative to traditional loans, aiming to provide immediate financial relief when needed most. This makes them a potentially attractive option for individuals who cannot afford to wait until their next payday to cover essential expenses. However, it’s crucial to understand the associated costs and potential risks before applying.

Typical Characteristics of Midweek Pay Loans

Midweek pay loans typically involve smaller loan amounts, ranging from a few hundred dollars to a maximum of $1,000, depending on the lender and the borrower’s creditworthiness. Repayment terms are usually short, often requiring repayment within a week or two, coinciding with the borrower’s next payday. Eligibility criteria typically include proof of regular income, a valid bank account, and a minimum age requirement. Specific requirements vary among lenders, so it’s vital to review each lender’s terms and conditions before applying.

Comparison with Other Short-Term Loan Options

Midweek pay loans share similarities with other short-term loan options, but key differences exist. Payday loans, for instance, typically have shorter repayment periods, often due within two weeks, and often carry higher interest rates and fees than midweek pay loans. Cash advances, offered by credit card companies or banks, provide access to a portion of available credit but often come with high interest charges if not repaid promptly. Compared to payday loans, midweek pay loans may offer slightly more flexible repayment terms and potentially lower fees, although this varies significantly depending on the lender. Cash advances, while offering speed, are tied to existing credit lines and can negatively impact credit scores if misused. Therefore, a careful comparison of fees, interest rates, and repayment terms across all three options is essential before selecting a loan.

Benefits and Drawbacks of Midweek Pay Loans

Midweek pay loans offer a unique financial solution, providing access to funds before the typical payday. However, understanding both the advantages and disadvantages is crucial before considering this type of borrowing. Weighing the potential benefits against the inherent risks will help borrowers make informed decisions and avoid potential financial pitfalls.

Accessing funds mid-week can provide significant advantages for borrowers facing unexpected expenses or urgent financial needs. This timely access can prevent late fees on bills, avoid disruptions to essential services, or allow for immediate repairs, ultimately minimizing financial stress. For example, a sudden car repair bill or a medical emergency could be addressed promptly, preventing further financial complications. The ability to address immediate needs before the next payday offers a crucial safety net for individuals facing unpredictable financial circumstances.

Advantages of Midweek Pay Loan Access

The primary benefit of a midweek pay loan lies in its timing. This allows borrowers to address urgent financial needs before their next scheduled payday, preventing a cascade of late fees and potential debt accumulation. This timely access to funds can be particularly beneficial for individuals living paycheck to paycheck, offering a crucial buffer against unforeseen expenses.

Disadvantages and Risks of Midweek Pay Loans

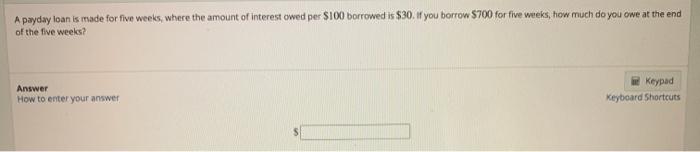

While convenient, midweek pay loans often come with high interest rates and fees. These costs can quickly escalate, leading to a cycle of debt if not managed carefully. The short repayment period also increases the pressure on borrowers to repay the loan quickly, potentially exacerbating financial difficulties if unexpected expenses arise before the repayment date. For example, a $200 loan with a 20% interest rate and a two-week repayment period might require a repayment of $240, adding significant strain on the borrower’s budget.

Responsible Borrowing Practices for Midweek Pay Loans

Responsible borrowing practices are paramount when considering a midweek pay loan. Borrowers should carefully assess their financial situation, ensuring they can comfortably repay the loan within the stipulated timeframe, including all interest and fees. Thoroughly comparing interest rates and fees from different lenders is crucial to secure the most favorable terms. Developing a clear repayment plan and budgeting for the loan repayment is essential to avoid falling into a debt trap. Only borrowing the necessary amount and avoiding unnecessary additional expenses further enhances responsible borrowing practices. For instance, creating a detailed budget outlining all income and expenses, including the loan repayment, can provide a clear picture of financial capacity and prevent over-borrowing.

