Fulton Bank home equity loans offer a compelling way to tap into your home’s equity for various needs, from home renovations to debt consolidation. Understanding the interest rates, eligibility requirements, and potential risks is crucial before making a decision. This guide provides a comprehensive overview, comparing Fulton Bank’s offerings to competitors and outlining the entire application process. We’ll delve into loan terms, explore alternative financing options, and help you navigate the complexities of using your home equity wisely.

This in-depth analysis covers everything from securing a personalized interest rate quote to understanding the potential tax implications of different loan types. We’ll also address common concerns, helping you make an informed decision that aligns with your financial goals. Whether you’re considering a kitchen remodel or need to consolidate high-interest debt, this guide empowers you to approach your home equity loan journey with confidence.

Fulton Bank Home Equity Loan Interest Rates

Securing a home equity loan involves careful consideration of interest rates, as they significantly impact the overall cost of borrowing. Understanding the factors that influence these rates and comparing them to competitors is crucial for making an informed financial decision. This section details Fulton Bank’s home equity loan interest rates, compares them to industry averages, and explains how to obtain a personalized quote.

Fulton Bank Home Equity Loan Interest Rates Compared to Competitors

Interest rates for home equity loans vary depending on several factors, including credit score, loan-to-value ratio (LTV), and prevailing market conditions. The following table provides a comparative analysis of Fulton Bank’s rates against three major competitors. Note that these rates are illustrative examples and may change based on individual circumstances and prevailing market conditions. It is crucial to contact the respective banks for the most up-to-date information.

| Bank Name | Interest Rate Range | Loan Term Options | APR |

|---|---|---|---|

| Fulton Bank | 6.5% – 10.5% | 5-15 years | 7.0% – 11.0% (example range, actual APR will vary) |

| Bank of America | 6.0% – 11.0% | 5-20 years | 6.5% – 11.5% (example range, actual APR will vary) |

| Wells Fargo | 6.2% – 10.8% | 5-15 years | 6.7% – 11.3% (example range, actual APR will vary) |

| Chase | 6.8% – 11.2% | 5-15 years | 7.3% – 11.7% (example range, actual APR will vary) |

Factors Influencing Fulton Bank Home Equity Loan Interest Rates

Several key factors influence the interest rate a borrower receives from Fulton Bank for a home equity loan. These factors are assessed during the loan application process. A higher credit score generally leads to a lower interest rate, reflecting lower perceived risk to the lender. The loan-to-value ratio (LTV), which is the loan amount divided by the home’s value, also plays a significant role. A lower LTV indicates less risk, potentially resulting in a more favorable interest rate. Prevailing market interest rates are another critical determinant, influencing the overall cost of borrowing across the financial industry. Finally, the type of home equity loan (e.g., fixed-rate versus variable-rate) will also affect the interest rate.

Obtaining a Personalized Interest Rate Quote from Fulton Bank

To obtain a personalized interest rate quote from Fulton Bank for a home equity loan, borrowers should begin by gathering necessary financial documentation, including proof of income, credit reports, and home appraisal information. This documentation helps Fulton Bank assess the applicant’s creditworthiness and determine the appropriate interest rate. Next, applicants can initiate the process either online through Fulton Bank’s website, by contacting a loan officer directly via phone, or by visiting a local branch. Providing accurate and complete information during the application process will streamline the quote generation and ensure the most accurate rate reflection of the borrower’s individual circumstances. It’s important to note that the provided rate is only an estimate and the final interest rate may differ slightly after the full underwriting process.

Loan Eligibility Requirements and Application Process

Securing a Fulton Bank home equity loan involves understanding the eligibility criteria and navigating the application process. This section details both, providing a clear path to obtaining financing. Understanding these requirements upfront will streamline your application and increase your chances of approval.

Obtaining a home equity loan requires meeting specific financial and property criteria. The application process itself is straightforward but requires careful attention to detail and accurate documentation. Failure to meet the requirements or provide complete information can delay or prevent loan approval.

Eligibility Requirements for a Fulton Bank Home Equity Loan

Meeting Fulton Bank’s eligibility requirements is crucial for loan approval. These requirements generally assess your creditworthiness and the value of your home. Failure to meet these standards will likely result in loan denial.

