Delta Community Credit Union loan rates: Understanding the costs associated with borrowing from Delta Community Credit Union is crucial for prospective borrowers. This guide delves into the various factors influencing these rates, comparing them to competitors, and providing insights into the application process. We’ll explore the types of loans available, eligibility criteria, and the importance of credit scores in securing favorable terms. We also highlight the transparency of Delta Community Credit Union’s rate communication and offer illustrative loan scenarios to help you better understand potential costs.

From auto loans to home equity lines of credit, Delta Community Credit Union offers a range of financial products tailored to diverse needs. However, understanding the nuances of their interest rate structure is key to making informed borrowing decisions. This comprehensive guide will equip you with the knowledge to navigate the loan application process effectively and secure the best possible terms for your financial situation.

Delta Community Credit Union Loan Overview

Delta Community Credit Union offers a range of loan products designed to meet the diverse financial needs of its members. These loans provide flexible options for various purposes, from purchasing a vehicle to consolidating debt or financing home improvements. Understanding the specifics of these loan offerings is crucial for members seeking financial assistance.

Delta Community Credit Union provides several types of loans to its members. These include auto loans to finance the purchase of new or used vehicles; home equity loans and lines of credit, allowing members to leverage the equity in their homes; and personal loans for a variety of purposes such as debt consolidation, home improvements, or unexpected expenses. They may also offer other specialized loan products depending on member needs and market conditions. It’s advisable to check their official website for the most up-to-date information on available loan types.

Loan Eligibility Criteria

Eligibility for Delta Community Credit Union loans generally depends on several factors. Creditworthiness, as assessed through credit scores and reports, plays a significant role. Applicants typically need to meet minimum credit score requirements, although these requirements can vary depending on the loan type and amount. Income verification is also a standard part of the application process, ensuring the applicant’s ability to repay the loan. Finally, the length of membership with the credit union may also influence eligibility, with longer-standing members potentially having access to more favorable terms. Specific requirements are subject to change and are best confirmed directly with Delta Community Credit Union.

Interest Rate Factors

Delta Community Credit Union’s loan interest rates are determined by a variety of factors, working in concert to assess the risk associated with lending to each individual borrower. Understanding these factors can help borrowers improve their chances of securing a more favorable interest rate. This section details the key elements influencing your loan’s cost.

Credit Score’s Influence on Interest Rates, Delta community credit union loan rates

Your credit score is arguably the most significant factor impacting your interest rate. Lenders use credit scores to gauge your creditworthiness – your history of repaying debts on time. A higher credit score demonstrates a lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score indicates a higher risk, leading to a higher interest rate to compensate for that increased risk. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate compared to a borrower with a fair credit score (650-699). The difference can amount to several percentage points over the life of the loan, significantly impacting the total cost.

Loan Amount and Term’s Impact on Interest Rates

The amount of money borrowed and the length of the loan term also influence interest rates. Generally, larger loan amounts often carry slightly higher interest rates due to the increased risk for the lender. Similarly, longer loan terms (e.g., a 60-month auto loan versus a 36-month auto loan) may also result in higher interest rates. This is because the lender is exposed to the risk of the borrower defaulting for a longer period. The increased risk over a longer period necessitates a higher interest rate to compensate the lender for the extended exposure.

Debt-to-Income Ratio and Other Factors

Beyond credit score and loan specifics, other financial factors play a role. Your debt-to-income ratio (DTI), which represents the percentage of your monthly income dedicated to debt payments, is a key consideration. A high DTI indicates a greater financial burden, signaling a higher risk to the lender and potentially leading to a higher interest rate. Other factors that may influence interest rates include the type of loan (e.g., auto loan, personal loan, mortgage), the presence of collateral (secured vs. unsecured loans), and prevailing market interest rates. These elements contribute to the overall risk assessment performed by Delta Community Credit Union before determining the final interest rate offered to a borrower.

