Americash Loans Greenville SC offers a range of financial solutions for residents needing quick access to funds. Understanding their services, loan products, and the application process is crucial before considering a loan. This guide explores Americash Loans’ offerings in Greenville, SC, comparing them to competitors and examining customer experiences to help you make an informed decision. We’ll delve into loan types, interest rates, eligibility requirements, and the overall borrowing experience, providing a comprehensive overview to empower your financial choices.

From payday loans to installment loans, Americash Loans caters to various financial needs. We’ll analyze the terms and conditions, highlighting key differences and potential benefits or drawbacks. This detailed look at Americash Loans in Greenville, SC will equip you with the knowledge to navigate the borrowing process confidently and responsibly.

Americash Loans Greenville SC

Americash Loans operates a branch in Greenville, South Carolina, providing short-term financial solutions to residents. This branch, like others in the Americash Loans network, offers a range of financial products designed to meet immediate financial needs. Understanding the specifics of their services, history in Greenville, and customer service approach is crucial for potential borrowers.

Americash Loans Services in Greenville, SC

Americash Loans Greenville likely offers a suite of short-term lending products typical of its other locations. These generally include payday loans, installment loans, and potentially other financial services such as check cashing or prepaid debit cards. Payday loans are small, short-term loans repaid on the borrower’s next payday, while installment loans are repaid in smaller, more manageable installments over a longer period. The specific terms and conditions, including interest rates and fees, will vary depending on the loan type and the borrower’s individual circumstances. It is important to note that interest rates on short-term loans can be significantly higher than those on traditional bank loans. Information on precise offerings should be obtained directly from the Greenville branch.

History and Background of Americash Loans in Greenville, SC

Precise details regarding the establishment date and initial growth of the Americash Loans Greenville branch are not readily available through publicly accessible information. However, Americash Loans’ overall history can provide context. The company, as a national lender, likely expanded into Greenville as part of a broader strategic plan to serve a wider geographic area and customer base. The specific reasons for choosing Greenville as a location likely involved factors such as population density, economic conditions, and competitive landscape within the local lending market. Further research into local business records might reveal more precise details on the Greenville branch’s history.

Americash Loans Customer Service Policies and Procedures

Americash Loans likely adheres to standard customer service practices, aiming to provide clear and concise information about their products and services. Their policies probably include provisions for addressing customer complaints and disputes, potentially through a formal complaint process. This process may involve contacting customer service representatives either by phone, email, or in person at the Greenville branch. While specific procedures are not publicly listed, it’s expected that they emphasize transparency and fair treatment of customers. Borrowers are advised to carefully review all loan agreements and understand the terms and conditions before signing.

Hypothetical Customer Experience Flow Chart: Loan Application Process, Americash loans greenville sc

This flowchart illustrates a simplified version of a potential loan application process at Americash Loans Greenville. Actual steps might vary.

| Step | Action |

|---|---|

| 1 | Customer visits the Greenville branch or accesses the online application. |

| 2 | Customer completes the loan application, providing necessary personal and financial information. |

| 3 | Americash Loans verifies the customer’s information and creditworthiness. |

| 4 | Loan approval or denial is communicated to the customer. |

| 5 | If approved, the loan agreement is reviewed and signed by the customer. |

| 6 | Funds are disbursed to the customer. |

| 7 | Customer makes scheduled repayments according to the loan agreement. |

Loan Products and Terms

Americash Loans in Greenville, SC, offers various financial products designed to meet diverse short-term borrowing needs. Understanding the specific terms and conditions associated with each loan type is crucial before applying. This section details the available loan products, compares their associated costs, and provides a sample amortization schedule.

Loan Product Details

Americash Loans likely provides payday loans and installment loans, though the exact offerings should be verified directly with the lender. Payday loans are typically small, short-term loans designed to be repaid on your next payday. Installment loans, conversely, are repaid over a longer period, usually in fixed monthly payments. The specific terms and conditions, including loan amounts, repayment periods, and fees, will vary depending on the applicant’s creditworthiness and state regulations.

