BMG loans for federal employees offer a unique financing option, but navigating the process requires understanding eligibility, interest rates, and potential risks. This guide provides a comprehensive overview, comparing BMG loans to alternatives and outlining the steps involved in securing and managing these loans. We’ll explore the advantages and disadvantages, examining real-world scenarios and offering practical advice to help federal employees make informed financial decisions.

Federal employees often face unique financial challenges. Understanding the intricacies of BMG loans, including interest rates, repayment terms, and potential long-term implications, is crucial for responsible borrowing. This guide breaks down the complexities, offering clear explanations and practical examples to empower federal employees to make smart choices.

Understanding BMGL Loans for Federal Employees

BMGL loans, or loans offered through the Federal Employee Credit Union (FECU) or similar organizations, provide a valuable financial resource for federal employees. These loans often come with competitive interest rates and terms designed to meet the specific needs of government workers. Understanding the nuances of BMGL loans and how they compare to other options is crucial for making informed financial decisions.

BMGL Loan Definition and Relevance to Federal Employees

BMGL loans are not a standardized, universally defined loan type. The term likely refers to loans offered by financial institutions that cater specifically to the needs of federal employees, often featuring benefits tailored to their employment status and income stability. The relevance to federal employees stems from the potential for access to competitive interest rates, streamlined application processes, and potentially more favorable loan terms compared to general-purpose consumer loans. This is because lenders recognize the generally stable employment and income associated with federal government positions.

Eligibility Criteria for Federal Employees Seeking BMGL Loans

Eligibility criteria for BMGL loans vary depending on the lending institution. However, common requirements generally include federal employment verification (pay stubs, employment letter), a minimum credit score (often above 660, though this can fluctuate), and a satisfactory debt-to-income ratio. Specific income requirements may also exist, depending on the loan amount and type. Some lenders might prioritize longer-term federal employment history, demonstrating financial stability and a reduced risk for the lender.

The Typical BMGL Loan Application Process for Federal Employees

The application process typically involves submitting a completed application form, providing proof of federal employment and income, and undergoing a credit check. Lenders will assess the applicant’s creditworthiness and financial capacity to repay the loan. Depending on the loan amount and the lender’s policies, additional documentation may be required, such as tax returns or proof of assets. Once approved, the loan proceeds are typically disbursed directly into the borrower’s account.

Comparison of BMGL Loans with Other Loan Options Available to Federal Employees

Federal employees have access to a variety of loan options, including those offered through their credit union, private lenders, and government programs. BMGL loans, assuming they represent loans specifically tailored for federal employees, may offer advantages in terms of interest rates and fees compared to general-purpose loans from private lenders. However, it’s essential to compare interest rates, fees, loan terms, and repayment schedules across all available options before selecting a loan. For instance, a federal employee might compare a BMGL loan with a loan offered through the Federal Employees’ Group Life Insurance (FEGLI) program or a personal loan from a local bank. The optimal choice depends on individual circumstances and financial goals.

Interest Rates and Loan Terms: Bmg Loans For Federal Employees

BMGL loans, specifically those offered to federal employees, come with a range of interest rates and loan terms designed to accommodate diverse financial needs and repayment capabilities. Understanding these variables is crucial for making informed borrowing decisions and ensuring manageable monthly payments. The specific rates and terms offered can vary based on several factors, including creditworthiness, loan amount, and the prevailing economic climate.

Interest rates for BMGL loans are generally competitive with other federal employee loan programs and are often fixed, providing borrowers with predictable monthly payments throughout the loan’s lifespan. Loan terms, referring to the repayment period, offer flexibility, allowing borrowers to choose a repayment schedule that aligns with their budget and financial goals. Longer repayment periods typically result in lower monthly payments but lead to higher overall interest paid over the life of the loan. Conversely, shorter repayment periods mean higher monthly payments but result in less interest paid.

Typical Interest Rates and Loan Terms

BMGL loans for federal employees typically offer interest rates ranging from 6% to 12%, though the exact rate depends on individual credit scores and the prevailing market conditions. Repayment periods usually range from 12 to 60 months, with the borrower selecting a term that best suits their financial circumstances. Borrowers with excellent credit histories may qualify for lower interest rates, while those with less-than-perfect credit may face higher rates. It’s essential to compare rates from multiple lenders before making a decision.

