Heart Payday Loans reviews are crucial for understanding this financial product. This guide delves into customer experiences, exploring both the positive and negative aspects of using Heart Payday Loans. We’ll examine interest rates, loan terms, customer service, and ultimately, help you determine if a Heart Payday Loan is right for your financial situation. We’ll also cover responsible borrowing practices and explore viable alternatives.

From application processes to repayment terms and potential financial consequences, we aim to provide a transparent and informative overview. This in-depth analysis will equip you with the knowledge to make an informed decision regarding Heart Payday Loans, empowering you to navigate the world of short-term borrowing with confidence.

Understanding “Heart Payday Loans”

Heart Payday Loans, like other payday loan providers, offers short-term, small-dollar loans designed to bridge the gap between paychecks. These loans are typically repaid on the borrower’s next payday, making them a quick solution for unexpected expenses. However, it’s crucial to understand the terms and conditions before applying, as high interest rates and fees can make these loans expensive if not managed carefully.

Heart Payday Loans’ services primarily focus on providing fast access to cash for individuals facing temporary financial difficulties. The company aims to streamline the borrowing process, making it convenient for those needing immediate funds. While specific services offered may vary depending on location and regulatory changes, the core offering remains consistent: providing small, short-term loans to individuals who meet their eligibility criteria.

Target Audience for Heart Payday Loans

Heart Payday Loans primarily targets individuals with limited access to traditional credit options, such as bank loans or credit cards. This typically includes those with low credit scores, unstable employment, or a history of missed payments. The target audience often comprises individuals needing a small amount of money to cover immediate expenses, such as unexpected medical bills, car repairs, or utility payments. These are individuals who may not qualify for or have time to secure financing through more conventional channels.

The Loan Application Process at Heart Payday Loans

The application process for Heart Payday Loans generally involves submitting an online application, providing personal information, employment details, and bank account information. The lender will then review the application and assess the applicant’s creditworthiness and ability to repay the loan. If approved, the funds are usually deposited directly into the borrower’s bank account within a short timeframe, often within 24 hours. The specific steps may vary slightly depending on the lender’s platform and policies. Applicants should carefully review the provided information and ensure the accuracy of all details submitted.

Comparison of Heart Payday Loans’ Interest Rates to Competitors

Interest rates for payday loans vary significantly depending on the lender, location, and the borrower’s creditworthiness. Direct comparison of Heart Payday Loans’ interest rates to competitors requires accessing specific rate information from multiple lenders, which is often not publicly available in a standardized format. However, it’s generally understood that payday loans carry high interest rates compared to other forms of borrowing, such as personal loans or credit cards. The annual percentage rate (APR) for payday loans can range from several hundred to over a thousand percent, depending on the loan amount and repayment terms. Borrowers should compare APRs and fees from several lenders before making a decision, and carefully weigh the cost of borrowing against the need for immediate funds. It is essential to explore all available options and consider the long-term financial implications before opting for a payday loan.

Review Analysis

Positive customer feedback provides valuable insights into the strengths of Heart Payday Loans. Analyzing these reviews allows us to understand what aspects of the service resonate most positively with borrowers and identify areas of excellence. This analysis focuses on recurring themes and specific examples to illustrate the positive experiences reported by customers.

Positive Feedback Themes

Common positive themes emerging from customer reviews of Heart Payday Loans frequently revolve around the speed and ease of the application process, the helpfulness and responsiveness of customer service representatives, and the clarity of the loan terms and conditions. Many reviewers praise the straightforward nature of the loan application, highlighting its accessibility even for those with limited financial literacy. The overall experience is often described as stress-free and efficient, contrasting with the potentially anxiety-inducing nature of seeking emergency financial assistance.

Examples of Positive Customer Experiences

One recurring positive comment centers on the rapid disbursement of funds. Many reviewers report receiving the loan amount within a matter of hours of application approval, providing immediate relief during financial emergencies. For example, one review stated, “I was in a desperate situation, and Heart Payday Loans got me the money I needed within the day. I can’t thank them enough.” Another common positive aspect highlighted is the exceptional customer service. Reviewers frequently describe representatives as patient, understanding, and helpful in answering questions and guiding them through the process. A typical positive review might read, “The customer service team was incredibly helpful and answered all my questions patiently. They made the whole process much less stressful.”