The Lending Process for Midweek Pay Loans

Securing a midweek pay loan typically involves a straightforward process, although specific steps may vary slightly depending on the lender. Borrowers can generally apply either online or in-person, each route offering its own advantages and potential drawbacks. Understanding the application process is crucial for a smooth and efficient loan acquisition.

The application process for a midweek pay loan prioritizes speed and convenience. Lenders recognize the urgent need for funds and aim to streamline the procedure to minimize wait times. This often involves a predominantly online application process, although some lenders may still offer in-person options.

Online Application Process for Midweek Pay Loans

Applying for a midweek pay loan online typically involves completing a simple application form on the lender’s website. This usually requires providing basic personal information, employment details, and bank account information. The entire process can often be completed within minutes. After submission, the lender will review the application and, if approved, will typically deposit the funds directly into the borrower’s designated bank account within a short timeframe, often within the same business day. This rapid turnaround is a key selling point of midweek pay loans.

In-Person Application Process for Midweek Pay Loans

While less common, some lenders still offer in-person applications for midweek pay loans. This usually involves visiting a physical branch or office of the lending institution. The application process will generally mirror the online process, requiring the submission of similar information. However, the in-person application allows for immediate interaction with a loan officer, who can answer any questions and potentially provide more personalized guidance. The approval and disbursement process may take slightly longer than an online application.

Required Documentation and Information for Loan Approval

To ensure a successful application, borrowers should gather the necessary documentation and information beforehand. This typically includes proof of identity (such as a driver’s license or passport), proof of income (such as pay stubs or bank statements), and bank account details. Some lenders may also request additional documentation, such as proof of address or employment verification. Providing complete and accurate information is crucial for a swift approval process. Incomplete applications can lead to delays or rejection. It’s advisable to carefully review the lender’s specific requirements before submitting the application.

Step-by-Step Guide to Obtaining a Midweek Pay Loan

A typical step-by-step guide for obtaining a midweek pay loan might look like this:

- Locate a Lender: Research and select a reputable lender offering midweek pay loans. Compare interest rates, fees, and repayment terms.

- Gather Necessary Documents: Assemble all required documentation, including proof of identity, income, and bank account details.

- Complete the Application: Fill out the loan application form accurately and completely, either online or in person.

- Await Approval: The lender will review the application and notify the borrower of their decision, usually within a short timeframe.

- Receive Funds: Upon approval, the funds will be deposited directly into the borrower’s bank account.

- Repay the Loan: Adhere to the agreed-upon repayment schedule to avoid late fees and negative impacts on credit scores.

Regulation and Legal Aspects of Midweek Pay Loans

Midweek pay loans, like all short-term lending products, operate within a complex legal framework that varies significantly across different jurisdictions. Understanding these regulations is crucial for both lenders and borrowers to ensure compliance and protect consumer rights. This section will explore the key legal and regulatory aspects governing midweek pay loans, highlighting variations and common themes.

Interest rate caps and other regulations are the cornerstones of consumer protection in the short-term lending industry. These regulations aim to prevent predatory lending practices and ensure fair treatment for borrowers. The specific regulations, however, differ considerably depending on the location.

Interest Rate Caps and Regulations

The interest rates charged on midweek pay loans are subject to various regulations, primarily designed to prevent exploitative lending practices. Many jurisdictions have implemented interest rate caps, limiting the maximum annual percentage rate (APR) that lenders can charge. These caps often vary based on the loan amount, loan term, and the type of lender. For instance, some states may have stricter caps on payday loans than on installment loans, while others may not differentiate between the two. Some jurisdictions may also impose additional fees or charges, which can significantly impact the overall cost of borrowing. Failure to comply with these regulations can result in significant penalties for lenders. For example, in some jurisdictions, exceeding the interest rate cap could lead to fines, license revocation, or even criminal charges. Borrowers, in turn, may have recourse to legal action to recover excessive charges.