Interest Rate Comparison Table

The following table illustrates a sample comparison of interest rates across different loan amounts and repayment periods. Note that these are hypothetical examples and actual rates may vary. Always check with a BMGL lender for the most current information.

| Loan Amount | 12-Month Term (APR) | 36-Month Term (APR) | 60-Month Term (APR) |

|---|---|---|---|

| $5,000 | 7.5% | 8.0% | 8.5% |

| $10,000 | 7.0% | 7.75% | 8.25% |

| $15,000 | 6.75% | 7.5% | 8.0% |

| $20,000 | 6.5% | 7.25% | 7.75% |

Advantages and Disadvantages of BMGL Loans

BMGL loans, offered to federal employees through the Federal Employees’ Group Life Insurance (FEGLI) program, present a unique borrowing opportunity. Understanding both the benefits and potential drawbacks is crucial for making an informed financial decision. This section will Artikel the key advantages and disadvantages to help federal employees weigh their options.

BMGL loans offer several compelling advantages, primarily stemming from their convenient accessibility and favorable terms compared to some other loan options. However, it’s essential to acknowledge potential downsides to ensure the loan aligns with individual financial goals and circumstances.

Advantages of BMGL Loans

BMGL loans offer several key advantages for federal employees. The primary benefit is the streamlined application process, often simpler than securing a loan from a traditional financial institution. This ease of access is particularly appealing to those with limited time or those who might face challenges qualifying for other loans. Furthermore, the interest rates are typically competitive, especially when compared to high-interest credit cards or payday loans. This lower cost of borrowing can significantly reduce the overall cost of the loan over its lifespan. Finally, the repayment terms are often flexible, allowing borrowers to tailor their payments to their budget. This flexibility can provide crucial financial breathing room during challenging times.

Disadvantages of BMGL Loans

While BMGL loans offer significant advantages, potential disadvantages should also be carefully considered. One key drawback is the limited loan amount. The maximum loan amount is typically capped at a percentage of the employee’s life insurance coverage, which may not be sufficient for larger purchases or significant financial needs. Furthermore, borrowing against your life insurance policy means that if you were to pass away before repaying the loan, the outstanding balance would be deducted from your death benefit, potentially reducing the amount available for your beneficiaries. This is a critical consideration that requires careful planning and a thorough understanding of the implications. Finally, while interest rates are generally competitive, they are not always the absolute lowest available on the market. It’s advisable to compare BMGL loan rates with other loan options before making a final decision.

Comparison of BMGL Loans with Other Loan Types

To provide a clear understanding of the relative merits of BMGL loans, let’s compare them to other common loan types. This comparison will highlight the strengths and weaknesses of BMGL loans in the broader context of personal finance.

- BMGL Loans vs. Personal Loans: BMGL loans often have a simpler application process but may offer smaller loan amounts and less flexible repayment terms compared to personal loans. Personal loans typically offer higher borrowing limits and a wider range of repayment options, but may require a more rigorous credit check.

- BMGL Loans vs. Credit Cards: BMGL loans offer lower interest rates than most credit cards, but they lack the flexibility and convenience of credit cards for everyday purchases. Credit cards provide immediate access to funds but often come with high interest rates and fees if balances are not paid in full each month.

- BMGL Loans vs. Home Equity Loans: Home equity loans generally offer larger loan amounts at potentially lower interest rates than BMGL loans, but they carry the risk of losing your home if you default on the loan. BMGL loans, while limited in amount, do not carry this significant risk.

Financial Implications and Considerations

Taking out a BMGL loan, while offering convenience for federal employees, carries significant long-term financial implications that require careful consideration. Understanding the potential impact on your budget and overall financial health is crucial before committing to a loan. Failure to properly assess these implications could lead to unforeseen financial strain.

Borrowing money always involves interest payments, which increase the total amount repaid. The length of the repayment period directly impacts the total interest paid; longer repayment terms generally result in higher total interest costs. Furthermore, unexpected life events, such as job loss or medical emergencies, can significantly affect a borrower’s ability to manage loan repayments, potentially leading to delinquency and negative credit consequences. Careful budgeting and planning are essential to mitigate these risks.

Repayment Plan Impact on Federal Employee Budgets

Different repayment plans significantly affect a federal employee’s budget. A shorter repayment term, while resulting in less overall interest paid, requires larger monthly payments, potentially straining a tight budget. Conversely, a longer repayment term reduces monthly payments, but increases the total interest paid over the life of the loan. Consider this example: A $20,000 BMGL loan at a 6% interest rate could have a 5-year repayment plan with a monthly payment of approximately $376, or a 10-year repayment plan with a monthly payment of approximately $212. While the monthly payment is significantly lower with the 10-year plan, the total interest paid will be substantially higher. A federal employee needs to carefully weigh the trade-offs between manageable monthly payments and minimizing total interest costs.

