FCCU auto loan rates are a key consideration for anyone seeking financing for a new or used vehicle. Understanding the factors that influence these rates—your credit score, the type of vehicle, and the loan term—is crucial to securing the best possible deal. This comprehensive guide navigates the intricacies of FCCU auto loans, comparing them to traditional banks and credit unions, and outlining the application process from start to finish. We’ll explore different loan types, strategies for managing your loan effectively, and special considerations to ensure you make an informed decision.

We’ll delve into the specifics of how your credit score impacts your interest rate, providing clear examples and a sample rate table. We’ll also cover the application process step-by-step, including required documentation and pre-approval benefits. Different loan types, such as new car loans, used car loans, and refinancing options, will be compared, highlighting their advantages and disadvantages. Finally, we’ll address potential challenges and offer practical advice for successful loan management.

Understanding FCCU Auto Loan Rates

Federal Credit Unions (FCUs) offer auto loans with competitive interest rates, often attracting borrowers seeking favorable terms. Understanding the factors that influence these rates is crucial for securing the best possible loan. This section will detail the key elements determining FCCU auto loan rates and compare them to those offered by traditional banks and credit unions.

Factors Influencing FCCU Auto Loan Interest Rates

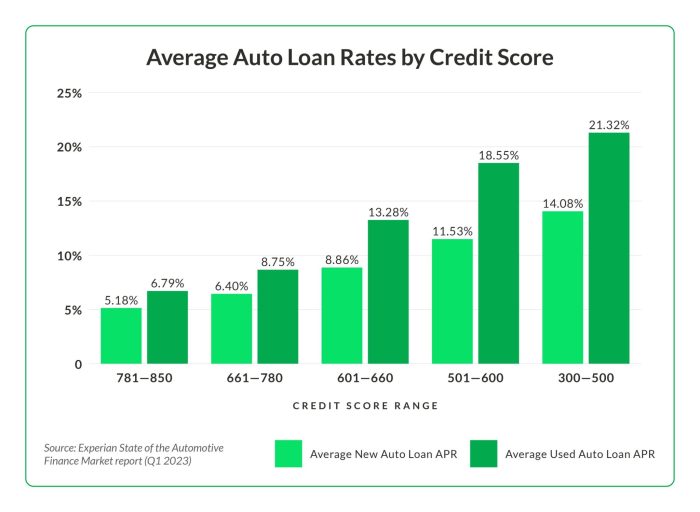

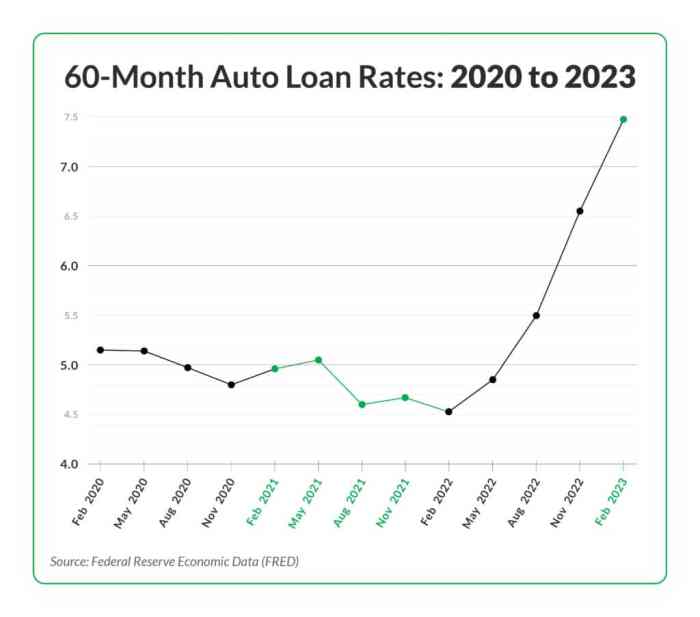

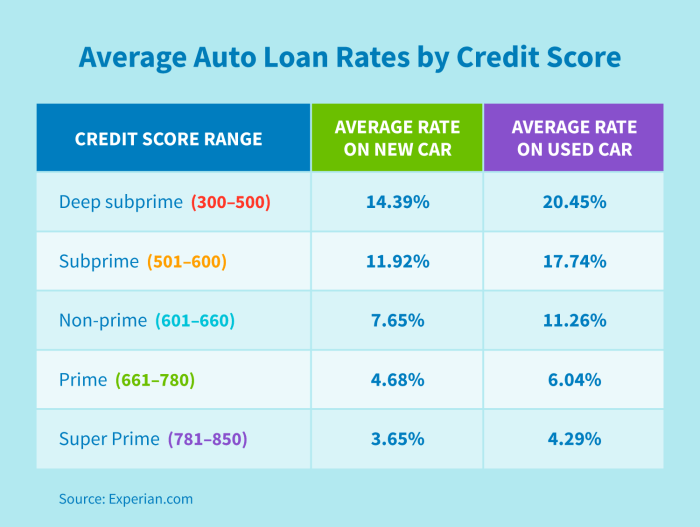

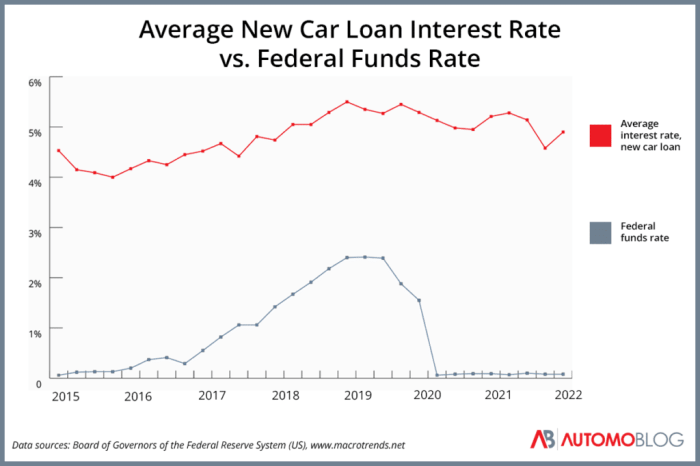

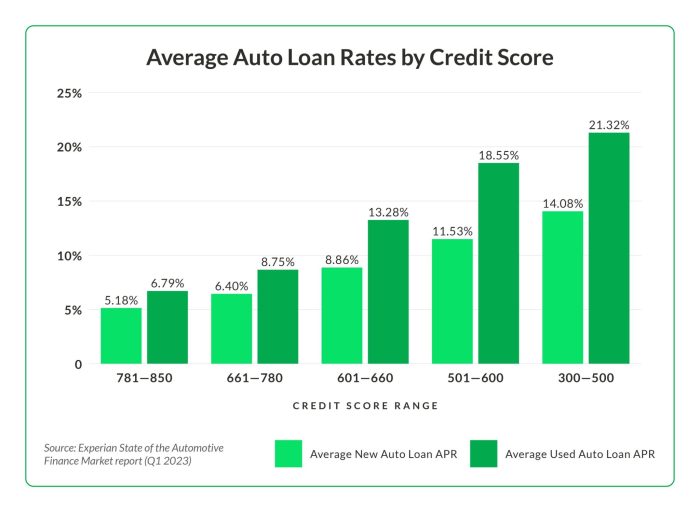

Several factors contribute to the interest rate an FCU offers on an auto loan. These include the borrower’s credit score, the loan term (length of the loan), the loan-to-value ratio (LTV), the type of vehicle (new or used), and the prevailing market interest rates. A higher credit score generally translates to a lower interest rate, reflecting lower risk for the lender. Longer loan terms often result in higher interest rates due to increased risk over a longer period. Similarly, a higher LTV (loan amount as a percentage of the vehicle’s value) may lead to a higher rate because it represents a greater risk for the lender. Finally, fluctuations in broader market interest rates influence the rates offered by FCUs, as they adjust their offerings to remain competitive.

New Versus Used Car Loan Rates

FCUs typically offer different interest rates for new and used car loans. New car loans often come with slightly lower interest rates compared to used car loans. This difference reflects the perceived lower risk associated with financing newer vehicles, which tend to depreciate less rapidly and hold their value better than used cars. The assessment of risk is a key factor in determining the interest rate offered. A newer car represents a lower risk of default for the lender, resulting in a more favorable interest rate for the borrower.

