Loan officer hiring is a critical process for any financial institution. Finding the right candidate requires a strategic approach encompassing job description creation, effective candidate sourcing, a well-structured interview process, comprehensive onboarding, competitive compensation, and a thorough assessment of cultural fit and compliance. This guide delves into each of these crucial steps, offering practical advice and actionable strategies to help you build a high-performing loan officer team.

From crafting compelling job descriptions that attract top talent to implementing robust background checks, we’ll cover the entire hiring lifecycle. We’ll explore different recruitment methods, interview techniques, and onboarding strategies to ensure a smooth transition for new hires. Additionally, we’ll examine compensation structures, benefits packages, and the importance of assessing cultural fit to create a positive and productive work environment.

Job Description Analysis

Analyzing loan officer job descriptions reveals crucial insights into the skills and experience sought by lenders. A thorough understanding of these requirements is vital for both recruiters crafting effective job postings and candidates tailoring their applications to stand out. This analysis will examine sample job descriptions, highlight key differences across various companies, and demonstrate how to effectively incorporate both hard and soft skills into a comprehensive job posting.

Sample Loan Officer Job Description

The following sample job description Artikels the essential qualifications for a Loan Officer position:

Loan Officer – [Company Name]

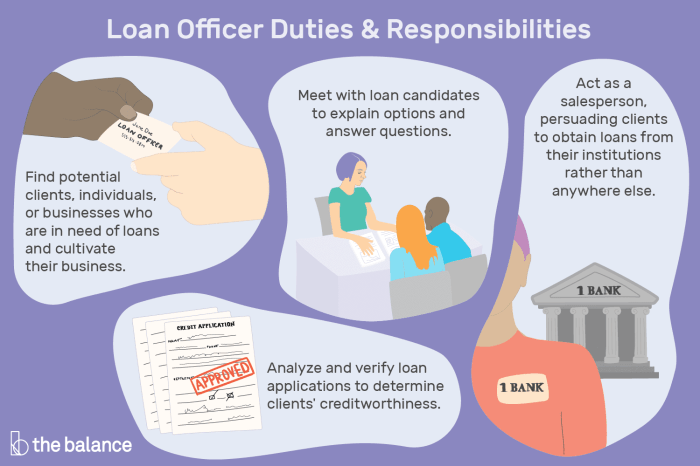

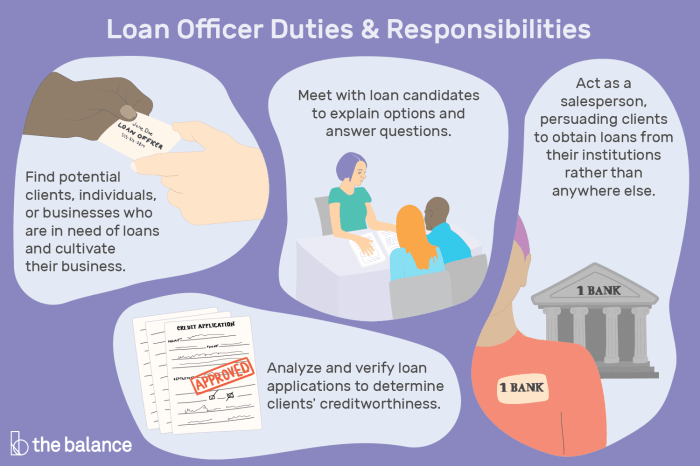

Job Summary: We are seeking a highly motivated and experienced Loan Officer to join our growing team. The successful candidate will be responsible for originating, processing, and closing residential mortgage loans. This role requires strong sales skills, excellent communication, and a deep understanding of the mortgage lending process.

Responsibilities:

* Originate residential mortgage loans through various channels, including referrals, networking, and marketing initiatives.

* Analyze borrower financial information to determine loan eligibility and risk assessment.

* Prepare and submit loan applications, ensuring accuracy and completeness.

* Maintain regular communication with borrowers throughout the loan process.

* Adhere to all applicable regulations and compliance standards.

* Build and maintain strong relationships with real estate agents, builders, and other referral sources.

