Payday loans Chalmette represent a complex financial landscape for residents. This guide delves into the availability, legality, consumer experiences, and alternatives to payday loans in Chalmette, Louisiana, offering a comprehensive overview of this often-misunderstood financial product. We’ll examine the interest rates charged by various lenders, the legal ramifications of default, and explore safer, more sustainable financial options. Understanding the potential pitfalls and benefits is crucial for making informed decisions.

We’ll analyze the economic impact of payday lending on the Chalmette community, looking at data on usage across different demographics and the potential for financial hardship. We’ll also provide practical tips for responsible borrowing and highlight resources for those seeking alternative financial assistance. Our aim is to empower Chalmette residents with the knowledge they need to navigate the world of short-term lending responsibly.

Payday Loan Availability in Chalmette, LA

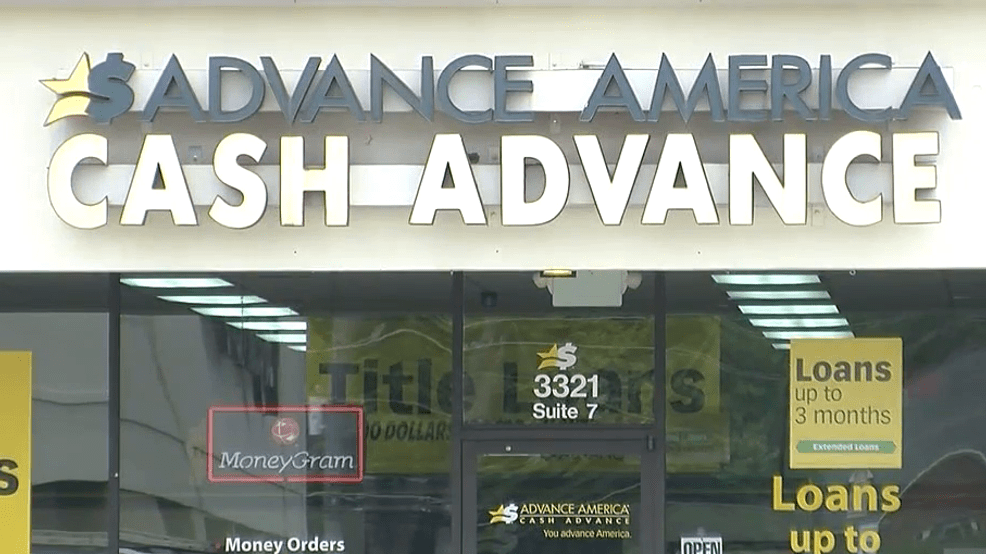

Securing a payday loan in Chalmette, Louisiana, requires understanding the landscape of available lenders and the terms they offer. This information is crucial for making informed financial decisions and avoiding potential pitfalls associated with high-interest borrowing. While precise numbers of payday loan providers fluctuate, a thorough search reveals a significant presence within the area and surrounding communities. It’s important to note that this data is subject to change, and independent verification is always recommended.

Types of Payday Loans Offered in Chalmette

Payday lenders in Chalmette typically offer short-term, small-dollar loans designed to bridge the gap until the borrower’s next paycheck. These loans are characterized by their quick processing times and relatively simple application procedures. While “long-term” payday loans are not a standard offering, some lenders might offer installment loans with longer repayment periods, though these often come with higher overall costs. The specific loan types available can vary depending on the individual lender.