Key factors considered include credit score, debt-to-income ratio, loan-to-value ratio (LTV), and the equity in your home. Specific requirements may vary depending on the loan amount and type.

- Credit Score: A good credit score is typically required. The minimum score may vary, but a higher score generally improves your chances of approval and may result in a more favorable interest rate.

- Debt-to-Income Ratio (DTI): Lenders assess your DTI to determine your ability to manage additional debt. A lower DTI is preferred, indicating a greater capacity to repay the loan.

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to your home’s value. A lower LTV suggests less risk for the lender and may lead to better terms.

- Home Equity: You must have sufficient equity in your home to secure the loan. Equity is the difference between your home’s value and the amount you still owe on your mortgage.

- Income Verification: Fulton Bank will require documentation verifying your income and employment stability.

- Property Appraisal: An appraisal may be necessary to determine your home’s current market value.

Application Process for a Fulton Bank Home Equity Loan

The application process for a Fulton Bank home equity loan is generally efficient and well-structured. Following these steps will help ensure a smooth and timely application.

The process typically begins with an initial inquiry, followed by application submission, documentation review, and finally, loan approval or denial. Accurate and timely submission of all required documents is critical for a quick processing time.

- Initial Inquiry: Contact Fulton Bank to discuss your loan needs and obtain preliminary information about interest rates and eligibility requirements.

- Application Submission: Complete the loan application form online or in person, providing all necessary personal and financial information.

- Documentation Review: Fulton Bank will review your application and supporting documentation, including credit reports, income verification, and home appraisal.

- Loan Approval or Denial: Upon completion of the review process, Fulton Bank will notify you of their decision. If approved, you will receive loan terms and closing instructions.

- Loan Closing: Once you accept the loan terms, you will complete the closing process, signing all necessary documents and receiving the loan proceeds.

Application Process Flowchart

The following describes a visual representation of the application process. Imagine a flowchart with boxes and arrows. The first box would be “Initial Inquiry,” leading to a box labeled “Application Submission.” This then connects to a box showing “Documentation Review,” which branches into two boxes: “Loan Approval” and “Loan Denial.” “Loan Approval” leads to “Loan Closing,” completing the process.

Loan Terms and Conditions

Understanding the terms and conditions of your Fulton Bank home equity loan is crucial for making an informed financial decision. This section details the various loan terms offered, associated fees, and available repayment options. Careful consideration of these factors will help you choose a loan that aligns with your financial goals and capabilities.

Loan Term Options and Associated Costs

Fulton Bank likely offers a range of home equity loan terms to suit different borrower needs. The specific terms available will vary depending on factors such as credit score, loan amount, and the value of your home. Below is an example of potential loan terms; it’s crucial to contact Fulton Bank directly for the most current and accurate information. Remember, interest rates are subject to change.

| Loan Term (Years) | Interest Rate (Example – APR) | Monthly Payment Example ($100,000 Loan) | Total Interest Paid (Estimate) |

|---|---|---|---|

| 10 | 7.5% | $1,100 | $40,000 |

| 15 | 8.0% | $850 | $65,000 |

| 20 | 8.5% | $750 | $90,000 |

*Note: These are example rates and payments. Your actual rate and payment will depend on several factors.*

Fees Associated with Fulton Bank Home Equity Loans

Several fees may be associated with obtaining a Fulton Bank home equity loan. These fees can significantly impact the overall cost of borrowing. It is essential to understand these charges before proceeding.

Closing costs are common and can include appraisal fees, title insurance, recording fees, and other administrative charges. The exact amount will depend on the loan amount and the specifics of your transaction. Prepayment penalties may apply if you pay off the loan early. These penalties are designed to compensate the bank for lost interest income. Fulton Bank’s loan agreement will clearly Artikel any applicable prepayment penalties. Other potential fees could include origination fees or application fees. Always request a complete breakdown of all fees from Fulton Bank before signing any loan documents.

Repayment Options

Fulton Bank typically offers a standard fixed-rate repayment plan for home equity loans. This means that your monthly payment remains consistent throughout the loan term. The payment amount is calculated based on the loan amount, interest rate, and loan term. It is crucial to confirm with Fulton Bank the specific repayment options available and to ensure that the repayment schedule aligns with your budget. While early repayment options are usually available, remember to check for any prepayment penalties.