Comparison with Other Short-Term Lending Products

The regulatory landscape for midweek pay loans is often compared to that of other short-term lending products, such as payday loans and installment loans. While the core principle of protecting borrowers from excessive interest rates applies across the board, the specific regulations may differ. Payday loans, for instance, are often subject to stricter scrutiny due to their high-interest rates and short repayment periods. Installment loans, with their longer repayment terms, may face less stringent regulations in some areas. The regulatory differences often stem from the perceived risk associated with each product and the potential for predatory lending. A comparative analysis of these regulatory frameworks across various jurisdictions reveals a complex interplay of factors influencing the overall cost and accessibility of short-term credit.

Jurisdictional Variations in Legal Frameworks

The legal framework governing midweek pay loans varies significantly from one jurisdiction to another. Some countries or states may have comprehensive laws specifically addressing short-term loans, including midweek pay loans, while others may rely on broader consumer protection legislation. This disparity often results in differing interest rate caps, licensing requirements, and collection practices. For example, some jurisdictions may require lenders to be licensed and undergo background checks, while others may have less stringent requirements. Similarly, the allowable collection methods may differ, with some jurisdictions prohibiting certain aggressive collection tactics. Understanding these jurisdictional variations is crucial for both lenders and borrowers to ensure compliance and avoid potential legal disputes.

Alternatives to Midweek Pay Loans: Midweekpay Loan

Securing funds to cover unexpected expenses can be stressful, but midweek pay loans aren’t the only solution. Several alternatives offer more sustainable and potentially less costly ways to manage financial emergencies. Choosing the right approach depends on your individual circumstances and the urgency of your need.

Exploring alternative financial solutions is crucial for long-term financial health. Relying solely on short-term, high-interest loans can create a cycle of debt. By understanding and utilizing these alternatives, you can build a stronger financial foundation and avoid the pitfalls associated with payday-style lending.

Budgeting Tools and Savings Plans

Effective budgeting and consistent savings are proactive strategies to prevent unexpected expenses from becoming financial crises. Budgeting tools, available through various apps and websites, help track income and expenses, identify areas for savings, and create realistic spending plans. These tools often offer features like automated budgeting, expense categorization, and financial goal setting. Simultaneously, establishing an emergency savings fund, even a small one, provides a readily accessible source of funds for unforeseen circumstances. Aim to save at least three to six months’ worth of essential living expenses. Consistent contributions, even small amounts, can accumulate over time.

Borrowing from Family or Friends

Borrowing from trusted family members or friends can be a more affordable alternative to formal loans. Interest rates are often lower, or even nonexistent, and repayment terms can be more flexible. However, it’s crucial to approach this with transparency and a well-defined repayment plan to maintain healthy relationships. Clearly outlining the terms of the loan, including the amount, interest (if any), and repayment schedule, is essential. Documenting the agreement in writing can prevent misunderstandings and ensure accountability.

Comparison of Financial Solutions

| Financial Solution | Pros | Cons | Suitability |

|---|---|---|---|

| Midweek Pay Loan | Quick access to funds | High interest rates, potential debt cycle | Emergency situations only, when other options are unavailable |

| Budgeting Apps/Tools | Improved financial awareness, expense tracking, goal setting | Requires discipline and consistent effort | Long-term financial management, preventing future emergencies |

| Emergency Savings Fund | Quick access to funds, avoids high interest | Requires consistent saving over time | Best for preventing emergencies, not addressing immediate needs |

| Borrowing from Family/Friends | Lower or no interest, flexible repayment terms | Potential strain on relationships if not handled carefully | Suitable for trusted relationships with clear repayment agreements |

Financial Literacy and Responsible Borrowing

Midweek pay loans, while offering a quick solution to immediate financial needs, often come with high interest rates and can easily lead to a cycle of debt. Understanding personal finance and practicing responsible borrowing are crucial to avoiding such situations. This section provides guidance on budgeting, understanding loan terms, and managing debt effectively.