Aspects Leading to Positive Reviews

Several key aspects of Heart Payday Loans contribute to the positive feedback received. The streamlined application process, requiring minimal documentation and information, is frequently praised. The transparent loan terms and conditions, clearly outlining interest rates, fees, and repayment schedules, also contribute to customer satisfaction. The accessibility of the service, both online and potentially through phone support, allows borrowers to apply at their convenience and receive personalized assistance. Finally, the speed of fund disbursement is a crucial factor, as it directly addresses the urgent financial needs of the borrowers.

Summary of Positive Feedback

| Category | Example |

|---|---|

| Speed of Disbursement | “Received funds within hours of approval.” |

| Customer Service | “Representatives were patient, helpful, and understanding.” |

| Ease of Application | “The application process was simple and straightforward.” |

| Transparency of Terms | “Loan terms and conditions were clearly explained.” |

Review Analysis

This section delves into the negative feedback surrounding Heart Payday Loans, identifying recurring themes and providing illustrative examples to offer a balanced perspective on customer experiences. Understanding the negative aspects is crucial for a comprehensive evaluation of the service.

Negative Feedback Themes

Analysis of customer reviews reveals several common negative themes concerning Heart Payday Loans. These frequently revolve around issues with the application process, high fees and interest rates, poor customer service, and difficulties in repayment. These recurring complaints paint a picture of potential challenges for borrowers.

Examples of Negative Customer Experiences

One recurring complaint centers on the unexpected fees associated with the loans. Many reviewers expressed frustration over hidden charges or fees that significantly increased the overall cost of borrowing. For instance, some users reported being charged late fees even with minor delays in payment, despite having made a good-faith effort to repay. Another common negative experience involves difficulties in contacting customer service. Several reviewers described long wait times, unhelpful representatives, or a complete lack of response to their inquiries. This lack of responsiveness adds to the stress of already difficult financial situations. Finally, the high-interest rates charged by Heart Payday Loans are a frequent source of negative feedback. Borrowers often felt trapped in a cycle of debt due to the high cost of repayment.

Aspects Leading to Negative Reviews

Several key aspects of Heart Payday Loans contribute to the negative reviews. The complexity of the loan application process, often coupled with unclear terms and conditions, leads to confusion and frustration. High interest rates and unexpected fees contribute significantly to negative experiences. Finally, inadequate customer service, characterized by long wait times and unresponsive representatives, exacerbates negative sentiments. The combination of these factors often leaves borrowers feeling exploited and dissatisfied.

Summary of Negative Feedback, Heart payday loans reviews

| Category | Example | Impact | Frequency |

|---|---|---|---|

| High Fees and Interest Rates | Unexpected charges significantly increasing loan cost. | Financial burden, debt trap. | Very High |

| Poor Customer Service | Long wait times, unhelpful representatives, lack of response. | Increased stress, unresolved issues. | High |

| Complex Application Process | Confusing terms and conditions, unclear requirements. | Frustration, potential for errors. | Moderate |

| Difficult Repayment | Strict repayment terms, high penalties for late payments. | Financial strain, potential for further debt. | High |

Loan Terms and Conditions: Heart Payday Loans Reviews

Understanding the terms and conditions associated with Heart Payday Loans is crucial before applying for a loan. These terms dictate the repayment schedule, potential penalties for late payments, and overall cost of borrowing. Failing to thoroughly review these details can lead to unexpected financial burdens.

Heart Payday Loans, like other payday lenders, typically offers short-term loans with relatively high interest rates. Repayment is usually expected within a short timeframe, often two to four weeks, coinciding with the borrower’s next payday. The exact terms, including the APR (Annual Percentage Rate), fees, and repayment schedule, will be Artikeld in the loan agreement. It’s imperative to read this document carefully before signing.