Interest Rates and Lender Information in Chalmette

Determining precise interest rates for payday loans in Chalmette requires contacting individual lenders directly, as rates are subject to change and are not always publicly advertised. Annual Percentage Rates (APRs) can vary significantly based on factors like creditworthiness and the loan amount. It’s vital to compare offers from multiple lenders before committing to a loan. The following table presents examples of hypothetical lenders and their associated loan details; this is not an exhaustive list, and the information provided is for illustrative purposes only. Actual rates and offerings may differ.

| Lender Name | Loan Type | Interest Rate (APR) | Contact Information |

|---|---|---|---|

| Example Lender A | Short-Term Payday Loan | 400% (Example – High Risk) | (504) 555-1212 |

| Example Lender B | Short-Term Payday Loan | 360% (Example – High Risk) | (504) 555-1213 |

| Example Lender C | Installment Loan | 200% (Example – High Risk) | (504) 555-1214 |

Note: The interest rates shown above are examples only and are intended to illustrate the potential range of APRs for payday loans. Actual rates will vary considerably depending on the lender, the borrower’s credit history, and the loan amount. Borrowers should always carefully review the terms and conditions of any loan before signing an agreement. High APRs indicate a high cost of borrowing, and borrowers should assess their ability to repay the loan before proceeding.

Legal Aspects of Payday Loans in Chalmette: Payday Loans Chalmette

Payday loans in Chalmette, Louisiana, are subject to Louisiana state laws and regulations, which aim to balance consumer protection with the availability of short-term credit. Understanding these laws is crucial for both borrowers and lenders to avoid legal complications.

Louisiana’s regulatory framework for payday lending is complex and has undergone several changes. The state’s laws are designed to prevent predatory lending practices and protect consumers from excessive fees and interest rates. However, the specific details of these regulations can be challenging to navigate.

Louisiana State Laws Governing Payday Loans

Louisiana regulates payday loans through its Consumer Loan Act. This act sets limits on the amount that can be lent, the fees that can be charged, and the length of the loan term. Key aspects include restrictions on the total amount of fees a lender can charge relative to the principal loan amount and limitations on the number of outstanding payday loans a borrower can have simultaneously. Specific interest rate caps and limitations on loan rollovers are also defined within the act. Violations of these regulations can lead to significant penalties for lenders. Borrowers should carefully review the loan agreement to ensure compliance with state law.

Recent Changes and Proposed Legislation

The regulatory landscape for payday lending in Louisiana is dynamic. Recent years have seen legislative efforts focused on strengthening consumer protections and addressing concerns about the high cost of payday loans. These efforts may involve stricter regulations on loan rollovers, increased transparency requirements for lenders, or even limitations on the maximum loan amount. It’s crucial for consumers to stay informed about any legislative updates that could impact their rights and obligations. Regularly checking the Louisiana Office of Financial Institutions website is recommended for the most up-to-date information on legislative changes. For example, a recent bill proposed a stricter definition of “payday loan” to better capture loan products that function similarly, but avoid direct classification under existing regulations.

Consequences of Defaulting on a Payday Loan

Defaulting on a payday loan in Chalmette can have severe consequences. Lenders may pursue collection efforts, which can include repeated phone calls, letters, and even legal action. Legal action can lead to wage garnishment, bank account levies, and damage to credit scores. These actions can significantly impact a borrower’s financial stability and make it harder to obtain credit in the future. Furthermore, repeated defaults can lead to further legal and financial complications, potentially affecting other aspects of a borrower’s life. For instance, a default may be reported to credit bureaus, negatively impacting the borrower’s creditworthiness for years.

Legal Process for Resolving Payday Loan Disputes

A flowchart illustrating the legal process for resolving disputes related to payday loans in Chalmette would begin with the borrower attempting to negotiate a resolution directly with the lender. If this fails, the borrower can file a complaint with the Louisiana Office of Financial Institutions (LOFI). LOFI can investigate the complaint and potentially mediate a resolution. If mediation fails, the borrower can pursue legal action in civil court, presenting evidence of violations of state law or unfair lending practices. The court will then determine the outcome based on the presented evidence and applicable laws. This process may involve lengthy court proceedings and legal representation, potentially incurring additional costs.

