21st mortgage loan application processes have been revolutionized by technology, offering streamlined efficiency and increased accessibility. This guide delves into the intricacies of securing a mortgage in the modern era, covering everything from the initial application to the final approval, highlighting the role of technology, credit scoring, and consumer protection.

We’ll explore the various loan products available, compare traditional methods with modern digital processes, and discuss the security measures in place to safeguard sensitive data. Understanding these aspects is crucial for navigating the complexities of securing a home loan in today’s dynamic market.

The Application Process

Securing a mortgage loan in the 21st century involves a streamlined yet rigorous process, leveraging technology to expedite the application while maintaining stringent underwriting standards. The entire journey, from initial inquiry to final loan approval, demands careful preparation and attention to detail. Understanding each step is crucial for a smooth and successful application.

The application process typically unfolds in several key stages, each building upon the previous one. A clear understanding of these stages empowers applicants to proactively manage their application and address any potential challenges promptly.

Steps in the 21st-Century Mortgage Loan Application Process

The following steps Artikel a typical mortgage application journey. While variations exist depending on the lender and the specific loan program, this provides a general framework.

- Initial Contact and Pre-Approval: This involves contacting a lender, discussing your financial situation and loan goals, and potentially obtaining a pre-approval letter, which strengthens your offer when making an offer on a property.

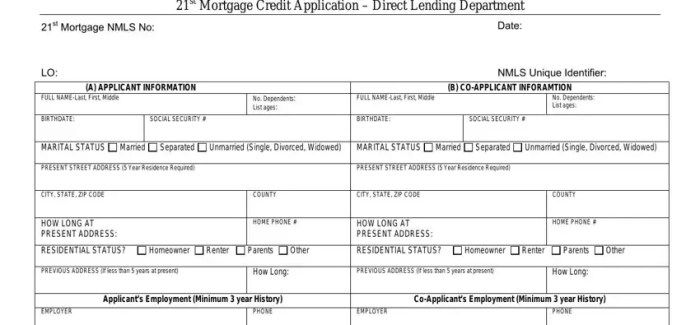

- Formal Application Submission: Once you’ve found a property, you’ll submit a formal application, providing detailed personal and financial information.

- Credit and Background Check: The lender will conduct a thorough credit check and verify your employment history, income, and assets.

- Property Appraisal: An independent appraiser will assess the value of the property to ensure it aligns with the loan amount.

- Loan Underwriting: The lender’s underwriters will review all documentation to assess your risk and determine loan eligibility.

- Closing and Funding: Once approved, you’ll proceed to closing, signing all necessary documents, and receiving the loan funds.

Required Documentation for a 21st-Century Mortgage Loan Application

Gathering the necessary documentation is a crucial step in the application process. Thorough preparation minimizes delays and increases the likelihood of a smooth and efficient approval.

| Category | Specific Document | Purpose | Example |

|---|---|---|---|

| Personal Identification | Driver’s License or Passport | Verify identity | A valid, unexpired driver’s license issued by a state or territory. |

| Income Verification | Pay stubs (last two months), W-2 forms (last two years), tax returns (last two years) | Demonstrate consistent income | Recent pay stubs showing regular income deposits. |

| Asset Documentation | Bank statements (last two months), investment account statements | Prove sufficient funds for down payment and closing costs | Bank statements showing sufficient funds for a down payment and closing costs. |

| Employment History | Letters of employment | Verify employment stability | A letter from your employer confirming your employment history, salary, and position. |

The Role of Technology in Streamlining the 21st-Century Mortgage Loan Application Process

Technology has significantly transformed the mortgage application process, accelerating timelines and enhancing efficiency. Digital tools and platforms have replaced many manual processes, resulting in a more streamlined and user-friendly experience.

For example, online portals allow applicants to submit documents electronically, track their application status in real-time, and communicate directly with their loan officer. Automated underwriting systems leverage sophisticated algorithms to analyze applicant data, speeding up the approval process. Digital signatures and e-closing capabilities further reduce paperwork and accelerate the closing process. These technological advancements have made the mortgage application process significantly faster and more convenient for both borrowers and lenders.