Interest Rates and Fees

Interest rates and fees for payday loans are generally higher than those for installment loans. This reflects the higher risk associated with short-term, high-principal loans. Payday loans often involve significant fees, sometimes expressed as a percentage of the loan amount or a flat fee. Installment loans typically have lower interest rates and fees but spread the repayment over a longer period, resulting in higher overall interest paid. Precise rates and fees are determined by the lender and are subject to change. It is essential to review all loan documents carefully before signing any agreement.

Loan Terms and Conditions

The following table summarizes the potential terms and conditions for typical loan products offered by similar lenders. Remember that these are examples and may not accurately reflect Americash Loans’ current offerings. Always confirm details directly with the lender.

| Loan Type | Loan Amount | APR (Annual Percentage Rate) | Repayment Period |

|---|---|---|---|

| Payday Loan | $100 – $500 | 390% – 780% (or higher) | 2-4 weeks |

| Installment Loan | $500 – $3,000 | 36% – 360% (or higher) | 3-12 months |

*Note: APRs and fees can vary significantly based on lender, state regulations, and individual borrower circumstances. These figures are illustrative examples only.*

Sample Loan Amortization Schedule

This example shows a simplified amortization schedule for a $500 installment loan with a 12-month repayment period and a 36% APR. Actual schedules will vary depending on the loan terms.

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $500.00 | $47.96 | $15.00 | $32.96 | $467.04 |

| 2 | $467.04 | $47.96 | $14.01 | $33.95 | $433.09 |

| 3 | $433.09 | $47.96 | $12.99 | $34.97 | $398.12 |

| … | … | … | … | … | … |

| 12 | $47.96 | $47.96 | $1.44 | $46.52 | $0.00 |

*Note: This is a simplified example. Actual amortization schedules will include more precise calculations and may include additional fees.*

Eligibility and Application Process

Securing a loan from Americash Loans in Greenville, SC, involves meeting specific eligibility requirements and navigating a straightforward application process. Understanding these aspects is crucial for a successful loan application. The process is designed to be efficient, but individual circumstances can affect processing times.

Eligibility Criteria for Loan Applicants

To be eligible for a loan, applicants generally need to meet certain criteria. These may include being at least 18 years old, possessing a valid government-issued photo ID, having a verifiable income source, and providing proof of residency within the Greenville, SC area. Specific income requirements and minimum credit scores may vary depending on the loan type and amount sought. It’s always advisable to contact Americash Loans directly to confirm the most up-to-date eligibility criteria.

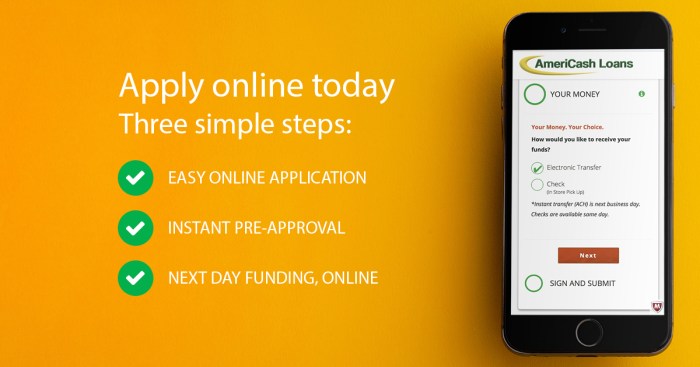

Application Process Steps and Required Documentation

The application process typically involves several steps. First, potential borrowers may complete an application either online or in person at a local branch. This application requires providing personal information, employment details, and financial information. Supporting documentation will be required to verify the information provided. This typically includes a government-issued photo ID, proof of income (pay stubs, bank statements, or tax returns), and proof of residence (utility bill or lease agreement). The lender will then review the application and supporting documentation.

Loan Application Processing Time

The processing time for loan applications can vary depending on several factors, including the completeness of the application, the volume of applications being processed, and the complexity of the applicant’s financial situation. While Americash Loans aims for efficiency, borrowers should expect a processing time ranging from a few hours to a few business days. In some cases, additional verification may be required, potentially extending the processing time.