Comparison with Traditional Banks and Credit Unions

While specific rates vary across institutions and depend on individual circumstances, FCUs often compete favorably with traditional banks and other credit unions in terms of auto loan rates. FCUs may offer lower rates due to their member-owned structure and non-profit status, allowing them to prioritize member benefits over maximizing profits. However, it’s crucial to compare offers from multiple lenders, including banks and credit unions, to ensure you secure the most competitive rate for your situation. Factors such as membership requirements and specific loan programs will influence the final rate offered.

Credit Score Impact on FCCU Auto Loan Rates

A borrower’s credit score significantly impacts the interest rate offered on an FCU auto loan. A higher credit score, generally considered 700 or above, typically qualifies for the lowest interest rates. Conversely, borrowers with lower credit scores (below 600) may face significantly higher interest rates, or may even be denied a loan altogether. This reflects the lender’s assessment of the borrower’s creditworthiness and their likelihood of repaying the loan. The credit score serves as a key indicator of risk, directly influencing the interest rate.

Sample FCCU Auto Loan Rates

The following table presents a sample range of FCCU auto loan rates, illustrating the impact of credit score and loan term. These are illustrative examples and actual rates may vary depending on the specific FCU, the borrower’s individual circumstances, and prevailing market conditions.

| Credit Score | 36-Month Loan (APR) | 48-Month Loan (APR) | 60-Month Loan (APR) |

|---|---|---|---|

| 750+ (Excellent) | 3.5% – 5.0% | 4.0% – 5.5% | 4.5% – 6.0% |

| 680-749 (Good) | 4.5% – 6.0% | 5.0% – 6.5% | 5.5% – 7.0% |

| 620-679 (Fair) | 6.0% – 7.5% | 6.5% – 8.0% | 7.0% – 8.5% |

| Below 620 (Poor) | 8.0% – 10%+ | 8.5% – 10.5%+ | 9.0% – 11%+ |

FCCU Loan Application Process: Fccu Auto Loan Rates

Securing an auto loan from your Federal Credit Union (FCCU) involves a straightforward process, typically simpler than those offered by traditional banks. Understanding the steps involved, required documentation, and processing times will ensure a smooth and efficient application experience. This section details the typical procedure for obtaining an FCCU auto loan.

Applying for an FCCU auto loan generally involves several key steps. These steps are designed to assess your financial situation and determine your eligibility for a loan. The entire process is designed to be transparent and efficient, minimizing the time and effort required from the applicant.

Required Documentation for FCCU Auto Loan Application

To successfully apply for an FCCU auto loan, you’ll need to provide certain documentation to verify your income, creditworthiness, and the details of the vehicle you intend to purchase. This documentation ensures the FCCU can accurately assess your loan application and make an informed decision. Incomplete applications may result in delays. Examples of typical required documents include:

- Proof of Income: Pay stubs, W-2 forms, tax returns, or other documentation demonstrating your consistent income stream.

- Proof of Residence: Utility bills, rental agreement, or other documentation verifying your current address.

- Valid Driver’s License or State-Issued ID: This verifies your identity and residency.

- Vehicle Information: Details about the vehicle you plan to purchase, including the make, model, year, VIN (Vehicle Identification Number), and purchase price.

- Credit Report Authorization: The FCCU will need your authorization to access your credit report to assess your creditworthiness.

FCCU Auto Loan Pre-Approval Process and Benefits

Before formally applying for an auto loan, many FCCUs offer a pre-approval process. This allows you to obtain an estimated loan amount and interest rate before you begin actively searching for a vehicle. Pre-approval provides several significant benefits.

- Knowing your borrowing power helps you set a realistic budget for your vehicle search.

- Pre-approval strengthens your negotiating position when purchasing a vehicle, as dealerships are more likely to work with pre-approved buyers.

- The pre-approval process itself is typically quick and easy, often involving only a brief application and credit check.

Typical Processing Time for FCCU Auto Loan Applications

The processing time for an FCCU auto loan application can vary depending on several factors, including the completeness of your application, your credit history, and the current workload of the loan processing department. However, many FCCUs aim to process applications efficiently.