Qualifications:

* Bachelor’s degree in finance, business administration, or a related field preferred.

* Minimum of 2 years of experience in mortgage lending.

* Strong understanding of mortgage loan products, underwriting guidelines, and regulatory compliance.

* Excellent communication, interpersonal, and sales skills.

* Proficiency in using loan origination software and Microsoft Office Suite.

* Valid driver’s license and reliable transportation.

Comparison of Loan Officer Job Descriptions

Three distinct loan officer job descriptions from different lending institutions illustrate variations in required qualifications:

* Company A: Emphasizes experience with a specific Loan Origination System (LOS) and a strong track record of closing a high volume of loans. This suggests a focus on efficiency and productivity.

* Company B: Prioritizes strong sales and relationship-building skills, indicating a sales-driven environment with a focus on customer acquisition. Technical skills are mentioned but are secondary to sales aptitude.

* Company C: Highlights compliance expertise and a deep understanding of regulatory requirements, suggesting a more risk-averse environment with a strong emphasis on adherence to lending regulations.

These differences reflect the unique priorities and operational models of each lending institution. Some prioritize speed and volume, others prioritize customer relationships, and still others prioritize regulatory compliance.

Job Description Emphasizing Soft and Technical Skills

This job description integrates both hard and soft skills crucial for success as a Loan Officer:

Loan Officer – [Company Name]

Job Summary: We are seeking a highly skilled and empathetic Loan Officer to provide exceptional service to our clients. This role requires a blend of technical expertise in mortgage lending and strong interpersonal skills to build lasting relationships.

Responsibilities: (Similar to the sample above, but potentially including additional responsibilities focused on client relationship management)

Qualifications:

* Technical Skills: Bachelor’s degree in a relevant field preferred; Minimum of 2 years experience in mortgage lending; Proficiency in [specific LOS]; Deep understanding of mortgage loan products, underwriting guidelines, and regulatory compliance; Proficiency in Microsoft Office Suite.

* Soft Skills: Excellent communication and interpersonal skills; Strong problem-solving and analytical abilities; Ability to build rapport and trust with clients; Exceptional customer service orientation; Ability to work independently and as part of a team; Strong organizational and time-management skills; Resilience and ability to handle challenging situations.

This revised description explicitly Artikels both the technical and interpersonal skills necessary for success, ensuring candidates understand the multifaceted nature of the role.

Candidate Sourcing Strategies

Securing top-tier loan officer talent requires a multifaceted approach to candidate sourcing. A well-defined strategy, encompassing diverse channels and methodologies, significantly increases the likelihood of attracting and hiring qualified individuals who align with the company’s culture and performance expectations. This section Artikels several effective sourcing methods, weighs the advantages and disadvantages of internal versus external recruitment, and details a social media strategy for attracting high-quality applicants.

Five Effective Loan Officer Candidate Sourcing Methods

Employing a variety of sourcing methods maximizes reach and access to a diverse pool of qualified candidates. Each method presents unique advantages and challenges, necessitating careful consideration of the specific needs and resources of the organization.

- Online Job Boards (e.g., Indeed, LinkedIn): Pros: Wide reach, relatively low cost, ease of use. Cons: High volume of unqualified applicants, potential for overlooking passive candidates.

- Professional Networking Sites (e.g., LinkedIn Recruiter): Pros: Targeted candidate search, access to passive candidates, detailed profile information. Cons: Can be expensive, requires time investment in profile screening.

- Employee Referrals: Pros: High-quality candidates, reduced recruitment costs, improved employee engagement. Cons: Limited pool of candidates, potential for bias.

- Industry Events and Conferences: Pros: Direct engagement with potential candidates, networking opportunities, brand building. Cons: Time-consuming, potentially costly, requires strategic planning.

- Direct Outreach to Target Companies: Pros: Access to high-performing individuals in competitor firms, targeted recruitment. Cons: Can be time-consuming, requires thorough research and a compelling value proposition.

Recruitment Agency versus Internal Recruitment

The decision to utilize a recruitment agency versus internal recruitment hinges on several factors, including the urgency of the hiring need, the availability of internal resources, and the desired level of expertise in candidate screening and selection.