Impact of Credit History on Loan Approval

Credit history plays a significant role in the loan approval process. A strong credit history, indicating responsible borrowing and repayment, generally increases the likelihood of loan approval and may result in more favorable loan terms, such as a lower interest rate. Conversely, a poor credit history may make it more difficult to secure a loan or may result in higher interest rates and stricter loan terms. Americash Loans, like many lenders, utilizes credit reports to assess risk and make informed lending decisions. However, even applicants with less-than-perfect credit history may still be considered for a loan, though the terms may be less favorable. It’s important to be transparent and accurate in providing credit information during the application process.

Customer Reviews and Complaints

Understanding customer feedback is crucial for any lending institution. Americash Loans, like other similar businesses, receives a range of reviews reflecting diverse experiences. Analyzing both positive and negative feedback helps identify areas for improvement and maintain customer satisfaction.

Analyzing online reviews reveals a mixed bag of experiences with Americash Loans in Greenville, SC. While some customers express satisfaction with the speed and convenience of the loan process, others voice concerns about fees and customer service.

Positive Customer Feedback

Many positive reviews highlight the speed and ease of obtaining a loan. Customers frequently mention the quick application process and the relatively fast disbursement of funds. Several comment on the helpfulness and professionalism of some staff members, describing their interactions as positive and efficient. These positive experiences often center around the convenience of accessing short-term financial assistance during emergencies.

Negative Customer Feedback

Conversely, negative reviews frequently cite high fees and interest rates as major drawbacks. Customers often express feeling misled or unprepared for the total cost of borrowing, leading to dissatisfaction. Another common complaint revolves around customer service, with some reporting difficulty reaching representatives or experiencing unhelpful interactions. Some reviews also mention difficulties navigating the loan repayment process or unclear communication regarding terms and conditions.

Categorization of Customer Complaints

The following bullet points categorize common complaints regarding Americash Loans:

* Service: Unresponsive customer service representatives, difficulty contacting the company, unhelpful or rude staff interactions.

* Fees: High interest rates, unexpected fees, unclear fee structures, feeling misled about the total cost of the loan.

* Loan Process: Lengthy or confusing application process (though many positive reviews contradict this), difficulties with repayment, lack of clear communication regarding terms and conditions.

Strategies to Address Negative Feedback

To address the negative feedback, Americash Loans could implement several strategies. Improving customer service training to emphasize empathy and clear communication would significantly mitigate complaints in this area. Providing more transparent and upfront information about all fees and interest rates, possibly with detailed examples and cost breakdowns, could reduce customer dissatisfaction related to financial expectations. Simplifying the loan application and repayment processes, perhaps through online tools and improved documentation, would enhance user experience. Proactively addressing customer concerns through follow-up communication after loan disbursement could also improve customer satisfaction and build trust. Finally, implementing a robust system for handling and responding to online reviews and complaints can demonstrate a commitment to customer satisfaction and provide opportunities for improvement.

Comparison with Competitors

Choosing a loan provider requires careful consideration of various factors. Understanding how Americash Loans stacks up against its competitors in Greenville, SC, is crucial for borrowers seeking the best financial solution. This comparison focuses on key aspects like interest rates, fees, and loan terms to help potential borrowers make informed decisions.

Americash Loans Compared to Other Greenville Lenders

A direct comparison of Americash Loans with other lenders in Greenville, SC, requires specific data which is often not publicly available. Interest rates and fees are subject to change based on creditworthiness, loan amount, and other individual circumstances. However, a general comparison can be made using publicly available information and general market trends. It’s crucial to contact each lender directly for the most up-to-date information.