Using Home Equity for Home Improvements

Unlocking the equity in your home offers a powerful financial tool for funding home improvements. A Fulton Bank home equity loan can provide the capital needed to transform your living space, increasing both its value and your enjoyment. This section explores the possibilities, advantages, and considerations involved in using home equity for renovations.

Home equity loans provide access to a significant amount of capital, often at a lower interest rate than other forms of borrowing. This makes them an attractive option for homeowners looking to undertake substantial home improvement projects. However, it’s crucial to understand both the benefits and potential drawbacks before proceeding.

Examples of Home Improvement Projects Financed with a Home Equity Loan

A Fulton Bank home equity loan can fund a wide range of home improvement projects, significantly enhancing your property’s value and livability. The following examples illustrate the versatility of this financing option.

- Kitchen Remodeling: Replacing cabinets, countertops, appliances, and flooring can dramatically increase a home’s value and appeal.

- Bathroom Renovations: Updating fixtures, adding a shower or bathtub, and improving accessibility can enhance both comfort and resale value.

- Additions: Building a new room, such as a sunroom, home office, or guest suite, significantly expands living space.

- Energy Efficiency Upgrades: Installing new windows, doors, insulation, or a more efficient HVAC system can lower energy bills and boost the home’s value.

- Landscaping Improvements: Significant landscaping projects, such as creating a patio, installing a new driveway, or adding mature trees, can greatly enhance curb appeal.

Advantages and Disadvantages of Using Home Equity for Home Improvements, Fulton bank home equity loan

Weighing the pros and cons is crucial before utilizing home equity for renovations. A balanced perspective is vital for making an informed decision.

- Advantages: Typically lower interest rates compared to personal loans or credit cards; larger loan amounts available; tax deductibility of interest payments (consult a tax professional for specifics).

- Disadvantages: Increased debt and monthly payments; risk of foreclosure if payments are not made; potential impact on credit score if payments are missed; loan terms can be lengthy.

Hypothetical Scenario: Kitchen Renovation

Imagine a homeowner, Sarah, wants to renovate her outdated kitchen. Her home’s appraised value is $400,000, and she has $100,000 in equity. She secures a $30,000 Fulton Bank home equity loan at a fixed interest rate of 6% over 10 years. The monthly payments are manageable within her budget. The renovation includes new cabinets, countertops, appliances, and flooring. The improvements significantly increase the home’s value, exceeding the loan amount and enhancing Sarah’s quality of life.

Risks and Considerations

A home equity loan, while offering financial flexibility, carries inherent risks that borrowers must carefully consider before proceeding. Understanding these risks and your financial situation is crucial to avoid potential negative consequences. Failing to do so could lead to serious financial hardship.

Understanding your debt-to-income ratio (DTI) is paramount before applying for a home equity loan. A high DTI indicates that a significant portion of your income is already allocated to debt repayment. Adding a home equity loan to this burden can severely strain your finances, potentially leading to missed payments and further financial complications.

Debt-to-Income Ratio and Loan Approval

Your debt-to-income ratio is a key factor lenders consider when assessing your loan application. This ratio compares your total monthly debt payments to your gross monthly income. Lenders typically prefer a lower DTI, usually below 43%, although this can vary depending on the lender and the type of loan. A higher DTI indicates a greater risk to the lender, potentially resulting in loan denial or less favorable terms. For example, if your gross monthly income is $6,000 and your total monthly debt payments are $2,500, your DTI is 41.67% (2500/6000*100). This is generally considered acceptable, but exceeding 43% could negatively impact your application.

Calculating the Total Cost of a Home Equity Loan

Accurately calculating the total cost of a home equity loan is essential to make an informed decision. This involves more than just the loan amount; it encompasses all associated fees and interest payments over the loan’s lifetime. The total cost can be significantly higher than the initial loan amount. For instance, consider a $50,000 home equity loan with a 6% interest rate over 10 years. Using a loan amortization calculator (widely available online), you can determine the total interest paid over the loan term, which, in this example, would be approximately $11,600. Adding this to the principal loan amount ($50,000), the total cost would be approximately $61,600. Remember to factor in closing costs, origination fees, and any other applicable charges, which can add several hundred or even thousands of dollars to the overall cost. This total cost represents the true financial burden of the loan.

