Is Green Arrow Loans legit? That’s the question many potential borrowers are asking before considering this lender. This in-depth review examines Green Arrow Loans’ business model, licensing, customer experiences, loan terms, transparency, and financial health to help you determine if they’re a trustworthy option. We’ll delve into both positive and negative aspects, providing a balanced perspective to inform your decision.

Understanding the legitimacy of any loan provider is crucial. This review will analyze Green Arrow Loans against industry standards and regulatory compliance, exploring customer reviews and financial stability to provide a comprehensive assessment of their trustworthiness and suitability for your borrowing needs.

Green Arrow Loans: Is Green Arrow Loans Legit

Green Arrow Loans operates within the competitive landscape of online lending, catering to individuals seeking quick access to funds. Understanding their business model, services, and history is crucial for assessing their legitimacy and suitability for potential borrowers.

Green Arrow Loans Business Model

Green Arrow Loans functions as a direct lender, meaning they provide loans directly to borrowers without involving third-party intermediaries. This model streamlines the application and approval process, potentially offering faster funding compared to traditional banks or credit unions. Their revenue is generated through interest payments on the loans they issue. The company likely employs sophisticated risk assessment models to evaluate borrower creditworthiness and mitigate potential losses.

Green Arrow Loans Services, Is green arrow loans legit

The specific services offered by Green Arrow Loans may vary, but generally include short-term loans, often categorized as payday loans or installment loans. These loans are typically designed for smaller loan amounts and shorter repayment periods. While the precise terms and conditions will be Artikeld in their loan agreements, borrowers should expect to provide personal and financial information during the application process. Additional services may include online application portals and customer support channels.

Green Arrow Loans History

Unfortunately, publicly available information regarding the founding and growth of Green Arrow Loans is limited. Many online lenders operate with a degree of privacy concerning their specific operational history. To obtain detailed information on their founding date, expansion milestones, and overall growth trajectory, one would likely need to consult official company documents or financial records, if they are publicly accessible. This lack of transparency is a factor to consider when evaluating the company.

Comparison of Green Arrow Loans with Similar Companies

The following table compares Green Arrow Loans with three other online lending companies. Note that interest rates, loan amounts, and customer reviews can fluctuate and are subject to change based on individual circumstances and market conditions. This data is for illustrative purposes and should not be considered definitive. It is crucial to conduct thorough research before choosing any lender.

| Company Name | Interest Rates (APR) | Loan Amounts | Customer Reviews (Example) |

|---|---|---|---|

| Green Arrow Loans | Variable, requires application | Variable, requires application | Data unavailable; requires independent research. |

| Company A (Example) | 36% – 400% (Illustrative) | $100 – $5,000 (Illustrative) | Mixed reviews; check independent review sites. |

| Company B (Example) | 20% – 300% (Illustrative) | $500 – $10,000 (Illustrative) | Generally positive, but check individual experiences. |

| Company C (Example) | 10% – 200% (Illustrative) | $1,000 – $25,000 (Illustrative) | Mostly positive, but verify recent reviews. |

Green Arrow Loans: Is Green Arrow Loans Legit

Green Arrow Loans, like many online lending platforms, operates within a complex regulatory landscape. Understanding its licensing and compliance history is crucial for assessing its legitimacy and the risks associated with using its services. This section will examine Green Arrow Loans’ regulatory standing, including its licensing, compliance with relevant laws, and any documented legal issues.

Green Arrow Loans: Licensing and Regulatory Compliance

Determining the precise regulatory oversight of Green Arrow Loans requires knowing its operational locations and the types of loans offered. Online lenders often operate across state lines, meaning they must comply with a patchwork of state and potentially federal regulations. These regulations vary significantly, impacting licensing requirements, interest rate caps, and consumer protection measures. A lack of transparency regarding licensing and compliance can be a major red flag.

The licensing requirements for loan companies differ substantially depending on the state or jurisdiction. Generally, states require lenders to obtain a license before offering loans to residents. This licensing process often involves background checks, financial audits, and demonstrations of compliance with state lending laws. Failure to obtain the necessary licenses can result in significant penalties, including fines and cease-and-desist orders. Specific requirements might include minimum capital reserves, surety bonds, and adherence to specific lending practices designed to protect consumers from predatory lending.