Technological Advancements

The 21st-century mortgage application process has undergone a dramatic transformation, shifting from primarily paper-based systems to largely digital platforms. This evolution has significantly impacted efficiency, accessibility, and security. This section will explore the key technological advancements that have reshaped the mortgage landscape.

The shift to digital mortgage applications has streamlined the process considerably, offering borrowers and lenders alike numerous advantages. This modernization involves not only the submission of documents but also the entire workflow, from initial application to loan closing.

Traditional vs. Modern Mortgage Application Methods

The contrast between traditional and modern mortgage application methods is stark. Traditional methods were heavily reliant on physical paperwork, requiring numerous in-person visits, extensive manual data entry, and a significantly longer processing time. Modern digital processes, in contrast, leverage technology to automate many steps, reducing processing times and improving efficiency.

- Traditional Methods: Paper applications, manual document review, physical mail exchanges, in-person meetings, slower processing times, higher risk of errors and lost documents.

- Modern Methods: Online applications, electronic document submission, automated data validation, digital signatures, faster processing times, reduced risk of errors, improved data security.

Impact of Online Portals and Mobile Apps, 21st mortgage loan application

Online portals and mobile apps have revolutionized the mortgage application experience, offering unparalleled convenience and accessibility. Borrowers can now apply for a mortgage from anywhere with an internet connection, track their application’s progress in real-time, and communicate directly with their lender through secure messaging systems. These platforms also often incorporate features such as automated document upload, credit score checks, and affordability calculators, simplifying the application process and empowering borrowers with greater control. For example, Rocket Mortgage’s online platform allows users to complete the entire application process digitally, receiving a decision within minutes in some cases.

Security Measures in 21st-Century Mortgage Applications

Protecting sensitive borrower data is paramount in the digital mortgage application process. Robust security measures are employed to safeguard information from unauthorized access and cyber threats. These measures typically include encryption of data both in transit and at rest, multi-factor authentication to verify user identities, regular security audits and penetration testing to identify vulnerabilities, and compliance with industry standards such as PCI DSS and HIPAA. Furthermore, many lenders utilize advanced fraud detection systems to identify and prevent fraudulent applications. For instance, biometric authentication, such as fingerprint or facial recognition, is increasingly being adopted to enhance security. The use of blockchain technology is also emerging as a potential solution to enhance data security and transparency in the mortgage process.

Credit Scoring and Underwriting

Securing a mortgage loan in the 21st century involves a rigorous process that assesses both the applicant’s creditworthiness and the risk associated with the loan itself. This assessment relies heavily on sophisticated credit scoring models and comprehensive underwriting criteria, often augmented by advanced data analytics.

Credit scoring models are mathematical algorithms that assign a numerical score reflecting an individual’s credit risk. Lenders use these scores to quickly evaluate the likelihood of loan repayment. The higher the score, the lower the perceived risk, and consequently, often the better the interest rate offered.

Credit Scoring Models in Mortgage Lending

The most prevalent credit scoring model in the United States is the FICO score, developed by the Fair Isaac Corporation. FICO scores range from 300 to 850, with higher scores indicating better credit history. Several variations of the FICO score exist, each tailored to specific lending purposes. These models consider various factors, including payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). Beyond FICO, VantageScore is another widely used credit scoring model, offering a similar scoring range and incorporating slightly different weighting of credit factors. Both models continuously evolve to reflect changing consumer behavior and lending practices. For example, recent adjustments account for the increasing use of alternative data sources like rent payments and utility bills in credit assessments.

Underwriting Criteria for Mortgage Loans

Underwriting goes beyond simply reviewing a credit score; it involves a holistic evaluation of the applicant’s financial capacity to repay the loan. Several key factors are considered. These are summarized in the table below:

| Criterion | Description | Data Source | Impact on Loan Approval |

|---|---|---|---|

| Credit Score | Numerical representation of creditworthiness. | Credit bureaus (e.g., Experian, Equifax, TransUnion) | Significant; higher scores generally lead to better terms. |

| Debt-to-Income Ratio (DTI) | Ratio of monthly debt payments to gross monthly income. | Applicant’s financial statements, pay stubs | Crucial; lower DTI ratios indicate greater repayment capacity. |