| Lender | Typical APR Range | Typical Fees | Loan Term Options |

|---|---|---|---|

| Americash Loans | Varies greatly depending on borrower’s creditworthiness; expect a higher range for those with less-than-perfect credit. Contact lender for specifics. | Origination fees, late payment fees, potential other fees; specifics vary depending on loan type and terms. Contact lender for specifics. | Short-term loans typically ranging from a few weeks to a few months. |

| Competitor A (Example: Local Credit Union) | Potentially lower APR than payday lenders, depending on credit history and loan type. | May have lower fees than payday lenders, potentially membership fees. | Offers a broader range of loan terms, potentially including longer-term loans. |

| Competitor B (Example: Online Payday Lender) | Likely higher APR than traditional lenders. | May have higher fees than traditional lenders. | Short-term loans, often with shorter repayment periods than Americash Loans. |

| Competitor C (Example: Bank) | Generally lower APR than payday lenders, especially for those with good credit. | May have lower fees than payday lenders, but potentially higher minimum loan amounts. | Offers a wide range of loan products and terms, from short-term to long-term loans. |

Advantages and Disadvantages of Choosing Americash Loans

Choosing Americash Loans offers certain advantages and disadvantages compared to its competitors. These advantages and disadvantages are relative and depend heavily on individual circumstances and financial needs.

Advantages might include convenience of location and potentially faster processing times compared to larger banks. Disadvantages might include higher interest rates and fees compared to credit unions or banks, particularly for borrowers with good credit.

Visual Representation of Loan Options

A chart comparing loan options could be visualized as a bar graph. The x-axis would represent different lenders (Americash Loans, Competitor A, Competitor B, Competitor C). The y-axis would represent the APR. Different colored bars would represent different loan types offered by each lender (e.g., payday loans, installment loans). The length of each bar would visually represent the APR for that specific loan type from that lender. This would allow for a quick visual comparison of the APRs and the variety of loan options available from each lender. A similar bar graph could be constructed to illustrate the typical fees associated with each loan type from each lender.

Legal and Regulatory Compliance

Americash Loans Greenville SC operates within a strict regulatory framework designed to protect consumers and ensure fair lending practices. Understanding and adhering to these regulations is paramount to the company’s operation and its commitment to responsible lending. Failure to comply can result in significant penalties and damage to the company’s reputation.

South Carolina’s lending regulations are a complex interplay of state and federal laws, primarily focused on transparency, interest rate caps, and consumer protection. Americash Loans’ adherence to these regulations involves rigorous internal compliance procedures, regular audits, and ongoing training for its staff.

South Carolina Lending Regulations

South Carolina’s regulatory landscape for payday and installment loans is governed by a combination of state statutes and interpretations by the South Carolina Department of Consumer Affairs. These regulations aim to prevent predatory lending practices and ensure borrowers understand the terms and conditions of their loans. Key aspects include limitations on loan amounts, interest rates, and fees, as well as requirements for clear and concise disclosure of all loan terms.

Americash Loans’ Compliance Procedures

Americash Loans employs a multi-faceted approach to ensure compliance. This includes maintaining detailed records of all loan transactions, conducting regular internal audits to identify and address any potential compliance issues, and providing ongoing training to employees on relevant laws and regulations. The company also utilizes third-party compliance services to ensure its practices remain current with any changes in legislation or regulatory interpretations. Furthermore, Americash Loans maintains a dedicated compliance officer responsible for overseeing all aspects of the company’s regulatory adherence.

Risks Associated with Non-Compliance

Non-compliance with South Carolina’s lending regulations carries significant risks for Americash Loans. These include substantial fines and penalties imposed by state regulatory agencies, potential legal action from borrowers claiming violations of consumer protection laws, and reputational damage that could severely impact the company’s business. In extreme cases, non-compliance could lead to the suspension or revocation of the company’s lending license, effectively shutting down its operations. For example, a lender failing to accurately disclose fees could face legal action and significant fines, negatively impacting its financial stability and public image.

Relevant South Carolina Consumer Protection Laws

The following South Carolina consumer protection laws are particularly relevant to payday and installment lending: The South Carolina Consumer Finance Act, which governs various aspects of consumer lending, including licensing requirements, interest rate caps, and disclosure requirements; and specific regulations related to payday lending, which may include limitations on loan amounts, rollover provisions, and the number of loans a borrower can obtain within a specific timeframe. Understanding and adhering to these specific regulations is crucial for maintaining compliance. Specific statutes and regulations should be referenced for the most up-to-date and precise information.