Repayment Terms and Conditions

Repayment terms typically involve a single lump-sum payment on the borrower’s next payday. However, some lenders may offer options for extended repayment plans, though these often come with additional fees. The loan agreement will specify the due date and the total amount due, including principal and any applicable fees and interest. Late payments can result in significant penalties, potentially escalating the total cost of the loan considerably.

Consequences of Defaulting on a Loan

Defaulting on a Heart Payday Loan, or failing to make the required payment by the due date, can have serious consequences. These can include additional late fees, damage to credit score, and potential debt collection actions. Repeated defaults can severely impact an individual’s ability to secure future loans or credit. In some cases, lenders may pursue legal action to recover the outstanding debt, which can involve court costs and further financial strain.

Comparison to Similar Lenders

Heart Payday Loans’ terms and conditions are generally comparable to other payday lenders. Many offer similar short-term loan durations, high interest rates, and fees. However, specific details like APR, fees, and repayment options can vary significantly between lenders. It’s recommended to compare offers from multiple lenders before making a decision to ensure you are getting the best possible terms. Borrowers should always prioritize transparency and clarity in the loan agreement.

Key Terms and Conditions

The following points highlight key aspects of a typical Heart Payday Loan agreement. It’s crucial to note that these are general examples and specific terms may vary. Always refer to the individual loan agreement for precise details.

- Loan Amount: The specific amount borrowed.

- APR (Annual Percentage Rate): The annual interest rate charged on the loan.

- Fees: Any additional charges, such as origination fees or late payment fees.

- Repayment Schedule: The date(s) on which payments are due.

- Late Payment Penalties: Fees and consequences for missed or late payments.

- Collection Practices: The lender’s procedures for collecting outstanding debt.

Customer Service Experience

Heart Payday Loans’ customer service accessibility and responsiveness are crucial factors influencing borrower satisfaction and overall loan experience. Understanding how easily customers can contact the company and the quality of support received is essential for a comprehensive review. This section analyzes the available contact methods, assesses representative responsiveness and helpfulness, and provides examples of both positive and negative interactions. A comparison to competitor practices will also be offered.

Contact Methods

Heart Payday Loans typically offers several methods for borrowers to contact customer service. These commonly include phone support, email, and possibly a live chat function on their website. The availability and hours of operation for each method should be clearly stated on their website. The ease of use and navigation to the contact information are also important aspects to consider. A lack of readily available contact information can be a significant negative point.

Responsiveness and Helpfulness of Representatives

The speed and efficiency of responses from customer service representatives are key indicators of customer service quality. Responsiveness can be measured by the time taken to answer phone calls, reply to emails, or resolve live chat inquiries. Helpfulness involves the representatives’ ability to address customer concerns effectively, provide accurate information, and resolve issues efficiently. A well-trained and knowledgeable customer service team can significantly improve the borrower experience.

Examples of Customer Service Interactions

Positive interactions might include instances where a representative quickly resolved a technical issue with the loan application, patiently answered complex questions about loan terms, or proactively contacted a borrower to address a potential problem. Negative examples could involve long wait times on hold, unhelpful or dismissive representatives, or failure to adequately address a complaint. Specific details from customer reviews and testimonials can be used to illustrate both positive and negative experiences. For example, a review might mention a representative going above and beyond to help a borrower in a difficult financial situation, or conversely, describe an experience with a rude or unhelpful representative who failed to resolve the issue.

Comparison to Competitors

Comparing Heart Payday Loans’ customer service to competitors requires analyzing similar metrics across various payday loan providers. Factors such as average response times, customer satisfaction ratings (where available), and the range of contact methods offered can be compared. This comparison helps determine whether Heart Payday Loans’ customer service is superior, comparable, or inferior to its competitors. For example, if competitor A consistently offers 24/7 phone support while Heart Payday Loans only offers limited hours, this could be considered a negative point for Heart Payday Loans. Similarly, if customer reviews consistently praise competitor B’s helpful and knowledgeable representatives, while Heart Payday Loans receives complaints about unhelpful staff, this would suggest a significant area for improvement.

Financial Implications

Payday loans, while offering quick access to cash, present significant financial risks if not managed responsibly. Understanding these implications is crucial before considering such a loan, as the potential consequences can outweigh the short-term benefits. This section details the potential benefits and drawbacks, emphasizing the importance of responsible borrowing practices.