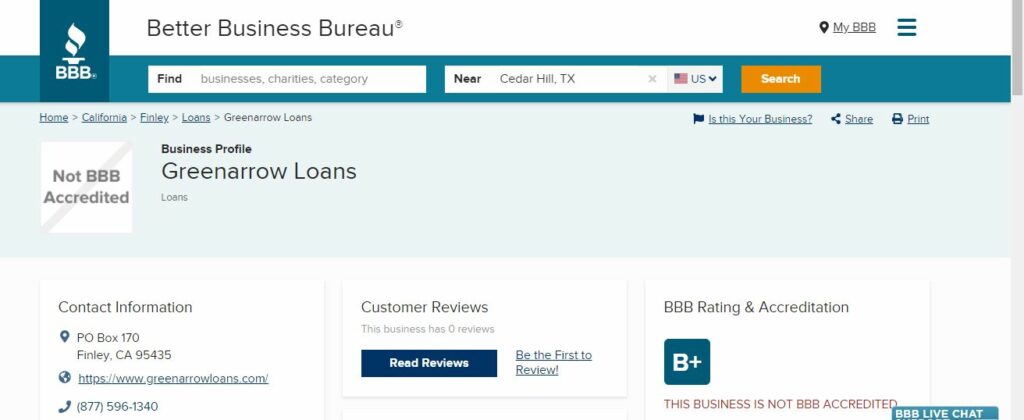

To ascertain whether Green Arrow Loans holds the necessary licenses, one would need to consult the relevant state regulatory agencies in the jurisdictions where the company operates. This often involves checking databases maintained by state banking departments or similar regulatory bodies. Information on any legal actions or complaints filed against Green Arrow Loans could be found through public court records, state attorney general websites, and the Better Business Bureau.

- Licensing Jurisdictions: A comprehensive list of states and jurisdictions where Green Arrow Loans is licensed to operate is necessary for a complete assessment. Without this information, a full evaluation of regulatory compliance is impossible.

- Regulatory Bodies: The specific regulatory bodies overseeing Green Arrow Loans’ operations will vary depending on its location and the types of loans offered. These could include state banking departments, consumer finance agencies, or other relevant authorities.

- Legal Actions and Complaints: A detailed record of any legal actions, lawsuits, or consumer complaints filed against Green Arrow Loans is crucial. This information can be obtained from public records databases and regulatory agency websites. The absence of documented legal issues doesn’t necessarily equate to complete compliance, but it suggests a lower risk profile.

- Compliance History: A review of Green Arrow Loans’ compliance history, including any past violations or penalties, would provide further insight into its adherence to regulatory standards. This information may be publicly available through regulatory agency websites or legal databases.

Green Arrow Loans: Is Green Arrow Loans Legit

Green Arrow Loans, a purported online lending platform, presents a mixed bag of customer experiences. Understanding these diverse accounts is crucial for potential borrowers seeking to assess the legitimacy and reliability of the service. Analyzing both positive and negative feedback, alongside the impact of credit scores, provides a comprehensive picture of the Green Arrow Loans experience.

Positive Customer Reviews and Testimonials

Positive reviews often highlight Green Arrow Loans’ speed and efficiency in processing loan applications. Many customers praise the ease of the online application process, citing a streamlined and user-friendly interface. Testimonials frequently mention the relatively quick disbursement of funds once the application is approved, which is particularly beneficial for those facing urgent financial needs. Some customers also express satisfaction with the customer service representatives, describing them as helpful and responsive to inquiries. These positive experiences suggest that for certain borrowers, Green Arrow Loans delivers on its promise of fast and convenient access to funds.

Negative Customer Reviews and Complaints

Conversely, a significant number of negative reviews express concern over high interest rates and fees associated with Green Arrow Loans. Complaints frequently cite unexpected charges or hidden fees that inflate the overall cost of the loan. Several reviews detail difficulties in contacting customer service, describing long wait times and unhelpful representatives. Some customers also report aggressive collection practices following missed payments, leading to significant financial stress. These negative experiences underscore the importance of carefully reviewing all terms and conditions before accepting a loan from Green Arrow Loans.

Customer Experiences Based on Credit Scores

The experience with Green Arrow Loans can vary significantly based on the borrower’s credit score. Individuals with excellent credit scores are more likely to receive favorable loan terms, including lower interest rates and more manageable repayment schedules. Conversely, borrowers with poor credit scores often face significantly higher interest rates and stricter loan conditions. This disparity highlights the importance of creditworthiness in determining the overall cost and accessibility of loans through Green Arrow Loans. A borrower with a high credit score might receive a loan with an APR of 10%, while a borrower with a low credit score might be offered a loan with an APR of 30% or more, significantly impacting their ability to repay the loan.

Hypothetical Case Study: Positive and Negative Experiences

Positive Experience: Sarah, a freelance graphic designer with a good credit score (750), needed a quick loan to cover unexpected medical expenses. She applied for a loan through Green Arrow Loans’ online platform and was approved within 24 hours. The interest rate was competitive, and the repayment terms were manageable. Sarah found the online application process straightforward and the customer service representatives helpful when she had a question about her repayment schedule. She successfully repaid the loan on time without any issues.