Financial Literacy Resources: Americash Loans Greenville Sc

Access to reliable financial literacy resources is crucial for Greenville, SC residents to make informed decisions about their finances and avoid potential pitfalls associated with borrowing. Understanding budgeting, responsible credit use, and the consequences of financial mismanagement can significantly improve overall financial well-being. This section Artikels available resources and provides practical tools for effective financial management.

Available Financial Literacy Resources in Greenville, SC

Several organizations offer financial literacy programs and resources to Greenville residents. These resources vary in their approach and the specific topics covered, but generally aim to equip individuals with the knowledge and skills necessary for responsible financial management. Examples include workshops, online courses, one-on-one counseling, and printed materials. Many of these services are offered free of charge or at a low cost. Specific organizations to explore include local credit unions, non-profit financial counseling agencies, and government programs such as those offered through the South Carolina Department of Consumer Affairs. Many libraries also provide access to financial literacy materials.

Responsible Borrowing and Personal Finance Management

Responsible borrowing involves understanding the terms and conditions of any loan before signing an agreement. This includes carefully reviewing the interest rate, fees, repayment schedule, and any potential penalties for late payments. Effective personal finance management involves creating and adhering to a budget, tracking income and expenses, and prioritizing savings. Building a good credit history is also essential for securing favorable loan terms in the future. Avoiding high-interest debt and prioritizing needs over wants are key components of responsible financial behavior. Unexpected expenses should be planned for through emergency funds, minimizing the need for high-interest loans.

Hypothetical Budget Template

A well-structured budget helps individuals track their income and expenses, enabling better control over their finances. The following is a sample budget template:

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Net Monthly Salary | $3000 | Housing (Rent/Mortgage) | $1000 |

| Other Income (e.g., side hustle) | $500 | Utilities (Electricity, Water, Gas) | $200 |

| Groceries | $400 | ||

| Transportation (Car payment, gas, insurance) | $300 | ||

| Healthcare | $150 | ||

| Debt Payments (Loans, Credit Cards) | $350 | ||

| Savings | $300 | ||

| Entertainment | $200 | ||

| Total Income | $3500 | Total Expenses | $3000 |

| Savings/Surplus | $500 |

This template can be adjusted to reflect individual circumstances and income levels. The key is to track expenses diligently and ensure that income exceeds expenses to allow for savings.

Consequences of Falling Behind on Loan Payments

Falling behind on loan payments can lead to several serious consequences. These include late payment fees, increased interest charges, damage to credit score, potential wage garnishment, and even legal action from the lender. A damaged credit score can make it difficult to obtain future loans, rent an apartment, or even secure employment. In severe cases, lenders may repossess collateral, such as a car or house, used to secure the loan. It’s crucial to contact the lender immediately if facing difficulties making payments to explore options such as repayment plans or debt consolidation to avoid these negative consequences. Ignoring the problem will only exacerbate the situation.

End of Discussion

Securing a loan can be a significant financial decision. By carefully weighing the terms, fees, and your personal financial situation, you can make an informed choice that aligns with your needs. Remember to explore all available options, compare lenders, and understand the implications of borrowing before proceeding. This guide provides a framework for evaluating Americash Loans Greenville SC, but thorough research and responsible borrowing practices remain paramount.

User Queries

What is the minimum credit score required for an Americash Loan?

Americash Loans’ credit score requirements vary depending on the loan type and applicant’s financial profile. It’s best to contact them directly for specific information.

What happens if I miss a loan payment?

Missing a payment will likely incur late fees and could negatively impact your credit score. Contact Americash Loans immediately if you anticipate difficulties making a payment to discuss possible solutions.

Are there any hidden fees associated with Americash Loans?

It’s crucial to review all loan documents thoroughly to understand all fees involved. Transparency about fees is important, so ask clarifying questions if anything is unclear.

How long does it take to get approved for a loan?

Approval times vary, but Americash Loans typically aims for a quick turnaround. The exact timeframe depends on factors like the loan type and the completeness of your application.