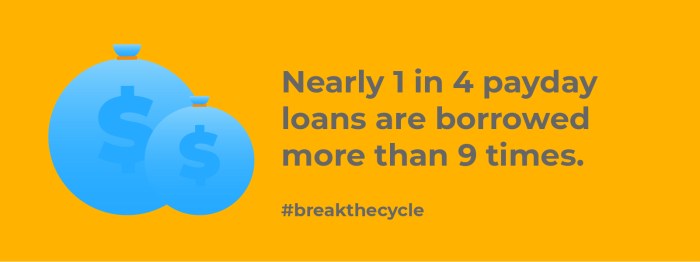

Payday loans can provide a temporary solution to unexpected expenses, preventing missed payments or bounced checks. However, their high interest rates and short repayment periods can quickly lead to a cycle of debt, making it difficult to repay the loan and accumulating further fees. The convenience of quick access to funds often overshadows the long-term financial burdens they can create.

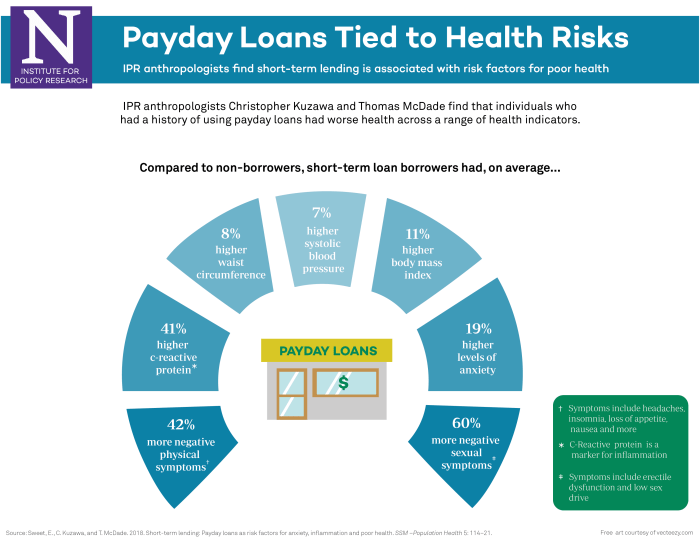

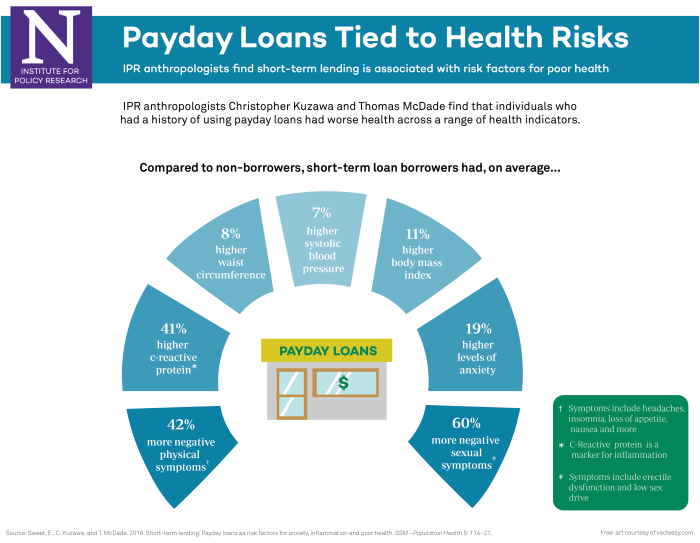

Potential Risks of Payday Loans

The primary risk associated with payday loans is the extremely high annual percentage rate (APR). These rates can far exceed those of traditional loans or credit cards, making it difficult to repay the loan on time. Late fees and rollover charges further exacerbate the debt, potentially trapping borrowers in a cycle of repeated borrowing. For example, a $300 payday loan with a $15 fee for a two-week loan translates to an APR exceeding 400% in many cases. This exorbitant cost can significantly impact a borrower’s financial stability. Furthermore, the short repayment period puts immense pressure on borrowers to repay the loan within a short timeframe, often leading to further financial strain if unexpected expenses arise.