Recruitment agencies offer specialized expertise in candidate sourcing and screening, often possessing access to a wider talent pool than internal teams. However, they come with associated costs, and control over the selection process is ceded to some degree. Internal recruitment, while potentially more cost-effective, demands a significant time investment from internal HR and hiring managers. A successful internal recruitment strategy requires a robust applicant tracking system and a clearly defined selection process. For a specialized role like a loan officer, the expertise of a recruitment agency may outweigh the cost, particularly when speed and access to a niche talent pool are crucial.

Social Media Strategy for Attracting Loan Officer Applicants

Social media platforms, particularly LinkedIn, offer a powerful tool for attracting high-quality loan officer applicants. A well-executed social media strategy involves more than simply posting job ads. It requires active engagement with potential candidates, showcasing company culture, and highlighting the unique aspects of the loan officer role.

A robust strategy would include:

- Targeted advertising on LinkedIn: Reaching potential candidates based on specific criteria, such as experience, location, and skills.

- Engaging content marketing: Sharing insightful articles, videos, and blog posts related to the financial industry and loan officer careers.

- Active participation in relevant industry groups: Building relationships and networking with potential candidates.

- Employee advocacy: Encouraging current employees to share job postings and company information on their personal social media profiles.

- Showcase company culture and values: Highlighting the positive aspects of working for the organization, fostering a positive employer brand.

Interview Process Design

A structured interview process is crucial for effectively evaluating loan officer candidates and ensuring a successful hire. This process should combine behavioral questions to assess soft skills and technical assessments to evaluate their understanding of loan products and procedures. A well-defined scoring rubric further enhances the objectivity and fairness of the evaluation.

The following Artikels a structured interview process designed to identify the best candidate for the loan officer position. The process balances assessing both the candidate’s practical skills and their interpersonal abilities, critical for success in client interaction and internal collaboration.

Structured Interview Process Components

The interview process will consist of three stages: a screening interview, a behavioral interview, and a technical assessment. The screening interview will focus on initial qualifications and suitability, while the behavioral interview will delve into past experiences and problem-solving abilities. The technical assessment will evaluate the candidate’s knowledge of loan products and procedures.

Behavioral Interview Questions, Loan officer hiring

Behavioral questions are designed to uncover how a candidate has handled past situations, providing insight into their problem-solving skills, decision-making abilities, and overall work style. These questions focus on specific scenarios relevant to the loan officer role.

The following five key behavioral questions will be used to assess a candidate’s problem-solving skills in a loan officer context:

- Describe a situation where you had to overcome a significant obstacle to close a deal. What was the obstacle, what steps did you take, and what was the outcome?

- Give an example of a time you had to make a difficult decision with limited information. How did you approach the situation, and what was the result?

- Tell me about a time you had to deal with a difficult or demanding client. How did you manage the situation, and what was the outcome?

- Describe a situation where you had to work as part of a team to achieve a common goal. What was your role, and what contribution did you make?

- Explain a time you failed to meet a deadline or expectation. What went wrong, and what did you learn from the experience?

Candidate Evaluation Scoring Rubric

A consistent scoring rubric ensures objective evaluation of candidate responses. The rubric below provides a framework for assessing responses to behavioral questions, focusing on the quality of the answer, the demonstration of relevant skills, and the overall impact.

Each question will be scored on a scale of 1 to 5, with 1 being the lowest and 5 being the highest. The scoring will consider factors such as clarity, relevance, depth of response, and demonstration of relevant skills.

| Candidate Name | Question | Score (1-5) | Comments |

|---|---|---|---|

| (Insert Question 1 from above) | |||

| (Insert Question 2 from above) | |||

| (Insert Question 3 from above) | |||

| (Insert Question 4 from above) | |||

| (Insert Question 5 from above) |

Onboarding and Training

A comprehensive onboarding and training program is crucial for new loan officers to quickly become productive and compliant members of the team. This program should blend practical training with mentorship, ensuring a smooth transition and a strong foundation for long-term success. A structured approach, incorporating both initial training and ongoing professional development, is essential.