Risk of Foreclosure

One of the most significant risks associated with a home equity loan is the potential for foreclosure. If you fail to make your loan payments, the lender can initiate foreclosure proceedings, resulting in the loss of your home. This is a severe consequence, leading to significant financial and personal hardship. Factors contributing to this risk include unexpected job loss, medical emergencies, or unforeseen financial difficulties. Responsible borrowing, including a thorough assessment of your financial capacity to repay the loan, is vital to mitigate this risk. Always ensure you can comfortably afford the monthly payments, including principal, interest, taxes, and insurance (PITI), even during periods of potential financial instability.

Alternatives to Home Equity Loans

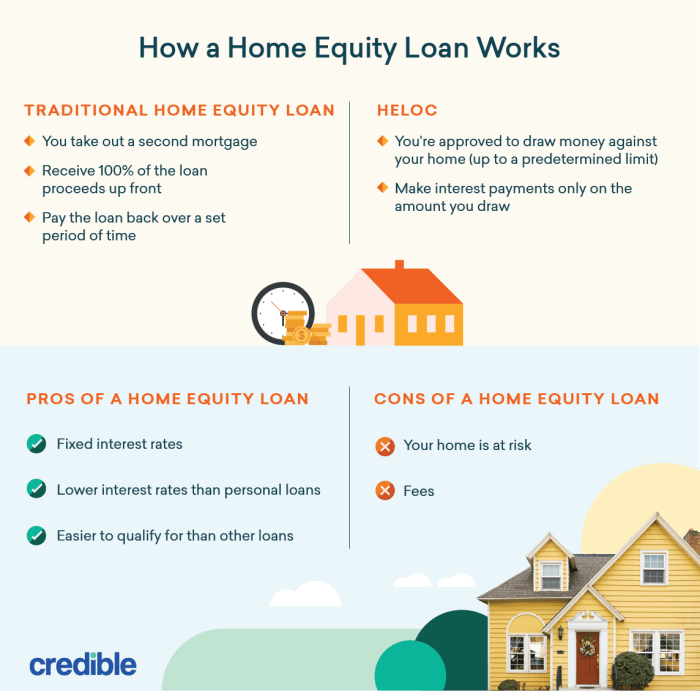

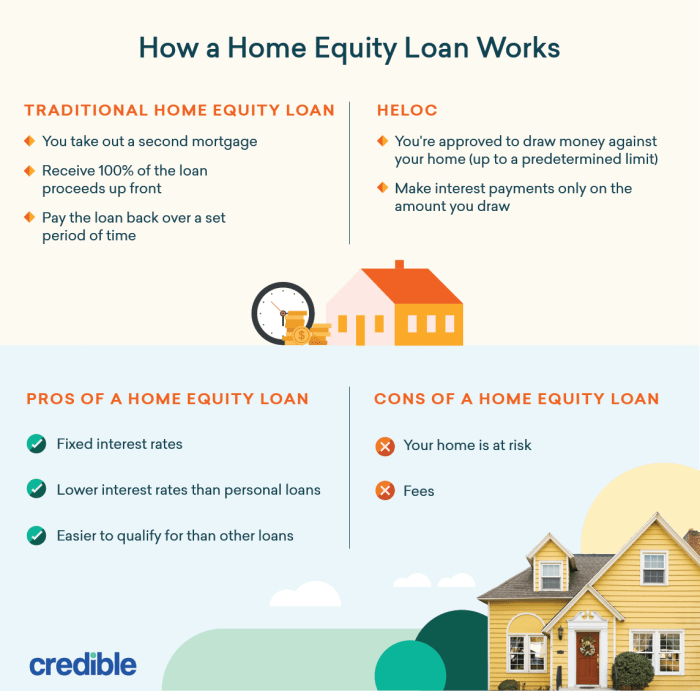

Choosing the right financing option for home improvements can significantly impact your financial well-being. While a home equity loan offers a potentially lower interest rate secured by your home’s equity, it’s crucial to consider alternatives that may better suit your individual circumstances and risk tolerance. This section compares home equity loans with personal loans and Home Equity Lines of Credit (HELOCs), highlighting their key differences and helping you make an informed decision.