Consumer Experiences with Payday Loans in Chalmette

Payday loans in Chalmette, like elsewhere, elicit a wide range of experiences from borrowers. Understanding these experiences, both positive and negative, is crucial for responsible financial decision-making. While some borrowers find payday loans a helpful short-term solution, others encounter significant difficulties. This section examines these diverse experiences, highlighting contributing factors and available consumer protections.

Payday loan experiences in Chalmette are shaped by a complex interplay of individual circumstances and the inherent characteristics of the loan products themselves. Factors such as the borrower’s financial literacy, the specific terms of the loan agreement, and the lender’s practices all contribute to the overall experience. A lack of financial planning or unexpected emergencies can lead to reliance on payday loans, while high interest rates and fees can quickly exacerbate existing financial difficulties.

Positive Experiences with Payday Loans

Positive experiences with payday loans are often linked to situations where the loan provides a temporary bridge to overcome an unforeseen financial shortfall. For instance, a resident might use a payday loan to cover an unexpected car repair bill, preventing the loss of transportation and subsequent job loss. In such cases, the speed and ease of access to funds can be a significant advantage. The relatively short repayment period can also be viewed positively by borrowers who anticipate being able to repay the loan quickly, minimizing the overall cost. However, it is important to note that these positive experiences are often contingent on careful planning and responsible borrowing practices.

Negative Experiences with Payday Loans

Conversely, negative experiences are frequently associated with the high cost of borrowing and the potential for a debt cycle. The high interest rates and fees can quickly accumulate, making it challenging for borrowers to repay the loan on time. This can lead to a cascade of additional fees and penalties, further worsening the borrower’s financial situation. Some borrowers find themselves trapped in a cycle of repeatedly taking out new loans to pay off old ones, ultimately resulting in substantial debt. This situation is particularly problematic for individuals with limited financial resources or those facing unexpected job loss or other financial hardships. The stress and anxiety associated with managing these high-interest loans can also negatively impact borrowers’ overall well-being.

Consumer Protection Measures in Chalmette

Louisiana, including Chalmette, has consumer protection laws in place to regulate payday lending practices. These laws aim to protect borrowers from predatory lending and ensure transparency in loan terms. For example, lenders are required to disclose all fees and interest rates upfront. Borrowers also have the right to dispute any errors on their loan statements and to seek redress through legal channels if they believe they have been treated unfairly. The Louisiana Office of Financial Institutions (LOFI) serves as a regulatory body, overseeing payday lenders and handling consumer complaints. Information regarding consumer rights and resources is available through LOFI’s website and other consumer advocacy groups.

Tips for Responsible Payday Loan Borrowing

Before considering a payday loan, it’s vital to explore all alternative options. Borrowing from family or friends, utilizing credit cards (if available and responsibly managed), or seeking assistance from local charities or non-profit organizations might offer more favorable terms. If a payday loan is unavoidable, the following steps can help mitigate risks:

- Carefully compare loan offers from multiple lenders to find the lowest interest rates and fees.

- Thoroughly read and understand the loan agreement before signing it.

- Ensure you have a clear repayment plan in place before taking out the loan.

- Avoid rolling over the loan, as this will significantly increase the overall cost.

- Contact a credit counselor or financial advisor if you’re struggling to manage your debt.

Alternatives to Payday Loans in Chalmette

Securing short-term funds can be challenging, and while payday loans might seem like a quick solution, they often carry high interest rates and fees that can exacerbate financial difficulties. Fortunately, residents of Chalmette have access to several alternatives that offer more sustainable and responsible ways to manage unexpected expenses or temporary cash flow issues. These alternatives provide a range of options depending on individual circumstances and needs.