Effective onboarding for a loan officer requires a multi-faceted approach, combining structured training modules with hands-on experience and mentorship. This ensures the new hire quickly integrates into the team and begins contributing meaningfully. The program’s success hinges on clear expectations, consistent feedback, and ongoing support.

Onboarding Plan for New Loan Officers

The onboarding plan for a new loan officer should be structured to facilitate a seamless transition into their role and responsibilities. The plan should cover essential aspects of the job, including company culture, product knowledge, and regulatory compliance. This structured approach ensures a consistent onboarding experience for all new hires.

- Week 1: Introduction to the company culture, values, and mission; overview of the loan process; introduction to key personnel and team members; assignment of a mentor; completion of necessary paperwork and system access setup.

- Week 2-4: In-depth training on loan products, underwriting guidelines, and internal systems; shadowing experienced loan officers; participation in role-playing scenarios to practice client interactions; initial performance review and feedback session.

- Month 1-3: Focus on practical application of learned skills; increasing responsibility in handling loan applications; regular meetings with mentor and manager; continued training on compliance and regulatory requirements; participation in team meetings and professional development opportunities.

- Ongoing: Continuous professional development opportunities, including workshops, conferences, and online training modules; regular performance reviews and feedback; access to ongoing mentorship and support.

Compliance and Regulatory Training Program

Thorough compliance training is paramount for loan officers. This training must cover all relevant federal and state regulations, ensuring adherence to best practices and mitigating potential legal risks. Regular updates are crucial to keep pace with evolving regulations.

- Federal Regulations: Training on the Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), Fair Credit Reporting Act (FCRA), Equal Credit Opportunity Act (ECOA), and other relevant federal laws and regulations.

- State Regulations: Training on state-specific licensing requirements, mortgage lending laws, and other relevant state regulations. This will vary depending on the state in which the loan officer operates.

- Internal Policies and Procedures: Comprehensive training on the company’s internal policies and procedures related to loan origination, underwriting, closing, and post-closing processes.

- Fraud Prevention and Detection: Training on identifying and preventing mortgage fraud, including red flags and best practices for risk mitigation.

- Ethical Conduct and Best Practices: Training on maintaining ethical conduct, adhering to best practices, and managing conflicts of interest.

- Ongoing Compliance Updates: Regular updates and training on changes in regulations and best practices through newsletters, online modules, and workshops.

30-60-90 Day Checklist for New Loan Officers

A structured checklist helps track progress and ensures new loan officers meet key milestones within their first three months. This provides a framework for consistent performance evaluation and identifies areas needing further support.

First 30 Days:

- Complete all onboarding paperwork and system access setup.

- Attend all scheduled training sessions.

- Meet with mentor and manager to discuss goals and expectations.

- Shadow experienced loan officers to observe daily operations.

- Begin familiarization with internal systems and processes.

First 60 Days:

- Start assisting with loan applications under supervision.

- Demonstrate proficiency in using internal systems and software.

- Participate in role-playing scenarios to practice client interactions.

- Attend team meetings and contribute to discussions.

- Complete a mid-point performance review with manager.

First 90 Days:

- Independently handle loan applications under supervision.

- Meet or exceed individual performance goals.

- Demonstrate a strong understanding of compliance and regulatory requirements.

- Actively participate in team activities and professional development opportunities.

- Complete a 90-day performance review with manager and establish long-term goals.

Compensation and Benefits

Attracting and retaining top-performing loan officers requires a comprehensive and competitive compensation and benefits package. This goes beyond simply offering a high salary; it involves crafting a holistic reward system that acknowledges the demanding nature of the role and incentivizes performance. A well-structured compensation plan, coupled with desirable benefits, is crucial for building a successful and motivated loan officer team.

Compensation packages for loan officers are highly variable, influenced significantly by geographic location, experience level, and the specific employer. Factors such as cost of living, market competition, and the type of lending institution all play a role in determining the overall compensation structure.

