Navy Federal auto loan under review? Navigating the application process can feel like a rollercoaster. Understanding the typical timeframe, the various stages, and the factors influencing approval is crucial. This guide unravels the mysteries of Navy Federal’s auto loan review, providing a step-by-step walkthrough, tips for effective communication, and alternative options if your application isn’t immediately approved.

From credit score impact to required documentation, we’ll cover the essential elements impacting your loan’s review. We’ll also explore strategies for expediting the process and addressing potential delays, equipping you with the knowledge to confidently manage your application.

Understanding the “Navy Federal Auto Loan Under Review” Status

Seeing your Navy Federal auto loan application marked “Under Review” is a normal part of the process. It signifies that your application has been received and is currently being assessed by the lender. While the exact timeframe varies, understanding the typical stages and how to track your progress can alleviate any anxiety.

The review process involves a thorough examination of your financial information to determine your creditworthiness and ability to repay the loan. This includes verifying your income, employment history, and credit score, as well as assessing the value of the vehicle you intend to purchase. The complexity of your application and the current workload of the loan processing team also influence the overall processing time.

Typical Timeframe for Navy Federal Auto Loan Application Review

The review process for a Navy Federal auto loan typically takes between a few days to several weeks. Factors such as the completeness of your application, your credit history, and the current volume of applications being processed by Navy Federal all contribute to the duration. While some applicants may receive a decision within a week, others may experience a longer review period, potentially lasting up to three weeks or more in some cases. For example, an application with incomplete documentation or a less-than-perfect credit score might undergo a more extensive review.

Stages Involved in the Navy Federal Auto Loan Application Process

The Navy Federal auto loan application process generally involves several key stages: Application submission, initial review, verification, underwriting, and final approval or denial. The initial review focuses on the completeness and accuracy of the information provided. Verification involves confirming the details provided in the application, such as income and employment. Underwriting involves a comprehensive assessment of your creditworthiness and risk profile. Finally, the loan is either approved, with terms Artikeld, or denied, with reasons provided.

Tracking Your Navy Federal Auto Loan Application Status

Applicants can typically track their application status online through the Navy Federal website or mobile app. This usually involves logging into your account and navigating to the loan application section. The status will be clearly displayed, providing updates on the progress of your application. Additionally, Navy Federal may send email or text message updates to keep you informed throughout the process. It is recommended to regularly check your account for updates and to contact Navy Federal directly if you have any questions or concerns.

Comparison of Review Processes: New vs. Existing Members, Navy federal auto loan under review

While the core stages remain the same, the review process might differ slightly for new versus existing Navy Federal members. Existing members often benefit from a streamlined process, as Navy Federal already possesses some of their financial information. This can potentially result in a faster review time. New members, however, will require more extensive verification of their information, potentially leading to a slightly longer review period. This difference, however, is often marginal, and both groups generally experience a similar level of thoroughness in the underwriting process.

Factors Influencing Review Time

The speed of a Navy Federal auto loan review depends on several interconnected factors. A straightforward application with complete, accurate documentation will typically process faster than one with missing information or inconsistencies. Understanding these factors can help applicants manage expectations and proactively address potential delays.

Credit Score Impact

Your credit score significantly influences the review process. A higher credit score generally indicates lower risk to the lender, resulting in faster approval. Lenders use credit scores to assess your creditworthiness and predict the likelihood of loan repayment. A lower credit score may trigger a more thorough review, potentially lengthening the processing time as Navy Federal verifies your financial stability through additional scrutiny. For example, an applicant with a credit score above 750 might experience a quicker approval compared to an applicant with a score below 600, who might face additional requests for documentation.

Income Verification and Employment History

Navy Federal requires verification of income and employment history to assess your ability to repay the loan. Stable employment with a consistent income stream significantly increases your chances of a swift approval. Conversely, inconsistent employment history or insufficient income relative to the loan amount can lead to delays. The review process might involve contacting your employer to verify your employment and income, adding time to the overall approval timeline. Applicants with self-employment or recent job changes might experience longer review periods as Navy Federal verifies their income through tax returns, bank statements, or other relevant documentation.