| Income Verification | Documentation of employment history and income stability. | Pay stubs, W-2 forms, tax returns | Essential for demonstrating repayment ability. |

| Appraisal Value | Professional assessment of the property’s market value. | Independent appraiser | Determines loan-to-value (LTV) ratio, impacting loan approval and terms. |

| Loan-to-Value (LTV) Ratio | Ratio of the loan amount to the appraised value of the property. | Loan amount and appraisal value | Impacts eligibility and may require private mortgage insurance (PMI) if above a certain threshold. |

| Down Payment | Initial payment made towards the purchase price. | Bank statements, gift letters (if applicable) | Larger down payments often result in better loan terms and reduce risk for lenders. |

Data Analytics in Mortgage Risk Evaluation

Lenders increasingly leverage data analytics to refine their risk assessment. This involves using sophisticated statistical techniques and machine learning algorithms to analyze vast datasets, identifying patterns and predicting potential risks more accurately than traditional methods. For instance, lenders might use predictive modeling to identify applicants who are likely to default, enabling them to adjust lending criteria or offer alternative loan products. Furthermore, data analytics can help detect fraud, assess the impact of macroeconomic factors on loan performance, and optimize pricing strategies. For example, a lender might use historical data on loan defaults to build a model that predicts the likelihood of default based on factors such as credit score, DTI, and property location. This model can then be used to adjust interest rates or loan terms to reflect the assessed risk. This data-driven approach allows lenders to make more informed decisions, reduce risks, and improve overall efficiency.

Loan Products and Options

Navigating the diverse landscape of 21st-century mortgage loan products can be challenging. Understanding the nuances of each option is crucial for borrowers to make informed decisions aligned with their financial goals and risk tolerance. This section Artikels various loan types and their key features to facilitate a more informed choice.

The modern mortgage market offers a wide array of loan products, each designed to cater to specific borrower needs and circumstances. The selection process should involve careful consideration of factors such as interest rates, loan terms, down payment requirements, and long-term financial implications.

Types of Mortgage Loan Products

Several distinct mortgage loan products are commonly available. Each possesses unique characteristics impacting affordability and long-term financial obligations. Understanding these differences is key to selecting the most suitable option.

- Fixed-Rate Mortgages: These loans offer a consistent interest rate throughout the loan term, providing predictable monthly payments. This predictability makes budgeting easier and eliminates the risk of fluctuating interest rates.

- Adjustable-Rate Mortgages (ARMs): ARMs feature an interest rate that adjusts periodically based on an index, such as the LIBOR or SOFR. While initially offering lower interest rates than fixed-rate mortgages, the potential for rate increases can lead to higher payments over time. ARMs can be attractive to borrowers who anticipate a shorter loan term or expect interest rates to remain low.

- FHA Loans: Backed by the Federal Housing Administration, FHA loans require lower down payments and credit scores than conventional loans, making homeownership more accessible to first-time buyers or those with less-than-perfect credit. However, they typically involve mortgage insurance premiums.

- VA Loans: Guaranteed by the Department of Veterans Affairs, VA loans offer competitive interest rates and often require no down payment for eligible veterans and active-duty military personnel. These loans are designed to support those who have served in the armed forces.

- USDA Loans: These loans, backed by the U.S. Department of Agriculture, are designed to assist rural homebuyers. They often require no down payment and offer favorable interest rates. Eligibility depends on location and income limitations.

- Jumbo Loans: Jumbo loans exceed the conforming loan limits set by Fannie Mae and Freddie Mac. These loans typically require higher credit scores and larger down payments, but they provide financing options for more expensive properties.

Mortgage Loan Comparison

A direct comparison of key features across different mortgage types helps illustrate the trade-offs involved in each option. This allows borrowers to weigh the advantages and disadvantages of various loan structures based on their individual circumstances.

| Loan Type | Interest Rate | Down Payment | Credit Score Requirements |

|---|---|---|---|

| Fixed-Rate | Fixed throughout loan term | Varies (typically 3-20%) | Varies (generally higher for lower down payments) |

| ARM | Adjusts periodically | Varies | Varies |

| FHA | Varies | As low as 3.5% | Lower than conventional loans |

| VA | Varies | Often 0% | Varies, but generally more lenient than conventional loans |

Factors Influencing Mortgage Loan Product Selection

The choice of a mortgage loan product is a multifaceted decision influenced by several interconnected factors. Careful consideration of these aspects ensures alignment with individual financial goals and long-term stability.

