Scratch PPP loan forgiveness presents unique challenges for businesses lacking established accounting systems. Securing forgiveness requires meticulous documentation of expenses, even without pre-existing records. This guide navigates the complexities of applying for forgiveness when starting from scratch, offering strategies for success and highlighting potential pitfalls to avoid.

We’ll delve into the specific eligibility criteria, explore effective methods for documenting expenses, and analyze the impact of incomplete records on forgiveness calculations. We’ll also provide practical examples and a step-by-step guide to maximize your chances of securing forgiveness, even with limited financial information. Understanding the nuances of a “scratch” application is crucial for navigating this process successfully.

Eligibility Criteria for PPP Loan Forgiveness with Scratch Applications

Applying for PPP loan forgiveness with limited or “scratch” accounting records presents unique challenges. The SBA’s focus remains on verifying eligible expenses, regardless of the applicant’s record-keeping practices. However, the process becomes significantly more complex and requires meticulous documentation to substantiate claims.

Documentation Requirements for Scratch Applications

Applicants using a “scratch” application, meaning they lack comprehensive and organized financial records, must provide alternative documentation to support their forgiveness request. This typically involves gathering primary source documents directly related to expenses. Examples include bank statements showing payments to vendors, invoices from suppliers, payroll records (even handwritten ones if meticulously maintained), and contracts for services rendered. The more comprehensive and detailed this documentation, the higher the chance of forgiveness. Incomplete or missing documentation will significantly hinder the process and likely lead to a rejection. The burden of proof rests squarely on the applicant to demonstrate eligibility.

Comparison of Eligibility Criteria: Scratch vs. Established Records

The core eligibility criteria for PPP loan forgiveness remain consistent regardless of the applicant’s accounting system. However, the *proof* of eligibility differs substantially. Businesses with established accounting systems can easily provide financial statements, tax returns, and payroll reports to support their claims. “Scratch” applicants, on the other hand, must meticulously compile primary source documents, potentially spending considerable time and effort reconstructing their financial picture. This increases the risk of errors and omissions, which can negatively impact the forgiveness application. The SBA will assess the completeness and accuracy of the provided documentation, regardless of its format.

Examples of Accepted and Rejected Scratch Applications

A “scratch” application might be accepted if the applicant meticulously documents all eligible expenses with supporting documentation such as original bank statements showing payments for eligible payroll, rent, utilities, and other approved costs. For example, a sole proprietor who kept detailed handwritten records of all business expenses, supported by invoices and bank statements, might have a successful application. Conversely, a business that cannot provide sufficient documentation to support its claims, such as a business that only has vague expense estimations or lacks any supporting evidence for payroll, would likely face rejection. The SBA’s review process prioritizes the substantiation of claimed expenses, not the sophistication of the accounting system.

PPP Loan Forgiveness: Scratch vs. Established Records, Scratch ppp loan forgiveness

| Criterion | “Scratch” Application | Established Records | Differences |

|---|---|---|---|

| Expense Documentation | Requires primary source documents (bank statements, invoices, etc.) | Uses financial statements, tax returns, payroll reports | Significant difference in ease of documentation and verification. |

| Payroll Verification | Requires detailed payroll records, potentially handwritten | Uses readily available payroll reports and tax filings | “Scratch” applications require substantially more effort for payroll verification. |

| Time Investment | Substantially higher time commitment for documentation compilation | Relatively less time required for data gathering | “Scratch” applications demand significantly more time and effort. |

| Risk of Rejection | Higher risk due to potential for incomplete or inaccurate documentation | Lower risk due to readily available and organized data | Increased risk of rejection for “scratch” applications due to the challenges of documentation. |

Documenting Expenses for “Scratch” PPP Loan Forgiveness Applications

Securing PPP loan forgiveness when starting from scratch requires meticulous record-keeping. Without pre-existing accounting systems, building a comprehensive expense tracking system is crucial for a successful application. This involves not only accurately documenting expenses but also organizing them in a manner that readily satisfies the SBA’s auditing requirements.