Documentation Impact

Providing complete and accurate documentation is crucial for expediting the loan review. Documents that expedite the process include a clear and concise application, proof of income (pay stubs, tax returns, W-2s), and proof of residence (utility bills, lease agreements). Conversely, missing documents, inaccurate information, or documents that are difficult to read or verify will slow down the review. For instance, submitting a blurry image of a pay stub or a pay stub that doesn’t clearly show your income could lead to delays, requiring the lender to request a clearer copy or alternative documentation. Similarly, inconsistencies between the information provided in the application and supporting documentation will likely prolong the review process.

Communicating with Navy Federal During the Review: Navy Federal Auto Loan Under Review

Effective communication is crucial when your Navy Federal auto loan application is under review. Proactive engagement can help clarify any issues and potentially expedite the process. Understanding the appropriate channels and methods for contacting Navy Federal is key to a smooth experience.

Maintaining clear and concise communication with Navy Federal during the review process is essential. This ensures your concerns are addressed promptly and prevents misunderstandings. A well-crafted email or a clear phone call can significantly improve your chances of a timely resolution.

Sample Email Template for Inquiring About Auto Loan Application Status

When contacting Navy Federal regarding your auto loan application status, a well-structured email can ensure your message is clear and efficiently addressed. Providing all relevant information upfront will help the representative quickly locate your application and respond to your inquiry. Here’s a sample email template you can adapt:

Subject: Auto Loan Application Status Inquiry – [Your Name] – Application Number [Your Application Number]

Dear Navy Federal Loan Specialist,

I am writing to inquire about the status of my auto loan application, submitted on [Date of Application] with application number [Your Application Number]. My name is [Your Name], and my phone number is [Your Phone Number].

I would appreciate an update on the review process and an estimated timeline for a decision. Please let me know if any additional information is required from my end.

Thank you for your time and assistance.

Sincerely,

[Your Name]

Helpful Phone Numbers and Contact Methods for Customer Service

Navy Federal offers multiple avenues for contacting their customer service department. Choosing the most appropriate method depends on your preference and the urgency of your inquiry. Direct phone calls are often the fastest method for immediate assistance, while email is suitable for less urgent inquiries or providing detailed documentation.

Contacting Navy Federal can be done via several methods:

- Phone: You can find the appropriate customer service number on the Navy Federal website, usually categorized by service type (auto loans, etc.). Be prepared to provide your application number and other identifying information.

- Email: The Navy Federal website typically provides an email address for general inquiries or loan-specific questions. Again, providing your application number is crucial for quick processing.

- Online Messaging/Chat: Many financial institutions, including Navy Federal, offer online chat support. This provides real-time assistance for quicker responses to less complex questions.

- Mobile App: The Navy Federal mobile app might provide messaging or contact options directly within the application itself.

Tips for Effectively Communicating with Navy Federal Representatives

Communicating effectively with Navy Federal representatives is key to a successful resolution. Being prepared and polite while clearly stating your needs will enhance the interaction and improve the likelihood of a positive outcome. Here are some tips for effective communication:

- Be polite and respectful: Maintain a professional and courteous tone throughout the interaction.

- Be prepared: Have your application number, loan details, and any relevant documentation readily available.

- Be clear and concise: State your inquiry or concern clearly and avoid unnecessary jargon.

- Listen actively: Pay attention to the representative’s responses and ask clarifying questions if needed.

- Keep records: Note down the date, time, representative’s name, and key details of your conversation.

Addressing Concerns Regarding Delays

If you experience delays in your auto loan application review, it’s important to address your concerns politely but firmly. Clearly expressing your timeline needs while maintaining a respectful tone will help the representative understand your situation and potentially expedite the process.

When addressing delays, you might say something like:

“I understand that reviews take time, however, I am concerned about the extended review period for my application (Application Number: [Your Application Number]). I am hoping to finalize the purchase of my vehicle by [Date], and I would appreciate an update on the timeline and any steps I can take to expedite the process.”