Borrowers should consider their credit score, down payment capacity, desired loan term, risk tolerance, and long-term financial projections. For instance, a borrower with a high credit score and a substantial down payment might opt for a fixed-rate mortgage for its stability. Conversely, a borrower with a lower credit score and limited savings might explore FHA or VA loan options. Understanding the potential impact of interest rate fluctuations is also crucial, particularly when considering ARMs. Furthermore, factors such as anticipated income changes, potential future home value appreciation, and personal financial goals all contribute to the overall decision-making process. A comprehensive financial plan often serves as a foundation for selecting the most appropriate mortgage loan product.

Consumer Protection and Regulations

The 21st-century mortgage landscape is heavily regulated to protect consumers from predatory lending practices and ensure fair and transparent transactions. A complex web of federal and state laws governs every stage of the mortgage application process, from initial disclosure to loan servicing. Understanding these regulations is crucial for both borrowers and lenders to navigate the system effectively and ethically.

The primary goal of these regulations is to empower consumers with the information they need to make informed decisions about their mortgages. This includes clear and concise disclosures about loan terms, fees, and potential risks. Simultaneously, these laws aim to deter lenders from engaging in deceptive or exploitative practices that could financially harm borrowers.

Key Regulations Governing Mortgage Loan Applications

Several key pieces of legislation significantly impact 21st-century mortgage loan applications. The Real Estate Settlement Procedures Act (RESPA) mandates specific disclosures regarding closing costs and prohibits kickbacks and referral fees. The Truth in Lending Act (TILA) requires lenders to clearly disclose the annual percentage rate (APR) and other loan terms, allowing borrowers to compare offers effectively. The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in response to the 2008 financial crisis, established the Consumer Financial Protection Bureau (CFPB) and strengthened consumer protections within the mortgage industry. This act introduced stricter regulations on mortgage origination and servicing, aiming to prevent the recurrence of widespread foreclosures and financial instability. State-level regulations also vary, often adding further layers of protection for consumers. For example, some states have stricter requirements for loan-to-value ratios or limits on prepayment penalties.

Consumer Protection Measures Against Predatory Lending

Predatory lending practices, such as deceptive marketing, excessive fees, and abusive loan terms, are actively combatted through a combination of regulatory oversight and consumer education. The CFPB plays a central role in monitoring lenders for compliance with federal regulations and investigating complaints from consumers. The agency has the authority to impose significant penalties on lenders found to have engaged in predatory lending. Furthermore, the increased transparency requirements imposed by laws like RESPA and TILA empower consumers to identify and avoid potentially predatory loans by carefully comparing offers and understanding the terms before committing. Consumer education initiatives, often provided by non-profit organizations and government agencies, play a critical role in equipping borrowers with the knowledge necessary to navigate the mortgage process safely and effectively. These initiatives often cover topics like understanding APR, identifying hidden fees, and recognizing the signs of predatory lending.

Resources for Consumers Seeking Assistance

Access to reliable information and support is vital for consumers navigating the complexities of mortgage loan applications. Several resources are available to assist borrowers:

- The Consumer Financial Protection Bureau (CFPB): The CFPB website provides comprehensive information on mortgage regulations, consumer rights, and complaint filing procedures. They offer resources in multiple languages and formats.

- The Department of Housing and Urban Development (HUD): HUD offers various programs and resources aimed at assisting homebuyers, including counseling services and educational materials.

- Non-profit Housing Counseling Agencies: Numerous non-profit organizations provide free or low-cost housing counseling services, offering guidance on the mortgage application process, financial literacy, and avoiding predatory lending.

- State Attorney General’s Offices: State attorneys general often have consumer protection divisions that investigate complaints related to predatory lending and can provide assistance to consumers.