While specific timelines aren’t universally guaranteed, a reasonable expectation is to receive a decision within a few business days to a couple of weeks. Complex applications or those requiring additional documentation may take slightly longer. Promptly providing all necessary documentation will significantly expedite the process.

Types of FCCU Auto Loans

Federal Credit Unions (FCUs) typically offer a range of auto loan options to cater to diverse borrowing needs. Understanding these different loan types is crucial for securing the best financing for your vehicle purchase. The specific offerings might vary slightly between individual FCUs, so it’s always advisable to check directly with your chosen institution for the most up-to-date details.

New Car Loans

New car loans are designed for the purchase of brand-new vehicles directly from dealerships. These loans often come with competitive interest rates, reflecting the lower risk associated with financing a new car. However, the total loan amount will likely be higher than for a used car loan, due to the higher purchase price. The terms of these loans are typically structured to align with the vehicle’s warranty period, which might span several years. A new car loan is ideal for borrowers seeking the latest safety features, technology, and warranty coverage, prioritizing a brand-new vehicle.

Used Car Loans

Used car loans provide financing for purchasing pre-owned vehicles. These loans generally offer slightly higher interest rates compared to new car loans because of the increased risk associated with used vehicles. However, the lower purchase price of a used car often results in a smaller overall loan amount and potentially lower monthly payments. The loan terms are flexible, ranging from shorter to longer repayment periods. A used car loan is suitable for budget-conscious buyers who prioritize affordability over having a brand-new vehicle, or those who seek a specific vehicle model that is only available used.

Refinancing Auto Loans

Refinancing an existing auto loan involves replacing your current loan with a new one from a different lender, often an FCU. This can be beneficial if you can secure a lower interest rate, thereby reducing your monthly payments and the total interest paid over the life of the loan. Refinancing might also allow you to extend or shorten the loan term, depending on your financial goals. For example, shortening the term will lead to higher monthly payments but will save you money on interest in the long run. Refinancing is a suitable option for borrowers seeking to lower their monthly expenses or improve their overall financial situation by securing a better interest rate.

Comparison of FCCU Auto Loan Types

The following table summarizes the key features of each loan type. Remember that specific rates and terms can vary depending on the FCU, your creditworthiness, and the vehicle being financed.

| Loan Type | Interest Rate | Loan Term | Suitable For |

|---|---|---|---|

| New Car Loan | Generally lower | Typically aligns with warranty period | Buyers prioritizing a new vehicle with warranty and latest features |

| Used Car Loan | Generally higher than new car loans | Flexible, shorter or longer terms available | Budget-conscious buyers or those seeking specific used vehicles |

| Refinancing | Potentially lower than existing loan | Can be adjusted (shorter or longer) | Borrowers seeking to lower monthly payments or improve overall financial situation |

Managing Your FCCU Auto Loan

Successfully managing your FCCU auto loan involves proactive planning and consistent effort. Understanding your payment schedule, utilizing available digital tools, and maintaining good credit habits are crucial for a positive loan experience. Failing to manage your loan effectively can lead to serious financial consequences.

Strategies for Timely Payments and Avoiding Late Fees

Establishing a system for timely payments is paramount. This can involve setting up automatic payments directly from your checking or savings account. Alternatively, consider scheduling recurring transfers to your FCCU loan account a few days before the due date to ensure sufficient funds. Review your payment due date regularly and mark it on your calendar or utilize reminder features offered by your bank or financial institution. Contact FCCU immediately if you anticipate difficulty making a payment to explore potential solutions, such as a temporary payment plan. Late fees can significantly impact your overall loan cost, so proactive communication is key.

Managing Your FCCU Auto Loan Online or Through Mobile Apps

FCCU offers convenient online and mobile app access to manage your auto loan. Through the FCCU website or mobile application, you can view your current balance, payment history, and upcoming payment due dates. You can also make payments directly through these platforms, reducing the risk of missed payments. These digital tools often provide notifications and alerts, ensuring you remain informed about your loan status and upcoming deadlines. Furthermore, you can usually access and download your loan statements electronically, simplifying record-keeping.