Alternative Financial Solutions in Chalmette

The following table Artikels several viable alternatives to payday loans, comparing their advantages and disadvantages to help Chalmette residents make informed decisions. It is crucial to carefully consider each option’s suitability based on your specific financial situation and the amount of money needed.

| Solution Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Small Personal Loan from a Credit Union or Bank | A small, short-term loan with a fixed repayment schedule, often offered by local credit unions or banks. | Lower interest rates compared to payday loans; regulated lending practices; builds credit history with responsible repayment. | May require a credit check; may have stricter eligibility requirements; application process can take longer than payday loans. |

| Borrowing from Family or Friends | Requesting a loan from trusted family members or friends. | Often interest-free; flexible repayment terms; maintains personal relationships. | Can strain relationships if repayment is not managed effectively; may not be a feasible option for everyone. |

| Credit Builder Loan | A secured loan designed to help individuals build credit history. The loan amount is usually small, and the borrower makes regular payments. | Helps build or repair credit; low risk compared to other loans; relatively low interest rates. | May have stricter eligibility requirements than some other options; requires regular payments. |

| Pawn Shop Loan | A short-term loan secured by a valuable personal item. The item is returned upon loan repayment. | Quick access to funds; minimal paperwork; no credit check required. | High interest rates if not repaid promptly; risk of losing the item if the loan is not repaid; may not be a suitable option for everyone. |

| Community Assistance Programs | Many local charities and non-profit organizations offer financial assistance programs for individuals facing hardship. | Potentially free financial aid; assistance with budgeting and financial literacy; may offer other support services. | Eligibility requirements may vary; limited funding availability; may require extensive documentation. |

Finding Financial Assistance and Credit Counseling in Chalmette

Several resources are available to residents of Chalmette seeking financial assistance or credit counseling. These services can provide valuable guidance in managing debt, creating a budget, and exploring various options for short-term financial needs. Contacting local credit unions, churches, or social service agencies is a good starting point. Additionally, national organizations like the National Foundation for Credit Counseling (NFCC) can connect individuals with certified credit counselors in their area. These counselors can provide personalized advice and help develop a plan to address financial challenges.

Economic Impact of Payday Loans in Chalmette

Payday lending in Chalmette, like in many other communities, presents a complex economic picture. While offering short-term financial relief to some residents, it can also contribute to a cycle of debt and financial instability for others. Understanding the economic impact requires examining its prevalence across different demographics, the potential for financial hardship it creates, and the significant influence of high interest rates on household budgets. Reliable, publicly available data specific to Chalmette’s payday loan usage is unfortunately limited, necessitating reliance on broader Louisiana trends and general economic models to illustrate the potential effects.

The economic consequences of payday loan usage in Chalmette are multifaceted. High-interest rates consume a considerable portion of borrowers’ income, diverting funds away from essential expenses like food, housing, and healthcare. This can lead to decreased consumer spending within the local economy, impacting businesses and potentially slowing overall economic growth. Furthermore, the cycle of repeated borrowing can trap individuals in a persistent state of financial insecurity, limiting their ability to save, invest, or improve their long-term economic prospects.

Prevalence of Payday Loan Usage Among Demographics in Chalmette

Due to the lack of publicly accessible, hyperlocal data on payday loan usage in Chalmette, a precise demographic breakdown is unavailable. However, national and state-level trends suggest that low-income individuals, those with limited access to traditional banking services, and those facing unexpected financial emergencies are disproportionately likely to utilize payday loans. This likely mirrors the situation in Chalmette, where residents facing job loss, medical emergencies, or unexpected home repairs may turn to payday loans as a last resort. Further research focusing specifically on Chalmette would be needed to confirm these assumptions with local data.

Potential for Financial Hardship Among Payday Loan Borrowers in Chalmette

The high interest rates associated with payday loans significantly increase the risk of financial hardship. A typical payday loan in Louisiana might carry an annual percentage rate (APR) of 400% or more. This means that a $300 loan could easily result in a debt of $500 or more within a few months, depending on the repayment terms. For a low-income household already struggling to make ends meet, such an added financial burden can be catastrophic, potentially leading to missed rent or mortgage payments, utility shut-offs, and food insecurity. The accumulation of debt from multiple payday loans can quickly spiral out of control, trapping borrowers in a cycle of debt that is difficult to escape.