The Future of Mortgage Applications

The mortgage application process, traditionally a paper-intensive and time-consuming endeavor, is undergoing a rapid transformation driven by technological advancements. The integration of artificial intelligence (AI), machine learning (ML), and other innovative technologies promises to streamline the process, improve accuracy, and enhance the overall borrower experience. This section explores the likely trajectory of mortgage applications in the coming years, focusing on the impact of these technological innovations and the challenges and opportunities they present.

The convergence of AI and ML is poised to revolutionize various aspects of the mortgage application process. AI-powered systems can automate tasks like data entry, document verification, and risk assessment, significantly reducing processing times and human error. ML algorithms can analyze vast datasets to identify patterns and predict borrower behavior, leading to more accurate credit scoring and improved underwriting decisions. For instance, companies like Blend and Roostify are already leveraging AI and ML to automate parts of the mortgage process, providing faster approvals and a smoother experience for borrowers. These technologies can also personalize the application process, tailoring it to individual borrower needs and preferences.

Artificial Intelligence and Machine Learning in Mortgage Lending

AI and ML are not merely automating existing processes; they are fundamentally changing how mortgage lenders operate. AI-powered chatbots can provide instant answers to borrower inquiries, improving customer service and reducing the burden on human agents. ML algorithms can analyze alternative data sources, such as bank transaction data and social media activity, to create a more comprehensive picture of a borrower’s creditworthiness, potentially expanding access to credit for underserved populations. Furthermore, AI can detect and prevent fraud, protecting both lenders and borrowers from financial losses. Consider the example of a lender using AI to flag applications with inconsistencies or red flags, leading to early detection of potentially fraudulent activity. This proactive approach minimizes financial risk and safeguards the lender’s assets.

Challenges and Opportunities in the Mortgage Industry

The integration of new technologies presents both challenges and opportunities for the mortgage industry. Successfully navigating this landscape requires careful planning and strategic investment.

The following points highlight some key aspects:

- Data Security and Privacy: The increased reliance on data necessitates robust security measures to protect sensitive borrower information from cyber threats. Implementing advanced encryption and data governance policies is crucial.

- Regulatory Compliance: Staying compliant with evolving regulations related to data privacy and lending practices is paramount. Lenders need to invest in systems and processes that ensure compliance.

- Technological Infrastructure: Upgrading existing technological infrastructure to accommodate new AI and ML tools requires significant investment. Lenders need to assess their current capabilities and plan for future upgrades.

- Workforce Adaptation: The automation of certain tasks may lead to workforce displacement. Lenders need to invest in retraining and upskilling programs to prepare their employees for new roles.

- Algorithmic Bias: AI algorithms are trained on data, and if that data reflects existing biases, the algorithms may perpetuate those biases. Mitigating algorithmic bias is crucial to ensure fair and equitable lending practices. Careful selection and monitoring of training data are essential to minimize this risk.

- Increased Competition: The adoption of AI and ML will likely intensify competition within the mortgage industry. Lenders who fail to adapt to these technological advancements may find themselves at a disadvantage.

- Enhanced Customer Experience: AI-powered tools can create a more personalized and efficient application process, leading to improved customer satisfaction and loyalty.

- Improved Risk Management: AI and ML can enhance risk assessment capabilities, allowing lenders to make more informed decisions and reduce the risk of loan defaults.

Final Wrap-Up

Securing a 21st-century mortgage involves navigating a complex but increasingly accessible system. By understanding the application process, technological advancements, credit scoring, and available loan products, prospective homeowners can confidently pursue their dream of homeownership. Staying informed about consumer protections and industry trends will empower you to make informed decisions and secure the best possible financing options.

Common Queries: 21st Mortgage Loan Application

What is the average processing time for a 21st-century mortgage application?

Processing times vary depending on lender and applicant factors, but generally range from 30 to 60 days.

How can I improve my credit score before applying for a mortgage?

Pay down existing debts, maintain consistent on-time payments, and avoid opening new credit accounts unnecessarily.

What happens if my mortgage application is denied?

Lenders usually provide an explanation. Review your credit report, address any issues, and reapply later if eligible.

Are there any government programs to assist with mortgage applications?

Yes, several government-backed programs offer assistance, such as FHA loans and VA loans. Research options based on your eligibility.