Accurate documentation is paramount for demonstrating compliance with PPP loan forgiveness eligibility criteria. The SBA scrutinizes applications rigorously, and insufficient or disorganized records can lead to application denial or delays. A well-structured system helps streamline the forgiveness process and increases the chances of a favorable outcome. This necessitates a proactive approach to record-keeping from the moment funds are received.

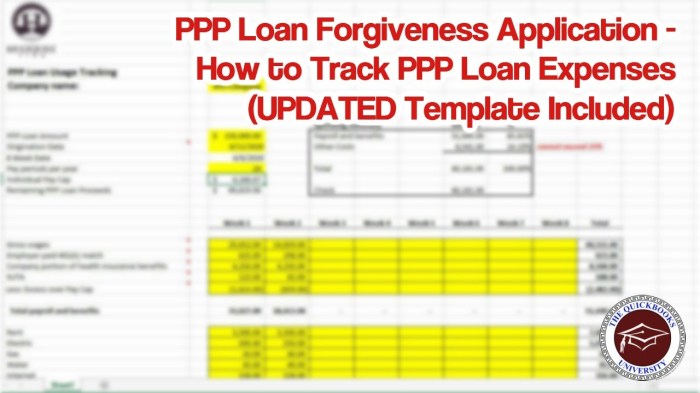

Expense Tracking System for Scratch Applicants

A simple yet effective expense tracking system for “scratch” applicants should include a dedicated spreadsheet or accounting software. This system should categorize expenses according to the eligible categories defined by the SBA (payroll costs, rent, utilities, and mortgage interest). Each expense entry should include the date, description, amount, and supporting documentation reference. For example, a column for “Payroll” might list employee names, pay periods, and the corresponding payroll documentation. A “Rent” column would list rent payments with lease agreement references. This detailed approach ensures clear traceability and simplifies the audit process.

Importance of Detailed Records for Audit Purposes

Maintaining detailed records is not merely a best practice; it’s a necessity for successful PPP loan forgiveness. The SBA may request supporting documentation for any expense claimed. Having readily available and organized records significantly reduces the time and effort required to respond to such requests. Incomplete or inaccurate records can lead to delays, denials, or even legal repercussions. The goal is to create a clear audit trail, demonstrating the proper use of PPP funds. This proactive approach minimizes the risk of complications during the audit process.

Challenges in Documenting Expenses Without Pre-existing Records and Solutions

One major challenge in documenting expenses from scratch is the lack of a pre-established system. This often leads to disorganized receipts and inconsistent record-keeping. Solutions include immediately implementing a structured system upon receiving PPP funds, using readily available tools like spreadsheets or free accounting software, and meticulously collecting and organizing all receipts and bank statements. For payroll, maintaining accurate payroll records from the outset is crucial. If digital record-keeping isn’t feasible, a well-organized filing system with clearly labeled folders can suffice. Regularly reviewing and updating the records is key to ensuring accuracy and consistency.

Essential Documents for a “Scratch” PPP Loan Forgiveness Application

Proper documentation is the cornerstone of a successful application. The following documents are essential for supporting a “scratch” application:

The importance of these documents cannot be overstated. They provide the necessary evidence to substantiate the expenses claimed and demonstrate compliance with PPP loan forgiveness requirements.

- Bank statements showing PPP loan disbursement and expense payments.

- Payroll records including pay stubs, tax forms (W-2s, 1099s), and payroll processing documentation.

- Lease agreements or mortgage statements to verify rent or mortgage interest payments.

- Utility bills (electricity, gas, water, internet).

- Receipts for eligible expenses, meticulously organized and dated.

- A completed PPP loan forgiveness application form.

- Schedule of expenses clearly categorized according to SBA guidelines.

Impact of “Scratch” Applications on Forgiveness Calculations

Submitting a PPP loan forgiveness application with limited or incomplete financial records, often termed a “scratch” application, significantly impacts the forgiveness calculation process. The accuracy and completeness of your documentation directly influence the amount of loan forgiveness you receive. This section details the challenges and strategies associated with calculating forgiveness using estimated expenses.