Comparison with Competitors: Delta Community Credit Union Loan Rates

Understanding Delta Community Credit Union’s loan rates requires comparing them to those offered by similar financial institutions in its service area. This allows for a more informed decision when choosing a lender. The following data provides a snapshot of auto loan rates, illustrating the competitive landscape. Note that rates are subject to change and depend on several factors, including credit score and loan term.

Auto Loan Rate Comparison

The table below compares auto loan rates from Delta Community Credit Union and two other prominent credit unions in the same region. These rates are illustrative examples obtained from publicly available information as of October 26, 2023, and may not reflect current rates. Always contact the credit union directly for the most up-to-date information.

| Credit Union Name | Loan Type | Interest Rate (APR) | Loan Term (Months) |

|---|---|---|---|

| Delta Community Credit Union | New Auto Loan | 6.50% | 60 |

| Example Credit Union A | New Auto Loan | 7.00% | 60 |

| Example Credit Union B | New Auto Loan | 6.25% | 72 |

Loan Rate Transparency

Delta Community Credit Union prioritizes transparency in its loan rate communication, ensuring potential borrowers have access to clear and readily available information. This commitment extends to multiple channels and methods, designed to provide a comprehensive understanding of loan costs before any commitment is made. The credit union aims to empower borrowers with the knowledge necessary to make informed financial decisions.

Delta Community Credit Union utilizes several methods to communicate loan rates. Their website features a loan rate calculator, allowing prospective borrowers to input relevant details such as loan amount, term, and credit score (if known) to receive an estimated interest rate. Additionally, rate ranges for various loan types are often published on the website, offering a general understanding of pricing. Finally, potential borrowers can contact a loan officer directly via phone or in person to discuss their specific financial situation and receive a personalized rate quote.

Personalized Rate Quote Process

Obtaining a personalized rate quote involves a straightforward process. Applicants should contact a Delta Community Credit Union loan officer, either by phone or in person at a branch. The loan officer will guide the applicant through the necessary steps, requesting information pertinent to the loan application, including income verification, credit history, and the intended use of the loan funds. This information allows the loan officer to assess the applicant’s creditworthiness and provide a rate quote tailored to their individual circumstances. The process typically involves a brief application, potentially requiring supporting documentation like pay stubs or tax returns. Following review, the loan officer will communicate the personalized interest rate and other loan terms.

Loan Fees

Several fees may be associated with obtaining a loan from Delta Community Credit Union. These fees vary depending on the loan type and the specific circumstances of the application. For instance, there might be an application fee, an appraisal fee (for loans secured by real estate), or a closing fee. It’s crucial for prospective borrowers to inquire about all applicable fees during the rate quote process to understand the complete cost of borrowing. Delta Community Credit Union’s loan officers are readily available to provide a detailed breakdown of all fees associated with a particular loan, ensuring borrowers have a complete picture of their financial obligations before proceeding. Transparency regarding fees is a key element of Delta Community Credit Union’s commitment to fair and ethical lending practices.

Loan Application Process

Applying for a loan with Delta Community Credit Union involves a straightforward process designed for efficiency and transparency. The application itself is relatively quick, but gathering the necessary documentation and meeting certain eligibility criteria may take some time. The entire process, from initial application to loan disbursement, is designed to be as smooth as possible.

The application process begins with submitting a loan application either online through their website or in person at a branch location. Applicants should be prepared to provide detailed information about their financial situation and the purpose of the loan. This initial step sets the stage for a comprehensive review of the application.

Required Documentation

To ensure a timely processing of your loan application, Delta Community Credit Union requires specific documentation to verify your financial standing and the details of your loan request. This documentation helps the credit union assess your creditworthiness and determine the appropriate loan terms. Incomplete applications will likely result in delays.

- Proof of Income: This typically includes pay stubs, W-2 forms, tax returns, or bank statements showing consistent income streams. The specific requirements may vary depending on the type of loan and the applicant’s employment history.

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is necessary to verify the applicant’s identity and prevent fraud.

- Proof of Residence: Documentation showing current residential address, such as a utility bill or lease agreement, is required to confirm the applicant’s location.