Alternatives and Next Steps if Loan is Denied

Denial of a Navy Federal auto loan can be disappointing, but it’s not the end of the road. Several alternatives exist, and understanding the reasons for denial can help you improve your chances of approval in the future. This section Artikels steps to take after a rejection and provides resources to strengthen your financial standing.

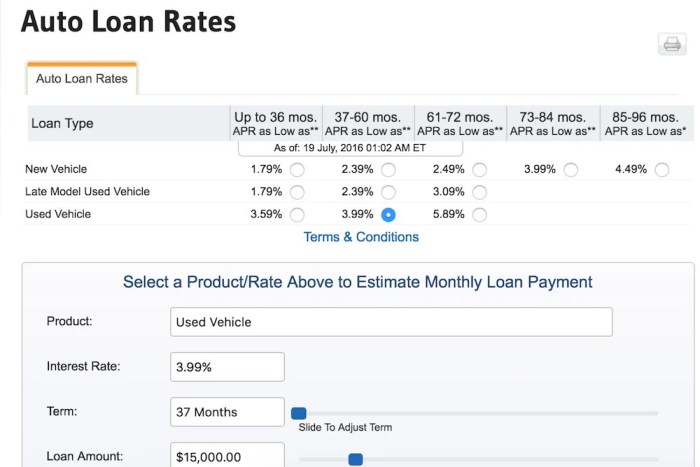

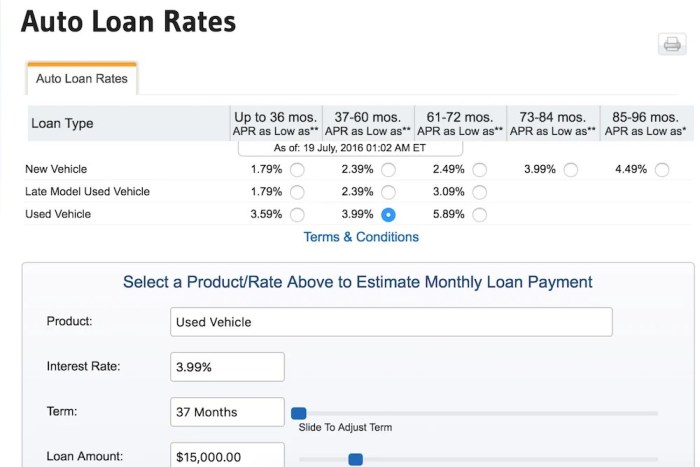

Comparing Auto Loan Providers

Choosing an alternative lender requires careful comparison. Interest rates, loan terms, and eligibility requirements vary significantly among institutions. The following table offers a comparison, though specific rates and terms are subject to change and depend on individual creditworthiness. Always check current rates and terms directly with the lender before applying.

| Lender | Interest Rate (Example – Subject to Change) | Loan Terms (Example) | Requirements (Example) |

|---|---|---|---|

| Capital One Auto Navigator | 5.99% – 18.99% APR | 12-84 months | Good to excellent credit score, verifiable income |

| USAA | 4.99% – 17.99% APR | 24-72 months | Membership eligibility, good credit score, verifiable income |

| MyAutoloan.com | Variable, depending on credit score and lender | Variable, depending on lender | Minimum credit score requirements vary by lender |

| Local Credit Unions | Variable, depending on credit score and credit union | Variable, depending on credit union | Membership eligibility, may require lower credit score than national banks |

Steps to Take After Loan Rejection

Following a loan denial, review the rejection letter carefully. It usually explains the reason for denial. This information is crucial for taking appropriate next steps. Common reasons include low credit score, insufficient income, or a high debt-to-income ratio. Addressing these issues directly improves the chances of future loan approvals. Contact Navy Federal to understand the specific reasons for their decision. They may offer suggestions for improving your application.

Appealing a Denied Auto Loan Application

Navy Federal, like other lenders, typically has an appeals process. This process usually involves submitting additional documentation to address the reasons for the initial denial. Carefully review the rejection letter for instructions on how to appeal. Gather any supporting documents that strengthen your application, such as proof of increased income or improved credit score. Present a strong case explaining why you deserve reconsideration. The success of an appeal depends on the strength of your supporting evidence and the specific reasons for the initial denial.