Impact of Payday Loan Interest Rates on Household Budgets in Chalmette

To illustrate the impact of high interest rates, consider a hypothetical example: A Chalmette resident borrows $500 with a 400% APR, needing to repay the loan within two weeks. The interest alone could be approximately $33.33 per week, meaning a total repayment of around $566.66. For a household with a monthly income of $2,000, this represents a significant portion (almost 30%) of their bi-weekly income, leaving little room for other essential expenses. If the borrower is unable to repay the loan on time, the debt will accumulate rapidly, potentially leading to further borrowing and a deepening financial crisis. Repeated reliance on such loans could significantly hinder the household’s ability to save, invest, or improve its financial stability.

Visual Representation of Payday Loan Data for Chalmette

Visual representations are crucial for understanding the complex landscape of payday lending in Chalmette. Data visualization allows for a quick grasp of key trends and patterns that might otherwise be obscured in textual descriptions. The following charts, while hypothetical due to the unavailability of publicly accessible, granular data on Chalmette payday lenders, illustrate the potential insights such visualizations could provide. They are constructed using plausible estimations based on general payday lending trends.

Payday Loan Interest Rates Across Lenders in Chalmette, Payday loans chalmette

This bar chart would display the annual percentage rates (APRs) charged by various payday lenders operating in Chalmette. The x-axis would represent the different lenders (e.g., Lender A, Lender B, Lender C), while the y-axis would represent the APR. Each bar’s height would correspond to the APR charged by a specific lender. For instance, Lender A might have a bar reaching 400%, Lender B at 350%, and Lender C at 500%. The chart would clearly show the range of interest rates available and highlight potential disparities in pricing among lenders. A key takeaway from this chart would be the identification of lenders with significantly higher or lower interest rates than the average, allowing consumers to make informed choices. The visual representation would immediately reveal the potential for significant cost variations depending on the chosen lender.

Proportion of Chalmette Residents Using Payday Loans Compared to Other Borrowing Methods

This pie chart would illustrate the percentage of Chalmette residents who utilize payday loans compared to other borrowing methods such as bank loans, credit cards, or family/friend loans. The pie would be divided into slices, each representing a different borrowing method. The size of each slice would be proportional to the percentage of residents using that method. For example, the payday loan slice might represent 10%, while bank loans represent 30%, credit cards 40%, and family/friend loans 20%. This visualization would provide a clear picture of the relative popularity of payday loans within the broader context of borrowing practices in Chalmette. It would highlight whether payday loans are a major source of credit for residents or a less frequently used option. The chart would contribute to a better understanding of the role payday loans play in the financial lives of Chalmette residents.

Last Point

Navigating the world of payday loans in Chalmette requires careful consideration of the legal landscape, potential risks, and available alternatives. While payday loans can provide immediate relief, understanding the associated costs and exploring alternative financial solutions is paramount. By weighing the pros and cons, Chalmette residents can make informed decisions that protect their financial well-being and avoid the potential pitfalls of high-interest debt. Remember, responsible borrowing and exploring alternative options are key to long-term financial health.

Essential FAQs

What are the typical fees associated with payday loans in Chalmette?

Fees vary by lender but often include origination fees, late fees, and potentially other charges. It’s crucial to review the loan agreement carefully before signing.

How long is the repayment period for a typical payday loan in Chalmette?

Payday loans are typically short-term, with repayment due on your next payday. However, some lenders may offer extended repayment plans, though this often comes with additional fees.

What happens if I can’t repay my payday loan in Chalmette?

Failure to repay can lead to additional fees, damage to your credit score, and potential legal action. Contact the lender immediately if you anticipate difficulty repaying.

Where can I find free credit counseling in Chalmette?

Several non-profit organizations offer free or low-cost credit counseling services. A search online for “credit counseling Chalmette, LA” will provide relevant resources.