- Information on Existing Debts: Applicants may be asked to provide details about any existing loans or debts, such as credit card balances or outstanding mortgages. This helps the credit union assess the applicant’s overall debt-to-income ratio.

- Loan Purpose Documentation: Depending on the loan type, additional documentation may be required. For example, a home improvement loan might require quotes from contractors, while an auto loan might require details about the vehicle being purchased.

Loan Processing and Approval Timeline

The time it takes for Delta Community Credit Union to process and approve a loan application varies depending on several factors, including the type of loan, the completeness of the application, and the applicant’s credit history. While exact timelines are not guaranteed, a general understanding of the process can be helpful.

After submitting a complete application and all required documentation, the credit union typically reviews the application within a few business days. This review includes verifying the information provided and assessing the applicant’s creditworthiness. If additional information is needed, the credit union will contact the applicant. Once the review is complete, the credit union will inform the applicant of their loan approval or denial. Approved loans usually take a few more business days to finalize and disburse the funds. In some cases, particularly for larger loan amounts or complex loan applications, the process may take longer. Applicants should contact the credit union directly to inquire about the status of their application.

Customer Reviews and Experiences

Understanding customer feedback is crucial for assessing Delta Community Credit Union’s loan services. Analyzing online reviews and testimonials provides valuable insights into both the positive and negative aspects of their loan rates and application process. This section summarizes key findings from various review platforms, focusing on common themes and experiences.

Customer reviews regarding Delta Community Credit Union loans reveal a mixed bag of experiences. While many praise the credit union’s competitive rates and efficient service, others express frustration with the application process or communication issues. The overall sentiment appears to be largely positive, though individual experiences vary considerably depending on the specific loan type and the individual’s circumstances.

Positive Customer Experiences

Many positive reviews highlight Delta Community Credit Union’s competitive loan rates and the helpfulness of their staff. Reviewers often emphasize the personalized service they received and the ease of navigating the online application process.

- Several reviewers praised the speed and efficiency of the loan approval process, stating that they received funding much faster than anticipated.

- Many customers commented favorably on the low interest rates offered compared to other financial institutions, resulting in significant savings over the loan term.

- Positive feedback frequently mentioned the responsiveness and helpfulness of loan officers, who were described as readily available to answer questions and provide support throughout the application process. One reviewer stated, “My loan officer was incredibly patient and explained everything clearly, making the whole experience stress-free.”

Negative Customer Experiences

Negative reviews often focus on aspects of the loan application process or communication. While less frequent than positive reviews, these criticisms offer valuable insights into areas where Delta Community Credit Union could improve.

- Some reviewers reported experiencing delays in the loan approval process, citing issues with required documentation or communication breakdowns.

- A few customers expressed dissatisfaction with the lack of transparency regarding loan fees and charges, suggesting that more detailed information should be provided upfront.

- One reviewer mentioned difficulty reaching a loan officer by phone, leading to frustration and delays in addressing their questions. The comment stated, “I had to leave several messages before getting a call back, which was quite inconvenient.”

Illustrative Loan Scenarios

Understanding the potential cost of a loan is crucial before committing. The following scenarios illustrate how loan amount, term length, and credit score impact monthly payments and total interest paid. These are estimates and actual rates may vary based on individual circumstances and Delta Community Credit Union’s current lending policies. Remember to consult with a loan officer for personalized rate information.

The examples below utilize hypothetical interest rates based on general market trends and Delta Community Credit Union’s typical lending practices. These should not be considered a guarantee of future rates.

Loan Scenario Examples

| Scenario | Loan Amount | Loan Term (Years) | Credit Score | Estimated Monthly Payment | Estimated Total Interest Paid |

|---|---|---|---|---|---|

| Scenario 1: Excellent Credit, Shorter Term | $20,000 | 3 | 780 | $620 | $1,440 |

| Scenario 2: Good Credit, Longer Term | $30,000 | 5 | 700 | $580 | $5,800 |

| Scenario 3: Fair Credit, Longer Term | $15,000 | 7 | 620 | $260 | $5,000 |

Note: These are estimated figures. Actual monthly payments and total interest paid may vary depending on the specific terms of your loan agreement and prevailing interest rates. A higher credit score generally results in a lower interest rate, leading to lower monthly payments and total interest paid. Similarly, shorter loan terms result in higher monthly payments but lower overall interest costs.