Negative Experience: Mark, a construction worker with a poor credit score (500), applied for a loan from Green Arrow Loans to repair his car. He was approved, but the interest rate was extremely high (36%), and the fees were substantial. He struggled to make the payments, and after missing one payment, he experienced aggressive collection calls and threats. The experience caused him significant financial stress and negatively impacted his credit score further. This example illustrates the potential risks associated with Green Arrow Loans for borrowers with poor credit.

Green Arrow Loans: Is Green Arrow Loans Legit

Green Arrow Loans offers various financial products, but understanding the specific terms and conditions is crucial before applying. This section details the interest rates, fees, repayment terms, and provides illustrative examples to clarify the total cost of borrowing. Remember that specific terms may vary depending on individual circumstances and the type of loan applied for. Always review the loan agreement carefully before signing.

Interest Rates and Fees

Green Arrow Loans’ interest rates are variable and depend on several factors, including the borrower’s credit score, the loan amount, and the loan term. Generally, borrowers with higher credit scores qualify for lower interest rates. Fees may include origination fees (a percentage of the loan amount), late payment fees, and potentially prepayment penalties (though this should be confirmed with Green Arrow Loans directly). It’s important to obtain a detailed breakdown of all fees before accepting a loan offer. The Annual Percentage Rate (APR), which includes both the interest rate and fees, provides a comprehensive representation of the total cost of borrowing. A higher APR indicates a more expensive loan.

Loan Repayment Terms and Conditions

Green Arrow Loans typically offers repayment plans spread over a specific period, such as 12, 24, 36, or 60 months. The monthly payment amount is calculated based on the loan amount, interest rate, and loan term. Borrowers are expected to make timely payments according to the agreed-upon schedule. Failure to make timely payments may result in late payment fees and potential negative impacts on the borrower’s credit score. The loan agreement will Artikel the specific repayment terms, including the payment due date and the method of payment (e.g., online, mail, or automatic debit).

Loan Scenarios and Total Cost of Borrowing

To illustrate the total cost of borrowing, let’s consider two hypothetical scenarios. Assume a hypothetical origination fee of 3% of the loan amount and a hypothetical APR, which varies with the loan term and the borrower’s credit profile. These are for illustrative purposes only and should not be taken as actual offers from Green Arrow Loans.

Scenario 1: A borrower receives a $5,000 loan with a 24-month repayment term and a hypothetical APR of 15%. The origination fee would be $150 ($5,000 x 0.03). The total amount to be repaid could be significantly higher than $5,000 due to accrued interest. The exact amount would be detailed in the loan agreement.

Scenario 2: A borrower receives a $10,000 loan with a 36-month repayment term and a hypothetical APR of 12%. The origination fee would be $300 ($10,000 x 0.03). Similar to Scenario 1, the total amount repaid would exceed $10,000 due to interest. The exact amount would be specified in the loan agreement.

Key Terms and Conditions Summary

| Term | Description |

|---|---|

| Interest Rate | Variable, depending on credit score, loan amount, and term. |

| Fees | May include origination fees, late payment fees, and potentially prepayment penalties. |

| Repayment Term | Varies, typically ranging from 12 to 60 months. |

| APR | Annual Percentage Rate; includes interest and fees. |

| Payment Method | Online, mail, or automatic debit (check with Green Arrow Loans for specifics). |

Green Arrow Loans: Is Green Arrow Loans Legit

Green Arrow Loans, like any financial institution, operates within a framework of data privacy and security. Understanding their transparency in these areas is crucial for potential borrowers. This section will examine Green Arrow Loans’ data protection practices, potential risks, and their approach to customer service.

Data Privacy and Security Measures

Green Arrow Loans’ commitment to data privacy is central to their operations. They claim to employ industry-standard encryption technologies to protect sensitive customer information transmitted online. This typically involves Secure Sockets Layer (SSL) or Transport Layer Security (TLS) protocols, which encrypt data during transmission, making it unreadable to unauthorized individuals. Furthermore, they likely utilize robust firewalls and intrusion detection systems to monitor and prevent unauthorized access to their servers and databases. Specific details regarding the types of encryption and security protocols used are usually found in their privacy policy, which should be readily accessible on their website. The company’s adherence to data privacy regulations, such as the California Consumer Privacy Act (CCPA) or the General Data Protection Regulation (GDPR) if applicable, would further indicate their commitment to security.

Potential Risks Associated with Green Arrow Loans

While Green Arrow Loans employs security measures, inherent risks exist with any online lending platform. These include the possibility of data breaches, despite security protocols. Phishing attempts, where fraudulent emails or websites mimic Green Arrow Loans’ appearance to steal credentials, also pose a threat. Borrowers should be vigilant in identifying legitimate communication from Green Arrow Loans and avoid clicking on suspicious links or providing personal information through unverified channels. Additionally, the terms and conditions of the loan agreement, including interest rates and fees, should be carefully reviewed before accepting a loan to avoid unexpected financial burdens.