Improving Credit Score for Future Loan Applications

A higher credit score significantly increases the likelihood of loan approval. Several strategies can help improve your credit score. These include paying bills on time, keeping credit utilization low (ideally below 30%), monitoring your credit report for errors, and maintaining a mix of credit accounts. Consider using credit monitoring services to track your progress and identify areas for improvement. Resources like Credit Karma, Experian, Equifax, and TransUnion provide free credit reports and scores, allowing you to monitor your credit health and identify areas needing attention. Remember that improving your credit score takes time and consistent effort.

Securing Financing After Review

If your Navy Federal auto loan application is denied, securing alternative financing is crucial to move forward with your vehicle purchase. Several options exist, each with its own set of advantages and disadvantages that significantly impact the overall cost of borrowing. Carefully weighing these factors is essential to making an informed decision.

Alternative Financing Options

Exploring alternative lenders is necessary when a Navy Federal auto loan application is rejected. This involves researching and comparing various financial institutions to find the most suitable option based on individual financial circumstances and creditworthiness. The availability and terms of these options will vary depending on credit score, income, and the type of vehicle being financed.

- Credit Unions: Credit unions often offer competitive interest rates and personalized service. However, membership requirements may apply, limiting accessibility for some borrowers. The specific rates and terms offered will vary widely based on the credit union and the borrower’s credit profile.

- Banks: Banks provide a wide range of auto loan products, catering to various credit profiles. However, interest rates may be higher than those offered by credit unions, especially for borrowers with lower credit scores. Large banks generally have standardized processes, which may lack the personalized attention of smaller institutions.

- Online Lenders: Online lenders offer convenience and a streamlined application process. However, interest rates can be higher than traditional lenders, and hidden fees may exist. Thorough research is crucial to compare APRs and fees across different online platforms.

- Dealership Financing: Dealerships often partner with multiple lenders to offer financing options. While convenient, interest rates through dealerships can be significantly higher than those offered by independent lenders, as they often target borrowers with less-than-perfect credit. This can result in paying substantially more over the life of the loan.

Impact of Choosing a Different Lender on Loan Cost

The choice of lender significantly impacts the total cost of the loan. Higher interest rates translate to higher monthly payments and a greater total amount paid over the loan’s lifespan. For example, a 1% difference in interest rate on a $25,000 loan over 60 months can result in hundreds or even thousands of dollars in additional interest paid. Furthermore, lenders may charge different fees, such as origination fees or prepayment penalties, adding to the overall cost. It’s crucial to compare not only the interest rate but also all associated fees when evaluating loan offers.

Obtaining Pre-Approval from Multiple Lenders

Obtaining pre-approval from multiple lenders is a crucial step in securing the best possible financing terms. This allows for a direct comparison of interest rates, fees, and loan terms before committing to a specific lender. The pre-approval process typically involves providing basic financial information, such as income, credit score, and desired loan amount. Lenders will then provide a conditional approval, outlining the terms they’re willing to offer. By comparing multiple pre-approvals, borrowers can identify the lender offering the most favorable terms and negotiate for better rates if needed. This proactive approach empowers borrowers to make informed decisions and secure the most cost-effective financing option.

Epilogue

Securing an auto loan can be stressful, but with a clear understanding of the Navy Federal auto loan review process, you can navigate the challenges effectively. Remember to maintain open communication, gather all necessary documents, and explore alternative financing options if needed. By being proactive and informed, you can increase your chances of securing the best possible auto loan terms.

FAQ Explained

What happens if my Navy Federal auto loan application is incomplete?

Navy Federal will likely contact you to request the missing information. Responding promptly is key to a faster review.

Can I check my application status online?

Yes, most Navy Federal members can track their application status through their online account.

What if my auto loan is denied? What are my appeal options?

Navy Federal usually provides a reason for denial. You can review this reason and potentially appeal the decision, providing additional information or addressing any concerns raised.

How long does it typically take to receive funds after approval?

This varies but generally takes a few business days once all documentation is complete and the loan is fully processed.