Loan Officer Compensation by Geographic Location

The following table provides a general overview of compensation packages for loan officers across different geographic locations. Note that these are broad ranges and actual salaries can vary considerably based on individual experience, performance, and employer. Data is based on industry reports and salary surveys, and should be considered an estimate.

| Location | Salary Range | Benefits | Bonus Structure |

|---|---|---|---|

| New York City, NY | $80,000 – $150,000+ | Health insurance, 401(k), paid time off, professional development opportunities | Commission-based, performance bonuses tied to loan volume and quality |

| Los Angeles, CA | $75,000 – $140,000+ | Health insurance, 401(k), paid time off, flexible work arrangements | Commission-based, potential for profit sharing |

| Chicago, IL | $65,000 – $120,000+ | Health insurance, 401(k), paid time off, employee assistance program | Commission-based, bonuses based on exceeding targets |

| Houston, TX | $60,000 – $110,000+ | Health insurance, 401(k), paid time off, company car allowance (in some cases) | Commission-based, bonuses for referrals and repeat business |

The Importance of Competitive Benefits Packages

Offering competitive benefits packages is paramount for attracting and retaining high-quality loan officers. In a competitive job market, benefits can be a significant differentiator, especially for experienced professionals. Comprehensive benefits demonstrate an employer’s commitment to employee well-being and contribute to increased employee satisfaction and loyalty. Examples of attractive benefits include comprehensive health insurance plans, retirement savings programs (401k matching), paid time off, professional development opportunities, and flexible work arrangements. These benefits not only improve employee morale but also reduce employee turnover, leading to cost savings in the long run.

Loan Officer Compensation Structures

Loan officers typically receive compensation through a combination of salary, commission, and bonuses. The specific structure varies widely depending on the employer and the individual’s role and experience.

A purely salary-based compensation model offers stability but may not incentivize high performance. A commission-only structure can lead to high earnings for top performers but also carries significant risk during periods of low loan volume. A hybrid model, combining a base salary with commission and bonuses, is frequently the most effective approach. This provides a safety net while still motivating loan officers to maximize their loan production. For example, a base salary might be coupled with a commission on closed loans and additional bonuses for exceeding predetermined targets or securing loans of a particular type (e.g., larger loans, commercial loans). The optimal balance between salary, commission, and bonuses needs to be carefully considered to align with both business goals and employee motivation.

Assessing Cultural Fit

A successful loan officer requires more than just financial acumen; they need to be a good fit for the company culture to thrive and contribute effectively. This section details the crucial personality traits, interview strategies, and culture-alignment assessment methods to ensure the selection of the right candidate.

Key Personality Traits for Loan Officer Success

Three key personality traits are essential for success as a loan officer: resilience, empathy, and strong communication skills. Resilience is crucial because loan officers often face rejection, deal with difficult clients, and navigate complex financial situations. Empathy allows them to understand clients’ needs and build rapport, leading to stronger relationships and ultimately, more successful loan applications. Strong communication skills are paramount for clearly explaining complex financial products, negotiating terms, and maintaining professional relationships with clients and colleagues alike. These traits, when combined, create a well-rounded professional capable of handling the pressures and complexities of the role.

Scenario-Based Interview Question for Stress Management

A scenario-based question to assess a candidate’s ability to handle stressful situations involves presenting a hypothetical scenario: “Imagine a client is extremely upset because their loan application was delayed due to unforeseen circumstances beyond your control. How would you approach this situation to de-escalate their anger, maintain professionalism, and provide them with a satisfactory explanation and a clear timeline?” This question allows the candidate to demonstrate their problem-solving skills under pressure, their ability to empathize with a frustrated client, and their communication skills in a high-stakes situation. A strong response will demonstrate active listening, clear and concise communication, and a proactive approach to resolving the client’s concerns.

Questions to Gauge Cultural Alignment

To assess a candidate’s alignment with the company culture, several questions can be posed, focusing on their work style, values, and team interaction preferences. For example, “Describe a time you had to work collaboratively with a team to achieve a challenging goal. What was your role, and what did you learn from the experience?” This explores teamwork and problem-solving skills within a collaborative context. Another example is, “Our company values integrity and client focus above all else. Can you share a situation where you demonstrated these values in a previous role?” This directly assesses alignment with the company’s core values. Finally, “How do you prefer to receive feedback, and how do you handle constructive criticism?” This reveals their receptiveness to feedback and their ability to adapt and learn, crucial for professional growth within the company.