Challenges of Incomplete Records in Forgiveness Calculations

Incomplete or inaccurate records present considerable hurdles in determining eligible expenses. The SBA requires detailed documentation to verify that funds were used for eligible purposes (payroll, rent, utilities, etc.), and a lack of this documentation makes it difficult to substantiate your claims. This can lead to a reduced forgiveness amount or even a denial of forgiveness. For example, if you only have a general idea of your payroll costs and lack precise records of employee wages, taxes, and benefits, the SBA may only partially forgive the loan portion attributable to payroll, or potentially not forgive that portion at all. Similarly, if you cannot provide receipts or bank statements for rent and utilities, these expenses might be excluded from the forgiveness calculation. The consequence is a significantly smaller loan forgiveness amount than anticipated.

Comparison of Forgiveness Calculations: “Scratch” vs. Established Accounting

Applications based on established accounting practices, where meticulous records are kept, offer a smoother forgiveness process. These applications typically involve straightforward calculations based on documented expenses. In contrast, “scratch” applications necessitate estimations and approximations, introducing a higher degree of uncertainty and potential for discrepancies. The SBA’s review process for “scratch” applications will be more rigorous, demanding thorough justification for all claimed expenses. A well-maintained accounting system provides clear evidence supporting the forgiveness request, while “scratch” applications rely heavily on the applicant’s credibility and ability to reconstruct financial information. This difference can lead to longer processing times and increased scrutiny.

Examples Illustrating Documentation Impact on Forgiveness Amounts

Consider two businesses, both applying for PPP loan forgiveness:

Business A: Maintains detailed financial records. They submit an application with supporting documentation for payroll costs of $50,000, rent of $10,000, and utilities of $5,000. Their forgiveness amount is calculated based on these verifiable figures.

Business B: Uses a “scratch” application. They estimate payroll costs at $50,000, but lack detailed records. They estimate rent and utilities at $15,000, with limited documentation. The SBA may only partially forgive the payroll portion, potentially reducing the forgiveness amount significantly, and may reject the rent and utility claims altogether due to lack of supporting documentation. This results in a substantially lower forgiveness amount than Business A.

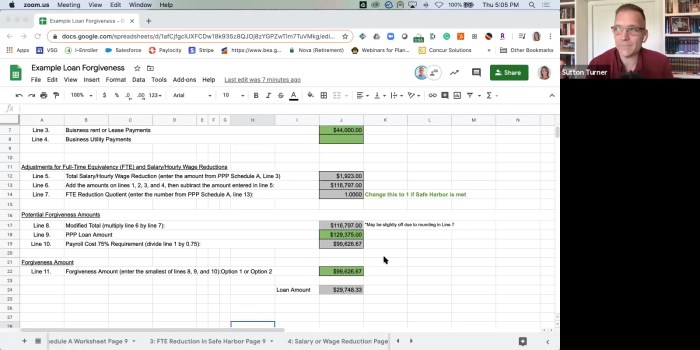

Calculating Forgiveness with Estimated Expenses

Calculating forgiveness with limited financial information requires a methodical approach. You must diligently gather any available documentation, even if incomplete, and clearly explain any estimations made. Justifications should be based on reasonable assumptions and supported by available data. For example, if you lack detailed payroll records, you might use bank statements to estimate payroll costs. Similarly, if you don’t have receipts for utilities, you could provide your utility bills showing average monthly expenses. It is crucial to be transparent about any estimations and clearly document the methodology used.

Step-by-Step Guide for Calculating Forgiveness with Limited Information

Calculating forgiveness with limited information requires a systematic approach. Here’s a step-by-step guide:

- Gather all available financial records: This includes bank statements, invoices, receipts, payroll records (even partial ones), and any other relevant documentation.

- Estimate eligible expenses: Based on the available data, estimate your payroll costs, rent, utilities, and other eligible expenses. Clearly document the basis for each estimate.