Impact of Loan Interest on Total Repayment Cost

Let’s illustrate the impact of loan interest on the total repayment cost with a hypothetical scenario. Suppose a federal employee takes out a $15,000 BMGL loan with a 7% annual interest rate. If the loan is repaid over 5 years, the total interest paid would be approximately $2,500, resulting in a total repayment of $17,500. Extending the repayment period to 10 years would reduce the monthly payment but significantly increase the total interest paid to approximately $5,500, leading to a total repayment of $20,500. This illustrates how seemingly small differences in interest rates and loan terms can significantly impact the overall cost of borrowing. Careful consideration of these factors is crucial for responsible financial management.

Finding and Selecting a Lender

Securing a BMGL loan requires careful consideration of the lender. Federal employees should prioritize finding a reputable institution offering competitive terms and excellent customer service. The selection process involves researching potential lenders, comparing their offerings, and ultimately choosing the best fit for individual financial needs and circumstances.

Choosing the right lender is crucial for a smooth and beneficial borrowing experience. A poorly chosen lender can lead to higher interest rates, hidden fees, and a generally unpleasant borrowing process. Conversely, selecting a reputable lender can provide peace of mind and access to favorable loan terms. Therefore, a thorough evaluation of various lenders is essential before committing to a loan.

Factors to Consider When Choosing a BMGL Lender, Bmg loans for federal employees

The decision of which lender to use for a BMGL loan should be based on several key factors. These factors will help ensure that the loan process is transparent, efficient, and ultimately beneficial for the borrower.

- Interest Rates: Interest rates are a primary determinant of the overall cost of the loan. Compare rates from multiple lenders to find the most competitive offering. Pay close attention to the Annual Percentage Rate (APR), which includes all fees and interest. For example, a lender advertising a low interest rate might have high origination fees, resulting in a higher APR than a lender with a slightly higher stated interest rate but lower fees.

- Fees and Charges: Lenders may charge various fees, including origination fees, application fees, and prepayment penalties. Carefully review all fees associated with each loan offer to avoid unexpected costs. A lender with seemingly low interest rates but high fees might end up being more expensive than one with slightly higher interest rates but fewer fees.

- Loan Terms and Repayment Options: Consider the loan’s repayment period and the associated monthly payments. Longer repayment periods result in lower monthly payments but higher overall interest costs. Shorter periods mean higher monthly payments but lower total interest paid. Evaluate which repayment schedule aligns best with your budget and financial goals. Some lenders might offer flexible repayment options like bi-weekly payments.

- Customer Service and Reputation: A lender’s reputation and customer service are vital. Research online reviews and ratings to gauge customer experiences. Consider whether the lender offers convenient communication channels, such as phone, email, and online portals, and whether they are responsive to inquiries. A responsive and helpful lender can significantly ease the borrowing process.

- Financial Strength and Stability: Choose a lender with a strong financial standing and a proven track record. This reduces the risk of potential lender issues affecting your loan. Review the lender’s financial statements or seek information about their credit rating from reputable financial sources.

Comparison of BMGL Lender Services

Different BMGL lenders offer varying services. A comparative analysis helps federal employees identify the lender that best suits their needs.

For example, some lenders might specialize in offering shorter-term loans with higher monthly payments but lower overall interest, while others might focus on longer-term loans with lower monthly payments but higher total interest. Some lenders might offer online applications and account management, while others may rely on traditional in-person processes. Some might offer additional financial planning or budgeting resources to help borrowers manage their debt effectively. A detailed comparison of these services is necessary for informed decision-making.

Illustrative Example: A Federal Employee’s Loan Journey

This example follows Sarah, a federal employee, as she navigates the process of obtaining a BMGL (Borrower-Based Mortgage Loan Guarantee) loan. Sarah, a mid-level analyst with a stable income and good credit history, decides to purchase a new home and explores her options for financing. She determines a BMGL loan is a suitable choice given her federal employment and the attractive terms often offered.

Loan Application and Pre-Approval

Sarah begins by researching lenders offering BMGL loans. She compares interest rates, fees, and loan terms from several institutions. After choosing a lender, she submits her application online, providing necessary documentation such as her pay stubs, tax returns, and credit report. The lender verifies her federal employment status and assesses her creditworthiness. This process includes a review of her debt-to-income ratio and credit score. Once the lender approves her application, Sarah receives a pre-approval letter outlining the loan amount she qualifies for and the associated interest rate.