Long-Term Financial Consequences

Repeated reliance on payday loans can have severe long-term financial consequences. The high interest and fees can lead to a significant accumulation of debt, potentially affecting credit scores and making it difficult to obtain future loans or credit. This can impact major life decisions, such as purchasing a home, financing a car, or even securing a credit card. The constant stress of managing multiple payday loans can also negatively affect mental health and overall well-being. For instance, a person consistently relying on payday loans to cover essential expenses might struggle to save for retirement, education, or emergencies, hindering their long-term financial security.

Responsible Borrowing Practices

Responsible borrowing is paramount when considering a payday loan. Borrowers should carefully evaluate their financial situation, ensuring they can comfortably repay the loan within the stipulated timeframe without compromising other essential expenses. Exploring alternative borrowing options, such as negotiating with creditors, seeking financial assistance programs, or utilizing credit counseling services, should be prioritized before resorting to payday loans. Only borrowing what is absolutely necessary and creating a realistic repayment plan are essential steps in minimizing the risks associated with payday loans.

Tips for Responsible Payday Loan Usage

Before taking out a payday loan, thoroughly research all fees and interest rates. Compare offers from multiple lenders to find the most favorable terms. Only borrow the minimum amount necessary to cover the immediate need. Develop a detailed repayment plan, ensuring that the loan amount can be repaid on the due date without resorting to further borrowing. Explore all other financial options first, and if a payday loan is unavoidable, ensure it is a last resort. Maintain open communication with the lender if facing difficulty repaying the loan, to explore possible solutions such as repayment extensions or alternative arrangements. Finally, build an emergency fund to avoid future reliance on high-cost loans.

Alternatives to Heart Payday Loans

Securing short-term financial assistance doesn’t solely rely on payday loans. Several alternatives offer comparable benefits with potentially lower risks and costs. Choosing the right option depends heavily on individual circumstances and the nature of the financial need. This section explores viable alternatives and compares their suitability to Heart Payday Loans.

Payday loans, while offering quick access to funds, often come with high interest rates and fees. Exploring alternative solutions can lead to better long-term financial health. Consider these options carefully, weighing their advantages and disadvantages against your specific financial situation.

Personal Loans from Banks or Credit Unions

Personal loans from traditional financial institutions provide a structured borrowing framework with fixed repayment schedules and typically lower interest rates compared to payday loans. Credit unions often offer more favorable terms than banks, particularly for members with established credit histories. However, securing approval may require a more robust credit score and a more rigorous application process than payday loans. The approval process can also take longer.

Small-Dollar Loans from Online Lenders

Numerous online lenders specialize in providing smaller loans, often with less stringent eligibility requirements than traditional banks or credit unions. Interest rates can vary significantly, so careful comparison shopping is crucial. Some online lenders prioritize responsible lending practices and offer flexible repayment options, making them a more appealing alternative to high-cost payday loans. However, it’s essential to scrutinize the terms and conditions carefully to avoid hidden fees or predatory lending practices.

Credit Builder Loans

Designed specifically to help individuals improve their credit scores, credit builder loans involve making regular, scheduled payments over a set period. The loan amount is usually small, and the repayment history is reported to credit bureaus, potentially leading to a higher credit score over time. While the interest rates may be higher than some other loan options, the long-term benefits of improved creditworthiness often outweigh the costs. This is particularly beneficial for individuals seeking to establish or rebuild their credit.

Borrowing from Family or Friends

Borrowing from trusted family members or friends can be a convenient and potentially cost-effective solution for short-term financial needs. This option often avoids interest charges and allows for flexible repayment arrangements. However, it’s crucial to approach such arrangements with transparency and a formal agreement to prevent misunderstandings or damage to personal relationships. Clearly defining repayment terms and timelines is essential.

Using a Credit Card

If you possess a credit card with available credit, using it to cover unexpected expenses can provide immediate access to funds. However, relying on credit cards for short-term borrowing can lead to accumulating debt if not managed carefully. High interest rates and potential late payment fees can quickly escalate costs. It’s crucial to only use credit cards when you can confidently repay the balance within the interest-free period.