- Determine the forgiveness calculation: Use the SBA’s forgiveness calculation formula, substituting your estimated expenses where necessary.

- Prepare supporting documentation: Create a comprehensive narrative explaining your estimations and providing any available supporting documentation. This narrative should clearly justify your estimates and address any potential discrepancies.

- Submit your application: Submit your application with all supporting documentation and your narrative explanation. Be prepared for a more thorough review by the SBA.

Strategies for Successful “Scratch” PPP Loan Forgiveness Applications: Scratch Ppp Loan Forgiveness

Securing PPP loan forgiveness when lacking comprehensive financial records presents significant challenges. However, proactive strategies and meticulous record-keeping can significantly improve the chances of a successful application, even with limited documentation. This section Artikels key approaches for navigating this complex process.

Maximizing Forgiveness Chances with Limited Records

Applicants with “scratch” applications must leverage every available resource to demonstrate compliance with PPP loan forgiveness requirements. This involves meticulously reconstructing financial data using alternative sources, such as bank statements, invoices from vendors, and client payment records. Careful analysis of these documents, coupled with detailed explanations of business activities, can paint a clearer picture of expenses eligible for forgiveness. Prioritizing the documentation of payroll costs is crucial, as they represent the largest portion of forgivable expenses. Supporting evidence should be organized chronologically and clearly linked to the specific expenses claimed. Where possible, use multiple sources to corroborate expenses. For instance, a bank statement showing a payment to a vendor should be accompanied by an invoice from the vendor to provide complete verification.

Importance of Consulting Financial Professionals

Navigating the complexities of PPP loan forgiveness, particularly with limited documentation, necessitates professional guidance. Financial advisors specializing in small business accounting and loan forgiveness can provide invaluable support. They possess the expertise to interpret SBA guidelines, identify eligible expenses, and strategically present the available financial information to maximize the chances of forgiveness. These professionals can also assist in reconstructing financial records, identify potential discrepancies, and ensure compliance with all regulatory requirements. The cost of professional consultation can be viewed as an investment in securing loan forgiveness and avoiding potential penalties.

Gathering and Organizing Financial Information from Alternative Sources

When primary financial records are incomplete or unavailable, alternative sources become critical. This might include personal bank statements reflecting business transactions, client communication records documenting services rendered and payments received, and even handwritten notes or spreadsheets tracking income and expenses. It’s vital to gather all potentially relevant documents, even if they seem insignificant initially. Organizing this information chronologically and categorizing it by expense type (payroll, rent, utilities, etc.) is essential for clear presentation to the SBA. Creating a comprehensive spreadsheet summarizing all gathered information can streamline the process and aid in identifying any gaps in documentation.

Common Mistakes in “Scratch” Applications and How to Avoid Them

A frequent mistake is failing to adequately explain the absence of traditional financial records. Simply stating that records are missing is insufficient. Applicants must provide a clear and plausible explanation for the lack of documentation, perhaps citing a natural disaster, theft, or a system failure. Another common error is neglecting to meticulously document all eligible expenses. Every expense claimed must be supported by credible evidence, even if that evidence is pieced together from multiple sources. Finally, failing to accurately calculate the forgivable amount based on SBA guidelines can lead to application rejection. Carefully review the eligibility criteria and ensure all calculations are accurate and properly documented.

Checklist of Actions Before Submitting a “Scratch” Application

Before submitting a “scratch” PPP loan forgiveness application, it’s crucial to undertake the following steps:

- Thoroughly gather all available financial records, regardless of format.

- Organize the gathered information chronologically and by expense type.

- Reconstruct missing financial data using alternative sources, such as bank statements and client communications.

- Consult with a financial professional to review the documentation and ensure accuracy and compliance.

- Prepare a comprehensive narrative explaining any gaps in financial records.

- Carefully calculate the forgivable amount based on SBA guidelines and supporting documentation.

- Review the application thoroughly for completeness and accuracy before submission.