Background Checks and Compliance

Thorough background checks are paramount in the loan officer hiring process, mitigating risks associated with financial malfeasance and protecting both the financial institution and its clients. Failing to conduct appropriate checks can lead to significant financial losses, reputational damage, and legal repercussions. This section details the importance of comprehensive background checks and Artikels the legal and regulatory requirements governing this process.

Background checks for loan officer candidates are crucial for several reasons. They help identify individuals with a history of financial misconduct, criminal activity, or other behaviors that could pose a risk to the institution. This proactive approach significantly reduces the likelihood of employing individuals who might engage in fraudulent activities, misuse confidential information, or compromise the security of client data. Furthermore, a thorough background check demonstrates due diligence, minimizing the institution’s liability in case of future incidents.

Legal and Regulatory Requirements for Background Checks

Federal and state laws, along with industry regulations, dictate the permissible scope and procedures for conducting background checks. The Fair Credit Reporting Act (FCRA) is a cornerstone of this regulatory framework, governing the collection, use, and disclosure of consumer information, including background check reports. Compliance with the FCRA is mandatory and requires obtaining consent from candidates before initiating background checks, providing them with a copy of the report, and allowing them to dispute any inaccuracies. Additionally, the Equal Employment Opportunity Commission (EEOC) guidelines prohibit discrimination based on protected characteristics during the background check process. Specific state laws may further restrict the types of information that can be considered and the permissible methods of obtaining it. For example, some states limit the time frame for considering past criminal convictions. Financial institutions are also subject to regulations from agencies like the Consumer Financial Protection Bureau (CFPB) and the Office of the Comptroller of the Currency (OCC), which may have specific requirements related to background checks for loan officers. Non-compliance can result in hefty fines and legal action.

Best Practices for Compliance

Ensuring compliance with all relevant regulations during the hiring process requires a proactive and systematic approach. This includes establishing clear written policies and procedures that Artikel the steps involved in conducting background checks, obtaining consent, and handling disputes. The institution should use reputable third-party background check providers that are FCRA-compliant and adhere to best practices. Regular audits of the background check process are necessary to identify and rectify any potential compliance gaps. Training for hiring managers and human resources personnel on the legal requirements and best practices is essential to ensure consistent and compliant implementation. Maintaining accurate and secure records of all background check activities is crucial for demonstrating compliance to regulatory bodies. Finally, the institution should develop a robust process for handling disputes, allowing candidates to challenge any inaccuracies in their background reports. This process should be fair, transparent, and compliant with all relevant regulations. Failure to adhere to these best practices can lead to legal challenges, reputational damage, and significant financial penalties.

Conclusive Thoughts

Successfully hiring loan officers requires a multifaceted approach that goes beyond simply filling a position. By carefully considering job descriptions, sourcing strategies, interview processes, onboarding plans, compensation packages, and cultural fit, financial institutions can attract and retain top talent. This comprehensive guide provides the tools and insights necessary to navigate the complexities of loan officer hiring, ultimately leading to a more successful and profitable organization. Remember, investing in your team is an investment in your future.

FAQ Explained: Loan Officer Hiring

What are the most common mistakes in loan officer hiring?

Common mistakes include vague job descriptions, ineffective sourcing, biased interviewing, inadequate training, and uncompetitive compensation packages.

How can I ensure compliance during the loan officer hiring process?

Conduct thorough background checks, adhere to all relevant federal and state regulations, maintain detailed records of the hiring process, and provide comprehensive compliance training.

What is the average salary for a loan officer?

Loan officer salaries vary significantly based on location, experience, and employer. Researching salary ranges in your specific area is recommended.

How long does the typical loan officer hiring process take?

The timeframe can range from several weeks to several months, depending on the complexity of the role and the size of the organization.