Tips for Improving Your Credit Score While Paying Off an FCCU Auto Loan, Fccu auto loan rates

Paying your auto loan on time and in full is a significant factor in building and maintaining a good credit score. Consistent on-time payments demonstrate responsible financial behavior to credit bureaus. Maintaining a low credit utilization ratio (the amount of credit you use compared to your total available credit) also positively impacts your score. This can be achieved by managing other credit accounts responsibly as well. Regularly checking your credit report for accuracy and identifying any potential issues can further contribute to improving your creditworthiness.

Consequences of Defaulting on an FCCU Auto Loan

Defaulting on your FCCU auto loan can have severe repercussions. Late payments can lead to increased interest charges and potentially late fees. Repeated defaults can severely damage your credit score, making it difficult to obtain future loans or even rent an apartment. In extreme cases, FCCU may pursue legal action to recover the outstanding debt, which could involve wage garnishment or repossession of the vehicle. The negative impact on your credit history can persist for years, making responsible loan management crucial.

Accessing Your Loan Details Online: A Step-by-Step Guide

1. Visit the FCCU Website: Navigate to the official FCCU website using your preferred web browser.

2. Login to Your Account: Locate the “Login” or “Member Sign In” button and enter your member ID and password.

3. Access Your Loan Information: Once logged in, locate the “Loans” or “Accounts” section of the website.

4. Select Your Auto Loan: From the list of your loans, select the specific auto loan you wish to review.

5. Review Your Loan Details: You should now be able to view your loan balance, payment history, due date, and other relevant information. Many systems also allow for downloading statements or making payments.

Special Considerations for FCCU Auto Loans

Choosing an auto loan involves careful consideration of various factors. While FCCU (Federal Credit Union) auto loans offer competitive rates and benefits, understanding specific requirements and comparing them to traditional bank loans is crucial for making an informed decision. This section details key aspects to consider when exploring FCCU auto financing options.

FCCU Auto Loan Requirements and Limitations

FCCU auto loans, like any financial product, have specific requirements and limitations. These may include minimum credit score thresholds, loan-to-value ratios (LTV), and restrictions on the type of vehicle eligible for financing. For example, some FCCUs may not finance vehicles older than a certain age or with excessively high mileage. Additionally, the loan amount might be capped based on the vehicle’s value and the borrower’s creditworthiness. It’s essential to review the specific terms and conditions of your chosen FCCU’s auto loan program before applying. Pre-approval can help you understand these limitations upfront.

Benefits of FCCU Auto Financing Compared to Other Lenders

FCCUs often offer several advantages over traditional banks and other lenders. These benefits frequently include lower interest rates, more flexible terms, and a potentially more personalized lending experience. The not-for-profit nature of credit unions often translates to lower fees and a greater focus on member satisfaction. Furthermore, FCCUs may offer member-exclusive benefits like loan discounts or special promotions not available elsewhere. The decision to choose an FCCU often comes down to a combination of these factors and the individual borrower’s financial circumstances.

FCCU Auto Loan Member Eligibility Criteria

To qualify for an FCCU auto loan, you must typically be a member of the credit union. Membership requirements vary depending on the specific FCCU, but often involve meeting certain criteria, such as employment at a particular company or residing in a designated geographic area. Some FCCUs may also have affiliation requirements, such as belonging to a particular professional organization. It’s crucial to check the specific membership requirements of the FCCU you are considering before beginning the application process. The application process itself typically involves providing documentation such as proof of income, employment, and residence.

Situations Where an FCCU Auto Loan is Preferable

An FCCU auto loan can be a superior option in several scenarios. For example, borrowers with less-than-perfect credit may find more favorable terms at an FCCU compared to a traditional bank. The personalized service often provided by FCCUs can be particularly beneficial for borrowers who require assistance navigating the loan application process. Additionally, if you value lower fees and a focus on member well-being, an FCCU loan might align better with your financial priorities. Borrowers seeking a more community-oriented lending experience might also find an FCCU more appealing.