Loan Processing and Closing

Following pre-approval, Sarah finds a suitable property and makes an offer. The lender then conducts a property appraisal to determine its market value. Once the appraisal is complete and the offer is accepted, the lender prepares the loan documents. This includes the loan agreement, promissory note, and closing disclosure. Sarah reviews all documents carefully before attending the closing meeting. At the closing, she signs the final documents, and the lender disburses the loan funds to the seller. The closing costs include appraisal fees, title insurance, and other administrative charges, which are typically around 2-5% of the loan amount. In Sarah’s case, these costs totaled $10,000 on a $200,000 loan.

Loan Repayment

Sarah’s loan has a 30-year term with a fixed interest rate of 4%. Her monthly payments, including principal and interest, are approximately $955. The lender provides her with a detailed amortization schedule showing the breakdown of each payment. Sarah diligently makes her monthly payments on time to avoid late fees and maintain a good credit history. Over the 30-year period, she will pay a total of approximately $343,800, including interest. This illustrates the significant cost of interest over the life of the loan.

Detailed Cost Breakdown for Sarah’s Loan

| Cost Item | Amount |

|---|---|

| Loan Amount | $200,000 |

| Interest Rate | 4% |

| Loan Term | 30 years |

| Monthly Payment (Principal & Interest) | $955 |

| Total Interest Paid (Estimated) | $143,800 |

| Closing Costs | $10,000 |

| Total Cost of Loan (Estimated) | $353,800 |

Potential Risks and Mitigation Strategies

BMGL loans, while offering convenience for federal employees, present certain financial risks. Understanding these risks and implementing proactive mitigation strategies is crucial for responsible borrowing and avoiding potential financial distress. This section details potential pitfalls and Artikels practical steps federal employees can take to protect their financial well-being.

Borrowing money, regardless of the source, carries inherent risks. For federal employees utilizing BMGL loans, specific concerns exist due to the nature of the loan and the borrower’s employment situation. Failure to adequately manage these risks can lead to serious financial consequences.

Default Risk and its Mitigation

Defaulting on a loan can severely damage an individual’s credit score, impacting future borrowing opportunities and potentially affecting other aspects of their financial life. For federal employees, default could also lead to garnishment of wages, further complicating their financial situation. To mitigate this risk, borrowers should carefully assess their ability to repay the loan before applying, creating a realistic budget that accounts for the monthly payments, and maintaining consistent communication with the lender in case of unforeseen circumstances. Proactive budgeting and responsible financial planning are key to preventing default.

High Interest Rates and Their Impact

BMGL loans may come with higher interest rates compared to other loan options. High interest rates can significantly increase the total cost of borrowing over the loan’s lifespan. To mitigate this, borrowers should thoroughly compare interest rates offered by different lenders before committing to a loan. Exploring alternative financing options, such as credit unions or personal loans from banks, can help secure more favorable interest rates. Negotiating a lower interest rate with the lender is also a possibility, though this depends on individual circumstances and lender policies.

Unexpected Life Events and Financial Strain

Unforeseen events, such as job loss, illness, or family emergencies, can significantly impact a borrower’s ability to make timely loan payments. Federal employees should consider establishing an emergency fund to cushion against such events. This fund can provide a safety net for covering loan payments during periods of financial instability. Furthermore, exploring options like loan deferment or forbearance with the lender can provide temporary relief during difficult times. Open communication with the lender is vital in navigating such situations.

Debt Consolidation and Overextension

Taking on multiple loans simultaneously can lead to debt overload and difficulty in managing repayments. Careful planning is crucial to avoid overextending oneself financially. Before applying for a BMGL loan, borrowers should assess their existing debt and determine if consolidating existing debts into a single loan would be a more manageable approach. This can simplify repayment and potentially lower the overall interest burden.

Flowchart: Minimizing BMGL Loan Risks

The following flowchart illustrates the steps a federal employee should take to minimize risks associated with a BMGL loan:

[Imagine a flowchart here. The flowchart would begin with “Assess Financial Situation,” branching to “Create Realistic Budget” and “Compare Loan Offers.” “Create Realistic Budget” would lead to “Determine Affordability.” “Compare Loan Offers” would lead to “Negotiate Interest Rate.” “Determine Affordability” and “Negotiate Interest Rate” would both converge to “Secure Loan.” “Secure Loan” would lead to “Establish Emergency Fund” and “Monitor Loan Payments.” Both of these would lead to “Successful Repayment.”]