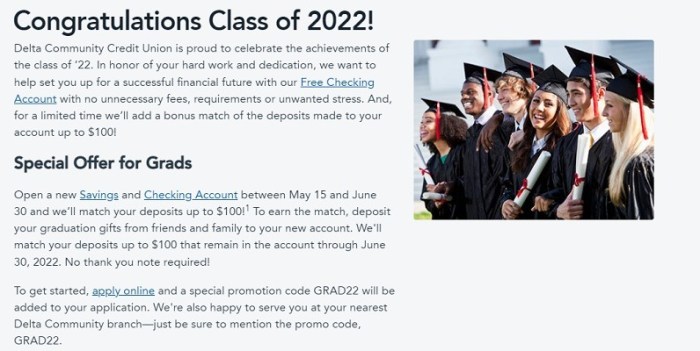

Special Offers and Promotions

Delta Community Credit Union frequently offers special promotions on its loan products to attract new members and reward existing ones. These offers can vary significantly in terms of interest rates, fees, and eligibility requirements, so it’s crucial to check the credit union’s website or contact a representative directly for the most up-to-date information. While specific promotions are not guaranteed to remain constant, understanding the general types of offers helps consumers prepare for potential savings.

It is important to note that these promotions are subject to change and may have limited-time availability. Terms and conditions, including eligibility criteria, will apply to each offer. Therefore, careful review of the fine print before applying is highly recommended. Borrowers should compare the overall cost of the loan, including interest and fees, across different offers to ensure they are selecting the most suitable option for their financial situation.

Current Promotional Loan Rates

Delta Community Credit Union’s website and branch locations are the primary sources for current promotional loan rates. These promotions might include reduced interest rates for a specific period, waived closing costs, or cash-back incentives. For example, a past promotion might have offered a 2.99% APR on auto loans for a limited time to members who met specific criteria, such as direct deposit of their paycheck into a Delta Community Credit Union account. Another example could be a reduced rate for members refinancing existing high-interest loans. The specifics of these offers, including the eligibility requirements, APR, and duration, would be detailed on the credit union’s official channels.

Terms and Conditions of Special Offers

Each special offer will have its own set of terms and conditions. These typically include a specific promotional period, minimum loan amount, and maximum loan term. Eligibility requirements might include membership status, credit score minimums, and the type of loan being sought (e.g., auto, home equity, personal). For instance, a promotional auto loan might require a credit score above 680, a loan term of no more than 60 months, and a minimum loan amount of $10,000. Furthermore, certain offers might include stipulations regarding prepayment penalties or other fees. Detailed information on these terms and conditions is usually available on the credit union’s website or in promotional materials. Consumers should carefully review these details before accepting any offer.

Wrap-Up

Securing a loan from Delta Community Credit Union involves understanding their rate structure and the factors that influence it. By considering your credit score, loan amount, and term length, you can better anticipate your monthly payments and total interest paid. Remember to compare Delta Community Credit Union’s offerings to those of other institutions to ensure you’re getting the most competitive rates. Ultimately, careful planning and a thorough understanding of the loan process will empower you to make informed decisions and achieve your financial goals.

FAQ Resource

What documents are typically required for a loan application?

Commonly required documents include proof of income, identification, and recent bank statements. Specific requirements may vary depending on the loan type.

How long does the loan application process usually take?

The processing time varies, but generally ranges from a few days to several weeks, depending on the complexity of the application and the availability of required documentation.

What happens if my loan application is denied?

Delta Community Credit Union will typically provide an explanation for the denial, often outlining areas for improvement to strengthen a future application.

Are there any prepayment penalties for paying off my loan early?

Check your loan agreement for specific details regarding prepayment penalties. Some loans may have penalties, while others do not.