Illustrative Examples of “Scratch” PPP Loan Forgiveness Scenarios

Understanding the nuances of “scratch” PPP loan forgiveness applications requires examining both successful and unsuccessful scenarios. These examples illustrate the critical factors influencing forgiveness outcomes and highlight the importance of meticulous record-keeping.

Successful “Scratch” Application Scenario: A thriving bakery, “Sweet Surrender,” meticulously documented all eligible expenses using a dedicated accounting system. They maintained detailed records of payroll, rent, utilities, and supplier invoices, all clearly tied to their PPP loan funds. Their application was straightforward, complete, and accurately reflected their eligible expenses. The SBA easily verified their claims, resulting in full loan forgiveness. The key to their success was proactive and organized record-keeping, ensuring compliance with all SBA guidelines.

Unsuccessful “Scratch” Application Scenario: “The Rusty Wrench,” a small auto repair shop, attempted a “scratch” application with insufficient documentation. While they claimed eligible expenses, they lacked supporting documentation for a significant portion of their claimed payroll. They failed to maintain separate bank accounts for PPP funds, commingling them with personal funds. Furthermore, their expense records were disorganized and lacked crucial details like dates and vendor information. As a result, the SBA could not verify their claims, leading to a denial of forgiveness and requiring repayment of the loan. The primary reason for their failure was a lack of proper record-keeping and failure to adhere to SBA guidelines regarding fund segregation.

Hypothetical Business Using a “Scratch” Application: “Cozy Corner Cafe,” a small coffee shop, received a $20,000 PPP loan. Their eligible expenses included $8,000 in payroll, $3,000 in rent, $2,000 in utilities, and $1,000 in supplier costs for coffee beans and other supplies. They allocated the remaining funds to cover other essential operating expenses. They used a simple spreadsheet to track expenses, ensuring each entry included the date, vendor, description, and amount. Their application included a detailed narrative explaining how the funds were used to support their business operations during the pandemic. This detailed approach, though simple, provided the necessary transparency for successful application processing.

Documentation Used to Support “Cozy Corner Cafe’s” Application: “Cozy Corner Cafe” supported their application with the following documentation:

Payroll records: Detailed payroll registers showing employee names, wages, dates of payment, and a breakdown of salary, benefits, and other compensation.

Lease agreement: A copy of their lease agreement clearly showing the monthly rent amount and payment schedule.

Utility bills: Copies of utility bills (electricity, water, gas) demonstrating payments made during the covered period.

Supplier invoices: Invoices from their coffee bean supplier and other vendors detailing purchases made during the covered period.

Bank statements: Bank statements showing the deposit of PPP funds and the disbursement of funds for eligible expenses. These statements demonstrated a clear and direct link between the PPP funds and the eligible expenses.

Narrative explanation: A detailed narrative explaining how the PPP funds were used to maintain payroll and cover essential business expenses, ensuring compliance with SBA guidelines.

The meticulous documentation allowed “Cozy Corner Cafe” to provide clear evidence supporting their expenses, significantly increasing their chances of loan forgiveness.

End of Discussion

Successfully navigating the scratch PPP loan forgiveness process requires careful planning, meticulous record-keeping, and a proactive approach. While the absence of established accounting records presents challenges, strategic planning and the utilization of alternative documentation methods can significantly improve your chances of securing forgiveness. Remember, seeking professional guidance can prove invaluable in ensuring a successful application and avoiding common pitfalls.

FAQ Guide

Can I still apply for PPP loan forgiveness if I don’t have formal accounting records?

Yes, but it requires more effort in documenting expenses. You’ll need to reconstruct your financial records using bank statements, invoices, receipts, and other supporting documents.

What if I can’t find all my receipts?

While complete records are ideal, you can still use other evidence like bank statements showing payments to support your expenses. Clearly explain any gaps in your documentation.

How long does the scratch PPP loan forgiveness process take?

The processing time varies, but expect it to take longer than applications with established records. Thorough documentation is key to speeding up the process.

What happens if my application is rejected?

You may be able to appeal the decision, providing additional documentation to support your claims. It’s advisable to consult with a financial professional to understand your options.