Calculating Monthly Payments for an FCCU Auto Loan

Calculating the monthly payment for an auto loan involves using a formula that considers the loan amount, interest rate, and loan term. Let’s consider a sample scenario: Suppose you borrow $20,000 at a 4% annual interest rate for a 60-month loan term. The monthly payment can be approximated using the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly Payment

P = Principal Loan Amount ($20,000)

i = Monthly Interest Rate (Annual Interest Rate / 12 = 0.04 / 12 = 0.00333)

n = Number of Months (60)

Using this formula, the approximate monthly payment would be around $366.88. However, it’s important to note that this is an approximation, and the actual monthly payment may vary slightly depending on the FCCU’s specific calculation methods and any applicable fees. Always refer to the loan agreement for the exact monthly payment amount.

Illustrative Examples of FCCU Auto Loan Scenarios

Understanding the various scenarios in which FCCU auto loans can be utilized helps illustrate the flexibility and benefits of this financial product. The following examples showcase different credit profiles, loan purposes, and the resulting financial implications. Note that these are illustrative examples and actual rates and terms may vary based on individual creditworthiness and FCCU’s prevailing interest rates.

New Vehicle Loan for Borrower with Excellent Credit

This scenario involves a borrower with an excellent credit score (750 or higher) seeking a loan for a new vehicle priced at $30,000. Due to their strong credit history, they qualify for a low interest rate of 3.5% APR. They choose a 60-month loan term. The monthly payment, calculated using a standard amortization schedule, would be approximately $548. The process would involve submitting a loan application, providing proof of income, and potentially providing documentation related to the vehicle purchase. The lender would review the application, verify the information, and then approve or deny the loan. Once approved, the borrower would receive loan funds which they then use to purchase the vehicle, and the lender would register a lien on the vehicle’s title until the loan is fully repaid.

Used Vehicle Loan for Borrower with Fair Credit

In this scenario, a borrower with a fair credit score (around 650) is seeking a loan for a used vehicle priced at $15,000. Due to their credit profile, they receive a higher interest rate of 7% APR. They opt for a 48-month loan term to reduce the overall interest paid. Their monthly payment would be approximately $350. The application process would be similar to the previous scenario, but the lender may require additional documentation or a larger down payment to mitigate the higher risk associated with a fair credit score. The borrower may also need to provide proof of insurance and vehicle appraisal documentation.

Auto Loan Refinancing with FCCU

This example illustrates a borrower currently paying 9% APR on a $20,000 auto loan with another lender. They decide to refinance with FCCU and secure a lower interest rate of 6% APR. By refinancing with a 36-month loan term, their monthly payment decreases from approximately $660 to $608. The refinancing process involves submitting an application to FCCU, providing documentation of their existing loan (including the current loan agreement and recent payment history), and providing updated financial information. FCCU would then assess the borrower’s creditworthiness and the value of the vehicle. Upon approval, FCCU pays off the existing loan and the borrower begins making payments to FCCU at the new, lower rate. The savings in interest over the life of the loan can be substantial. For example, in this case the total interest paid over 36 months would be approximately $1,100 less with FCCU than with their previous lender.

Epilogue

Securing an auto loan through your FCCU can offer significant advantages, from potentially lower interest rates to personalized service. By understanding the factors influencing FCCU auto loan rates, carefully reviewing the application process, and managing your loan responsibly, you can navigate the financing process with confidence and secure a favorable deal. Remember to compare rates from different lenders and choose the option that best suits your financial circumstances and long-term goals. This guide provides a solid foundation for making informed decisions about your auto financing needs.

FAQ Corner

What is the typical processing time for an FCCU auto loan application?

Processing times vary, but generally range from a few days to a couple of weeks, depending on the completeness of your application and the lender’s workload.

Can I refinance my existing auto loan with my FCCU?

Yes, many FCCUs offer auto loan refinancing options. This can be beneficial if you can secure a lower interest rate or more favorable terms.

What happens if I miss a payment on my FCCU auto loan?

Missing payments will result in late fees and can negatively impact your credit score. Contact your FCCU immediately if you anticipate difficulty making a payment to explore potential solutions.

What is the minimum credit score required for an FCCU auto loan?

The minimum credit score requirement varies by FCCU and loan type. While some may accept borrowers with lower credit scores, a higher score typically results in more favorable interest rates.

How can I check my FCCU auto loan balance online?

Most FCCUs offer online account access through their website or mobile app, allowing you to view your loan balance, payment history, and other details.