Comparison of Home Equity Loans, Personal Loans, and HELOCs

The following table summarizes the key features of home equity loans, personal loans, and HELOCs, allowing for a direct comparison to aid in decision-making. Interest rates, loan terms, and advantages and disadvantages are considered. Remember that actual rates and terms vary depending on individual creditworthiness and lender policies.

| Loan Type | Interest Rates | Loan Terms | Advantages/Disadvantages |

|---|---|---|---|

| Home Equity Loan | Generally lower than personal loans, variable rates are less common. Rates are influenced by the borrower’s credit score and the loan-to-value ratio (LTV). Expect rates to range from 6% to 12%, but this is a broad range. | Fixed-rate loans typically have a term of 10-15 years. | Advantages: Lower interest rates than personal loans, fixed monthly payments, potentially tax-deductible interest (consult a tax professional). Disadvantages: Requires significant home equity, fixed repayment schedule, risk of foreclosure if payments are missed. |

| Personal Loan | Generally higher than home equity loans, ranging from 6% to 36% depending on creditworthiness and lender. | Typically shorter terms, ranging from 2 to 7 years. | Advantages: Easier to qualify for than a home equity loan, flexible use of funds, no risk of foreclosure. Disadvantages: Higher interest rates than home equity loans, shorter repayment periods leading to higher monthly payments. |

| HELOC (Home Equity Line of Credit) | Variable interest rates, typically tied to an index like the prime rate. Rates can fluctuate over the life of the loan. | Draw period (access to funds) typically lasts 10 years, followed by a repayment period of 10-20 years. | Advantages: Access to funds as needed, lower interest rates than personal loans, potentially tax-deductible interest (consult a tax professional). Disadvantages: Variable interest rates can lead to unpredictable payments, risk of foreclosure if payments are missed, potential for overspending. |

Determining the Best Financing Option

Selecting the most suitable financing option depends on several factors, including the amount of home equity, credit score, desired loan term, and financial goals. Individuals with substantial home equity and good credit may find home equity loans or HELOCs advantageous due to potentially lower interest rates. Those with less equity or lower credit scores might find personal loans a more accessible option, despite the higher interest rates. The length of the loan term also influences monthly payments and total interest paid. A shorter term results in higher monthly payments but lower overall interest, while a longer term reduces monthly payments but increases overall interest. Consider your comfort level with variable versus fixed interest rates when choosing between a HELOC and a home equity loan.

Tax Implications of Home Equity Loans, Personal Loans, and HELOCs

The interest paid on home equity loans and HELOCs used for home improvements may be tax-deductible, while interest on personal loans generally is not. However, the deductibility of home equity loan and HELOC interest is subject to certain limitations and depends on your overall debt and income. It is crucial to consult with a tax professional to determine the tax implications of your chosen loan type and your specific financial situation. Tax laws are complex and subject to change, so professional advice is vital for accurate assessment. For example, the amount of deductible interest might be limited by the amount of equity in your home or the amount of debt you have, and the tax benefits might not offset the higher interest rates compared to other financing options.

Epilogue: Fulton Bank Home Equity Loan

Securing a Fulton Bank home equity loan requires careful planning and understanding. By weighing the advantages and disadvantages, comparing interest rates and loan terms with competitors, and carefully considering alternative financing options, you can make an informed decision that best suits your financial situation. Remember to assess your debt-to-income ratio and fully understand the potential risks involved before proceeding. This guide serves as a starting point; consult with a financial advisor for personalized guidance.

Top FAQs

What credit score is needed for a Fulton Bank home equity loan?

Fulton Bank’s minimum credit score requirements vary depending on the loan amount and other factors. It’s best to contact them directly for specific requirements.

What documents are typically required for the application process?

Expect to provide proof of income, employment history, tax returns, and details about your property. The specific documents may vary.

Can I use a home equity loan to pay off other debts?

Yes, home equity loans can be used for debt consolidation, but carefully consider the long-term implications and interest rates.

What happens if I can’t make my loan payments?

Late or missed payments can negatively impact your credit score and potentially lead to foreclosure. Contact Fulton Bank immediately if you anticipate difficulties.