Creating a Personal Budget, Midweekpay loan

A well-structured personal budget is the cornerstone of responsible financial management. It allows you to track your income and expenses, identify areas where you can cut back, and plan for future expenses, thus reducing the likelihood of needing short-term loans. Creating a budget involves several key steps: First, meticulously record all sources of income, including salary, investments, and any other regular inflows. Next, list all your expenses, categorizing them into essentials (housing, food, utilities) and non-essentials (entertainment, dining out). Many budgeting apps and spreadsheets can simplify this process. Finally, compare your total income to your total expenses. If expenses exceed income, you need to identify areas where you can reduce spending or increase income. A realistic and achievable budget is key to avoiding financial emergencies and the need for high-interest loans. For example, a person earning $3,000 per month and spending $3,500 needs to reduce expenses by $500 or find a way to increase their income by the same amount.

Understanding APR and Interest Rates

The Annual Percentage Rate (APR) represents the total cost of borrowing, including interest and fees, expressed as a yearly percentage. It’s crucial to understand the APR before taking out any loan, including a midweek pay loan. A higher APR means a more expensive loan. For instance, a midweek pay loan with a 400% APR will cost significantly more than one with a 100% APR, even if the initial loan amount is the same. Understanding the interest rate and calculating the total repayment amount helps borrowers make informed decisions and avoid getting trapped in a cycle of debt. It’s vital to compare APRs from different lenders before committing to a loan.

Strategies for Managing Debt and Avoiding a Cycle of Borrowing

Effective debt management involves several key strategies. Prioritizing high-interest debts, such as payday loans, is crucial. Consider debt consolidation, where multiple debts are combined into a single loan with a lower interest rate, simplifying repayment. Negotiating with creditors to reduce interest rates or payment amounts can also provide relief. Building an emergency fund, ideally with 3-6 months’ worth of living expenses, acts as a safety net, reducing reliance on short-term loans during unexpected financial difficulties. For example, someone consistently using midweek pay loans to cover unexpected car repairs might benefit from establishing an emergency fund to cover such costs in the future. Finally, seeking professional financial advice from a credit counselor can provide personalized guidance and support in navigating debt management effectively.

Impact of Midweek Pay Loans on Borrowers

Midweek pay loans, while offering a seemingly convenient solution to short-term financial emergencies, can have both positive and negative impacts on borrowers’ financial well-being. The effects depend heavily on individual circumstances, borrowing habits, and the responsible use (or misuse) of these loans. Understanding these potential consequences is crucial for making informed borrowing decisions.

Midweek pay loans can provide a temporary financial lifeline for individuals facing unexpected expenses between paychecks. This can prevent late fees, bounced checks, or other negative consequences associated with short-term cash flow problems. However, the ease of access and the often-high interest rates associated with these loans can quickly lead to a cycle of debt that is difficult to escape. The short repayment period, often just until the next payday, can create a situation where borrowers find themselves constantly needing to take out another loan to repay the previous one.

Positive Impacts of Midweek Pay Loans

Access to midweek pay loans can offer a crucial safety net for individuals facing unforeseen circumstances, such as urgent car repairs or unexpected medical bills. For example, a borrower might use a midweek pay loan to cover an essential car repair, preventing them from losing their job due to lack of transportation. This temporary financial assistance allows them to maintain their financial stability and avoid more significant long-term financial problems. The loan allows for timely payment of critical bills, avoiding late payment fees and damage to credit scores.

Negative Impacts of Midweek Pay Loans

The high interest rates and short repayment periods associated with midweek pay loans can trap borrowers in a cycle of debt. Repeated reliance on these loans can lead to a snowball effect, where the interest charges accumulate faster than the borrower can repay the principal. This can severely impact credit scores, making it harder to obtain loans or credit in the future. For instance, a borrower who consistently relies on midweek pay loans to cover essential expenses might find themselves unable to obtain a mortgage or auto loan down the line, significantly impacting their long-term financial goals.