Selling Unused Items

Selling possessions no longer needed or used can generate immediate cash to address short-term financial needs. Platforms like eBay or Craigslist offer avenues to sell various items, from electronics and furniture to clothing and collectibles. This option avoids debt and helps manage expenses without incurring interest charges. The amount of money generated depends on the value of the items sold.

Negotiating with Creditors

If facing difficulty in meeting payment deadlines, contacting creditors directly to negotiate a payment plan can prevent further debt accumulation. Many creditors are willing to work with borrowers experiencing temporary financial hardship. Negotiating a reduced payment amount or extending the repayment period can alleviate immediate financial pressure. However, this requires proactive communication and a willingness to cooperate with creditors.

| Feature | Heart Payday Loans | Personal Loan | Online Small-Dollar Loan |

|---|---|---|---|

| Interest Rates | Typically Very High | Moderately High to Low | Variable, Potentially High |

| Application Process | Fast and Easy | More Rigorous | Moderately Easy |

| Repayment Terms | Short-Term | Longer-Term | Variable |

| Fees | Often High | Lower | Variable |

Illustrative Scenarios

Understanding the potential benefits and drawbacks of Heart Payday Loans requires examining specific scenarios. The financial implications, and ultimately, the narrative outcome, heavily depend on the borrower’s financial situation and ability to repay the loan on time.

Beneficial Scenario: Emergency Home Repair

Imagine Sarah, a single mother, whose washing machine breaks down unexpectedly. The repair costs $500, a sum she doesn’t have readily available. Her next paycheck is two weeks away, and she cannot afford to delay the repair due to the risk of mold damage and further expense. A Heart Payday Loan of $500, with a reasonable interest rate and repayment terms, allows her to repair the washing machine promptly. She repays the loan in full from her next paycheck, avoiding additional fees and preventing a more significant financial setback. The financial implication is a relatively small interest payment, easily manageable within her budget, preventing a far greater cost from a prolonged malfunction. This scenario illustrates how a payday loan can act as a short-term solution for an unavoidable emergency expense.

Detrimental Scenario: Unforeseen Debt Accumulation

Consider Mark, who uses a Heart Payday Loan to cover recurring expenses, such as groceries and utilities, each month. He initially borrows $300, but consistently rolls over the loan due to his inability to repay the principal amount. Each rollover incurs additional fees and interest, quickly accumulating debt. His initial $300 loan balloons to over $1000 within six months. The financial implication is a crippling debt burden, significantly impacting his credit score and overall financial well-being. This scenario showcases the potential for a payday loan to create a vicious cycle of debt, ultimately leading to significant financial hardship and stress. Mark’s inability to manage his finances, coupled with the high-interest rates and fees associated with loan rollovers, resulted in a catastrophic financial outcome.

Closing Summary

Ultimately, deciding whether to utilize Heart Payday Loans requires careful consideration of your individual financial circumstances. While they can offer short-term relief, the high-interest rates and potential for debt cycles necessitate responsible borrowing habits. This review has aimed to provide a balanced perspective, highlighting both the advantages and disadvantages to help you make the best choice for your financial well-being. Remember to explore alternative financial solutions and prioritize responsible financial management.

Common Queries

What are the typical fees associated with Heart Payday Loans?

Fees vary depending on the loan amount and repayment terms. It’s crucial to review the loan agreement carefully for a complete breakdown of all charges.

How long does it take to get approved for a Heart Payday Loan?

Approval times can vary, but many lenders offer quick approval processes, often within a few hours. However, this depends on the completeness of your application and the lender’s verification procedures.

What happens if I can’t repay my Heart Payday Loan on time?

Late payments can result in additional fees and negatively impact your credit score. Contact the lender immediately if you anticipate difficulties making a payment to explore possible solutions.

Are there any hidden fees I should be aware of?

Always read the loan agreement thoroughly. Hidden fees are illegal in many jurisdictions, but it’s essential to be vigilant and ensure transparency in all charges.