Legal and Regulatory Aspects

BMGL loans for federal employees, while offering convenient financing options, are subject to a complex web of legal and regulatory frameworks designed to protect both borrowers and lenders. Understanding these regulations is crucial for federal employees to navigate the loan process effectively and avoid potential pitfalls. These frameworks aim to ensure fair lending practices, transparent terms, and accessible recourse in case of disputes.

Federal employees seeking BMGL loans are protected by a range of consumer protection laws, ensuring transparency and fair treatment. These laws dictate how lenders must disclose loan terms, handle disputes, and interact with borrowers. Failure to comply can result in significant penalties for lenders.

Applicable Federal Laws

Several federal laws significantly impact BMGL loans. The Truth in Lending Act (TILA) mandates clear disclosure of loan terms, including interest rates, fees, and repayment schedules. The Fair Credit Reporting Act (FCRA) governs how lenders can access and use credit information, protecting borrowers from inaccurate or discriminatory practices. The Fair Debt Collection Practices Act (FDCPA) regulates how debt collectors can contact borrowers and prohibits harassing or abusive collection methods. The Real Estate Settlement Procedures Act (RESPA), if applicable to the loan’s purpose, regulates closing costs and ensures transparency in real estate transactions. Violation of any of these laws can lead to legal action against the lender, potentially resulting in refunds, penalties, and other forms of redress for the borrower.

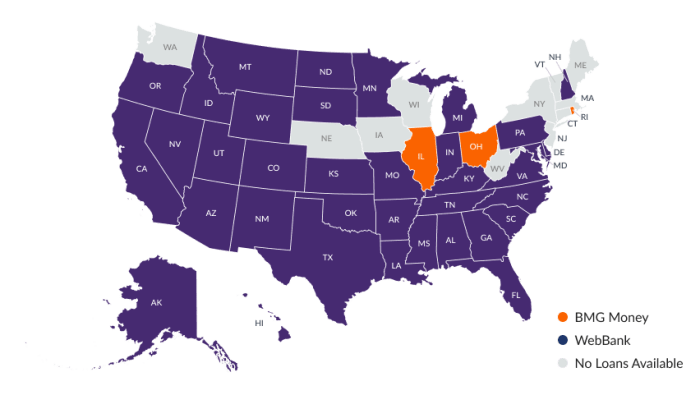

State Laws and Regulations

In addition to federal laws, state laws also play a crucial role. Each state may have its own regulations regarding interest rates, loan fees, and collection practices. For instance, some states have usury laws that cap the maximum allowable interest rate, offering additional protection to borrowers. Federal employees should research their state’s specific laws to gain a complete understanding of their rights and protections. This information is usually available on the state’s attorney general website or through consumer protection agencies.

Recourse for Federal Employees

If a federal employee encounters problems with their BMGL lender, several avenues of recourse exist. They can first attempt to resolve the issue directly with the lender through formal complaint procedures. If this fails, they can file a complaint with the Consumer Financial Protection Bureau (CFPB), a federal agency responsible for enforcing consumer financial protection laws. State attorney general offices also handle consumer complaints and can investigate lender misconduct. In some cases, legal action may be necessary, potentially involving a lawsuit to enforce rights under federal or state laws. Documentation of all communication with the lender is crucial in pursuing these avenues of recourse. This includes loan agreements, correspondence, and records of payments.

Final Thoughts

Securing a BMG loan as a federal employee can be a beneficial financial tool when approached strategically. By carefully weighing the advantages and disadvantages, understanding the application process, and selecting a reputable lender, federal employees can leverage these loans to achieve their financial goals while mitigating potential risks. Remember to thoroughly research and compare options before committing to any loan agreement. Careful planning and responsible borrowing practices are key to a successful loan experience.

Helpful Answers

What credit score is needed for a BMG loan?

Lenders vary, but generally, a good to excellent credit score (typically 680 or higher) is preferred for favorable interest rates.

Can I use a BMG loan for any purpose?

The intended use of BMG loans can vary by lender. Some may restrict use to specific purposes, while others offer more flexibility.

What happens if I miss a payment on my BMG loan?

Late payments can negatively impact your credit score and may incur late fees. Contact your lender immediately if you anticipate difficulties making a payment.

Are there prepayment penalties for BMG loans?

Whether or not prepayment penalties apply depends on the specific terms of your loan agreement. Review your loan documents carefully.