Long-Term Consequences of Repeated Reliance

Continuous reliance on midweek pay loans can have devastating long-term financial consequences. The high-interest rates can lead to substantial debt accumulation, potentially exceeding the original loan amount many times over. This can result in significant financial stress, difficulty meeting other financial obligations, and even potential legal action from creditors. In the long run, the short-term convenience of these loans can create a far more serious long-term financial burden, impacting creditworthiness and overall financial health. For example, an individual might initially use a midweek pay loan for a minor emergency, but due to repeated use and accumulating debt, they may eventually struggle to meet basic living expenses.

Examples of Midweek Pay Loans Impacting Financial Stability

A single mother facing an unexpected medical bill for her child might use a midweek pay loan to cover the cost, ensuring her child receives necessary treatment without delaying the payment. This represents a positive impact, as it prevents a more significant financial crisis. Conversely, an individual repeatedly using midweek pay loans to fund non-essential spending might quickly find themselves deeply in debt, unable to meet their regular expenses, and facing severe financial instability. This illustrates how the same financial tool can lead to drastically different outcomes depending on the borrower’s financial discipline and responsible use of the loan.

Illustrative Scenarios

Understanding the potential benefits and drawbacks of midweek pay loans requires examining real-world examples. The following scenarios illustrate how these loans can be both helpful and harmful, depending on the borrower’s circumstances and financial management.

Successful Use of a Midweek Pay Loan

Successful Midweek Pay Loan Scenario

Sarah, a single mother, works as a waitress and receives her bi-weekly paycheck on Fridays. Unexpectedly, her car’s alternator failed on Tuesday, leaving her unable to get to work and jeopardizing her income. She needed $300 for repairs to get back on the road. A midweek pay loan provided the necessary funds. She repaid the loan in full on Friday with her paycheck, incurring only a small fee. This allowed her to maintain her job and avoid further financial hardship. Her financial situation before the loan was characterized by a tight budget and limited savings, but with a manageable level of debt. After securing and repaying the loan, her financial situation remained relatively unchanged, as she avoided the more significant financial setback of job loss.

Unsuccessful Midweek Pay Loan Scenario

Mark, a freelance graphic designer, experienced a slow month with fewer projects than anticipated. He took out a midweek pay loan to cover his rent and utility bills, expecting a large payment from a client the following week. However, the payment was delayed, and he struggled to repay the loan on time. The accumulated interest and late fees quickly spiraled out of control, leaving him in a worse financial position than before. He found himself trapped in a cycle of borrowing to cover previous loan repayments. Before the loan, Mark’s financial situation was precarious, with limited savings and a reliance on irregular income. After taking out the loan, his financial situation deteriorated significantly, resulting in increased debt and financial stress. He experienced a visual representation of his financial state shifting from a somewhat balanced budget (before the loan), where income and expenses were nearly equal, to a severely unbalanced one (after the loan), with expenses drastically exceeding his income. This imbalance was further emphasized by the rapidly accumulating interest and fees on the loan.

Ending Remarks

Navigating the world of midweekpay loans requires careful consideration. While they offer a convenient solution for immediate financial needs, understanding the associated risks and exploring alternative financial strategies is paramount. Responsible borrowing practices, including budgeting and understanding APR, are key to avoiding a cycle of debt. By weighing the pros and cons and considering alternatives, you can make informed decisions that protect your financial well-being.

Expert Answers

What are the typical interest rates for midweekpay loans?

Interest rates vary significantly depending on the lender and your creditworthiness. They are generally higher than traditional loans due to the short repayment period and higher risk for lenders. Always compare rates before borrowing.

How long does it take to get approved for a midweekpay loan?

Approval times vary but are typically faster than traditional loans, often within a few hours or a day, depending on the lender’s process and the completeness of your application.

What happens if I can’t repay my midweekpay loan on time?

Late payments can result in additional fees and penalties, potentially impacting your credit score. Contact your lender immediately if you anticipate difficulties in making your repayment.

Are midweekpay loans suitable for long-term financial problems?

No. Midweekpay loans are designed for short-term, unexpected expenses. For long-term financial difficulties, seek professional financial advice and explore long-term solutions like budgeting, debt consolidation, or credit counseling.