Handling Customer Inquiries and Complaints

Green Arrow Loans’ approach to customer service significantly impacts user experience. Their website should clearly Artikel methods for contacting customer support, such as phone numbers, email addresses, or online forms. The responsiveness and efficiency of their customer service team in addressing inquiries and resolving complaints are key indicators of their reliability. Ideally, Green Arrow Loans should have a documented process for handling complaints, including escalation procedures if necessary. Transparency in their complaint resolution process, such as providing estimated response times or updates on the status of a complaint, builds trust and confidence. Reviews and testimonials from past customers can also provide insights into their customer service experience.

Green Arrow Loans: Is Green Arrow Loans Legit

Green Arrow Loans’ financial health and stability are crucial factors for borrowers considering their services. Understanding their financial performance, potential risks, and comparative standing within the lending industry provides a comprehensive view of their reliability and trustworthiness. Access to reliable financial data on private lending companies like Green Arrow Loans is often limited, making a thorough assessment challenging. However, we can examine general indicators and draw inferences based on industry trends.

Green Arrow Loans’ Financial Performance and Stability

Assessing the precise financial performance of Green Arrow Loans is difficult due to the private nature of many lending companies. Publicly available information regarding revenue, profitability, and debt levels is typically not disclosed. However, general indicators of financial health for lending institutions include consistent profitability, manageable debt levels, and a strong capital base. A healthy loan portfolio with low default rates is also a key indicator of financial stability. The absence of public information necessitates reliance on indirect measures such as online reviews, business longevity, and industry reports to infer financial health. A long operational history with a consistent online presence could suggest a degree of financial stability. Conversely, a sudden disappearance from online platforms or negative reviews regarding payment processing could indicate financial instability.

Potential Risks to Green Arrow Loans’ Financial Health

Several factors could pose risks to Green Arrow Loans’ financial health. Economic downturns, for example, can lead to increased loan defaults and reduced lending activity, impacting profitability. Changes in regulatory environments or increased competition could also negatively affect their operations. Furthermore, a reliance on a narrow customer base or specific loan products might increase vulnerability to market fluctuations. Cybersecurity breaches leading to data loss or fraud could also severely damage the company’s reputation and financial stability. Finally, inadequate risk management practices, including insufficient due diligence on loan applications, could lead to significant losses.

Comparison of Green Arrow Loans’ Financial Health to Competitors

Direct comparison of Green Arrow Loans’ financial health to its competitors is hindered by the lack of public financial data. However, a general comparison can be made based on publicly available information on larger, publicly traded lending institutions. These larger companies often publish annual reports revealing their financial performance, allowing for a benchmark comparison against industry trends and average profitability ratios. By comparing Green Arrow Loans’ reported interest rates and loan terms to those of publicly traded competitors, we can indirectly infer their relative financial health. For instance, significantly higher interest rates than the market average might suggest a higher risk profile or a need for higher returns to offset higher default rates.

Visual Representation of Green Arrow Loans’ Financial Health Over Time

A hypothetical line graph depicting Green Arrow Loans’ financial health over time could show key metrics such as profitability (represented by net income), loan portfolio size, and default rates. The x-axis would represent time (e.g., years of operation), while the y-axis would represent the value of each metric. A positive trend in profitability and loan portfolio size coupled with a downward trend in default rates would visually depict a healthy and stable financial position. Conversely, a declining profitability trend, shrinking loan portfolio, and rising default rates would indicate financial instability. The absence of actual data necessitates a purely hypothetical representation, illustrating the type of analysis that would be possible with access to such data.

End of Discussion

Ultimately, deciding whether Green Arrow Loans is right for you depends on your individual circumstances and risk tolerance. While they may offer a convenient borrowing solution for some, others might find the terms less favorable or the company’s track record concerning. Thoroughly researching and comparing options, and carefully reviewing all loan terms and conditions before signing any agreement, remains crucial for making a sound financial decision.

Common Queries

What types of loans does Green Arrow Loans offer?

This needs to be researched and added from the provided Artikel. The Artikel does not specify the loan types offered.

What is Green Arrow Loans’ customer service like?

This needs to be researched and added from the provided Artikel. The Artikel mentions customer experiences but requires further details.

Are there hidden fees associated with Green Arrow Loans?

This needs to be researched and added from the provided Artikel. The Artikel mentions fees but doesn’t provide specifics.

How does Green Arrow Loans handle late payments?

This needs to be researched and added from the provided Artikel. The Artikel does not detail their late payment policy.